Transcription

COVID-19 RELIEFPA STATEWIDE SMALL BUSINESSASSISTANCE PROGRAM

CDFI GUIDELINESUPDATED 08/05/20

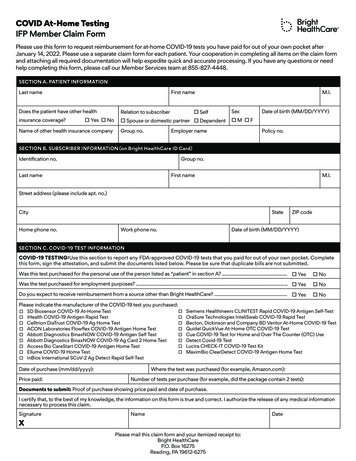

1PROGRAM OVERVIEW1. 225 million of funding designated by the PA Department of Community andEconomic Development will be administered by the Pennsylvania CDFI Network.2. 200 million is allocated for grants to small businesses 100 million allocated for historically disadvantaged businesses 100 million allocated for other small businesses3. 25 million is allocated to Pennsylvania CDFI Network members for support of loanloss reserves and to process portfolio loan deferrals. The process for LLR and loandeferrals is in development and will be outlined in separate procedures.4.The program is not a “first come, first served” basis. The application portal will openfor a specific period of time determined by the Network.5.CDFIs will conduct outreach and marketing to ensure small, vulnerable anddisadvantaged businesses have access to the grant application platform.6.CDFIs will provide technical assistance to business owners during applicationpreparation and online submission.7.Once applications are received, Lendistry will process applications based on theNetwork approved rating method set forth below.8.A six-member review committee of Network designees will approve the final list ofbusiness grant recipients for each round of funding.9.Lendistry will fund grants to approved businesses.10. Businesses will be required to provide certifications regarding accuracy andtruthfulness of information submitted in the application. CDFIs must be aware ofsuch certifications outlined in these guidelines.WE SUPPORT SMALL BUSINESSES INPENNSYLVANIAThis grant provides funds up to 50,000 to small businesses in thestate of Pennsylvania that have been impacted by COVID-19.

2PROGRAM ELIGIBILITY1. Grants of 5,000 to 50,000 are available for small businesses that havebeen negatively affected by the COVID-19 pandemic and relatedstatewide business closure. Funding tiers are listed below.2. Grants are available only for businesses with annual revenues (prior toMarch 1, 2020) of 1 million or less and have 25 or fewer full-timeemployees (FTEs). (Revenues are based on the IRS tax form definition:Gross Sales (less any returns and allowances) as reported on Line 1.c. onboth the 1120 (corporate return), 1120S (S-Corp return), and on IRSSchedule C for single member LLC's and sole proprietorships, Line 3.3. Eligible businesses must operate primarily in Pennsylvania and must file aPennsylvania tax return. Applicants will self-certify that 51% or more ofrevenues are generated in PA.4. Eligible businesses may be structured as C-corporations, S-corporations,limited liability corporations, sole proprietors, independent contractors orself-employed individuals.5. Businesses must have must have been in operation as of February 15,2020.6. Businesses must currently be operating or have a clear plan to re-openonce the Commonwealth permits re-opening of the business.

3PROGRAM PRIORITIES1. Primary Priority will be given to: Historically disadvantaged businesses are defined as businesses that are51% or more owned and operated by people identifying as AfricanAmerican, Hispanic, Native American, Asian American or Pacific Islander(based on the US CDFI Fund definition of individuals historically lackingaccess to financial services.) Businesses owned and operated by low and moderate income businessowners. Low and moderate income business owners are defined as thosewith a total household income of 80% or less than the county MedianFamily Income, based on the US Census Bureau’s 2018 AmericanCommunity Survey (2018 ACS) or HUD 80% of Median HouseholdIncome. Businesses located in rural communities and disadvantaged areas definedas U.S. CDFI Fund Investment Areas including those located incommunities experiencing higher than average poverty rates, lowerincome (less than 80% of area median), higher than averageunemployment rates and/or high population loss. Certain industry sectors including retail, food and hospitality, health andwellness, personal care (beauty/nail salons, spas, and barbershops), andchild care and adult day care. Businesses impacted the most financially based on gross revenue losses.2. Secondary Priority will be given to: Women-owned businesses Businesses operating in communities participating in one of the followingdesignated revitalization programs including: an active Main StreetProgram or Elm Street Program, a town in the Trail Town Program , atown located in the PA Wilds , or designated commercial corridors inPhiladelphia, and Neighborhood Business Districts in Pittsburgh.

