Transcription

ESTIMATES OF THE ECONOMICOF MOTOR VEHICLE ACCIDENTSAND HUMAN CONSEQUENCESIN VIRGINIA DURING 1980byJohn Regan, Jr.andAlden L. AtkinsGraduate Legal AssistantsDanielAReport Prepared by the Virginia Highway and TransportationResearch Council Under the Sponsorship of theVir:ginia Depirtme, nt of Transportation Safety(The opinions,report are those(Afindings, and conclusions expressedof the authors and not necessarilythe sponsoring agencies.)in thisthoseofVirginia Highway & Transportation Research CouncilCooperative Organization Sponsored Jointly by the VirginiaDepartment of Highways & Transportation andthe University of Virginia)Charlottesville, VirginiaOctober 1982VHTRC 83-R13

irman, Programs Director, Va. Dept. ofTransportation Safe yASH, JR., Chief of Police, Staunton, VirginiaBURGESS, VASAP Administrator, Va. Dept. of TransportaTionSafetyCLARK, Driver Services AdministraTor, Division of MotorDOUGLAS,VehiclesR.W.FAHY, Assistant Attorney General,Officeof theAttorneyGeneralJR., Program Manager, Div. of Management Analysisand Systems n.Supervisor, Driver Education, Dept. of EducationJOHNSON, JR., Field Supervisor--. West, Dept. of State PoliceMCALLISTER, Traffic Engineer, Va. Dept. of TransportationSafetyMCCARTY, Safety Program Coordinator, FHWAMCC0 MICK, Assistant District Engineer, VDH TMCDONALD, Project Director, Transportation Safety TrainingCenter, Virginia Commonwealth UniversityMCHENRY, Director, Bureau of Emergency Medical Services,JOHNSON,Dept. ofF.F.C.B.E.W.HealthHighWay Engineering Program Supervisor,STOKE, Research Scientist, VH&TRCT!MMONS, Director of Public Affairs, TidewaterVirginia, Norfolk, VirginiaSMALL,iiVDHgT AAof

ABSTRACTThepurposethis reportin two ways"ofis to describethecostof motorfirst, by identifying the costcomponents and quantifying them, and second by showing the severityof such accidents in terms of human suffering.Although many statistics are kept concerning the causes of motor vehicle accidents,This report identifies techfew are kept concerning the results.niques for estimating these statistics and points out the problemsassociated with each method.Alternative, and possibly more accurate, techniques are recommended for study.vehicleaccidentsThe report concludes that motor vehicle accidents cost theCommonwealth of Virginia over 800 million in 1980.Further, itshows that crashes are a leading cause of death for all Virginians,particularly for those younger than forty. Finally, it comparesmotor vehicle injuries with other accidental injuries, and itconcludes that those caused by motor vehicles are, in general, sig-nificantlymoresevere.iii

AC KN 0WLEDGEMENT SRichard Mapp, formerly a graduate legal assistant on theCouncil staff, is recognized for assembling much of the financialMany of theand medical data presented throughout this report.his efforts.incompleteitfortables would have beenhadnot been

SUMMARYi.MonetaryOFFINDINGSCostslosses from traffic accidents in VirginiaBecause this figure wasat least 800 million.derived with a conservative methodology, it probably understates the true extent of loss.Intotalled2.Human1980,Costs"FatalitiesOver one thousand Virginia ns died in traffic accidents1980.Motor vehicle accidents were the sixth leadingof death for all V irginians and the leading cause ofcausedeath for those between the ages of ten and thirty-four.during3.InjuriesA significant number of emergency room admittees aretraffic accident victims.Further, motor vehicle injuriesdisproportionatelycompared to other accidentalaresevereasinjuries; they accounted for one-third of the cases of paraplegia and quadriiplegia and half of the cases of brain damagesuffered during nwealthandintheVirginia impose significanthealthviiofhercitizens.costsupon

