Transcription

170 outof170points(100%)

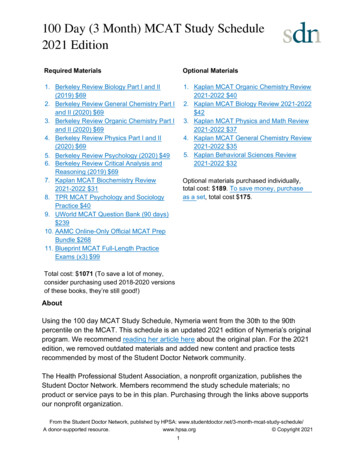

1.award:10 out of10.00Tano issues bonds with a par value of 180,000 on January 1, 20 13. The bonds' annual contract rate is8%, and interest is paid semiannually on June 30 and December 31. The bonds mature in three years.The annual market rate at the date of issuance is 10%, and the bonds are sold for 170,862.1. What is the amount of the discount on these bonds at issuance?Discount9,1 38.I 2. How much total bond interest expense will be recognized over the life of these bonds?iTotal bond interest expense over fife of bonds:Amount repaid:6.1 payments of7,200.I 43,200-- Par value at maturity180,000.I223,200Total repaid---Less amount borrowed170,862.ITotal bond interest expense 3. Use the straight-line method to amortize the discount for these bonds.Semiannual PeriodEnd01/01/20 13UnamortizedDiscount carrying Value9,1 38,./ 170,862.I06/30/20 0120 144,569,./175,43 1.I12/31/20 143,046,./176,954.I06/30120 151,523178,47712/3 112015 0 180,000

2.award:10 out of10.00Prepare the journal entries for the issuance of th e bonds in both OS 14-1 and OS 14-2. Assume thatboth bonds are issued for cash on January 1, 20 13.1. Enviro Company issues 8%, 10-year bonds with a par value of 250,000 and semiannual interestpayments. On the issue date, the annual market rate forthese bonds is 10%, which implies a sellingprice of 87 112. The straight·line method is use d to allocate interest expense.General JournalDateJan. 1, 20 11./J.cashDiscount on bonds payableBonds /2. Garcia Company issues 10%, 15·year bonds with a par value of 240,000 and semiannual interestpayments. On the issue date, the annual market rate forthese bonds is 8%, which implies a sellingprice of 11 7 1/4 . The effective interest method is used to allocate interest expense.DateJan. 1, 20 11General JournalIIGashBonds payablePremium on bonds payableDebit./././Credit28 1,400./1240,000./41,400./

m.vard:3.10 out of10.00. ··points·· .Sylvestor Company issues 10%, five-year bonds, on December 31, 20 12, with a par value of 100,000and semiannual interest payments.Semiannual Period-EndUnamortized DiscountCarrying Value(0) 1213 112012 7,3606,624 92,640(1) 6130120 13(2) 12/31120135,88893,37694, 11 2Use the above bond amortization table and prepare journal entries to record the following.(a) The issuance of bonds on December 31, 20 12.DateDec. 31DebitGeneral JournalCashDiscount on bonds payableBonds payable.I.I.ICredit92,640./7,360./100,000./(b) The first interest payment on June 30, 20 13.DateJun 30DebitGeneral Journal[Bond interest expense.IGash./Discount on bonds payableviiCredit5,736./J5,000./I736./(c) The second interest payment on December 31, 20 13.DateDec.3 1DebitGeneral JournalBond interest expenseCashDiscount on bonds payable.I.I.ICredit5,736./'-5,000./736./

4.award:10 out of10.00Garcia Company issues 10%, 15-year bonds with a par value of 240,000 and semiannual interestpayments. On the issue date, the annual market rate for these bonds is 8%, which implies a sellingprice of 117 V4. The effective interest method is used to allocate interest expense.1. What are the issuer's cash proceeds from issuance of these bonds? ,;;sh pr;,.;o,;;ce;,.;e;,.;d;,.;s 28 1,400.I2. What total amount of bond interest expense will be recognized over the life of these bonds?:rotaI bond interest expense over Die of bonds:Amount repaid:---30.I payments of 12,000.1 360,000-- --Par value at maturity240,000V"Total repayments600,000Less amount borrowed28 1,400.ITotal bond interest expense 318,6003. What is the amount of bond interest expense recorded on the first interest payment date?Bond interest expense 11,256.I

