Transcription

2021Department of the TreasuryInternal Revenue ServiceInstructions for Form1120-RICU.S. Income Tax Return for Regulated Investment CompaniesFuture DevelopmentsSection references are to the InternalRevenue Code unless otherwise noted.ContentsPhotographs of Missing ChildrenThe Taxpayer Advocate Service .How To Get Forms andPublications . . . . . . . . . . .General Instructions . . . . . . . . .Purpose of Form . . . . . . . . . . .Who Must File . . . . . . . . . . . .General Requirements To Qualifyas a RIC . . . . . . . . . . . . .Other Requirements . . . . . . . .Definition of a Fund . . . . . . . . .Where To File . . . . . . . . . . . . .When To File . . . . . . . . . . . . .Who Must Sign . . . . . . . . . . . .Paid Preparer Authorization . . . .Assembling the Return . . . . . . .Tax Payments . . . . . . . . . . . .Estimated Tax Payments . . . . .Interest and Penalties . . . . . . . .Accounting Methods . . . . . . . .Accounting Periods . . . . . . . . .Rounding Off to Whole Dollars . .Recordkeeping . . . . . . . . . . . .Other Forms That May BeRequired . . . . . . . . . . . . .Statements . . . . . . . . . . . . . .Specific Instructions . . . . . . . . .Period Covered . . . . . . . . . . .Name and Address . . . . . . . . .Item B. Date RIC WasEstablished . . . . . . . . . . .Item C. Employer IdentificationNumber (EIN) . . . . . . . . . .Item D. Total Assets . . . . . . . . .Item E. Final Return, NameChange, Address Change, orAmended Return . . . . . . . .Part I—Investment CompanyTaxable Income . . . . . . . .Part II—Tax on Undistributed NetCapital Gain Not DesignatedUnder Section 852(b)(3)(D) .Schedule A—Deduction forDividends Paid . . . . . . . . .Schedule B—Income FromTax-Exempt Obligations . . .Schedule J—Tax Computation . .Schedule K—Other Information .Schedule L—Balance Sheets perBooks . . . . . . . . . . . . . . .Schedule M-1 . . . . . . . . . . . . .Feb 02, 2022Page. 1. 1.1222.223333444455666.67888. 8. 8. 8. 8. 9. . . 14. . . 14. . . 15. . . 15. . . 17. . . 19. . . 19For the latest information aboutdevelopments related to Form1120-RIC and its instructions, such aslegislation enacted after this form andinstructions were published, go toIRS.gov/Form1120RIC.What’s NewCredit for qualified sick and familyleave wages. The American RescuePlan Act of 2021 (the ARP) providedcredits for qualified sick and familyleave wages similar to the credits thatwere previously enacted under theFamilies First Coronavirus ResponseAct (FFCRA) and amended andextended by the COVID-related TaxRelief Act of 2020. See theInstructions for Form 941 for moreinformation.COVID-19 related employee retention credit. The employee retentioncredit, enacted by the CoronavirusAid, Relief, and Economic Security(CARES) Act, and amended by theARP and other recent legislation, islimited to qualified wages paid beforeOctober 1, 2021 (or, in the case ofwages paid by an eligible employerthat is a recovery startup business,before January 1, 2022). See theInstructions for Form 941 for moreinformation.Photographs of MissingChildrenThe Internal Revenue Service is aproud partner with the National Centerfor Missing & Exploited Children (NCMEC). Photographs of missingchildren selected by the Center mayappear in instructions on pages thatwould otherwise be blank. You canhelp bring these children home bylooking at the photographs and calling1-800-THE-LOST (1-800-843-5678) ifyou recognize a child.Cat. No. 64251JThe Taxpayer AdvocateServiceThe Taxpayer Advocate Service(TAS) is an independent organizationwithin the IRS that helps taxpayersand protects taxpayer rights. TAS'sjob is to ensure that every taxpayer istreated fairly and knows andunderstands their rights under theTaxpayer Bill of Rights.As a taxpayer, the RIC has rightsthat the IRS must abide by in itsdealings with the RIC. TAS can helpthe RIC if: A problem is causing financialdifficulty for the business; The business is facing animmediate threat of adverse action; or The RIC has tried repeatedly tocontact the IRS but no one hasresponded, or the IRS hasn'tresponded by the date promised.The TAS toolkit atTaxpayerAdvocate.IRS.gov can helpthe RIC understand these rights.TAS has offices in every state, theDistrict of Columbia, and Puerto Rico.Local advocates' numbers are in theirlocal directories and atTaxpayerAdvocate.IRS.gov. The RICcan also call TAS at 877-777-4778.TAS also works to resolvelarge-scale or systemic problems thataffect many taxpayers. If the RICknows of one of these broad issues,please report it to TAS through theSystemic Advocacy ManagementSystem atIRS.gov/SAMS.For more information, go toIRS.gov/Advocate.How To Get Formsand PublicationsInternet. You can access the IRSwebsite 24 hours a day, 7 days aweek, at IRS.gov to: Download forms, instructions, andpublications;

Order IRS products online; Research your tax questions online; Search publications online by topicor keyword; View Internal Revenue Bulletins(IRBs) published in recent years; and Sign up to receive local andnational tax news by email.Tax forms and publications. TheRIC can download or print all of theforms and publications it may need atIRS.gov/FormsPubs.Otherwise, the RIC can go toIRS.gov/OrderForms to place anorder and have forms mailed to it. TheIRS will process your order for formsand publications as soon as possible.General InstructionsPurpose of FormUse Form 1120-RIC, U.S. Income TaxReturn for Regulated InvestmentCompanies, to report the income,gains, losses, deductions, credits, andto figure the income tax liability of aregulated investment company (RIC)as defined in section 851.Who Must FileA domestic corporation that meetscertain conditions (discussed below)must file Form 1120-RIC if it elects tobe treated as a RIC for the tax year (orhas made an election for a prior taxyear and the election has not beenterminated or revoked). The electionis made by computing taxable incomeas a RIC on Form 1120-RIC.Qualified opportunity funds. To becertified as a qualified opportunityfund, the corporation must file Form1120-RIC and attach Form 8996,even if the corporation had no incomeor expenses to report. SeeSchedule K, Question 15. Also, seethe Instructions for Form 8996.General Requirements ToQualify as a RICThe term “regulated investmentcompany” applies to any domesticcorporation that: Is registered throughout the taxyear as a management company orunit investment trust under theInvestment Company Act of 1940(ICA), Has an election in effect under theICA to be treated as a businessdevelopment company, or Is a common trust fund or similarfund that is neither an investmentcompany under section 3(c)(3) of theICA nor a common trust fund asdefined under section 584(a).Other RequirementsIn addition, the RIC must meet the (1)income test, (2) asset test, and (3)distribution requirements explainedbelow.The income test: At least 90% of itsgross income must be derived fromthe following items: Dividends; Interest (including tax-exemptinterest income); Payments with respect to securitiesloans (as defined in section 512(a)(5)); Gains from the sale or otherdisposition of stock or securities (asdefined in ICA section 2(a)(36)) orforeign currencies; Other income (including gains fromoptions, futures, or forward contracts)derived from the RIC's business ofinvesting in such stock, securities, orcurrencies; and Net income derived from an interestin a qualified publicly tradedpartnership (as defined in section851(h)).Income from a partnership (otherthan a qualified publicly tradedpartnership) or trust qualifies underthe 90% test to the extent the RIC'sdistributive share of such income isfrom items described above asrealized by the partnership or trust.Income that a RIC receives in thenormal course of business as areimbursement from its investmentadvisor is qualifying income forpurposes of the 90% test if thereimbursement is includible in theRIC's gross income.A RIC that fails to meet therequirements of section 851(b)(2) maystill be considered to have satisfiedthe requirements of this test if: Following the RIC's identification ofthe failure, a description of each itemof its gross income described insection 851(b)(2) is set forth in astatement for the tax year; and Failure to meet the requirements ofthis test is due to reasonable causeand not due to willful neglect.The asset test:-2-1. At the end of each quarter of theRIC's tax year, at least 50% of thevalue of its assets must be invested inthe following items: Cash and cash items (includingreceivables); Government securities; Securities of other RICs; and Securities of other issuers, exceptthat the investment in a single issuerof securities may not exceed 5% ofthe value of the RIC's assets or 10%of the outstanding voting securities ofthe issuer (except as provided insection 851(e)).2. At the end of each quarter of theRIC's tax year, no more than 25% ofthe value of the RIC's assets may beinvested in the securities of: A single issuer (excludinggovernment securities or securities ofother RICs); Two or more issuers controlled bythe RIC and engaged in the same orrelated trades or businesses; or One or more qualified publiclytraded partnerships as defined insection 851(h).See sections 851(b)(3) and 851(c)for further details.3. A RIC that fails to meet therequirements of section 851(b)(3) fora quarter may be considered to havesatisfied the requirements of this testif: After the RIC identifies the failure,the RIC provides a statement with adescription of each asset that causesthe RIC to fail to satisfy therequirements at the close of thequarter; The failure is due to reasonablecause and not due to willful neglect;and The RIC disposes of the assets setforth on the statement (or therequirements of section 851(b)(3) areotherwise met) within 6 months afterthe last day of the quarter that the RICidentified the failure.4. De minimis failures. A RIC thatfails to meet the requirements ofsection 851(b)(3) for a quarter may beconsidered to have satisfied therequirements of this test if: Such failure is due to ownership ofassets that the total value does notexceed the lesser of:a. One percent of the total value ofthe RIC's assets at the end of thequarter for which the measurement isdone, or

b. 10 million; and The RIC disposes of the assetfollowing the identification of thefailure (or the requirements of section851(b)(3) are otherwise met) within 6months after the last day of thequarter in which the RIC identified thefailure.Note. For special rules regardingfailure to meet the requirements of theincome and asset tests, see sections851(d)(2) and 851(i).Distribution requirements. TheRIC's deduction for dividends paid forthe tax year (as defined in section561, but without regard to capital gaindividends) equals or exceeds the sumof: 90% of its investment companytaxable income determined withoutregard to section 852(b)(2)(D); and 90% of the excess of the RIC'sinterest income excludable from grossincome under section 103(a) over itsdeductions disallowed under sections265 and 171(a)(2).A RIC that does not satisfy thedistribution requirements willCAUTION be subject to taxation as a Ccorporation.!Earnings and profits. The RICmust either have been a RIC for all taxyears ending after November 7, 1983,or, at the end of the current tax year,have had no accumulated earningsand profits from any non-RIC tax year.Note. For this purpose, current yeardistributions are treated as made fromthe earliest earnings and profitsaccumulated in any non-RIC tax year.See section 852(c)(3). Also, seesection 852(e) for procedures thatmay allow the RIC to avoiddisqualification for the initial year if theRIC did not meet this requirement.Definition of a FundThe term “fund” refers to a separateportfolio of assets, whose beneficialinterests are owned by the holders ofa class or series of stock of the RICthat is preferred over all other classesor series for that portfolio of assets.When To FileGenerally, a RIC must file its incometax return by the 15th day of the 4thmonth after the end of its tax year. Anew RIC filing a short period returnmust generally file by the 15th day ofWhere To FileFile the RIC's return at the applicable IRS address listed below.If the RIC's principalbusiness, office, or agencyis located in:Connecticut, Delaware, Districtof Columbia, Georgia, Illinois,Indiana, Kentucky, Maine,Maryland, Massachusetts,Michigan, New Hampshire,New Jersey, New York, NorthCarolina, Ohio, Pennsylvania,Rhode Island, South Carolina,Tennessee, Vermont, Virginia,West Virginia, WisconsinAnd the total assets atthe end of the tax yearare:Use the following address:Less than 10 million andSchedule M-3 is not filedDepartment of the TreasuryInternal Revenue ServiceKansas City, MO64999-0012 10 million or more orSchedule M-3 is filedDepartment of the TreasuryInternal Revenue ServiceOgden, UT84201-0012Any amountDepartment of the TreasuryInternal Revenue ServiceOgden, UT84201-0012Alabama, Alaska, Arizona,Arkansas, California,Colorado, Florida, Hawaii,Idaho, Iowa, Kansas,Louisiana, Minnesota,Mississippi, Missouri,Montana, Nebraska, Nevada,New Mexico, North Dakota,Oklahoma, Oregon, SouthDakota, Texas, Utah,Washington, WyomingA group of corporations with members located in more than one service centerarea will often keep all the books and records at the principal office of themanaging corporation. In this case, file the tax returns with the service centerfor the area in which the principal office of the managing corporation is located.the 4th month after the short periodends. A RIC that has dissolved mustgenerally file by the 15th day of the4th month after the date of dissolution.However, a RIC with a fiscal taxyear ending June 30 must file by the15th day of the 3rd month after theend of its tax year. A RIC with a shorttax year ending anytime in June willbe treated as if the short year endedon June 30, and must file by the 15thday of the 3rd month after the end ofits tax year.If the due date falls on a Saturday,Sunday, or legal holiday, the RIC mayfile its return on the next business day.Private Delivery ServicesRICs can use certain private deliveryservices (PDS) designated by the IRSto meet the “timely mailing as timelyfiling” rule for tax returns. Go toIRS.gov/PDS for the current list ofdesignated services.The PDS can tell you how to getwritten proof of the mailing date.For the IRS mailing address to useif you're using PDS, go to IRS.gov/PDSstreetAddresses.-3-Private delivery services can'tdeliver items to P.O. boxes.CAUTION You must use the U.S. PostalService to mail any item to an IRSP.O. box address.!Extension of Time To FileFile Form 7004, Application forAutomatic Extension of Time To FileCertain Business Income Tax,Information, and Other Returns, torequest an extension of time to file.Generally, the RIC must file Form7004 by the regular due date of thereturn.Who Must SignThe return must be signed and datedby: The president, vice president,treasurer, assistant treasurer, chiefaccounting officer; or Any other corporate officer (such asa tax officer) authorized to sign.If a return is filed on behalf of a RICby a receiver, trustee, or assignee, thefiduciary must sign the return, insteadof the corporate officer. Returns andforms signed by a receiver or trustee

in bankruptcy on behalf of a RIC mustbe accompanied by a copy of theorder or instructions of the courtauthorizing signing of the return orform.Note. If this return is being filed for aseries fund (as defined in section851(g)(2)), the return may be signedby any officer authorized to sign forthe corporation in which the fund is aseries.If an employee of the RICcompletes Form 1120-RIC, the paidpreparer's space should remain blank.A preparer who does not charge theRIC to prepare Form 1120-RIC shouldnot complete that section. Generally,anyone who is paid to prepare thereturn must sign it and fill in the “PaidPreparer Use Only” section.The paid preparer must completethe required preparer information and: Sign the return in the spaceprovided for the preparer's signature,and Give a copy of the return to thecorporation.A paid preparer may signTIP original or amended returnsby rubber stamp, mechanicaldevice, or computer softwareprogram.Paid PreparerAuthorizationIf the RIC wants to allow the IRS todiscuss its 2021 tax return with thepaid preparer who signed the return,check the “Yes” box in the signaturearea of the return. This authorizationapplies only to the individual whosesignature appears in the “PaidPreparer Use Only” section of theRIC's return. It does not apply to thefirm, if any, shown in that section.If the “Yes” box is checked, the RICis authorizing the IRS to call the paidpreparer to answer any questions thatmay arise during the processing of itsreturn. The RIC is also authorizing thepaid preparer to: Give the IRS any information that ismissing from the return; Call the IRS for information aboutthe processing of the return or thestatus of any related refund orpayment(s); and Respond to certain IRS noticesabout math errors, offsets, and returnpreparation.The RIC is not authorizing the paidpreparer to receive any refund check,bind the RIC to anything (includingany additional tax liability), orotherwise represent the RIC beforethe IRS.The authorization will automaticallyend no later than the due date(excluding