Transcription

GUIDE FOR BASIC ACCOUNTING AND REPORTINGFOR UPWARD AND DOWNWARD ADJUSTMENTS TOPRIOR YEAR OBLIGATIONS(Effective Fiscal Year 2018)GENERAL LEDGER AND ADVISORY BRANCHFISCAL ACCOUNTING OPERATIONSBUREAU OF THE FISCAL SERVICEU.S. DEPARTMENT OF THE TREASURY

UPWARD AND DOWNWARD ADJUSTMENTS TO PRIOR YEAR OBLIGATIONSVersion NumberDateDescription of ChangeEffectiveUSSGL TFM1.02.0200509/01/2018Original VersionUpdated Transaction Codes, financial statements andappendicesNot in ArchivesBulletin 2017-162Final Upward and Downward Scenario 2018

UPWARD AND DOWNWARD ADJUSTMENTS TO PRIOR YEAR OBLIGATIONSOverviewThis guide is designed for those who: Prepare agency Financial and non-Financial statements; Audit the agency financial statements; Manage or provide service to participants in upward and downward adjustments Design and maintain computer systems for financial programs; Instruct others in basic accounting and reporting.In order to understand and gain the most from this guide, users must have a working knowledge of the following: Budgetary and proprietary accounting, reporting, and terminology; The United States Standard General Ledger (USSGL) accounts for basic multiyear and annual appropriations, revolving fund and Specialand Trust Funds The concepts of Federal credit program accounting and reporting, fund structures, and terminology.Scenario AssumptionsScenarios can vary depending on many variables. Below is clarifying guidance to assist in the identification of an upward or downwardadjustment.In general, the status of the appropriation (unexpired vs. expired) is not used as a basis for determining upward or downward adjustments. Thisscenario can be applied to annual, no year as well as multiple year appropriations. This scenario occurs as a two year multiyear appropriation.The basis for determining whether a transaction should be classified as an upward or downward adjustment depends on the specific event and thefiscal year of the adjustment. Upward and downward adjustments are based strictly on dollar value adjustments. An error or mistake does notconstitute an upward or downward adjustment. In addition, changes to the budget/accounting structure (i.e. object class, direct/reimbursableindicator, budget (cost) center, program, Federal/nonfederal indicator, vendor code, etc. [within a TAFS]) does not constitute an upward ordownward adjustment. Reference to OMB guidance Appendix F of OMB Circular No. A-11.Unexpired and Expired Phase TAS: Upward and downward adjustments occur in subsequent years (year two and later), year one and year two are unexpired. The upward ordownward adjustments are to be recorded in year two if the original transaction occurred in year one.3Final Upward and Downward Scenario 2018

UPWARD AND DOWNWARD ADJUSTMENTS TO PRIOR YEAR OBLIGATIONSRecovery of prior year Obligations: During the expired phase the upward and downward adjustments occur in subsequent years (year two and later) when year one wasunexpired and year two was expired whereby expired unobligated balances are available for upward adjustments of obligations (obligatedor paid).Unpaid: Upward and downward adjustments of prior year unpaid obligations occur in subsequent years (year two and later), even if year one andyear two are unexpired.Refunds of Prior Year Paid Obligations: Downward adjustments of prior year paid obligations should occur in subsequent years (year two and later). Original disbursementadjustments in year one (first year of disbursement) do not require a downward adjustment.Prior Year Budgetary entries: All budgetary accounts with the GTAS domain value is X where applicable unless otherwise specifiedThe Chart of Accounts and beginning trial balance will be the same for all years, and the outstanding orders differently illustrated for each TASYear. The scenario highlights events that occur during the second year of a two year appropriation as well as the third, fourth, and fifth year(expired) of the appropriation. The assumption is that funds have been apportioned and allotted through year five. Matching USSGL Section IIITransaction Codes are shown at the end of the description and/or in the Table for each entry. Where necessary, a new transaction Code isproposed and shown in italics. This scenario does not include entries for cancellations.Several blocks of Purchase Order numbers are used in the scenario. PO numbers falling in the range of 10 through 50 are used for PurchaseOrders that were outstanding at the beginning of the first year. Purchase Order numbers 101, 102, 103, and 104 are used for transactions thatoccurred in Year two of the two year appropriations. No new PO’s were incurred in Year two.4Final Upward and Downward Scenario 2018