P IQuestion #5 (of 17) nts ······· ················· ··On January 1, 20 13, Eagle borrows 100,000 cash by signing a four-year, 7% installment note. Thenote requires four equal total payments of accrued interest and principal on December 31 of each yearfrom 20 13 through 20 16. ( Tab!e 0.1, Table 0.2, Table a.3, and Table a.4) (Use appropriate factor(s) from thetables provided.)Prepare the journal entries for Eagle to record the loan on January 1, 20 13, and the four payments fromDecember 31, 20 13, through December 31, 2-0 16.I Interest Rate II Notes Payable7.0% Table Value100,000vl3 3s72v1cash Paid I 29.523 - --DateJan 01, 20 13Dec 31, 20 13GashNotes payableviviInterest expenseviviviNotes payableCashDec 31, 2014Interest expenseNotes payableCashDec 31, 20 15Interest expenseNotes payableCashDec 31, 20 16DebitGeneral JournalInterest expenseNotes 29,523vl5,423vlt 24,l 0vl29,523vl

6.award:10 out of10.00.poii'its . .On January 1, 20 13, the 2,000,000 par value bonds of Spitz Company with a carrying value of 2,000,000 are converted to 1,000,000 shares of 1.00 par value common stock.Record the entry for the conversion of the bonds.Genera l JournalDateJan. 1, 20 11I Bonds payableDebit./Credit2,000,000./Common stock, 1 par./1,000,000./Paid-In capital in excess of par value./1,000,000./

award:10 out of7 10.00. ··points . · ·Enviro Company issues 8%, 10-year bonds with a par value of 250,000 and semiannual interestpayments. On the issue date, the annual market rate for these bonds is 10%, which implies a sellingprice of 87 11.2. The straight·line method is used to allocate interest expense.1. What are the issuer's cash proceeds from issuance of these bonds?Gash proceeds 218,750.I2. What total amount of bond interest expense will be recognized over the life of these bonds?Total bond interest expense over life of bonds:Amount repaid:20.I payments of 10,000.11 200,000 Par value at maturi /250,000.IJTotal repaymentsLess amount borro'AoedtTotal bond interest expense450,000218,750.I , ,231,2503. What is the amount of bond interest expense recorded on the first interest payment d ate?Bond interest expense --11,563.I

award:10 out of8.·. 10.00pomts .·· . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .On January 1, 2013, Eagle borrows 100,000 cash by signing a four-year, 7% installment note. Thenote requires four equal total payments of accrued interest and principal on December 31 of each yearfrom 2013 through 20 16. (Table 0.1. Tab!e 0.2, Table 8.3, and Tab' 0.4) (Use appropriate factor(s) from thetables provided.)1. Compute the amount of each of the four equal total payments.Initial NoteBalanceInterest RateAmount of EachPaymentTable Value100,000.113.3872./ j 29,5232. Prepare an amortization table for this installment note. (Round your intermediate calculations tothe nearest dollar t InterestDebit ncePeriod 20 13100,000./ 7,000./ 22,523./ 29,523./ 77,477./20 1477,477./5,423./24,100./29,523./53,377./20 1553,377./3,736v'25,787./29,523v'27,590v'20 1627,590./1,93327,59029,523v'TotalJ1 18,092 1 100,000' 118,0920

9 award:10 out of10.00. ··points . · .WoodwicK Company issues 10%, five.year bonds, on December 31, 20 12, with a par value of 200,000 and semiannual interest payments.Semiannual PeriodEnd(0) 12/3112012(1) 6/30/20 13(2) 12/31/20 13Unamortized Premium 16,222Carrying Value 2 16,222214,600212,97814,60012,978Use the above straight·line bond amortization table and prepare journal entries for the following.(a) The issuance of bonds on December 31, 20 12.(b)The first interest payment on June 30, 20 13.(c)The second interest payment on December 3 1, 20 13.Genera l JournalDateDec 31, 20 12CashPremium on bonds payableBonds payableJun 30, 2013Bond interest expensePremium on bonds payableCashDec 31, 20 13Bond interest expensePremium on bonds payableCashDebit./ 216,222./././f - - ,622./10,000./1,622./10,000./

10.8'1Nard:10 out of10.00On July 1, 2013, Advocate Company exercises. an 8,000 call option (plus par value) on its outstandingbonds that have a carrying value of 416,000 and a par value of 400,000. The company exercises thecall option after the semiannual interest is paid on June 30, 20 13.Record the entry to retire the bonds.General JournalDllteJul01Bonds payablePremium on bonds payableCashGain on retirement of bondsDebit400,000./16,000./Credit

