Transcription

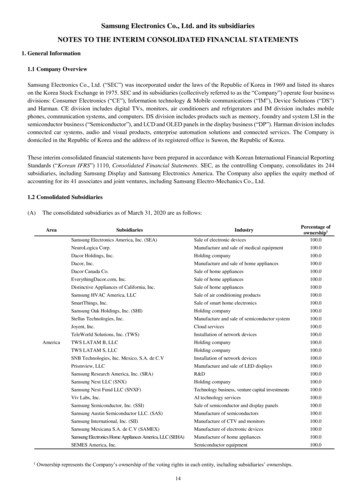

DIRECTORS’ REPORTV. SUBSIDIARIES1. SBI CAPITAL MARKETS LIMITED (SBICAP)( crore)Name of the subsidiary companyOwnership(SBI Interest)% ofOwnershipNet Profit(Losses) for FY202058.03100%215.42SBI CAPITAL MARKETS LTD.SBICAP SECURITIES LIMITED (SSL)NOT APPLICABLE84.94SBICAP VENTURES LIMITED (SVL)11.01SBICAP (UK) LIMITED (SUL)(2.57)SBICAP (SINGAPORE) LIMITED (SSGL)0.46SBICAP TRUSTEE CO. LIMITED (STCL)20.51SBICAPs is India’s leading investmentbanker, offering a bouquet of investmentbanking and corporate advisory servicesto diversified clients across three productgroups - Project Advisory and StructuredFinance, Equity Capital Markets and DebtCapital Markets. These services includeProject Advisory, Loan Syndication,Structured Debt Placement, Mergers andAcquisitions, Private Equity, RestructuringAdvisory, Stressed Assets Resolution,IPO, FPO, Rights Issues, Debt, HybridCapital raising, Inv IT advisory, REITadvisory and COC advisory (Committeeof Creditors). On a standalone basis,SBICAPs posted a PBT of 275.56 croreduring FY 20 as against 242.60 croreduring FY19 and a PAT of 215.42 crore forFY 20 as against R.168.19 crore in FY19.On a consolidated basis it has posted aprofit of 334.04 crore as against 236.38crore in the previous year.A. SBICAP SECURITIESLIMITED (SSL)SSL, a wholly owned subsidiary of SBICapital Markets Limited, besides offeringequity broking services to retail andinstitutional clients both in cash as well asin Futures and Options segments, is alsoengaged in sales and distribution of otherfinancial products such as Mutual Funds,Tax Free Bonds, Home Loan, Auto Loan,amongst others.SSL has over 100 branches and offersDemat, e-broking, e-IPO, and e-MFservices to both retail and institutionalclients. SSL currently has over 20 lakhclients. The Company has booked grossrevenue of 495.95 crore during FY 20 asagainst 404.52 crore in FY 19.B. SBICAP VENTURESLIMITED (SVL)SVL is a wholly owned subsidiary of SBICapital Markets Limited. SVL is acting asthe Asset Management Company. SVL ispresently actively managing three funds– Neev Fund, SWAMIH Investment Fund Iand SVL-SME fund.NEEV FUNDNeev Fund, an AIF Cat I InfrastructureFund had its final close on 31st March2019 and is now fully invested with itscapital of 430.23 crores deployed over10 portfolio companies.SWAMIH INVESTMENTFUND IOn September 14, 2019, the HonourableFinance Minister announced the settingup of a special window to provide last milefinance to complete stalled affordable /mid-income housing projects. SBICAPVentures as the Investment Manager tothe first AIF set-up under this windowcompleted the registration of the SWAMIHInvestment Fund I (“Fund”) as a categoryII AIF under SEBI regulations.The AIF has a target size of INR 12,500crore with a green shoe option of INR12,500 crore. The Fund has achieved itsfirst closing on 6th Dec, 2019 at 10,037.50crores with Government of India, SBI,LIC, HDFC Ltd and all major public sectorbanks as investors in the Fund. SWAMIHfund team has already held a series ofmeeting across the major cities to meetdevelopers and provide information onthe Fund.SME FUNDSME fund was also launched on 19-112018, legal & tax advisors and trusteefor SME fund have been appointed,and it is in process of draftingInvestment Management Agreementand Contribution Agreement. The trustis registered and SEBI registration forthe fund was received on 25-Sep-2019.The company is in process of meetingpotential investors for investing inSME fund.C. SBICAP (UK)LIMITED (SUL)SUL, a wholly owned subsidiary of SBICapital Markets Limited, is a relationshipoutfit for SBI Capital Markets Limited inUK and Europe. It has built relationshipswith FIIs, Financial Institutions, Law Firms,Accounting Firms, amongst