Transcription

Project V-Swarm LiveCharlotte 2020www.HawkeyeTraders.comAll material contained herein is protected by U.S. and International copyright law. No material containedin this presentation can be used without the written, expressed permission of Hawkeye Traders, LLC

Project V-Swarm LiveBasic Trainingwww.HawkeyeTraders.comAll material contained herein is protected by U.S. and International copyright law. No material containedin this presentation can be used without the written, expressed permission of Hawkeye Traders, LLC

DisclaimerFUTURES, FOREX, STOCK, AND OPTIONS TRADING ARE NOT APPROPRIATE FOR ALLTRADERS. THERE IS A SUBSTANTIAL RISK OF LOSS ASSOCIATED WITH TRADING THESEMARKETS. LOSSES CAN AND WILL OCCUR. NO SYSTEM OR METHODOLOGY HAS EVERBEEN DEVELOPED THAT CAN ENSURE RETURNS OR AGAINST LOSSES. NOREPRESENTATION OR IMPLICATION IS BEING MADE THAT USING ANY OF THESEMETHODOLOGIES OR SYSTEMS WILL GENERATE RETURNS OR ENSURE AGAINST LOSSES.CFTC RULE 4.41 - HYPOTHETICAL OR SIMULATED PERFORMANCE RESULTS HAVECERTAIN LIMITATIONS. UNLIKE AN ACTUAL PERFORMANCE RECORD, SIMULATEDRESULTS DO NOT REPRESENT ACTUAL TRADING. ALSO, SINCE THE TRADES HAVE NOTBEEN EXECUTED, THE RESULTS MAY HAVE UNDER-OR-OVER COMPENSATED FOR THEIMPACT, IF ANY, OF CERTAIN MARKET FACTORS, SUCH AS LACK OF LIQUIDITY. NOREPRESENTATION IS BEING MADE THAT ANY ACCOUNT WILL OR IS LIKELY TO ACHIEVEPROFIT OR LOSSES SIMILAR TO THOSE SHOWN.

Topics Covered So you want to be a trader?Trading PersonalityTrader TypesTrading PlansVolume Price Analysis6 Ways a Market MovesPsychology for TradersHawkeye Basic/Advanced Tools Review3 Step Entry Exit MethodTrade Management

So you want to be a trader? Pitfalls Hard WorkTuitionIsolatedEmotional Rollercoaster

So you want to be a trader? Benefits Flexible work dayFinancial securityFreedomNo more rush hour trafficMentally Challenging

Failure ExperienceExperience Success

Types of Traders Scalpers – Take small profits outthroughout the day, fast tradesIntraday Trader – Enter in the morning,exit in the afternoonSwing Trader – Will hold trade from acouple of days to a couple of weeks.Position Trader – Will hold trade frommonths to year.

Having a Plan Suppose for a moment that you wantedto open a new business. What are your first steps?What is your objective?What are your entry parameters?What are your risk parameters?What are your exit parameters?

Having a Plan Successful business owners anticipate: Their goalsTheir business needs EquipmentCapitalThey follow their plan and modify as neededto achieve their ultimate business objectiveThey review their plan quarterlyWe WILL be going over Trade Plans indetail later on in this seminar

Timeframes Scalpers and Intraday Traders See quick price action which is not restrictedby timeframe.Swing and Position Traders Use time charts to smooth volatility

Break

Trading Plans

Break

Volume and Price

History of Volume In the 1930s, there were three great traders. W.D. Gann – An eccentric who used methods basedon ancient mathematics, geometry, and astrology.Ralph Nelson Elliott – Method based on wavecount. Although a great hindsight tool, in the liveedge of the market, where do you start the wavecount?Richard Wycoff – Method based on analyzingvolume with price movement.