UPWARD AND DOWNWARD ADJUSTMENTS TO PRIOR YEAR OBLIGATIONSCHART OF ACCOUNTSListing of USSGL Accounts Used in This ScenarioAccount NumberAccount TitleBudgetary420100Total Actual Resources – Collected431000Anticipated Recoveries of Prior-Year Obligations445000Unapportioned Authority459000Apportionments - Anticipated Resources - Programs Subject to Apportionment461000Allotments – Realized Resources465000Allotments – Expired Authority480100Undelivered Orders – Obligations, Unpaid480200Undelivered Orders - Obligations, Prepaid/Advance487100Downward Adjustments of Prior-Year Unpaid Undelivered Orders – Obligations, Recoveries487200488100Downward Adjustments of Prior-Year Prepaid/Advance Unexpended - Obligations, RefundsCollectedUpward Adjustments of Prior-Year Undelivered Orders - Obligations, Unpaid488200Upward Adjustments of Prior-Year Undelivered Orders - Obligations, Prepaid/Advanced490100Delivered Orders – Obligation, Unpaid490200Delivered Orders – Obligation, Paid497100Downward Adjustments of Prior-Year Unpaid Delivered Orders – Obligations, Recoveries497200Downward Adjustments of Prior-Year Paid Delivered Orders- Refunds Collected498100Upward Adjustments of Prior-Year Delivered Orders-Obligations, Unpaid498200Upward Adjustments of Prior-Year Delivered Orders-Obligations, Paid5Final Upward and Downward Scenario 2018

UPWARD AND DOWNWARD ADJUSTMENTS TO PRIOR YEAR OBLIGATIONSAccount NumberAccount TitleProprietary101000Fund Balance With Treasury131000Accounts Receivable141000Advances and Prepayments211000Accounts Payable310000Unexpended Appropriations – Cumulative310100Unexpended Appropriations – Appropriations Received310700Unexpended Appropriations – Used570000Expended Appropriations610000Operating Expenses/Program Costs679000Other Expenses not Requiring Budgetary Resources6Final Upward and Downward Scenario 2018

UPWARD AND DOWNWARD ADJUSTMENTS TO PRIOR YEAR OBLIGATIONSUSSGL TAS ScenarioTRIAL BALANCEBEGINNING OF SECOND YEAR AFTER INITIAL APPORTIONMENT AND ALLOTMENTTrial Balance Beginning After Initial Apportionment and Allotment(Second Year)AccountsBudgetaryDebit420100 Total Actual Resources-Collected34,500431000 Anticipated Recoveries of Prior-Year Obligations459000 Apportionments - Anticipated Resources - ProgramsSubject to Apportionment461000 AllotmentsCredit2,6802,6805,980480100 Undelivered Orders - Obligations , Unpaid21,800480200 Undelivered Orders – Obligations, Prepaid/Advanced2,220490100 Delivered Orders – Obligation, 101000 Fund Balance with Treasury32,280141000(F) Advances and Prepayments2,000141000(N) Advances and Prepayments220211000(F) Accounts Payable4,500310000 Unexpended Appropriations – CumulativeTOTAL30,00034,50034,5007Final Upward and Downward Scenario 2018

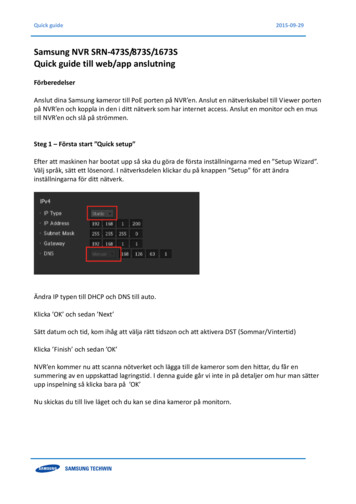

UPWARD AND DOWNWARD ADJUSTMENTS TO PRIOR YEAR OBLIGATIONS480100 Undelivered Orders – Obligations, UnpaidPO#10 7,000FedPO#15 600 NFedPO#20 5,000 NFedPO#25 1,200FedPO#30 8,000 NFed480200 Undelivered Orders - Obligations, PaidPO#40 2,000 FedPO#45 220 NFed490100 Delivered Orders – Obligation, UnpaidPO#50 4,500 FedUNPAID1. Due to a dollar value contract modification adjustment, PO#10 increases from 7,000 to 8,600. No goodsand services were delivered. Post an upward adjustment to Undelivered Orders – Obligations, UnpaidUSSGL Account 488100.Budgetary Entry461000 Allotments – Realized Resources488100 Upward Adjustments of Prior-Year Undelivered Orders – Obligations,UnpaidDRCRTC1,6001,600D114Proprietary EntryNone8Final Upward and Downward Scenario 2018

