Transcription

Annuities :Future value & Present Valueof an ordinary Annuitieshttp://science.utm.my/norhaiza/Department of Mathematical SciencesFaculty of ScienceSSCE 2193Room: C10 336/C22 441Tel: 34321/34274/019-7747457

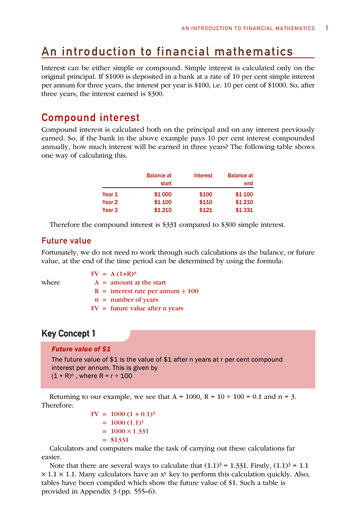

AnnuitiesPV of AnnuitiesTime0RRRR123n-1RRRR123n-1n1 periodPRESENT VALUEFV of AnnuitiesTime0n1 periodFUTURE VALUE1 1 𝑖𝑃𝑉 𝑅𝑎 𝑖 𝑅𝑖𝑛Eqn.11 𝑛𝐹𝑉 1 𝑖 𝑛 1𝑅𝑠 𝑅𝑖𝑖𝑛Eqn.12

Annuities Definition Future value of an ordinary annuity Present value of an ordinary annuity Annuities due Perpetuities Deferred annuities Summary of annuities

Annuities dueDefinition An annuity due is an annuity whose periodic payments are paid at thebeginning of each payment period. The term of an annuity:Time of 1stpaymentstart termOne payment periodafter the date of lastpaymentend term

Annuities dueExample of an annuity due of n payments:Payment period and interest period coincideRRRRR0123n-1Present Value nFuture ValueThese annuities are also known as annuities payable in advance.Typically arise in insurance premiums, annual subscriptions

Future Value of Annuities dueRRRRR0123n-1Present ValuenFuture ValueRecall that the FV of an annuity can be defined as the equivalent value of thepayment at the end of the term,è By definitionFV of an annuity due is an equivalent value due one period after the last payment

Future Value of Annuities dueRecallè FV of an ordinary annuity of n payments of RM R each,𝐹𝑉 1 𝑖 𝑛 1𝑅𝑠 𝑅𝑖𝑖𝑛Eq.10Thus Using Eq. 10, the FV of the payments at the end of the (n-1)th period is 𝑅 𝑠 𝑖𝑛è To determine the FV of an annuity due at the end of the term,𝑖we accumulate 𝑅 𝑠 𝑛 for 1 interest period. i.e.𝐹𝑉 𝑅 𝑠 𝑖𝑛1 𝑖1 𝑖 𝑛 1𝐹𝑉 𝑅1 𝑖𝑖Eq.12

Present Value of Annuities dueRRRRR0123n-1Present ValuenFuture ValueRecall that the PV of an annuity can be defined as the equivalent value of thepayment at the beginning of the term,è By definitionPV of an annuity due is an equivalent value due one period before the first payment

Present Value of Annuities dueRecallè PV of an ordinary annuity of n payments of RM R each,1 1 𝑖𝑃𝑉 𝑅𝑎 𝑖 𝑅𝑖𝑛 𝑛Eq.11Thus Using Eq. 11, the PV of the payments, 1 period before the 1st payment is 𝑅 𝑎 𝑖𝑛è To determine the PV of an annuity due (i.e. on the date of the 1st payment),we accumulate 𝑅 𝑎 𝑖𝑛 for 1 interest period. i.e.𝑃𝑉 𝑅 𝑎 𝑖𝑛Eq.131 𝑖1 1 𝑖𝑃𝑉 𝑅𝑖 𝑛1 𝑖

PV and FV for Ordinary Annuities vs Annuities DueOrdinary AnnuityAnnuity DuePresent Value𝑅 𝑎 𝑖𝑛𝑅 𝑎 𝑖𝑛 1 𝑖Future Value𝑅 𝑠 𝑖𝑛𝑅 𝑠 𝑖𝑛 1 𝑖Note:The PV of annuity may also be considered to equal the following:Payment if R now