others, tomarket the business products of SBICAP.SBI London has also requisite regulatoryapproval to carry out the activities carriedout by SUL. To improve the operationalefficiency and minimize the cost, it hasbeen decided to wind up SUL and carryout the business handled by SUL throughSBI London.D. SBICAP (SINGAPORE)LIMITED (SSGL)SSGL, is a wholly owned subsidiaryof SBI Capital Markets Limited. Itcommenced business in December2012. It has built relationships withFIIs, Financial Institutions, Law Firms,Accounting Firms, amongst others, tomarket the business products of SBICAP.It is specialized in marketing of ForeignCurrency Bonds and securing clients forSBICAP SEC. Annual Report 2019-2091

DIRECTORS’ REPORTE. SBICAP TRUSTEE CO.LIMITED (STCL)SBICAP Trustee Co Limited (STCL), is awholly owned subsidiary of SBI CapitalMarkets Limited. STCL commencedsecurity trustee business with effect from1st August 2008. STCL posted Net Profitof 20.51 Crores during FY 20 as against 14.90 Crores in FY 19. STCL plays anactive role in providing Security TrusteeServices to High Value lending to InfraProjects, Large and Medium Corporatesand is the No.1 Security Trustee in theindustry. They also have significantpresence as Debenture Trustee in theDebenture/Bond market.STCL have launched the Virtual DataRoom (VDR) platform which will helpin disseminating information by ARCsand Lenders to prospective buyers ofStressed Assets.2. SBI DFHI LIMITED (SBI DFHI)( crore)Name of the subsidiary companySBI DFHI LimitedSBI DFHI Limited is one of the largeststandalone Primary Dealers (PD) with apan India presence. As a Primary Dealer(PD) it is mandated to support the bookbuilding process in primary auctions andprovide depth and liquidity to secondarymarkets in G-Sec. Besides GovernmentOwnership(SBI Interest)% ofOwnershipNet Profit(Losses) for FY2020131.5269.04% 176.34securities, it also deals in money marketinstruments, non G-Sec debt instruments,amongst others. As a PD, its businessactivities are regulated by RBI.State Bank of India group holds 72.17%(SBI - 69.04% & SBI Capital Market Ltd-3.13%) share in the Company, whichposted a Net Profit of 176.34 crore as on31st March 2020 as against 76.85 croreas on 31st March 2019. Total balancesheet size was 11,383.36 crore as on 31stMarch 2020 as against 7,357.25 crore ason 31st March 2019.3. SBI CARDS & PAYMENT SERVICES LTD (SBICPSL) (FORMERLY SBI CARDS &PAYMENT SERVICES PVT LTD( crore)Name of the subsidiary companySBI Cards and Payment Services LimitedOwnership(SBI Interest)% ofOwnershipPATFY2020652.6369.51%1,245(EX COVID 1,662)Note: Ex COVID: After excluding COVID impacts of 489 Cr towards additional credit provisions and 90 Cr towards late fee reversals in Q4 FY20 and adjusted for taxSBI Cards and Payment Services Limited(SBICPSL) is a subsidiary of State Bankof India wherein State Bank of India holds69.51% stake. SBI Cards and PaymentServices Limited (formerly known as SBICards and Payment Services PrivateLimited) (“SBI Card”) is a non-bankingfinancial company that offer extensivecredit card portfolio to individualcardholders and corporate clientswhich includes lifestyle, rewards, travel& fuel and banking partnerships cardsalong with corporate cards covering allmajor cardholders’ segments in termsof income profile and lifestyle. It hasdiversified customer acquisition networkthat enables to engage prospectivecustomers across multiple channels. SBICard is a technology driven company.Furthermore, the IPO of SBI Cards, led tosignificant value discovery and is a strongindication of the Bank’s ability to incubate92 Annual Report 2019-20

