Transcription

LINCOLN VARIABLE ANNUITIESLincoln Lifetime Income Advantage 2.0SMAvailable with Lincoln ChoicePlus Assurance variable annuitiesSMLINCOLN ANNUITIESNot a depositInvestment Options GuideNot FDIC-insured May go down in valueNot insured by any federal government agencyNot guaranteed by any bank or savings associationInsurance products issued by:The Lincoln National Life Insurance CompanyLincoln Life & Annuity Company of New York1965321For use with the general public.

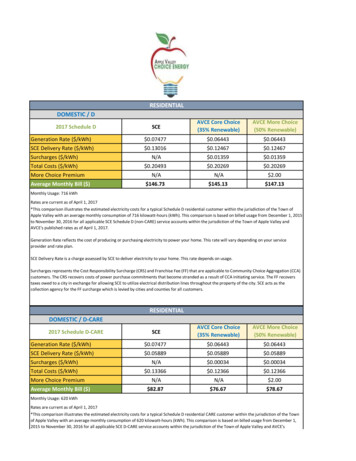

5.75% lifetime income withnursing home enhancementLincoln Lifetime Income SM Advantage 2.0 1, an optional living benefit rider available for anadditional charge with a Lincoln variable annuity, gives investors: 5.75% guaranteed lifetime income at age 65(5.50% joint). Protection for beneficiaries with a dollar-fordollar Guarantee of Principal death benefit Income Base grows annually at the greaterof 6% simple or account value growth2 Nursing home enhancement increaseswithdrawals to 10% starting at age 703 Tax-deferral during accumulation for greatergrowth potential9 Option to take income using i4LIFE Advantage Guaranteed Income Benefit6% simple growth, 5.75% guaranteed lifetime income,10% nursing home enhancement5.75% income for lifesingle and 5.50% jointIncome Base grows annually at the greater of:6% simple growthoror transfer to i4LIFEAccount value growthAVAV6%AVAV6%6%6%6%6%6%5.75%Yr 1Yr 2Yr 3Yr 4Yr 5Yr 6Yr 7Yr 8ACCUMULATION PHASEnAccount value6% simple growthIncome BaseAccount value growthYr 9Yr 10Yr 11Yr 12Yr 13Yr 14Yr 15INCOME PHASE10% nursing homeenhancementThis hypothetical example does not reflect a specific investment.Powered by risk managed strategies Build up to an 80/20 equity/fixed income portfoliofrom a large selection ofindividual funds2 World-class investment risk Risk overlay automaticallymanagement from SSGA andlowers equity exposureMilliman Asset Managementduring volatile periods