Richard Wyckoff Traded in the 1930’s Studied volume and price Traveled to America and metwith Wyckoff’s family Got his original course notes

How Volume Trading WorksTrading using volume gives you the following: Volume confirms the strength of a trend orsuggests its weakness. Rising volume indicates rising interest Falling volume suggests a decline in interest, or astatement of no interest. Extreme volume readings, i.e. climax volume,often highlights price reversals. Points where the market trades on high volumeare the points of strong support and resistance. Breakouts and market spikes can be validated orignored with the help of volume.

Why Volume Is So ImportantVolume Is the only leading indicator Signals price movement before it happens Signals market intentAll other indicators by comparison are lagging.Volume On Triple Time Frames Is The Key!

Monitoring Volume InThree Timeframes

Traditional Trading Between 70% and 80% of traders are failing Using traditional trading strategies–MACD–Stochastic–Bollinger bands–Elliott Wave

Understanding VolumePrice Analysis

The Opening Price Principle Standard VSA doesn’t consider the open Hawkeye considers this as paramount Very similar to an auction Sets the basis for the session

The Opening Price PrincipleAdd 3Add 2Add 1 85With Profit Accelerator: 403

Volume Price Analysis In the 1930’s, stock market wizard Richard Wyckofftook volume and found a predictive indicator he calledVolume Spread Analysis (VSA). Hawkeye Volume takes VSA and compares it to price,ATR, and other key information to create what we callVolume Price Analysis. The end result is a very accurate prediction of marketdirection and sentiment.

Standard Volume Standard Volume is the total number of sharesbought and sold during a specific time or tickinterval and takes no account of the open andclose.Volume 174,273

Volume Price me Volume Price Analysis takes into accountvolume plus comparing the open and close.

Hawkeye VolumeAverage of X number of volume barsCompared toAverage True RangeCompared toOpen and Close of the price barThe Hawkeye Volume indicator performs over 300calculations per bar.

Volume Price Analysis Sophisticated way of trading More Forensic analysis than technical How you perceive charts (structure of mkt) How to see trades more clearly How to keep the profits you make How you protect your positions

Application ofVolume Price Analysis

Wide Price Bar With High VolumeBar AYou should expect a greater than average volume. The relationship of the close onBar A is an indication of whether it is buying or selling – the close is in the bottom1/3 of the range indicating selling.

Wide Price Bar With Low VolumeBar AYou should expect a greater than average volume. Although, Bar A appears to havemore volume than previous bars for the range of that bar, it should have hadsubstantially more volume for that range. So this is, in fact, a low volume barindicating a pause. This is confirmed with the close being at the midpoint of therange.

Narrow Price Bar With Low VolumeBar ANarrow price bar you should expect low volume. Bar A shows a narrow range andlow volume – indicating a pause. Even though the close is less than the open, itshows that there was no demand for selling.

Narrow Price Bar With High Volumein UptrendBar AEven at the top of the trend, Bar A shows that there is above average volume for thatrange indicating buying. If it was selling, the range would have been far greater asthe bid and offer would have expanded. Even though the close is less than the open,it is showing that this share was not being sold, in fact it is a sign of strength.

Narrow Price Bar With High Volumein DowntrendBar ABar A shows there is above average volume for the range indicating buying. Eventhough the close was less than the open, it indicates accumulation, for if it was sellingthe range would have been far greater.

Applying Volume Spread AnalysisTwo weeks beforereport was due.

Applying Volume Price Analysis Ebay Began the new year at 58.60 per share Earnings report expected January 19, 2005 Close on January 20, 2005 41.67 per shareHowever, with volume price analysis, sellers wereidentified entering the market as early as January 3,200516 Days before the Earnings Report was published

Applying Volume Spread Analysis

ES 5-min Chart

Break

Back to Basics:6 Ways a Market Moves A market can only move 6 ways TrendTrend PauseCongestion EntranceCongestionCongestion ExitTrend Reversal

Back to Basics:6 Ways a Market Moves Identifying where you are in a market isabsolutely vital to being a successfultrader.

Isolated LowsALower low than previous bar and next bar (Point A) and alower high than previous bar and next bar (Point A).Note: Phantom isolated lows occur when only the lowcondition Point A is met. There is no need to see where thehigh is.

