Transcription

Spotlight on life settlementtransactions: Getting the best valueBy: Jason T. MendelsohnJune 2019The Tax AdviserPHOTO BY KAMISOKA/ISTOCKPERSONAL FINANCIAL PLANNING

The law known as the Tax Cutsand Jobs Act (the TCJA)1contained two provisions that affectlife settlements. First, the TCJAincreased the estate tax exemption (it is 11.4 million per individual and 22.8million for married couples for 2019).2This provision will sunset in 2026.Wealthy families who are affected bythe increase’s pending expiration haveconcerns about what they should dowith life insurance put in place forestate protection. Another provisionchanged how life settlements are taxed,making life settlements more favorablefor sellers and making the tax due onthe proceeds from a life settlementeasier to calculate for CPAs.3Both of these new provisions did notgo unnoticed by life settlement providers/investors, igniting a renewed level ofdirect marketing to consumers. Directmarketing exploits a crack in the chainof fiduciary oversight and places seniorclients in a position where they mightenter into a contract to sell their lifeinsurance policy without having anyoneto protect their best interests in the lifesettlement transaction.This article discusses factors thathave affected life insurance owned bysenior clients and why so many seniorsare selling their life insurance policieswhen they are not represented by a fiduciary at a time when they may need onethe most. The article ends with a list ofbest practices to alleviate the confusionthat has caused many fiduciaries to avoiddiscussing life settlements with their clients, leaving them vulnerable to directto-consumer marketing on the subject.Tax practitioners who arewary about discussing lifesettlements are not aloneIn 2018, Ashar Group conducted asurvey of 454 CPAs. Of those survey respondents, 48% held job titles of owner,partner, principal, president, CEO, orshareholder. The first question on thesurvey was designed to find out whymore CPAs do not discuss life settlements with their clients. Respondentswere asked to complete the sentence: “Idon’t feel comfortable talking with myclients about life settlements because ” 59% said: “I don’t feel qualified todiscuss life settlements.” 28% said: “It’s not part of my jobresponsibilities.” 13% said: “I’ve heard stories thatmake me feel uncomfortable aboutlife settlements.”Why do the majority of CPAs feelunqualified to discuss life settlements?There are no special qualifications todiscuss life settlements, as long as theCPA does not receive any money fromthe policy’s sale proceeds or from anyoutside sources. The CPA does not needto be licensed to sell life insurance orbe registered as a life settlement brokerto discuss life settlements with clients.Rules covering life settlements substantiate what practitioners already know tobe true for attorneys, CPAs, or financialadvisers who act in a fiduciary capacityto protect their client’s best interest andtake a fee for services.A model act adopted by the NationalConference of Insurance Legislators(NCOIL) clearly states that CPAs,attorneys, and financial planners thatcommonly represent clients in a purelyadvisory capacity are not considered tobe life settlement brokers and therefore1. P.L. 115-97.2. Sec. 2010(c)(2)(3) as amended by TCJA §11061(a); 2019 inflation-adjustedamounts are in Rev. Proc. 2018-57.www.thetaxadviser.com cannot be compensated by a life settlement provider or any other person,except their client (the policy owner).4Even though CPAs can provide adviceabout life settlements that is in theirclients’ best interest, they do not have afiduciary duty in the life settlement process under the NCOIL model act.Who has a fiduciary duty tothe client in the life settlementprocess?Choosing the best life settlement resource to work with to represent a clientwho may benefit from a life settlementcan be confusing. It is easy to be misledabout who represents whom and howvalue is created for the client. In the lifesettlement industry, there is a buy-sideand a sell-side similar to other investments. It is important to understandwho sits on the same side of the tablewith the CPA and the client in the lifesettlement process.On the buy-side, a life settlementprovider/buyer is the representativefor the institutional investors. The lifesettlement market is regulated in themajority of states and requires speciallicensing. For this reason, most institutional investors choose to use a lifesettlement provider who is licensed tohandle the life settlement process so thatinvestors do not have to go through thecumbersome task of securing and renewing licenses in multiple states. The provider/buyer is obligated to the individualor entity purchasing the life insurancepolicy on the secondary market andworks to secure the highest internal rateof return for the investor(s).The provider cannot serve two masters; therefore, a provider/buyer doesnot have a fiduciary duty to the client3. Sec. 101(a). Life settlements are commercial transactions where life insurance policy holders (usually individuals) sell their life insurance policy to athird party.4. National Council of Insurance Legislators (NCOIL) Life Settlements ModelAct, §2(B).June 2019 453

