Transcription

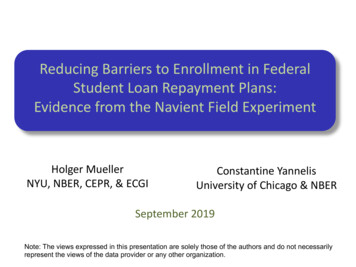

Reducing Barriers to Enrollment in FederalStudent Loan Repayment Plans:Evidence from the Navient Field ExperimentHolger MuellerNYU, NBER, CEPR, & ECGIConstantine YannelisUniversity of Chicago & NBERSeptember 2019Note: The views expressed in this presentation are solely those of the authors and do not necessarilyrepresent the views of the data provider or any other organization.Vu Pham

Student Loan Debt CrisisHolger Mueller and Constantine YannelisNavient Field Experiment

Student Loan Debt Crisis Student loan balances, delinquencies, and defaults: With over 44 million borrowers and 1.46 trillion in outstanding balances,student loan debt is second largest consumer debt category behind onlymortgages ( 9.12 trillion) and before auto loan debt ( 1.27 trillion) andcredit card debt ( 0.87 trillion). Student loans exhibit highest delinquency and default rates among anytype of household debt: 11.4% of student loan debt is either seriously (90days or more) delinquent or in default, compared to 1.2% of mortgagedebt, 4.5% of auto loan debt, and 7.8% of credit card debt.Source: FRBNY Quarterly Report on Household and Credit (2018:Q4)Holger Mueller and Constantine YannelisNavient Field Experiment

Student Loan Debt CrisisBalance Time TrendHolger Mueller and Constantine YannelisNavient Field Experiment

Income-Driven Repayment (IDR) Plans 10-year standard repayment plan: Total loan balance is divided evenly into fixed monthly (annuity) paymentsover a 10-year repayment period. To help student loan borrowers avoid delinquency and default, federalgovernment provides Income-Driven Repayment (IDR) plans: Monthly payments depend on borrower’s discretionary income—difference between annual income and (typically) 150% of federalpoverty guideline. If annual income is low, monthly payments are low oreven zero. Repayment period is extended up to 25 years, at the end of which anyremaining loan balance is forgiven.IDR PlansHolger Mueller and Constantine YannelisNavient Field Experiment

IDR Take-Up Value of government subsidy for federally issued student loans in IDRplans estimated to be 74 billion. 21% subsidy rate, or average cost to government of 21 for every 100 instudent loans disbursed (GAO, 2016). IDR take-up remains incomplete Only about 20% of borrowers who are eligible for IDR are enrolled inprogram (Treasury Department, 2015). even among borrowers who are pre-qualified and hence fully awareof their program eligibility. “Only 27% of pre-qualified borrowers were returning their applications.We studied the process and determined that the complexity and effortrequired to print, sign and return the IDR application was negativelyimpacting the application return rate” (Navient, 2017).Holger Mueller and Constantine YannelisNavient Field Experiment

IDR Take-Up “Too many borrowers have had difficulties navigating and completingthe IBR application process once they have started it [.] Although theDepartment of Education has recently removed some of the hurdles tocompleting the process, too many borrowers are still struggling toaccess this important repayment option due to difficulty in applying.”Barack Obama, White House Presidential Memorandum, 2012IDR ApplicationHolger Mueller and Constantine YannelisNavient Field Experiment

IDR Take-Up “In the IDR application process, once we review the program with theborrower and pre-qualify them for the program, we have to send themaway from Navient to studentloans.gov where they have to complete a12-page application. They do it on the government’s website, either onlineor by printing it and filling it out. There are no edit checks in that process,so if a customer makes a mistake or selects the wrong program, it getssent to us by the Department of Education. We then have to return it, tellthe borrower they’ve made a mistake, fix it. All of those things are verytime-consuming and complex. [.] We’ve asked the department to be ableto co-browse with borrowers on the website to assist them in completingthe application to make sure they complete it correctly. We’ve asked forthe right to do verbal enrollment. We’ve argued extensively forsimplification and received zero response or action.”Navient President and CEO Jack Remondi, Washington Post, January 23, 2017Holger Mueller and Constantine YannelisNavient Field Experiment

