Transcription

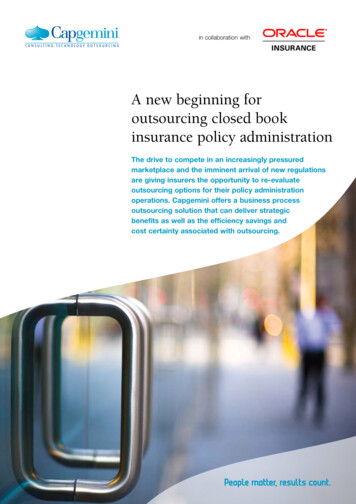

in collaboration withA new beginning foroutsourcing closed bookinsurance policy administrationThe drive to compete in an increasingly pressuredmarketplace and the imminent arrival of new regulationsare giving insurers the opportunity to re-evaluateoutsourcing options for their policy administrationoperations. Capgemini offers a business processoutsourcing solution that can deliver strategicbenefits as well as the efficiency savings andcost certainty associated with outsourcing.

Facing up to the challengeIn spite of recent technologicaladvances in the insurance industry,the in-house management of closedbook operations presents manyobstacles to businesses looking foragility in an increasingly competitiveenvironment. These challenges touchmost areas of the business making itharder to reduce operational costs,complicating financial reporting, andobstructing new selling opportunities,to name but three.In addition, maintaining the legacysystems often used for closed booksflies in the face of current IT bestpractices. In many cases, individualclosed books require independentteams of developers, engineers andcustomer relationship managers. Itis often difficult, if not impossible,to consolidate these fragmentedoperations and achieve efficienciesof scale.The need to reduce costs and becomemore agile is all the more urgent ata time when new capital and riskregulatory requirements — includingSolvency II and Retail DistributionReview (RDR) — are bearing down onthe insurance industry.So it is hardly surprising that insurancecompanies are redoubling their effortsto outsource the cost and complexityof their closed book operations to athird-party organization. The questionis, how?

Financial Servicesthe way we do itA new approachto closed book outsourcingIn earlier outsourcing contracts,success was measured simply by costreduction goals governed by ServiceLevel Agreements (SLAs). But today,offsetting the financial burden is nolonger enough. Insurers are lookingfor ways to extract additional valuefrom their closed book operations byintegrating them within an overallclient management strategy. As wellas cost, success is driven by customersatisfaction, delivery of services andcross-sell/up-sell opportunities.This multifaceted approach tooutsourcing requires an equally agilesolution. Based on our technologyand business process optimizationexpertise, Capgemini has deviseda new approach to closed bookoutsourcing that addresses theconcerns of insurers and offers a rapidroadmap to benefits.Removing complexity,accelerating benefitsThe Capgemini business processoutsourcing solution takes advantageof a ‘lift and drop’ approach to closedbook outsourcing. Unlike solutionsfrom other vendors, this involves a‘once only’ migration at the start of theprocess. There is no need for a secondmigration phase after the initial legacytransition has stabilized. This meansthat insurers enjoy a clear, structuredroadmap to benefits, supported by clearmilestones and cost transparency.This removes the uncertainty anddisruption associated with a secondmigration step that comes with otheroutsourcing solutions.Oracle: a proven partner, anoutstanding solutionCapgemini’s closed book outsourcingsolution transitions legacy systems toOracle Insurance Policy Administrationfor Life and Annuity, a flexible rulesbased system that helps insurersbecome more adaptive enterprises andachieve true business transformation.To underpin this partnership andmaximize customer benefits, Capgeminihas invested in an Oracle Insurance PolicyAdministration Center of Excellence tobuild expertise, foster innovation andsupport the creation and standardizationof processes and methodologies specificallyto support policy administrationtransformation using Oracle InsurancePolicy Administration. The Center ofExcellence brings together over 75professionals with hands-on experienceimplementing Oracle Insurance PolicyAdministration with our global insuranceclients.This next generation policy administrationsolution has been:Tested and proven in real-worldimplementations Designed to address requirements forglobal reach without losing local focus Ranked highly by independent analystsincluding Gartner and Celent1 Created using a state-of-the-art approachthat supports next generation platformssuch as service oriented architecture The Capgemini SolutionDisruptionLegacy TransitionDisruptionStabilizationMigrationRun0 Years 5 Years‘lift and drop’Process Transition StabilizationOne time disruptionKnowledge transferas the people arestill availableInsurance companystill involved andcommitted totransition whichenables the migrationRunThe Capgemini solution involvesjust one transition instead of thetwo disruption points required whenworking with other outsourcingcompanies. Following the transition,Capgemini stabilizes the system beforepreparing for ‘run’. No additionalmigration is required.Gartner, Inc.: “MarketScope for North American Life Insurance Policy Administration Vendors,”June 2010; Celent: “North American Policy Administration Systems, Life, Health, AnnuitiesABCD Vendor View,” January 201013

