Transcription

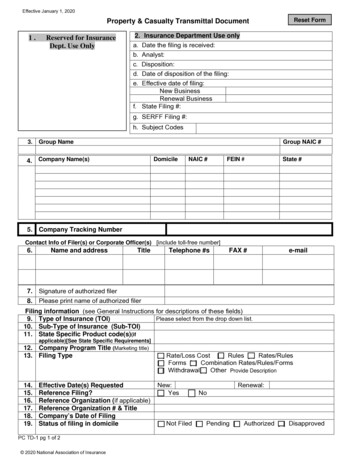

SERFF Tracking #: USAA-130915624State Tracking #:Company Tracking #: PA1721798State:PennsylvaniaFirst Filing Company:TOI/Sub-TOI:04.0 Homeowners/04.0000 Homeowners Sub-TOI CombinationsProduct Name:PA Homeowners Rate RevisionGarrison Property and Casualty InsuranceCompany, .Project Name/Number: PA Homeowners Rate Revision/PA1721798Filing at a GlanceCompanies:Garrison Property and Casualty Insurance CompanyUnited Services Automobile AssociationUSAA Casualty Insurance CompanyUSAA General Indemnity CompanyPA Homeowners Rate RevisionPennsylvania04.0 Homeowners04.0000 Homeowners Sub-TOI oduct Name:State:TOI:Sub-TOI:Filing Type:Date Submitted:SERFF Tr Num:SERFF Status:State Tr Num:State Status:Co Tr Num:Received Review in ProgressPA1721798Effective DateRequested (New):Effective DateRequested (Renewal):Author(s):Reviewer(s):Disposition Date:Disposition Status:Effective Date (New):Effective Date (Renewal):06/01/201708/15/2017Jose Lara, Jenifer Wendell, Melissa CantuXiaofeng Lu (primary), Michael McKenneyState Filing Description:PDF Pipeline for SERFF Tracking Number USAA-130915624 Generated 02/13/2017 01:45 PM

SERFF Tracking #: USAA-130915624State Tracking #:Company Tracking #: PA1721798State:PennsylvaniaFirst Filing Company:TOI/Sub-TOI:04.0 Homeowners/04.0000 Homeowners Sub-TOI CombinationsProduct Name:PA Homeowners Rate RevisionGarrison Property and Casualty InsuranceCompany, .Project Name/Number: PA Homeowners Rate Revision/PA1721798General InformationProject Name: PA Homeowners Rate RevisionProject Number: PA1721798Reference Organization:Reference Title:Filing Status Changed: 02/13/2017State Status Changed: 02/13/2017Created By: Jenifer WendellCorresponding Filing Tracking Number:Status of Filing in Domicile:Domicile Status Comments:Reference Number:Advisory Org. Circular:Deemer Date:Submitted By: Jenifer WendellFiling Description:Based on a review of our latest Homeowner experience, United Services Automobile Association (USAA), USAA-CasualtyInsurance Company (USAA-CIC), USAA-General Indemnity Company (USAA-GIC), and Garrison Property and CasualtyInsurance Company (Garrison) propose revision to Homeowner premium rates with an overall effect of 2.3% to be effective6/01/2017 for new business and 8/15/2017 for renewal business. The proposed changes include base rate revisions for bothOwners and Unit-Owners.The maximum and minimum percentage changes on the rate/rule schedule reflect first renewal capped effects for the member.The attached exhibits support these revisions and are described below.Company and ContactFiling Contact InformationJenifer Wendell, Compliance Advisor9800 Fredericksburg RdA-3-WSan Antonio, TX 78288jenifer.wendell@usaa.com210-332-2020 [Phone]PDF Pipeline for SERFF Tracking Number USAA-130915624 Generated 02/13/2017 01:45 PM