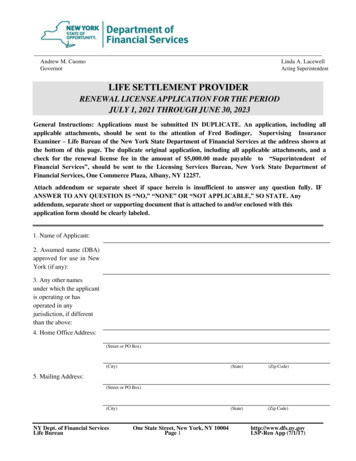

PERSONAL FINANCIAL PLANNINGFiduciary duties in the life settlement processFiduciary roleadvising clientsAttorneyCPACertified FinancialPlannerChartered LifeUnderwriterFamily officeTOLI trusteeRegistered investmentadviserOthersLife settlementfiduciary duty topolicy owner/sellerLicensedlife settlementbroker/fiduciaryDuty to protectinvestment returnsProvider/buyerInstitutional investorsPrivate-equity firmsGlobal banksReinsurersAsset managersPension fundsMunicipal fundsPortfolio aggregatorsSource: Ashar Group LLC (2019).even if a CPA is involved as a fiduciaryadviser for the client. The provider/buyer can represent one fund, a groupof funds, or the provider’s personallyowned fund(s). In other scenarios, theprovider/buyer is not the owner of anyof the funds that it represents, andsome providers aggregate policies for5. Id.EXECUTIVE SUMMARY The law known as the Tax Cutsand Jobs Act (TCJA) affected lifesettlement transactions in twoways — by doubling the estatetax exemption, which made itless necessary for many wealthyfamilies to keep life insurancepolicies, and by making the taxation of the sale of life insurancepolicies, i.e., life settlements,more favorable to sellers. Life settlement brokers have afiduciary duty to the policy ownerin a life settlement transaction.Policy owners who use brokers454 June 2019a portfolio they then sell in the tertiary market.The chart “Fiduciary Duties in theLife Settlement Process” shows whoowes a fiduciary duty to whom in thelife settlement process.On the sell-side, a life settlementbroker has a legal fiduciary duty to thepolicy owner/seller during the life settlement process. A broker, as the seller’srepresentative, facilitates the negotiations that protect the seller’s interestsin a life settlement auction. NCOIL’smodel act defines the role of a broker asan individual or entity that representsthe policy seller (Owner), owes a fiduciary duty to the Owner, and must actin the best interest of the Owner.5 Thebroker sits on the same side of the tablewith the seller and the seller’s advisers and is the only legally appointedrepresentative who carries the fiduciarytorch for a client in the life settlementprocess itself.A competent broker has the policyowner/seller and the adviser sign an engagement agreement and then skillfullydesigns a case that will be presentedto the secondary market to maximizevalue to the seller. The broker followsall compliance and Health InsurancePortability and Accountability Act(HIPAA)6 procedures, protects sensitiveclient data, and manages the expectations of the policy owner and his or heradviser/advisory team. The broker, as the6. Health Insurance Portability and Accountability Act (HIPAA), P.L. 104-191.rather than dealing with buyersthemselves usually obtain ahigher price for their policy. The TCJA equalized the taxtreatment of the surrender of alife insurance policy and a lifesettlement. Before attempting to negotiatea life settlement, a policy ownershould always obtain an appraisal of the value of the policyfrom a qualified appraiser. The recent sustained period oflow interest rates has causedmany current assumptionuniversal life policies to becometoo expensive for policy ownersto keep. A life settlement willoften be a better option for thesepolicy owners than allowing thepolicy to lapse or surrenderingthe policy. CPAs can provide a valuable service by inquiring about a client’s life insurance policies andproviding the client advice or referring the client to a competentlife settlement broker if the clienthas policies that may be in danger of lapsing or that the client isconsidering surrendering.The Tax Adviser