ESTIMATES OF THE ECONOMICOF MOTOR VEHICLE ACCIDENTSAND HUMAN CONSEQUENCESIN VIRGINIA DURING 1980byJohn Regan, Jr.andAlden L. AtkinsGraduate Legal AssistantsDanielPURPOSEThis research sought to specify and estimate components ofeconomic costs imposed by traffic accidents in Virginia.Specific attention was directed toward assembling estimates thatdo not appear in Crash Facts, the annual report on traffic lossespublished by the Virginia S ate Police. The research also focusedimpact of motor vehicle accidentsthehealth of Viron theginians. Lastly, it sought to identify, onfor use in future research,of financial and health data that are updated annually.sourcestheSCOPEresearch was designed to measure traffic accident costsfor one year.Future research will be directed towardmethodologiesand year-by-year comparisons of trafficaccuratemorelosses.The most recent year for which adequate data were available1980, and the report focuses on that year.wasTheinVirginiaMETHODOLOGYderiving monetary costs, the methodology used in thisreport paralleled that found in Accident Facts, a nationally recognized authority on accident costs ublished by the National SafetyCouncil.This report also suggests potentially more accurate methodologies. Because it focuses on Virginia, it places a premium uponinformation specific to this state.Various state and federal agencies supplied the bulk of the information.The health data were derived from fatality statistics solicitedfrom the Virginia Bureau of Vital Statistics and from injury statistics ob tained from a Virginia hospital and Virginia rehabilitationfacility.For

Throughout the report, it has been necessary to disaggregatereported figures by using percentage distributions from earlierepidemiological studies. Because these studies are not repeatedeachit mustyear,nificantly acts58,036 injured in "theOF tsig-ACCIDENTS1,045 peoplevehiclemotordokilled andwereaccidents that occurredestimates that thesein Virginia during 1980.That publicationAlthough theaccidents imposed an economic loss of 690,000,000.accident information is broken down in a number of ways, the economicRigorous analysis reloss is not divided into its component parts.quires that the separate components of economic loss be identifiedIn anand estimated before being summed to a single estimate.economicloss, cost figuresattempt to measure these components ofagencies.However,obtained from various state and federalwereintofiguresthosedownbecause these agencies rarely break therelated to motor vehicle accidents and those which are not estimations had to be based on figures and rates obtained elsewhere.Occasionally, these estimations are strained; in those places, anattempt has been made to explain why this estimation technique wasIt should bechosen and the problems arising from that ntheconservativethere are significantthe question of whatMany of the economic costs measured are notThe difference between a cost and acosts at all but transfers.transfer is that a cost results from an expenditure (or loss) ofresources, while a transfer is an exchange of resources from oneThus, a transfer has only distribusegment of society to another.tional effects.An attempt has been made to distinguish the transfers from the economic costs as well as to articulate the assumptions necessary for these transfers to reasonably estimate theThe description of the human costs given later helpsactual cost.However, beyond,conceptual problems.actually is a ppendix specifiesexactly what costs these transfers attempt to estimate and suggestsalternative, and. perhaps more accurate, approaches to measuring put this problemthesecosts.inperspective; however,an