SERFF Tracking #: USAA-130915624State Tracking #:Company Tracking #: PA1721798State:PennsylvaniaFirst Filing Company:TOI/Sub-TOI:04.0 Homeowners/04.0000 Homeowners Sub-TOI CombinationsProduct Name:PA Homeowners Rate RevisionGarrison Property and Casualty InsuranceCompany, .Project Name/Number: PA Homeowners Rate Revision/PA1721798Filing Company InformationGarrison Property and CasualtyInsurance Company9800 Fredericksburg RoadSan Antonio, TX 78284-8496(800) 531-8722 ext. [Phone]CoCode: 21253Group Code: 200Group Name: USAAFEIN Number: 43-1803614State of Domicile: TexasCompany Type: StockState ID Number:United Services AutomobileAssociation9800 Federicksburg RoadSan Antonio, TX 78288(800) 531-8722 ext. [Phone]CoCode: 25941Group Code: 200Group Name: USAAFEIN Number: 74-0959140State of Domicile: TexasCompany Type: ReciprocalState ID Number:USAA Casualty InsuranceCompany9800 Fredericksburg RoadSan Antonio, TX 78288(800) 531-8722 ext. [Phone]CoCode: 25968Group Code: 200Group Name: USAAFEIN Number: 59-3019540State of Domicile: TexasCompany Type: StockState ID Number:USAA General IndemnityCompany9800 Fredericksburg RoadSan Antonio, TX 78288(800) 531-8722 ext. [Phone]CoCode: 18600Group Code: 200Group Name: USAAFEIN Number: 74-1718283State of Domicile: TexasCompany Type: StockState ID Number:Filing FeesFee Required?NoRetaliatory?NoFee Explanation:State Specific*Filing Fee Amount: N/A*Date Filing Fee Mailed: N/A*Filing Fee Check Number: N/A*Filing Fee Check Date: N/A*NAIC Number: 25941, 25968, 18600, 21253PDF Pipeline for SERFF Tracking Number USAA-130915624 Generated 02/13/2017 01:45 PM

SERFF Tracking #:USAA-130915624State Tracking #:Company Tracking #:State:PennsylvaniaTOI/Sub-TOI:04.0 Homeowners/04.0000 Homeowners Sub-TOI CombinationsFirst Filing Company:Product Name:PA Homeowners Rate RevisionProject Name/Number:PA Homeowners Rate Revision/PA1721798PA1721798Garrison Property and Casualty Insurance Company, .Rate InformationRate data applies to filing.Prior ApprovalFiling Method:Rate Change Type:Overall Percentage of Last Rate Revision:Effective Date of Last Rate Revision:Filing Method of Last Filing:Increase1.700%08/15/2016Prior ApprovalCompany Rate InformationOverall %CompanyIndicatedName:Change:Garrison Property and%Casualty InsuranceCompanyUnited Services%Automobile AssociationUSAA Casualty Insurance %CompanyUSAA General Indemnity %CompanyOverall %RateImpact:0.300%Written PremiumChange forthis Program: 18,629Number of PolicyHolders Affectedfor this Program:5,195WrittenPremium forthis Program: 6,561,786Maximum %Change(where req'd):10.100%Minimum %Change(where req'd):0.000%0.300% 187,51541,734 54,085,63610.200%0.000%0.300% 107,02326,816 39,911,15210.100%0.000%12.400% 1,870,82915,698 15,026,76212.500%0.000%PDF Pipeline for SERFF Tracking Number USAA-130915624 Generated 02/13/2017 01:45 PM

SERFF Tracking #:USAA-130915624State Tracking #:Company Tracking #:State:PennsylvaniaTOI/Sub-TOI:04.0 Homeowners/04.0000 Homeowners Sub-TOI CombinationsFirst Filing Company:Product Name:PA Homeowners Rate RevisionProject Name/Number:PA Homeowners Rate Revision/PA1721798PA1721798Garrison Property and Casualty Insurance Company, .Rate/Rule ScheduleItemNo.1Schedule ItemStatusExhibit NamePAHOM Rate PageRule # or Page #PA-R-1.1Rate ActionReplacementPrevious StateFiling NumberUSAA-130428931PDF Pipeline for SERFF Tracking Number USAA-130915624 Generated 02/13/2017 01:45 PMAttachmentsPA Rate Page.pdf