4GRANT FUNDING STRUCTUREThe Emergency Fund includes the following eight (8) CategoriesOwners of multiple businesses will be considered for only one grantRELIEF PROGRAMELIGIBLE BUSINESSESAMOUNT AVAILABLEPER BUSINESSMicro Business GrantAnnual revenueup to 50,000 5,000 GrantMicro Business GrantAnnual revenue 50,001 - 75,000 10,000 GrantMicro Business GrantAnnual revenue 75,001 - 100,000 15,000 GrantSmall Business GrantAnnual revenue 100,001 - 250,000 20,000 GrantSmall Business GrantAnnual revenue 250,001 - 500,000 25,000 GrantSmall Business GrantAnnual revenue 500,001 - 750,000 35,000 GrantSmall Business GrantAnnual revenue 750,001 - 850,000 40,000 GrantSmall Business GrantAnnual revenue 850,001 - 1,000,000 50,000 Grant

51.ELIGIBLE USES OF FUNDSPayroll costs, costs related to the continuation of group health care benefits duringperiods of paid sick, medical, or family leave, and insurance premiums.Working capital for the purpose of paying mortgage principal and interest payments (butnot mortgage prepayments); and principal and interest payments on any other debtobligations that were incurred before February 15, 2020.Rent payments, utility payments.Working capital for the purpose of covering the costs of re-opening business operationsafter being fully or partially closed due to the state-mandated business closure periodcommencing March 2020, as long as the expense was incurred do to COVID-19.Any expenses (costs) incurred related to the expense of implementing COVID-19,including but not limited to specialized equipment, barriers, PDE’s, and employeetraining expense to ensure compliance with state and federal CDC guidelines forreopening.Any Covid-19 related expenses not already paid for with other relief measures such asstate grants or loans, US SBA Paycheck Protection Loans, local or regional grant and/orloan programs.2.3.4.5.6.6REQUIRED DOCUMENTATIONPA CARES DOCUMENTATION CHECKLISTMost recent tax return filed (2019 or 2018) – must be in an electronic form for onlineupload, such as PDF.If the applicant was a startup in 2019 and has not yet filed taxes, a managementprepared statement of revenue and expenses as of December 31, 2019; must be inan electronic form for online upload, such as PDF.If the applicant is a startup as of January 1, 2020, a profit and loss statement as of3/31/20 - must be in an electronic form for online upload, such as PDF.Copy of official filing with theDepartment of State or localmunicipality for your business such as:(one of the following); must be providedin electronic format for upload, such asPDFArticles of IncorporationCertificate of OrganizationFictitious Name RegistrationGovernment-Issued Business LicenseAny form of acceptable government-issued photo ID; must be in an electronic formfor online upload, such as PDF.Applicant Certification: CLICK HERE TO DOWNLOAD THE ELECTRONIC FORM