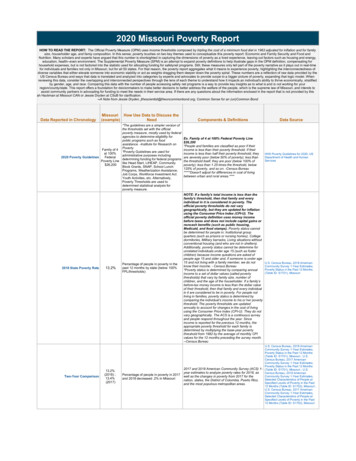

IndemnityLinesComnensationthroughi4 ofTableby PrivateInsurersi showtheinsurableinVirginia, 1980lossesVir-ginia's private and commercial motorists claimed during 1980. itmust be noted that these figures represent transfers from insurcompanies to people who suffered injury either to their perancethey do not represent true costs.However, theysonsor twocanonceareFirst, it must be assumed that the award an insurancemade.company pays accurately reflects the medical costs, costs to repairThisproperty, and lost wages of accident victims.or ssumesaway anyorcompensation; however, it is likely that the insurance industry astends to undercompensate injured claimants because of dea wholeductibles and because of the expense of suing for more.Second,the lost wages must accurately reflect the productivity lost wheninjured employee misses work. For this second assumption toanhold, the production function must be linear; hence, the marginalproductivity of labor is constant, in other words, a company of500 employees will have the same increase in output as a companyof 5,000 employees when each hires a single new worker.Becausepurchases insurance in order to be compensated in case ofoneinjury, these assumptions are consistent with the purpose of insurance.Tab le iTotalCostsof MotorVehicleIndemnity Compensation lisionBenefitss CompensationSecurity DisabilitySecurity SurvivorshipUncompensated Wage urers,LossesIncurred: ial Auto LiabilityPrivate Passenger Auto 0,00021,036,0001,769,000Costs-Insurances CompensationSecurity 355,184,0005,975,000114,000 845,300,000

the losses incurred and reported toprivate and commercial automobileliability policies in Virginia during 1980. (1) Lines 3 and 4,which show the losses incurred for collision policies, must bederived from physical damage losses reported to the Bureau ofInsurance.These figures include not only collision losses butalso payments for comprehensive policies.Because these paymentsthe result of such things as theft, fire, or vandalism, butarenot traffic accidents, the comprehensive losses must be subtractedLinestheBureaui and 2 representof Insurance foro t.The most accurate estimate available of the collision shareof physical damage insurance was provided by a representative ofA. M. Best Company, Inc., the organization that publishes Best,"sInsuranc e Aggregates and Averages. (2) The analyst totalled the'collision and phgSieal damage premiums received by ten New Yorkinsurers for their private passenger and commercial automobilepolicies, and he reported collision premiums as a percentage ofthe premiums for all physical damage.Although proprietaryinterests prevented the release of the companies' names, the analyst did report the highest and lowest percentages"76% andfor private passenger vehicles, 74% and 27% for con mercial vehicles.The weighted averages were S .6% for private passenger vehicles and64.1% for commercial ones.In order to estimate the collision shareof the physical damage figure, it must be assumed that the percentThere are two problems with this assumption"ages hold in Virginia.(i) because they are New York figures, they may not apply to Virginia; and (2) they may not be pagticularly accurate even for NewYork, since only ten companies were sampled and the variance washigh.TheBureauofInsurancereportsthat losses incurredpassenger automobilesduringfor physical damage to privatetotalled 150,120,000; multiplying this by 67.6% gives i01,481,000, theSimilarly, multiplying 64.1% by theamount reported in line 3.reported physical damages for commercial vehicles, 25,131,000,gives the amount shown in line 4, 16,109,000. Adding these tolosses incurred due to motor vehicle accidents during 1980 totalled 461,221,000.1980Work.men '.s,. Compensa,t!.onCompensation is a system created by Virginia statuteemployees injured in the course of their work. TheWorkmen' s Compensation Act, Title 65.1 of the Virginia Code, hasvery broad coverage and includes nearly every employee in the stateof Virginia.The Industrial Commission, whose primary purpose isWorkmen'stocompensate