State:Line of SJUNE 1, 2017 (NEW BUSINESS)AUGUST 15, 2017 (RENEWAL BUSINESS)UNITED SERVICES AUTOMOBILE ASSOCIATIONUSAA CASUALTY INSURANCE COMPANYUSAA GENERAL INDEMNITY COMPANYGARRISON PROPERTY AND CASUALTY INSURANCE COMPANYBASE RATES AND MINIMUM PREMIUMSBASE RATESPerilOther PerilsOther FireOther Wind and HailTheftWaterLightningLiabilityHurricaneSevere ThunderstormWinter 762.30Fire Following EarthquakeEarthquake Coverage **5.25210.745.55210.748.42210.745.55210.74Other PerilsOther FireOther Wind and HailTheftWaterLightningLiabilityHurricaneSevere ThunderstormWinter 1838.339.6130.82263.190.9780.396.5412.040.73Fire Following EarthquakeEarthquake Coverage **3.3130.283.3130.283.3130.283.3130.28Form TypeOwnersUSAA 250USAA-CIC 250USAA-GIC 250Garrison 250Unit-Owners 150 150 150 150Form TypeOwnersUnit-Owners* Base limits are 300,000 Liability and 5,000 Medical Payments to Others** Earthquake Coverage is an optional coverageMINIMUM PREMIUMSPA-R-1.1

SERFF Tracking #:USAA-130915624State Tracking #:State:PennsylvaniaTOI/Sub-TOI:04.0 Homeowners/04.0000 Homeowners Sub-TOI CombinationsProduct Name:PA Homeowners Rate RevisionProject Name/Number:PA Homeowners Rate Revision/PA1721798Company Tracking #:First Filing Company:Garrison Property and Casualty Insurance Company, .Supporting Document SchedulesBypassed - Item:Bypass Reason:Attachment(s):Item Status:Status Date:Authorization to File (PC)N/ASatisfied - Item:Comments:Attachment(s):Item Status:Status Date:Actuarial Explanatory Memorandum & Supporting Exhibits (PC)PA1721798PA Explanatory Memorandum and Exhibits.pdfPDF Pipeline for SERFF Tracking Number USAA-130915624 Generated 02/13/2017 01:45 PM

USAA, USAA-CIC, USAA-GIC, and GARRISONPENNSYLVANIAHomeowners Explanatory MemorandumBased on a review of our latest Homeowner experience, United Services Automobile Association (USAA), USAACasualty Insurance Company (USAA-CIC), USAA-General Indemnity Company (USAA-GIC), and GarrisonProperty and Casualty Insurance Company (Garrison) propose revision to Homeowner premium rates with anoverall effect of 2.3% to be effective 6/01/2017 for new business and 8/15/2017 for renewal business.The effects by company apply as follows:USAAUSAA-CICUSAA-GICGarrisonUSAA .0%9.9%10.0%10.0%Total0.3%0.3%12.4%0.3%2.3%The proposed changes include base rate revisions for both Owners and Unit-Owners.The maximum and minimum percentage changes on the rate/rule schedule reflect first renewal capped effects forthe member.The attached exhibits support these revisions and are described below.USAA-GIC Owners Forms Exhibits:Exhibit I – Indicated Rate ChangeThis exhibit provides experience for the latest five accident years ending June 30, 2016, as of September 30, 2016for USAA-GIC Owners forms. The indicated rate level change is developed in this exhibit and the proposedchange provided.Exhibit II – Projected Premium TrendThis exhibit provides the calculation and selection of premium trend factors. The average written premium atpresent rates over 20 year-ending quarters has been fit to an exponential model and an appropriate trend selectedfrom the point fits.Exhibit III – Large Loss AdjustmentThis exhibit displays the method used to smooth large losses. We establish an excess loss cut-off as apercentage of the average amount of insurance written for each year. We then remove the portion of developedloss in excess of the cut-off, ratio the excess losses to the developed non-excess (normal) losses, and select aweighted average of this ratio as the excess loss factor.Exhibit IV – Loss DevelopmentThis exhibit displays the calculation of loss development factors. Loss data used for these calculations excludecatastrophes.Exhibit V – Loss TrendThis exhibit shows the calculation and selection of loss trends. Frequency and severity over twenty year-endingquarters have each been fit to an exponential model. The selected current and trended cost factors are based onthe results of these exponential fits. Because of volatility and lack of credibility in Pennsylvania USAA-GIC data,the selected Pennsylvania USAA-GIC trends are credibility weighted with countrywide trends in order to calculatean appropriate set of loss trend factors. Pages 1 and 4 show the state data and the countrywide data. Pages 2 and5 show the calculation of state loss trend factors; pages 3 and 6 show the calculation of countrywide loss trendfactors.

