Transcription

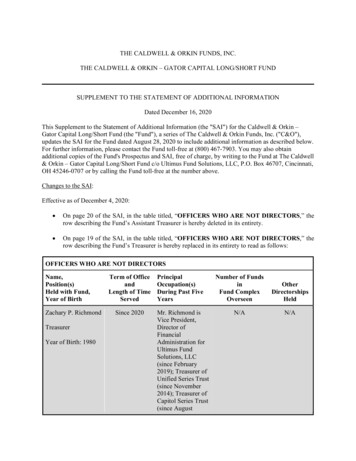

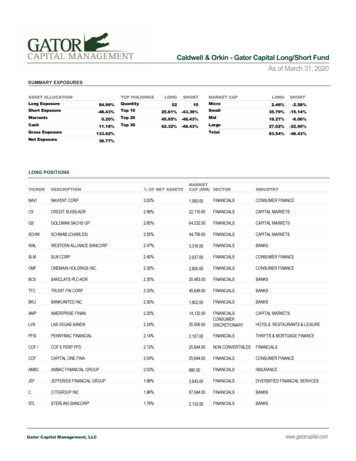

Caldwell & Orkin - Gator Capital Long/Short FundAs of March 31, 2020SUMMARY EXPOSURESASSET ALLOCATIONTOP HOLDINGSLong Exposure84.99%Short Exposure-48.43%Warrants0.20%CashGross ExposureNet Exposure11.18%QuantityTop 10Top 20Top .43%133.62%MARKET 77%LONG POSITIONSTICKERDESCRIPTION% OF NET ASSETSMARKETCAP (MM) SECTORNAVINAVIENT CORP3.02%1,560.00FINANCIALSCONSUMER FINANCECSCREDIT SUISS-ADR2.99%22,110.00FINANCIALSCAPITAL MARKETSGSGOLDMAN SACHS GP2.85%64,232.00FINANCIALSCAPITAL MARKETSSCHWSCHWAB (CHARLES)2.55%44,759.00FINANCIALSCAPITAL MARKETSWALWESTERN ALLIANCE BANCORP2.47%3,316.00FINANCIALSBANKSSLMSLM CORP2.40%2,937.00FINANCIALSCONSUMER FINANCEOMFONEMAIN HOLDINGS INC.2.35%2,800.00FINANCIALSCONSUMER FINANCEBCSBARCLAYS PLC-ADR2.35%20,483.00FINANCIALSBANKSTFCTRUIST FIN CORP2.33%45,649.00FINANCIALSBANKSBKUBANKUNITED INC2.30%1,802.00FINANCIALSBANKSAMPAMERIPRISE FINAN2.25%14,132.00CAPITAL MARKETSLVSLAS VEGAS PFSIPENNYMAC FINANCIAL2.14%2,107.00FINANCIALSTHRIFTS & MORTGAGE FINANCECOF ICOF 5 PERP PFD2.13%25,844.00NON CONVERTIBLESFINANCIALSCOFCAPITAL ONE FINA2.04%25,844.00FINANCIALSCONSUMER FINANCEAMBCAMBAC FINANCIAL GROUP2.03%680.00FINANCIALSINSURANCEJEFJEFFERIES FINANCIAL GROUP1.98%3,643.00FINANCIALSDIVERSIFIED FINANCIAL SERVICESCCITIGROUP INC1.96%97,944.00FINANCIALSBANKSSTLSTERLING BANCORP'1.79%2,132.00FINANCIALSBANKS1DIAMOND HILL CAPITAL MANAGEMENT, INC. QUARTERLY GUIDE DECEMBER 31, 2018 DIAMOND-HILL.COMGator Capital Management, LLCINDUSTRYHOTELS, RESTAURANTS & LEISUREwww.gatorcapital.com