the system, roughly estimates that it covers 97% ofVirginia's work force. The compensation paid is based on the employee's weekly wage; he receives two-thirds of his wage, with aminimum payment of 25% of the average weekly wage in Virginia andLike the insurance company payments, Workmen' sof i00%.a maximumCompensation payments are not actual costs but transfers. However, these payments can accurately estimate true costs if it isassumed that the worker's wages represent the productivity lostdue to his absence, one of the two assumptions made earlier.Another assumption must be made as well"that the total amount onereceives from Workmen's Compensation and private parties fully comThis assumption is consistent with the Workpensates his losses.men's Compensation Act, which calls for offsetting the rty tortfeasor'spayments.Industrial Commission divided work-related motor vehicleinto three categories"motor vehicle accidents, " "workeragainst object" and worker struc by objectIn the first,accidents.injuriesvehicleattributabletheto motorareDuring 1980, 1,442 workmen were awarded compensation totalling 2,490,773 for "motor vehicle accidents," and this amount, ( r un edto the nearest thousand, is the figure reported in line 5.This amount does not include the accident categories of "workerstruck by object" or "worker struck against object" because the Industrial Commission keeps no data concerning whether the object wasAn upper bound estimate of the Workmen's Compensaan automobile.tion figure can be made by using the national ratio of work acciMultiplying this by thedents caused by motor vehicles, 12.3%. (4)total number of awards in 1980, 35,887, gives 4,414 as an estimateSubtracting theof those accidents caused by motor vehicles.1,442 already classified as "motor vehicle accident" leaves a residual of 2,972, which would be divided into either of the otherIn 1980, 3,337 workers "struck by objects" weretwo categories.awarded compensation, and 3,850 received it for being "struckagainst object." Thus, of the 7,187 awards in both classifications,46.4% were "struck by object" and 53,6% were "struck against object."Allocating the 2,972 residual accidents by these percentages estimates that 1,379 were "struck by" and 1,593 were "struck against"Because the average awards in 1980 in these catemotor vehicles. i,058gories wereand 1,143, respectively, a total of 1,459,000under "worker struck by object" and 1,821,000 under "worke r struckagainst object" can be attributed to motor vehicle accidents. Adding these estimates to the lower bound estimate shown in line 5 ofTable i gives the upper bound estimate of 5,771,000.struckall of""

Security Paxmen,t sSocial6 and 7 represent the Social Security payments attribTo be eligible for Socialmotor vehicle accidents.Security payments, one must be either a worker or a dependent ofUnlikewho has become disabled for at least a year.a workerWorkmen's Compensation, the source of the disability need not bework.Once eligible, one's benefits are based on an annual averageof one's lifetime earnings, not counting his five lowest incomeSurvivorship benefits go toyears and corrected for inflation.dependents of killed workers. Unlike Workmen's Compensation,Social Security is not offset by third parties' payments; however,LinesutabletoCompensation payments. Social Securityinsurance and Workmen's Compensation,The assumptions previously made mustcosts.estimates are to accurately reflect true economicit is offset by Workmen'spayments, like those fromaretransfers,alsonotif theseholdcosts.The Social Security Administration reports both disabilitysurvivorship statistics on a regular basis. Table 2 showsdisability payments made in Vir ginia from July I, 1979, through30, 1980. Although the Social Security Administration doesit does recordnot record .the specific cause of one's disability,it by diagnostic classification.In 1976, the most recent year forwhich data are available, 5.3% of the Social Secur ity awards inVirginia were the result of accidents in general. (5) Assumingthat the amount of benefits does not vary with the cause, then 5. %of the total gives 17,551 000 as the amount attributable to acciThis assumption is consistent with the basis of the awardsdents.lifetime earnings rather than cause.Also, because the 5.3% isbased on people, newly awarded compensation during 1976, it must beassumed that this figure does not vary over time.This assumptionverifiedbediagnosticclassificationsdid notbecause thecannotinclude "accidents" prior to 1976 and also because accurate datafor later dates are not yet available.An underlying assumptionmust be made that those receiving benefits as a result of accidentsandtheJunereceivethemforthesamelength of timeasotherbeneficiaries.TableSocial Security DisabilityVirginia by Type of Receipt andJuly 1979 throughBeneficiaries inAmount of BenefitsJune 1980-Nu,,m, be,r ,of . R.ecipie.nts (6)66,074WorkersTo t al Benefi.ts.(7). 272,798,000Dependents(SpousesTotal&Children)43,194 58,357,000109,268 331,14 ,000

