Transcription

FY 2020-2021Adopted BudgetBoard of EducationJune 29, 2020

Operational ExcellenceSafety Partnerships Communication Physical and psychological safety: We will invest inprograms and services to ensure our students and staff feelsafe and supported with an emphasis on building resilience,addressing bullying and substance abuse and reducing selfharm. Stakeholder Partnerships: We will build and strengthen therelationships with stakeholders in order to create and enhanceresources for our students, families and staff to build robustschool communities. Communication: We will work to improve communicationacross our school community by broadening our audiencereach, creating opportunities for meaningful dialogue and liftingthe voices of all stakeholders, especially Black, Brown andIndigenous people.2

Agenda Review of Budget Process Major Changes from the Proposed Budget Review of Key Assumptions for General Fund Approval of Preliminary Plans for CARES Act Funding Timeline and Process Going Forward Board Action: Appropriation Resolution, Use of Beginning Fund Balance Resolution,Resolution Authorizing use of CARES CRF Funding for New Contract Duties Appendix Detailed General Fund Information Other Funds Economic and State Budget Information3

Review of Budget ProcessApril 28 Budget Task Force & Council of ChairsMay 4 – May 28 Budget Discussion to CCSD Groups May 4-May 28 SEAC, PASS, Parents Council, Leadership CherryCreek, Gifted & Talented Parent Group, CCSF (Foundation)May 22 State Revenue and Budget assumptions Review Budget Task Force recommendations Budget impactsMay 29 COVID-19 Economic Effects National and Local; Unemployment Levels Legislative updates State Budget; Introduction of School Finance Act Funding GapJune 5 Proposed Budget Economic Updates Estimated Per Pupil Revenue (PPR) reduction of 5% Information on all District funds Preliminary information on CARES ActJune 12 School Finance Bill Introduced HB20-1418 PPR 7,989, ( 475) per student reduction 5.6% Revenue Reduction Detail on Department / Central Office cuts and reductions Bond refinancing completedJune 17 Wrap up 2020 Legislative Session HB20-1418 School Finance approved through the Senate PPR 8,001, ( 463) Per student reduction 5.5% Revenue Reduction DAC Budget PresentationJune 23 Budget Task Force & Council of ChairsJune 29 FY2020-21 Budget Adoption Appropriation of Funds Use of Fund Balance FY2020-21 Resolution CARES Expenditure Use FY2019-20 Resolutions for Designated Grants (CARES allocation) and BondRedemption Fund (Bond refunding)4

Major Changes from Proposed Budget (6/5/2020) toAdopted Budget (6/29/2020) General Fund: Per Pupil Revenue finalized. 5.5% reduction to PPR 463 per student or 25.2M Designated Purpose Grants Fund: CARES Act funding included andpreliminary uses are detailed (see slide 11) 9.5M allocated for 40 additional hours of substantially different work forall Exempt staff related to responding to the public health crisis Bond Redemption Fund: Debt service updated to reflect successfulrefunding of 2010B bonds that will save taxpayers over 25M of interestcosts over life of bond5

Net Total Program Funding per Pupil Comparison 8,464 8,092 8,001 7,627 7,387 �21Actual**FY2020‐21 funding level comparisons for the approved HB20‐1418 show approximately 463less per pupil, or 5.5% less than that of 2019‐20. The length of reduced economic activity tocontrol the spread of COVID‐19 has caused severe and long lasting impacts to per pupilfunding.6

FY2020-21 GENERAL FUND PRELIMINARY ASSUMPTIONSFY2020-21 Budget DevelopmentRevenue 0 No FY2020-21 projected increase in Funded Pupil Count 54,540 FTE ( 25.2M) 5.5% PPR reduction - 8,001 PPR Decrease of ( 463) per student Expenditure 2M increase in MLO funding tied to 25% of Total Program Salary Freeze (cost avoidance of 9M from Budget Task Force recommendations) ( 5M) Capital Reserve transfer reduction ( 4M) Move of Nurses to Medicaid Grant ( 2.6M) Unfilled positions from central office hiring freeze ( 3.1M) Teacher ratio increase .25 at 19.0:1, continues at .25 increase per year ( 2.4M) 15% reduction of Decentralized budgets for departments 2M.5% employer PERA rate change due to automatic trigger7

