Transcription

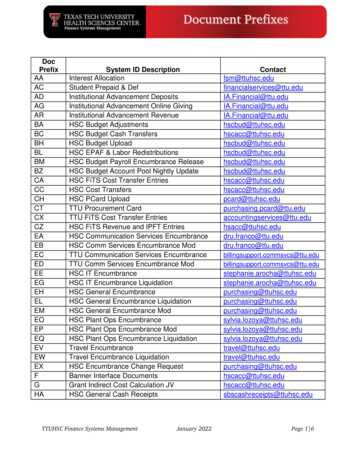

General MathematicsHSC Mathematics General 2 CourseStage 6FM5 Annuities and loan repaymentsDistance Education Mathematics Network, Rural and Distance EducationFM5 Annuities and loan repayments0

AcknowledgementsWriter:Mandi Sutherland, Sydney Distance Education High SchoolEditors:Mathematics staff at Camden Haven High School, Dubbo School of Distance Education,Karabar High School, Southern Cross School and Sydney Distance Education High School Distance Education Mathematics Network, Rural and Distance Education, NSW Department ofEducation and Communities, April 2013.We thank the following owners of copyright material for permission to reproduce their work. Board of Studies Mathematics General Stage 6 Syllabus 2012 Learning Materials Production, Open Training and Education Network - Distance Education,NSW Department of Education and Training 2002FM5 Annuities and loan repayments0

ContentsIntroduction . 31.1Annuities . 41.2Future value annuities . 5Future value of an annuity formula . 7Future value interest factor tables . 81.3Present value annuities . 13Present value of an annuity formula . 15Present value interest factor tables . 161.4Paying off a loan . 191.5Home loans . 211.6Graphing loan repayments . 25Increasing repayments . 25A sudden windfall . 26Monthly vs. fortnightly repayments . 271.7Additional fees and charges . 31Stamp duty . 31Assignment – Annuities and loans . 34Appendix . 39Terminology . 43Student evaluation. 44Answers . 45FM5 Annuities and loan repayments1

Strand: Financial MathematicsA sound understanding of credit, the responsible use of, and costs associated with, creditcards, and borrowing and investing money are important in developing students’ ability tomake informed financial decisions. This includes a sound understanding of annuities, whichrepresent fixed payments into an investment account or for the repayment of a loan.In the Financial Mathematics Strand in the HSC Mathematics General 2 course, the principalfocus is on the mathematics of borrowing money and making informed decisions aboutfinancial situations.Outcomes addressedA student:MG2H-1uses mathematics and statistics to evaluate and construct arguments in a rangeof familiar and unfamiliar contextsMG2H-3makes predictions about situations based on mathematical models, includingthose involving cubic, hyperbolic or exponential functionsMG2H-6makes informed decisions about financial situations, including annuities andloan repaymentsMG2H-9chooses and uses appropriate technology to locate and organise informationfrom a range of contextsMG2H-10uses mathematical argument and reasoning to evaluate conclusions drawnfrom other sources, communicating a position clearly to others, and justifies aresponse.Content summaryFM4Credit and borrowingFM5Annuities and loan repaymentsFM5 Annuities and loan repayments2

IntroductionThe principal focus of this topic is the nature and mathematics of annuities, the processes bywhich they accrue, and ways of maximizing their value as an investment. Annuitycalculations are also used to calculate the present value of a series of payments and tocalculate the repayment amount of a reducing-balance loan. Emphasis should be placed onusing tables of interest factors to facilitate calculations.Outcomes addressed:MG2H-1, MG2H-3, MG2H-6, MG2H-9, MG2H-10Students develop the following knowledge, skills andunderstanding recognise that an annuity is a financial plan involving periodical, equal contributionsto an account, with interest compounding at the conclusion of each period calculate (i) the future value of an annuity (FVA) and (ii) the contribution per period,using a table of future value interest factors for calculating a single future value of anannuity stream recognise that the values in a table of future value interest factors can be obtainedusing the formula for the future value of an annuity calculate (i) the present value of an annuity (PVA) and (ii) the contribution per period,using a table of present value interest factors for calculating a single present value ofan annuity stream recognise that the values in a table of present value annuity interest factors can beobtained using the formula for the present value of an annuity use a table of interest factors for the present value of an annuity to calculate loaninstalments, and hence the total amount paid over the term of a loan investigate the various processes for repayments of loans calculate the monthly repayment for a home loan from a table, given the principal,rate and term calculate the fees and charges that apply to different options for borrowing money inorder to make a purchase interpret graphs that compare two or more repayment options for home loans.For students in Distance Education Centres only:there is an evaluation page at the back of this part; fill it in when you have finished the work;say how easy/hard/interesting you find this work; ask relevant questions and return yourcomments to your teacher.FM5 Annuities and loan repayments3