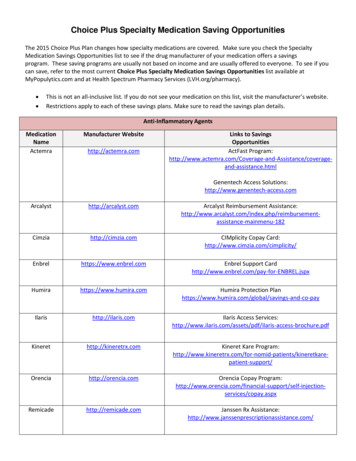

Maximize lifetime income potential with i4LIFE You have the option to transition the greater of your Income Base or account value to i4LIFE Advantage GIB, a living benefit rider available for an additional charge.4 i4LIFE gives investors: Potential for rising income when your account value grows greater than 4% Continued access to your account value with control of your investments5 Tax-efficient income for you and your beneficiaries when investing nonqualified moneyEach payment returns a portion of theoriginal investment with a portion of thegains until the original cost basis has beenrecovered. Systematic withdrawals are fullytaxable until any gains in the contract arecompletely withdrawn.The GIB is a percentage of your locked-inIncome Base6 or account value, if greater, andensures that your total payment will never fallAge(Male, Single)GuaranteedIncome Benefit(GIB)First-YearTotal Income7805.50%785.50%7674below that amount each year. Your first yeartotal income is a percentage of your accountvalue based on several variables includingage, gender and Access Period.To receive the same after-tax first payment,a withdrawal would have to be taken in theamount shown, expressed as a percentage ofthe initial investment.NontaxablePortion 8ComparableTaxable .16%73%8.59%These assumptions represent a Lincoln nonqualified B-Share variable annuity with i4LIFE Advantage Guaranteed Income Benefit(GIB) Managed Risk, Guarantee of Principal death benefit, and a 4% assumed interest rate (AIR). These returns are only estimates ofan initial annualized return based on a 35% tax bracket. The tax-exclusion amount varies by age. Nonqualified i4LIFE payments areavailable at any age, please ask your advisor for more details.Variable annuities are long-term investment products that offer a lifetime income stream, access to leading investmentmanagers, options for guaranteed growth and income (available for an additional charge), and death benefit protection. Todecide if a variable annuity is right for you, consider that its value will fluctuate; it’s subject to investment risk and possibleloss of principal; and there are costs associated such as mortality and expense, and administrative fees. All guarantees,including those for optional features, are subject to the claims-paying ability of the issuer.Lincoln Lifetime Income SM Advantage 2.0 is available for an additional annual charge of 1.25%, or 1.50% for joint coverage, above standard contract expenses (maximum annualcharge of 2.25%, or 2.45% joint). As your Income Base increases, your cost will increase proportionately. The Income Base is not a cash or surrender value, nor is it available as alump sum.2 The 6% annual enhancement will continue for the earlier of 10 years or through age 85 and resets upon an account value step up. If a withdrawal is taken, the 6% enhancement isnot available that year, but account value can be locked in through age 85 (based on the oldest life for joint coverage). In New York, the 6% enhancement is not available once thefirst Guaranteed Annual Income withdrawal occurs, but account value can be locked in through age 85.3 In order to qualify for the nursing home enhancement, you must be 70 (based on youngest life for joint); you cannot be in a nursing home the year prior to rider election or forfive years after; you must have a minimum 90 consecutive-day stay; and your account value must be greater than zero. With joint life, the first person to qualify and file willreceive the enhancement. Not available in CA, CT, HI, IL, NV, and VT.4 Available for an additional charge of 1.35% above standard contract expenses, or 1.55% for joint coverage (maximum annual charge for the GIB of 2.25%, or 2.45% joint). Iftransitioning from Lincoln Lifetime Income SM Advantage the charge is 1.25% single or 1.50% joint.5 For a defined period of time based on the Access Period chosen.6 Your GIB amount is set as a percentage of the greater of your Income Base less allowable withdrawals or Account Value and is determined by your age (youngest life for joint life).7 First-year income is based on your current account value.8 Assumes the account value is equal to the cost basis at income start. Percentage is based on IRS exclusion ratio.9 Withdrawals of earnings are taxable as ordinary income and, if taken prior to 59 1/2, may be subject to an additional 10% federal tax.1 3

Build your own investment strategyYou have the investment flexibility and choice to build your portfolio based on your specificneeds. Talk with your advisor to decide which approach is best for you.3480ALPS / Stadion5EquityCustom portfolios20Choose from a selection of 28 individual funds based on your investmentstyle, risk profile and investment objectives.Fixed IncomeBlackRock8Legg Mason910Check-the-box optionsChoose from 11 asset allocation funds that were carefully selected toachieve different risk objectives. These funds have been built by leadingasset managers with a focus on portfolio construction.LVIP SSGA Moderate Structured Allocation Fund†13MFS VIT Total Return Series1415Asset allocation modelsFranklin Income VIP Fund18BlackRock Global Allocation V.I. Fund†Choose from 2 asset allocation multimanager models constructed withbalancing return enhancement opportunities and strategic diversificationthrough underlying fund weighting and selection.Delaware1920Choose from these leading asset managersFidelity VIP FundsManager 50% Portfolio22LVIP Franklin Templeton Multi-AssetOpportunities FundLVIP Goldman Sachs Income Builder Fund23SM4