Field Experiment Navient: services over 300 billion in student loans for 12 million DirectLoan, Federal Family Education Loan (FFEL), and private student loancustomers. Largest student loan servicer in the country (2017). Between April 12 and July 31, 2017, 7,319 FFEL borrowers wererandomly assigned to two groups of call center agents. The agentsmodeled repayment options with the borrowers and pre-qualifiedeligible borrowers for the IDR program. Treatment agents: borrowers received pre-populated IDR applications byemail that could be signed and returned electronically. Control agents: borrowers had to complete the IDR application on theirown, either by applying online through the Education Department’scentralized application portal, or by printing, signing, and returning acompleted paper application.StatisticsHolger Mueller and Constantine YannelisNavient Field Experiment

Field Experiment Random assignment: Calls are routed through an automated Interactive Voice Response (IVR)system, as is common in most call centers, that interacts with customers,gathers basic information, and then routes them to a call center agent. IVR system places borrowers in a holding queue until their call isanswered by the next available agent. Call center agents, in turn, do notknow the identity of a caller before answering the call. Accordingly,borrowers do not get to pick which agent (treatment/control) they talkto, and vice versa.Agent PlaceboHolger Mueller and Constantine YannelisNavient Field Experiment

Empirical Strategyapplying online through the Education Department’s centralized website or by printing,signing, and returning a completed paper application. We estimate the ITT effect of thisintervention–that is, the difference in mean outcomes between control and treatmentgroups–by estimating the following equation using ordinary least squares (OLS): Intent-to-treat (ITT) effect of receiving pre-populated IDR applications: 0 1 Treatment 2 (1)where yit is an outcome for borrower i at time t, Treatmenti is anis an outcomevariablefor borrower, Treatmentis an indicatorvariable forwhere indicatorof whetherborroweri was routedto a Treatmentagent, andXi is a set ofreceivedpre-randomization(March2017) covariates.whether borrowerassistance withcompletingthe IDR application,is a setis the errorterm. estimate,While thebutcovariatesare notof pre-randomizationcovariates,andfor obtaining Covariates: notnecessaryunbiasedcanpotentiallypowerby accountingfor chancedifferencesstrictly necessaryforimproveobtainingan unbiasedestimateof the effectof assisting studentbetween treatment and control groups.loan borrowers with completing IDR applications, they can potentially improve powerBorrower age, citizenship, indicators for Census regions (West, Midwest,by accountingSouth,for chancedifferencesin amountborrowercharacteristicsbetweentreatment andNortheast),principaldisbursed,and indicatorsfor whethertheTheborrowerin deferment,in forbearance,or ofhaspre-randomizationsubsidized loans. borrowercontrol groups.set of iscovariatesincludesthe full set characteristics from Table 1: borrower age, citizenship, indicators for the four CensusregionsHolger(West,Midwest,South, Northeast),disbursed,and indicatorsMuellerand ConstantineYannelis principal amountNavientField Experiment

Local AverageTreatment EffectEmpiricalStrategy4.3While equation (1) provides an estimate of the total impact of assisting student loanborrowers with completing applications for IDR enrollment, we are also interested inthe effect of IDR enrollment on borrower outcomes as such. To this end, we model theLocal average treatment effect (LATE) of IDR enrollment onrelationshipborrowerbetween outcomesborrower outcomesIDR enrollmentas follows: credit(monthly andpayments,new delinquencies,card balances): where0 1 IDR 2(2) yit is anvariableoutcomeborrower, iIDRat timet, and IDRit indicatesiswherean her borrower i is enrolled in IDR at time t.enrolled in an IDR plan,is a set of pre-randomization covariates, andisis the error Exclusionrestriction:receivingpre-populatedIDR applicationsterm. Outcomevariablesare monthlypayments,delinquency,and credit hascard balances.The setno direct effect on monthly payments, new delinquencies, or creditof covariates is the same as in equation (1).card balances, other than through its effect on IDR enrollment.We estimate equation (2) by two-stage least squares (2SLS). The first-stage equationis given by the ITT equation (1) with IDR as the dependent variable. For Treatmentto be a valid instrument, the exclusion restriction requires that assisting borrowers withHolger Mueller and Constantine YannelisNavient Field Experiment