USAA, USAA-CIC, USAA-GIC, and GARRISONPENNSYLVANIAHomeowners Explanatory MemorandumExhibit VI – Loss Adjustment Expense FactorsThis exhibit develops a loss adjustment expense (LAE) factor for non-catastrophe losses and a LAE factor forcatastrophe losses. The non-catastrophe LAE factor is based upon USAA Group countrywide data for calendaraccident years 2013, 2014, and 2015. The catastrophe LAE factor is based upon USAA Group countrywide datafor the most recent twenty-five years.Exhibit VII – Historical (Non-Modeled) Catastrophe Provision RatioThis exhibit illustrates the calculation of the Pennsylvania USAA Group non-modeled catastrophe loss and LAEratio. The non-modeled catastrophe loss is divided by the direct earned premium for each of the last twentyaccident years. The mean and standard deviation of these ratios is calculated, along with a t-statistic. A 55%confidence was selected on a state basis to reflect the variability of losses within the twenty-year experienceperiod and to ensure that our catastrophe provision is sufficient in the long run.Exhibit VIII - Expected Net Hurricane Catastrophe Provision RatioThis exhibit displays the Pennsylvania USAA-GIC Owners forms expected hurricane catastrophe provision ratiocalculation based on a hurricane simulation model developed by AIR Worldwide (AIR) of Boston,Massachusetts. The provision includes average annual hurricane loss, LAE, and net cost of insurance. AIR’sCatastrophe Loss Analysis Service models hurricanes based on meteorological, engineering, and propertydamage data. The hurricane model generates 50,000 years of simulated hurricanes, with the resultant hurricanecharacteristics superimposed on USAA Group’s geographical distribution of exposures within the state. The modelestimates the effects of various hurricane characteristics, including landfall location, size, intensity, storm track,direction, and wind speed.Exhibit IX – Expected Net Severe Thunderstorm Catastrophe Provision RatioThis exhibit displays the Pennsylvania USAA-GIC Owners forms expected severe thunderstorm catastropheprovision ratio calculation based on a severe thunderstorm simulation model developed by AIR Worldwide (AIR) ofBoston, Massachusetts. The provision includes average annual severe thunderstorm loss, LAE, and net cost ofreinsurance. AIR’s Severe Thunderstorm Model is based on meteorological, engineering, and property damagedata. The severe thunderstorm model generates 10,000 years of simulated severe thunderstorms (hail, tornadoes,and straight line winds) with the resulting storm characteristics superimposed on USAA Group’s geographicaldistribution of exposures within the state. The model estimates severe thunderstorm damage based on variousthunderstorm characteristics, including size, intensity, and storm track.Exhibit X - Expected Net Winter Storm Catastrophe Provision RatioThis exhibit displays the Pennsylvania USAA-GIC Owners forms expected winter storm catastrophe provision ratiocalculation based on a winter storm simulation model developed by AIR Worldwide (AIR) of Boston,Massachusetts. The provision includes average annual winter storm loss, LAE, and net cost of reinsurance. AIR’sWinter Storm Model is based on meteorological, engineering, and property damage data. The winter storm modelgenerates 10,000 years of simulated winter storms (extra-tropical cyclones) with the resulting storm characteristicssuperimposed on USAA Group’s geographical distribution of exposures within the state. The model estimateswinter storm damage based on various winter storm characteristics, including size, intensity, and storm track.Exhibit XI – Total Insured Value TrendThis exhibit displays the average total insured value (TIV) over twenty quarters in order to determine TIV trendfactors which are used to calculate the catastrophe provision ratio in Exhibit VII. These factors reflect increasingamounts of insurance and other distributional changes.