DIRECTORS’ REPORTand nurture future industry leaders with astrong potential for value creation in thetimes ahead. During the quarter endedMarch 31 , 2020, the Company had comeup with an Initial Public Offering (IPO) of137,149,314 Equity Shares of face valueof 10 each comprising of a Fresh Issueof 6,622,516 Equity Shares and an Offerfor Sale of 130,526,798 Equity Sharesaggregating to 1,034,078.82 lakhs(Selling Shareholders 984,146.35 lakhsand 49,932.47 lakhs of the Company).The equity shares of the Company werelisted on Bombay Stock ExchangeLimited and National Stock Exchange ofIndia Limited on March 16, 2020.The company delivered Profit afterTax (PAT) of 1,245 Crore in FY20 ascompared to 865 crore in FY19 at YoYgrowth of 44%. (Ex COVID PAT 1,662Cr in FY20 at YoY growth of 92%).Performance Highlights (FY20)zPAT grew by 44% to 1,245 Crore (ExCOVID 1,662 Crore; up 92%).zROAA up by 64bps at 5.5% (ExCOVID at 7.2%)zROAE at 27.4% (FY19: 28.4%; FY20Ex COVID at 35.0%)zCapital Adequacy Ratio (CAR) at22.4% (FY19: 20.1%); Tier 1 at 17.7%(FY19: 14.9%)Key MetricszCards grew by 28% to 1.05 Cr,Spends grew by 27% to 130,915Crore, Receivables grew by 30% to 24,141 CrorezMarket share - Cards at 18.2%, up68bps; Spends at 17.9%, up 77bps(Till Jan’20)zCost to Income ratio improved by388bps to 56.6%zGNPA improves by 43bps to 2.01%Significant Awards received me&SanctionsCompliance award at the Global‘ComplianceRegisterPlatinumAwards 2019’ at London.zGolden Bridge Awards in thecategories of customer servicedepartment of year in 2019 at SanFranciscozzStevie (Gold Award) for customerservice executive of year in 2019and Stevie (Silver Award) for thecustomer service department ofthe year in 2019 by the InternationalBusiness Awards at ViennaChampion Security Award for theSouth Asia region at Visa SecuritySummit 2019 held in Shanghai China.4. SBI LIFE INSURANCECOMPANY LIMITED(SBILIFE)year ended March 31, 2020 with numerouno position in Individual New BusinessPremium among private insurers.Individual business has always been apart of core strategy of the Company.The company witnessed a 17% growthin Individual New Business Premium(NBP) vis-à-vis the industry growth of4%. The market share of SBI Life RetailNew Business Premium (NBP) amongall private players as on 31st March 2020is 22.4%. Total New Business of theCompany for the year ended FY2020stands at 16,592 crore; growth of 20%.( crore)Name of the subsidiary companySBI Life Insurance Company Ltd.SBI Life Insurance Co. Ltd. is one of theleading listed Life Insurance Company inIndia. Established in 2001, the Companyoffers a wide range of individual andgroup insurance solutions that meetvarious life stage needs of customers.TheproductsincludeSavings,Protection, Pension, Health, etc. As onMarch 31, 2020 the promoters viz. StateBank of India and BNP Paribas Cardifholds 57.6% and 5.2% of the equity sharecapital respectively. The equity shares ofthe Company are listed on National StockExchange of India Limited (‘NSE’) andBombay Stock Exchange Limited (‘BSE’).SBI Life has a multi-channel distributionnetwork comprising an expansivebancassurance channel, including StateBank, the largest bancassurance partnerin India, a large and productive individualagent network comprising 130,418agents as of March 31, 2020, as well asother distribution channels includingdirect sales and sales through corporateagents, brokers, insurance marketingfirms and other intermediaries.Ownership(SBI Interest)% ofOwnershipNet Profit(Losses)FY2020575.9957.601,422The Company continues to maintainthe leadership position amongst privateplayers in number of policies issued,which reflects mass coverage and strongmarket acceptance across geographiesamongst life insurer. During the year, total15,51,862 individual new policies wereissued and registered growth of 2%.SBI Life witnessed a PAT of 1,422crore in FY2020 against 1,327 crore inFY2019, growth of 7%. Largest