Transcription

Your PEBB Benefits for 2020Employee Enrollment GuideHCA 50-100 (10/19)

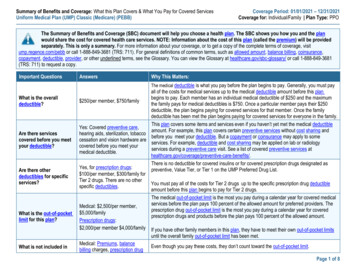

Now servingGreat coverage. Great care networks. Great price.The providers in the plansbelow have committed to: What does this mean for you? Follow evidence-based treatment practices.Coordinate care with other providers in yourplan’s network.Meet standards about the quality of carethey provide. Lower out-of-pocket costs for many plans.Providers who communicate with each other toensure you get the right care at the right time.Easy access to providers and scheduling.Great value menuMonthly premiums1 for:subscriber, spouse2,subscriberand child(ren)Annual medical deductibles for:subscriber, spouse2,subscriberand child(ren)Kaiser Permanente NW3This page left intentionally blank.ClassicConsumer-Directed Health Plan (CDHP)with a health savings account 140 / 395 300 / 900 25/ 79 1,400 / 2,800 176 / 494 175 / 525 27 / 84 1,400 / 2,800 42 / 126 125 / 375 100 / 285 250 / 750 69 / 200 125 / 375 69 / 200 125 / 375Kaiser Permanente WAClassicConsumer-Directed Health Plan (CDHP)with a health savings accountSoundChoiceValueUMP PlusPuget Sound High Value NetworkUW Medicine Accountable Care Network123Employees who work for a city, tribal government, county, educational service district, etc., must contact their personnel, payroll,or benefits office to see their monthly premiums.or state-registered domestic partner.Kaiser Foundation Health Plan of the Northwest offers plans in Clark and Cowlitz counties in Washington and select counties inOregon.Before you enroll 1. Find out which medical plans serve the countyyou live in (see pages 34 – 35).2. Contact the plan or check their providerdirectory to make sure your providers are in theplan’s network (see page 2).HCA 53-0001 (10/19)3. Ready to pick a plan? Submit your 2020 PEBBEmployee Enrollment/Change form to yourpersonnel, payroll, or benefits office. Youremploying agency must receive your form no laterthan 31 days after the date you become eligiblefor PEBB benefits. Note: UW employees must useWorkday.

Contact the plansMedical PlansKaiser Permanente NWClassic or CDHP*Kaiser Permanente WAClassic, CDHP, SoundChoice, or ValueUniform Medical Plan (UMP) Classic orCDHP, administered by Regence BlueShieldand Washington State Rx Services (WSRxS)UMP Plus—Puget Sound High ValueNetworkUMP Plus—UW MedicineAccountable Care NetworkWebsite addressesCustomer servicephone numbersPortland area:503-813-2000my.kp.org/wapebbkp.org/wa/pebbAll other areas:1-800-813-2000TTY: 711TTY: 1-800-833-6388 or 711Medical services:1-888-849-3681TRS: 711Prescription drugs: escription drugs:1-888-361-1611TRS: 711pebb.uwmedicine.org1-855-776-9503DeltaCare, administered byDelta Dental of WashingtonWillamette Dental of Washington, Inc.1-855-520-9500TRS: 711Uniform Dental Plan, administeredby Delta Dental of Washington2Website addressesCustomer servicephone numbersdeltadentalwa.com/pebb1-800-650-1583TTY: alwa.com/pebbAuto and Home InsuranceHealth Savings AccountTrusteeLiberty Mutual Kaiser Permanente quityUMP members call:1-844-351-6853TRS: 711Metropolitan 8-7139Long-Term Disability (LTD)InsuranceStandard InsuranceCompanyn/a1-800-368-2860Medical Flexible SpendingArrangement (FSA)andDependent Care AssistanceProgram (DCAP)Navia Benefit desmarthealth.hca.wa.gov1-855-750-8866Life InsuranceSmartHealthTRS: 711* Kaiser Foundation Health Plan of the Northwest offers plans in Clark and Cowlitz counties in Washington and select countiesin Oregon.Dental PlansCustomer servicephone numbers1-866-648-1928Medical services: Regence etwork.orgWebsite addressesAdditional contacts1-855-4DENTAL (433-6825)TTY: 7111-800-537-3406TTY: 1-800-833-6384Blue ink indicates information only for subscribers who have PEBB dental, life, AD&D, and long-term disability insurance.Contact the health plans for help with: Specific benefit questions.Checking if your provider contracts with the plan.Checking if your medications are covered by the plan.ID cards.Claims.Contact your personnel, payroll, or benefitsoffice for help with: Enrollment questions and procedures, and deadlines. Eligibility questions and changes to your account(Medicare, divorce, etc.). Changing your name, address, and phone number. Finding forms. You can also find forms on HCA’s websiteat hca.wa.gov/pebb-employee under Forms & publications. Adding or removing dependents. Payroll deduction information. Eligibility complaints or appeals. Life and LTD insurance eligibility and enrollment questions. Premium surcharge questions.The PEBB Programis saving the greenHelp reduce our reliance on paper mailings —and their toll on the environment — by signingup to receive PEBB mailings by email. Tosign up, go to PEBB My Account athca.wa.gov/my-account.Note: Your personnel, payroll, or benefits officemust key your enrollment in PEBB coveragebefore you can access PEBB My Account.Exception: University of Washingtonemployees must sign up in Workday.Blue ink indicates information only for subscribers who have PEBB dental, life, AD&D, and long-term disability insurance.3