USAA, USAA-CIC, USAA-GIC, and GARRISONPENNSYLVANIAHomeowners Explanatory MemorandumExhibit XII – ExpensesThis exhibit shows the calculation of both variable and fixed expense provisions as well as development of thevariable permissible loss and LAE ratio. Taxes, licenses, and fees are based on Pennsylvania USAA-GICexperience while provisions for other expense categories are based on countrywide data from the InsuranceExpense Exhibit.This exhibit also shows the development of the selected expense trend. This trend is derived by taking a weightedaverage of the Employment Cost Index and the Consumer Price Index. The expense trend is used to trend fixedexpenses as shown on the first pages of this exhibit.USAA Group Unit Owners Forms Exhibits:Exhibit XIII – Indicated Rate ChangeThis exhibit provides experience for the latest five accident years ending June 30, 2016, as of September 30, 2016for USAA Group Unit Owners forms. The indicated rate level change is developed in this exhibit and the proposedchange provided.Exhibit XIV – Projected Premium TrendThis exhibit provides the calculation and selection of premium trend factors. The average written premium atpresent rates over 20 year-ending quarters has been fit to an exponential model and an appropriate trend selectedfrom the point fits.Exhibit XV – Large Loss AdjustmentThis exhibit displays the method used to smooth large losses. We establish an excess loss cut-off as apercentage of the average amount of insurance written for each year. We then remove the portion of developedloss in excess of the cut-off, ratio the excess losses to the developed non-excess (normal) losses, and select aweighted average of this ratio as the excess loss factor.Exhibit XVI – Loss DevelopmentThis exhibit displays the calculation of loss development factors. Loss data used for these calculations excludecatastrophes.Exhibit XVII – Loss TrendThis exhibit shows the calculation and selection of loss trends. Frequency and severity over twenty year-endingquarters have each been fit to an exponential model. The selected current and trended cost factors are based onthe results of these exponential fits. Because of volatility and lack of credibility in Pennsylvania USAA Group UnitOwners data, the selected Pennsylvania USAA Group Unit Owners trends use the countrywide trends.Exhibit XVIII – Loss Adjustment Expense FactorsThis exhibit develops a loss adjustment expense (LAE) factor for non-catastrophe losses and a LAE factor forcatastrophe losses. The non-catastrophe LAE factor is based upon USAA Group countrywide data for calendaraccident years 2013, 2014, and 2015. The catastrophe LAE factor is based upon USAA Group countrywide datafor the most recent twenty-five years.Exhibit XIX – Historical (Non-Modeled) Catastrophe Provision RatioThis exhibit illustrates the calculation of the Pennsylvania USAA Group non-modeled catastrophe loss and LAEratio. The non-modeled catastrophe loss is divided by the direct earned premium for each of the last twentyaccident years. The mean and standard deviation of these ratios is calculated, along with a t-statistic. A 55%confidence was selected on a state basis to reflect the variability of losses within the twenty-year experienceperiod and to ensure that our catastrophe provision is sufficient in the long run.