7INELIGIBLE BUSINESSES1.Businesses that are not physically based in Pennsylvania2.Businesses that are in active default (not on a payment plan) with taxes or fees owed to thefederal government or Commonwealth3.Businesses engaged in any activity that is illegal under Federal, state, or local law4.Businesses owned or controlled by any owner that has ever obtained a direct or guaranteedloan from the State of Pennsylvania or any Federal agency that is currently delinquent or hasdefaulted within the last seven years and caused a loss to the government.5.Non-Profits, Churches and other religious institutions6.Financial businesses primarily engaged in the business of lending, such as banks, financecompanies, and factors7.Passive real estate companies and investors who file a Schedule E on their personal taxreturns are not eligible. Real estate businesses in which the majority ( 51%) of their income isrental income are also not eligible8.Life insurance companies9.Private clubs and businesses which limit the number of memberships for reasons other thancapacity10. Government-owned entities or elected official offices11. Businesses primarily engaged in political or lobbying activities12. Businesses engaged in any illegal activity, socially undesirable or those that may beconsidered predatory in nature, such as pawnshops, rent to own, check cashing businessesand adult bookstores13. An owner of 20 percent or more of the equity of the applicant is presently incarcerated or, forany felony, presently subject to an indictment, criminal information, arraignment, or othermeans by which formal criminal charges are brought in any jurisdiction; or has beenconvicted of, pleaded guilty or nolo contendere to, or commenced any form of parole orprobation (including probation before judgment) for, a felony involving fraud, bribery,embezzlement, or a false statement in a loan application or an application for federal financialassistance within the last five years or any other felony within the last year

APPLICANTCERTIFICATIONHOW TO DOWNLOADAND COMPLETE THE FORM

1APPLICANT CERTIFICATIONCLICK THE LINK TODOWNLOAD THEELECTRONIC FORMINSTRUCTIONSBefore starting a new grant application, locate the ApplicationCertification in the box labeled IMPORTANTINFORMATION. To download the form, click [DOWNLOADHERE]. This is a required document for your grantapplication. You will need to upload it to the Portal duringStep 13: Upload Documents ofUrthe application process. Youcan also download the form by CLICKING HERE.NOTE: This is an electronic form and can be completed andsaved on your computer, laptop, tablet, or other mobiledevices.

COVID-19 Relief Pennsylvania Statewide Small Business Assistance ProgramBusiness Owner CertificationsThe Pennsylvania CDFI Network, as program administrator for the COVID-19 Relief PennsylvaniaStatewide Small Business Assistance Program (Program), may rely on Business Owner (Applicant)certifications for use of funds, business eligibility, owner information and financial information for boththe business and the owner, for all information that was submitted as any part of its grant application orfinal grant agreement documentation. Applicant must make this certification in good faith, taking intoaccount their current business activity and their ability to access other sources of liquidity sufficient tosupport their ongoing operations in a manner that is not significantly detrimental to the business.If the Applicant uses grant funds for unauthorized Program purposes, the Commonwealth ofPennsylvania will direct the Applicant to repay those amounts. If Applicant knowingly uses the funds forunauthorized purposes, Applicant will be subject to additional liability, such as charges for fraud. If oneof the Applicant’s shareholders, members, or partners uses grant funds for unauthorized purposes, theCommonwealth will have recourse against the shareholder, member, or partner for the unauthorizeduse.An authorized representative of the Applicant must certify such compliance under penalty of perjuryand fines pursuant to 18 Pa. C.S. § 4904 (relating to unsworn falsification to authorities) to all of thebelow.ENTER YOUR INITIALS HEREBy signing this document you acknowledge you are certifying to each of the following statements:The Applicant’s business selected for funding in this Program was in operation on February 15,2020 and, if required, paid income taxes to the state and federal government, as reported on individualor business tax returns.Applicant’s business operations are conducted primarily in Pennsylvania, defined as no less than51% of annual business revenues (pre-COVID) were generated by sales and services conducted inPennsylvania. Applicant confirms that such revenues are reflected on its most recently filedPennsylvania tax return.COVID-19 has had an adverse economic impact on the Applicant’s business, and makes thisgrant necessary to support the ongoing operations of the Applicant.The grant will be used only to cover COVID-19 related costs incurred between March 1, 2020and December 30, 2020. Applicant acknowledges that if the funds are knowingly used for unauthorizedpurposes, the state and federal government may hold Applicant’s business owner(s) legally liable, suchas for charges of fraud.During the period beginning on June 1, 2020 and ending on December 31, 2020, the Applicant’sbusiness selected for funding in this Program has not and will not receive another grant under theCOVID-19 Relief Pennsylvania Statewide Small Business Assistance Program.Page 11 of2