Table of contentsEligibility summary. 7Who’s eligible for PEBB benefits?. 7Can I cover my dependents?. 8If I die, are my surviving dependents eligible?.10Verifying dependent eligibility. 9Valid dependent verification documents. 11To enroll a spouse .11To enroll a state-registered domestic partneror legal union partner.11To enroll children.11Enrollment summary. 12Which forms do I use?.12Am I required to enroll in this health coverage?.12Can I enroll in two PEBB medical or dental plans?.12When does coverage begin?.13What if I’m entitled to Medicare?.15How much will my monthly premiums be?.16How do I pay for coverage?.16Making changes in coverage. 17What changes can I make any time?.17What changes can I make during thePEBB Program’s annual open enrollment?.17What is a special open enrollment?.18What happens when a dependent loses eligibility?.20What happens when a dependent dies?.20What if a National Medical Support Noticerequires me to provide health plan coveragefor a dependent?.20Waiving medical coverage. 21How do I waive enrollment in medical coverage?.21What happens if I waive coverage?.21How do I enroll after waiving coverage?.21What happens if I don’t waive enrollment inPEBB medical?.22What if I am a retiree/rehire enrolled in PEBB retireeinsurance coverage?.22When coverage ends. 23What are my options when coverage ends?.23What happens to my Medical FSA or DCAPfunds when coverage ends?.24What happens to my CDHP with an HSAwhen coverage ends?.24PEBB appeals. 25How can I make sure my personal representativehas access to my health information?.262020 monthly premiums. 27Premium surcharges. 28Selecting a PEBB medical plan. 30How can I compare themedical plans?.30What is a value-based plan andwhy should I choose one?. 31The PEBB Program offers three types of medical plans.31Can I enroll in a CDHP plan andMedicare Part A or Part B?.32What do I need to know about the CDHPwith an HSA?.32What happens to my HSAwhen I leave the CDHP? .33How do I find Summaries of Benefitsand Coverage?.332020 medical plans available by county. 342020 medical benefits comparison. 37Selecting a PEBB dental plan. 43Dental benefits comparison. 44Group term Life and AD&D insurance. 45What are my PEBB life and AD&D insuranceoptions?. 45When can I enroll?. 45How do I enroll?. 46Monthly rates. 46Long-term disability insurance. 47What are my PEBB long-term disability insuranceoptions?. 47What is considered a disability?. 47How much does supplementalLTD insurance cost?. 48When can I enroll?. 48How do I enroll?. 48Need more help making decisions?For general information and resources tohelp make informed health care decisions,visit Own Your Health’s website atownyourhealthwa.org.HCA is committed to providing equal access to our services. If you need anaccommodation, or require documents in another format,please contact your personnel, payroll, or benefits office.You have 31 daysto enroll or waiveafter you becomeeligible for PEBBbenefits.If your employing agencydoesn’t receive your requiredforms by this deadline, youwill be enrolled as a singlesubscriber in Uniform MedicalPlan Classic, Uniform DentalPlan, basic life insurance,basicaccidental death anddismemberment, and basicLTD insurance.Note: Meeting a deadlinedepends on when yourpersonnel, payroll, or benefitsoffice (or applicable vendor)receives your form orinformation, regardless of whenyou send it.Medical FSA and DCAP. 49What is a Medical Flexible Spending Arrangement?.49What is the Dependent Care Assistance Program?.49When can I enroll?. 50How can I enroll?. 50When can I change my Medical FSA orDCAP election?.50SmartHealth. 51Auto and home insurance. 52Enrollment forms2020 PEBB Employee Enrollment/Change2020 PEBB Employee Enrollment/Change forMedical Only GroupsMetLife Enrollment/Change FormLong Term Disability (LTD) Enrollment/Change Form2020 PEBB Premium Surcharge Attestation Help Sheet. 844Blue ink indicates information only for subscribers who have PEBB dental, life, AD&D, and long-term disability insurance.Blue ink indicates information only for subscribers who have PEBB dental, life, AD&D, and long-term disability insurance.5