Cherry Creek’s Funding GapWithin the next year, Cherry Creek will face a 60M funding problemCurrent Budget AssumptionsRevenue: FY2020-21 (5.5%) Per Pupil Revenue (PPR),FY2021-22 (7%) PPR, FY2022-23 Flat PPR No increase in Funded Pupil Count MLO tied to 25% of Total Program No Facility rentals FY2020-21, resumes in FY2021-22and FY2022-23Expenditures: All below held constant over the next 3 years Assumes a salary freeze for all employee classes Assumes ratio increasing .25 each year Capital transfer reduced in FY2020-21; no change after 15% Department decentralized budget reduction F2020-21; 0 increase decentralized departments’ budgets each yearafter8

At A Glance – General FundForecasted FY2020-21 Budget (5.5%) PPR, FY2022 (7%) PPR, FY2023 Flat PPR (Projected FY2020 YE)General Fund ( in millions)RevenueExpendituresRevenue over (under) ExpendituresProjected Ending General Fund BalanceFY2019-20FY2020-21FY2021-22FY2022-23 633.34 609.55 581.91 581.91644.55639.30640.70640.96( 11.21)( 29.75)( 58.79)( 59.05) 74.49 44.74( 14.05)( 73.10)CURRENT STATE While the FY2021-22 fund balance shows a negative 14M, please keep in mind that we must fund our TABORreserve. Therefore, the actual deficit is approximately 32M Solving for the TABOR issue in FY2020-21 and FY2021-22, in FY2022-23 the District has an approximate 59M budget deficit (ongoing revenue of 582M vs. ongoing expenditures of 640M)9

CARES Act – Summary Direct allocation to Cherry Creek School District based upon Title I funding formula 3.5M Elementary and Secondary School Emergency Relief (ESSER) Funds forCherry Creek Schools The State of Colorado has received 1.67B from the Coronavirus Relief Fund (CRF)as part of the CARES Act 510M for school districts and charter schools 28.2M CRF Funds for Cherry Creek Schools Use of these funds is highly restrictive based on the following (including but notlimited to):1. Necessary expenditures incurred due to the public health emergency withrespect to the Coronavirus Disease 2019 (COVID–19);2. Were not accounted for in the budget most recently approved as of March27, 2020 (the date of enactment of the CARES Act) for the State orGovernment;3. Were incurred during the period that begins on March 1, 2020, and endson December 30, 2020.10

Cherry Creek School District - CRF Funds Summary(Expenditures are Included in the Adopted Budget)Committed/Expended FY2019-20DRAFT Planned expense for FY2020-21Total Funding 28,184,504Projected Balance as of 6/30/2020 26,435,606Charter School Allocation Additional PPE 6,000,000Protective Supplies 1,089,000Additional HVAC 700,000Insurance for Devices 78,130Online Curriculum 500,000Overtime Costs 58,000 68,000Sub Total 1,748,898Assistant Principal/Registrar forOnline40 Additional Hours (Admin, Certified,Pro Tech) 9,500,000Additional Devices for Free/ReducedStudents 4,757,600Sub Total 21,525,600Projected Balance 12/31/2020 4,910,006523,76811

Next Budget PhasesSummer 2020January 202112 Engage the community in budget conversationsRe-engage Budget Task ForceDetermine/Finalize use of CARES fundingCommunity SurveyDetermine furlough days, staff reductions, cost savingstrategies, etc. Communication to community Update on work, furloughs, survey results Recommendation for cuts to balance budget Potential recommendation for a November election Updated PPR based on December Forecast Cost savings strategies include in budget Final CARES funding uses include in budget12