ENTER YOUR INITIALS HERENOTE:COMPLETEThe Applicant’s business has been and remains in compliance with all relevant laws, orders, andALL FIELDS ONregulations during the period of the COVID-19 disaster emergency under the Pennsylvania Governor’sproclamation dated March 6, 2020, and any and all subsequent renewals. The foregoing includes, but isTHE FORMnot limited to, orders by the Governor, Secretary of Health, or other commonwealth officialsempowered to act during the emergency. Any noncompliant business will be ineligible for fundingunder TOPRIORthis program and may be required to return all, or a portion, of the funds awarded.UPLOADINGI understand that I am ineligible to receive funding under this COVID-19 Relief Statewide SmallBusiness Assistance Program if I, or any owner of 20 percent or more of the equity of the applicant, ispresently incarcerated or, for any felony, presently subject to an indictment, criminal information,arraignment, or other means by which formal criminal charges are brought in any jurisdiction; or hasbeen convicted of, pleaded guilty or nolo contendere to, or commenced any form of parole or probation(including probation before judgment) for, a felony involving fraud, bribery, embezzlement, or a falsestatement in a loan application or an application for federal financial assistance within the last five yearsor any other felony within the last year.By executing this Business Certification, I hereby authorize the Pennsylvania CDFI Network andits authorized representative (Lendistry) under the COVID-19 Relief Pennsylvania Statewide SmallBusiness Assistance Program to request access to, and review of, the Applicant’s Pennsylvania state taxreturns and tax return information. I hereby warrant that I am an authorized representative of theApplicant and have full authority to waive confidentiality under Pennsylvania law and authorize releaseof this information. I authorize the Pennsylvania Department of Revenue (the Department) to releaseconfidential information in the possession of the Department, including but not limited to methods suchas phone discussions, mail, facsimile, e-mail or other electronic means, and release the Departmentfrom liability for said disclosure.As Applicant, I further certify that the information provided in the grant application submittedfor this program and the information provided in all supporting documents and forms is true andaccurate in all material respects. I understand that knowingly making a false statement to obtain a grantfrom the State of Pennsylvania is punishable under state and federal law, including under 18 USC 1001and 3571 by imprisonment of not more than five years and/or a fine of up to 250,000; under 15 USC645 by imprisonment of not more than two years and/or a fine of not more than 5,000; and, ifsubmitted to a federally insured institution, under 18 USC 1014 by imprisonment of not more than thirtyyears and/or a fine of not more than 1,000,000.As Applicant, I acknowledge that the Pennsylvania CDFI Network will confirm the eligible grantamount using tax documents I have submitted. I affirm that these tax documents are identical to thosesubmitted to the Internal Revenue Service. I also understand, acknowledge, and agree that thePennsylvania CDFI Network and its authorized representatives can share the tax Information with stateand federal authorized representatives for the purpose of compliance with federal and state grantrequirements and reviews.Signature of Business OwnerDateSIGN AND DATEPage 12 of2