AssetUnder Management amongst private lifeinsurers. AUM of the Company recordeda growth of 14% at 1,60,363 crore as on31st March 2020 as compared to 1,41,024crore as on 31st March 2019. Operatingreturn on embedded value of 20.5% as on31st March 2020, one of the best amongstthe peers.Leveraging wider reach achieved throughits network of 937 offices, SBI Life hassystematically brought large rural areasunder insurance reach.During the year ended March 31, 2020,the Company operated in sound andstable manner, with its sole objectiveof increasing insurance penetrationand concentrating on individual regularbusiness through an active and prudentstrategy, sales team maintaining thequality as well as quantity and establisheda firmer market position. The Companyhas proven its market leadership in the Annual Report 2019-2093

DIRECTORS’ REPORTAwards and recognitionsduring the year include:1.2.received3.‘Best Life Insurance Company’Award at ICC Emerging AsiaInsurance Conclave & Awards 2019.Won a “SMART Life InsuranceAward” in large category at ETInsurance Summit 20194.Won a Gold shield for “Excellencein Financial Reporting” at the ICAIAwards 2019Won Gold award - Life InsuranceProvider of the Year 2019 (PrivateSector) at Outlook Money Conclaveand Awards 20195.Received the Company PerformanceAward, 2019 under the category‘India’s Leading Life InsuranceCompany - Private’ at the BFSISummit & Awards by Dun &Bradstreet5. SBI FUNDS MANAGEMENT PRIVATE LIMITED (SBIFMPL)( Crore)Name of the subsidiary companySBI Funds Management Pvt. Ltd.SBI Mutual Fund Trustee Company Pvt. Ltd.SBI Funds Management (International) Pvt. Ltd.SBIFMPL is a Joint Venture between SBIand AMUNDI (France), one of the world’sleading fund management companies.The Asset Management Company ofSBIFMPL, is amongst the fastest growingAMCs with a growth of over 31.5%against the industry average of 10.4% in2019-20. In the last three years, SBIFMPLhas achieved a CAGR of 33.4% againstthe industry average of around 13.9%.As on quarter ended 31st March the fundhouse became the largest Mutual Fundmanager in India with Quarterly AverageAsset Under Management (QAAUM)of 3,73,537 crores moving up with 2Ownership (SBI Interest)% ofOwnershipNet Profit(Losses) FY202031.500.10100% by SBI FundsManagement Private Limited63%100%63%603.451.952.41ranks in the financial year. Over all assetsmanaged and advised by SBIFMPL was 10,33,663 crores as on 31st March 2020.SBIFMPL has one of largest investorbase of around 109 lakh investors with13 Lac new customers added during theyear. The Company has 14.5 Lakh directinvestors and over 2.5 Lakh institutionalinvestors including 1236 retirement funds.SBIFMPL is the Largest ETF manager inthe country.SBIFMPL posted a PAT of 603.45 croresduring the period ended March 2020 asagainst 427.54 crores earned duringthe year ended March 2019 under IndianAccounting Standard (Ind AS). The average“Assets Under Management” (AUM) of theCompany during the quarter ended March2020 were 3,73,537 crores with a marketshare of 13.82% as against the averageassets under management of 2,83,807crores with a market share of 11.59%during the quarter ended March, 2019.The Company has a fully owned foreignsubsidiary viz. SBI Funds Management(International) Private Limited, which isbased at Mauritius and manages Offshore Fund. SBIFMPL also providesPortfolio Management services (PMS) andAlternative Investment Funds (AIF).6. SBI GLOBAL FACTORS LIMITED (SBIGFL)( Crore)Name of the subsidiary companySBI Global Factors Ltd.SBIGFL is a leading provider of factoringservices for domestic and internationaltrade. SBI holds 86.18% share in theCompany. The Company’s services areespecially suitable for MSME clientsfor freeing up resources locked in bookdebts. By virtue of its membership