Transcription

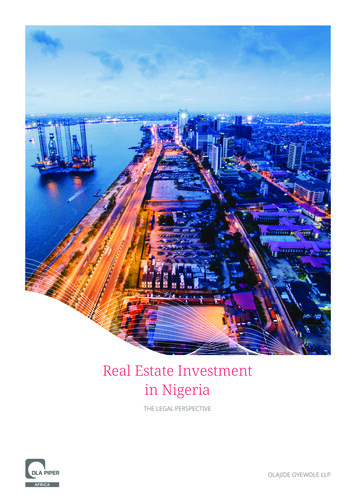

Real Estate Investmentin NigeriaTHE LEGAL PERSPECTIVEOLAJIDE OYEWOLE LLP

INVESTMENT GUIDE FOR NIGERIA2

WWW.DLAPIPER.COM/AFRICAIntroductionThe Nigerian real estate market hasin Lagos State, the Dangote Oil Refinery,remained one of the key contributors toit is anticipated that new large-scalethe Nigerian economy in terms of grossinvestments will be observed in thedomestic product (GDP) over the years.country. Nigeria is without doubt anIn recent times, the real estate marketattractive investment destination.has benefited from government policytargeted at diversifying the economy fromWhile the real estate sector is primarilythe oil sector to the non-oil sector, whichdriven by private sector investment,has resulted in significant infrastructuregovernment policy-making impacts thespending by the government.real estate market. Nigeria has a federalThe Nigerian government has also takenconstitution governing the entire countrya strong stance on the ease of doingand in which lands and real property rightsbusiness and has devoted considerableof the state and individuals are placedresources towards making the countryunder the Concurrent List. This meansattractive to investors, with a committee –that the federal government can makethe Presidential Council on Ease of Doinglaws that apply to the entire country; andBusiness – established and headed by thethe state government can make lawsvice president. Real property investment isand ancillary legislations governing theirone of the avenues being streamlined byrespective states, which are subsidiary tothe ease of doing business committee.federal statute.The real estate sector in Nigeria hasThis document aims to provide a guide togrown particularly in states of thethe key legislations and policies in NigeriaFederation that are experiencing highthat impact on real estate investment.rates of urbanization such as LagosHowever, the guide is not exhaustiveand the Federal Capital Territory, Abuja.and our DLA Piper Africa member firmCurrent trends in the market show anin Nigeria will be delighted to assistincreased demand for high-end realinvestors considering investment in theestate in prime locations. The demand forNigerian real estate market.high-end developments cuts across theresidential and commercial real estatemarket, with projects such as the EkoAtlantic City, a new coastal city in LagosState, setting the pace. The averageasking rent for A-grade and prime gradecommercial spaces in Lagos range fromUSD750–1,000/m²/annum; comparablewith rates seen in more developedmarkets. On the residential front, luxuryapartments are sold in the region ofUSD3,750-7,000/m². With the completionof the world’s largest single line refinery3

INVESTMENT GUIDE FOR NIGERIAContents1. OWNERSHIP OF REAL ESTATE 051.1 Freehold ownership 056.4 Operating expenses 126.5 Maintenance repair, andrenovation at the end of the lease 121.2 Leasehold ownership 056.6 Assignment/transfers 121.3 Restrictions on foreign investment 056.7 Termination 122. ACQUISITION OF REAL ESTATE 066.8 Sale of leased property 132.1 Formal requirements 067. TAX 142.2 Asset deals 067.1 Transfer taxes 142.3 Share deals 077.2 Value added tax 143. OTHER RIGHTS TO PROPERTY 087.3 Other real estate taxes 153.1 Mortgages and charges 087.4 Taxation on rental income 153.2 Easements 087.5 Taxation on dividends from3.3 Pre-emption rights 08a company owning real estate 154. ZONING AND PLANNING LAW 097.6 Taxation of capital gains 155. ENVIRONMENTAL LAW 107.7 Real estate investment trusts 156. LEASES 118. REAL ESTATE FINANCE 16Types of leases 118.1 Assets held as security 176.1 Duration 118.2 Further collateral agreements 176.2 Rent 8.3 Taxation on the creation of security 18116.3 Rent review 114CONTACTS 19