11.sward:10 out �····points ··Dobbs Company issues 5%, two-year bonds, on December 31, 20 13, with a par value of 200,000 andsemiannual interest payments.Semiannual PeriodEnd(0) 12/31/2013(1) 6/30/20 14(2) 12/3112014(3) 6/3012015(4) 12/31/20 15Unamortized DiscountCarrying Value 12,0009,0006,0003,0000 188,000191,000194,000197,000200,000Use the above straight-line bond amortization table and prepare journal entries for the following.Required :(a)The issuance of bonds on December 31, 201 3.Genera IJournalDateDec 31, 20 13CashDiscount on bonds payableBonds payable- e first through fourth interest payments on each June 30 and December 31.General JournalDateJun 30, 20 14Bond interest expenseDiscount on bonds payableGash- -Dec 31, 20 14Bond interest expenseDiscount on bonds 000./5,000./3,000./5,000./IJun 30, 20 15Bond interest expenseDiscount on bonds payableGashDec 31, 20 15 IBond interest expenseDiscount on bonds /3,000./5,000./(c)Record the payment to retire tl1e bonds on December 31, 20 15.DateDec 31, 20 15------General JournalBonds payableCashDebit././Credit200,000./200,000./

award:10 out of12 10.00. ··points . .On January 1, 20 13, Boston Enterprises issues bonds that have a 3,400,000 par value, mature in 20years, and pay 9% interest semiannually on June 30 and December 31. The bonds are sold at par.1. How much interest will Boston pay (in cash) to the bondholders every six months?x3,400,000.,I SemiannualRatePar (maturityl Value4.5%.,I----- -Semiannual cashInterest P ment , 153,0002. Prepare journal entries for the following.(a)The issuance of bonds on January 1, 20 13.General JournalDateJan 01, 20 13Debit.,I.,ICashBonds payableCredit3,400,000.,I3,400,000.,I(b) The first interest payment on June 30, 20 13.Gene al JournalDateJune 30, 20131--Bono interest expens-eDebit./Credit153,000./Cash153,000.,I(c) The second interest payment on December 3 1, 20 13.General JournalDateDec 3 1, 20 13Bond interest expenseCashDebit.,I.,ICredit153,000.,I153,000.,I3. Prepare the journal entry for issuance of bonds assuming.(a) The bonds are issued at 98.DateJan 01, 20 13GashGeneral Journal--Discount on bonds payableBonds 400,000.,I(b) The bonds are issued at 102.General JournalDateJan 01, 20 13GashBonds payablelPremium on bonds payable- --Debit.,I.,I.,ICredit3,468,000./ 3,400,000.,I68,000.,I----

13.award:10 out of10.00· ·· ·· ·· ·· ····poifits · ·· ·· ·· ·· ·· ·· ·· ·· ·· ·· ·· ·· ·· ·· ·· ·· ·· ·· ·· ·· ·· ·· ·· ·· ·· ·· ·· ·· ·· ·· ·· ·· ·· ·· ·· ·· ·· ·· ·· ·· ·· ·· ·· ·· ·· ·· ·· ·· ·· ·· ·· ·· ·· ·· ·· ·· ·· ·· ·· ·· ·· ·· ·· ·· ·· ··· ·Quatro Co. issues bonds dated January 1, 20 13, with a par value of 400,000. The bonds' annualcontract rate is 13%, and interest is paid semiannually on June 30 and December 31. The bondsmature in three years. The annual market rate at the date of issuance is 12%, and the bonds are soldfor 409,850.1. What is the amount of the premium on these bonds at issuance?Premium9,850./ 2. How much total bond interest expense will be recognized over the life of these bonds?ifotal bond interest expense over life of bonds:Amount repaid:- --6./ payments of---26,000./ Par value at maturi /Total repaid156,000400,000./----556,000Less amount borrowed- -1 Total bond interest expense409,850./J46J 503. Prepare an amortization table for these bonds; use the straight-line method to amortize thepremium. (Round your intermediate calculations to the nearest dollar amount.)UnamortizeSemiannual PeriodEnd01/0112013 carrying Value9,850./ 409,850./06/30/20 138,208.,I408,208./12/3 1120136,566.,I406,566./06/30/20 144,924.,I404,92412131120143,282.,I403,28206/30/20 151, 40 1,64012/3 112015400,000

14 award:10 out of10.00· · · · · · .points · · · · · · · · · · · · · · · · · · · · · · · · · · · · · · · · ·Atlanta CompanyTotal liabilitiesTotal equityCompute the 429,000572,000debt-to-equi /SpokaneCompany 548,0001,827 ,000ratio for each of the following companies.Debt to equilV ratioChoose Nwnerator:11- .- Total liabilitiesIviAtlanta Company429,000./Spokane Company548,000./Choose Denominator:Total equi /Which company appears to have a riskier financing structure? Explain.0 Spokane Company Atlanta Company;J./ Debt·to-equi!y ratio572,000./0.751,827,000./0.30

15.8'1Nard:10 out of10.00Select the phrase that best fits each term of the description A through H .DescriptionI

Premium on bonds payable Cash Gain on retirement of bonds Debit 400,000./ 16,000./ Credit . 11. sward: 10 out of 10.00 ·points·· Dobbs Company issues 5%, two-year bonds, on December 31, 2013, with a par value of 200,000 and semiannual interest payments. Semiannual Period- End (0) 12/31/2013 (1) 6/30/2014 (2) 12/3112014 (3) 6/3012015 (4) 12 .