Budget Risk ItemsCoronavirusImpact –Current / FutureEconomy –State and LocalPERAElections andOutcomes Additional healthrestrictions/requirements More rigorous cleaning Protective supplies forstudents/teachers Mid year Rescission concerns Changes to School Finance Specific ownership tax Estimates vs Actual reduction Property tax collections Estimates vs Actual reductionInstructionalandOperationalChangesOther Fundsand GeneralFund Backfill Health & SafetyContinuity of LearningConditions of LearningPlanningLogistics Transportation Cafeteria Food and Nutrition Services Early Childhood Services Contribution Rates Automatic Adjustment Provisions National and LocalEnrollment Brick and mortar vs online Possibility of some students notreturning Family decisions Declining vs growing13

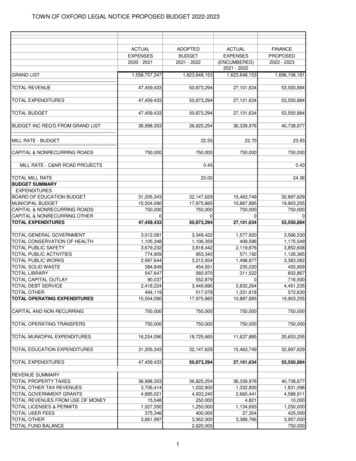

APPROPRIATION SUMMARYGENERAL FUND 684.88 669.58( 15.30)(2.23%)DESIGNATED PURPOSE GRANTS29.4064.6335.23119.83%EXTENDED CHILD SERVICES16.7715.59(1.18)(7.04%)PUPIL ACTIVITIES17.2817.460.181.04%FOOD SERVICES19.6020.250.653.32% 767.93 787.51 19.582.55%BUILDING FUND69.5721.53(48.04)(69.05%)BOND REDEMPTION59.1868.459.2715.66%CAPITAL RESERVE28.3314.18(14.15)(49.95%) 925.01 891.67( 33.34)(3.60%)TOTAL OPERATING/SPECIAL REVENUE FUNDSTOTAL Growth in Designated Purpose Grants related to CARES Act funding. CARES fundingincludes uses on slide 11. Notably, the appropriation includes the 40 hours of substantiallydifferent additional work for Exempt staff related to responding to the public health crisiscaused by COVID 19.14

Use of Beginning Fund Balance SummaryFundGeneral FundBuilding FundAmountReason 29,747,486To balance the General Fund whereexpenditures & transfers exceedrevenue 21,471,543Completion of planned projects forFY2020-21, from initial 2016 bondissue15

ellence16

APPENDIXEconomic impactsState BudgetRevenue ForecastGAAP Fund BalanceGeneral Fund BudgetPositions UnfilledOther Funds SummaryCapital Reserve & Building FundBond Redemption FundDesignated Purpose GrantsFood ServicesExtended Child ServicesPupil ServicesResourcespage 18page 19page 20page 21page 22page 23page 24pages 25-27pages 28-29pages 30-31pages 32-33pages 34-35pages 36-37page 3817

Economic ImpactsNational and State Nationally, April’s jobs report showed that the US economylost a record 20.5 million jobs and the unemployment ratespiked to 14.7%, the highest since the depths of the GreatDepression Colorado’s unemployment rate more than doubled fromMarch to April with 11.3% unemployed State revenue has declined by 25% - 3.4 billion belowDecember estimates K-12 makes up 35% of the State’s Budget June forecast still reflecting a roughly 3.0 billionrevenue decline from December18

State Budget FY2020-21Actions to Balance the Budget leads to Significant Cuts 25% Reduction to the State General Fund Budget overall 15% Cut from the 4.6 Billion K-12 Education Budget 58% Cut to Higher Education nearly 493 Million to state colleges and universities 135 Million cut to BEST (Building Excellent Schools Today) grant program that funds construction in cashstrapped districts Elimination of 225 Million payment to state’s pension fund PERA19