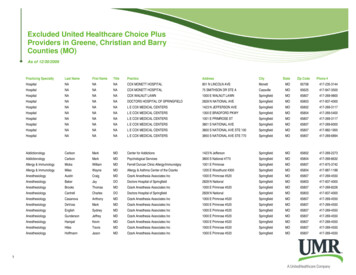

Select individual fundsEquity style: Value (V) Blend (B) Growth (G)When you build a portfolio, you can choose from our diverse selectionof investment options and styles from leading asset managers.Each fund has been assigned to a style box based on its investmentfocus and portfolio composition. The following key can help you betterunderstand the differences between the funds:Equity – elect up to 80%U.S. Large Cap - Volatility/Risk ManagementLVIP BlackRock Dividend ValueManaged Volatility FundLVIP ClearBridge QS Select Large Cap ManagedVolatility FundLVIP Blended Large Cap GrowthManaged Volatility FundLVIP Dimensional U.S. EquityManaged Volatility FundLVIP Fidelity Institutional AMSM Select CoreEquity Managed Volatility FundLVIP Franklin Templeton ValueManaged Volatility FundLVIP Invesco Select Equity Income ManagedVolatility FundLVIP SSGA Large Cap Managed Volatility FundPFixed income duration: Short-rangematurity (S) Intermediate-range maturity (I)Long-range maturity (L)Passive investing: Passive funds aredenoted with aP in the following charts.Fixed income – elect at least 20%Net %V0.92%B0.73%BYourAllocation%Fixed Income Conservative toModerate Fund OptionsNet .88%S0.65%I0.96%S0.60%ILVIP SSGA Short-Term Bond Index Fund0.61%ILVIP Western Asset Core Bond Fund0.80%LDelaware VIP DiversifiedIncome Series*Delaware VIP Limited-Term DiversifiedIncome Series*JPMorgan Insurance TrustCore Bond PortfolioLVIP BlackRock Inflation ProtectedBond FundLVIP Delaware Bond Fund*LVIP Delaware DiversifiedFloating Rate Fund*LVIP Dimensional/VanguardTotal Bond Fund†LVIP PIMCO Low Duration Bond FundLVIP SSGA Bond Index Fund§Net FundExpenseStyleLVIP American Century Select Mid CapManaged Volatility Fund1.25%VLVIP Blended Mid Cap Managed Volatility Fund1.02%GLVIP JPMorgan Select Mid Cap ValueManaged Volatility Fund1.05%V0.87%BNet FundExpenseStyle1.06%B1.00%V1.23%G1.20%B0.89%BU.S. Mid & Small Cap - Volatility/Risk ManagementLVIP SSGA SMID Cap Managed Volatility FundPGlobal/International - Volatility/Risk ManagementLVIP Dimensional International EquityManaged Volatility FundLVIP Franklin Templeton Global EquityManaged Volatility FundLVIP MFS International EquityManaged Volatility FundLVIP Multi-Manager Global EquityManaged Volatility FundLVIP SSGA InternationalManaged Volatility FundPTotal % (max 80%)YourAllocation%P§YourAllocation%Total % (min 20%)YourAllocation%Consider these risks and restrictions before investing in any of these options:Investing internationally involves risks not associated with investing solely in the UnitedStates, such as currency fluctuation, political risk, differences in accounting, and thelimited availability of information.Funds that invest in small- and/or mid-size company stocks typically involve greater risk,particularly in the short term, than those investing in larger, more established companies.You could lose money by investing in the Fund. Although the Fundseeks to preserve the value of your investment at 1.00 per share(or, for the LVIP Government Money Market Fund, at 10.00 pershare), it cannot guarantee it will do so. An investment in the Fundis not insured or guaranteed by the FDIC or any other governmentagency. The Fund’s sponsor has no legal obligation to providefinancial support to the Fund, and you should not expect that thesponsor will provide financial support to the Fund at any time.Funds that concentrate investments in one region or industry may carry greater riskthan more broadly diversified funds.The return of principal in bond portfolios is not guaranteed. Bond portfolios have thesame interest rate, inflation, credit, prepayment and market risks that are associatedwith the underlying bonds owned by the fund (or account).Asset allocation does not ensure a profit or protect against loss in a declining market.High yield portfolios may invest in high-yield or lower-rated fixed income securities(junk bonds), which may experience higher volatility and increased risk of nonpaymentor default.Alternative funds expect to invest in (or may invest in some) positions that emphasizealternative investment strategies and/or nontraditional asset classes and, as a result,are subject to the risk factors of those asset classes and/or investment strategies.Some of those risks may include general economic risk, geopolitical risk, commodityprice volatility, counterparty and settlement risk, currency risk, derivatives risk, emergingimportant disclosures continued on page 75