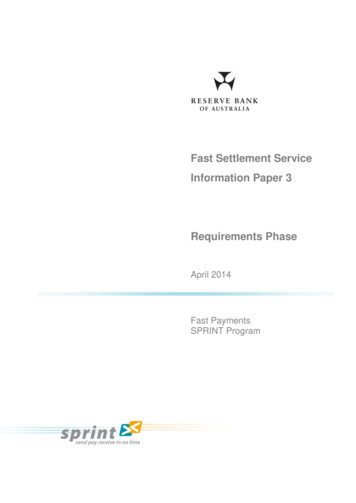

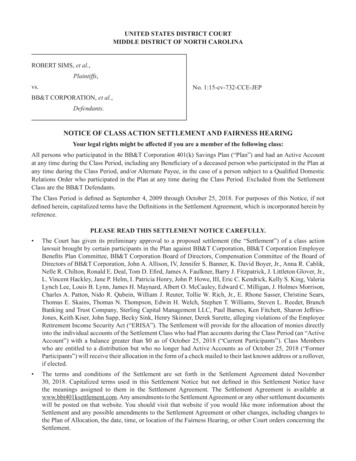

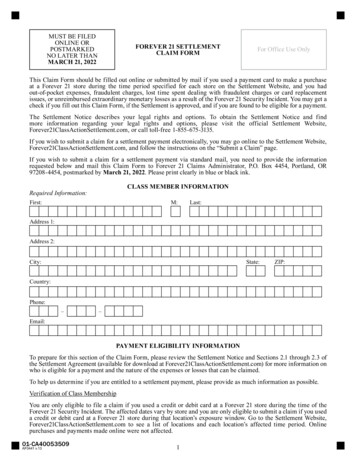

life settlement fiduciary in the transaction, handles the negotiation process andcreates a competitive bidding auctionbetween life settlement buyers.For a highly desirable policy, it isnot uncommon to go through 10 to 15rounds of bidding to generate 20 to 30bids and incremental bid increases. Theproviders/buyers usually pay a substantially higher price to acquire the policywhen a broker is involved than theywould if the policy owner/seller worksdirectly with a provider. The chart “BidTransparency: Competitive AuctionProcess,” on p. 456, shows an abbreviatedbid matrix that demonstrates why CPAsneed a life settlement broker to createcompetition and to ensure their clientshave a licensed fiduciary to protecttheir best interests in the life settlement process.Due diligence that protectsCPAs and their clientsOne of the most confusing aspects ofthe life settlement market is related todetermining who represents whom. Theart of omission is a common tactic usedby providers/buyers/direct marketersthat can easily mislead consumers andadvisers. CPAs hear a lot about “fairvalue,” which in reality is discountedfair market value (FMV) that is higherthan cash surrender value (CSV). CPAsshould demand FMV for their clientsand verify the auction process used toachieve it. Here are several due-diligencequestions CPAs should ask any lifesettlement provider/buyer or life settlement broker to choose the right one: Do you have a licensed fiduciary dutyto represent the best interests of myclient in the life settlement process? How many years have you beeninvolved in the life settlementindustry?Clients likely receiveseveral directlife settlementsolicitations everyday from television,radio, social media,publications, andthe internet. Can you provide information tovalidate your good reputation in theindustry? Do you provide bid transparency? How do you handle privacy andprotect sensitive client data andmedical information? Have any of the principals or members of your team been involved inlitigation relating to life settlements?Representative sample ofsettled policies, by typeIt is now safe to go back intothe waterThe first survey question showed that13% of the CPAs said, “I’ve heard storiesthat make me feel uncomfortable aboutlife settlements.” That is understandablewhen one considers the early history ofthe life settlement market, which wascontroversial at best. Viatical settlements, which are different from lifesettlements, originally involved sales oflife insurance policies by people whowere suffering from HIV/AIDS in the1980s, providing much-needed cash forterminally ill patients.Viatical settlements were followedby the stranger-originated life insurance (STOLI) debacle, which also left abad taste in the mouths of the fiduciarycommunity. In a STOLI arrangement,a person purchased life insurance for an7. Kingma and Leimberg, “Deterring STOLI: Two New Model Life SettlementsActs,” 35-7 Estate Planning 3 (July 2008).www.thetaxadviser.com unrelated third party solely as an investment, rather than to benefit beneficiaries, and circumvented the life insurancerequirement that the owner of thepolicy have an insurable interest in theperson whom the insurance covers. BothNCOIL and the National Association ofInsurance Commissioners (NAIC) haveintroduced model acts to help stop thetrafficking of life insurance policies bySTOLI programs.7 Laws that prohibitSTOLI have been enacted in 20 states.8Prudent investors want to avoid investing in risky STOLI policies, and lifesettlement providers/buyers that purchase life insurance policies for investorswill not touch any policy that has even ahint of STOLI. Life settlement brokersn Universal life (including current assumption, survivorship,indexed, guaranteed, andvariable UL products) .87%n Term insurance .12%n Whole life.1%Source: Ashar Group LLC (2019).8. Casey and Coan, “The Rise of Stranger-Originated Life InsuranceLawsuits,” 2011 Emerging Issues 6111 (Dec. 2, 2011), available attinyurl.com/y5n2ymk8.June 2019 455

