Transcription

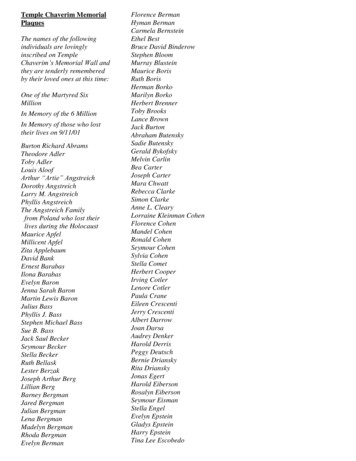

BRIEFING BOOKDataInformationKnowledgeWISDOMRON BARONLocation: Forbes, New York, New YorkAbout Ron Baron .2Debriefing Baron .3Baron in Forbes"#721Ron Baron,” 03/10/10 . ."Capturing Alpha With Closed-End Funds," 12/01/09 .“Small Stocks, No Leverage," 12/02/08 "Sharks In The Water," 04/19/99 .56913The Baron Interview .15-1-

ABOUT RON BARONIntelligent Investing with Steve ForbesRon Baron is the chairman, chief executive officer, chiefinvestment officer and portfolio manager at BaronGrowth Fund, Baron Partners Fund and BaronRetirement Income Fund.After graduating from college, Baron worked atGeorgetown University as a biochemistry teachingfellow. After that, he worked for about four years at theU.S. Patent Office as a patent examiner. While doingthat, he went to George Washington University's lawschool.From 1970 to 1982, Baron worked for several brokeragefirms in the capacity of an institutional securities analyst.He founded Baron Capital in 1982.Baron has a bachelor's degree in chemistry fromBucknell University.-2-

DEBRIEFING BARONIntelligent Investing with Steve ForbesInterview conducted by Alexandra ZendrianSeptember 7, 2010Forbes: How would you describe your investment strategy and how is it holding up in thismarket?Ron Baron: The strategy is that everything we do is long-term. We invest in a world that'sfocused and obsessed with short-term developments and jobs reports and next quarter'searnings, we're long-term investors. And long-term I mean by that goes on average for fourto five years although we've also owned stocks for 15 and 20 years. So in CharlesSchwab, we've been investors since 1992, so long-term. And that's a rarity in the world ofmutual funds and it's a rarity in terms of investing in general.Investing for the long-term and investing in businesses that have real big opportunities andinvesting in people who we think are capable and talented, ethical, smart, hard-working,able to inspire other people to follow their lead.What we're trying to do is to provide alpha. Alpha means that we're trying do better thanthe stock market over the long-term. We don't believe in the efficient market theory thateverything is priced the way that it's supposed to be priced and we think that if you investin businesses that can become a lot bigger, people don't give you credit for that and sotherefore you tend to make excess returns. And over the long-term, we've been able to domuch better than the stock market.The Baron Growth Fund is a fund that I manage, it's over 15 years old, and that'soutperformed the stock market by 770 basis points a year for about 15 years.ETFs are on the rise and computer trading is on the rise, all these things have made themarket more volatile and made the idea of long-term growth less palatable.When you were talking about finding the right opportunity, you also seem to put anemphasis on management. How do you evaluate a management team and howmuch does a company's team influence whether you invest in it or not?It's everything. You have to find someone who you think will be a good steward of thecapital that you've entrusted with him to manage. But if you have someone who's really,really smart and you don't care for them and you don't trust them, that's a really badcombination. So you have to bet on people and a lot of people we invest in areentrepreneurial. So people are everything and how do you value them? You do it yourwhole life. You do it from the time you're in grade school about who you want to be friendswith and who you trust and who you think is the smartest kid in class. So everything isabout, "Do you want to be friends with this person? Do you trust them? Do you think-3-

they're ethical? Do you think they live up to their word? Do you think they live up to theirpromises?"How much of an impact do you think things like the increased usage of ETFs andhigh-frequency trading are affecting the markets?Tremendously. The volumes five years ago were about two billion shares a day in NewYork Stock Exchange stocks. The Securities and Exchange Commission thought that tohave an efficient market you would need an electronic market. They said that there's amonopoly and we had to break it. So what they did is enabled high-frequency trading. Andwhat it does, it's really legalized front-running, and it costs all the people, and they'rewithout any negative or affirmative obligations. You're paying someone a commission onevery one of your trades because someone is running in front of your orders. They havethese algorithms that pick out what's going on. Number one they do that and number two,the market near the close they're making the market go up a lot or go down a lot by tradingETFs at the end of the day, and that used to be called marking the close. So there'strading that is taking place with high-frequency and by the way volume in this past fiveyears has gone from 2 billion shares a day to 6 billion shares a day and 75% of it is thishigh-frequency trading. Orders used to be larger; now they're about 200 shares. Peoplesaid that there used to be a lot of liquidity; well now there's no liquidity because there's justa lot of little trading that goes on all the time, it scares the heck out of people. And becausemarkets are so volatile and the market can have a flash crash, you have these hugemoves all the time that are just the result of this trading.-4-