ofFactors Chain International (FCI), theCompany is able to ameliorate creditrisk from export receivables under the2-factor model.94 Annual Report 2019-20Ownership(SBI Interest)% ofOwnershipNet Profit(Losses) FY2020137.7986.18%16.77The Company reported a PBT of 40.28crore during the period ended Mar 2020against previous period ended Mar2019 PBT of 4.28 crore. It’s PAT duringthe period ended March 2020 is 16.77crore against previous period ended Mar2019 PAT of 1.68 crore (under IND AS).Turnover for 12 months ended FY2020is 4,394 crore as compared to turnoverof 4,387 crore in previous year. Fundsin use (FIU)as on 31st Mar 2020 is 1,317crore as compared to 1,374 crore as on31st Mar 2019. However, the average FIUincreased to 1305 crores in FY 201920 as compared to 1211 crores duringprevious year. The total income of theCompany also increased to 118.65crores in FY 2019-20 as against 108.64crores last year.

DIRECTORS’ REPORT7. SBI GENERAL INSURANCE COMPANY LIMITED (SBIGIC)( Crore)Name of the subsidiary companyOwnership (Sharecapital - SBI Interest)% ofOwnershipNet Profit(Losses) FY202015170%412SBI General Insurance Company Ltd.SBI General Insurance Company Limitedwas originally a joint venture betweenState Bank of India (SBI) and IAGInternational Pty Limited, a subsidiary ofInsurance Australia Group Limited. Aftera small divestment in mid-2018, SBI nowowns 70% of the total capital, whereasIAG, the erstwhile JV partner of 26%,has made a complete exit in March 2020,thereby divesting its entire stake. WhileSBI’s divested equity of 4% is held by PIOpportunities Fund - I (2.35%) and AxisNew Opportunities- AIF-I (1.65%), IAG’sstake of 26% has been bought by NapeanOpportunities LLP (16.01%), and HoneyWheat Investments Ltd (9.99%). SBIGeneral Insurance became the first nonlife insurance company in India to cross 6,000 Crores in a decade of operations.The company has continued to focuson profitable growth in bancassurancechannel along with other distributionchannels and line of businesses that meetour business objectives and drive profitablegrowth. SBI General has been focused ona rigorous business continuity plan andhave built capabilities to handle disruptiondue to COVID 19 in FY2020. The Companydefined strategies to target profitablegrowth, efficient expenses managementand business continuity plan that hasresulted in significant profits in FY2020.leaders “Personal Accident” and “Fire”insurance segment amongst privateinsurers in FY2020.SBI General has retained iAAA rating byICRA for highest claims paying ability forthe 4th consecutive year. The Company wonthe ‘Silver Award’ in the category ‘NonLife Insurance Provider of the Year 2019’at Outlook Money Awards, won the SmartGI Compact, in the insurance segment atthe 2nd Insurance Awards during the 6thET Insurance Summit. In addition to thementioned awards The Company receivedvarious prestigious recognitions acrossfunctions during FY2020.8. SBI SG GLOBALSECURITIESSERVICES PRIVATELIMITED (SBI-SG)SBI-SG, a joint venture between StateBank of India and Societe Generale with65% holding by SBI. The Company wasset up to offer high quality custodial andfund administration services to completethe bouquet of premier financial servicesoffered by the SBI Group. SBI- SGcommenced commercial operations in2010. The Company’s Net Profit was 61.96 Crore as on 31st March 2020 asagainst 34.45 crore as on 31st March2019. Accumulated profit is 141.86 crore.Assets Under Custody as on 31stMarch 2020 rose to 7,33,983 crorefrom 5,40,919 crore as on 31st March2019, while the Average Assets UnderAdministration were at 5,43,697 crorein 31st March 2020 as against 3,18,198crore in 31st March 2019.