PERSONAL FINANCIAL PLANNINGBid transparency: Competitive auction processOffer matrixFace value 4,000,000Cash surrender value 109,088Round 1Round 2Round 3FinalBuyer 1Offer 411,000 411,000Buyer 2Offer 800,000 1,100,000 1,320,000 1,320,000Buyer 3DeclineBuyer 4Offer 925,000 1,250,000 1,450,000 1,475,000Buyer 5Offer 850,000 950,000 1,300,000 1,225,000Buyer 6Accepted 975,000 1,215,000 1,400,000 1,550,000Buyer 7Offer 1,040,000 1,085,000Buyer 8Offer 725,000 995,000 995,000Buyer 9Offer 875,000 1,090,000 1,090,000Buyer 10DeclineBuyer 11DeclineBuyer 12Offer 480,000 1,085,000 480,000Source: Ashar Group LLC (2018).have anti-fraud methods to detect thesetypes of schemes or bad behaviors.Early life settlement regulations focused on preventing fraud and protecting insurance carriers. However, over thepast several years, there has been a shiftin life settlement rules to protect consumers’ right to sell their life insurancepolicies. NCOIL introduced the LifeInsurance Consumer Disclosure ModelAct, which has a provision that requirescarriers to disclose the settlement optionto individuals who are age 60 or olderor who are known by the insurer to beterminally or chronically ill and who areconsidering surrendering a policy.9 Aversion of this is currently statutory orregulatory law in several states: Kentucky, Ky. Rev. Stat. §304.15075(3)(b); Maine, Me. Rev. Stat. tit. 24-A,§6808-A(4)(D); New Hampshire, N.H. Code Admin.Rules Ins. 302.07; Oregon, Or. Rev. Stat. §744.362; Washington, Wash. Rev. Code§48.102.100(1); and Wisconsin, Wis. Admin. Code Ins.§2.18(8).Currently, 44 states regulate lifesettlement transactions through theirinsurance codes.10The TCJA improves the taxtreatment of a life settlementA further example of how the scales aretipping in favor of consumer rights isthe way the TCJA addressed the highlycontested issue of how life settlementsare taxed. Section 13521(a) of the TCJAoverrules the IRS’s previous positionon this matter. The first IRS ruling onlife settlement tax treatment, Rev. Rul.2009-13, was issued on May 1, 2009, asit became clear that life settlements weregaining in popularity and here to stay.The much-anticipated revenue rulingaddressed the tax consequences of life9. NCOIL Life Insurance Consumer Disclosure Model Act §§3 and 4.456 June 2019settlements to sellers. This revenue ruling created more awareness of the optionof life settlement for policy owners andsignaled a coming age of life settlementsto the planning community.However, instead of bringing clarityto financial professionals, advisers, andtheir clients on the tax treatment of thesale of clients’ life insurance policies,it raised more questions than answersabout this emerging market. The problem with Rev. Rul. 2009-13 was thatthe tax treatment of a policy sale wastreated differently than the tax treatmentof a policy surrender. This difference intaxation hampered insurance policy saleson the secondary market, negatively affected consumer confidence, and made itmore difficult for practitioners to calculate taxes for life settlements. The rulingimposed a formula on life settlementsrequiring a calculation that deductedthe cost of insurance (COI) from thepolicy’s cost basis.10. Casey and Sherman, “Looking Back at the Life Settlement Industry in 2018,”Law360.com (Jan. 29, 2018), available at tinyurl.com/y3nscjsx.The Tax Adviser