June 2020 Economic Revenue Forecast May business activity and consumer spending improved slightly, but remain constrained For FY2019-20 revenues projected up slightly from May, but still show 4.7% decline For FY2020-21 revenues projected to fall 9.5% further as a result of deep economic issues State reserves for FY2019-20 anticipated to finish better than projected in May 364.7 million above the 3.07% required reserve Reserves over the next two years projected will have slim margins and will need to be monitoredclosely For FY2020-21 Legislative balancing actions and income tax policy changes show slightly higherrevenues, but total revenue is still 2.7 billion below the TABOR cap. Over a two year forecast period revenues show a cumulative increase of 1.34 billion.20

GAAP FUND BALANCEPPR REDUCTION: FY2020-21 (5.5%), FY2021-22 (7%), FY2022-23 FLATActualAs of6-30-19Estimated Asof6-30-20ProjectedAs of6-30-21ProjectedAs of6-30-22ProjectedAs of6-30-23 17.59 18.77 18.77 18.81 mmitted and Assigned Reserve31.458.484.410.000.00Unassigned Reserve14.1323.530.00(37.79)(96.85) 85.50 74.49 44.74( 14.04)( 73.09)General Fund as of June 30th( in millions)RESERVES3% TABOR Reserve3% Board Designated Policy ReserveNonspendable ReserveGAAP Fund Balance21

General FundRevenue and Expense Comparison - FY2020-21 (5.5%) PPR, FY2021-22 (7%) PPR, FY2022-23FLAT PPRFY2019-20PROJECTEDYEAR BUDGETFY2022-23ESTIMATEDBUDGETLOCAL REVENUE 286.76 287.67293.98293.98STATE REVENUE343.70319.44285.48285.48FEDERAL REVENUE1.481.481.481.48TRANSFERS IN1.400.97.97.97 633.34 609.55 581.91 581.91434.64430.73430.73430.73PERA & MEDICARE BENEFITS93.9695.2397.3999.54HEALTH & OTHER BENEFITS34.6734.6434.7035.03OPERATIONAL EXPENDITURES62.3364.9363.8461.61TRANSFER TO CAPITAL RESERVE18.9413.7713.7713.77EXPENDITURES & TRANSFERS 644.55 639.30640.70640.96EXPENDITURES (OVER)/UNDER REVENUE( 11.21)( 29.75)( 58.79)( 59.05) 74.4944.74( 14.05)( 73.10)DESCRIPTION( IN MILLIONS)TOTAL REVENUE & TRANSFERSSALARIESPROJECTED ENDING GENERAL FUNDBALANCE22

Positions Not Filled – FY2020-21DepartmentPositionAreaPositionSpecial Pops1 GT Coordinator for Math/ScienceIT2 Analyst Positions1 LD SpEd Position3 Senior Analysts1 SpEd Autism CoordinatorLegal1 Truancy CoordinatorEdOps6 Assistant PrincipalsInnovation1 CTE CoordinatorHR1 EOP PositionFiscal1 Concurrent EnrollmentCoordinator3 Generalist1 CE Data Specialist1 Employee RelationsLiaison1 STEM Coach1 Director1 Risk Management Specialist1 Director Supply ChainManagementPerformanceImprovement1 Director of Curriculum2 Star MentorsEstimated General Fund annual savings of 2.6 million including salaries and benefits1 Warehouse Staff Position23

Other Funds Capital ReserveBuilding FundBond Redemption FundDesignated GrantsFood Services FundExtended Child ServicesPupil Activities24