All of the benefits, no surprisesCapgemini’s ‘lift and drop’ approachto closed book outsourcing isfounded on precise analysis andrealistic projections that enable usto determine clear time to benefitand cost transparency. By exercisingthorough due diligence at the outset,Capgemini works with insurers tounderstand the complexities of theirexisting operations and identify theright approach that takes into accountthe business and technical objectivesof the insurer.Structured AnalysisBy putting in the hard work upfront using Capgemini’s structuredanalysis process, it becomes possibleto measure the risk and cost ofoutsourcing a closed book operation.Structured AnalysisReports of Source SystemProduct Codes and AssociatedProducts with Product FeaturesSource System DataProduct Files &DocumentationAnalysisProduct FeaturesSystem FeaturesCensusProduct/PlanCounts FileAnalysisSystem FeaturesReports of Source SystemProduct Codes notassociated to a ProductSystem Files &DocumentationReports of all ProductFeatures supported bythe Target SystemGroup Source System Product Codes into actual ProductsReports of required ProductFeatures not supportedby the Target System(Indicates modifications required)Map Product Features for each Source System ProductEnter Product Features supported by Target SystemPMAReports of Source SystemProduct Codes related toTarget System Product CodesCreate/Enter Target System Product codesMap Source System Product Codes toTarget System Product Codes4Reports of Source SystemProduct Codes not mappedto a Target System Plan Code

Financial ServicesMeasuring the opportunity –and the riskThe structured analysis enables theinsurer and Capgemini to positionthe size of the opportunity againstthe business value of the portfolioand the net cost/risk of transfer. Mostclosed book operations are associatedwith Zone C1 (Block 2).the way we do itHighZone A1Zone A2Zone A3Block 1Block 4Business Valueof PortfolioZone B1Block 3Zone B2Zone B3Block 6Data migration as a standardprocessIf the decision to migrate to the newsolution is taken, Capgemini usesits proven data migration modelto clean, consolidate and uploaddata to Oracle Insurance PolicyAdministration. This process is99 percent automated.Block 2Block 7Zone C1Zone C2Zone C3Block 5LowLowHighNet Cost/Risk of TransferNB: The size of the circle indicates the size the BlockData Migration as a Standard ProcessDownloadData intakeUpgradeMergeConvertUploadCheckFilter / Cleanse / De-duplicate / EnrichLogical DataObjectSourceTarget.Cleanse“Object View”TechnicalCorrectDataCorrect eptionHandling ReportsCorrect setof groupeddataMapping & Tansformbased on the LDOExceptionHandling ReportsTechnical Audit Control ProcessExceptionHandling ReportsAudit TrailBusiness Audit Control ProcessDataAnalysisAnalysisReporting5

Implementation andconfigurationThis structured, predictable approachto analysis, migration and deploymentensures that Capgemini outsourcingprojects maintain their momentumacross their lifespan. BecauseCapgemini has the tools that makethis a measured and seamless process,projects don’t run the risk of runninginto delays that postpone or evenprevent the delivery of long-termbenefits. In addition, it ensures thatboth data and functionality migratesmoothly to the Oracle platform. Aspart of this step, Capgemini takesadvantage of the highly configurablefunctionality associated with Oracle’stechnology to implement insuranceproducts.6A global solutionWorking with Capgemini offersthe opportunity to take advantageof our global delivery model calledRightshore . This means thatinsurers who opt for our outsourcingsolutions can realise the full benefitsof Capgemini business processoptimization experts at multiplelocations worldwide. Again, part ofthe solution involves working withthe insurer to determine the optimumlocation for outsourced operationsbased on specific skill sets, languagesand more. From a customer servicepoint of view, once the closedbook operation has been migrated,Capgemini can offer services in anylanguages that are required.Managing employeesIdentifying the right approach tostaffing is a key component of anoutsourcing strategy, and withmore than 40 years of outsourcingand business process optimizationexperience, Capgemini is wellequipped to carefully manage thisissue. The insurer’s staff have avast amount of knowledge andexperience which needs to be retained.Accordingly, the right balance needsto be struck between staff transferand transition to new arrangements.Capgemini has a network of worldclass Delivery Centers that offereffective and efficient operations. Thiscapability must be effectively balancedwith an appropriate strategy for theclient’s existing personnel.

