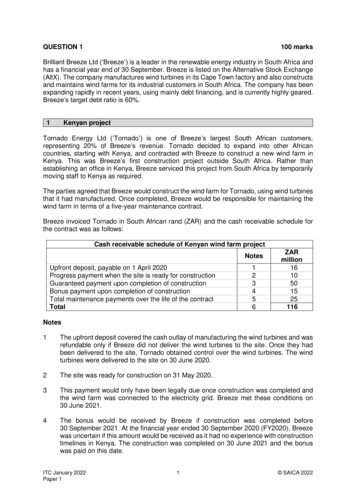

Transcription

SCUF—News Letter—Breeze— December, 2012Thisai: South Thendral: 091st December, 2012Two Things that Define SUCCESS In LIFE: The Way You Manage when You Have Nothing &Way You Behave when You Have Everything!ISO/IEC 27001 StandardISO/IEC 27001 formally specifies a management system that is intended tobring information security under explicit management control. Organizations that claim to have adopted ISO/IEC 27001 can thereforebe formally audited and certified compliant with the standard.Standard AdoptionISO/IEC 27001 requires that management:Systematically examine the organization's informationsecurity risks, taking account of the threats, vulnerabilities, and impacts;Design and implement a coherent and comprehensivesuite of information security controls and/or otherforms of risk treatment (such as risk avoidance orrisk transfer) to address those risks that are deemedunacceptable; andAdopt an overarching management process to ensurethat the information security controls continue tomeet the organization's information security needson an ongoing basis.CertificationThe ISO 27001 adopts the process model “Plan-Do-CheckAct” (PDCA) which is applied to the structure of all the processes in ISMS.The ISO/IEC 27001 certification, like other ISO managementsystem certifications, usually involves a three-stage externalaudit process:Stage 1 is a preliminary, informal review of the ISMS, for example checking the existence and completeness of key documentation such as the organization's information securitypolicy, Statement of Applicability (SoA) and Risk TreatmentPlan (RTP). This stage serves to familiarize the auditors withthe organization and vice versa.Inside this issue:Stage 2 is a more detailed and formal compliance audit,independently testing the ISMS against the requirementsspecified in ISO/IEC 27001. The auditors will seek evidence to confirm that the management system has beenproperly designed and implemented, and is in fact in operation (for example by confirming that a security committee or similar management body meets regularly to oversee the ISMS). Certification audits are usually conductedby ISO/IEC 27001 Lead Auditors. Passing this stage results in the ISMS being certified compliant with ISO/IEC27001.Stage 3 (Surveillance Audit) involves follow-up reviews oraudits to confirm that the organization remains in compliance with the standard. Certification maintenance requiresperiodic re-assessment audits to confirm that the ISMScontinues to operate as specified and intended. Theseshould happen at least annually.ISO/IEC 27001 Certification for ShriramCityShriramCity has taken up the assignment in the year 2010and we have certified on Stage-1 in the same year. Subsequently, in the year 2011, we have completed the stage-2audit. And, this year we have successfully completed theStage-3 Surveillance Audit.We, on behalf of the Information Security team, would liketo sincerely thank one and all who have contributed forthe success of the certification program for ShriramCity.Benny ThomasProgram Manager- IT@ Santhome Office/Special points of interest:Q & A - ECS2Messg. from TED — EDLIS3 ECSNavfest4 EDLISMessg. from TED5 Little ScufiansFestival Greetings6 From Editorial Desk71