1.1 AnnuitiesAn annuity is a series of regular payments made over a number of periods. These paymentsmay be made either by an individual or to an individual.Examples of annuities include: dividends loan repayments Austudy payments mortgage repayments rental payments social security benefits superannuation payments.If payments are made at the end of a period the annuity is called an ordinary annuity.If they are made at the beginning of a period, the annuity is called an ordinary annuity due.In the previous booklet FM4 Credit and borrowing we learnt the terms future value andpresent value. This terminology is also used when working with annuities.The future value of an annuity is the total value of the investment at the end of the lastpayment period.The present value of an annuity is the single sum of money which, if invested today at therate of compound interest which applies to the annuity, would produce the same financialresult over the same period of time.It is important to remember that payments/withdrawals are made at the end of each period inan ordinary annuity.In the next two sections you will be shown how to use formulas to calculate the future valueand present value of an annuity.FM5 Annuities and loan repayments4

1.2 Future value annuitiesThe future value of an annuity is the total of all payments plus the compound interestearned over the term of the annuity. (Revise FM4 Credit and borrowing if you haveforgotten your work on the compound interest formula)To find the total returned, you can use repeated applications of the compound interestformula since the principal is different each period.EXAMPLE 1You deposit 100 at the end of each month into a savings account earning 6% p.a.,compounded monthly for four months. What is the future value of your annuity?SolutionUsing A P (1 r ) and r 6% p.a.n 0.5% per month(Don’t forget to change this value to a decimal!)The first 100 is invested for three months so it amounts to:A 100(1 0.005)3 101.51The second 100 is invested for two months so it amounts to:A 100(1 0.005)2 101.00The third 100 is invested for one month so it amounts to:A 100 (1 0.005)1 100.50The fourth 100 is deposited at the end of the fourth month with 0 interest.Value of the annuity is 101.51 101.00 100.50 100 403.01FM5 Annuities and loan repayments5

EXAMPLE 2Complete the following table, showing the future value of each 200 deposited at the end ofeach month for 6 months at and interest rate of 12% p.a., compounded monthly. Then findthe future value of the annuity.Number of months, n,investedAmount invested,P5 2004 2003 2002 2001 2000 200Future Value, ATotal SolutionNumber of months, n,investedAmount invested,PFuture Value, A5 200 210.204 200 208.123 200 206.062 200 204.021 200 2020 200 200Total 1230.40Note that there is not a sum of 200 invested for 6 months. This is because the money isdeposited at the end of each month.This tells us that if we were to deposit 200 into an account at the end of every month for 6months, at the end of this time the future value of the annuity is 1230.40.FM5 Annuities and loan repayments6

Future value of an annuity formulaA formula has been developed to calculate the future value of an annuity without having torepeatedly apply the compound interest formula as done in the examples on the previouspages.The future value, FVA, of an annuity is given by𝑭𝑭𝑭 𝒂 (𝟏 𝒓)𝒏 𝟏𝒓 where a contribution per period made at the end of the periodr interest rate per compounding period, expressed as a decimaln number of periodsNote: You do not need to use this formula. However, it is expected that you are aware of thisformula and how it is used.EXAMPLE 3Find the future value of an annuity when 200 is deposited at the end of each month for sixmonths if interest is 12% p.a. compounded monthly.SolutionUse the future value formula and a 100,r 12% p.a.n 6 months 1% per month 0.01 (as a decimal)𝐹𝑉𝐴 𝑎 (1 𝑟)𝑛 1𝑟 Note that the payment, interest rateand periods are all in months. You mustcheck that the same units are used ineach of these three values beforesubstituting into the formula.(1 0.01)6 1 200 0.01 1230.40So the future value of the annuity is 1230.40.Note: this is the answer you got on page 6 by adding the five amounts found using the compound interestformula.FM5 Annuities and loan repayments7