Example 1Maria deposits RM100 at the beginning of each year for 10 years in anaccount paying 12% p.a. How much is in her account at the end of 10 years?RM1000RM100RM100RM100RM1001239Future ValueR 100; i 0.12; n 10𝐹𝑉 𝑅 𝑠 𝑖𝑛101 𝑖1 𝑖 𝑛 1𝐹𝑉 𝑅1 𝑖𝑖1 0.12 10 1 100𝑠 0.12 1 0.12 1001 0.12100.12 𝑅𝑀1956.46

Example 2The monthly rent for a flat is RM520 payable at the beginning of each month. If moneyis worth 𝑗89 9% (a) what is the equivalent yearly rental payable in advance? (b) whatis the cash equivalent of 5 years in rent?

Example 2The monthly rent for a flat is RM520 payable at the beginning of each month. If moneyis worth 𝑗89 9% (a) what is the equivalent yearly rental payable in advance? (b) whatis the cash equivalent of 5 years in rent? #exerciseR 520; m 12; i jm/m 0.09/12 0.0075;t 1 yearè n 12𝑃𝑉 𝑅 𝑎 𝑖𝑛1 𝑖1 1 𝑖𝑃𝑉 𝑅𝑖 520 𝑎 0.007512 𝑛1 𝑖1 1 0.00751 0.0075 5200.0075 151 0.0075 𝑅𝑀5990.75This is the Present value of an annuity due of 12 payments of RM520 each at 𝑗89 9%

Example 3A debt of RM10 000 with interest at 𝑗 11% is to be paid off by 8 equal quarterlypayments, the first due today. Find the quarterly paymentR ?; m 4; i jm/m 0.11/4 0.0275;n 8; PV 10000RR0110000𝑃𝑉 𝑅 𝑎 𝑖𝑛RR23RR45R61 𝑖1 1 𝑖𝑃𝑉 𝑅𝑖 𝑛1 𝑖1 1 0.027510000 𝑅 𝑎 0.0275 1 0.0275 𝑅80.0275𝑅 𝑅𝑀1371.85 81 0.0275This is the Present value of an annuity due of 12 payments of RM520 each at 𝑗89 9%R78

Exercise1. A debt of RM1000 with interest t j12 18% is to be paid off over 18 months byequal monthly payments, the first due today. Find the monthly payment.(𝑅𝑀62.86)2. A used car sells for RM2550. Khairin wishes to pay for it in 18 monthlyinstallments, the first due on the day of purchase. If 21% payable monthly is charged,find the size of the monthly payments.(𝑅𝑀163.51)3. A fridge is bought for RM60 deposit and RM60 a month for 15 months. If interestis charged at j12 18.5%, what is the cash price of the fridge?(𝑅𝑀858.06)

Annuities Definition Future value of an ordinary annuity Present value of an ordinary annuity Annuities due Perpetuities Deferred annuities Summary of annuities

PerpetuitiesDefinition Perpetuity is an annuity whose payments begin on a fixed date and continueforever.Examples: series of interest payments from a set of money invested permanently at acertain interest rate a scholarship paid from an endowment on a perpetual basis Dividends paid in respect of preference shares

Perpetuities: illustratedConsider a person who invests RM10000 at rate 10% p.a., maintains the originalinvestment intact and collects RM1000 interest at the end of each year.As long as the interest rate does not change and the original principal of RM10000is kept intact, interest payments of RM1000 can be collected forever.We say interest payments of RM1000 form a perpetuity.The present value of this infinite series of payments is RM10 000, as shownbelow:.RM10000RM10 0001RM10002RM10003RM1000RM1000

Present value of PerpetuitiesPV of a perpetuity is defined as the equivalent value of the set of paymentswhich begins at the beginning of the perpetuity’s term.PV of a perpetuity must be equivalent to the set of payments R shownbelow:RRRRR0123Present ValueTypes of Perpetuity: Applies similarly to annuities: eg. Ordinary perpetuity, perpetuity due, perpetuity defered.Note: Ordinary perpetuity is a series of level periodic payments made at the end of each interestperiod, which continue forever.