USAA, USAA-CIC, USAA-GIC, and GARRISONPENNSYLVANIAHomeowners Explanatory MemorandumExhibit XX - Expected Net Hurricane Catastrophe Provision RatioThis exhibit displays the Pennsylvania USAA Group Unit Owners forms expected hurricane catastrophe provisionratio calculation based on a hurricane simulation model developed by AIR Worldwide (AIR) of Boston,Massachusetts. The provision includes average annual hurricane loss, LAE, and net cost of insurance. AIR’sCatastrophe Loss Analysis Service models hurricanes based on meteorological, engineering, and propertydamage data. The hurricane model generates 50,000 years of simulated hurricanes, with the resultant hurricanecharacteristics superimposed on USAA Group’s geographical distribution of exposures within the state. The modelestimates the effects of various hurricane characteristics, including landfall location, size, intensity, storm track,direction, and wind speed.Exhibit XXI - Expected Net Fire Following EQ Catastrophe Provision RatioThis exhibit displays the Pennsylvania USAA Group Unit Owners forms expected fire following earthquakecatastrophe provision ratio calculation based on a fire following earthquake simulation model developed by AIRWorldwide (AIR) of Boston, Massachusetts. The provision includes average annual fire following earthquake loss,LAE, and net cost of reinsurance. AIR’s Catastrophe Loss Analysis Service models fire following earthquakebased on geological, engineering, and property damage data. The fire following earthquake model generates50,000 years of simulated earthquakes, with the resulting fires superimposed on USAA Group’s geographicaldistribution of exposures within the state. The model estimates the effects of the fire based on various earthquakecausative characteristics, including ignition, population, and fire suppression ability.Exhibit XXII – Expected Net Severe Thunderstorm Catastrophe Provision RatioThis exhibit displays the Pennsylvania USAA Group Unit Owners forms expected severe thunderstormcatastrophe provision ratio calculation based on a severe thunderstorm simulation model developed by AIRWorldwide (AIR) of Boston, Massachusetts. The provision includes average annual severe thunderstorm loss,LAE, and net cost of reinsurance. AIR’s Severe Thunderstorm Model is based on meteorological, engineering, andproperty damage data. The severe thunderstorm model generates 10,000 years of simulated severethunderstorms (hail, tornadoes, and straight line winds) with the resulting storm characteristics superimposed onUSAA Group’s geographical distribution of exposures within the state. The model estimates severe thunderstormdamage based on various thunderstorm characteristics, including size, intensity, and storm track.Exhibit XXIII - Expected Net Winter Storm Catastrophe Provision RatioThis exhibit displays the Pennsylvania USAA Group Unit Owners forms expected winter storm catastropheprovision ratio calculation based on a winter storm simulation model developed by AIR Worldwide (AIR) of Boston,Massachusetts. The provision includes average annual winter storm loss, LAE, and net cost of reinsurance. AIR’sWinter Storm Model is based on meteorological, engineering, and property damage data. The winter storm modelgenerates 10,000 years of simulated winter storms (extra-tropical cyclones) with the resulting storm characteristicssuperimposed on USAA Group’s geographical distribution of exposures within the state. The model estimateswinter storm damage based on various winter storm characteristics, including size, intensity, and storm track.Exhibit XXIV – Total Insured Value TrendThis exhibit displays the average total insured value (TIV) over twenty quarters in order to determine TIV trendfactors which are used to calculate the catastrophe provision ratio in Exhibit VII. These factors reflect increasingamounts of insurance and other distributional changes.Exhibit XXV – ExpensesThis exhibit shows the calculation of both variable and fixed expense provisions as well as development of thevariable permissible loss and LAE ratio. Taxes, licenses, and fees are based on Pennsylvania USAA-GICexperience while provisions for other expense categories are based on countrywide data from the InsuranceExpense Exhibit.This exhibit also shows the development of the selected expense trend. This trend is derived by taking a weightedaverage of the Employment Cost Index and the Consumer Price Index. The expense trend is used to trend fixedexpenses as shown on the first pages of this exhibit.

USAA, USAA-CIC, USAA-GIC, and GARRISONPENNSYLVANIAHomeowners Explanatory MemorandumAll Forms Exhibits:Exhibit XXVI – Underwriting Profit ProvisionThis exhibit outlines the method used to select our underwriting profit and contingency provision, which is includedin the permissible loss ratio. A separate explanatory memorandum is included with this exhibit.Exhibit XXVII – HistogramsThis exhibit displays the frequency distribution of uncapped rate level impacts and uncapped dollar impacts of theproposed changes. Pages 1 and 2 display impacts of policyholders for USAA-GIC Owners forms. Pages 3 and 4display impacts of policyholders in USAA Group Unit Owners forms.Exhibit XXVIII – 5-Year Rate Change HistoryThis exhibit displays USAA Group’s 5-year rate change history, as well as the rate change history for eachcompany individually, expressed both in dollars and as a percent. The exhibit also provides a description of whatstructural changes were implemented with each filing.