UPWARD AND DOWNWARD ADJUSTMENTS TO PRIOR YEAR OBLIGATIONS2.Goods and Services delivered for 9,000 against PO#10 for 8,600. Post an upward adjustment toUndelivered Orders – Obligations, Unpaid USSGL Account 488100.Budgetary Entry461000 Allotments – Realized ResourcesDRTC400488100 Upward Adjustments of Prior-Year Delivered Orders - Obligations,Unpaid480100 Undelivered Orders – Obligations, UnpaidCR400D1149,000B402490100 Delivered Orders – Obligation, Unpaid9,000Proprietary Entry610000(F) Operating Expenses/Program Costs9,000B402211000(F) Accounts Payable310700 Unexpended Appropriations – Used570000 Expended Appropriations9,0009,000B1349,0009Final Upward and Downward Scenario 2018

UPWARD AND DOWNWARD ADJUSTMENTS TO PRIOR YEAR OBLIGATIONS3.Goods and services delivered for 655 against PO#15 for 600. Post an upward adjustment to UndeliveredOrders - Obligations, Unpaid USSGL Account 498100.Budgetary Entry461000 Allotments – Realized ResourcesDRTC55D114488100 Upward Adjustments of Prior-Year Delivered Orders - Obligations, Unpaid480100 Undelivered Orders – Obligations, UnpaidCR55655B402490100 Delivered Orders – Obligation, Unpaid655Proprietary Entry610000(N) Operating Expenses/Program Costs655B402211000(N) Accounts Payable310700 Unexpended Appropriations – Used655655B134570000 Expended Appropriations6554a. Delivered a progress billing for 330 against PO#25 for 1,200.Budgetary Entry480100 Undelivered Orders – Obligations, UnpaidDRCRTC330B402490100 Delivered Orders – Obligation, Unpaid330Proprietary Entry610000(F) Operating Expenses/Program Costs330B402211000(F) Accounts Payable310700 Unexpended Appropriations - Used570000 Expended Appropriations330330330B13410Final Upward and Downward Scenario 2018

UPWARD AND DOWNWARD ADJUSTMENTS TO PRIOR YEAR OBLIGATIONS4b. The progress bill is for 30 more than originally anticipated for this portion of the order. No paymentmade at this time. Post an upward adjustment to Upward Adjustments of Prior-Year Undelivered Orders –Obligations, Unpaid USSGL Account 488100.Budgetary Entry461000 Allotments – Realized ResourcesDRCRTC30D114488100 Upward Adjustments of Prior-Year Undelivered Orders – Obligations, Unpaid305. Due to a dollar value contract modification adjustment, PO#20 is reduced from 5,000 to 4,700. No goodsor services delivered. Post a downward adjustment to Downward Adjustments of Prior-Year UnpaidUndelivered Orders – Obligations, Recoveries USSGL Account 487100.Budgetary Entry487100 Downward Adjustments of Prior-Year Unpaid Undelivered Orders –Obligations, RecoveriesDR461000 Allotments – Realized ResourcesTCD134300431000 Anticipated Recoveries of Prior-Year Obligations459000 Apportionments - Anticipated Resources - Programs Subject to ApportionmentCR300300A122300Proprietary EntryNone11Final Upward and Downward Scenario 2018