Isolated HighsAHigher high than previous bar and the next bar (Point A) and ahigher low than previous bar and next bar (Point A).NOTE: Phantom isolated highs occur when only the highcondition Point A is meet. There is no need to see where the lowis.

Trend RunBATrend run is established (Point A) when the close is above the dot,the dot is rising and the close is greater than the open and in the top40% of range.NOTE: At Point B the dot is equidistant from the previous dot andcontinues to be equidistant.

Trend

Trend PauseA Is exactly the same as a trend run. However, when a close is under thedot and open (Point A) but the dot is still rising, it denotes a pause. You are then looking to see resumption of the trend run (close beinggreater than the dot ) this should occur within three to five time frames .

Trend Pause

Congestion EntranceABWhen the close is under the dot and the dot is flatish to theprevious dot, you have congestion entrance (Point B). You thenlook for the last isolated/phantom high (Point A).

Congestion Entrance

CongestionACDB Once congestion entrance has been defined you are then waiting for the first isolated/phantom low to form (Point B). This has to be within 5 bars.Extend a dotted line from the isolated/phantom high (Point A) and the isolated/phantomlow (Point B), you then have your congestion high and low channel.As the chart continues, you will see new lower isolated highs (not phantoms) and isolatedlows developing you then move your congestion parameters to these newly formed pivots(Point C and Point D).NOTE: If after congestion entry there are no isolated / phantom low formed within 5 bars, youare in trend run down and trade it according to the rules.

Congestion

Congestion ExitEACDB Once having defined congestion you are waiting for a close either above the lastisolated high (Point C) or below the last isolated low (Point D). At Point E the close is greater than at Point C and a congestion exit to the upsidehas commenced. The bar close must be greater than the open and in the top 40%of the range of the bar (approximately).NOTE: In this example at Point E, the dot has also printed above the dotted line atPoint C. This is a stronger indication of congestion exit but a close greater thanPoint C is sufficient.

Congestion Exit

Trend ReversalBAt Point B the bar is wide and the dot is less than the dot 3 barspreviously and close less than dot.

Trend Reversal

Putting It All TogetherThe Power of the Trend Dots1 contract 4,487 Profit

Break

Psychology for Traders -It is said that trading is 20% technicals and80% psychologicalWhy: Because emotions short-circuit ourlogical brains.It’s not your fault .

Psychology for Traders -What to ExpectEmotional Sabotage FearFrustrationRageSelf-doubtOver-confidenceLoss of capital

Psychology for Traders -Possible Trigger for Emotional Sabotage Being a winnerBeing a loserHaving an opinionTrading your opinionOver analyzingImpulsivityGamblingPlaying “catch up”

Psychology for Traders -What Emotions are taking over when thishappens? Not taking the trade set upMoving stops or targetsEntering trades not in your trade planReversing a losing tradePlacing entries slowlyClosing a winning position before it hits thepre-defined target or stop-loss

Psychology for Traders -Successful TradersIdentify their emotional obstaclesAnd, then Separate those emotions from their trading Trade what they see Are consistent

Psychology for Traders –Successful Traders Clinical in their executionDo not think of the financial reward of eachtradeThink in probabilities- not of winning or losingDo not have opinions -- Do not have opinionsDo not have opinions -- Do not have opinions

Psychology for Becoming aSuccessful TraderChange your thought processes Having a minus day does not make you abad traderYou cannot “will” the market to do what youwantYou cannot “predict” where the market isgoing -- because the market will go where itwants, when it wants, how it wants

Psychology for Becoming aSuccessful Trader You do not have to work 12 hoursBe consistent in entries, stops, and exitsYou trade only your rules - not opinionsEffort is not rewarded by time but bydiscipline for the time you are in front ofyour chartsTrade smart, not hard

Psychology for Becoming aSuccessful Trader Remember losses are part of trading.Small losses are actually a good thing –you are successfully protecting yourbusiness capital.Stop searching for the next indicator.Remember trading is a skill, or even anart. not a science.