LONG POSITIONS (continued)TICKERDESCRIPTION% OF NET ASSETSMARKETCAP (MM) SECTORSYFSYNCHRONY FINANCIAL1.78%9,460.00FINANCIALSCONSUMER FINANCECFGCITIZENS FINANCIAL GROUP1.74%9,057.00FINANCIALSBANKSSXCSUNCOKE ENERGY INC1.69%287.00MATERIALSMETALS & MININGUBSUBS GROUP AG1.69%37,471.00CAPITAL MARKETSJNPRJUNIPER NETWORKS1.68%7,229.00BBXBBX CAPITAL UMERDISCRETIONARYALLYALLY FINANCIAL, INC.1.65%5,897.00FINANCIALSCONSUMER FINANCEMTGMGIC INVT CORP1.61%2,260.00FINANCIALSTHRIFTS & MORTGAGE FINANCEDBDEUTSCHE BANK-RG1.61%13,475.00FINANCIALSCAPITAL MARKETSNMIHNMI HOLDINGS, INC.1.53%823.00FINANCIALSTHRIFTS & MORTGAGE FINANCEMSMORGAN STANLEY1.49%62,360.00FINANCIALSCAPITAL MARKETSPNFPPINNACLE FINANCIAL PTNRS1.42%3,203.00FINANCIALSBANKSIBKRINTERACTIVE BROKERS GRO1.40%18,482.00CAPITAL MARKETSDELLDELL MTDTD AMERITRADE HOLDING1.37%19,498.00CAPITAL MARKETSMLCOMELCO RESORTS & ENTERTAIN1.31%6,394.00VIACVIACOMCBS MMUNICATIONSERVICESLNCLINCOLN NATL CRP1.02%6,324.00INSURANCEBBBLACKBERRY MBIA INC1.00%585.00INSURANCEHRBH&R BLOCK GBRIGHTSPHERE INV GROUP0.89%543.00FINANCIALSCAPITAL MARKETSFNMATFNMA 8.25 PERP0.85%NON CONVERTIBLESFINANCIALSBGSB&G FOODS INC0.83%1,073.00CONSUMER STAPLES FOOD PRODUCTSCNOBCONNECTONE BANCORP INC0.83%564.00FINANCIALSBANKSALLY 0 02/15/40 PFD0.81%NON CONVERTIBLESHEALTH CAREFNMAJFNMA 7.625 PERP PFD0.80%FINANCIALSETMENTERCOM COMMUNICATIONS0.78%138.00NON CONVERTIBLESCOMMUNICATIONSERVICESSITCSITE CENTERS CORP0.73%1,221.00MGMMGM MIRAGE0.73%6,853.00OFGOFG BANCORP0.66%637.00HPEHEWLETT-PACKARD ENTERPRIS0.64%13,347.001DIAMOND HILL CAPITAL MANAGEMENT, INC. QUARTERLY GUIDE DECEMBER 31, 2018 DIAMOND-HILL.COMGator Capital Management, LLC2REAL CHNOLOGYINDUSTRYCOMMUNICATIONS EQUIPMENTHOTELS, RESTAURANTS & LEISURESOFTWAREHOTELS, RESTAURANTS & LEISUREMEDIASOFTWAREDIVERSIFIED CONSUMER SERVICESMEDIAEQUITY REAL ESTATE INVESTMENTTRUSTS (REITS)HOTELS, RESTAURANTS & LEISUREBANKSTECHNOLOGY HARDWARE, STORAGE &PERIPHERALSwww.gatorcapital.com

LONG POSITIONS (continued)% OF NET ASSETSMARKETCAP (MM) SECTORTICKERDESCRIPTIONNRZNEW RESIDENTIAL INVMT0.59% 2,219.00FINANCIALSMORTGAGE REAL ESTATE INVESTMENTTRUSTS (REITS)CITCIT GROUP INC0.41% 2,080.00FINANCIALSBANKSCOWNCOWEN GROUP INC0.40% 265.00FINANCIALSSRGSERITAGE GROWTH PROP0.38% 439.00REAL ESTATECWKCUSHMAN & WAKEFIELD PLC0.31% 2,564.00REAL ESTATECAPITAL MARKETSEQUITY REAL ESTATE INVESTMENTTRUSTS (REITS)REAL ESTATE MANAGEMENT &DEVELOPMENTAIG/WSAMERICAN INTNL- CW210.20%FINANCIALSINSURANCEZIONWZIONS BANCORP NA-CW200.00%FINANCIALSBANKS1DIAMOND HILL CAPITAL MANAGEMENT, INC. QUARTERLY GUIDE DECEMBER 31, 2018 DIAMOND-HILL.COMGator Capital Management, LLC3INDUSTRYwww.gatorcapital.com