Empirical StrategyTreatment – Control BalancePre-randomization covariates (March 2017)Holger Mueller and Constantine YannelisNavient Field Experiment

Empirical StrategyTreatment – Control BalancePre-randomization outcome variables (March 2017)Coefficient on Treatment is marginally significant (at 10% level) in only one out of 14regressions, consistent with what one would expect by chance if assignment is random.Holger Mueller and Constantine YannelisNavient Field Experiment

IDR Take-Up60.5%24%Holger Mueller and Constantine Yannelis26.6%Navient Field Experiment

IDR Take-UpDependent variable: IDR enrollment in August 2017Coefficient on Treatment: difference in mean enrollment ratesbetween control and treatment groups in August 2017.Holger Mueller and Constantine YannelisNavient Field Experiment

Monthly Student Loan Payments 273 152Holger Mueller and Constantine YannelisNavient Field Experiment

Monthly Student Loan PaymentsMassive shift toward very low and zero monthly paymentsMarch 2017Holger Mueller and Constantine YannelisNavient Field Experiment

Monthly Student Loan PaymentsMassive shift toward very low and zero monthly paymentsMarch 2017Holger Mueller and Constantine YannelisAugust 2017Navient Field Experiment

Monthly Student Loan PaymentsDependent variable: monthly payments in August 3197,3197,3197,3197,3197,319Graphical evidence: 273 (control) vs. 152 (treatment).OLSHolger Mueller and Constantine YannelisNavient Field Experiment

Monthly Student Loan PaymentsDependent variable: monthly payments in August 3197,3197,3197,3197,3197,319LATE estimate implies reduction in monthly payments of 355.Holger Mueller and Constantine YannelisNavient Field Experiment

Monthly Student Loan Payments Characterizing compliers: LATE estimate measures impact of IDR enrollment on set of compliers—borrowers who enrolled in IDR because of treatment intervention, andwho would have not enrolled otherwise. Following Angrist and Pischke (2009), estimate first-stage equationseparately for different borrower sub-populations stratified by (prerandomization) monthly payments in March 2017. Find that compliers are more likely to have high initial monthly payments,which explains large LATEs associated with monthly payments.Holger Mueller and Constantine YannelisNavient Field Experiment

This figure shows monthly new delinquency rates (fraction of borrowers becoming 60 days or more past due for thefirst time) for 7,319 FFEL borrowers that had contact with either a control agent (circles) or a treatment agent(diamonds) during the field experiment, which took place between April 12 and July 31, 2017. Treatment agents aredescribed in Table 1. Dashed lines represent 95% confidence intervals.New Delinquencies2.8%0.4%New delinquencies: borrowers who become delinquent (60 days past due) for first time.Holger Mueller and Constantine YannelisNavient Field Experiment

New DelinquenciesDependent variable: new delinquencies in August 2017Graphical evidence: 2.8% (control) vs. 0.4% (treatment).Holger Mueller and Constantine YannelisNavient Field Experiment

New DelinquenciesDependent variable: new delinquencies in August 2017LATE estimate implies reduction in new delinquencies of 7 pp.Holger Mueller and Constantine YannelisNavient Field Experiment

Effects of Increased Liquidity? LATE estimates: monthly student loan payments decrease by 355.Borrowers may respond to increase in liquidity in various ways: Increase savings Pay down other debts Spend more Monthly (total) credit card balances from TransUnion credit reports for7,115 of the 7,319 borrowers based on annual snapshots in August. August 2016: no difference between control and treatment groups (oneof 14 pre-randomization checks).Holger Mueller and Constantine YannelisNavient Field Experiment

Effects of Increased Liquidity? LATE estimates: monthly student loan payments decrease by 355.Borrowers may respond to increase in liquidity in various ways: Increase savings Pay down other debts Spend more Monthly (total) credit card balances from TransUnion credit reports for7,115 of the 7,319 borrowers based on annual snapshots in August. August 2016: no difference between control and treatment groups (oneof 14 pre-randomization checks). August 2017?Holger Mueller and Constantine YannelisNavient Field Experiment