extensions) for filing theRIC's 2022 tax return. If the RIC wantsto expand the paid preparer'sauthorization or revoke theauthorization before it ends, see Pub.947, Practice Before the IRS andPower of Attorney.Assembling the ReturnTo ensure that the RIC's tax return iscorrectly processed, attach allschedules, statements, and otherforms after page 4, Form 1120-RIC, inthe following order.1. Schedule N (Form 1120).2. Schedule D (Form 1120).3. Form 8949.4. Form 4136.5. Form 8948.6. Form 965-B.7. Form 8941.8. Form 3800.9. Form 8997.10. Additional schedules inalphabetical order.11. Additional forms in numericalorder.12. Supporting statements andattachments.Complete every applicable entryspace on Form 1120-RIC. Do notenter “See attached” instead ofcompleting the entry spaces. If morespace is needed on the forms orschedules, attach separate sheetsusing the same size and format as theprinted forms.If there are supporting statementsand attachments, arrange them in thesame order as the schedules or formsthey support and attach them last.Show the totals on the printed forms.Enter the RIC's name and EIN oneach supporting statement orattachment.Tax PaymentsGenerally, the RIC must pay the taxdue in full no later than the due datefor filing its tax return (not includingextensions). See the instructions for-4-line 31. If the due date falls on aSaturday, Sunday, or legal holiday,the payment is due on the next daythat isn't a Saturday, Sunday, or legalholiday.Electronic DepositRequirementRICs must use electronic fundstransfer to make all federal taxdeposits (such as deposits ofemployment, excise, and corporateincome tax). Generally, electronicfunds transfers are made using theElectronic Federal Tax PaymentSystem (EFTPS). However, if the RICdoes not want to use EFTPS, it canarrange for its tax professional,financial institution, payroll service, orother trusted third party to makedeposits on its behalf. Also, it mayarrange for its financial institution tosubmit a same-day tax wire payment(discussed below) on its behalf.EFTPS is a free service provided bythe Department of the Treasury.Services provided by a taxprofessional, financial institution,payroll service, or other third partymay have a fee.To get more information aboutEFTPS or to enroll in EFTPS, visitEFTPS.gov, or call 800-555-4477(TTY/TDD 800-733-4829).Depositing on time. For any depositmade by EFTPS to be on time, theRIC must submit the deposit by 8 p.m.Eastern time the day before the datethe deposit is due. If the RIC uses athird party to make deposits on itsbehalf, they may have different cutofftimes.Same-day wire payment option. Ifthe RIC fails to submit a deposittransaction on EFTPS by 8 p.m.Eastern time on the day before thedate a deposit is due, it can still makeits deposit on time by using theFederal Tax Collection Service(FTCS). To learn more about theinformation the RIC will need toprovide its financial institution to makea same-day wire payment, go toIRS.gov/SameDayWire.Estimated Tax PaymentsGenerally, the following rules apply tothe RIC's payments of estimated tax. The RIC must make installmentpayments of estimated tax if it expectsits total tax for the year (less

applicable credits) to be 500 ormore. The installments are due by the15th day of the 4th, 6th, 9th, and 12thmonths of the tax year. If any datefalls on a Saturday, Sunday, or legalholiday, the installment is due on thenext regular business day. The RIC must use electronic fundstransfer to make installment paymentsof estimated tax. Use Form 1120-W, Estimated Taxfor Corporations, as a worksheet tocompute estimated tax. See theInstructions for Form 1120-W. If the RIC overpaid its estimatedtax, it may be able to get a quickrefund by filing Form 4466,Corporation Application for QuickRefund of Overpayment of EstimatedTax. The overpayment must be atleast 10% of the RIC's expectedincome tax liability and at least 500.For more information, includingpenalties, see the instructions forline 30, Estimated tax penalty, later.Interest and PenaltiesInterest. Interest is charged on taxespaid late even if an extension of timeto file is granted. Interest is alsocharged on penalties imposed forfailure to file, negligence, fraud,substantial valuation misstatements,substantial understatements of tax,and reportable transactionunderstatements from the