Eligibility summaryAre you a school employee? Startingin 2020, eligible school employees(school districts, representedmembers of educational servicedistricts, and charter schools) willreceive their health insurance andother benefits through the SchoolEmployees Benefits Board (SEBB)Program.Visit hca.wa.gov/sebb-employee tolearn more.Who’s eligible forPEBB benefits?This page left intentionally blank.This guide provides a general summaryof employee eligibility for PEBB benefits.In this booklet, employees are alsocalled “subscribers.” Your employerwill determine if you are eligiblebased on your specific employmentcircumstances, and whether you qualifyfor the employer contribution (see WAC182-12-114 and 182-12-131).Please contact your personnel, payroll,or benefits office to find out whenbenefits begin once you are eligible. Ifyou disagree with their determinationabout your eligibility, see “PEBB Appeals”on page 25.For details on PEBB eligibility andenrollment, refer to Chapters 182-08 and182-12 Washington Administrative Code(WAC) at hca.wa.gov/pebb-rules.Employees from anemployer group undercontractual agreementEmployees from an employer group(such as a county, municipality, politicalsubdivision, tribal government, oreducational service district) obtainingPEBB benefits through a contractualagreement with the Health CareAuthority (HCA), should contact theirpersonnel, payroll, or benefits office foremployee eligibility criteria.6EmployeesEmployees are eligible for PEBB benefitsupon employment if the employeranticipates the employee will work anaverage of at least 80 hours per monthand for at least eight hours each monthfor more than six consecutive months.If the employer determines theemployee is ineligible, and theemployee later works an average of atleast 80 hours per month and at leasteight hours each month for more thansix consecutive months, the employeebecomes eligible for PEBB benefits thefirst of the month after the six-monthperiod.If the employer changes the employee’santicipated work hours or duration ofemployment, and the change allowsthe employee to meet the criteria listedabove, the employee becomes eligiblefor PEBB benefits when the change ismade.Employees may also “stack” or combinehours worked in more than one positionto establish and keep eligibility, as longas the work is within one state agency inwhich the employee: Works two or more positions at thesame time (concurrent stacking); Moves from one position to another(consecutive stacking); or Combines hours from a seasonalposition and a non-seasonal position.Employees must notify their employer ifthey believe they are eligible for benefitsbased on stacking (see WAC182-12114 (1)(c)). Employees become eligiblethrough stacking when they meet thecriteria listed in the first paragraph ofthis section.Higher-education faculty“Faculty” means an academic employeeof an institution of higher educationwhose workload is not defined bywork hours but whose appointment,workload, and duties directly serve theinstitution’s academic mission.A higher-education faculty memberis eligible for PEBB benefits uponemployment if the employer anticipatesthey will work half-time or more for theentire instructional year or equivalentnine-month period.If the employer doesn’t anticipatethat this will happen, then the facultymember is eligible for PEBB benefits atthe beginning of the second consecutivequarter or semester of employment,in which they are anticipated to work(or has actually worked) half-time ormore. (Spring and fall are consideredconsecutive quarters/semesters whenfirst establishing eligibility for facultymembers who work less than half-timeduring the summer quarter/semester.)A faculty member who receivesadditional workload after the beginningof the anticipated work period (quarter,semester, or instructional year), andmeets the criteria listed above, becomeseligible for PEBB benefits when therevision is made.A faculty member may become eligibleby working as faculty for more than onehigher-education institution. When afaculty member works for more thanone higher-education institution, theymust notify all employing agencies thatthey may be eligible for PEBB benefitsthrough stacking. A faculty memberbecomes eligible for PEBB benefitsthrough stacking when the employeranticipates they will work half-time ormore for the entire instructional year orequivalent nine-month period.(continued)7