SHORT POSITIONSTICKERDESCRIPTIONMARKET% OF NET ASSETS CAP (MM) SECTORINDUSTRYSPYSPDR S&P 500 ETF-22.65%252,706.00FAZDIREXION DAILY FINL BEAR-2.67%366.00U.S. LARGE CAPU.S. LARGE CAP EQUITIESEQUITIESEXCHANGE TRADEDEXCHANGE TRADED FUNDS (ETF'S)FUNDS (ETF'S)CBUCOMMUNITY BANK SYSTEM INC-2.63%3,167.00FINANCIALSBANKSDSLVVELOCITYSHARES 3X INVSLVR-2.58%21.00COMMODITIESCOMMODITIESHSTHOST HOTELS & RE-2.55%8,054.00REAL ESTATEEQUITY REAL ESTATE INVESTMENTTRUSTS (REITS)CVBFCVB FINANCIAL CORP-2.27%2,628.00FINANCIALSBANKSUALUNITED MBIA FINANCIAL INC-2.18%1,645.00FINANCIALSTHRIFTS & MORTGAGE FINANCEDREDUKE REALTY CORP-2.13%12,487.00REAL ESTATEEQUITY REAL ESTATE INVESTMENTTRUSTS (REITS)TMPTOMPKINS FINANCIAL CORP-1.51%1,057.00FINANCIALSBANKSPKPARK HOTELS & RESORTS-1.46%1,908.00REAL ESTATEEQUITY REAL ESTATE INVESTMENTTRUSTS (REITS)USLVVELOCITYSHARES 3X LNGSLVR-1.34%261.00COMMODITIESCOMMODITIESHOTELS, RESTAURANTS & LEISURECCLCARNIVAL CORP-1.16%8,781.00CONSUMERDISCRETIONARYNBTBN B T BANCORP INC-0.64%1,438.00FINANCIALSBANKSPJTPJT PARTNERS INC- A-0.44%1,764.00FINANCIALSCAPITAL MARKETS1DIAMOND HILL CAPITAL MANAGEMENT, INC. QUARTERLY GUIDE DECEMBER 31, 2018 DIAMOND-HILL.COMGator Capital Management, LLC4www.gatorcapital.com

DisclaimerHoldings are subject to change. Stocks of smaller companies generally will have more risks than those of larger companies, such as greater price volatility,business risk, less liquidity, and increased competitive threat. Investing involves risk, including loss of principal. The Fund uses aggressive investment strategies(including short positions and option) that have the potential for yielding high returns; however, these strategies may also result in losses. Stocks sold short haveunlimited risk. Investment return and principal value will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Options arenot suitable for all investors.Gross exposure is the sum of the absolute values of the fund’s long and short exposures. Net exposure is the fund’s total long exposure less the fund’s totalshort exposure.Investors should carefully consider the investment objectives, risks, management fees, and charges and expenses of the Fund before investing. To obtain aprospectus containing this and other important information, please call (800) 237-7073. Read the prospectus carefully before you invest. The Fund is distributedby Ultimus Fund Distributors, LLC.10034923-UFD-4/15/20201DIAMOND HILL CAPITAL MANAGEMENT, INC. QUARTERLY GUIDE DECEMBER 31, 2018 DIAMOND-HILL.COMGator Capital Management, LLC6www.gatorcapital.com

gator capital management, llc www.gatorcapital.com 2 ticker description % of net assets market cap (mm) sector industry sxc suncoke energy inc 1.69% 287.00 materials metals & mining information technology communications equipment bbx bbx capital corp 1.68% 182.00 consumer discretionary hotels, restaurants & leisure