Transcription

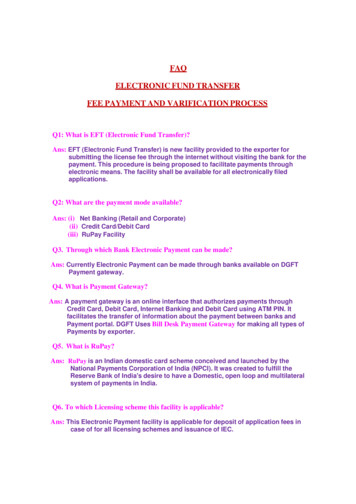

FAQELECTRONIC FUND TRANSFERFEE PAYMENT AND VARIFICATION PROCESSQ1: What is EFT (Electronic Fund Transfer)?Ans: EFT (Electronic Fund Transfer) is new facility provided to the exporter forsubmitting the license fee through the internet without visiting the bank for thepayment. This procedure is being proposed to facilitate payments throughelectronic means. The facility shall be available for all electronically filedapplications.Q2: What are the payment mode available?Ans: (i) Net Banking (Retail and Corporate)(ii) Credit Card/Debit Card(iii) RuPay FacilityQ3. Through which Bank Electronic Payment can be made?Ans: Currently Electronic Payment can be made through banks available on DGFTPayment gateway.Q4. What is Payment Gateway?Ans: A payment gateway is an online interface that authorizes payments throughCredit Card, Debit Card, Internet Banking and Debit Card using ATM PIN. Itfacilitates the transfer of information about the payment between banks andPayment portal. DGFT Uses Bill Desk Payment Gateway for making all types ofPayments by exporter.Q5. What is RuPay?Ans: RuPay is an Indian domestic card scheme conceived and launched by theNational Payments Corporation of India (NPCI). It was created to fulfill theReserve Bank of India's desire to have a Domestic, open loop and multilateralsystem of payments in India.Q6. To which Licensing scheme this facility is applicable?Ans: This Electronic Payment facility is applicable for deposit of application fees incase of for all licensing schemes and issuance of IEC.

Q7. What are the requirements for making Electronic Payment?Ans: (i) An exporter having valid Importer Exporter Code (IEC) have an InternetBanking account from any of the Banks listed in Appendix-1.(ii) They need to have a Debit / Credit Card / RuPay to make payment.Q8. How to make Electronic Payment?Ans: Please Click Here to view Steps for making Payment through Payment Gateway.Q9. What will happen to the transaction if after entering transaction password“The page cannot be displayed” message comes ?OrIf the payment was successful but before the exporter returns to DGFT return webpage the Internet connection breaks ?OrThough the transaction with Bank shows successful transaction but DGFT server doesnot show any status for the same ?Ans: To verify if these kind of error messages comes, the exporter can doverification of the payment.Q10.What are the benefits of making Payment through Electronic Fund Transfer?Ans: Licence Fee can be submitted simultaneously while filing the E-Com applicationwithout visiting the Bank. It will also reduce the time required to make thepayment as compared to manual mode like DD etc.Q11.Whether fee needs to be paid while applying for issuance of scrips on or after01.04.2015 for goods exported or services rendered before the date of notificationof new FTP 2015-2020, i.e, 31.03.2015 ?Ans: Yes

Q12. How much fee is to be paid for application for duty credit scrip underrewards/incentive scheme ?Ans: Rs.1,000/- (Rupees one thousand only) is to be deposited towards fee forapplication for duty credit scrip under rewards/incentive scheme. The details aregiven in Appendix 2K of the FTP 2015-2020.Q13. As per provision contained in para 3.14 of the FTP 2015-2020, scrip applied/issuedon or after notification of this policy against exports made upto the date of notificationof new policy, i.e., FTP 2015-20, the then prevailing policy and procedure regardingeligibility, entitlement, transferability, usage of scrip and any other condition in force atthe time of export of goods or rendering of the services shall be applicable to such scrips.Then why the fee of Rs.1,000/- is required to be paid while applying for issuing of scripson or after 01.04.2015 for goods exported or services rendered before the date ofnotification of new FTP 2015-2020, i.e, 31.03.2015 ?Ans: The fee is charged for processing of application as per the provisions containedin the new FTP 2015-20.Q14. What is the procedure for depositing fee for issuance of scrips on or after 01.04.2015for goods exported or services rendered before the date of notification of new FTP2015‐2020, i.e, 31.03.2015 ?Ans: The detailed procedure for depositing fee is available in Appendix 2-K of theFTP 2015- 2020 which is available on the Directorate General of Foreign Tradewebsite, i.e., www.dgft.gov.inQ15. How to get the refund of fee ?Ans: If acknowledgement receipt is generated than no refund can be processed throughBilldesk / Banks. For taking such refunds applicant has to apply to DGFT inAppendix 2K of Appendices and AayatNiryat Forms notified as per FTP (200152020).