EXAMPLE 4Shelley wants to buy an apartment in five years. She estimates it will cost 250 000 and sheneeds a 10% deposit. She makes monthly deposits to a bank earning 12% p.a., compoundedquarterly until she is ready to buy.a) How much deposit does Shelley need for the apartment?b) How much should she set aside each month to reach her deposit goal?Solutionsa) The deposit is 10% 250 000 25 000b) FVA 25 000,𝐹𝑉𝐴 𝑎 r 12% p.a.,n 20 quarters 3% per quarter 0.03(1 𝑟)𝑛 1 𝑟(1 0.03)20 1 0.0325000 𝑎 26.87037 25000 𝑎 𝑎 2500026.87037 930.39So 930.39 should be deposited each quarter to have a deposit of 25 000 in five years time.Future value interest factor tablesAs mentioned earlier, you are not expected to apply the future value annuity formulayourself. Instead, you will be using annuity tables, otherwise known as future value interestfactor tables.These tables are often used by those working in finance as it allows them to make quickcalculations without the use of the future value annuity formula we have just seen.An example of such a table is given on the following page. You will see that all values in thetable are rounded to five decimal places.FM5 Annuities and loan repayments8

This table gives the future value (FVA) of an annuity with a contribution of 1per period.A larger version of this table is given on page 39 of the Appendix.Let us now reconsider EXAMPLE 3, from page 7:Find the future value of an annuity when 200 is deposited at the end of each month for sixmonths if interest is 12% p.a. compounded monthly.Here we already know that our interest rate is 1% per period, and we have 6 periods.Looking at the table to where these values meet (as shown circled in red) we have a value of 6.15202.Remembering that the future value table gives the future value of an annuity with acontribution of 1 per period, this tells us that if we were to contribute 1 per month at 1%per month for six months it would grow to 6.15. However, since we are investing 200 permonth:200 6.15202 1230.40 which is the same answer as earlier.You can calculate each value in the table above by using the future value annuityformula and substituting in the different interest rates and periods, and setting a 1.FM5 Annuities and loan repayments9

EXAMPLE 6You deposit 4000 at the end of every six months into an account that pays 6% p.a.,compounded half yearly. If you do this for four years, how much will be in the account afterthe last deposit has been made?Solutiona 4000,r 6% p.a.n 8 periods 3% per six monthsLooking at our table, the future value table 3% and 8 periods leads to 8.89234Since we are depositing 4000 per period:4000 8.89234 35 569.36Therefore 35 569.36 will be in the account after four years.EXAMPLE 7This example was done earlier using the formula but now we will look at it again with thetables instead.Shelley wants to buy an apartment in five years. She estimates it will cost 250 000 and sheneeds a 10% deposit. She makes monthly deposits to a bank earning 12% p.a., compoundedquarterly until she is ready to buy.a) How much deposit does Shelley need for the apartment?b) How much should she set aside each month to reach her deposit goal?Solutionsa) The deposit is 10% 250 000 25 000b) FVA 25 000,r 12% p.a.,n 20 quarters 3% per quarterHere we know what the future value needs to amount to and we’re looking for thecontribution amount (a).First, using the table and 3% and 20 periods we get the value of 26.87037So 25 000 a 26.870372500026.87037 930.39𝑎 So 930.39 should be deposited each quarter to have a deposit of 25 000 in five yearstime.FM5 Annuities and loan repayments10

Please complete allexercises on your ownlined A4 paper. Makesure each question islabelled clearly.Exercise 1.2Use the table of future value interest factors on page 39 of the Appendix toanswer the following questions.1An annuity is organised so that 1000 is deposited at the end of each month into anaccount earning 9% p.a. compounding monthly for two and a half years.a)What is the interest rate per month?b) What is the value of an annuity at the end of the two and a half years.2c)How much of this is interest?a)What is the value of an annuity at the end of ten years if 5000 is deposited every sixmonths into an account earning 8% p.a., compounded half yearly.b) What amount is interest?3To provide for the purchase of a car, Alexis deposits 1200 at the end of every quarterinto an account earning 12% p.a. compounded quarterly.a)How much does Alexis have at the end of four years?b) How much more does she need to save before she can buy a car costing 25 000?c)4Will she have enough for this car if she saves for four and a half years?Jim is planning to take an overseas trip in two and a half years time. He estimates thecost will be 10 000. He has been advised to put 300 each month into an account whichpays 9% p.a., compounded monthly.a)How much will he have saved, including interest, at the end of two and a half years?b) Will he have enough money in two and a half years for his trip?c)5By how much will he fall short or overshoot his goal?Mary wants to renovate her kitchen in three years time and will need 10 000. Startingin one month, she will begin making regular monthly deposits into an account earning9% p.a., compounded monthly. How much should she deposit each month? Write youranswer correct to the nearest dollar. Note: Since she missed the first monthly payment Mary willonly be making 35 deposits.6A self-employed person has a retirement plan. If 7500 is paid each year into an accountearning 12% p.a., how much will be in the retirement account after 20 years?FM5 Annuities and loan repayments11