Present value of PerpetuitiesRecall: PV of an ordinary annuity is can be determined usingEqn.11 below1 1 𝑖𝑃𝑉 𝑅𝑎 𝑖 𝑅𝑖𝑛 𝑛Eq.11To calculate the present value of a perpetuity, we let n be infinityin Eqn.11. i.e. (1 i)-n becomes zero. Thus we have,𝑃𝑉 i.e.𝑅𝑖𝑃𝑉 𝑅𝑎 𝑖 Eq.14

Example 4How much money is needed to establish a scholarship fund paying scholarships ofRM1000 each half year if the endowment can be invested at j2 10% and if the firstscholarships will be provided:(a) A half year from now?(b) immediately?

Example 4How much money is needed to establish a scholarship fund paying scholarships of RM1000 each halfyear if the endowment can be invested at j2 10% and if the first scholarships will be provided:(a) Ahalf year from now?(b) immediately?R 1000; m 2; i jm/m 0.1/2 0.05(a)𝑅𝑃𝑉 𝑖1000𝑃𝑉 0.05(b) Sum ofperpetuity RM1K𝑅𝑀20 000 𝑅𝑀1000 𝑅𝑀21000 𝑅𝑀20 0?123

Exercise1. A company is expected to pay RM3.50 every 3 months on its preference shares. Ifmoney is worth j4 16%, what should the share be selling for?RM87.502. A preference share pays a RM6 dividend annually. If money is now worth 9% p.a,what should an investor pay for this stock if a dividend has just been paid?RM66.673. It costs RM100 at the end of each month to maintain a railway level crossing. Howmuch can the railways contribute toward the cost of an underpass which willeliminate the level crossing if money is worth 15% p.a. payable monthly?RM8000

Annuities Definition Future value of an ordinary annuity Present value of an ordinary annuity Annuities due Perpetuities Deferred annuities Summary of annuities

Deferred AnnuitiesDefinition An deferred annuity is an annuity whose 1st payment is due some time laterthan the end of the first interest period.è An ordinary deferred annuity is an ordinary annuity whose term is deferred fork periods.RRR0123Period of defermentPresent Valuekk 1 k 2Ordinary annuity of npaymentsk nFuture ValueIn the above diagram: the period of deferment is k periods the 1st payment of the ordinary annuity is at time k 1. This is because the term of an ordinaryannuity starts 1 period before its first payment. So when the date of 1st payment given, we need to determinethe period of deferment by moving back one period.

Present Value of Deferred AnnuitiesTo calculate the present value of a deferred annuity, we find thevalue of n payments one period before the first payment and thendiscount this sum for k periods to obtain.𝑃𝑉 𝑅𝑎 𝑖𝑛 (1 𝑖)-kEq.15

Example 5What sum of money should be set aside at a child’s birth to provide annual paymentsof RM1500 to cover the expenses for 4 years’ tertiary education if the first payment isto be made on the child’s 19th birthday? The fund will earn interest at 12% p.aeffectiveRM1.5K01Present ValueR 1500; i 0.12; n 4; k 82183Period of defermentk 18RM1.5KRM1.5Kk n 18 4 2219Ordinary annuity of npaymentsn 4Future Value𝑃𝑉 𝑅𝑎 𝑖𝑛 (1 𝑖)-k(1 0.12)-8 1500𝑎0.1241 1 0.12 15000.12 RM592.46 4(1 0.12)-8

Exercise1. Find the present value of an ordinary annuity deferred 3 years 6 months which paysRM500 half yearly for 7 years if interest is 7% pa convertible half-yearly.RM4291.722. On here 55th birthday, Ms Smith decides to sell her house and move into anapartment. She obtains RM80K on the sale of her house and invests this money in afund paying 9% pa. On her 65th birthday she makes her 1st withdrawal that willexhaust the fund over 15 years (ie 15 withdrawals). What is the size of eachwithdrawal?RM21 555.41

Future Value of Annuities due 0 1 n R 2 R 3 R n-1 R Present Value R Future Value Recall that the FV of an annuity can be defined as the equivalent value of the payment at the end of the term, èBy definition FV of an annuity due is an equivalent value due one period after the last payment