COI is a calculation that one mightthink could easily be provided by theinsurance carrier. Unfortunately, itbecame abundantly clear that COI wasoften very difficult, if not impossible, toobtain from the carrier. Advisers consequently hit roadblocks in their planning, and often had to gather dozens ofpolicy statements from previous yearsto piece together their analysis. Onthe other hand, when a policy ownersurrendered a life insurance contract,no such penalties were imposed on theclient. This seemed inherently unfair topolicy owners seeking to benefit from alife settlement.The TCJA corrected this inconsistency and eliminated the requirementfor practitioners to remove COI fromthe cost basis of a policy sale, therebyputting life settlements on a level playing field with other policy exit strategies.Those tax changes have significantimplications for clients choosing tosell their life insurance policy onthe secondary market and result insubstantial tax savings for sellers. Foruniversal life (UL) and term insurancepolicies, COI represents most, if not all,of the premiums paid. Now, under theTCJA, the premiums paid — whichinclude COI — equal the cost basis,thereby lowering the total tax obligationresulting from a life settlement. Anotherbenefit is a more simplified tax calculation for tax professionals without theunnecessary obstacle of trying to determine the COI. Example 1 demonstratesthe effect of these changes:Example 1. TCJA’s changes in taxation to the seller of life settlements:Policy type: 1 million UL insurance policy.Factors: Life settlement proceeds to seller 90,000. Premiums paid 64,000. COI 20,000. CSV 30,000.www.thetaxadviser.com An Insurance StudiesInstitute poll revealedthat 50% of seniorsare unaware of lifesettlements. Thisshould be a red flagto fiduciaries whohave senior clients.Calculations under Rev. Rul.2009-13:Step 1: Computation of basis: 64,000 premiums paid – 20,000 COI 44,000adjusted basisStep 2: Computation of tax liability: 90,000 sale price – 44,000adjusted basis 46,000 taxable gainNew methods of calculationresulting from the TCJA:Step 1: Computation of basis: 64,000 premiums paid 0taxation for up to 64,000 ofthe sale priceStep 2: Computation of tax liability: 90,000 sale price – 64,000basis 26,000 taxable gainas a long-term capital gainThe TCJA’s change reduces the taxable gain in Example 1 from 46,000to a more favorable 26,000. The newcalculation is more in line with howpolicy gains are taxed when policies aresurrendered back to the insurance carrierthat issued the policy. Ultimately, therevision to the law brings more clarityto planning professionals and the clientsthey serve.With an aging population facingthe reality of outliving their savings, asignificant number of individuals aresearching for ways to fund their independence and long-term-care needs.Life settlements might be the optionthat helps people uncover the liquidityneeded to solve other planning needs.An ancillary benefit would also contribute to the mental and financial freedomof the older generation’s adult children,who will not need to reallocate theirplanning dollars to fund their parent’sneeds. Instead, 40- to 60-year-olds willbe able to focus on their own planningneeds so that they can avoid the complicated consequences of outliving theirown financial plans.Informed people make betterdecisionsThe second question the Ashar Groupasked in its survey dealt with life insurance valuation. The survey askedrespondents, “When was the last timeyou suggested to your clients thatthey should get their life insuranceappraised?” 82% said: “Never.” 13% said: “Within the last sixmonths.” 5% said: “Within the last six weeks.”These answers indicate that the vastmajority of CPAs never suggest gettingan appraisal of the present value of alife insurance policy for any clients. Thesame is true for most fiduciaries, who donot feel qualified or obligated to discusslife settlements with their clients. Thismeans that there is often no one actingin a fiduciary adviser capacity on behalfof the client requesting an appraisalbefore the client decides to lapse or surrender a policy that he or she no longerwants or needs. This creates a void thatis being filled by life settlement providers/buyers marketing direct to consumers, none of whom owe a fiduciary dutyto the CPA’s client.The introduction to this articlenoted the significant increase in lifesettlement direct marketing to consumers and warned that “direct marketingexploits a crack in the chain of fiduciaryoversight and places senior clients in aposition where they might enter into acontract to sell their life insurance policyJune 2019 457