Eligibility summaryFaculty members may continue anycombination of medical, dental, lifeinsurance, and AD&D insurance whenthey are between periods of eligibilityby enrolling in and self-paying for PEBBContinuation Coverage (Unpaid Leave).They can only do so for a maximum of12 months. See WAC 182-12-142 forcontinuation coverage information. ThePEBB Program must receive the faculty’selection to self-pay benefits no laterthan 60 days from the date the PEBBhealth plan coverage ends, or from thepostmark date on the election noticesent by the PEBB Program, whichever islater.Seasonal employees“Seasonal employee” means a stateemployee hired to work during arecurring, annual season of threemonths or more, and who is anticipatedto return each season to perform similarwork.A seasonal employee is eligible if theyare anticipated to work an average ofat least 80 hours per month and areanticipated to work for at least eighthours in each month of at least threeconsecutive months of the season. (Aseason means any recurring, annualperiod of work at a specific time of yearthat lasts 3 to 11 consecutive months.)If an employer revises a seasonalemployee’s anticipated work hours oranticipated duration of employmentsuch that the employee meets theeligibility criteria above, the employeebecomes eligible for PEBB benefits whenthe change is made.A seasonal employee who is determinedineligible for benefits, but who laterworks an average of at least 80 hoursper month and works for at least eighthours in each month for more than sixconsecutive months, becomes eligiblefor PEBB benefits the first of the monthfollowing the six-month averagingperiod.8If a seasonal employee works in morethan one position or job within one stateagency, the employee may “stack” orcombine hours worked to establish andmaintain eligibility. See WAC 182-12114(2) for details on when a seasonalemployee becomes eligible. A seasonalemployee must notify their employer ifthey believe they are eligible throughstacking. A seasonal employee becomeseligible for PEBB benefits throughstacking when the employer anticipatesthey will work an average of at least 80hours per month and are anticipatedto work for at least eight hours in eachmonth of at least three consecutivemonths of the season.A benefits-eligible seasonal employeewho works a season of 9 months ormore: Is eligible for the employercontribution in any month of theseason in which they are in paystatus for 8 or more hours during thatmonth, and through the off seasonafter each season worked. Eligibility may not exceed a total oftwelve consecutive calendar monthsfor the combined season and of fseason.A benefits-eligible seasonal employeewho works a season of less than 9months: Is not eligible for the employercontribution during the off season. Is eligible for the employercontribution in any month of theseason in which they are in a paystatus of 8 or more hours during thatmonth. May continue any combination ofmedical, dental, life insurance, andAD&D insurance when they arein between periods of eligibilityby enrolling in and self-payingfor PEBB Continuation Coverage(Unpaid Leave) (for a maximum of12 months). See WAC 182-12-142 forcontinuation coverage information.The PEBB Program must receive theseasonal employee’s election to selfpay benefits no later than 60 daysfrom the date the PEBB health plancoverage ends or from the postmarkdate on the election notice sent bythe PEBB Program, whichever is later.Elected and full-timeappointed officialsLegislators are eligible for PEBB benefitson the date their term begins. All otherelected and full-time appointed officialsof the legislative and executive branchesof state government are eligible on thedate their terms begin or the date theytake the oath of office, whichever occursfirst.Justices and judgesA justice of the Supreme Court andjudges of the court of appeals and thesuperior courts become eligible for PEBBbenefits on the date they take the oathof office.Can I cover mydependents?You may enroll the following dependents(as described in WAC 182-12-260): Your legal spouse. Your state-registered domesticpartner, as defined in WAC 182-12-109and RCW 26.60.020(1). This includessubstantially equivalent legal unionsfrom other jurisdictions as defined inRCW 26.60.090. Strict requirementsapply to these partnerships, includingthat