ENTITY DOCUMENTSEXAMPLES

Entity #: 4006460Date Filed: 01/27/2011Carol AicheleActing Secretary of the CommonwealthINC AlPENNSYLVANIA DEPARTMENT OF STATECORPORATION BUREAUArticles of Incorporation-For Profit(15 Pa.C.S.).Bus.iness-stocl (§ 1306)Business-nonstock (§ 2102)Business-statutory close(§ 2303)Cooperative(§ 7102)·Entity NumberM a n a g e m e n t ( § 2703)Professional (§ 2903)I n s u r a n c e ( § 3101)Document will be returned to thename and address you enter to the leftNameI.N.C. Corporate ServicesAddressr-- c:::,45-04 162ndStreet, Suite 205CityFlushlngStateNYZip Code11358Fee; 125Commonwealth of PennsylvaniaARTICLES OF INCORPORATION 3 11111111111T1102865038'In compliance with the requirements of the applicable provisions (relating to corporations and unincorporatedassociations), the undersigned, desiring to incorporate a corporation for profit, hereby states that:1. The name of the corporation (corporate designaJ.or required i.e., "corporation'',· incorporated", "limited"''company" or any abbreviation. "Professional corporation" or "P.C''):JW APPLE CLEANERS CORP.2. The (a) address of this corporation's current registered office i.nthis Commonwealth (post qffice box, alone, is notacceptable) or (b) name of its commercial registered office provider and the county of venue is;, (a) Number and Street260 North Sycamore StreetCityNewtownStatePAZip18940(b) Name ofCommei:cial 'Registered Office Providerc/o:3. The corporation is incorporated under the provisions of the Business Corporation Law of1988.·4. The aggregate number ohhares authorized: 200No Par ValueCountyBucksCounty

01/27/201111:22INC /3l01/7102A-2S. The name and address, including number and street, ifsign below):any, of each incorporator (all incorporalors mus/NameAddressH. Don Ahn, lncorporator45-04 162nd Street. Suite 205, Flushing, NY 113586, The specified effective date, if any:month/day/year hour, if any7. Additional provisions ofthe articles, if any, attach an 8½ by 11 sheet8. S/olutory close corporation only; Neither the corporation nor any shareholder shall make an offoring of any ofits shares of any class that would constil:ute a "public offering'' within the meaning of the Securities Act of 1933(15 U.S.C. 77a et seq.)9. Cooperative corporations only: Complete and strike out inapplicable term:The common bond of membership among its members/shareholders is:TESTIMONY WHEREOF, the incorporator(s)has/have signed these Articles of Incorporation thisIday of January2011SignatureSignature03

BUSINESS LICENSE

CERTIFICATE OF ORGANIZATIONEntity# : 6774505Date Filed : 09/21/2018Pennsylvania Department of StatePENNSYLVANIA DEPART!\IENT OF STATEBUREAU OF CORPORATIONS AND CHARITABLE ORGANIZATIONSDCertificate of Organization DomesticLimited Liability CompanyReturn document by mail to:MARSHASlHA-:-JameDSCB 15-882l(rev. 212017)17350 STAIE HWY 249. STE 1IIIIIIIIIIZip CodeReturn document by email to:8821Read all instructions prior to completing. This form may be submitted online at https:··www.c01:porations.pa.Qov·.Fee: 125.00I qualify for a veteran/reservist-owned small business fee exemption (see instructions)In compliance with the requirements of 15 Pa.C.S. § 8821 (relating to certificate of organization), the undersigned desiringto organize a limited liability company, hereby ce11ifies that:1.The name of the limited liability company (designator is required, i.e., "company", "limited" or "limited liabilitycompany" or abbreviation):DUCOR FINANCIAL SERVICES LLC2.Complete part (a) or (b) - not both:(a) The address of the limited liability company's initial registered office in this Commonwealth is:(post office box alone is not acceptable)212 S 52ND STPHILADELPHI PAA19139PhiladelphiaNumber and StreetCityZipCountyState(b) name of its commercial registered office provider and the county of venue is:c/o:CountyName of Commercial Registered Office Provider3.4.The name of each organizer is (all organizers must sign on page 2):NameAddressMARSHASIHA17350 STATE HWY 249, #220, HOUSTON, Out OfState TX United States 77064Effective date of Statement of Registration (check, and if appropriate complete, one of the following):DThe Certification of organization shall he effective upon filing in the Dept of State.The Certification of organization shall he effectiveaton:Date(MM/DD/YYYY)PENN File: September 21, 2018Hour (if any)