BARON IN FORBESIntelligent Investing with Steve ForbesThe World's Billionaires#721 Ron Baron03.10.10, 06:00 PM ESTBorrowed 1,600 to invest in nursing home operator Manor Care 1969.Net Worth: 1.4 bilFortune:Self MadeSource:money managmentAge:66Country Of Citizenship:United StatesResidence:New York, New YorkEducation:Bucknell U, Bachelor of Arts /ScienceMarital Status:Married, 2 childrenBorrowed 1,600 to invest in nursing home operator Manor Care 1969. Founded Baron Capital 1982; today manages 15.2 billion. Array of funds recovering amid recent market rally. Hosts popular annual investors conference; pastconferences have featured performances by Elton John, Billy Joel, Paul Simon. Bookended real estate bubble withpurchase of 103 million Hamptons mansion in 2007. Other assets: Vail real estate, art.-5-

Income InvestingCapturing Alpha With Closed-End FundsPatrick W. Galley , 12.01.09, 04:25 PM ESTOne of the best ways to beat the market is to buy assets at a discount and sell when thediscount disappears.An investment manager's prowess is often measured using two Greek letters, beta and alpha. Beta isthe market return and alpha is the excess return over a benchmark. The hunt for alpha is the harderone. But there's at least one overlooked way to capture it: closed-end funds.To understand the closed-end fund opportunity, it's important to first know how they work. A closed-endfund, like the more popular open-end mutual fund, is a registered investment company. However, unlikean open-end fund, a closed-end fund issues a fixed number of shares that trade in the secondarymarket exactly like shares of any publicly traded company.Because closed-end funds have a fixed number of shares and the share price is based on supply anddemand in the secondary market, the share price will sometimes trade at a discount or premium to itsnet asset value, which is the liquidation value of the portfolio of securities that it holds. In the case of a15% discount, that is synonymous with buying a dollar worth of assets for 85 cents.Closed-end funds are unique because they give investors the opportunity to gain exposure to mostasset classes (beta), and generate additional return if the "discount" of the closed-end fund narrows(alpha). It's this discernible source of alpha that gives investors a significant advantage. In addition,income generating funds trading at a discount offer an opportunity to generate alpha and to beatbenchmark returns through yield alone.There are more than 620 closed-end funds that trade on the U.S. equity exchanges, giving investors theability to gain exposure to virtually every modern day asset class. Closed-end funds are typicallymanaged by household names such as PIMCO, BlackRock, and Nuveen. As it happens, today manyU.S. focused closed-end equity funds are trading at attractive discounts, some of which are wider than15%.When it comes to alpha, there are two good examples of how discounted closed-end funds get youthere. One is "discount narrowing." In this scenario, a shareholder holds an equity based closed-endfund trading at a 15% discount. If the market appreciates by 10% and the fund's discount narrows to10%, the shareholder would have an approximate 16.5% return. In this case the shareholder's alphawas 6.5%. This specific alpha source is completely unique to closed-end funds.Another example is "yield enhancement." Here, a shareholder owns a bond fund at a 15% discount. Ifthe underlying bonds yield 5%, and the fund is trading at a 15% discount, then it would yield 5.9%. Inthis case the 0.9% of additional yield is considered alpha.-6-

