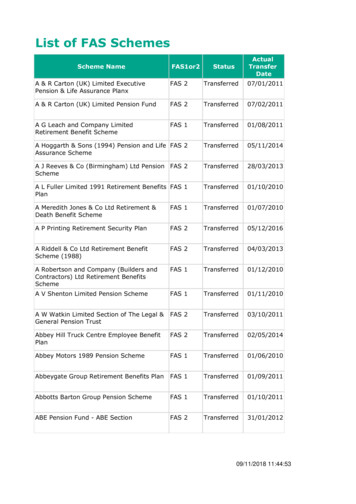

Transcription

MARKET INSIGHTFAS 115-2: A Practical AnalysisJune 2009Executive SummaryThe Financial Accounting Standards Board’s (FASB) recent changesto its standards for mark-to-market accounting—effective forreporting periods ending after June 15th, 2009—include a measurenow compelling investors to re-evaluate their other-than-temporaryimpairment (OTTI) conclusions and make material changes in theiraccounting policies to ensure compliance.Amending OTTI guidance under U.S. generally accepted accountingprinciples (GAAP) for debt securities, the FASB Staff Position (FSP)FAS 115-2, Recognition and Presentation of Other-Than-TemporaryImpairments , requires credit-related losses to be recognizedin earnings, with remaining losses documented through OtherComprehensive Income (OCI).1Intended to make the guidance more operational and to facilitate moretransparent disclosure of OTTI in financial statements, the change wasprompted by US Congressional passage of the Emergency EconomicStabilization Act in October of 2008 . The mandates therein included,among other things, that the US Securities and Exchange Commission(SEC) conduct a study on mark-to-market accounting.Subsequently, during hearings March 12, 2009, Congress requested theFASB review GAAP accounting rules, specifically “mark-to-market” and“other-than-temporary impairment” rules, leading to the FASB issuingits final FSPs April 2.5Directly applicable for interim and annual reporting periods endingafter June 15, 2009, the directives of FAS 115-2 in estimating creditlosses may prove challenging for investors. This article is intended toprovide a framework for understanding FAS 115-2 and the process ofrecognizing income and loss in a manner that is consistent with theFSP. It assumes a common understanding of FAS 115-1 and provides ananalysis of the practical application of the pronouncement.5In addition to FAS 115-2 and FAS 124-2, the FASB approved FAS 157-4 (Determining Fair ValueWhen the Volume and Level of Activity for the Asset or Liability Have Significantly Decreasedand Identifying Transactions That Are Not Orderly) and FAS 107-1 and APB 28-1 (InterimDisclosures about Fair Value of Financial Instruments).23In its study issued Dec. 30, 2008, the SEC concluded not to suspendmark-to-market accounting, though stipulated, “The current globaleconomic crisis has highlighted difficulties in performing OTTIevaluations.” Furthermore, the SEC recommended that the FASB“should evaluate the need for modifications (or the elimination) ofcurrent OTTI guidance to provide for a more uniform system ofimpairment testing standards for financial instruments.”41FAS 115-2 was introduced by the FASB on April 9, 2009.2Signed into law by President George W. Bush, this legislation most notably created a 700 billionTroubled Assets Relief Program to purchase failing bank assets.3Emergency Economic Stabilization Act in October of 2008, Section 133: Required the SEC, inconsultation with the Federal Reserve and the Treasury, to perform a study on mark-to-marketaccounting standards as provided in FAS 157, including the effects on balance sheets, impact onthe quality of financial information, and other matters, and to report to Congress within 90 dayson its findings.4Report and Recommendations Pursuant to Section 133 of the Emergency Economic StabilizationAct of 2008: Study on Mark-To-Market Accounting, US SEC, Dec. 2008.www.clearwateranalytics.com