Psychology for Becoming aSuccessful Trader Let the market lead you – no opinions.Find a setup that works for you and STICKwith it!Realize there is NO HOLY GRAIL, you willhave negative trades, which is why you havea stop loss to protect your capital.Realize that the market is always there, todayand tomorrow.Patience – Patience - Patience

Trading Behavior That Will Result ina Loss Refusing to define your loss per trade, ienot placing a stop loss order.Not closing a losing trade even afteracknowledging that your analysis wasincorrect.Having an opinion regarding marketdirection.

Trading Behavior That Will Result ina Loss OPINION - OPINION - OPINIONNot following the rules of your tradingsystem.Being immobilized to take the trade.Establishing a successful track recordand becoming over-confident, reckless,and disregarding your moneymanagement and trading rules.

Let’s do an Exercise For Fun Neuro-Linguistics Programming - NLPAnchoring technique to instill, and then later recall, a certain stateof mind.Champion Trader State to help get into the right frame of mindbefore trading.

Exercise For Fun Pick three qualities you would like tohave while you tradeWe will install them one at a time

Exercise For Fun

Exercise For Fun Reinforce your AnchorCreate new Anchors

Trading Personality Not all traders are alike Do you view the world visually? Do you view the world through sounds thatyou hear? Impatient, you want fast results.Patient but can get bored with watching charts.Do you view the world through what youfeel? Tend to wait and analyze how you feel about atrade.

Trading Personality Important Questions to Ask Yourself(keep a log): Why did you enter the trade?Why did you exit the trade?What were your thoughts and emotionalreactions when you had a negative trade?What were your thoughts and emotionalreactions when you had a positive trade?

Break

Keep Charts SimpleProportion can make a difference!

Hawkeye Basic Tools Hawkeye Volume Hawkeye Trend Levels ATR Auto, Up, DownHawkeye Grabba Trend Stops, Heatmap, AddsHawkeye Levels ATR Volume PaintBar, Volume RadarGrabba Auto, Up, DownPivots & Widebar

Basic Tools Review

Hawkeye Advanced Tools Hawkeye RoadkillHawkeye FatmanHawkeye ZonesHawkeye ToolsetHawkeye GearsHawkeye FatboyHawkeye Kiss

Advanced Tools Review

Break

Hawkeye Entry and Exit

3-Step Entry Exit Method General Principles: 3 timeframes are used for entry Fast - enter and exit on this timeframeMedium - double Fast timeframeSlow - double Medium timeframeConservative Trend Speed DefaultIf trading stocks/options, do not tradeagainst the direction of the Hawkeye Trendon the daily S&P 500

Entry MethodStep 1 - Fast TimeframeA, B, and C MUST be in placeLongA.B.C.ShortTrend dot greenVolume green (min 2 bars green)Heatmap bright greenA.B.C.Trend dot redVolume red (min 2 bars red)Heatmap bright redYou now have to look at the next TWO timeframes for confirmation

Entry MethodStep 2 - Medium TimeframeA, B, and C MUST be in placeLongA.B.C.ShortTrend dot rolled over or risingVolume green. The second volumebar may be green or whiteHeatmap dark (red or green) or brightgreenA.B.C.Trend dot rolled over or fallingVolume red. The second volume barmay be red or whiteHeatmap dark (red or green) or brightredYou now have to look at the Slow timeframe for confirmation

Entry MethodStep 3 - Slow TimeframeA and B MUST be in placeLongA.B.ShortTrend dot rolled over/flat/crunched uptightVolume green( Note: No consideration of Heatmap)A.B.Trend dot rolled over/flat/crunched uptightVolume red( Note: No consideration of Heatmap)

Exit MethodThere are 3 types of exits1. Trend Following2. ATR Levels Stop3. Profit Target