This amount must be reduced by the number of recipients whoseNeither the Social Seaccidents did not involve motor vehicles.curity Administration nor the National Safety Council keep theclear-cut statistics necessary for making a definitive estimate;however, upper and lower bounds of this estimate can be calculated.Table 3, derived from figures showing the average number of annualaccidental injuries occurring nationally from 1977 to 1979, showsthe percentage attributable to motor vehicle accidents by seriousof injury. (8)As can be seen from Table 3, the more seriousnessthe accident, the more likely it is that the accident involved aThe 50.1% shown for "deaths" is an appropriatemotor vehicle.it includes only the most serious accidents.boundbecauseupperbound is derived from data presented in Accidentestimates th motor vehicles caused 20% of'"al' '"'disabiing injuries" in 1980 (9) The 20% is an appropriate lower boundbecause Accident Facts defines a "disabling injury" as one whichdisables the'"victim beyond the day of the accident, a far lessstringent definition than the one year used by the Social ing each of these percentages by the 17,551,000 deearlier gives a lower bound of 3,510,000 and an upper bound 8,793,000. In the interest of a conservative estimate, line 6rivedofofTableipresentsthelowerofthetwo.Line 7 represents the survivorship benefits paid as a resultof motor vehicle deaths.The Social Security Administration reportsthat survivorship benefits paid in Virginia during fiscal 1980 toDividing this by 13,067, the number oftalledVirginians between 24 and 64 who died during 1980, gives an averagebenefit per death of 41,086.Because the survivorship benefitspaid in 1980 may be the result of deaths not only in 1980 but alsofor ones prior to that, it must be assumed that motor vehicles haveconsistently caused a constant proportion of Virginia's death .Thus, multiplying 41,086 by the number of people between 24 and 64who died in traffic accidents during 1980, 512, gives line 7 ofTable i, the share of Social Security survivorship benefits attributable to motor vehicle accidents. (II) 536,872,000.(i0)TablePercentageof1977Injuries Attributable toby Seriousness of Injuryto19 79 AnnualVehicles,Average,Inj urie,.SDeathsBed50.1%NationalMotorNo.t B,e pi, strictionRestrictionBut RequiringMedical Treatment6.75%4.76%

Unc omPensa.t.e d Wag eLossBy statute,those who receive Workmen's Compensation maythan two-thirds of thei wage, nor can theymeceive benefits fore the first week after the injury.The benefits must also be at least 25%, but no mome than i00% of theThe estimations assume thataverage weekly wage in Virginia. (12)these two limitations do not bias the proportion of one's wagesnot paid by Workmen's Compensation.Although the loss from thebenefit ceiling is likely to outweigh the gain fmom the benefitminimum, this bias is probably,insignificant. Thus line 5 ofTable 1 represents only a portion of the wages lost by people injured while womking, and line 8 repmesents the potation fore whichthey ame not compensated.Fore this to equal an economic cost,the assumptions made with the Womkmen's Compensation estimates tomytheworkemlosesone-third of his wage, an amount equal to one-half of the benefits-hemeceives.Dividing line 5 in half gives 1,272,000 as the costsimposed by the code' s first limitation.theloss imposed by the one-week limitation,in motor, vehicle accidents while workthe average weekly wage in Vir ) Itby should 5be noted that this amount,include the wage loss of those who return to workof their injury.Adding this to the loss alreadytotal uncompensated wage loss of 1 799 000.To calculate thenumber of peoplei, 2, must bemul.t l eding,ginia during 1980, 97 O00 doesnotseven dayscalculated giveswithinwageinjuredaearlier, this understates the true number of workmenwehicle accidents by those categories as either"worker struck by object" or "worker struck against object."Usingthe methoddescribed earlier, the upper bound of this estimate is 4,419,000, which is 2,650,000 greater than the lower bound figureAsinjurednotedin mo torin lineshown8 ststhe insurance administrative costof doing business and it is a partIt includes the cost of offices,equipment, and personnel. It also includes the profits earned byinsurance companies because it represents the "opportunity cost" ofmoney in insurance companies instead of other enterprises.Because mnsurance companies do not break down their administrativecosts between those associated with processing motor vehicle claimsand those from other types of policies, these costs must be estimated from data provided by the Bureau of Insurance.to. Accident Facts,insurance companies " costof the accident cost total. ''(14)is theinvesting,