Exhibit IPage 1 of 1USAA - GICPennsylvaniaOwners FormsIndicated Rate ChangeAs of 9/30/2016AccidentYear Ending Earned Premium(YYYYQ)at Present RatesPremium Trend FactorBCDEFGHISmoothedDeveloped IncurredLosses pheDLAE FactorProspective Lossesand LAE ExcludingCatastrophesProspective Lossand LAE RatioExcludingCatastrophesPremium Weight(1)(2)(3)(4) (2) * (3)(5)(6)(7)(8) (5) * (6) * (7)(9) (8) / (4)(10) (4) / ctedEarnedPremium atPresent RatesPlease refer to Exhibit II, Page 1 of 1Please refer to Exhibit III, Page 1 of 1Please refer to Exhibit V, Page 2 of 2Please refer to Exhibit VI, Page 1 of 1Please refer to Exhibit VII, Page 1 of 1Please refer to Exhibit VIII, Page 1 of 1Please refer to Exhibit IX, Page 1 of 1Please refer to Exhibit X, Page 1 of 1Please refer to Exhibit XII, Page 1 of 2Weighted Loss and LAE Ratio Excluding CatastrophesHistorical Catastrophe and LAE Ratio E0.700(12)(13)Hurricane Catastrophe Provision Ratio F0.020(14)Severe Thunderstorm Catastrophe Provision Ratio G0.078(15)Winter Storm Catastrophe Provision Ratio H0.022(16)Projected Fixed Expense Provision I(17)(18)Total Loss, LAE & Fixed Expense RatioVariable Permissible Loss and LAE Ratio I(19)Indicated Rate Level Change(20)Proposed Rate Level Change0.0040.160 (11) (12) (13) (14) (15) (16)0.984 (17) / (18) - 118.6%0.83012.5%

Exhibit IIPage 1 of 1USAA - GICPennsylvaniaOwners FormsPremium TrendAccident YearEnding(YYYYQ)Average WrittenPremium atPresent RatesAnnual ChangeAverage EarnedPremium atPresent ,200.831,189.66Current PremiumTrend Factor(5) Latest (2) / 975Exponential Fit8-point20-point16-point12-pointExponential cted Premium Trend:-3.5%Accident YearEnding(YYYYQ)CurrentPremium TrendFactorPremium edPremium TrendFactorPremium Trend Factor(4)(5) [1 (3)] (4)(6) (2) * 9350.8400.8330.8500.8750.903Trend PeriodAFrom the average written date in the most recent accident year, 3/31/2016to the average written date in the effective period, 2/15/2018

Exhibit IIIPage 1 of 1USAA - GICPennsylvaniaOwners FormsLarge Loss AdjustmentAs of 9/30/2016Accident d Average Excess FactorAIncurred LossesNet Sal SubExcludingCatastrophesDeveloped IncurredLosses Net Sal SubExcludingCatastrophes A(3) 0.35 * rgeAverage Amount ofLossInsuranceCutoffAs of 12/31AmountPlease refer to Exhibit IV, Page 1 of e Losses(6) (5) / 7144,093,1022,258,340DevelopedLarge LossesNumber ofExcess Losses(8) (7) * edAverageExcess Ratio(10) (8) - (9) * (3)(11) (5) - (10)(12) (10) / (11) Σ(10) / 35722,024,952Excess Losses Normal Losses(13)Smoothed DevelopedIncurred Losses Net SalSub ExcludingCatastrophes(14) (11) * [Selected 2,890,7316,470,7927,813,3328,195,3420.3471.347

Exhibit IVPage 1 of 1USAA - GICPennsylvaniaOwners FormsLoss DevelopmentAs of 9/30/2016ALL PERILS COMBINEDIncurred Losses Net Sal Sub Excluding CatastrophesAccident 0220112201222013220142201522016215 58,2716,043,1567,982,9347,200,03927 03,9356,216,9318,470,44739 31,5786,238,977Accident 2012220132201422015215 to 0281.0621.0291.06127 to 9681.0111.00439 to 0030.990Latest 3-YearLatest 4-YearLatest 5-YearLatest 50.9980.9980.9991.000Selected Factors1.0511.0051.00051 05,378Age-to-Age Factors51 to 00863 Months0007889,495467,821457,508767,9973,102,30375 Months0007889,495467,821457,508767,99787 Months0007889,495467,821457,50863 to 75Months1.0001.0001.0001.0001.0001.0001.0001.00075 to 87Months1.0001

United Services Automobile Association USAA Casualty Insurance Company USAA General Indemnity Company Product Name: PA Homeowners Rate Revision State: Pennsylvania TOI: 04.0 Homeowners Sub-TOI: 04.0000 Homeowners Sub-TOI Combinations Filing Type: Rate Date Submitted: 02/09/2017 SERFF Tr Num: USAA-130915624 SERFF Status: Assigned State Tr Num: