Transcription

eNote Updates from Ginnie Mae, the Federal Home Loan Banks andMERSNovember 14, 2019

Our Moderator and Panelists2Amy MosesAnn PloetzJames FrondorfAngel HernandezManager, Marketing & MediaSenior Product ManagerFirst Vice President, CreditMBS Policy and Strategic PlanningMERSCORP Holdings, Inc.MERSCORP Holdings, Inc.Federal Home Loan Bankof CincinnatiGinnie Mae

Surge in eNotesSource: MERSCORP Holdings, Inc.3PROPRIETARY

Secured Party Field:Coming in November to MERS eRegistry4PROPRIETARY

Secured PartyDefinition“The Participant named on the MERS eRegistry that has been sold, pledged, assigned, or granted asecurity interest in the eNote by the Controller.”Contemplates that a Secured Partycould be warehouse lenders,collateralized lenders such as the FHLBs,or security guarantors such as GinnieMae5PROPRIETARY

How Does Secured Party Work?Controller NamesSecured Party6Controller InitiatesTransfer ofControl/LocationSecured PartyTransfer CompleteThe Controller can The Secured Party can The Secured Party can The Secured Party Include the Secured Partyat time of eNoteRegistration Or, add the Secured Partypost-Registration Receive notification ofeNote activity Release its interests Restrict eNotedeactivations based upona profile setting Also initiate of Transferof Control/Location toanother participant oritself Is cleared from the eNoterecord once the transferis completePROPRIETARY

Federal Home Loan Banks (FHLBs) – Who We AreThe 11 FHLBs are government-sponsoredenterprises (GSEs) organized ascooperatives under an act of Congress(Federal Home Loan Bank Act of 1932)BostonNew YorkFHLBs provide readily-available, low-costfunding to approximately 7,000 membersnationwide, increasing availability of creditfor residential mortgage lending andinvestment in housing and communitydevelopment.ChicagoIndianapolisDes MoinesSan FranciscoPittsburghCincinnatiTopekaAtlantaFHLBs fund theiroperations principally throughthe sale of debt securitiesthrough the Office of FinanceDallasH AW AI IU.S. TerritoriesA L AS KA7Puerto RicoGuamVirgin IslandsAmericanSamoa

FHLBs – How it works!Cooperatively OrganizedNo public equity – FHLB customersare our owners, this fostersconservative management and along-term view of financialperformance.Share Joint & Several SupportFHLBs share joint & several liabilityto repay all senior debt obligations8Well CapitalizedSelf-capitalizing business model andcapital preservation authority worktogether to provide a stable capitalbase.Fully CollateralizedFully-collateralized lending modelcombined with the “super lien” haveshielded the FHLB from any creditlosses on advances in the System’snearly 90 year history!

FHLBs – Sharing Our Point of View Collateral-based lenders. Regulation sets many requirements around eligibility. Must be able to value collateral Must be able to liquidate collateral (need for a secondary market) We have a long-tail interest in the ‘Secured Party’ role. As opposed to a ‘purchase’ position (traditional GSE/MERS model)9

FHLBs – Secured Party Activities (High-Level Function) Entities identify their FHLB as ‘Secured Party’ and ‘Location’. FHLBs may elect to utilize an auto-accept default approval of transfers(for control and location), or require FHLB approval for such transfers. Borrowing capacity only granted against FHLB ‘Secured Party’ loans. In event of member failure / liquidation - FHLB may initiate transfers ofcontrol or location to itself or another party (right of Secured Party).10

FHLBs – Where We’ve Been Systemwide efforts began in 2017. Partnered with industry experts to assist with development. Worked with industry participants to define ‘Secured Party’ field. Self-education initiative (with GSEs, MERS, eVault vendors, and othersin the eCommunity). Joined MISMO and participate in sponsored events. Attended MBA technology conferences. Frequent FHLB Systemwide eNote gatherings / collaboration. Legal, Operational Requirements (eVault), eRegistry, Valuation, MemberOutreach11

FHLBs – Where We Are Request for Proposal (RFP) from eVault Vendors is underway. Expect to decide on a Vendor around year-end 2019. FHLB’s residential loan requirements guide is coming soon! Check with your respective FHLB for details.Expect to see sometime between late 2019 or early 2020 (per FHLB). Additional items to be addressed Drafting FHLB Pledge Agreement Addendum language. Settling MERS Agreement details (Member on-boarding details). UCC language.12

FHLBs – Where We’re Going Acquire an eVault; test capabilities (FHLB joint and individual effort). MERS reporting system integration / vault integration intoreconciliation processes. Define collateral review standards / attributes specific to eNotes. Monitor evolution/depth of secondary markets.13

FHLBs – Where We’re Going (continued) Adoption speed will vary by FHLB and likely depend on FHLB memberreadiness/interest. Education efforts will persist. Industry Participants (maintaining definition/agreement on ‘standards’) Member education (valid eNote generation) Potentially other collateral types as “e” takes hold. Staying on top of industry evolution (block chain, eNotary, eRecording). Other enhancements as the markets evolve.14

FHLBs – YOUR eNote ContactsAtlanta Don DeAngelo404-888-8489DDeAngelo@fhlbatl.comBoston Ana Dyer617-292-9762ana.dyer@fhlbboston.comChicago Chris Claffy312-552-1295cclaffy@fhlbc.comCincinnati James C. Frondorf513-852-7563frondorfjc@fhlbcin.comDallas Chandra Quaite800-541-0597Chandra.Quaite@fhlb.comDes Moines Vonda Renfrow515-412-2342vrenfrow@fhlbdm.comIndianapolis Doug Houck317-465-0508dhouck@fhlbi.comNew York Tisa Surat201-356-1058tisa.surat@fhlbny.comPittsburgh Michael May412-288-3475michael.may@fhlb-pgh.comSan Francisco Anthony P. King415-616-2986kinga@fhlbsf.com15Topeka Kylie Mergen785-478-8203kylie.mergen@fhlbtopeka.com

Ginnie Mae – MissionGinnie Mae’s mission is to bring global capital into thehousing finance market. We serve as the principal financingarm for government-backed loans. Our programs providethe necessary liquidity to ensure that lenders have the fundsnecessary to provide loans to consumers.16

Ginnie Mae – How We Meet Our MissionGinnie Mae delivers mortgage securitizationprograms for mortgage lenders and attractivesecurity offerings for global investors.We guarantee investors the timely paymentof principal and interest on MBS issuedthrough our programs.The Ginnie Mae Guaranty carries the full faithand credit guaranty of the United StatesGovernmentOur model limits the taxpayers' exposure torisk associated with secondary markettransactions17

Ginnie Mae – Digital Mortgage EffortsWe believe that creating a digital mortgage ecosystem, from loan application through securitization, willincrease access to credit for many Americans and enhance the integrity of our collateral. Enhance attractiveness of our program Support issuer liquidity Reduce risk to our programs and taxpayersIn June 2018, we published Ginnie Mae 2020, which announced our commitment to implement thepolicies, technology, and operational capabilities necessary to take in digital mortgages and otherdigitized collateral files. Collaborated extensively with key industry stakeholders to create an overarching process and policy frameworkfor our digital collateral initiative. Worked with GSA to select an eVault provider. Published draft guidance for public input.18

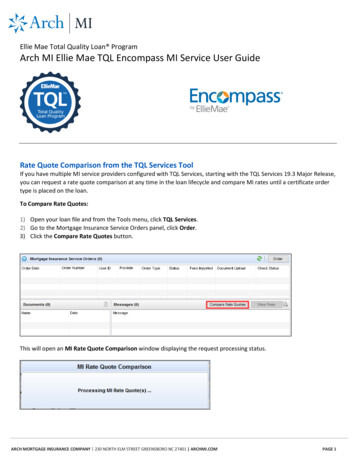

Ginnie Mae – RFI Ginnie Mae Digital Collateral GuideeIssuer &eCustodianRequirementLoan and ipation19

Ginnie Mae – Next StepsRFI EvaluationandAssessments20Publication ofOfficial estingPilot Launchand MBSIssuance

Questions

(Federal Home Loan Bank Act of 1932) FHLBs provide readily-available, low-cost funding to approximately 7,000 members nationwide, increasing availability of credit . Chandra.Quaite@fhlb.com Des Moines Vonda Renfrow 515-412-2342 vrenfrow@fhlbdm.com Indianapolis Doug Houck 317-465-0508 dhouck@fhlbi.com New York Tisa Surat