due date(including extensions) to the date ofpayment. The interest charge isfigured at a rate determined undersection 6621.Late filing of return. A RIC thatdoes not file its tax return by the duedate, including extensions, may bepenalized 5% of the unpaid tax foreach month or part of a month thereturn is late, up to a maximum of 25%of the unpaid tax. The minimumpenalty for a return that is over 60days late is the smaller of the tax dueor 435. The penalty will not beimposed if the RIC can show that thefailure to file on time was due toreasonable cause.Late payment of tax. A RIC thatdoes not pay the tax when due maygenerally be penalized 1/2 of 1% of theunpaid tax for each month or part of amonth the tax is not paid, up to amaximum of 25% of the unpaid tax.The penalty will not be imposed if theRIC can show that the failure to payon time was due to reasonable cause. Any other method authorized by theInternal Revenue Code.Reasonable cause determinations.If the RIC receives a notice about apenalty after it files its return, send theIRS an explanation and we willdetermine if the RIC meets thereasonable cause criteria. Do notattach an explanation when the RIC'sreturn is filed.For more information, see Pub.538, Accounting Periods andMethods.Trust fund recovery penalty. Thispenalty may apply if certain excise,income, social security, and Medicaretaxes that must be collected orwithheld are not collected or withheld,or these taxes are not paid. Thesetaxes are generally reported on: Form 720, Quarterly Federal ExciseTax Return; Form 941, Employer'sQUARTERLY Federal Tax Return; Form 944, Employer's ANNUALFederal Tax Return; or Form 945, Annual Return ofWithheld Federal Income Tax.The trust fund recovery penaltymay be imposed on all persons whoare determined by the IRS to beresponsible for collecting, accountingfor, or paying over these taxes, andwho acted willfully in not doing so.The penalty is equal to the full amountof the unpaid trust fund tax. See theInstructions for Form 720 or Pub. 15(Circular E), for details, including thedefinition of responsible persons.Note. The trust fund recovery penaltywill not apply to any amount of trustfund taxes an employer holds back inanticipation of the credit for qualifiedsick and family leave wages or theemployee retention credit that theyare entitled to. See Pub. 15 or Pub. 51for more information.Other penalties. Other penalties canbe imposed for negligence,substantial understatement of tax,reportable transactionunderstatements, and fraud. Seesections 6662, 6662A, and 6663.Accounting MethodsFigure taxable income using themethod of accounting regularly usedin keeping the RIC's books andrecords. In all cases, the method usedmust clearly reflect taxable income.Generally, permissible methodsinclude: Cash, Accrual, or-5-Accrual method. Generally, a RICmust use the accrual method ofaccounting if its average annual grossreceipts for the prior 3 years exceed 26 million. See section 448(c).Mark-to-market accounting method. Generally, dealers in securitiesmust use the mark-to-marketaccounting method described insection 475. Under this method, anysecurity that is inventory to the dealermust be held at its fair market value(FMV).Any security held by a dealer that isnot inventory and held at the close ofthe tax year is treated as sold at itsFMV on the last business day of thetax year. Any resulting gain or lossmust be taken into account that yearin determining gross income. The gainor loss taken into account is generallytreated as ordinary gain or loss.For details, including exceptions,see section 475, the relatedregulations, and Rev. Rul. 97-39,1997-39 I.R.B. 4.Dealers in commodities and tradersin securities and commodities mayelect, with some exceptions, to usethe mark-to-market accountingmethod. To make the election, theRIC must file a statement describingthe election, the first tax year theelection is to be effective, and in thecase of an election for traders insecurities or commodities, the trade orbusiness for which the election ismade. Except for new taxpayers, thestatement must be filed by the duedate (not including extensions) of theincome tax return for the tax yearimmediately preceding the electionyear and attached to that return, or ifapplicable, to a request for anextension of time to file that return. Formore details, see Rev. Proc. 99-17,1999-7 I.R.B. 52, and sections 475(e)and (f).Change in accounting method.Generally, the RIC must get IRSconsent to change either an overallmethod of accounting or theaccounting treatment of any materialitem for income tax purposes. Toobtain consent, the RIC must file Form3115, Application for Change in