MARKET INSIGHTIntroductionThis article is the result of discussionsconducted by Clearwater Analytics withcurrent and prospective clients, auditors,and financial professionals regarding theinterpretation and application of FAS 115-2.The release of FAS 115-2 reflects howaccounting standards, compliancerequirements, and perceptions evolve,especially in an economic downturn. FAS115-1 and FAS 115-2 trace their lineage toFAS 115 , issued by the FASB in 1993 toaddress accounting for and reporting oninvestments in equity securities that havereadily determinable fair values, as well asinvestments in debt securities. In paragraph16 of FAS 115, the FASB states “if the declinein fair value is judged to be other thantemporary, the cost basis of the individualsecurity shall be written down to fair valueas a new cost basis and the amount of thewrite-down shall be accounted for in earnings(that is, accounted for as a realized loss).” Thisphrase quickly sparked debate surroundingthe interpretation and application of “otherthan-temporary [impairment].”12As companies began implementing Statement115, more guidance was needed to assist theirauditors in assessments of OTTI-relevantassets. As a result, the Emerging IssuesTask Force (EITF) published guidance fordetermining the meaning of OTTI and itsapplication to debt and equity securitieswithin the scope of Statement 115 and FAS124 Accounting for Certain Investments Heldby Not-for-Profit Organizations.3451FAS 115, Accounting for Certain Investments in Debt andEquity Securities, FASB, May 19932For more details, see: FAS 115-1 – A Practical Analysis,Clearwater Analytics - Treasury Topics, Jan. 2007.3Formed in 1984 by the FASB to provide assistance withtimely financial reporting. The EITF holds public meetings inorder to identify and resolve accounting issues occurring inthe financial world.45Setting forth a daunting list of impairmentindicators for auditors to identify OTTI whenanalyzing a portfolio, EITF 03-1 fosteredconfusion in the impairment process.Determined to simplify its guidance onthe impairment process, the FASB issuedFAS 115-1, replacing most of the guidanceoffered in EITF 03-1 and creating a moreprinciples-based approach to the impairmentprocess, rather than the rules-based approachestablished in EITF 03-1.Investors must then determine what portionof the impairment is due to a credit loss(the difference between the present value offuture expected cash flows and amortizedcost). Investors must then realize a loss (equalto the total credit loss) through earningsand recognize the remaining portion ofIn this next phase of evolution of OTTIaccounting, designed to make the guidancemore operational, FAS 115-2 appliesspecifically to debt securities. Previously, inorder for an impairment to not be consideredother-than-temporary, investors had toassert ability and intent to hold the securityfor a period of time sufficient to allow fora recovery of the fair market value to itsamortized cost.FAS 115-1 established a three-step process toevaluate and handle securities with otherthan-temporary impairments. This processencompasses:impairment through OCI.Process for Evaluating/Handling Securities1.Determine Whether an Investment isImpaired2.Evaluate Whether an Impairment isOther Than Temporary3.If the Impairment is Other ThanTemporary, Recognize an ImpairmentLoss Equal to the Difference between theInvestment’s Cost and Its Fair Value6Under the new guidance, investors now haveto assert that they (1) do not have the intent tosell the security and (2) it is likely the securitywill not have to be sold prior to the security’smarket value returning to its amortized cost.If investors intend to sell the security orwill likely be required to sell the security,they should realize a loss equal to the fulldifference between the amortized cost andfair market value in earnings.7Even if investors are able to assert that theydo not have the intent to sell, and are notlikely to be required to sell, they cannot assertthat they will be able to hold the security to arecovery of the amortized cost if the presentvalue of future expected cash flows is lessthan the amortized cost. This will result in anOTTI.8Moving beyond the FAS 115-1 guidelines, thehigh-level steps (identify, evaluate, recognize)applied by 115-2 are not that different. Thefirst step to identify the impaired securities isto evaluate “if the fair value of a debt securityis less than its amortized cost basis at thebalance sheet date . . .”. This guidance lists anumber of aspects included in the calculationof amortized cost, including adjustments foraccretion, amortization, collection of cash,previous OTTIs recognized in earnings, andfair-value hedge accounting adjustments.9Analytics - Treasury Topics, Dec. 2007.6Actual language of FAS 115-2: “ more likely than not willnot be required to sell the security prior to its anticipatedrecovery.”EITF 03-1 The Meaning of Other-Than-Temporary Impairmentand Its Application to Certain Investments, EITF, Oct. 20047Actual language in FAS 115-2: “ or more likely thannot ”For more details, see: FAS 115-1—A Thought Frameworkon Impairment and the Organizational Policy, Clearwater8Actual language in FAS 115-2: “ and more likely than notwill not be required to sell ”9FAS 115-2, Paragraph 19www.clearwateranalytics.com