Q16. In what cases refund of fee is applicable ?Ans: The fee once received will not be refunded except in the following circumstancesviz.,a) Where the fee has been deposited in excess of the specified amount of fee;orb) Where fee has been deposited but no application has been made; orc) Where the fee has been deposited in error but the applicant is exempt frompayment of fee.Processing of refund of fee submitted through net banking shall be through anapplication in hard copy as per form given in appendix 6-B. This may be submittedto the licensing authority against whom the e-com number has been generated.On receipt of application the licensing authority shall pass refund after they haveverified from the Pay and Accounts Office, Ministry of Commerce & Industry, NewDelhi that the amount was credited to the Government of India.No claim for refund of application fee shall be entertained by the licensing authorityafter expiry of one year from the date of payment to the concerned bank. However,on merits, for reasons to be recorded in writing, the licensing authority maycondone the delay but in no case shall an application for refund of fees beentertained after the expiry of three years with regard to the date as mentionedabove.Refund Order of fees will be valid for three months from the date of issue. Requestfor revalidating the same may be considered on merits by the authority whichissued the Refund Order.Please refer to the Appendix 2K of Appendices and AayatNiryat Forms notified asper FTP (20015-2020) to know the provision of refund ofapplication fee.

STEPS FOR MAKING PAYMENTFollowing are the steps for making payment (For IEC Schemes):(a):Applicant should select ‘Pay Online’ button from the Licensing scheme menu. To payfee for issuance of IEC, click on the ‘Application Fee’option.Following screen appears tomake the Payment:(SCR: 1)Initial Payment Screen will display the following information:(i)For making fee payment for licensing scheme, this display IEC.(ii) IEC: In case of application is for IEC, this option display ‘PAN’ of Applicant.(iii)Actual Fee:Fee amount to be paid by applicant.(iv) Total No. of successful transactions and total amount already paid by the exporter.(v) Pay Balance Fee: Amount to be paid by the applicant.(b): If Applicant make his first Payment then system generate this screen on PaymentInitiation Screen:(SCR: 2)

(c): If Applicant done any successful transactions previously then this screen displays allthe successfultransactions and total amount already paid by him to date:(SCR: 3)(d): If Applicant already paid the requisite fee and try to make fresh payment, thenMessage “TOTAL AMT ALREADY PAID(Rs)” display on the screen for making freshpayment. After click on Submit button Alert Message will appear on the screen“Please Check, You are making excess payment !”. The system will not allowed toproceed further.(SCR: 4)(e):After Pressing SUBMIT button in Payment Initiation Screen system will displayPayment Confirmation Screen as shown below:

(SCR: 5)Press “PROCEED” button. If the details is not proper or exporter want to change thedetails, press “Back” button.(f): After pressing Proceed button in Payment Confirmation Screen system will displaynext payment interface which allow an exporter to make payment using followingoptions:(i): Pay by using Credit Card: By using Credit Card option applicant fill all the detailsLike Credit Card Number, Expiration Date, CVC/CVV Number and Card HolderName.(SCR: 6)After Pressing “Make Payment” button the system will ask following details:

(SCR: 7)(i)(ii)(iii)Destination to send OTP.You will receive OTP from your bank on your registered mobile number.Input the OTP as shown below.(SCR: 8)Applicant enter his one time password and press submit button. The paymentstatus of the transaction will be shown below screens:In case of Successful Transaction:

(SCR: 9)In case of UnSuccessful Transaction:(SCR: 10)(ii): Pay by using Debit Card: By using Debit Card option Applicant fill all the detailsLike Pay by ATM-cum-Debit Card, Pay by using VISA/Master Card, Pay by usingRuPay Facility.(SCR: 11)

For Eg. Pay by VISA/MASTERCard/Maestro, Fill all the details about your DebitCard and press “Make Payment” button.(SCR: 12)In the next screen enter your secure One Time Password (Applicant try to resendyour secure OTP) as shown below figure:(SCR: 13)Applicant enter his one time password and press submit button. The paymentstatus of the transaction will be shown below screens:

In case of Successful Transaction:(SCR: 14)In case of UnSuccessful Transaction:(SCR: 15)Note (Ex for Debit Card Option): If Applicant press CANCEL link (marked as redcolor) in Payment Screen then Transaction will be aborted as shown in SCR: 12.(SCR:16)