UPWARD AND DOWNWARD ADJUSTMENTS TO PRIOR YEAR OBLIGATIONS6. Goods, services delivered for 2,700 against PO#20 for 4,700. Post a downward adjustment to DownwardAdjustments of Prior Prior-Year Unpaid Undelivered Orders – Obligations, Recoveries USSGL Account487100.Budgetary Entry487100 Downward Adjustments of Prior-Year Unpaid Undelivered Orders –Obligations, Recoveries431000 Anticipated Recoveries of Prior-Year Obligations459000 Apportionments - Anticipated Resources - Programs Subject to ApportionmentDRTCD1342,0002,0002,000A122461000 Allotments – Realized Resources480100 Undelivered Orders – Obligations, UnpaidCR2,0002,700490100 Delivered Orders – Obligation, UnpaidB4022,700Proprietary Entry610000(N) Operating Expenses/Program Costs2,700211000(N) Accounts Payable310700 Unexpended Appropriations -Used2,700B1342,700570000 Expended Appropriations2,7007. Due to a dollar value contract modification adjustment, a previously unrecorded obligation of 4,000 PO#101 is discovered. No goods, services or invoice delivered. The obligation is properly chargeable tothe prior year.Budgetary Entry461000 Allotments – Realized Resources480100 Undelivered Orders – Obligations, UnpaidProprietary EntryDRCR4,000TCB3064,000None12Final Upward and Downward Scenario 2018

UPWARD AND DOWNWARD ADJUSTMENTS TO PRIOR YEAR OBLIGATIONS8. Goods and services of 4,000 are delivered for PO#101.Note: This transactions represents an adjustment to a current year Unpaid obligation.Budgetary Entry480100 Undelivered Orders – Obligations, UnpaidDRCRTC4,000490100 Delivered Orders – Obligation, Unpaid4,000Proprietary Entry610000(F) Operating Expenses/Program Costs211000(F) Accounts Payable310700 Unexpended Appropriations - UsedB402B1344,0004,0004,000570000 Expended Appropriations4,0009. An error was discovered recording PO#101 in Year 2. Purchase Order should have been recorded on line 2versus Line 1 of contract. Additionally, the budget (cost) center and object class were incorrect in thebudget/accounting structure. Based on the error no dollar value contract value changed. Therefore, thisdoes not constitute a dollar value contract modification adjustment justifying an upward or downwardadjustment of a prior year obligation.Budgetary EntryDRCRTCNoneProprietary EntryNone13Final Upward and Downward Scenario 2018

UPWARD AND DOWNWARD ADJUSTMENTS TO PRIOR YEAR OBLIGATIONSPAID10. Goods and services of 4,000 are paid for PO#101. Payment of a previously recorded unpaid obligation isnot an adjustment.Budgetary Entry490100 Delivered Orders – Obligation, UnpaidDRCRTC4,000B110490200 Delivered Orders – Obligation, Paid4,000Proprietary Entry211000(F) Accounts Payable4,000101000 Fund Balance with Treasury4,00011. Due to a dollar value contract modification adjustment, PO#30 decreased by 80 in Year 2. No goods andservices are delivered. Post Downward Adjustments of Prior-Year Unpaid Undelivered OrdersObligations, Recoveries.Budgetary Entry487100 Downward Adjustments of Prior-Year Unpaid Undelivered OrdersObligations, RecoveriesDR80431000 Anticipated Recoveries of Prior-Year Obligations459000 Apportionments - Anticipated Resources - Programs Subject to ApportionmentCRTCD1348080A122461000 Allotments – Realized Resources80Proprietary EntryNone.14Final Upward and Downward Scenario 2018

UPWARD AND DOWNWARD ADJUSTMENTS TO PRIOR YEAR OBLIGATIONS12. The 80 dollar value contract modification adjustment was determined to be incorrect in Year 2 andshould have only been a 50 decrease to PO#30. No goods and services have been delivered. Post areversal of the Downward Adjustments of Prior-Year Unpaid Undelivered Orders- Obligations, Recoveries(previously recorded in transaction 11, in Year 2).Note: Even though there is a possibility of an abnormal balance in Year 2 with USSGL 487100, thedocumentation supporting the adjustment is the contract modification to Year 2, in this situation theGTAS prior year adjustment domain value is “P’.Budgetary Entry461000 Allotments – Realized Resources487100 Downward Adjustments of Prior-Year Unpaid Undelivered OrdersObligations, RecoveriesDRCR30TCD120R30Proprietary EntryNone.15Final Upward and Downward Scenario 2018