PERSONAL FINANCIAL PLANNINGwithout having any advocate at the tableto protect their best interests in the lifesettlement transaction.” This “crack inthe chain of fiduciary oversight” is morelike a massive sinkhole that far too manyseniors are falling into.CPAs and other fiduciaries who seetheir clients regularly most likely assumethat their client’s insurance adviser orsome other adviser is watching over policy performance and ordering appraisalswhen needed. This author’s experiencewould indicate that this is simply nottrue. Many of the seniors selling theirpolicies purchased them many years ago.In some cases, the insurance broker whowrote the policy is now either retiredor deceased. The same is likely true forthe clients’ CPA and attorney who wereinvolved when the policy was originallyissued. Usually, no insurance representative is following up on how the policy isperforming. The planning communityrefers to these as “orphaned policies”because there is no insurance specialistor anybody in a fiduciary relationshipwith the policy owner monitoring thesepolicies. Fiduciaries who could helpsenior clients are often unaware of thislack of representation and therefore donot get involved.Providers/buyers and their directmarketing surrogates are very awareof this “crack in the chain of fiduciaryoversight” and are taking it upon themselves to educate policy owners about lifesettlements. In the absence of fiduciaryrepresentation, providers/buyers hopeto engage policy owners before theylapse or surrender their policies so thatthey can purchase these policies at adiscount for institutional investors. AnInsurance Studies Institute poll revealedthat 50% of seniors are unaware of lifesettlements.11 This should be a red flagto fiduciaries who have senior clients.Seniors would be best served byfirst getting information about lifesettlements from their advisory team.Providers/buyers have no obligation todetermine what is best for the policyowner. The issue of suitability is notsomething that providers/buyers address since they are licensed only onthe buy-side. Advisers with a fiduciaryresponsibility to protect their client’sbest interests are in the best position toexplore hold, change, surrender, or selldecisions to determine if a life settlement makes sense in the first place. Ifthe decision is made to sell the policy,the adviser should contact a full-servicelicensed life settlement broker to designthe case and handle negotiations and theclosing process. Without proper representation, no competitive auction willoccur, and settlement payments made tounrepresented policy owners are oftensubstantially lower than offers resulting from the auction process controlledby a competent life settlement broker/fiduciary.Willing buyers changethe face of life insurancevaluationLife insurance is often one of a client’smost valuable assets and can be appraised just like any other valuable asset.Fiduciaries who advise their clients onfinancial matters such as the sale of abusiness, real estate holdings, fine art,or other valuable assets usually start byrequesting an appraisal from a qualifiedappraiser. The same process can be followed when working with clients whoneed to make hold, change, surrender,or sell decisions concerning their lifeinsurance. If a client needs to determinethe present value of his or her life insurance policy, the fiduciary should requestan independent appraisal from a lifesettlement broker who is a qualifiedappraiser. Brokers who produce qualified life insurance appraisals avoid anyconflicts of interest with the fiduciaries11. Siegert, “Portrayal of Life Settlements in Consumer Focused Publications,”SSRN.com (Sept. 10, 2009), available at ssrn.com/abstract 1558742.458 June 2019that use their services. Due diligence isnecessary when choosing a resource forqualified appraisals.Life insurance, especially UL insurance, has long been considered a hardto-value asset. This is no longer true.The life settlement marketplace hasmatured to a point where comparablemarket data are readily available. Brokerswho produce appraisals have defensiblereal-time market data available frommultiple providers/buyers who have beenforced to compete. These data have enabled the development of a life insurancevaluation methodology that accuratelyreflects the market. A market-basedsecondary market valuation (SMV)determines the FMV of an in-force lifeinsurance policy if it were to be sold onthe secondary market. The SMV is amark-to-market life insurance valuationthat incorporates individualized longevity analytics and conforms to the IRS’swilling buyer/willing seller definitionof FMV.Determining FMV for whole lifeand renewable term products is prettystraightforward. When universal lifeentered the picture, the calculation ofinterpolated terminal reserve (ITR)provided on Form 712, Life InsuranceStatement, became much more complicated. Each insurance carrier uses itsown formula to determine ITR, whichleads to inconsistent results. If a clientpurchased two identical UL products, onthe same date, from two carriers with thesame face value and premium payments,it is highly probable that years later, theForm 712/ITR calculations would varygreatly from one carrier to another.12Here is the problem: If these valuesvary so much, then which one is accurate? In the IRS’s eyes, they both are.The ITR value or PERC (premiumsplus earnings less reasonable charges)value is considered a safe harbor. However, when it comes to valuing UL and12. Buck and Leimberg, “Life Insurance Valuation: What Advisors Need toKnow,” LISI Estate Planning Newsletter No. 1638 (May 10, 2010).The Tax Adviser