7Starting on her 21st birthday and continuing on every birthday up to and including her60th, Hariklea deposits 5000 into a fund as savings towards her retirement. How much,to the nearest dollar, will be in the fund when she retires (aged 60 years) if the fundearns:a)6% p.a., compounded annually?b) 9% p.a., compounded annually?8The camping gear William wants will cost him 12 000. He will buy it in two years timeand finds a bank willing to offer him interest of 3% p.a., compounded monthly. Howmuch must he contribute each month?9The parents of a newborn child decide that on each birthday from the 1st to the 17thinclusive, they will deposit a certain amount into an investment account to save towardsthe child’s education. The account offers 6% p.a. interest. How much should they putaway each year to have 16 000 after the seventeenth deposit?10 A company estimates it will need 250 000 in eight years to replace its computer system.If it establishes a sinking fund by making fixed six-monthly payments into an accountpaying 12% p.a., compounded six-monthly, how much should each payment be?Note: a sinking fund is any account that is established to accumulate funds to meet future obligations ordebts.FM5 Annuities and loan repayments12

1.3 Present value annuitiesWhile the future value of an annuity looks at the total amount after a certain time, the presentvalue of an annuity looks at the value now.The present value of an annuity is the ‘lump sum’ amount that you could invest now toproduce a regular income each month for a set length of time. We say that the ‘lump sum’ isthe present value of the series of regular payments.EXAMPLE 1Find how much needs to be invested now at 6% pa, compounded monthly if a payment of 100 is required at the end of each month for four months. That is, find the present value ofthe annuity.SolutionUsing A P(1 r)n , A 100, r 6% p.a.P ? 0.5% per month 0.05 (as a decimal)The first 100 is paid at the end of the first month:A P (1 r )n100 P (1 0.005)1100P 1.0051 99.50So we need to invest 99.50 now to have 100 after one month.The second 100 is paid at the end of the second month100 P (1 0.005)21001.0052P 99.01P So we need to invest 99.01 now to have another 100 after two monthsFM5 Annuities and loan repayments13

The third 100 is paid at the end of the third month100 P (1 0.005)100P 3(1.005)3 98.51So we need to invest 98.51 now to have another 100 after three months.The fourth 100 is paid at the end of the fourth month100 P (1 0.005)100P (1.005)44 98.02So we need to invest 98.02 now to have another 100 after four monthsPresent value of the annuity 99.50 99.01 98.51 98.02 395.04This means that 395.04 must be deposited now to be able to produce the four monthlypayments of 100.FM5 Annuities and loan repayments14

Present value of an annuity formulaA formula has been developed to calculate the present value of an annuity without having torepeatedly apply the compound interest formula as done in the examples on the previouspages.The present value, N, of an annuity is given by(𝟏 𝒓)𝒏 𝟏𝑷𝑷𝑷 𝒂 𝒓(𝟏 𝒓)𝒏 where a contribution per period made at the end of each periodr interest rate per per compounding period, expressed as a decimaln number of periodsNote: You do not need to use this formula. However, it is expected that you are aware of thisformula and how it is used.EXAMPLE 2What amount needs to be deposited in an account now so you can withdraw 100 at the endof each month for four months if interest is 6% p.a., compounded monthly?Solutiona 100,r 6% p.a.n 4 months 0.5% per months(1 𝑟)𝑛 1 𝑃𝑉𝐴 𝑎 𝑟(1 𝑟)𝑛 100 (1 0.005)4 1 0.005(1 0.005)4 395.05The present value is 395.04, that is, you need to deposit 395.04 now to be able towithdraw 400 over the next four months.Note: this is the same amount you obtained in EXAMPLE 1 where you totalled four amounts,each calculated using the compound interest formula.FM5 Annuities and loan repayments15