When Abort Transaction Screen was displayed then Applicant can either press AbortTransaction for cancel his transaction process (marked as black color) by choosing anyoption for feedbackButton process or he press Continue Transaction link for continuehis transaction (marked as red color ) in below screen :(SCR: 17)(iii): Pay by using Debit Card plus ATM PIN: By using Debit Card ATM PIN selectbank name as displayed in below screen:(SCR: 18)

Press “Make Payment” button, system will redirect to next screen as shownbelow:(SCR: 19)After entering payment details, Applicant will receive the payment status oftransaction as like below screen:In case of Successful Transaction:(SCR: 20)In case of UnSuccessful Transaction:

(SCR: 21)(iv): Pay by using Internet Banking: Select Internet Banking option followed by BankName on which you have Net Banking Act like below screen:(SCR: 22)After pressing “Make Payment” button the system redirect to next screen that is InternetBanking Login screen as shown below:(SCR: 23)

After entering correct username and password and press submit button systemgenerate next screen for making payment confirmation as shown below:(SCR: 24)After pressing “Confirm”button Applicant will receive the payment status oftransaction as like below screen:In case of Successful Transaction:(SCR: 25)

In case of UnSuccessful Transaction:(SCR: 26)Please Note That Screens above is only for illustrative purpose. Screen may differdepending upon the Bank/Debit Card/Credit Card selected.Q17. What will happen to the transaction if after entering transaction password "The pagecannot be displayed" message comes?OrIf the payment was successful but before the exporter returns to DGFT return webpage the Internet connection breaks?OrThough the transaction with Bank shows successful transaction but DGFT serverdoes not show any status for the same?Ans: To verify if these kind of error messages comes, the exporter can do verification ofthe payment. Please Click here Steps to Verify the Payment.

STEPS FOR VERIFYING THE PAYMENTFollowing are the Steps to Verify the Payment :(a): Press ‘Verify Pay” option from ECOM application Dialog. In Case of IECclick “Verify Fee” link.(b): If Applicant has not made any payment previously then following messagewill appears:(SCR:27)(c):System will display all the transactions made by Applicant on the sameday as shown below:(SCR:28)(either successful or unsuccessful) as shown below screen:

(SCR: 29)(SCR: 30)Q18. How I came to know that my payment is successfully received or not by DGFT?Ans: After make the payment, DGFT site will display the status of payment successfulor unsuccessful. Use Print button from the Licensing Application Menu to see the detailsof successful or unsuccessful payments.Q19. How I can verify the status of unsuccessful transaction?Ans: Exporter can verify the status of unsuccessful transaction using “Verify Pay” facility.It may be possible that Amt. has been deducted from the exporter account but on DGFTsite it remain unsuccessful.In such cases payment can be verified before 12 PM on thetransaction day.Q20. Can I verify a successful transaction?Ans: No, You can verify only the unsuccessful transaction before 12 PM on the day oftransaction.

Q21. Can I pay full fee by one transaction only?Ans: No, System does not restrict the applicant to make payment only in onetransaction. Exporter can make multiple payment to pay the fee provided total fee paid inmultiple transactions should be equalto the fee to be paid.Q22. Can I make excess payment?Ans: No, System does not allow an Exporter to make excess payment. System displaythe message in screen shot no. 4 and stop exporter to proceed further.Q23. Whether I can submit the application to DGFT RA office without paying therequisite fee?Ans: No.Q24. Fee Amt. has been debited from my account but payment remains unsuccessfulat DGFT site. What to do?Ans: For all unsuccessful payments, amount is to be recredit by the concerned bankafter 4-5 working days of payment reconciliation. Payment reconciliation generally takesplace on the nextworking day.Q25. One payment is unsuccessful for my ECOM application. Can I make anotherpayment for same ECOM application?Ans: You can make fresh payment irrespective of the fact that previous transaction isunsuccessful. However it is advised to verify the unsuccessful payment on the same daybefore 12 PM first.Q26. Can I verify the unsuccessful transaction on the next day?Ans: No, You can verify the unsuccessful transaction before 12 PM on the same day.only.Q27. I made a payment through corporate net banking account. My account is debitedbut DGFT site shows the payment status “unsuccessful”. Even I tried to verifythe payment. What to do?Ans: For all the payments made through corporate net banking account, initial status willbe unsuccessful at DGFT site because DGFT get the initial status pending authorization.Hence in such casesexporters are advised to verify the payment after 3-4 hours from thetime of starting thetransaction. This process of verification can be utilized up to 12 PM onthe same day.