DSCB: 15-8821-25.Restricted professional companies only.Check the box if the limited liability company is organized to render a restricted professionalservice and check the type ofrestricted professional service(s).DThe company is a restricted professional company organized to render the following restricted professionalservice(s): 6.DentistryLawMedicine and surgeryOptometryOsteopathic medicine and surgeryPodiatric medicinePublic accountingPsychologyVeterinary medicineBenefit companies only.Check the box immediately belowif the limited liability company is organized as a benefit company:This limited liability company shall have the purpose of creating general public benefitOptional specific public benefit pu rpose.Check the box immediately below if the benefit company is organized to have oneor more specific public benefits and supply the specific public benefit(s).See instructions for examplesof specific public benefit.This limited liability company shall have the purpose of creating the enumerated specific public benefit(s):7.For additional provisions of the certificate, if any, attach an 8½ x 11 sheet.IN TESTIMOI"lry \VHEREOF, the organizer(s) has (have) signed this Certificate of Organization this.11 day of September, 2018 .MARSHA SIHASignature

FICTITIOUS NAME

APPLICATION PROCESS

1START A NEW APPLICATIONINSTRUCTIONSTo begin your application, click [APPLY NOW].NOTE: Please use Google Chrome for optimal web browserexperience.

2LET’S GET STARTED WITH YOUR APPLICATIONINFORMATION NEEDED First NameLast NameE-mailPhone NumberBusiness NameZip Code of BusinessIf you’d like toreceive text messageupdates on yourgrant application,read the SMS/TEXTPolicy and check thebox to agree. If you’dlike to opt out of thisfeature, leave thebox unchecked.

3OWNER DETAILS2INFORMATION NEEDED Owner First NameOwner Last NameOwner E-mailOwner Address City, State, Zip Code, and CountyOwner BirthdayOwner Social Security% of OwnershipCheck the box toacknowledge thatyou have read andagree to the Termsand Conditions. Youmust agree in orderto move forwardwith your grantapplication.

4BUSINESS INFORMATIONINFORMATION NEEDED Business NameDBA (if applicable)Business EINBusiness Phone NumberBusiness TypeState of IncorporationBusiness Address, City, State, Zip Code, and CountyBusiness Start DateBusiness Website

5HOW CAN WE HELP?INFORMATION NEEDED Purpose of GrantAmount RequestedWill this Grant create new jobs?Annual Revenue# of Full-Time Employees# of Part-Time Employees# of Jobs Created# of Jobs RetainedNOTE:The form field,AMOUNTREQUESTED, is basedon your annualrevenue. To check thegrant amount you arequalified for, click[CHECK ELIGIBILITY]and locate youreligible amount. Youmay only request theamount you areeligible for.

6BUSINESS DEMOGRAPHICSINFORMATION NEEDED Who is your customer base?What does your business do? What type of business isit? (TIP: View page 18 for a list of business types)Tell us more.NAICS CodeWomen Owned ?Rural?Don’t know yourNAICS Code? Clickthe following link tofind it.