Exit MethodExit Type 1 - Trend FollowingLongA.B.C.ShortHold until stopped outIf volume green or white, use crashbarrierIf volume red then close under HKstop (green cross) or intraday touchof barrierNote: With the trend stop there is the abilityto pull the stop into aggressive after yourpre-determined nominated amount of barsi.e. if in profit after 7 bars you can pull stopin from conservative to aggressiveA.B.C.Hold until stopped outIf volume red or white, use crashbarrierIf volume green then close over HKstop (red cross) or intraday touch ofbarrierNote: With the trend stop there is the abilityto pull the stop into aggressive after yourpre-determined nominated amount of barsi.e. if in profit after 7 bars you can pull stopin from conservative to aggressive

Exit MethodExit Type 2 - Hawkeye Levels ATRLongA.B.C.ShortUntil price closes ABOVE 2 ATR thenuse close below ATR Level stop or atouch of the HK stop (green cross) toexitIf it continues to move in yourdirection once there is a price closeABOVE 2 ATR then exit if there is aclose below 1 ATR or an intradaytouch of 0 ATR.Move up every NEW ATR level breake.g. Close over 3 ATR then exit onclose below 2 ATR or touch of 1 ATRA.B.C.Until price closes BELOW 2 ATR thenuse close below ATR Level stop or atouch of the HK stop (red cross) toexitIf it continues to move in yourdirection once there is a price closeBELOW 2 ATR then exit if there is aclose above 1 ATR or an intradaytouch of 0 ATR.Move down every NEW ATR levelbreak e.g. Close below 3 ATR thenexit on close above 2 ATR or touch of1 ATR

Exit MethodExit Type 3 - Profit TargetYou may choose to exit on a price touch of a pre-defined ATR Level (HKLevel 3, the “sunshine level”) or any other pre-defined profit target.My Favorite Predefined Profit Levels:ES, RTY, EMD - 2ptsYM - 15ptsNQ - 5ptsCL - 20ticksForex - 10pipsEquities - too many variables Options - 0.20

Stops Definitive Stops Hawkeye Crash Barrier – Emergency Brake; iftouched, exit Hawkeye Stop – If volume is contrary to yourposition and price closes below Stop, exit.

Stops Optional Stops Zero Level – If after entry, price closes below ZeroLine, ask yourself, “Do I still want to be in thisposition?” Seven Bar No Progress, count 7 bars from yourentry point. At the close of the 7th bar, ask yourself,“Do I still want to be in this position?”

Taking Your Profits If market is moving, take Profits at Level 3 – 50%Level 5 – 25%Level 7 – 25%If market is not moving normally (novolatility), take one level

Adding Scalpers – Do not add Take small profits throughout the dayIntraday – Add once Holds position for hours or to end of daySwing – Add once Holds positions from days to weeksPosition – Use Hawkeye Adds Holds positions from months to year

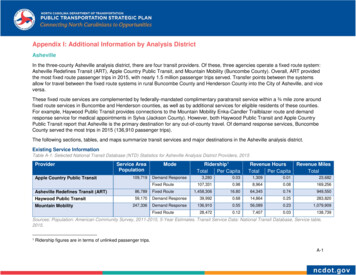

Basic Risk Management Maximum number of trades open at anyone time 3If you want to open a new position, youmust close the weakest existing tradeNever risk more than 10% equity on anyone trade

Basic Risk ManagementTotal Capital 18,000Cash Box 9,00050% of Profits goin Cash BoxCash BoxTrade Box 9,000 3,000 3,000 3,00050% of Profits goin Trade BoxTrade Box

Basic Risk Management

Break

Customer SupportWeekly Live Training om/E-mailteam1@hawkeyetraders.comPhone(302) 261-2830

How Volume Trading Works Trading using volume gives you the following: Volume confirms the strength of a trend or suggests its weakness. Rising volume indicates rising interest Falling volume suggests a decline in interest, or a statement of no interest. Extreme volume readings, i.e. climax volume, often highlights price reversals.