WWW.DLAPIPER.COM/AFRICA1. Ownership of real estate1.1 Freehold ownershipPrivate ownership of land isAny revocation for public purposeWith the introduction of therecognized in the form of acan only be carried out upon dueLand Use Act 1978, whichleasehold which is subject to thenotice and fair compensation paid.regulates the incidence ofrights of the state government toownership of property, freeholda reversion of the interests, afterImportantly, the Land Use Actinterest (absolute ownership) inthe term granted to the ownerprohibits alienation or transferNigeria was abolished. The Acthas expired. Such leaseholdsof any interest in land withoutvests powers of control andare usually granted for a term ofobtaining the consent of theadministration of all land within a99 years, and are continuouslygovernor of the state wherestate on the governor of the staterenewable on expiry, subject to thethe land is located. Therefore,who grants interests to individualsfulfilment of conditions of grantsthe governor’s consent must beand corporate entities to hold andand renewal imposed by the state.sought and obtained before ause subject to the conditions ofvalid legal transfer of interest inthe grant. The interest is knownThe right of occupancy is grantedas a right of occupancy and isby the state and usually subjecttypically for a term not exceedingto certain express conditions,99 years. The Land Use Actranging from the term of years,1.3 Restrictions onforeign investmentprovides that title to land may alsopayment of an annual rental,Under Nigerian law, foreigners arebe held by the federal governmentpayment of a premium, purpose ofgenerally not allowed to directlyor any of its agencies.use, nature of development, andown real estate assets. By therevocation for non-compliance. Itprovisions of the Acquisition ofis noteworthy that a Certificate ofLands by Aliens Law of LagosOccupancy typically prescribes astate, a non-Nigerian may acquireThe Land Use Act vests in thetwo-year period within which landreal estate from a Nigerian citizengovernor of a state, the ownershipis to be developed and restrictsonly with a prior approval of theof all land in the state, to holdthe transfer of interest until aftergovernor. However, no specificin trust and administer for thethe expiration of ten years fromregulations are in force withuse and common benefit of allthe date of issuance. The intentionregards to the enforcement ofNigerians in accordance with theis to encourage land use andthese provisions.provisions of the Act. Therefore,discourage speculation.1.2 Leaseholdownershipthe nature of interest in propertyproperty may be effected.Notwithstanding this, thewhich can be acquired under theThe governor of a state may revokerestriction does not apply to aLand Use Act is a statutory righta statutory right of occupancy onNigerian registered companyof occupancy (leasehold) for athe grounds of breach of any ofwholly owned by foreigners.term not exceeding 99 years andthe express or implied conditionsTherefore, a non-Nigerian maythis is evidenced by the issuancewhich a Certificate of Occupancyinvest in real estate in Nigeria byof a Certificate of Occupancyis deemed to contain or where thethe acquisition of such propertyby the state government, andland is required for public purposethrough a corporate vehicle dulythe acquirer holds a Right ofor overriding public interest.incorporated in Nigeria.Occupancy.5

INVESTMENT GUIDE FOR NIGERIA2. Acquisition of real estate21. Formalrequirementsland in rural areas. Transactionsfor processing of governor’s consent,for transfer of real estate interestspayment of the assessed fees/taxesThe preliminary and fundamentalbetween individuals or corporateand obtaining governor’s consent tostep in any transaction forentities necessarily requires thethe transfer of title transaction, andacquisition of real estate involvespreparation of transfer of titleformal registration of the interestcarrying out a proper due diligencedeeds which are not limited to theacquired in the Register of Deedson the title of the vendor. At thisfollowing: (i) Sale and Purchasemaintained at the Lands Registrystage, engaging experiencedAgreement, (ii) Deed of Assignment,Office of the relevant state.professionals for advice and(iii) Lease/Sublease Agreement andguidance is highly recommended(iv) Power of Attorney (optional).to avoid the usual pitfalls withacquisition of real estate interests.The grant of governor’s consent andfinal registration of a real estate titleThe parties to the transferis subject to the payment of officialtransaction are also required tofees and/or applicable property taxesIt is important that the scope ofcomplete and sign the relevantsuch as consent and registrationthe due diligence clarifies issuesapplication forms for consent of thefees, capital gains tax, stamp dutysuch as the nature of the title andgovernor to transfer the interests inand other sundry fees. The ratesinterests in the property, status andthe real property.of assessment for the fees payablecapacity of the vendor to sell, thefor grant of governor’s consentland use designation and zoningGOVERNOR’S CONSENTand registration differ across thepurpose, existence of third-partyUnder the Land Use Act 1978,various states in Nigeria. In practice,adverse claims/interests or litigation,the consent of the governor ofit is after completion of the transferthe unexpired term of years,the state where a real estate assettransaction between the parties thatsurvey and size of the property andis located must be obtained for agovernor’s consent is processedconfirmation as to whether or nottransfer of the interests in the realtogether with the registration ofthe property is under governmentestate asset to be valid.the deed of transfer. Usually, it isacquisition. Other due diligencethe purchaser that is responsible forinvestigations such as structuralREGISTRATIONensuring that all required costs andand environmental surveys mayRegistration of title is the process oftaxes for consent and registration ofalso be conducted by appropriateregistering the holder of intereststhe interests are paid.professionals.in real estate as legal owner to the2.2 Asset dealsexclusion of any other person. ByIn Lagos state, the official feesthe provisions of the relevant states’payable for grant of consent andAcquisition of real estate interestsLand Instrument Registration Law,registration of title with respect toand registration of the intereststhere is a general requirement thattransactions involving individualsacquired requires certaininstruments relating to transfer ofis 3% of the assessed fair marketdocumentation. By law, transactionsinterests in land must be registered.value of the property representingfor the transfer of title and interestsHowever, it is important to note thatConsent fees (1.5%), registrationin real property for a term abovean unregistered title deed is notfees (0.5%), stamp duties (0.5%) andthree years are required to be ininvalid but is inadmissible in courtcapital gains tax (0.5%) respectively.writing and by deed duly executedas proof of title. The importance ofThe other applicable charges areby the parties.registration is that it gives priorityneighborhood improvement charge,and it is an indication that thebusiness premises charge (atproperty is encumbered.nominal fees) and ground rent orWhere land is acquired directly fromthe government, a Certificate ofland use charge.Occupancy is issued evidencing theThe registration process involvestitle. A statutory Right of Occupancysubmitting an application togetherFor transactions involving corporateis granted in the case of land inwith the transfer of title deeds andentities, the applicable capital gainsurban areas while a customary rightother ancillary documents at thetax and stamp duties are payable toof occupancy is usually granted forLands Bureau of the relevant statethe Federal Inland Revenue Service6

WWW.DLAPIPER.COM/AFRICA(FIRS). The rate under the CapitalSale and Purchase Agreement.In addition to conducting dueGains Tax Act is 10% of the gainsThereafter, statutory returns willdiligence investigations in respectfrom the sales. The FIRS stampbe filed at the Corporate Affairsof the underlying assets, it isduty rate is 1.5% of the value of theCommission and the company’sadvisable to conduct due diligenceproperty.register of members updated toon the target company to ascertainreflect the changes in the ownershipthe tax liabilities of the company,The parties to the transactionstructure and shareholding of theencumbrances on the shares orare also required to settle theiracquired entity.assets and other potential liabilities.the relevant state government forIn Nigeria, the sale and purchaseThe parties are free to negotiatecompletion of the process.or transfer of shares in a companythe terms of the Share Sale andis not subject to tax, irrespective ofPurchase Agreement; and agreethe value of the real estate assetsupon matters such as warrantiesInvestment in real estate may alsothe company may have. The shareand liabilities for defects. Uponbe effected through the acquisitionacquisition structure is therefore ancompletion of the sale, it will beof a corporate entity that owns realattractive option for investors. Whilenecessary to file with the Corporateestate assets. In such a case thethe transfer of stocks and sharesAffairs Commission the necessaryresolution of the members of theare exempt from the paymentreturns in accordance with thecompany is necessary for the sale.of taxes, in practice, a nominalprovisions of the law.Further, the parties will be requiredstamp duty of NGN500 is payableto execute a Share Transfer Formas stamping costs for the shareand, where necessary, a Sharetransfer agreement.respective income tax obligations to2.3 Share deals7

INVESTMENT GUIDE FOR NIGERIA3. Other rights to property3.1 Mortgages andchargesThe fees payable for processingNotwithstanding, a right ofgovernor’s consent and registrationeasement may also be implied orA mortgage refers to the legal orof mortgage deeds are not thepresumed in certain instances,equitable conveyance of interests insame across the states in Nigeria.such as on the grounds of necessityproperty as security for a debt, uponThe applicable fees and the rateswhere the property will bethe express or implied conditionin Lagos state are consent fees atinaccessible without the easement;that the interests in the property0.25%, registration fees at 0.5%where it was the intention of thewill be re-conveyed to the debtorand stamp duties payable to FIRSparties at the time of conveyance;following the discharge/settlementat 0.375% respectively. There isand where the dominant owner hasof the debt. It does not requirealso a requirement for registrationused the servient land over a perioddelivery of possession.of the mortgage transaction at theof time.Corporate Affairs Commission.A legal mortgage involves an actual3.3 Pre-emption rightstransfer of legal interest from a3.2 Easementsmortgagor to a mortgagee, subjectThe right of easement is a non-right to acquire property beforeonly to reversionary rights in thepossessory right attached to landit may be offered to a third party.asset where payment obligationswhich allows the owner of that landUnder Nigerian law, parties retainare settled. The equitable mortgage(the dominant owner) to either usethe right to agree to the commercialon the other hand may take thea neighboring land belonging toterms of an agreement, thus a pre-form of an agreement to create aanother (the servient owner) in aemption right may be negotiatedlegal mortgage by a deposit of titleparticular manner or to restrict itsas one of the terms of a contract.deeds without an actual transferuse by that other person. A right toTypically, the option is containedof legal interest to the mortgageeeasement is usually not exclusivein a long lease and grants thefor the period for which repaymentas it does not confer a proprietarylessee the option of first refusal toobligations remain outstanding.right. Any person claiming a rightpurchase the property in the eventof easement must show that thethe lessor intends to sell.An equitable charge connoteseasement had its origin either inan appropriation of interest ingrant or statutory provision.real property giving the chargeeA pre-emption right is a contractualIn the case of direct acquisitionof interests in land from the statethe rights to enforce the securityAn easement by grant may beevidenced by a Certificate ofwithout an actual transfer of legalacquired through the express wordsOccupancy, it is a usual term of theinterest in such an asset.in the conveyance of the legalgrant that the holder of the right ofestate to the owner of the dominantoccupancy shall not transfer sameIt is important to note thatland. An express grant may also bewithin the first ten years of the grantgenerally, a mortgage involves amade without the conveyance ofand shall be obligated to first offertransfer of interests in land whichlegal estate, for example where athe property to the governor in theby law requires the consent ofright of way is granted in exchangeevent of a sale. In Lagos state, thethe governor and registration infor consideration. The grant of apractice is that upon the sale ofaccordance with the provisions oflegal easement must be by deed,property within the ten–year periodthe relevant state’s laws regulatingotherwise the right of easement willof the state grant, an additionalregistration of land instruments.only be equitable.consent fee (about 1.5 % of thevalue of the property) will apply atregistration of the transfer.8

WWW.DLAPIPER.COM/AFRICA4. Zoning and planning lawZoning and planning in Nigeria island use and zoning for the areapurposes. It is also commonplaceregulated by specific legislationswhere the property is located andfor residential estates to seek toand the various states in Nigeriathe permissible use.impose restrictions on the design ofhave enacted their own Physicalbuildings.Planning Laws to suit the peculiarPrior to the commencement ofcircumstances. The respectiveconstruction works, the approvalThe Building Control Department orstates’ town planning authoritiesof the relevant planning authorityAgency of the respective states arethat administer the zoning andis required for all buildingresponsible for enforcing the lawsplanning legislations are alsodevelopments, alterations andand regulations on land use andcharged with the responsibilityrenovations; and the conditions forzoning. The relevant authority willof initiation, formulation andthe grant of development permitissue enforcement notices againstimplementation of physical planningmust conform with the conditions ofthe owner of any developmentand urban development policiesuse stated in the title document orcommenced without obtainingand programmes that supplementgrant of right of occupancy for therequisite planning approval and forexisting legislation.land in question.other cases of contravention suchThe Land Use Act also plays aThe permissible use of thewhere the building constitutes asignificant role in physical planningland, location and nature of thedanger to occupiers or the public.and zoning within the country asproposed building developmentcertain specific provisions of thewill determine the necessaryContravention of physical planningLand Use Act relating to zoningpermits to be obtained as there areregulations may result in therules must also be complied with.restrictions that apply to the use ofdemolition of the building atproperty in accordance with zoningcosts to be paid by the owner orIt is prudent for a potential investorlaws. Generally, the Certificate offorfeiture to the property. Criminalin real estate to apply to the relevantOccupancy prescribes the purposeprosecution is also prescribed forstate’s physical and town planningof use which are usually fora contravention of the provisionsauthorities for planning informationresidential, commercial, recreational,of physical planning laws andon the property to ascertain thetourism, industrial or mixed–useregulations.as unauthorized change of use or(residential and commercial)9

INVESTMENT GUIDE FOR NIGERIA5. Environmental lawNigeria is committed to a National(Construction Sector) RegulationsGenerally, the polluters paysEnvironment Policy that is aimed atseeks to regulate and minimizeprinciple, which implies that theensuring sustainable developmentenvironmental hazards suchpolluter should bear the cost ofon the basis of proper managementas pollution from construction,preventing and controlling pollution,of the environment. The Nigeriandecommissioning and demolitionis applicable. Therefore, the ownergovernment has therefore publishedactivities. Also, the Nationalor tenant/occupier of a propertyvarious statutes which set out theBuilding Code makes provisions foris directly responsible for theliability for environmental pollutionenvironmental issues relating toenvironmental sanitation of theirand procedure for enforcing publicbuilding construction.premises. The federal and statepolicy on environmental protectionand sustainability.laws impose liability for causingThe law requires that anpollution or contamination andEnvironmental Impact Assessmentimpose liability for non-complianceThe various states have specific(EIA) is carried out by professionalsby owners of buildings. The buyerenvironmental laws mirroringand a report issued and filed withor owner of real estate has athe federal legislation with slightthe relevant town planning andresponsibility to comply with allmodifications. The environmentalbuilding control agency of theenvironmental laws and regulationslegislations in Nigeria include thestate. An EIA refers to the processaffecting its property, but will notEnvironmental Impact Assessmentof gathering information about thebe liable for any offence whereAct, the National Environmentalpotential impacts of a proposedthe pollution or contamination byStandards and Regulationsdevelopment on the environmentthe property is caused by a thirdEnforcement Agency Act 2007and using the information toparty’s action if the owner is not(NESREA Act) and the Harmful Wastedecide whether to proceed. Thisa contributor. A purchaser who(Special Criminal Provisions, etc.) Act.is to ensure that the potentialdiscovers any form of environmentalenvironmental hazards posed bycontravention by the previousThe National Environmentala proposed building developmentowner will not be held liable forStandards and Regulationsare identified prior to constructionthe pollution. The purchaser isEnforcement Agency (NESREA)and adequate mitigation actionshowever obligated to immediatelyhas also developed a numberare put in place. The nature oftake appropriate steps to stop theof environmental regulationsthe building construction orcontravention if it is of a continuingtargeted at particular areas ofdevelopment determines whethernature, otherwise they will be asconcern and published in thethe environment assessment reportguilty as the principal party whoFederal Government Gazettes.is required.committed the environmentalMore specific to the constructionsector, the National Environmental10infraction.

WWW.DLAPIPER.COM/AFRICA6. LeasesTypes of leasesIf the parties’ agreement specifiesand that it is also unlawful for a newLeases may be classified inthe mode of notice to determinetenant to pay advance rent in excessaccordance with their purpose orthe lease, it must be compliedof one year.tenure (length of the term granted).with, otherwise, the lessor mustWith respect to purpose of use ofstrictly adhere to the provisions ofThe rent for long-term commercialproperty, leases may be categorizedthe law to serve on the lessee, allleases do not have to remain theas residential, commercial ormandatory notices to determine thesame for the entire term providedindustrial lease.lease (Notice to Quit and Notice ofthe parties agree in the leaseIntention to Recover Possession)agreement for a rent review clause.and seek an order of the court toWhere the lessor fails to negotiateThe parties to a lease agreement arerecover possession and evict theand insert in the lease agreementat liberty to negotiate and agree tolessee from the property.a condition that the reserved6.1 Durationthe commercial terms of the lease.rental can be reviewed withinAs long as the term of years underA lessee holding over possessionspecified periods, the lessor cannotthe head-lease is not exceeded,after the expiration of its lease isunilaterally alter the agreementa lessor may grant to the lessee theregarded as a statutory tenant andand demand a rent review withoutentire unexpired term of the leasecannot be evicted except by laidnegotiating with the lessee andheld under its title or may grant adown procedures which mandatorilyobtaining their consent. It is notlesser term, thereby retaining a rightare to be strictly complied withsufficient that the applicableof reversion subject to terms andby the lessor. The failure to issuecommercial rates for similarcovenants agreed by the partiesthe appropriate notices rendersproperties in the location of thesuch as the option of renewal of theany action taken to recoverproperty differs from the rent paidlease for a further term.possession of the property from theby the lessee.lessee invalid.In state allocations or direct grants of6.3 Rent reviewproprietary interests by government,6.2 Rentit is the discretion of the state asRent is the consideration for theto contract and specify the rentgrantor to give any term of years,grant of the lease by the lessor toapplicable to the lease from yeartypically not exceeding 99 years.the lessee. Generally, it is negotiatedto year and also agree on rentand agreed upon by the parties,escalation rates and a reviewWhere the lessor has no intentionand in most cases the parties aremechanism for the rent.of renewing the lease, subject toguided by the applicable marketthe agreement of the parties, arental value of the property. There isCommercial leases for shorternotice is to be issued to the lesseeno specific statute that regulates theterms typically have provisionsbefore the expiry of the leasesum to be paid as rent. Rent mayfor rent review where on expiry,affirming the lessor’s intention notbe paid in advance or in arrears. Inthe lessee exercises an optionto renew the lease.Nigeria, the common practice is thatto renew the lease for a furtherrent is usually demanded and paidperiod. Furthermore, the lessor inA lessee of real property underin advance before the lessor grantsa lease that is expiring is at libertyany category, whether residentialpossession of the premises to theto negotiate new rent rates as aor commercial, is protected underlessee and executes the Leasecondition to renew the lease.the law to hold over possessionAgreement.even after expiration of the lease.The parties to a lease are at libertyFor leases directly granted by theThe lessor does not have anHowever, the Lagos State Tenancystate pursuant to the Land Use Act,automatic right to re-enter orLaw, 2011 provides that it isthe governor may revise the rent atrecover possession of the propertyunlawful for a lessor to demand orsuch intervals as stipulated in theeven if the parties inserted in thereceive advance payment of rentCertificate of Occupancy, otherwise,contract a provision for re-entry intofrom a sitting tenant in excess ofat such reasonable intervals withinthe property by the lessor, upon thesix months for a monthly tenantthe term of the grant.expiry of the lease.and one year for a yearly tenant;11

INVESTMENT GUIDE FOR NIGERIAIn determining the increase in rent,and sewerage disposal and otherthe property to the condition inthe lessor and the lessee may applyancillary services to the lessees ofwhich it was at the commencementany rate, percentage incrementthe development who are requireddate, fair wear and tear excepted.on the base rent for the precedingto pay a service charge along withperiod, or a specific amount alreadythe rent.6.6 Assignment/transfersagreement to be applicable uponUsually the lessor has an obligationSubject to the terms of therenewal. The parties may also agreeto insure the property againstagreement between the parties,to use the central bank inflationarydamages covered by unforeseena lessee can transfer its right andindex or the market rental value forissues like fire, natural disasters andinterests in the property to a thirdsimilar properties in the location.other such events which may occur.party. It is commonplace for leaseThe lessor’s insurance, however,agreements to restrict the right ofIt is usual for parties to indicate indoes not have to extend to damagesthe lessee to assign or otherwisethe lease agreement that the rentto the lessee’s possessions andtransfer the interest in the propertyshall be mutually agreed based onother fittings within the propertyby imposing an obligation on themarket rates and further specifyand for which the lessee has anlessee not to transfer the intereststhat in the event of a disagreementobligation to insure. In a propertyor cede possession of the propertyon the rent, a professional qualifiedcomprising multiple apartments orto any person without the writtenas an estate surveyor/valuer oroffice spaces with several occupiersconsent of the lessor and onlyany other qualified person may beas lessees, the lessor may undertakeupon the fulfilment of any conditionagreed to advise on the rate of thethis obligation to insure the propertyagreed for the transfer of theincrease of the rent.(except the lessee’s personallease interests.mutually agreed in the leaseproperty) and recover the costs ofIt is noteworthy that the Tenancythe insurance premium from all the6.7 TerminationLaw of Lagos state prescribeslessees, proportionally.The parties reserve the rightthat any increase in rent must beto terminate a lease where thethe increase in rent payable under6.5 Maintenancerepair, and renovationat the end of the leasean agreement is unreasonable. InGenerally, the lessor is responsiblewith the legal prerequisite ofdetermining whether an increasefor all external and structural repairsissuance of appropriate notices.in rent is unreas

INVESTMENT GUIDE FOR NIGERIA Contents 1. OWNERSHIP OF REAL ESTATE 05 1.1 Freehold ownership 05 1.2 Leasehold ownership 05 1.3 Restrictions on foreign investment 05 2. ACQUISITION OF REAL ESTATE 06 2.1 Formal requirements 06 2.2 Asset deals 06 2.3 Share deals 07 3. OTHER