Credit Card BalancesDependent variable: credit card balances in August NYNY7,1157,1157,1157,1157,1157,115(63.78)Increase in credit card balance of 343 (almost) matches drop in monthly paymentsof 355. Suggests that freed-up liquidity is used for consumer spending.Holger Mueller and Constantine YannelisNavient Field Experiment

Concluding Remarks IDR: potential solution to student loan repayment crisis by linkingmonthly repayments to discretionary income. Problem: low take-up. Navient field experiment: pre-filling of IDR applications. Take-up increases by 36.5 pp (34 pp relative to control group). Simple intervention that can be potentially used in other federal supportprograms. IDR effective at reducing student loan delinquency (through reduction inmonthly payments) and relaxing liquidity constraints. Results suggest thatborrowers use freed-up liquidity for consumer spending. Welfare? Depends on desirability of increasing IDR enrollment.Holger Mueller and Constantine YannelisNavient Field Experiment

Concluding Remarks First field-experimental evaluation of a U.S. government program designedto address the soaring debt burdens of U.S. households. Quasi-experimental evidence: Home Affordable Modification Program(HAMP). In many ways, similar to IDR: Modification of mortgage terms (interest rate and principal reduction,forbearance, term extension). Monthly mortgage payments capped at fraction of monthly income. Agarwal et al. (2017); Ganong and Noel (2018): effect of HAMP on monthlypayments, foreclosure, delinquency, default, and consumer spending. Our study: effect of IDR on monthly payments, delinquency, and consumerspending by exploiting randomized IDR enrollment.Holger Mueller and Constantine YannelisNavient Field Experiment

Concluding RemarksThank you!Holger Mueller and Constantine YannelisNavient Field Experiment

Student Loan Debt CrisisBackHolger Mueller and Constantine YannelisNavient Field Experiment

Student Loan Repayment Plans2015201220091994BackHolger Mueller and Constantine YannelisNavient Field Experiment

I amApplicationalready in an income-driven repayment plan,IDRbut want to change to a different income-drivenrepayment plan - Continue to Item 2.INCOME-DRIVEN REPAYMENT PLAN REQUEST:IDRFor the Revised Pay As You Earn (REPAYE), Pay As You Earn (PAYE), Income-Based(IBR), and Income-Contingent (ICR) repayment plans under the William D. FordFederal Direct Loan (Direct Loan) and Federal Family Education Loan (FFEL) ProgramsOMB No. 1845-0102Form ApprovedExp. Date 10/31/2018WARNING: Any person who knowingly makes a false statement or misrepresentation on this form or on any accompanyingdocument is subject to penalties that may include fines, imprisonment, or both, under the U.S. Criminal Code and 20 U.S.C.1097.SECTION 1: BORROWER IDENTIFICATIONPlease enter or correct the following information.Check this box if any of your information has changed.SSN-No - CoYes, buimmedYes, buthe defNameAddressIf you have FFEL Program loans, they may only be repaid under IBR. If youconsider you for IBR on your FFEL Program loans. You may be able to consoConsolidation Loan to take advantage of other income-driven plans by visitCity, State, Zip CodeTelephone - Primary((Telephone - Alternate))-Email (Optional)SECTION 2: REPAYMENT PLAN OR RECERTIFICATION REQUESTREAD BEFORE COMPLETING THIS FORM: You can apply online at StudentLoans.gov. It is faster and easier to complete this form online. Income-driven repayment plans offer many benefits, but may not be right for everyone. You can learn more about these plans at StudentAid.gov/IDR and by reading Sections 9 and 10. It's simple to explore all of your repayment options at StudentAid.gov/repayment-estimator. You can find out which types of loans you have and who your loan holder or servicer is at nslds.ed.gov. If you need help completing this request, contact your loan holder or servicer for free assistance. You may have to pay income tax on any loan amount forgiven under an income-driven plan.1. Select the reason you are submitting this form (Checkonly one):Page 1 of 122. Choose a plan and then continue to Item 3.(Recommended) I want my loan holder to place me onthe plan with the lowest monthly payment.I am not in an income-driven repayment plan, butwant to enter one - Continue to Item 2.I am already in an income-driven repayment planand am submitting documentation for the annualrecalculation of my payment - Skip to Item 5.I am already in an income-driven repayment plan andam submitting documentation early because I wantmy loan holder to recalculate my paymentimmediately - Skip to Item 5.I am already in an income-driven repayment plan,but want to change to a different income-drivenrepayment plan - Continue to Item 2.REPAYEIBRPAYEICR3. Do you have multiple loan holders or servicers?Yes - Submit a separate request to each loan holder orservicer. Continue to Item 4.No - Continue to Item 4.4. Are you currently in a deferment or forbearance?No - Continue to Item 5.Yes, but I want to start making payments under my planimmediately - Continue to Item 5.Yes, but I do not want to start repaying my loans untilthe deferment or forbearance ends - Continue to Item 5.If you have FFEL Program loans, they may only be repaid under IBR. If you request a different plan, your loan holder willconsider you for IBR on your FFEL Program loans. You may be able to consolidate your FFEL Program loans into a DirectConsolidation Loan to take advantage of other income-driven plans by visiting StudentLoans.gov.BackPage 1 of 12Holger Mueller and Constantine YannelisNavient Field Experiment