( Crore)Name of the subsidiarycompanyOwnership(Share CapitalSBI Interest)% ofOwnershipNet Profit(Losses) FY2020SBI SG Global SecuritiesServices Pvt. Ltd.5265%61.96SBI General has registered Gross WrittenPremium (GWP) of 6,840 with a growthof 45% compared to the industry growthof 12% in FY2020.SBI General has achieved a profit of 412crore in FY20. The Company recorded20% growth in its profit before tax to 564 crore in FY2020 from 470 Crore inFY2019.The overall market share of the companyamong all general insurance companiesstands at 3.59% in FY2020 as against2.77% in corresponding period ofFY2019.In terms of market ranking inthe Industry, SBI General is at 8th amongprivate insurers and at 13th in the industry.SBI General remains one of the market Annual Report 2019-2095

DIRECTORS’ REPORT9. SBI PENSION FUNDS PRIVATE LIMITED (SBIPF)( Crore)Name of the subsidiary companyOwnership(SBI Interest)% ofOwnershipNet Profit(Losses) FY20201860%2.28SBI Pension Funds Pvt. Ltd.**SBI Capital Markets and SBI Funds Management are holding 20% equity each in the Company.SBIPFPL has been appointed as thePension Fund Manager (PFM) alongwith six others to manage the pensioncorpus under National Pension System(NPS). SBIPFPL is one of the threePFMs appointed by the Pension FundRegulatory & Development Authority(PFRDA) for management of PensionFunds under the NPS for CentralGovernment (except Armed Forces)and State Government employees andone of the seven PFMs appointed formanagement of Pension Funds under thePrivate Sector. The total Assets UnderManagement (AUM) of the company ason 31st March 2020 was 1,60,491 crore(YoY growth of 32%) against 1,21,959crore on 31st March 2019.The Company maintained lead positionamongst PFMs in terms of AUM in bothGovernment and Private Sectors. Theoverall AUM market share in PrivateSector was 58%, while in the GovernmentSector it was 35%.The Company was awarded ‘PensionFund House-2019’ in Silver Category byOutlook Money. Outlook money Awardshas been received by the company for 5thconsecutive time in a row.The company had obtained license fromRegulator (PFRDA) to act as a Point ofPresence (PoP) under NPS. In connectionwith this, the company had developeddigital POP platform and it is fullyfunctional from March 2020. Companyhas successfully registered its firstcorporate client10.SBI INFRAMANAGEMENTSOLUTIONS PRIVATELIMITED (SBIIMS)SBIIMS is a wholly owned subsidiaryincorporated on 17th June, 2016. TheCompany is operating on PAN India with17 Circle Offices located at all SBI LHOCentres. The Company aims to provide96 Annual Report 2019-20specialised services on premises andestate related matters to State Bank of Indiaand to relieve State Bank of India officialsfrom dealing with non-core activities.The focus areas of activities undertakenby SBIF are illustrated below:SBIIMS has taken over all ongoingprojects from your Bank as is where isbasis and is executing them efficiently.SBIIMS has also successfully completed“Uniform Signage Project” by replacingold State Bank of India signage acrossIndia, which has resulted in the uniquebrand identity of State Bank of India.SBIIMS has also taken the challengeof completing your bank’s ambitious“Uniform Branch Ambience Project”in time, which shall enable refined anddelighted ambience of branches of StateBank of India.i) SBI Youth for India – a 13monthrural fellowship program connectingIndia’s best young minds to work forrural communitieszii) Centre of Excellence for Personswith Disabilities – a program with anobjective to be a centralised supportCentre to empower PwDsiii) SBI Gram Seva – the programaims at working towards holisticdevelopment of villages covering 50villages across six states in India.Nearly, 55% of the allocated amountto SBIF was spent for the flagshipprograms.11.SBI FOUNDATIONSBI Foundation was established by StateBank of India in 2015 