one partner is age 62 or older andyou live in the same residence. Your children through the last day ofthe month in which they turn age 26,except for children with a disability(who may be covered past the age of26 if they qualify).Blue ink indicates information only for subscribers who have PEBB dental, life, AD&D, and long-term disability insurance.Employees enrolling non-qualifiedtax dependents (like state-registereddomestic partners or their children,or an extended dependent) mustsubmit a 2020 PEBB Declaration of TaxStatus form to indicate whether theseindividuals qualify as dependents fortax purposes under IRC Section 152, asmodified by IRC Section 105(b).official residence with the custodian orguardian.Employees with non-qualified taxdependents will be able to keepmaking premium payments for theirown insurance coverage with pre-taxpayroll deductions, but premiums forthe dependents must be deducted on apost-tax basis.Eligible children withdisabilitiesHow are children defined?Children are defined based on theestablishment of a parent-childrelationship as described in RCW26.26A.100, except when parental rightshave been terminated. This definitionincludes: Your children. Children of your spouse. Children whose total or partialsupport is your legal obligation inanticipation of adoption. Children of your state-registereddomestic partner. Children specified in a court order ordivorce decree for whom you have alegal obligation to provide support orhealth care coverage.Eligible extendeddependentsChildren may also include extendeddependents in your, your spouse’s, oryour state-registered domestic partner’slegal custody or legal guardianship.An extended dependent may be yourgrandchild, niece, nephew, or otherchild for whom you, your spouse, oryour state-registered domestic partnerhave legal responsibility as shownby a valid court order and the child’sThis does not include foster childrenunless you, your spouse, or yourstate-registered domestic partner hasassumed a legal obligation for theirtotal or partial support in anticipation ofadoption.Eligible children also include childrenof any age with a developmental orphysical disability that renders the childincapable of self-sustaining employmentand chiefly dependent upon theemployee for support and ongoing care,provided the condition occurred beforethe age of 26. You must provide proof ofthe disability and dependency within 60days of the child turning age 26.The PEBB Program, with input from yourmedical plan (if the child is enrolled inPEBB medical), will verify the disabilityand dependency of a child with adisability beginning at age 26, but nomore frequently than annually after thetwo-year period following the child’s26th birthday. These verifications mayrequire renewed proof from you. If thePEBB Program does not receive yourverification within the time allowed, thechild will no longer be covered.A child with a developmental or physicaldisability who becomes self-supportingis not eligible as of the last day of themonth they become capable of selfsupport. If the child becomes capableof self-support and later becomesincapable of self-support, the child doesnot regain eligibility as a child with adisability.You must notify the PEBB Program inwriting when your child with a disabilityis no longer eligible. The PEBB Programmust receive notice within 60 days ofthe last day of the month your childloses eligibility for health plan coverage.Verifying dependenteligibilityWhen you add a dependent to yourPEBB insurance coverage, you mustsubmit proof of their eligibility withinthe PEBB Program’s enrollmenttimelines. The PEBB Program reservesthe right to review a dependent’seligibility at any time.If a dependent’s eligibility cannot beverified, they will not be enrolled. Youcan find a list of documents you cansubmit to verify eligibility on page 11.Submit these documents with yourenrollment form.If you are enrolling a dependentdescribed in the table below, youmust also submit the listed form(s)with your election or change form. Allforms are available at ications.If enrolling a . then alsocompletethis formState-registereddomestic partneror their child,or other nonqualified taxdependent2020 PEBBDeclaration of TaxStatusDependent childwith a disabilityage 26 or older2020 PEBBCertification ofa Child With aDisabilityExtendeddependent child2020 PEBB ExtendedDependentCertification2020 PEBBDeclaration of TaxStatus(continued)9