SCUF—News Letter—Breeze— December, 2012Electronic Clearing Service (ECS) - FAQs .Contd .ECS debit systemQ.16.What is ECS (Debit) scheme?Ans: It is a scheme under which anaccount holder with a bank canauthorise an ECS user to recoveran amount at a prescribed frequency by raising a debit in hisaccount.The ECS user has tocollect an authorisation which iscalled ECS mandate for raisingsuch debits.These mandateshave to be endorsed by the bankbranch maintaining the account.Q.17.How does the scheme work?AnsAny ECS user desirous ofparticipating in the scheme has toregister with an approved clearinghouse. The list of approved clearinghouses is available at RBI web-sitewww.rbi.org.in. He should also collect the mandate forms from the participating destination account holders, with bank's acknowledgement.A copy of the mandate should beavailable with the drawee bank.The ECS user has to submit the datain specified form through the sponsor bank to the clearing house.The clearing house would pass onthe debit to the destination accountholder through the clearing systemand credit the sponsor bank's account for onward crediting the ECSuser. All the unprocessed debitshave to be returned to the sponsorbank within the time frame specified.Banks will treat the electronic instructions received throughthe clearing system on par with thephysical cheques.Q.18.What are the advantages tothe ultimate beneficiary?Trouble free- Eliminates the need togo to the collection centres/banksby the customers and no need tostand in long „Q‟s for paymentPeace of mind- Customers also neednot track down payments by lastdates.The debits would be monitored by theECS users.Q.19.How does the scheme benefitthe ECS user-like corporatebodies/ institutions?Ans: The ECS user saves on administrative machinery for collecting the cheques, monitoringtheir realisation and reconciliationBetter cash management.Avoids chances of frauds due tofraudulent access to the paperinstruments and encashment.Realize the payments on a singledate instead of fractured receiptof payments.Q.20.What are the advantages tothe banks?Ans: Banks handling ECS get freedof paper handling.Paper handling also creates lot ofpressure on banks as they haveto encode the instruments, present them in clearing, monitortheir return and follow up withthe concerned bank and customers.In ECS banks simply get the mandate particulars relating to theircustomers. All they need to dois to match the account particulars like name, a/c number anddebit the accounts.Wherever the details do not match,they have to return it back, asper the procedure.Q.21. Can the mandate given oncebe withdrawn or stopped?Ans Yes. The mandate given ison par with a cheque issued by acustomer.The only stipulationunder the scheme is that the customer has to give prior notice tothe ECS user, to ensure that theydo not include the debits.Q.22. Can the customer stipulateany maximum debit, purposeor validity period for the mandate?Ans Yes. It is left to the choice ofthe individual customer andthe ECS user to finalise theseaspects.The mandate cancontain a maximum ceiling; itcan also specify the purposeas also a validity period.Q.23. What is the currentcoverageofthescheme?Ans Atp r e se n tt hescheme is in operation at15 RBI centres (ie centreswhere RBI manages theClearing House operations) and at other centreswhere Public SectorBanks manage the clearing operations. The list ofcentres is available at theRBI web-site under theprocedural guidelines.Q.24. Processing charges onindividual transactionsAnsThe Reserve Bank ofIndia has deregulated thecharges to be levied bysponsor banks from userinstitutions. The sponsorbanks are, however, required to disclose thecharges in a transparentmanner. With effect from1st July 2011, originatingbanks are required to pay anominal charge of 25 paiseand 50 paise per transaction to the Clearing houseand destination bank respectively. Bank branchesdo not generally levy processing / service charges fordebiting the accounts ofcustomers maintained withthem.Q.25.Which are the institutions eligible to participate in the ECSDebit scheme?Ans: Utility service providerssuch as telephone companies, electricity supplying companies, electricityboards, credit card collections, collection ofloan installments bybanks and financial institutions, and investmentschemes of Mutual funds,etc.Compiled By:CH. P.V.Krishna Rao,Zonal Office, Tirupathi.2