Inefficiencies in the closed-end space exist for various reasons. First, closed-end funds are mainlyowned by retail investors. The discount or premium often reflects retail investor sentiment such as fearor over-confidence.Additionally, many retail investors purchase closed-end funds based on the yield alone. The trouble isthat sometimes closed-end funds with above-average yields are taking increased risks to generate thatyield either through higher risk investments and/or leverage. Closed-end funds sometimes just distributereturn of capital, meaning an investor is only getting their investment back, not net investment income.Savvier closed-end fund investors will focus on closed-end funds that have catalysts to drive a discountnarrower. Such catalysts include corporate actions such as tender offers, liquidations and conversionsto open-end funds; shareholder activists pushing the board to take action in addressing the discount;and discounts that are statistically attractive compared to historical levels.Obviously, there are no free lunches and there is a risk that the discount of a closed-end fund willwiden, producing negative alpha. By focusing on closed-end funds with discount narrowing catalysts,investors can skew the odds in their favor.The following are a couple of closed-end funds that RiverNorth Capital currently finds interesting andowns in their portfolios.The Royce Value Trust has been managed by Chuck Royce (Co-CIO of Royce & Associates) for morethan 20 years. The current discount of 17% of this small-cap value equity strategy is attractive ascompared to the fund's three-year average discount of 5%. In addition, unbeknownst to most currentshareholders, Royce waives the management fee on RVT if the fund's rolling 36-month total return onnet assets is negative, which is currently the case. Therefore the manager will not charge the fund amanagement fee until either short-term performance improves or poor performance in the fourth quarterof 2008 is rolled off in approximately two years.SunAmerica Focused Alpha Growth Fund. The fund is co-managed by well-known managers TomMarsico (CIO of Marsico Capital) and Ron Baron (CIO of Baron Capital). While trading at a narrowerdiscount of 11% as compared with many of its peers, the fund's discount may benefit further fromshareholder activism. The fund is currently being attacked by shareholder activist Phillip Goldstein ofBulldog Investors, who is requesting board seats to afford stockholders the opportunity to realize netasset value. Nearly 25% of the fund is owned by institutional shareholders that have a history ofsupporting corporate actions that permit shareholders to redeem their shares at or near net asset value.We believe this is an opportunity to own a well managed fund with the potential for net asset valuerealization.Discounts alone shouldn't drive investment decisions. Investors should first be comfortable with theunderlying portfolio of a closed-end fund. It's only once you're fine with the beta you're purchasing in thefund, the hunt for alpha begins.-7-

Patrick W. Galley is chief investment officer of RiverNorth Capital Management, an investmentmanagement firm based in Chicago, Ill. The firm specializes in quantitative and qualitative closed-endfund trading strategies and is the investment adviser to RiverNorth Funds.-8-

MarketsSmall Stocks, No LeverageJames M. Clash, 10.02.08, 06:00 PM EDTForbes Magazine dated October 27, 2008Ron Baron likes somewhat expensive companies growing very fast.Ron Baron wants you to own somewhat expensive companies growing very fast.His performance history says he's worth a listenEvery man has his limits, and Hollywood is clearly beyond those of Ronald Baron. When the founder ofBaron Capital Group hired Jerry Seinfeld to entertain his funds' investors a few years ago, the comedianquipped, "The man who picks your stocks didn't think I was a good investment." Seinfeld was referringto Baron's personal verdict years earlier that the stand-up comic's routine was amusing but tooparochial for the national stage.Fortunately for his investors the founder of Baron Capital has a far better record picking stocks--like theBest Small Companies members profiled below--than entertainers. Baron, 65, oversees 19 billionamong 17 funds, which puts him on The Forbes 400 with a net worth of 1.4 billion. He has alsopersonally managed the flagship Baron Growth Fund (assets: 6.2 billion) since its 1994 inception.During that 14-year run the fund has returned 14.2% annually after fees, which is 5.3 percentage pointsahead of the S&P 500. The fund carries no load, but it is not particularly cheap at 1.3% a year inexpenses.Baron has delivered his impressive performance by digging up well-run small companies that areleaders in their industries and enjoy high barriers to entry. He wants firms that have a decent shot atdoubling their earnings in five years by dint of their business growth rather than using leverage. Lessthan a tenth of Baron Growth holdings have a debt-to-equity ratio above 67%."The use of leverage is the principal reason small businesses go out of business," says Baron. "Readthe papers."Baron is patient for a growth guy. His annual turnover of 21% is less than one-fifth that of the smallcompany growth fund average. He hangs on to his best picks until they reach 10 billion in marketcapitalization, at which point he will usually sell. Baron also eats his own cooking, with more than 250million personally invested in his firm's funds. (The rest of his wealth is tied up in the funds' parentcompany, real estate and art.) He scoffs at the notion small caps are best shunned amid economicuncertainty."I constantly tell my analysts, 'I don't want you thinking about the stock market, interest rates or theeconomy,'" he says. "'I want you on the phone with great companies, visiting them, bringing them tovisit us.'"-9-