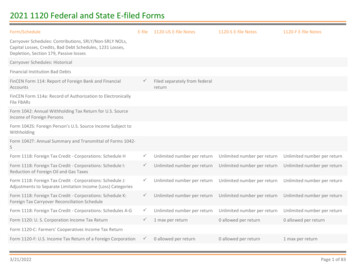

Accounting Method, during the taxyear for which the change isrequested. See the Instructions forForm 3115 and Pub. 538 for moreinformation and exceptions.Accounting PeriodsA RIC must figure its taxable incomeon the basis of a tax year. A tax yearis the annual accounting period a RICuses to keep its records and report itsincome and expenses. RICs can usea calendar year or a fiscal year. Formore information about accountingperiods, see Regulations sections1.441-1 and 1.441-2.Change of tax year. Generally, aRIC must receive consent from theIRS before changing its tax year. Toobtain the consent, file Form 1128,Application To Adopt, Change, orRetain a Tax Year. However, undercertain conditions, a RIC may changeits tax year without obtaining theconsent.See the Instructions for Form 1128and Pub. 538 for more information onaccounting periods and tax years.Rounding Off toWhole DollarsThe RIC may enter decimal pointsand cents when completing its return.However, the RIC should round offcents to whole dollars on its return,forms, and schedules to makecompleting its return easier. The RICmust either round off all amounts onits return to whole dollars, or usecents for all amounts. To round, dropamounts under 50 cents and increaseamounts from 50 to 99 cents to thenext dollar. For example, 8.40rounds to 8 and 8.50 rounds to 9.If two or more amounts must beadded to figure the amount to enter ona line, include cents when adding theamounts and round off only the total.RecordkeepingKeep the RIC's records for as long asthey may be needed foradministration of any provision of theInternal Revenue Code. Usually,records that support an item ofincome, deduction, or credit on thereturn must be kept for 3 years fromthe date the return is due or filed,whichever is later. Keep records thatverify the RIC's basis in property foras long as they are needed to figurethe basis of the original orreplacement property.The RIC should keep copies of allfiled returns. They help in preparingfuture and amended returns and in thecalculation of earnings and profits.Other Forms That May BeRequiredIn addition to Form 1120-RIC, the RICmay have to file some of the followingforms. Also, see Pub. 542,Corporations, for an expanded list offorms the RIC may be required to file.Form 976, Claim for DeficiencyDividends Deductions by a PersonalHolding Company, RegulatedInvestment Company, or Real EstateInvestment Trust. Use this form toclaim a deficiency dividend deductionunder section 860.Form 1096, Annual Summary andTransmittal of U.S. InformationReturns. Use Form 1096 to transmitForms 1099 and 5498 to the InternalRevenue Service.Form 1099-DIV, Dividends andDistributions. Report certain dividendsand distributions.Form 1099-INT, Interest Income.Report interest income.Form 2438, Undistributed CapitalGains Tax Return, must be filed by theRIC if it designates undistributed netlong-term capital gains under section852(b)(3)(D).Form 2439, Notice to Shareholder ofUndistributed Long-Term CapitalGains, must be completed and a copygiven to each shareholder for whomthe RIC paid tax on undistributed netlong-term capital gains under section852(b)(3)(D).Form 3520, Annual Return ToReport Transactions With ForeignTrusts and Receipt of Certain ForeignGifts, may be required if the RICreceived a distribution from, was agrantor of, or transferor to a foreigntrust during the tax year. SeeQuestion 5 of Schedule N (Form1120).Form 5471, Information Return ofU.S. Persons With Respect ToCertain Foreign Corporations. UseForm 5471 if the RIC is a U.S.shareholder of a controlled foreigncorporation, a specified foreigncor

The term "regulated investment company" applies to any domestic corporation that: Is registered throughout the tax year as a management company or unit investment trust under the Investment Company Act of 1940 (ICA), Has an election in effect under the ICA to be treated as a business development company, or Is a common trust .