Conclusion and call to actionNobody is pretending that successfuloutsourcing of closed book operationsis easy. That’s why selecting theright carrier with the best blendof technology skills, consultancyskills and operational capability isparamount. Capgemini has investedin proprietary methodologies, modelsand tools to help insurers make theright business calculations to drive ITinvestments for the future.Capgemini’s commitment to helpinginsurers with policy administrationtransformation includes more than 15years of experience with life insurancepolicy migrations using our proprietarymethodology and toolset. Using provenmethods, Capgemini has achieveda consistent conversion success rateof over 99 percent predictabilityand accuracy of the migration withportfolios ranging from one hundred toover 500,000 policies.Capgemini is also one of the leadingservice providers in IT outsourcing,with clients in the life insurance domain.Over 36 percent of Capgemini’s 2010revenue came from outsourcing,primarily application and infrastructuremanagement. We have more than 400insurance clients across the globe andour financial services business in 2010was 1.6 billion.To find out more about Capgemini’sbusiness process outsourcing solution forinsurance policy administration, contactus at lifeinsurance@capgemini.com7

www.capgemini.com/financialservicesAbout OracleOracle Corporation (NASDAQ: ORCL) is the world’s largest enterprise softwarecompany, providing database, middleware, and collaboration products; enterprisebusiness applications; application development tools; and professional servicesthat help customers collaborate, grow, measure outcomes, and report results withconfidence. For more than 30 years, Oracle has led the industry through continuousinnovation and a relentless focus on customer success.Oracle believes that insurers should be able to leverage technology to helptransform their business. Oracle Insurance provides adaptive, rules-driven systemsthat let insurance companies easily change business processes as their businessneeds change. These systems position insurers to become more adaptive themselves,ready to respond to dynamic market conditions and take advantage of newopportunities as they arise. Engineered to work together, Oracle’s solutions supportthe entire insurance lifecycle – from product development, to marketing and sales,to customer service and support, to management and compliance.For more information on Oracle Insurance, please visit oracle.com/insurance,contact us by e-mail at insurance ww@oracle.comAbout Capgemini and theCollaborative Business ExperiencePresent in 40 countries, Capgemini reportedCapgemini, one of globalthe revenues of EUR 8.7 billion andemploys Experiencearound 110,000 people worldwide.of consulting, technologyand outsourcingCollaborativeBusinessservices, enables its clients to transformCapgemini’s Global Financial Servicesand perform through technologies.BusinessinUnitbrings deepindustry reportedPresent40 countries,CapgeminiCapgemini, one of theexperience,offerings2010global innovativerevenues ofserviceEUR mini providesclients withnext generationdeliveryserve theemploysaround logythatandboostoutsourcinginsightsand capabilitiestheirfinancial services industry.services,its clientstoresultstransformfreedom enablesto achievesuperiorCapgemini’s Global Financial Servicesandperformthroughthrougha uniquewaytechnologies.of working, theWith a networkof 17,000professionalsBusinessUnit bringsdeep industryCollaborative Business Experience .serving overinnovative900 clientsserviceworldwide,experience,offerings andCapgemini provides its clients withCapgeminicollaborateswith leadingbanks,nextgenerationglobal deliveryto servetheinsightsandreliescapabilitiesthat boosttheirThe Groupon its globaldeliveryinsurers andcapitalmarket companies tofinancialservicesindustry. freedomto achievesuperiorresultsmodel calledRightshore, whichaims todeliver business and IT solutions and thoughtthrougha uniquewayofoftheworking,theget the rightbalancebest talentWith a network of 17,000 professionals leadership which create tangible value.CollaborativeBusinessExperience.from multiple locations, working as oneserving over 900 clients worldwide,team to create and deliver the optimumFor more informationvisit banks,Capgeminicollaboratespleasewith leadingThe Group relies on its global n for clients.insurersandcapitalmarketcompaniesto model called Rightshore , which aims todeliver business and IT solutions and thoughtget the right balance of the best talentleadership which create tangible value.from multiple locations, working as oneCopyright 2011rights reserved.team to createandCapgemini.deliver theAlloptimumFor more information please visitsolution for ht 2011 Capgemini. All rights reserved.Oracle and Oracle Insurance Policy Administration are registered trademarks of Oracle.Rightshore is a trademark belonging to Capgemini

The Capgemini business process outsourcing solution takes advantage of a 'lift and drop' approach to closed book outsourcing. Unlike solutions from other vendors, this involves a 'once only' migration at the start of the process. There is no need for a second migration phase after the initial legacy transition has stabilized. This means