Which of the Forbes Best Small Companies are attractive enough to find their way into a Baron fundportfolio? Among them are these five.Blue Nile. This online diamond and jewelry merchant (No. 42 on our list) says it can sell a 1-caratengagement ring for 20% to 40% less than what you'd pay at a walk-in store. Since 1999 Blue Nile hasbeen signing exclusive contracts with big diamond suppliers to list their stones exclusively on its site.Blue Nile is thus able to give customers access to 55,000 certified diamonds while maintainingnegligible inventory; its suppliers benefit from fast inventory turns.To leverage its supply chain, Blue Nile focuses on the fragmented 4.5 billion market for engagementrings. With only a 4% share, it has already surpassed Tiffany & Co. as the largest unit buyer of highend domestic diamonds.Blue Nile already controls 50% of online jewelry sales and should be able to weather rocky economictimes by taking additional sales from more expensive offline sellers, as well as by moving abroad.Baron bought Blue Nile in June 2004 at 36; he still likes it at 42.50, despite its lofty price/earningsmultiple of 43. It has little debt.Copart. Ranked No. 79 on the Best Small Companies list, Copart, has expanded from a lone junkyardinto the industry's largest chain. Its 130 North American yards handle a million scrap vehicles a year.(For a profile of a rival, see page 120.) Cars are stripped for parts, rebuilt or scrapped for steel. Baronfirst bought Copart in January 2005 at 24; now, at 37.64 (with a P/E of 22), it makes up 1.9% of theBaron Growth Fund. The firm has no debt.Some cars live long, productive lives; some die young. But almost all of them eventually end up in ajunkyard. Zoning restrictions make it hard to set up new yards, keeping barriers to entry high. Copart isbuying smaller lots.With demand for recycled auto parts strong, the company just pushed through a 19% price hike. VB2,Copart's online sales network, is drumming up buyers around the globe; it ships a third of its vehiclesabroad.The company last year bought the first of its 15 junkyards in the U.K. Its next markets: continentalEurope and Asia.Genesee & Wyoming. A locomotive can haul a ton of cargo four times as far on a gallon of gas as atruck can. So costly diesel is great for Genesee & Wyoming (No. 94), which owns 10,000 miles ofrailroads in the U.S. and Australia. Three things make this short-haul outfit stand out in the railroadbusiness. One is that it is, in a sense, family run. Chairman Mortimer Fuller III is the founder's greatgrandson. Another is the industry's high barrier to entry; replacement track costs 1 million per mile.Third, half of Genesee's workforce is nonunion.- 10 -

This gives Genesee advantages over big rails like Burlington Northern, CSX and Norfolk Southern,which tend to be unionized. A Genesee train engineer can make 75,000 to 100,000 per year,comparable to that of the big railroads. But the Genesee worker is more flexible, a jack-of-all-tradesable to tackle different jobs and shifts. Genesee shares have nearly tripled in four years and are now at20 times trailing earnings.Strayer Education. When the economy turns down, vendors of post-high-school education turn up.Unemployment, or the fear of it, drives people to hit the books. That's good news for Strayer Education(No. 20), a 354 million (sales) outfit that provides college degrees to 37,000 working adults annually.Strayer, with a 2.9 billion market value and no debt, is adding 9 campuses this year to the 57 it alreadyruns. Since 2001 Strayer has been expanding enrollment by 18% and tuition by 5% a year. Earningsand the company's share price have tripled over that same period.Under Armour. A pioneer in athletic clothing that wicks sweat away from the skin and regulates bodyheat, this company (No. 28 on our list) has expanded into pants, gloves, socks, hats and footwear. Ithas managed to do so while remaining virtually debt-free.UA has developed a cult following. That explains how it manages to get more than 100 (retail) forcross-training shoes. It may also explain how UA can get away with something that not too manyapparel companies can, which is to compete with its retailers. Since its inception in 1996 it has beenselling goods to consumers over its Web site.There's room for UA to grow, Baron says, in women's apparel (now 20% of the business) and inEurope. This stock has more than doubled in the past three years and will cost you 38 times trailingearnings.The Ones To OwnThese companies on our Best Smalls list are Baron favorites. They have negligible debt and bigshares in industries with high entry ( mil)CompanyRecent52WeekHighBlue Nile 42.50 103.694329% 639Copart37.6449.3422203,134Genesee 2,856- 11 -