Present value interest factor tablesAs mentioned earlier, you are not expected to apply the present value annuity formulayourself. Instead, you will be using annuity tables, otherwise known as present value interestfactor tables. These are very similar to the future value interest factor tables looked at in theprevious section.Let’s reconsider EXAMPLE 3 above, using the present value table on the following page.We already know that r 0.5% and there are 4 periods.Looking at where these values meet (as circled in red) they give a value of 3.95050As we wish to be able to withdraw 100 each month: 100 3.95050 395.05 which is thesame answer as both previous methods.A larger version of this table is provided in the Appendix on page 40.You can calculate each value in the table above by using the present value annuityformula and substituting in the different interest rates and periods, and setting a 1.FM5 Annuities and loan repayments16

EXAMPLE 3A computer is sold on the terms that it will be repaid in monthly instalments of 75 for thenext two and a half years. Interest is charged at 18% p.a., compounded monthly. What is theequivalent cash price of the computer?SolutionHere r 1.5% per month and there are 30 periods.Using the table given on page 40 of the Appendix we get a value of 24.0158475 24.01584 1801.19Therefore the equivalent cash price of the computer is 1801.19EXAMPLE 4John establishes an annuity by depositing 100 000 into an account that pays 10% p.a.,compounded quarterly. Equal quarterly withdrawals will be made for the next five years. Atthe end of this time the account will have zero balance. Calculate the amount of eachwithdrawal.Here PVA 100 000,r 2.5% per quarter and there are 20 periods.Looking at our table, this gives a value of 15.58916100 000 a 15.58916𝑎 10000015.58916 6414.71Therefore John is able to withdraw 6414.71 every quarter for the next five years before heruns out of money.FM5 Annuities and loan repayments17

Please complete allexercises on your ownlined A4 paper. Makesure each question islabelled clearly.Exercise 1.3Use the table of present value interest factors on page 40 of the Appendix toanswer the following questions.1How much should you deposit now into an account paying 6% p.a., compoundedquarterly, in order to withdraw 1500 each quarter (three months) for the next five years?2What is the present value of an annuity that pays 500 a month for two years given thatinterest is 9% p.a., compounded monthly?3Arthur is able to repay 3000 at the end of each six month period for the next fifteenyears. If interest is 8% p.a. compounded six-monthly, how much can he borrow on theseconditions?4Shelley pays off her car loan at 325 per month for four years and two months. There isno down payment and she is charged 1.5% interest per month on the unpaid balance:a)What was the original cost of the car to the nearest dollar?b) What total interest will be paid, correct to the nearest dollar?5Trent establishes an annuity by depositing 250 000 into an account that pays 8% p.a.,compounded six-monthly. Equal six-monthly withdrawals will be made for the nextfifteen years. At the end of this time the account will have zero balance. Calculate theamount of each withdrawal. Write your answer correct to the nearest dollar.FM5 Annuities and loan repayments18

1.4 Paying off a loanThe loan amount is the present value of the series of loan repayments. For reducing balanceloans, the present value formula (and hence the present value table) can be used to calculateboth loan repayments (a) and the total loan amount (PVA).EXAMPLE 1Kris borrows 2000 and repays it in four equal monthly instalments. If interest is charged at24% p.a., compounded monthly, finda)the monthly instalmentb) the total repaidc)the interest paidSolutionsa) PVA 2000,r 2% per monthand there are 4 periods.Using the interest rate and periods in the present value table on page 40 of the Appendix,we have a value of 3.807732000 a 3.80773𝑎 20003.80773 525.25Therefore the monthly instalment is 525.25.b) The total repaid 4 525.25 2101c) Interest paid 2101 – 2000 101FM5 Annuities and loan repayments19