as a Section VIIIcompany under Companies Act (2013) toundertake the CSR activities of SBI andits Subsidiaries in a planned and focusedmanner.zProjectunderEducation:Education is one of the most powerfuland proven tools to bring abouttransformational change in the socialdevelopment landscape. Towardsthis end, State Bank of India aimsto address the major hindrances inthe education sector of India. To doso, your Bank undertakes initiativessuch as enhancing access toquality education to slum children ofAhmedabad, strengthening qualityof education in 3,000 AnganwadiCenters of Meghalaya, benefitting60,000 children and Personal SafetyEducation and Child Sexual Abuseprevention trainings to children andcaregivers. For Education projects,11% of fund was spent for theFY2020.zProjectsunderHealthcare:SBIF is committed to making apositive contribution to the livesof the unprivileged sections of thesociety by providing free access toquality healthcare through variousinitiatives such as Organ Donation,Home-based hospice and palliativecare services, Cochlear Implantsfor children having hearing loss,To give back to the society by workingtowards the socio-economic well-beingof the marginalised and vulnerablecommunities, your Bank is activelyworking towards the upliftment ofunderprivileged sections of the societywith a vision to provide ‘Service BeyondBanking’.SBI Foundation has undertaken multipleinitiatives to build momentum for atransforming India by creating an inclusivedevelopment paradigm that servesall Indians without any discriminationbased on region, language, caste, creed,religion amongst others. For FY2020, thetotal CSR spend of SBI Foundation was 14.65 crore. The grants received fromBank and its subsidiaries amounted to 27.81 crore. The remaining/unspentfunds are earmarked to various ongoingCSR projects and shall be utilised insubsequent months.Flagship Programs: SBIF has threeflagship programs:

DIRECTORS’ REPORTMedical-aid to cancer patients,Primary Healthcare services onfour-wheelers, and Mitigating thedamages of sickle cell anaemiaby supporting sickling tests. Forhealthcare projects, 13% of fundwas spent for the FY2020.zLaunch of Flagship Programon Healthcare: Considering theenormity of the challenge posed byCovid-19 and its adverse impact onthe health sector, the Foundation haslaunched a new flagship programon healthcare. The program isaimed to identify and implementpossible areas of collaborativeinterventions for defeating COVID-19in India in association with ity Building of Health Staffand Creating General Awareness forPublic.RRBs Sponsored by SBIWith 2/3rds of our country’s populationliving in Rural, it presents a huge yetunder tapped opportunity for the IndianBanking Sector. Our large network ofsponsored Regional Rural Banks (RRBs)is well placed, to play a larger role andhave a great potential to address thisscenario. Regional Rural Banks have adistinct competitive advantage, due totheir large account base and decades oftrust-earning service tradition, resultingin close proximity to the rural customers.zThe State Bank has sponsored (15)Regional Rural Banks operating atregional levels in (15) different States.These RRBs have a combined branchstrength of (5,318) spread across (226)Districts. (as on 31st March 2020).zState Bank of India holds 35% stakein each of them except Ellquai DehatiBank (36.27%), Madhyanchal GraminBank (35.46%) and Utkal GrameenBank (36.51%) as on 31st March2020 with the Government of Indiaholding 50% and the respective StateGovernments holding the remaining15% stakes.zThe Sponsored RRBs of SBI areon CBS platform and offer bankingservices on par with any othercommercial Banks operating in thecountry. The Banks have adopted thebest practices and are well placed tohandle the