Capital Reserve and Building FundFund Description & PurposeCapital Reserve Description & PurposeThe Capital Reserve Fund receives transfers from the General Fund for ongoing capital needs ofthe District such as maintenance improvements to facilities, as well as purchases ofequipment, technology related items, and vehicles. These funds continue to be restricted to high priority needs required to enable thesafety, security, asset preservation, instructional technology, and basic operation ofschools and facilities throughout the Cherry Creek School DistrictBuilding Fund Description & PurposeThe District uses the Building Fund as its primary Capital Improvement Fund to budget andaccount for the major capital outlays for school facilities, which is funded by the issuance ofauthorized general obligation school bonds. The District Long-Range Facility Planning Committee develops facility planningrecommendations for new schools and other facility projects that accommodatestudent enrollment and improve instructional programs;These recommendations are presented to the Board of Education for approval and onceapproved by the Board of Education, the bond issue is placed before the voters forconsideration25

Capital Reserve FundBEGINNING FUND BALANCE 22.15 20.10 11.590.840.060.05Transfer from General Fund22.8118.9413.77Transfer from Building Fund0.000.000.00Instructional Tech. Lease Proceeds0.000.000.00Bus Replacement Lease Proceeds0.000.000.00Certificates of Participation7.000.000.0030.6519.0013.82 52.80 39.10 25.4121.4713.102.50Equipment, Software and Internet4.908.075.00Debt Service – Technology and Buses6.336.346.2732.7027.5113.77 20.10 11.59 11.64REVENUESInvest. Income/Cash in Lieu of LandTotal RevenuesTOTAL FUNDS AVAILABLEEXPENDITURESBuilding and ImprovementsTotal ExpendituresENDING CAPITAL RESERVE FUND BALANCE FY2020‐21 transfer from General Fund reduction is result of decreases in majormaintenance projects, network Infrastructure, and Full Day Kindergarten start‐ up.26

Building FundBEGINNING FUND BALANCE 153.91 71.24 24.46REVENUESSale of Bonds0.000.000.00Premium on Bonds0.000.000.00Investment Income3.600.890.06Total Revenues3.600.890.06 157.51 72.13 24.520.950.390.09Land, Building and ofessional Services0.442.1813.35Bond Issue Costs0.000.000.0086.2747.6721.53 71.24 24.46 2.99TOTAL FUNDS AVAILABLEEXPENDITURESSalaries & BenefitsTotal Expenditures and TransfersENDING BUILDING FUND BALANCE Year over year budget changes represent the close out of the 2016 Bond projects27

Bond Redemption FundFund Description & PurposeThe Bond Redemption Fund is used to account for property taxes levied and investment income, to provide forpayment of general long-term debt principal retirement, semi-annual interest, and related fees. The District’s long-term debt,in the form of general obligation bonds, totals 576,880,000 as of June 30, 2020;The preliminary budgeted amount for this debt service in Fiscal Year 2020-21 is 59.2 million In accordance with Colorado School Law, the legal debt limit is 20% of the District'sassessed valuation;The legal debt limit, based on 20% of the District’s 2018 assessed valuation of 6.146 billion, is 1.229 billion;The District refers to the 20% of assessed value limit for purposes of debt issuance limits;This debt limit exceeds the net amount of the District's bonds payable, minus funds available fordebt service payment by 677 million Scheduled Bond Refunding will save taxpayers money;Savings of 25,195,432 over the life of the bond28

Bond Redemption FundBEGINNING FUND BALANCE 55.07 58.94 63.1661.6562.3671.00Refunding Bond Proceeds0.000.000.00Investment Income0.621.040.83Refunding Bond Premium0.000.000.0062.2763.4071.83 117.34 122.34 134.99Bond Principal 020.020.0258.4059.1868.45 58.94 63.16 66.54REVENUESProperty TaxesTotal RevenuesTOTAL FUNDS AVAILABLEEXPENDITURESTransfer to Escrow Agent/Fiscal ChargesTotal ExpendituresENDING BOND REDEMPTION FUND BALANCE Fund balance amounts reflect the difference between calendar year and fiscal year payment timing General obligation credit ratings of Aa1 from Moody’s and AA from Standard & Poor’s29