Please complete allexercises on your ownlined A4 paper. Makesure each question islabelled clearly.Exercise 1.4Use the table of present value interest factors on page 40 of the Appendix toanswer the following questions.1A company buys fax machines for its office for 15 000 and finances them at 12% p.a.,compounded monthly. If the loan is to be repaid in two years with equal monthlypayments:a)how much is each payment?b) what is the total repaid?c)2how much interest will be paid?Suppose you take out a loan for a fridge valued at 1450 and agree to pay for it in 18equal monthly instalments at interest of 0.75% per month.a)How much is each payment?b) How much interest will be paid?3A car loan for 68 000 is taken out over a 10 year period .a)If the repayments are made six-monthly, at an interest rate of 10% p.a. compoundedsix-monthly findi) the six-monthly repaymentsii) the total repaidiii) the total interest paid.b) If the repayments are made quarterly, at an interest rate of 8% p.a. compoundedquarterly findi) the quarterly repaymentsii) the total repaidiii) the total interest paid.c)Which is the better loan repayment option? Justify your answer with mathematicalreasoning.FM5 Annuities and loan repayments20

1.5 Home loansMost home loans are reducing balance loans. A reducing balance loan is a loan whereinterest calculated each period is less than for the previous period (provided that you aremaking regular repayments of course). This is because some of the principal has been repaid.It is not unusual when taking out a home loan over 20 – 30 years to end up repaying two orthree times as much as you originally borrowed. This is why it is important to understandexactly what you are signing yourself up for.In this section, you will use tables to determine monthly repayments on a reducing balanceloan.The table in the Appendix on page 41 shows the monthly repayments for differing loanamounts over 20 years at various interest rates.Even though repayments are generally made monthly, interest rates are quoted as yearlyamounts. Financial institutions quote yearly rates to customers but convert to a monthly rateto fit with monthly repayments.EXAMPLE 1Kelly takes out a home loan of 350 000 over 20 years at an interest rate of 6% p.a.a) Use Table A in the Appendix to find the monthly repayment.b) How much is paid back altogether for this loan?c) How much interest was paid?Solutionsa) A section of the table is provided on the following page:From the table, go across the 350 000 row and down the 6% p.a. column. This is circledfor you in green. A value of 2507.51 is obtained.Therefore the monthly repayment is 2507.51.FM5 Annuities and loan repayments21

b) Monthly repayment is 2507.51Total repaid 2507.51 240 601 802.40c) Interest amount repaid – loan amount 601 802.40 – 350 000 251 802.40EXAMPLE 2Luke takes out a home loan of 460 000 over 25 years at an interest rate of 7% p.a.a) Use Table B in the Appendix on page 42 to find the monthly repayment.b) How much is paid back altogether for this loan?c) How much interest was paid?Solutionsa) The table is provided on the following page:From the table, go across the 7% p.a. row and down the 25 year column. This is circledfor you in green. A value of 7.07 is obtained.Note that this table shows the monthly repayments per 1000 borrowed.As Luke has borrowed 460 000: 460 000 1000 460Therefore 460 7.07 3252.20Hence Luke’s monthly repayment is 3252.20FM5 Annuities and loan repayments22

Monthly repayments per 1000 borrowedb) 3252.20 300 975 660c)Interest 975 660 – 460 000 515 660FM5 Annuities and loan repayments23

Please complete allexercises on your ownlined A4 paper. Makesure each question islabelled clearly.Exercise 1.5Use Table A in the Appendix on page 41 to answer the following questions1Find the monthly repayment over 20 years for a loan of:a) 305 000 at 8% p.a.b) 490 000 at 12% p.a.2c) 335 000 at 10% p.a.a)What is the monthly repayment for a loan of 390 000 over 20 years at 11% p.a.?b) What is the total repaid on this loan?c)How much interest is charged?Use Table B in the Appendix on page 42 to answer the following questions.3Jane takes out a home loan for 600 000 over a 30 year period at an interest rate of8% p.a.a)What is her monthly repayment?b) What is the total repaid on this loan?c)4How much interest is charged?Jane’s friend Joan also takes out a home loan for 600 000 at an interest rate of 8% p.a.However Joan takes out her loan over a 20 year period.a)What is her monthly repayment?b) What is the total repaid on this loan?c)5How much interest is charged?Compare your answers to 3 c) and 4 c)a)What difference was there between the two loans that Jane and Joan had?b) Who paid more inter

using the formula for the future value of an annuity calculate (i) the present value of an annuity (PVA) and (ii) the contribution per period, . ordinary annuity due. In the previous booklet . FM4 Credit and borrowing. we learnt the terms future value and present value. This terminology is also used when working with annuities.