MARKET INSIGHTThe next step is to determine whetherthe impairment is other-than-temporary.Previously, investors could avoid classifyingan impairment as other-than-temporary byasserting the ability and intent to hold thesecurity until a fair-market value returnto its amortized cost. The FASB modifiedits guidance for debt securities to be moreoperational in certain scenarios, including:Scenario 1: If investors have the intent to sellthe security, an OTTI has occurred.Scenario 2: If investors will more likely thannot be required to sell the security prior torecovery of a security’s market value to itsamortized cost, an OTTI has occurred. Thismay be due to cash flow requirements orcontractual or regulatory obligations.Scenario 3: If investors do not expect torecover the entire amortized cost basis of thesecurity—meaning that the present value offuture expected cash flows is less than theamortized cost—an OTTI has occurred.The first two scenarios are situations thatinvestors can quickly determine. An intentto-sell would be clear if there were a trade inprogress, if the investor were actively seekinga buyer for the security, or if the investorhad requested that their security be sold.Determining whether investors would likelybe required to sell the security depends onmultiple factors, including contractual orregulatory obligations and business cash-flowneeds. If either situation exists, they shouldrecognize a loss in earnings equal to thedifference between the security’s fair-marketvalue and its amortized cost.1The third scenario requires investors toconsider a broad range of factors in order todetermine if a credit loss exists, encompassingthe length and duration of the credit loss;historic and implied volatility; paymentstructure of the security and the likelihoodof the issuer being able to make requiredpayments; defaults; changes in credit rating1Actual language in FAS 115-2: “ will more likely than notbe required to sell ”Figure 1: Investor Decision TreeTotal PortfolioNot ImpairedImpairedEquity SecuritiesAbility &Intent toHold toRecoveryCannotAssertAbility orIntent toHold toRecoveryDebt SecuritiesIntentto SellLikelyRequiredto SellBeforeRecoveryIf after an analysis of these factors, investorsdetermine that a credit loss exists, they mustcalculate the portion of the impairment dueto the credit loss. This is done by subtractingthe best estimate of the present value of cashflows expected to be collected from the debtsecurity from the security’s amortized cost.This amount should be recognized as a lossin earnings. They should also recognize theamount of the impairment due to all otherfactors in OCI. The income statement shouldshow the total impairment with an offset forthe amount recognized in OCI, similar to thisexample.No CreditLoss ExistsCredit LossExistsCredit Loss Realized in Earnings (Net Income)Remaining Portion of Impairment Recognizedin Other Comprehensive IncomeRealize Difference BetweenAmortized Cost & Fair Market ValueIn Net Income (Earnings)by various rating agencies; and performancesince the report close date.Change in Fair Market ValueRecognized in OtherComprehensive Incomepresent value of future cash flows. Theyshould account for a significant increase infuture expected cash flows, or cash flowsactually received as a prospective adjustmentto the remaining total amount of expectedaccretion (accretable yield).22FAS 115-2, Paragraph 32: Debt securities accounted forunder EITF Issue 99-20 should follow that guidance forchanges in cash flows expected to be collected. For allother debt securities, an increase in future expected oractually received cash flows should be “accounted for as aprospective adjustment to the accretable yield in accordancewith SOP 03-3, even if the debt security would not otherwisebe within the scope of that standard.”Figure 1 (above) presents a typical investordecision tree when considering other-thantemporary impairment. After investorsrecognize an OTTI in any of these scenarios,the amortized cost of the security shouldbe the previous amortized cost, less theamount that has been recognized in earnings.Investors should accrete the differencebetween the new amortized cost and the cashflows expected to be collected. Additionally,investors should continue to estimate thewww.clearwateranalytics.com

MARKET INSIGHTCumulative Effect AdjustmentPost June 15, 2009, investors should recognizea cumulative effect adjustment on thosesecurities that they hold, that they do notintend to sell, and that they will not likelybe required to sell before the security’smarket price returns to its amortized cost.Investors should determine the cumulativeeffect adjustment by subtracting the presentvalue of future cash flows from the security’samortized cost and should also considerany tax effects. This cumulative effectadjustment should affect retained earningsand accumulated OCI. The amortized costshould be adjusted for the cumulative effectTotal Other-Than-Temporary Impairment (OTTI) losses.( 10,000)Portion of loss recognized in other comprehensive income (before taxes). 4,000Net impairment losses recognized in earnings.( 6,000)1adjustment amount before taxes.DisclosureThe disclosures required by FAS 115-1 werepreviously requisite on annual reports, butnot on quarterly reports. This statementrequires that these disclosures now beincluded in the quarterly reports as well.There should also be additional disclosuresexplaining the methodologies and inputsused to determine the amount of creditloss on securities that had a portion of theimpairment recognized in earnings.ApplicationFigure 2 depicts the life of an other-thantemporarily impaired lot. In this example,the bond was purchased at a premium.The amortization schedule used par and aneffective maturity date at the end of 2010as the target end point. By the end of 2008the bond was impaired (the market pricewas less than the amortized price) and theinvestor determined that the impairmentwas other than temporary. Under FAS115-1—the requirements at that time—theinvestor realized the full impairment through1Actual language in FAS 115-2: “ will more likely than notbe required to sell ”Figure 2: An Other-Than-Temporarily Impaired Lotearnings (net income), and the bond’s marketvalue became the new amortized cost. Theinvestor adjusted the bond’s amortizationschedule from the write-down price topar and from the write-down date to finalmaturity. The investor adopted FAS 115-2 inthe second quarter of 2009 and recognizedthe cumulative effect adjustment at that time.By the end of 2009, the investor determinedthat this bond had a credit loss. The value ofthe future expected cash flows was 85 andthe present valuation of those future expectedcash flows was 80. The investor realizeda loss equal to the difference between thebond’s amortized cost and 80.The investor recognized the remainingimpairment—the difference between 80 and the fair market value—in othercomprehensive income. The differencebetween the future expected cash flows andthe present value of the future expected cashflows ( 85- 80) determines the total amountto be recognized through accretion over theremaining life of the bond.Additional ThoughtsOne of the stated goals of the FAS 115-2pronouncement was to make the OTTIguidance more operational. In some ways,this was successful. For instance, it is easier tosupport the conclusion that there is no intentto sell a lot. It is also lessproblematic to provide supporting evidencethat it is not likely that the security will besold before recovery than it is to supportthe ability and intent to hold a security torecovery.23However, FAS 115-2 introduces a significantnumber of new data points for investors totrack, and analyze for each of their securities.This has the potential of creating a significantamount of work for accounting organizationsthat are suffering with constrained resources.42FAS 115-2, Paragraph 23Actual language in FAS 115-2: “ is not more likely thannot ”4FAS 115-2, Paragraph 25www.clearwateranalytics.com