Check-the-box optionsYou can select one or more of these asset allocation funds to create a portfolio that meets your specific needs and objectives.Allocate 100% to any one, or combination of, these funds1Net FundExpenseU.S. %LVIP Global Growth Allocation Managed Risk Fund†‡0.99%39.40%29.90%28.40%2.30%LVIP American Global Growth Allocation Managed Risk Fund1.05%36.30%28.00%24.30%11.40%LVIP Global Moderate Allocation Managed Risk Fund†‡1.00%34.30%24.40%40.90%0.40%American Funds Managed Risk Asset Allocation Fund0.91%47.20%11.40%26.60%14.80%LVIP BlackRock Global Allocation V.I. Managed Risk Fund†‡1.18%30.00%25.00%40.00%5.00%LVIP American Global Balanced Allocation Managed Risk Fund1.03%28.50%17.60%41.70%12.20%LVIP Global Conservative Allocation Managed Risk Fund†‡1.00%25.90%14.00%59.80%0.30%Global Asset AllocationLVIP SSGA Global Tactical Allocation Managed Volatility Fund†‡LVIP BlackRock Global Growth ETF Allocation Managed Risk Fund†‡PHIGHEST TO LOWEST EQUITY EXPOSURE Domestic Asset AllocationLVIP BlackRock U.S. Growth ETF Allocation Managed Risk Fund†‡LVIP US Growth Allocation Managed Risk Fund†‡PNet FundExpenseU.S. 9%69.50%—30.40%0.10%1.09%71.30%—28.70%—If building a portfolio using the equity funds on the previous page, these are also available as 80% options.12The percentage of fund assets that includes but is not limited to commodities, derivatives, cash, and other short-term securities. Allocations do not include fund assets allocated toexchange-traded futures.6