doingtrative costsassumption isestimation, it must be assumed that the adminisdirectly proportional to the premiums paid. Thisarebased on premiums paid rather than losses incurred,because it is unlikely that a claim for twice as much as a secondclaim costs twice as much to process.It is based on premiums be Tin its charges to policyincludewillinsurancecausecompanyanholders of different types of insurance the expected costs ofadministering the policy. For this assumption to hold, it must alsoInthisassumed that there are neither economies nor diseconomies of scale;in other words, it costs a small insurance company the same amountto administer a particular policy as it does a large company.beTable 4 shows the costs reported to the Bureau of Insuranceby all domestic property and casualty insurance companies. (15) NetDividends are thoseincome is the after-tax profit to the firms.dividends paid to policyholders of mutual ins urance companies beThus, theythey are considered part owners of the company.causeincludedbec ause they representanalogous to profits and areareopportunity costs as well. These companies e arned 16,190,000 forprivate passenger liability policies, 1,94! , 000 for commercialnhv ica! damage,liability policies, and 7,593,000 and 684,0 00 for (IZ) discounted with the A.M. Best ratios used ear !ier.sumto 26,408,000, which is 42.3% of the 62,434 ,000 in total premiumsthey earned. TheseTab le 4AdministrativeCostsof All DomesticProperty andCasualty Insurers, 1980LossOther 5,840,000Expenses IncurredUnder riting Expenses14,417,0001,456,0007,651,000995,000Federal TaxesNet IncomeDividendsTotal Administrative 30,359,000Costsapproach must be used for foreign (non Virginian)insurance companies transacting business in Virginia.Table 5These companies reportedpresents their administrative costs.premiums of 399,123,000 for private passenger liability, 106,419,000 for commercial liability, 166,176,000 for privateA similarpassengerusing thecollisionA MBest(discountingratios)andout 8,the comprehensive portioni00 000 for commercial collision

TableAdministrativeCostsCasualty5Foreign Property andInsurers, 1980of AllLoss Expenses IncurredOther Underwriting ExpensesFederal TaxesNet IncomeDividendsOther Deductions 7,213,181,000Total Administrative 068,0001,232,251,0001,926,000(similarly discounted) policies in Virginia. Theim sum, 699,818,000 makes up 0.91% of their 76,171,484,000 in totalpremiums eaPned. Multiplying that by the total administrative 28,77 ,000 as the amoun attributable to automocostsbiles. 17)Adding that to the already derived figuPe for domesticcompanies gives . 355,1ag,000, he amount how in line 9 ofTable ivesW0. men's. Compensation Administrative. Costsautomobile insurance, the costs of administeringCompensation must be included. Similar estimationproblems arise as well, since the costs of administering Workmen'sCompensation are not reported by type of accident. Theme are twothe first to private insurers who writecomponents to this cost"the insurance policies, and the second Zo the sZate of Virginia.To do this estimate it must be assumed that these Workmen'sCompensation claims for automobile injuries cost the same toAswithWorkmen'sprocessasothertypesofclaims.To calculate the costs to the private insurers, the sametechnique is used as in the calculations for line 9 of Table i.Domestic insurers earned 5 788,000 in premiums for Workmen'sCompensation policies in 1980, and this is 9.26% of the 82, 8 ,000Multiplying this by 80,859,000,in otal premiums, earned. (18)the total domestic administrative costs derived earlier in Table ,gives 2,811,000 as the share attributable to Workmen's Compensation.Similarly, the 288,188,000 earned by foreign insurersfor Virginia Workmen's Compensation policies make up 0.87% of the 76 ,171, 8 000 total premiums they earned.Using Zhis to apportionthe total foreign administration costs derived in Table 5, 6,129,189,000, gives 18 ,678,000 as the share for Workmen'sCompensation. Summing these figures gives i 8, 89,000 as the total,I0