UPWARD AND DOWNWARD ADJUSTMENTS TO PRIOR YEAR OBLIGATIONSPRE-CLOSING ENTRIES SECOND YEARPC1. Close Anticipated Recoveries of Prior Year ObligationsBudgetary EntryDR459000 Apportionments - Anticipated Resources - Programs Subject to Apportionment300431000 Anticipated Recoveries of Prior-Year ObligationsCRTCF112300Proprietary EntryNone16Final Upward and Downward Scenario 2018

UPWARD AND DOWNWARD ADJUSTMENTS TO PRIOR YEAR OBLIGATIONSPre closing Adjusted Trial Balances (Second Year)AccountsBudgetaryDebit420100 Total Actual Resources-Collected34,500Credit461000 Allotments – Realized Resources2,245480100 Undelivered Orders Obligations, Unpaid9,115480200 Undelivered Orders – Obligations, Prepaid/Advanced487100 Downward Adjustments of Prior-Year Unpaid Undelivered Orders- Obligations,Recoveries488100 Upward Adjustments of Prior-Year Undelivered Orders – Obligations, Unpaid2,2202,3502,085490100 Delivered Orders – Obligation, Unpaid17,185490200 Delivered Orders – Obligation, 1000 Fund Balance with Treasury28,280141000(F) Advances and Prepayments2,000141000(N) Advances and Prepayments220211000(N) Accounts Payable3,355211000(F) Accounts Payable13,830310000 Unexpended Appropriations – Cumulative30,000310700 Unexpended Appropriations16,685570000 Expended Appropriations16,685610000(F) Operating Expenses/Program Costs13,330610000(N) Operating Expenses/Program Costs3,355TOTAL63,87063,87017Final Upward and Downward Scenario 2018

UPWARD AND DOWNWARD ADJUSTMENTS TO PRIOR YEAR OBLIGATIONSBALANCE SHEETLine No.1.5.6.Assets:IntragovernmentalFund Balance with Treasury (101000E)Other (141000(F))Total intragovernmental28,2802,00030,28014.15.Other (141000(N))Total Accounts Payable (211000(F))Total Intragovernmental13,83013,830Accounts payable (210000(N))Total liabilities3,35517,18531.33.35.37.Net Position:Unexpended Appropriations-All Other FundsCumulative results of operations-All Other Funds (570000E, 610000E)Total Net Position – All Other FundsTotal liabilities and net position13,31513,31530,500Line No.1.2.3.5.8.Gross Program CostsGross costs (610000E)Less: earned revenueNet program costsNet Program Costs including Assumption ChangesNet cost of operations21.STATEMENT OF NET COST16,68516,68516,68516,68518Final Upward and Downward Scenario 2018

UPWARD AND DOWNWARD ADJUSTMENTS TO PRIOR YEAR OBLIGATIONSSTATEMENT OF CHANGES IN NET POSITIONLine No.5.Cumulative Results from Operations:Budgetary Financing Sources:Appropriations used (570000E)16,68514.Total Financing Sources (calc.)16,68515.Net Cost of Operations ( /-)16.Net Change (calc.)-17.Cumulative Results of Operations (calc.)-(16,685)Unexpended Appropriations:18.Beginning Balance (310000E)30,00020.Beginning balance, as adjusted30,000Budgetary Financing Sources:24.Appropriations used (310700E)(16,685)25.Total Budgetary Financing Sources (calc.)(16,685)26.Total Unexpended Appropriations (calc.)13,31527.Net Position (calc.)13,31519Final Upward and Downward Scenario 2018