Designated Purpose GrantsFund Description & PurposeThe Designated Purpose Grants Fund is used to manageLocal, State, and Federal Grant funding sources and expenditures. Every Student Succeeds Act (ESSA) Grants include:Title I, Part A: Improving Basic Programs Operated by State and Local Educational AgenciesBeing the largest federal program which allocates its resources based on student poverty rates, this funding provides financial assistance to school districts for services that improve teachingand learning in at-risk schools and ensures student access to scientifically based instructional strategies and challenging academic contentTitle II, Part A: Preparing, Training, and Recruiting High-Quality Teachers, Principals or Other School LeadersThis funding provides for teacher training and recruitment of highly qualified teachers, principals and other school leaders capable of ensuring that all children achieve successTitle III: Language Instruction for English Learners and Immigrant StudentsThis grant provides English Learner and immigrant students with language instruction to develop high levels of academic attainment in English in order to meet the state academicachievement standards set for each grade level; to address the need for family literacy, English language instruction is also offered to parents and preschool age childrenTitle IV, Part A: Student Support and Academic Enrichment GrantsThis program provides students with a well-rounded education, supports safe and healthy students, and allows for effective use of technology Individuals with Disabilities Education Act (IDEA)Public Law 94-142 (Education for All Handicapped Children Act) requires free appropriate public education in the least restrictive environment for all school-aged children. Public Law99-457 extends services to children with developmental delay from birth to 3 years of age and their families School to Work Alliance Program (SWAP)The SWAP program provides successful employment outcomes, increased community linkages, and new patterns of service for young people; students who need assistance goingfrom school to the working world receive services each year; the SWAP staff helps place students in apprenticeship programs through Vocational Rehabilitation Elementary and Secondary School Emergency Relief (ESSER)The Coronavirus Aid, Relief, and Economic Security Act (CARES) was enacted in March 27, 2020. The ESSER fund is a piece of this legislation that provides a direct allocation to theDistrict based upon Title 1 funding. CARES ActCARES Act funding is included in the appropriation at 28.5M, however, it is likely that some will be spent in FY2020, those amounts are being determined at this time.30

Designated Purpose GrantsREVENUES AND EXPENDITURESLocal/Private FundsState FundsFederal FundsEducation of the HandicappedEvery Student Succeeds Act (ESSA)- Title I – A- Title II – A- Title III- Title IV- OtherSubtotal ESSASchool to Work Alliance ProgramMedicaidCARES Act (CRF)Other FederalTotal Federal GrantsTOTAL REVENUES/EXPENDITURES 3.08 4.80 2.585.532.873.45 8.74 10.11 11.185.100.980.430.170.42 7.110.183.08-0.26 19.37 27.984.770.990.580.390.52 7.250.203.92-0.25 21.73 29.404.771.030.540.504.06 10.900.217.9328.180.20 58.60 64.63Other Federal Grants includes an anticipated 3.4M, from the Elementary and Secondary SchoolEmergency Relief Fund (ESSER) under the Coronavirus Aid, Relief, and Economic Security (CARES) Act31enacted March 27, 2020.

Food Services FundFund Description & PurposeThe District uses the Food Services Fund to manage Food and Nutrition Programsoffering student meals and Nutrition Education in compliance withthe Federal Child Nutrition Program Guidelines. The Food and Nutrition Services Department manages theseprograms within the District, which nourish the whole student bycreating nutritious meals, building healthy habits, and cultivatingpositive relationships;Approximately 900,000 breakfasts and 3.2 million lunches are servedannuallyFood and supplies are purchased and distributed weekly to 62 schoolkitchen sites; bread items are prepared daily in a Central BakeryTo comply with State and Federal requirements, all necessaryrecords are maintained for reporting purposesCatering is also available for District Functions upon Request The Department goal is to operate on a financially selfsupporting basis, while meeting the needs of students,parents, staff, and community with outstanding customerservice; Nutrition Education is a daily part of the cafeteriaexperience;In collaboration with District personnel and communitymembers, a District Wellness Policy (Policy ADF) wasestablishedThe District’s Wellness Committee is comprised of Food andNutrition Service representatives to provide leadership in thewellness area32