Eligibility summaryValid dependent verification documentsIf I die, are mysurviving dependentseligible?Dependent verification helps makesure the PEBB Program covers onlypeople who qualify. If you want toenroll dependents, you must providedocuments to show they are eligiblebefore they can be enrolled underyour account.If you are an eligible employee, yoursurviving dependent (a spouse,state-registered domestic partner ordependent child) may be eligible toenroll or defer (postpone) enrollmentas a survivor under PEBB retireeinsurance coverage. To do so, theymust meet both the procedural andeligibility requirements described inWAC 182-12-265.The PEBB Program must receive allrequired forms to enroll or defer(postpone) enrollment as a survivorin PEBB retiree insurance coverage nolater than 60 days after the later ofthe date of the employee’s death orthe date the survivor’s PEBB insurancecoverage ends.If your surviving spouse, stateregistered domestic partner, ordependent child does not meet theeligibility requirements described inWAC 182-12-265, they may be eligibleto continue health plan enrollment inPEBB Continuation Coverage (COBRA)as described in WAC 182-12-146. See“What are my options when coverageends?” on page 23.You must submit all documentsin English. Documents written ina foreign language must includea translated copy prepared by aprofessional translator and notarized.Use the lists below to determine whichverification documents to submit.If you submit a tax return, you maysubmit just one copy if it includes alldependents that require verification.Submit the document(s) with yourenrollment form(s) within the PEBBProgram’s enrollment timelines.To find forms and more information,go to hca.wa.gov/pebb-employee,or contact your personnel, payroll, orbenefits office.To enroll a spouseProvide a copy of (choose one): Most recent year’s federal tax returnfiled jointly that lists the spouse (blackout financial information) The most recent year’s federal taxreturn for the subscriber and thespouse if filed separately (black outfinancial information) Marriage certificate and evidence thatthe marriage is still valid (example: autility bill or bank statement withinthe last 2 months showing both yourand your spouse’s name, – black outfinancial information) Petition for dissolution or invalidity ofmarriage Legal separation notice Defense Enrollment EligibilityReporting System (DEERS) registrationTo enroll a state-registereddomestic partner or legalunion partnerInclude the 2020 PEBB Declaration of TaxStatus form to indicate whether theyqualify as a dependent for tax purposesunder IRC Section 152, as modified byIRC Section 105(b).Provide a copy of (choose one): A certificate/card of state-registereddomestic partnership or legal unionand evidence that the partnership isstill valid (example: a utility bill withinthe last 2 months showing both yourand your partner’s name, a bankstatement within the last 2 months –black out information – showing bothyour and your partner’s name) Petition for invalidity (annulment) of astate-registered domestic partnershipor legal union Petition for dissolution or invalidityof a state-registered domesticpartnership or legal union Legal separation notice of a stateregistered domestic partnership orlegal union Valid J-1 or J-2 visa issued by the U.S.governmentTo enroll childrenIf you are enrolling the child of astate-registered domestic partner, anextended dependent child, or othernon-qualified tax dependent, submitthe 2020 PEBB Declaration of TaxStatus form to indicate whether thechild qualifies as a dependent for taxpurposes under IRC Section 152, asmodified by IRC Section 105(b).For all other children, provide a copyof one of the documents listed belowwith your enrollment form: The most recent year’s federal taxreturn that includes dependentchild(ren) (black out financialinformation). Note: You can submitone copy of your tax return if itincludes all dependents that requireverification. Birth certificate (or hospital certificatewith the child’s footprints on it)showing the name of the parent whois the subscriber, the subscriber’sspouse, or the subscriber’s stateregistered domestic partner* Certificate or decree

*aiser Foundation Health Plan of the Northwest offers plans in Clark and Cowlitz counties in Washington and select c K ounties egon.in Or Additional contacts Website addresses Customer service phone numbers Auto and Home Insurance Liberty Mutual Insurance Company hca.wa.gov/employee-retiree-benefits/ employees/auto-and-home-insurance 1-800-706-5525