UPWARD AND DOWNWARD ADJUSTMENTS TO PRIOR YEAR OBLIGATIONSSTATEMENT OF BUDGETARY RESOURCESLine No.100010201020.5102110511910Budgetary resourcesUnobligated balance brought forward, Oct 1 (420100B, 480100B, 480200B,490100B)Adjustment to unobligated balance brought forward, Oct 1 (487100E)Unobligated balance brought forward, Oct 1, as adjusted (calc.)Recoveries of Prior Year Unpaid Obligations (487100E)Unobligated balance from prior year budget authority, netThis line is calculated. Equals sum of SBR lines 1000, 1020, 1021, and 1043Total budgetary resources (calc.)5,98005,9802,3508,3308,330Status of budgetary resourcesUnobligated balance, end of year:2190New obligations and upward adjustments (total) (Note 31) (480100E – 480100B,480200E – 480200B, 488100E, 490100E – 490100B, 490200E)Unobligated balance, end of year:6,0852204Apportioned: unexpired account (461000E)2,2452412Unexpired unobligated balance, end of yearThis line is calculated. Equals sum of SBR lines 2204, 2304, and 2404Unobligated balance, end of year (total)Total budgetary resources (calc.)2,2452,245249025008,330Change in obligated balanceUnpaid obligations:3000Unpaid obligations, brought forward Oct 1 (480100B, 490100B)30123020New obligations and upward adjustments (480100E – 480100B, 480200E – 480200B,488100E, 490100E – 490100B, 490200E)Outlays gross (-) (480200E - 480200B, 490200E)30423050Recoveries of prior year unpaid obligations (487100E)Unpaid obligations, end of year (480100E, 487100E, 488100E, 490100E)18,3006,085(4,000)(2,350)18,03520Final Upward and Downward Scenario 2018

UPWARD AND DOWNWARD ADJUSTMENTS TO PRIOR YEAR OBLIGATIONSSTATEMENT OF BUDGETARY RESOURCESMemorandum add entries:31003200Obligated balance, start of year ( or -) (calc.)Obligated balance, end of year ( or -) (calc.)18,30018,035Budget Authority and Outlays, Net4185Outlays, gross (discretionary and mandatory) (480200E – 480200B, 490200E)4190Outlays, net (total) (discretionary and mandatory) (calc.)4,0004,000SF 133 AND SCHEDULE P- REPORT ON BUDGET EXECUTION AND BUDGETARYRESOURCES & BUDGET PROGRAM AND FINANCING SCHEDULESF 133Schedule PLine No.OBLIGATIONS BY PROGRAM ACTIVITY0900Total new Obligations, unexpired accounts6,085BUDGETARY RESOURCES1020Unobligated balance:Unobligated balance brought forward, Oct 1 (420100B, 480100B, 480200B,490100B)Adjustment to unobligated balance brought forward, Oct 1 (487100E)1021Recoveries of prior year unpaid obligations1050Unobligated balance (total)1910Total budgetary resources (calc.)8,3301930Total budgetary resources available Final Upward and Downward Scenario 2018

UPWARD AND DOWNWARD ADJUSTMENTS TO PRIOR YEAR OBLIGATIONSSF 133 AND SCHEDULE P- REPORT ON BUDGET EXECUTION AND BUDGETARYRESOURCES & BUDGET PROGRAM AND FINANCING SCHEDULESF 133Schedule PMemorandum (non-add) entries:1940Unobligated balance expiring (-) (461000E)(2,245)STATUS OF BUDGETARY RESOURCESNew obligations and upward adjustments:Direct20016,0852004Category A (by Quarter) (480100E- 480100B, 480200E – 480200E, 488100E,490100E-490100B, 490200E)Direct obligations (total) (calc)2170New obligations, unexpired accounts6,0852190New obligations and upward adjustments (total) (calc.)6,0852201Allotments – Realized Resources2412Unexpired unobligated balance: end of year (total) (calc.)2,2452500Total budgetary resources (calc.)8,3306,0852,245Memorandum (non-add) entries:2501Subject to apportionment – excluding anticipated amounts (465000E, 480100E –480100B, 480200E – 480200B, 488100E, 490100E – 490100B, 490200E)CHANGE IN OBLIGATED BALANCE6,085Unpaid obligations:3000Unpaid obligations brought forward, Oct 1( 480100B, 490100B)3010New obligations, unexpired accounts3020Outlays (gross) (-) (480200E – 480200B, 490200E)3040Recoveries of prior year unpaid obligations, unexpired accounts (-)3050Unpaid obligations, end of year (480100E, 487100E, 488100E, 490100E)3100Obligated balance, start of year ( or -) (calc.)18,3003200Obligated balance, end of year ( or -) (2,350)18,03518,03518,03518,03522Final Upward and Downward Scenario 2018