Food Services FundBEGINNING FUND BALANCE 6.29 5.54 5.58Sales, Investment, Catering9.6110.6311.14Federal Meal Reimbursement (less than 50% of total revenue)7.077.317.67USDA Donated Food1.121.020.90State Meal Reimbursement0.320.350.2118.1219.3119.92 24.41 24.85 10.960.241.140.9218.8719.2719.91 5.54 5.58 5.59REVENUESTotal RevenuesTOTAL FUNDS AVAILABLEEXPENDITURESSalaries and BenefitsServices, Capital, OtherTotal ExpendituresENDING FOOD SERVICE FUND BALANCE Due to COVID FY2019-20 revenue losses are estimated at 1.8M for the Food Services Fund and arenot reflected herein33In Fall of FY21 school breakfast prices are proposed to increase 0.15 for Elementary, Middle, and High School meals.

Extended Child Services FundFund Description & PurposeThe Extended Child Services Fund is used to account for the District’s Before & After and Intersession SchoolPrograms offered outside of the traditional classroom schedule. Extended Child Services (ECS) programs give parents and guardians the peace of mind andsecurity of knowing that their children are engaged in safe, educational and constructiveactivities;ECS programs strive to provide school age children with a safe and nurturing environment whilepromoting physical, emotional and intellectual developmentActivities include, but are not limited to, homework assistance, creative expression, science,technology, indoor/outdoor recreational games, health and fitness, music appreciation, dramatic play,communication skills, cognitive reasoning, building and construction, and appreciation of diversity Additionally, these programs offer a variety of activities that promote life skills such asteamwork, problem-solving, creativity, leadership, sportsmanship, and community service ECS programs are fee-based and self-supporting34

Extended Child Services FundBEGINNING FUND BALANCE 6.64 5.82 4.89REVENUESTuition19.3115.3515.3419.3115.3515.34 25.96 21.17 20.23EXPENDITURESBefore and After School9.1310.8211.19Kindergarten Enrichment4.770.000.00Preschool1.611.881.55Other Enterprise Programs2.350.930.78Other Costs0.871.090.91Transfer to General Fund1.401.560.7020.1416.2815.13 5.82 4.89 5.10Total RevenuesTOTAL FUNDS AVAILABLETotal Expenditures and TransfersENDING ECS FUND BALANCE Due to COVID Tuition losses for FY2019-20 are estimated at 2.8M and are not reflected herein35

Pupil Activities FundFund Description & PurposeThe Pupil Activities Fund accounts for the self-supporting financial activities associated withelementary school, middle school, and high school extracurricular activities. The sale of athletic and activity tickets, fund-raising events, user and club fees,and fund-raising generates revenue.36

Pupil Activities FundBEGINNING FUND BALANCE 6.33 6.70 6.7012.8816.7816.95 19.21 23.11 23.65EXPENDITURESHigh School Activities9.0211.8111.93Middle School Activities1.162.072.09Elementary School Activities1.782.592.61Other Expenditures0.550.310.3212.5116.7816.95 6.70 6.70 6.70Total RevenuesTOTAL FUNDS AVAILABLETotal ExpendituresENDING PUPIL ACTIVITIES FUND BALANCE37

RESOURCESUS Bureau of Labor ary of .pdfBusiness ��5#7‐jolts‐well‐jolted‐7Colorado State files/juneforecast2020.pdfColorado 0/38

Creek, Gifted & Talented Parent Group, CCSF (Foundation) May 4 -May 28 State Revenue and Budget assumptions Review Budget Task Force recommendations Budget impacts May 22 . Assumes a salary freeze for allemployee classes Assumes ratio increasing .25 each year Capital transfer reduced in FY2020-21; no change after