EducationUnder Armour30.8263.9038651,512Prices as of Sept. 29Source: Reuters Fundamentals via FactSet Research Systems.- 12 -

Sharks in the waterCaroline Waxler, 04.19.99RONALD BARON maintains a zenlike calm, or seems to. The latest of his long-term holdings to melt is VailResorts, down from 31 to 14 in a year. As of the end of the quarter, it made up 3% of his largest portfolio,the small- and mid-cap Baron Asset Fund. Thats one reason the fund has slightly lagged the S&P this year.Barons management company, which runs 6.8 billion in three mutual funds and 1.3 billion in privateaccounts (mostly pension funds), is Vails largest shareholder with one-third of the outstanding shares. Heexpects Vail to double in price by the end of this year. Im a long-term investor, says Baron. If you own acandy store, do you sell it if its having a bad month?By placing big bets on a few mostly well-chosen stocks and then holding on for dear life, Baron has built up alucrative management business. Hes done well by investors, with Baron Asset Fund gaining an average17.7% per year since inception in 1987, beating the S&P by 1.6 points per year. When FORBES wrote aboutBaron in 1997, we said: You take him on faith or not at all. Today he holds 5% of Charles Schwab Corp.,20% of AMF Bowling, 35% of Choice Hotels Corp., 35% of Polo Ralph Lauren Corp. Class A, 43% of SagaCommunications Class A and 58% of Sothebys Class A.Low turnover, with its tax advantages, is a good thing in general.But Barons big bets and dogged refusal to cut his losses are now attracting the wrong element: professionalshort-sellers. Some are using his holdings as a prospecting list -- so they claim, although none that we couldfind was willing to stand up and say so in the open.Snipes one: We are not targeting Baron, exactly, but it certainly makes an existing idea even more attractiveif you know Ron Baron is a big holder.The short-selling community smells blood in the water -- the blood of one of its own. In the early 1970s Baronmade a living selling stock research reports to full-time and occasional short-sellers, including MichaelSteinhardt and George Soros. He later managed some accounts for Soros. Today Barons specialty is buyingflashy, small- and mid-cap growth stocks. His portfolios recent average price/earnings ratio was 37, loftyenough in a bull market but potentially lethal in a bear market, which, he admits, is exactly what small capsare going through.Although Baron says he has avoided volatile technology plays, thats not entirely true. Sothebys and Schwab(which make up 20% of his portfolio) last year gained 70% and 110%, respectively, partly due to Internethype.- 13 -

Baron is the number one shareholder in a quarter of Baron Asset Funds positions, which raises seriousliquidity questions (see table).He is not defenseless; with 8 billion to play with, he can try to squeeze the shorts in a stock by buying moreof it and refusing to allow his shares to be lent out. But his funds have cash positions of only 2% to 3%, andthe enemies are circling. A spate of shareholder redemptions -- remember that unlike hedge fund managers,Baron cant say no to redemptions -- could give the short-sellers a chance to pounce.His Sothebys stake, for example, represents 56 days of the stocks average trading volume. On average, hisseven top positions, which account for 40% of Baron Asset Funds portfolio, represent volume equal to 85trading days in those stocks. Two of those positions are particularly sticky: Vail at 186 trading days andChoice Hotels at 247.Baron contends that his shareholders know and embrace his style and wont hit him with mass redemptionseven in a bear market. Shareholders did not embrace one recent trade, however. In October Baron sold650,000 shares of AMF Bowling from the account of a private client who demanded to exit the stock after itfell to near 7 from an April high of 31.Baron says he made the sale to generate tax losses for the client, not because he had lost faith in the stock.Instead of selling on the open market, he sold the shares to the Baron Asset Fund.No law forbids managers from making wholesale transfers of depressed stock from one clients account toanothers, but the potential for a conflict of interest is so great that few would think of doing so. AMF, in fact,has dropped another one-third since the sale, to a recent 4.50. After the Internet financial siteTheStreet.com questioned the transactions last month, Baron paid his funds shareholders 1.6 million tocover losses since the purchase.Baron says hes going to gradually increase the number of positions in his funds for diversification, and hastrimmed his stakes in Polo (near its 52-week low) and Schwab. Shareholders have asked for the trims, hesays. How about Vail? Still wants more. Theres no disputing that shareholders have done well over the longhaul with Barons intense style. But they should know he plays a dangerous game.- 14 -