ever-evolving demandsof customers, particularly in Ruraland Semi-urban space, through theircustomer centric approach.12.REGIONAL RURAL BANKS (RRBS)OWNERSHIP PERCENTAGE OF SBI IN RRBS SPONSORED BY SBISr.No.Name of RRBs%1Andhra Pradesh Grameena Vikas Bank35.00%2Arunachal Pradesh Rural Bank35.00%3Chhattisgarh Rajya Gramin Bank35.00%4Ellaquai Dehati Bank 36.27%5Jharkhand Rajya Gramin Bank35.00%6Madhyanchal Gramin Bank ##35.46%7Meghalaya Rural Bank35.00%8Mizoram Rural Bank35.00%9Nagaland Rural Bank35.00%10Purvanchal Bank35.00%11Rajasthan Marudhara Gramin Bank35.00%12Saurashtra Gramin Bank35.00%13Telangana Grameena Bank35.00%14Utkal Grameen Bank **36.51%15Uttarakhand Gramin Bank35.00% Sponsor Bank and State Govt have infused their part of 5.48 crore and 2.35 crore respectively ofapproved fresh infusion of Share Capital. As Central Govt is yet to infuse their part of share capital of 7.83 crore. On infusion of remaining capital of Central Govt, our share will be at 35%.## Sponsor Bank and GOI have infused their part of 8.91 crore and 12.73 crore respectively of approvedfresh infusion of Share Capital. As Govt of MP is yet to infuse their proportionate part of share capital of 3.82 crore. On infusion of remaining capital by Govt of MP, our share will be at 35%.** Sponsor Bank and GOI have infused their part of 93.856 crore and 134.08 crore respectively ofapproved fresh infusion of Share Capital. As the Government of Odisha is yet to infuse their proportionatepart of share capital of 40.22 crore. On infusion of remaining capital by the Government of Odisha, ourshare will be at 35%. Annual Report 2019-2097

DIRECTORS’ REPORTBusiness Highlights of FY 2020:zzzzzThe aggregate deposits and advancesof the (15) RRBs (sponsored by theBank) as on (31st March 2020) stoodat (1,07,539 crore) and (62,469 crore)respectively.During the year under review,despite the persistently challengingmacroeconomic environment, theBank improved its business, withDeposits growing by (11.59%) andAdvances by (11.65%) on YoY. Asa planned strategy to diversify tothe portfolio, RRBs expanded theirHousing Loan exposure by 30.84%(YoY) to take the portfolio to 7,492.21crore.During FY2020, the RRBs togetherhave posted a Net-Profit ( 260.29crore) despite substantial provision ofPension 1,589.63 crore. The Bankscontinue to focus on improvingearnings from their core bankingbusiness, strengthening the feeincome streams and maintainingcontrol on operating costs.ThecombinedGrossNonPerforming Assets ratio of the RRBshas decreased to (6.37%) in currentFinancial year as against 6.97% inFY2019 due to focused approachfor reduction of NPA. The Net NPAstands at (2.78%) as against (3.32%)in FY2019.Business per employee duringFY2020 improved to ( 8.44 crore) (ason 31st March 2020) as against 7.35crore in FY2019.Major Developments in FY 2020:zIn accordance with notification dated26th November 2019 issued by theGovernment of India, PurvanchalBank sponsored by us will beamalgamated with Baroda U.P. Bankunder the sponsorship of Bank ofBaroda w.e.f. 1st April 2020.zThe 14 RRBs with 4,718 Branchnetwork, are expected to workmore efficiently in the upcomingyears, thanks to the introduction ofAsset Management Hubs (AMHs)- a Centralised Credit Processingsystem.The year under review witnessed severalsignificant events, some of which arelisted below:zIn January 2019, in line with aGovernment of India decision toamalgamate all RRBs o

the Fund. SME FUND SME fund was also launched on 19-11-2018, legal & tax advisors and trustee for SME fund have been appointed, and it is in process of drafting Investment Management Agreement and Contribution Agreement. The trust is registered and SEBI registration for the fund was received on 25-Sep-2019. The company is in process of meeting