MARKET INSIGHTAdditionally, there are a number of requiredcalculations and analyses that many investorshave not had to perform previously. Investorswho have been subject to EITF 99-20 or SOP03-3 have already been required to performfuture expected cash flow analysis in theirreporting. FAS 115-2 extends the cash flowanalysis obligation to a much larger numberof investors. Depending on the complexityand type of security, this can be a formidabletask. Securities with any type of optionalitywill require the most work. This additionalwork may have unintended consequences asinvestors trade off the burden of reportingwith the benefit of holding the security intheir portfolio. Many may choose to exit theirpositions and buy other security types withless onerous reporting requirements.DISCLAIMERThe information provided in this article isthe result of experience with investmentaccounting issues and interaction withaccountants and investment serviceproviders. It is not intended to be relied uponsubstantively; rather, it is intended to informand provide a discussion framework thattreasury practitioners, internal management,and accounting and audit staff can use todiscuss the impairment process.OUR LOCATIONSHEADQUARTERS950 Bannock StreetSuite 1050Boise, ID 83702PH: 208-918-3630NEW YORK OFFICE88 Pine Street, 7th FloorNew York, NY 10005PH: 212-364-1900EMAIL rwater recommends investorsproactively develop and endorse a processthat responds to FAS 115-2 in a way thatwill satisfy their auditors. Ultimately, thisstatement enables investors to avoid realizinglosses beyond the value that they expect tolose over the life of the security.GENERAL INQUIRYInfo@clearwateranalytics.comFurther ReadingAs FAS 115-2 expands the guidance of FAS115-1, Clearwater Analytics recommends itsclients be familiar with FAS 115 and 115-1.Clearwater Analytics has two white papersthat provide analysis and guidance: FAS115-1 – A Thought Framework on Impairmentand the Organizational Policy and FAS 115-1—A Practical Analysis—Both documents areavailable for download online.Clearwater Analytics closely monitors FASBproclamations and interprets ramifications,providing a range of guidance (incl. FreeConsultations, White Papers, Training, Alerts,Links to Industry Resources, and more) easilyaccessible at ation.asp.About ClearwaterClearwater provides web-based, investment portfolio reporting and analytics for institutionalinvestors, investment managers, custody banks, and electronic trading portals. With solutionsfor both separately-managed and commingled accounts, Clearwater delivers the highest levelof portfolio transparency available on the market today for clients such as Cisco, Oracle,Starbucks and Yahoo! Launched in 2004, with offices in New York and Boise, Idaho, Clearwaterreports on more than 650 billion in assets for 4,500 institutional investors. 2009 Clearwater AnalyticsAll rights reserved. This material is for informational purposes only. Clearwater makes no warranties, expressed orimplied, in this summary. All technologies described herein are either registered trademarks or trademarks of theirrespective owners in the United States and/or other countries.www.clearwateranalytics.com

FSP. It assumes a common understanding of FAS 115-1 and provides an analysis of the practical application of the pronouncement. 5 In addition to FAS 115-2 and FAS 124-2, the FASB approved FAS 157-4 (Determining Fair Value When the Volume and Level of Activity for the Asset or Liability Have Significantly Decreased