SCUF—News Letter—Breeze— December, 2012Message from TEDByMs. S. Muthumariamma TED.EMPLOYEES' DEPOSIT LINKED INSURANCE SCHEME , 1976Introduction :The Central Government with the motive of providing additional Social Security in the form of LifeInsurance to the family of the deceased member of the Provident Fund, introduced the EmployeesDeposit Linked Insurance Scheme with effect from 1-8-1976 as provided under Section 6(C) of theEmployees' Provident Fund & MP Act, 1952. The benefit under the Scheme is so devised that it actsas an incentive to the members to save more in their Provident Fund Account. As the name of theScheme says, the benefit is linked to the amount of accumulation in the Provident Fund Account ofthe member.Applicability :The Scheme applies to all the establishments to which the Employees' Provident Fund Schemeapplies.Membership :All the members of the Employees' Provident Fund Scheme are covered as members of theEmployees' Deposit Linked Insurance Scheme also.Contribution :Under this Scheme, the member do not contribute any amount as contribution. However, theemployer pays an amount equal to 0.5% of the total wages paid to the members as contribution.Administrative Charges :As regards Administrative charges, the employer is required to pay an amount equal to 0.01% ofthe wages subject to a minimum of Rs. 2/- per month.Exemption : (Section 17(2A) of the Act and Para 28 of Employees'Deposit Linked Insurance Scheme , 1976)The provisions are available as per Section 17(2A) of the Act and para 28(1) and 28(4) of theEmployees' Deposit Linked Insurance Scheme , 1976 for grant of exemption to an establishment orto an employee or to a class of employees as the case may be, from the operation of all or any ofthe provisions of the Scheme, where the Life Assurance benefit of the Scheme in the establishmentis more beneficial than the benefits provided under the statutory Scheme.Inspection Charges :An employer of an establishment exempted from the provisions of the Employees' Deposit LinkedInsurance Scheme is required to pay inspection charges at the rate of 0.005% subject to a minimumof Re.1/- per month.Assurance Benefit :The benefit provided under the Employees' Deposit Linked Insurance Scheme is called AssuranceBenefit. On the death of the member while in service, the nominee or any other person entitled toreceive the Provident Fund benefits will, in addition to the Provident Fund, receive the AssuranceBenefit under Employees' Deposit Linked Insurance Scheme .Scale of Assurance Benefit :From 1-4-93 onwards the amount of Assurance Benefit payable is an amount equal to the averagebalance in the amount of deceased in the Fund during the preceding 12 months or during the period of his membership whichever is less, except where the average balance exceeds Rs. 25,000/amount payable shall be Rs. 25,000/- plus 25% of the amount in excess of Rs.25,000/- subject to aceiling of Rs. 35,000/-. The Form prescribed for claiming the Assurance Benefits under the Employees' Deposit Linked Insurance Scheme, 1976 , is Form 5(IF).* Now the amount of benefits has been increased to Rs.100,000/-3

SCUF—News Letter—Breeze— December, 2012“ Navfest “ held at Santhome, ( Chennai ) Office on 19th Oct. 2012A few more snaps for your eyes.4

SCUF—News Letter—Breeze— December, 2012Message from TED5

SCUF—News Letter—Breeze— December, 2012GREETINGS6

SCUF—News Letter—Breeze— December, 2012Best Wishes from Breeze to the little one of SCUFian.Selvan TD.HiteshKumar son of SriJ.ThirumuruganBranch Accounts,Santhome Office.2nd Prize in FancyDress competition.Bring OutTheHidden TalentsofYour Kids.Editorial CommitteeShri K.SubramaniamSenior Consultant, HO.Smt M.SubhashreeTED., Santhome OfficeSri M.RadhakrishnanConsultant, Santhome OfficeThe articles,photos are verygood.Kiran GGSenior Executive,Accounts .AP.Sat 08-12-2012kiran.gg@shriramcity.inFrom Editorial Desk:Communication Address:Editorial Committee,(News Letter—Breeze)SCUF, Santhome Office,Chennai—600 004Phone: 43925300Email:efchennai@shriramcity.inOur members of staffarerequestedtocontribute to our NewsLetter“Breeze” byw ayofarticles,photos, art work doneby them, tips, messg.on special events attheir work place, andsuch other matter ofinterestforpublication.Mailyourviews, i@shriramcity.inOur News Letter“Breeze”can be accessed inthefollowing URL:http://27.251.33.2327

Employees' Provident Fund & MP Act, 1952. The benefit under the Scheme is so devised that it acts as an incentive to the members to save more in their Provident Fund Account. As the name of the Scheme says, the benefit is linked to the amount of accumulation in the Provident Fund Account of the member. Applicability :