Q28. What are the benefits of making Payment through Electronic Fund Transfer?Ans: License Fee can be submitted simultaneously while filing the E-Com applicationwithout visiting the Bank. It will also reduce the time required to make the payment ascompared to manual mode like DD etc.Q29. How the payment made through electronic means is secure?Ans: Payment can be made only by logging on valid unique ID and password provided tothe exporter by the Bank.The transaction is carried out in secured environment throughBanks gateway specially created for the purpose.Q30. Can the Fee once paid through EFT be refunded?Ans: The fee once received will not be refunded except in the following circumstancesviz.,a)b)c)Where the fee has been deposited in excess of the specified amount offee; orWhere fee has been deposited but no application has been made; orWhere the fee has been deposited in error but the applicant is exempt frompayment of fee.Processing of refund of fee submitted through net banking shall be through anapplication in hard copy as per form given in appendix 6-B. This may be submittedto the licensing authority against whom the e-com number has been generated.On receipt of application the licensing authority shall pass refund after they haveverified from the Pay and Accounts Office, Ministry of Commerce & Industry, NewDelhi that the amount was credited to the Government of India.No claim for refund of application fee shall be entertained by the licensing authorityafter expiry of one year from the date of payment to the concerned bank. However,on merits, for reasons to be recorded in writing, the licensing authority maycondone the delay but in no case shall an application for refund of fees beentertained after the expiry of three years with regard to the date as mentionedabove.Refund Order of fees will be valid for three months from the date of issue. Requestfor revalidating the same may be considered on merits by the authority whichissued the Refund Order.

Q31. How can I open the account with Banks for EFT payments withDGFT?Ans: Eg. For opening account with ICICI Bank for DGFT payments Click Here.Q32. Whether fee needs to be paid while applying for issuance of scrips on or after01.04.2015 for goods exported or services rendered before the date of notificationof new FTP 2015-2020, i.e., 31.03.2015?Ans: YesQ33. How much fee is to be paid for application for duty credit scrip underrewards/incentive scheme?Ans: For these details please refer to Appendix 2K of the FTP 2015-2020.Q34. As per provision contained in para 3.14 of the FTP 2015-2020, scrip applied/issued onor after notification of this policy against exports made upto the date of notification of newpolicy, i.e., FTP 2015-20, the then prevailing policy and procedure regarding eligibility,entitlement, transferability, usage of scrip and any other condition in force at the time ofexport of goods or rendering of the services shall be applicable to such scrips. Then why thefee of Rs.1,000/- is required to be paid while applying for issuing of scrips on or after01.04.2015 for goods exported or services rendered before the date of notification of newFTP 2015-2020, i.e., 31.03.2015?Ans: The fee is charged for processing of application as per the provisions contained inthe new FTP 2015-20 .Q35. What is the procedure for depositing fee for issuance of scrips on or after01.04.2015 for goods exported or services rendered before the date of notificationof new FTP 2015-2020, i.e., 31.03.2015?Ans: The detailed procedure for depositing fee is available in Appendix 2-K of theFTP2015-2020 which is available on the Directorate General ofForeign Trade website,i.e., www.dgft.gov.in .

Appendix-1List of all the Banks For Payment:Allahabad BankAxis BankBank of BarodaBank of MaharashtraCatholic Syrian BankCity Union BankCosmos BankDeutsche BankDhanlaxmi BankHDFC BankIDBI BankIndian Overseas BankING Vysya BankKarnataka Bank LtdKotak BankOriental Bank of CommercePunjab and Sind BankRatnakar Bank LtdShamraoVithal Co-Operative Bank LtdStandard Chartered BankState Bank of HyderabadState Bank of MysoreState Bank of TravancoreTamilnad Mercantile Bank LtdUCO BankAndhra BankBank of Bahrain and KuwaitBank of IndiaCanara BankCentral Bank of IndiaCorporation BankDena BankDevelopment Credit BankFederal BankICICI BankIndian BankIndusInd BankJammu and Kashmir BankKarurVysya BankLakshmi Vilas BankPunjab & Maharashtra Co-op BankPunjab National BankThe Saraswat Co-Operative Bank LtdSouth Indian Bank Ltd.State Bank of Bikaner and JaipurState Bank of IndiaState Bank of PatialaSyndicate BankTNSC BankUnion Bank of India

Payment gateway. Q4. What is Payment Gateway? Ans: A payment gateway is an online interface that authorizes payments through Credit Card, Debit Card, Internet Banking and Debit Card using ATM PIN. It facilitates the transfer of information about the payment between banks and Payment portal. DGFT Uses Bill Desk Payment Gateway for making all .