UPWARD AND DOWNWARD ADJUSTMENTS TO PRIOR YEAR OBLIGATIONSSF 133 AND SCHEDULE P- REPORT ON BUDGET EXECUTION AND BUDGETARYRESOURCES & BUDGET PROGRAM AND FINANCING SCHEDULESF 133Schedule PBUDGET AUTHORITY AND OUTLAYS, NETDiscretionary:Outlays, gross4011Outlays from discretionary balances (480200E – 480200B, 490200E)4020Outlays, gross total (calc.)40804190Outlays, net (discretionary) (calc.)Outlays, net (total) SING ENTRIES FOR SECOND YEARUNPAIDC1. To record the closing of upward adjustments and transfers to undelivered orders – obligations, unpaid.Budgetary Entry488100 Upward Adjustments of Prior-Year Undelivered Orders – Obligations, UnpaidDRCRTC2,085F330480100 Undelivered Orders - Obligations, UnpaidProprietary Entry2,085None23Final Upward and Downward Scenario 2018

UPWARD AND DOWNWARD ADJUSTMENTS TO PRIOR YEAR OBLIGATIONSC2. To record the closing of downward adjustments and transfers to undelivered orders – obligations, unpaid.Budgetary Entry48010 Delivered Orders - Obligations, Unpaid487100 Downward Adjustments of Prior-Year Unpaid Undelivered Orders –Obligations, 3. To record the closing of expended authority – paid.Budgetary Entry490200 Delivered Orders – Obligation, Paid420100 Total Actual Resources – CollectedProprietary EntryDRCRTC4,000F3144,000None24Final Upward and Downward Scenario 2018

UPWARD AND DOWNWARD ADJUSTMENTS TO PRIOR YEAR OBLIGATIONSC4. To record the closing of revenue, expense and other financing source accounts to cumulative results ofoperations.Budgetary EntryDRCRTCNoneProprietary Entry331000 Cumulative Results of Operations16,685610000(F) Operating Expenses/Program Costs13,330610000(N) Operating Expenses/Program Costs570000 Expended Appropriations3,355F33616,685331000 Cumulative Results of Operations16,685C5. To record closing of fiscal-year activity to unexpended appropriations.Budgetary EntryDRCRTC16,685F342CRTCNoneProprietary Entry310000 Unexpended Appropriation – Cumulative16,685310700 Unexpended Appropriations - UsedC6. To record the closing of unobligated balances to expiring authority.Budgetary Entry461000 Allotments – Realized Resources465000 Allotments – Expired AuthorityProprietary EntryDR2,2452,245F312None25Final Upward and Downward Scenario 2018

UPWARD AND DOWNWARD ADJUSTMENTS TO PRIOR YEAR OBLIGATIONSPost-Closing Trial Balance End (Second Year)AccountsBudgetaryDebit420100 Total Actual Resources-Collected30,500Credit465000 Allotments – Expired Authority2,245480100 Undelivered Orders - Obligations, Unpaid8,850480200 Unexpended Obligations – Prepaid/Advance2,220490100 Expended Authority – t101000 Fund Balance with Treasury28,280141000(F) Advances and Prepayments2,000141000(N) Advances and Prepayments220211000(N) Accounts Payable3,355211000(F) Accounts Payable13,830310000 Unexpended Appropriation – Cumulative13,315TOTAL30,50030,50026Final Upward and Downward Scenario 2018

UPWARD AND DOWNWARD ADJUSTMENTS TO PRIOR YEAR OBLIGATIONS480100 Undelivered Orders-Obligations, UnpaidPO#25 900 FedPO#30 7,950 NFed480200 Undelivered Orders - Obligations, Prepaid/AdvancedPO#40 2,000 FedPO#45 220 NFed490100 Delivered Orders – Obligations, UnpaidPO#10 9,000 FedPO#15 655 NFedPO#20 2,700 NFedPO#25 330 FedPO#50 4,500 Fed27Final Upward and Downward Scenario 2018

UPWARD AND DOWNWARD ADJUSTMENTS TO PRIOR YEAR OBLIGATIONSTHIRD YEAR13. Advanced payment processed for outstanding PO#30 for 7,950Budgetary Entry480100 Undelivered Orders-Obligations, UnpaidDRCR7,950480200 Undelivered Orders-Obligations, Prepaid/Advanced7,950Proprietary Entry141000(N) Accounts PayableTCB3087,950101000 Fund Balance with Treasury7,95014. Payment processed for outstanding PO#10 for 9,000 and PO#20 for 2,700. Payment of an outstandingobligation in an expired year is not an adjustment.Budgetary Entry490100 Delivered Orders-Obligations, UnpaidDRCR11,700490200 Delivered Orders-Obligations, Paid11,700Proprietary EntryB110211000(F) Accounts Payable9,000211000(N) Accounts Payable2,700101000 Fund Balance with TreasuryTC11,70028Final Upward and Downward Scenario 2018