annual renewable term products,many practitioners use an alternativevaluation such as SMV value.The following examples addressclients of different ages, health, and lifecircumstances and whether they shouldkeep their current life insurance policyor do a life settlement.Example 2 compares two valuecalculations.Example 2. Form 712/ITR value vs.SMV value:Planning objective: Determinethe SMV value of a 10.8 millionguaranteed no-lapse UL (GUL) policyselling from an individual estate to atrust.Case background: Female age 64, with substandardhealth. Life expectancy 11-13 years. Policy basis 2.73 million. CSV 0.The attorney involved contacted theinsurance carrier informally by phoneasking them to indicate what the ITRvalue would be if she ordered a formal712/ITR: The potential Form 712/ITRvalue was more than twice thepolicy basis. This figure seemedunreasonably high, so the attorneyordered a formal report of SMVvalue from a life settlement brokerwho is also a qualified life insuranceappraiser. The market-based SMVvalue 3.14 million. The SMV value was based onindividualized longevity analyticsfor the insured and then presentedto the market for providers to makecompetitive bids.Planning decision: The attorneyused the SMV as the foundation forchoosing an alternative value to theForm 712 value.Note: It is up to the attorneyto determine what value to use.Independent life settlement brokersdo not give legal advice or financialplanning advice.www.thetaxadviser.comUniversal lifeinsurance attractsinvestors because ithas a flexiblepremium structure,whichcan be manipulatedby investors tomaximize profit.Practice tip: Planners should neverorder a formal Form 712 without firstrequesting an estimated value andunderstanding the implications. Oncethe Form 712 is produced, its valuecannot be changed.Example 3. Fiduciary issue - trust-totrust sale:Planning concerns: There wasconcern over potential litigation fromfamily members when transferring fromtrust to trust and changing beneficiaries.The original trust would receive cashfrom the purchase of the life insurancepolicy. The policy would be placed inthe new trust for the new beneficiaries.The first trustee wanted the highestvalue; the second trustee wanted thelowest value.Planning objective: Determine theSMV value for a defensible transfer.Case background: Male, 82, with only age-relatedhealth conditions. 7 million GUL. CSV 2,260,129The attorney ordered a formal SMVReport to help substantiate FMV. SMV value 2.7 M.Planning decision: The originaltrust received a gift of 2.7M and thenew trust received the 7M policy forthe new trust beneficiaries.Example 4. Retiring business ownerextracts business term policy from the saleof the business:Planning objective: The retiring business owner’s business advisersuggested that her client determine ifthe business-owned term policy had anySMV value. The prospective buyer ofthe business had no interest in keepingthe term policy on the seller andmaking ongoing premium payments.(Note: Since life insurance is not notedon the business balance sheet, businessvaluation reports do not recognizeit. Knowledge of this fact can be anopportunity for the sell-side or the buyside depending on whom the attorney/adviser represents.)Case background: Male, 73, selling his business. 8 million business-ownedconvertible term insurance policy.Insured

provider/buyer is not the owner of any of the funds that it represents, and some providers aggregate policies for a portfolio they then sell in the ter-tiary market. The chart "Fiduciary Duties in the Life Settlement Process" shows who owes a fiduciary duty to whom in the life settlement process. On the sell-side, a life settlement