THE BARON INTERVIEWIntelligent Investing with Steve ForbesHow To Be Long TermSteve Forbes: Ron, good to have you here and congratulations on being on the Forbes400 again.Ron Baron: Thank you.Forbes: You call yourself a long-term investor. That's a description much used by moneymanagers, but you seem to actually adhere to it.Baron: Well, I've always been a long-term investor in everything that we do. And so, oneof the problems that we have in America now is that people, they always want to consume;they always want something now. And as opposed to investing now so you'll have morelater. And so, I've always been oriented toward, saving and investing, and investing inbusinesses that do that. So investing in businesses that invest in themselves. So manycompanies, people will say, "Well, Steve Wynn," they say, "Well, gee, why would you goout there and spend all that money to build that casino? You're not going to make moneyon it for five or six years; you can't get it in the ground and built and I'll invest in yourcompany when it's about to open."And we invested with Steve Wynn. We've been investors with him since 1980. JayPritzker introduced me to him in 1975. Jay was one of the first people that helped me inbusiness. In 1980, he introduced me to Steve Wynn, because I was interested in gaming.He says, "He's the guy. He's the number one guy.""Steve Wynn? What kind of name is that? Is this a comic strip character?" "No, no. He'sthe guy." So in 1980, we invested with him; from '80 to '83; from '87 to 2000 and, in 2001,we became one of the founding investors in Wynn Resorts.And in those years, '80 to '83, that was a triple; '87 to 2000, that was 20 times. And then in2001, we invested, I guess 135 million over two years, 2001, 2002, initially, when it wasprivate, one of three investors, and then, when it became a public company 40 millionwhen it was private, the rest of it when public. And we ultimately got, over eight years, aninvestment of, we got about 60 million or 70 million back in dividends and we've madeabout 800 million in profits. And people would say, so it's this 40 million or 50 million or 60 million investment, 800 million in eight years when people are saying, "How can youmake money in stocks?" And people would say, when he would go around, this is themost incredible thing. He goes around in 2001 trying to raise money for a hotel that he'sgoing to build in Las Vegas. And here's a guy who made Las Vegas Las Vegas.And he's going to build this hotel and he needs the capital to do it. And he says he wouldgo to meetings and he couldn't get people around the table. He couldn't get a dozen- 15 -

people to have lunch with him. And ultimately, he would say, "I'm confoundedlydepressed. You know, your friends, they tell me that, 'I'm interested in investing with you;you made me a lot of money before. But Steve, you're not going to have a hotel until2006, 2007. I'm going to invest in 2005.'" And Steve said, "There's not going to be a 2005unless I get the money now." So when they ultimately invested, the stock went from 13to 170 or 150. Right? And so, people, they missed it. And so, if you're investing andjudging, so we're judging people all the time. You're judging opportunity; you're judgingfinancing capabilities and then, you're judging people. So you ask about screens, there'sno screens. You have to meet people; you have to think about where there'sopportunities.Importance Of MoatsForbes: Now do you look for what investors like Buffett would call "moats"?Baron: Yes.Forbes: That it's not easy to go up against them?Baron: Very difficult to compete against the companies in which we're investing, we think.And, in fact, Morningstar, which was one of the evaluators of mutual funds, when they lookat our mutual funds, their comments are that their analysts believe that the moats thatsurround the businesses in which we invest and when you look at the parameters thatmost people use, the metrics that most people use to judge the companies in whichthey've invested, they say, "Gee, that doesn't seem that different from all the othercompanies: price to sales, price to earnings, price to book, price to cash flow, anythingyou want to look at. It doesn't look that dissimilar than other companies."But what's different about those companies that these guys happen to invest in is that theyseem, that it's very hard to compete against them. The analysts at Morningstar say thatthe moats that surround the businesses in which we've invested are stronger, bigger, widerthan the moats that surround the companies that other mutual funds invest in. Yes, moatsare very important. Critical, critical, critical. Can other people take away that opportunity?Because we're investing in smaller and middle-size companies -The Story Behind PoloForbes: So you still have holdings, say, in Polo?Baron: Yes, since they've been public.Forbes: And same thing? Everyone can design a suit, but few know how to do it in a waythat sells consistently?Baron: Well, not only that. I mean, he's got an eye, and now he's got a brand.- 16 -

Forbes:

Schwab, we've been investors since 1992, so long-term. And that's a rarity in the world of mutual funds and it's a rarity in terms of investing in general. Investing for the long-term and investing in businesses that have real big opportunities and investing in people who we think are capable and talented, ethical, smart, hard-working,