UPWARD AND DOWNWARD ADJUSTMENTS TO PRIOR YEAR OBLIGATIONS15. Received dollar value contract modification adjustment for goods and services of a 700 increase to PO#40(Fed). The goods and services were paid in advance. Post an upward adjustment to Upward Adjustments ofPrior-Year Undelivered Orders-Obligations, Prepaid/Advanced– USSGL Account 488200. This transaction isa valid adjustment an existing unpaid obligation recorded during the unexpired phase.Budgetary EntryDR465000 Allotments – Expired Authority488200 Upward Adjustments of Prior-Year Undelivered prietary Entry141000(F) Advances and PrepaymentsTC700700101000 Fund Balance with Treasury16. Received dollar value contract modification adjustment for a 40 increase on PO#45. Invoice NOT paid. Nogoods and services delivered. Post an upward adjustment to Upward Adjustments of Prior-Year UndeliveredOrders -– Obligations, Unpaid USSGL Account 488100. This transaction is a valid adjustment an existingunpaid obligation recorded during the unexpired phase.Budgetary Entry465000 Allotments – Expired Authority488100 Upward Adjustments of Prior-Year Undelivered Orders – Obligations, UnpaidDRCRTC4040D114Proprietary EntryNone29Final Upward and Downward Scenario 2018

UPWARD AND DOWNWARD ADJUSTMENTS TO PRIOR YEAR OBLIGATIONS17. Prepaid PO#30 (Non Fed) for 7,950 is reduced to 6,800 and the refund is collected. No goods and servicesare delivered. Post a downward adjustment to Downward Adjustments of Prior-Year Prepaid/AdvancedUndelivered Orders -Obligations Refund Collected USSGL Account 487200.Budgetary Entry487200 Downward Adjustments of Prior-Year Prepaid/Advanced Undelivered Orders Obligations Refund Collected465000 Allotments – Expired AuthorityDRCRTC1,1501,150C130Proprietary Entry101000 Fund Balance with Treasury1,150141000(N) Advances and Prepayments1,15018. Prepaid PO#40 (Fed) for 2,700 (after transaction #11) is reduced to 2,410. Do not collect refund. Reclassifyadvance to receivable. No goods or services delivered.Budgetary EntryFor this example, the USSGL does not endorse recording a budgetary resource forFederal refunds receivable.Proprietary EntryDR131000(F) Accounts Receivable290141000 (F) Advances and PrepaymentsCRTCD13029030Final Upward and Downward Scenario 2018

UPWARD AND DOWNWARD ADJUSTMENTS TO PRIOR YEAR OBLIGATIONS19. Prepaid PO#30 for 6,800 will be reduced to 4,950. Do not collect refund. Reclassify advance to areceivable. No goods or services delivered. A budgetary resource cannot be recorded because PO#30 is witha non-Federal entity.Budgetary EntryFor this example, the USSGL does not endorse recording a budgetary resource for nonFederal refunds receivable.Proprietary Entry131000(N) Accounts ReceivableDRCRTCD1301,850141000(N) Advances and Prepayments1,85020. Partial portion of goods and services delivered for 3,200 against PO#30. PO is not complete.Budgetary EntryDR480200 Undelivered Orders- Obligations, Prepaid/AdvancedCR3,200490200 Delivered Orders-Obligations, Paid3,200Proprietary Entry610000(N) Operating Expenses/Program Costs141000(N)570000 Expended AppropriationsB604B1343,200Advances and Prepayments310700 Unexpended Appropriations – UsedTC3,2003,2003,20031Final Upward and Do

211000(N) Accounts Payable : 2,700 310700 Unexpended Appropriations -Used . 2,700 570000 Expended Appropriations : 2,700 . 7. Due to a dollar value contract modification adjustment, a previously unrecorded obligation of 4,000 - PO#101 is discovered. No goods, services or invoice delivered. The obligation is properly chargeable to