Managed Volatility modelsChoose from 2 asset allocation multimanager models constructed with balancing return enhancement opportunities andstrategic diversification through underlying fund weighting and selection. Neither asset allocation nor diversification can ensurea profit or protect against loss.Allocate 100% to either one of these models70/30 Global Allocation Managed Volatility Model80/20 U.S. Allocation Managed Volatility ModelLVIP BlackRock Dividend Value Managed Volatility Fund30%LVIP Delaware Bond Fund30%LVIP Blended Large Cap Growth Managed Volatility Fund30%LVIP Dimensional U.S. Equity Managed Volatility Fund30%LVIP Delaware Bond Fund20%LVIP Dimensional International Equity Managed Volatility Fund12%LVIP SSGA SMID Cap Managed Volatility Fund10%LVIP MFS International Equity Managed Volatility Fund12%LVIP American Century Select Mid Cap Managed Volatility Fund5%LVIP American Century Select Mid Cap Managed Volatility Fund6%LVIP Blended Mid Cap Managed Volatility Fund5%LVIP Blended Mid Cap Managed Volatility Fund6%LVIP SSGA SMID Cap Managed Volatility Fund4%The risk managed strategiesThe strategies are designed to stabilize volatility througha combination of asset allocation and ongoing volatilitymanagement. In periods of elevated volatility, the risk overlayautomatically lowers equity exposure to lessen the impact ofpotential bear markets without adjusting the actual portfolioallocation. In periods of low volatility, the overlay increasesequity exposure — giving you the potential to participatein rising markets. Talk with your advisor about the bestapproach for you.Neither asset allocation nor diversification can ensure a profit or protect against loss.The risk-managed strategies are not guaranteed, may not perform as expected, andcontractowners may experience loss.continued from page 5markets risk, foreign securities risk, high yield bond exposure, index investing risk,exchange-traded notes risk, industry concentration risk, leveraging risk, real estateinvestment risk, master limited partnership risk, master limited partnership tax risk,energy infrastructure companies risk, sector risk, short sales risk, direct investments risk,hard assets sectors risk, active trading and “overlay” risks, event driven investing risk,global macro strategies risk, temporary defensive positions and large cash positions.REITs involve risks such as refinancing, economic conditions in the real estate industry,changes in property values, dependency on real estate management, and otherrisks associated with a portfolio that concentrates its investments in one sector orgeographic region.Investing in emerging markets can be riskier than investing in well-established foreignmarkets. International investing involves special risks not found in domestic investing,including increased political, social, and economic instability.Floating rate funds should not be considered alternatives to CDs or money marketfunds, and should not be considered as cash alternatives.Exchange-traded funds (ETFs) in this lineup are available through collective trusts ormutual funds. Investors cannot invest directly in an ETF.*Investments in the Funds are not and will not be deposits with or liabilities ofMacquarie Bank Limited ABN 46008 583 542 and its holding companies, includingtheir subsidiaries or related companies, and are subject to investment risk, includingpossible delays in prepayment and loss of income and capital invested. No MacquarieGroup company guarantees or will guarantee the performance of the Series or Funds,the repayment of capital from the Series or Funds, or any particular rate of return.Strategy strengths Enables diversification across equities and fixed income Designed to manage the volatility of the portfolio Lower equity exposure during periods of high volatilityStrategy limitations May not protect against sudden market shocks or duringsmall market pullbacks May not capture all of the upside of an equity rally†The Fund is operated as fund of funds, which invests primarily in other funds ratherthan individual securities. Funds of this nature may be more expensive than otherinvestment options. These types of funds are asset allocation funds; asset allocationdoes not ensure a profit nor protect against loss.‡THE LVIP MANAGED RISK FUNDS AND LVIP MANAGED VOLATILITY FUNDS ARE NOTGUARANTEED OR INSURED BY LINCOLN OR ANY OTHER INSURANCE COMPANY ORENTITY, AND SHAREHOLDERS MAY EXPERIENCE LOSSES. THE STRATEGIES USED BYTHESE FUNDS ARE SEPARATE AND DISTINCT FROM ANY ANNUITY OR INSURANCECONTRACT RIDER OR FEATURES.§An index is unmanaged, and one cannot invest directly in an index. Indices do notreflect the deduction of any fees.AB VPS refers to AllianceBernstein Variable Products Series Fund, Inc. AmericanCentury VP refers to American Century Investments Variable Portfolio Funds. LVIPAmerican (Fund) refers to the Lincoln Variable Insurance Products Trust, whichoperates as a Feeder Fund, investing all of its assets in the American Funds InsuranceSeries Master Fund, a separate mutual fund. BlackRock V.I. refers to BlackRockVariable Series Funds, Inc. Delaware VIP refers to Delaware Variable InsuranceProducts Trust. VIP refers to Fidelity Variable Insurance Products. VIP Contrafund, VIPFundsManager, Fidelity, Fidelity Institutional AM, and the Fidelity Investments logoare service marks of FMR LLC. Used with permission. LVIP refers to Lincoln VariableInsurance Products Trust. MFS VIT refers to MFS Variable Insurance Trust. PIMCO VITrefers to PIMCO Variable Insurance Trust. SSGA refers to State Street Global Advisors.7

Lincoln Lifetime Income SM Advantage 2.0At-a-GlanceInvestment flexibilityAccess to a diversified lineup of risk managed investment options managed by leading asset managers.Tax-deferred growth potentialParticipation in the long-term growth potential of the market. If invested with nonqualified money, savings growtax-deferred, and tax bills are not impacted until a withdrawal is made.96% guaranteed growthThe Income Base increases annually by the greater of 6% simple growth or the account value growth. The 6% annualgrowth will continue for the earlier of 10 years or through age 85 (based on the oldest life for joint) with

LINCOLN ANNUITIES 1965321 Investment Options Guide For use with the general public. Lincoln Lifetime Income SM Advantage 2.0 Available with Lincoln ChoicePlus Assurance SM variable annuities LINCOLN VARIABLE ANNUITIES Insurance products issued by: The Lincoln National Life Insurance Company