Agent PlaceboTo see whether control and treatmentagents have different (innate) successrates of enrolling borrowers in IDR inthe absence of the intervention, wematched the agents to a different setof 1,636 FFEL borrowers who spokewith these agents in January,February, or March 2017. During this(Placebo) period, calls were alsorandomly assigned—by virtue ofNavient’s IVR system—but control andtreatment agents did not (yet) differin their authority to pre-populate IDRapplications.Figure shows fraction of borrowers who are enrolled in IDR separately for borrowers that spokewith treatment agents and borrowers that spoke with control agents during Placebo period. Ascan be seen, control and treatment agents not only exhibit parallel trends, but their IDRenrollment rates are statistically indistinguishable from one another.Back

Field Experiment IDR application statistics: about 40% of IDR applications aresubmitted online, half are submitted using paper only by printing outthe application from the Education Department’s website, and theremainder uses the website but submits hardcopy incomedocumentation (Navient, 2015).BackHolger Mueller and Constantine YannelisNavient Field Experiment

Monthly Student Loan PaymentsDependent variable: monthly payments in August 3197,3197,3197,3197,3197,319OLS likely lower than true effect, as borrowers in IDR may be moresophisticated and have higher incomes relative to other borrowers.BackHolger Mueller and Constantine YannelisNavient Field Experiment

Literature Papers using field experiments to study the take-up of public and privateprograms, as well as their impact on program participants (Currie, 2006). E.g., Medicaid (Finkelstein et al., 2012), earned income tax credits (EITC)(Bhargava and Manoli, 2015), food stamps (SNAP) (Finkelstein andNotowidigo, 2019), retirement savings plans (Duflo et al., 2006), collegefinancial aid (Bettinger et al., 2012), weatherization assistance programs(Fowlie, Greenstone, and Wolfram, 2018). Interventions include information about program eligibility, behavioralnudges, and assistance with the application process (as in our case).Literature in household finance studying the role of psychological costs infinancial decision making (Agarwal, Chomsisengphet, and Lim, 2017).Holger Mueller and Constantine YannelisNavient Field Experiment

Literature First field-experimental evaluation of a U.S. government program designedto address the soaring debt burdens of U.S. households. Quasi-experimental program studies: Home Affordable Modification Program(HAMP) (Agarwal et al., 2017; Ganong and Noel; 2019); Home AffordableRefinancing Program (HARP) (Agarwal et al., 2015); consumer bankruptcy(Dobbie and Song, 2015; Mahoney, 2015; Dobbie, Goldsmith-Pinkham, andYang, 2017).Cox, Kreisman, and Dynarski (2018): incentivized laboratory experimentwhere the default option is either the standard 10-year repayment plan oran income-driven repayment plan. Changing the default option from standard repayment to IDR results in a 27pp increase in the share of subjects selecting IDR.Holger Mueller and Constantine YannelisNavient Field Experiment

Student loans exhibit highest delinquency and default rates among any type of household debt: 11.4% of student loan debt is either seriously (90 days or more) delinquent or in default, compared to 1.2% of mortgage debt, 4.5% of auto loan debt, and 7.8% of credit card debt. Source: FRBNY Quarterly Report on Household and Credit (2018:Q4)