private insurersof administering Workmen's Compensation.this amount represe nts the administrative costs associatedwith all work-related accide nts in Virginia, not merely accidentsin motor vehicles.In 1980, the 1,469 motor-vehicle-related awardscomprised 4.09% of the 35,88 7 total awards made in Virginia. Multiplying this by the private insurers total administrative costsgives 5,582,000 as the amou nt attribut able to motor vehicle accidents.The upper bound is f ound using the na tional r ate of wor kaccidents involving motor ve hicles, 12. 3%. (19)This gives 16,788,000 as the upper bou nd estimatecoststoHowever,of Virginia also incurs costs because the Industrialpurpose is to administer the Workmen's Compensation1980 to 1982 budget of 6,385,400 represents the costsof administering the system for two fiscal years.I20)Assuming thatthe costs in the second year are no greater than in the first, thenthe costs in 1980 are 3,193,000.Multiplying this by the 4.09%gives 131,000 as the amount attributable to motor vehicle accidents,with an upper bound of 393,000.Adding this lower estimate to thelower bound estimate of private insurance costs gives the amountreported in line i0, 5,975,000.ThestateCommission'sItssystem.Social Sec.u.rity, Admini.str, atiye, Co.s.t The final component of administrative costs is that arisingfrom processing Social Security.In calculating this cost, it mustbe assumed that the assumptions made earlier when estimating theSocial Security figures still holdand that claims arising fromvehicleaccidentsmotorcost the same to process as other claims.In fiscal 1980, it cost 1.77% of the amount of benefits paidadministerthe 01d Age and Survivorship Insurance, and 2.19% totoadminister the Disability Insurance Program. (21)Mu itiplying thesurvivorship estimate in line 7 of Table i by 1.77% gives 37,000,and doing the same with the disability figure in lin e 6 and 2.19%gives 77,000. Their sum, 114,000, is the amount r eport ed inline II.It must be remembered, however, that this is a lowerUsing the upper bound of the disability paymentsbound estimate.estimated earlier shows that the Social Security administrativecostsdonotHUMAN 230,000.exceedCOSTSOFVIRGINIA'SMOTORThus far, the losses imposed bymeasumed in strictly monetary scanhavealsobeenbe

in thefamilies.measumedtheirsightofpainandsuffering bomne by accident victims andand cents, one losesanguish associated with Zhe amputations,By emphasizing dollarsanddeaths wrought by traffic accidents.The humanconsequences of motor vehicle accidenZs will be shown in two ways.First, death statistics show that motor vehic]'e accidents are amajor cause of death for all Virginians, dispmoportionately sofor younger people.Second, hospital emergency room data showthat injuries due to motor vehicle accidents are significantlythan those due to other causes.As a result, it thetraumaor.DeaZh.s F.ro.m. M.o tor Vehicl.e. Ac.cidents. 0mpared.toOtherof DeathCausesEach year, the Virginia Bureau of Vital Statistics tabulatesresidents' deaths by cause and age,Overall, 2, 96 Virginia residents died in 1980, 1,081 of them in motor vehicle accidents. (22)As Table 6 shows, motor vehicle accidents were the sixth leadingcauseofdeath.6TableLeadingofCausesVirginia Residents' Deaths, 1980RankNumberCauseCardiovasculardisease otherthan strokeCancer(cerebrovascular disease)Strokeand influenzaPneumoniaChronicobstructiveMOTOR Chronici0All691mellitusliverConditio

ACCIDENTS The 1980 Crash Facts shows that 1,045 people were killed and 58,036 injured in "the ii6,382 motor vehicle accidents that occurred in Virginia during 1980. That publication estimates that these accidents imposed an economic loss of 690,000,000. Although the accident information is broken down in a number of ways, the economic loss is not