WHAT DOES YOUR BUSINESS DO?MANUFACTURERSELLING PRODUCTSERVICECONSTRUCTIONTRANSPORTATIONIt Grows, Builds, and/orManufactures Something orMultiple ThingsIt Sells Products to People orBusinesses (including food andlodging)It Provides a Service to People orBusiness (Including Healthcare)ConstructionTransportation/ Communication/Electric/ Gas/ SanitaryWHAT TYPE OF BUSINESS IS IT? Food ProductsMeat and DairyCanned, Frozen and PreservedProductsGrain MillBakery, Sugar, Fats and OilsBeveragesOther ProductsTextileFabric Mill (Cotton, wool, silk &other)Knitting MillDyeing and FinishingCarpets and RugsYarn and Thread Wholesale - Durable"Motor Vehicles"Technology Services"Furniture and Fixtures"Lumber and other constructionProfessional and CommercialEquipmentMetals and MineralsMachinery & sale - Non-DurablePaper & Paper ProductsApparelGroceries & Related ProductsFarm ProductsChemical and PetroleumBeer, Wine and Distilled EntertainmentFull Service RestaurantLimited Service RestaurantFranchiseFull Service Bar/LoungeBar/lounge includingentertainmentInsurance/Real EstateIndependent Insurance CarriersInsurance Agent/Broker/ServiceReal Estate OperatorsReal Estate Agent/Manager Personal ServicesLaundry/cleaning/GarmentPhotographic and PortraitBeauty/Barber/NailShoe repairFuneral Services PrintingCommercial PrintingManifold Business FormsGreeting cardsService industries for printingtradeMiscellaneous Business ServicesAdvertisingReporting AgenciesServices to dwelling and otherEquipment rental and leasingPersonal supply servicesComputer/technology related Rubber, Plastic, Leather/GlassTires/tubes/hoses/beltingsPlastic productsAny leather goodsGlass and other glass products Auto Repair and ServicesRentalParkingServices (except repair)Repair Amusement and RecreationDance StudiosTheater and BandBowlingCommercial sports Health ServicesOffices and clinicsNursing and personal careHospitalsMedical and dental labsHome health care services ccountingMgmt and Public relations Furniture and FixturesHousehold FurnitureOffice FurniturePublic Building and RelatedOffice and Store FixturesCement/Clay/Stone/MetalAny cement productAny Clay productAny stone productFabricated Metal productIndustrial/Commercial Machineryand Computer Equipment Transportation Farm and Garden Construction and Metalworking Medical Computer and Office Refrigeration Electronic/Electrical(includingHousehold appliances,lighting,A&V) General ContractorSingle FamilyResidential - other then SingleIndustrial/WarehouseNonresidential - other thenindustrial Retail TradeBuildingMaterials/Hardware/Garden/Mobile HomesGeneral MerchandiseFood and GroceryAutomotive Dealers andGasolineApparel and accessoryHome furniture, furnishings andequipmentPharmacy Hotels/Camps and LodgingHotels/Motels and BoardingHousesCamps and RV ParksLodging Houses ApparelMens, Women's, childrenHats and CapsMiscellaneous Apparel andaccessoriesMiscellaneous FabricatedTextile Special Trade ContractorPlumbing, heating, AirconditioningPainting and Paper HangingElectricalMasonary, Stonework, Tile andplasteringCarpentry and Floor WorkRoofingConcreteOther Special Trade ContratorTransportationRailroadLocal and suburbanTransportationBuses (all)Motor Freight Transport andWarehousingWater TransportationAir TransportationTransportation Services(agencies, operators, etc) CommunicationsTelephoneRadioCable Electric/Gas/SanitaryElectrical servicesGas Prodcution and DistributionWater SupplySanitary ServicesSteam and Irrigation

7DISCLOSUREINSTRUCTIONSTo see if your business operates in a designatedrevitalization area for Question #2, click [CHECKELIGIBILITY] and locate your business area.Once you have completed all fields for the Disclosures,click [SUBMIT] to complete your application.

8CONFIRMATIONNOTEYou will not be able to edit your applicationonce it has been submitted.1. If you would like to finish your application at another time,click [SAVE & CONTINUE LATER].2. If all of the information provided is correct and you wouldlike to complete your application submission, type in YES andclick [CONTINUE].TO FINISH YOURAPPLICATION LATERTO COMPLETE YOURAPPLICATION SUBMISSIONTYPE “YES”LEAVE BLANKLEAVE THE FIELDBLANK AND CLICK[SAVE & CONTINUE]TYPE IN “YES” ANDCLICK CONTINUE]

9CONFIRMATIONINSTRUCTIONSYou will receive the following message when yourapplication has been successfully submitted.Please check the email address that you entered in the“let’s get started with your application” section of thegrant application for your username and password to ourPortal.You will need to activate your account using the assignedlogin in order to upload the required documents for yourgrant application.

10ACTIVATE ACCOUNT AND CHANGE PASSWORDMUST BE A MINIMUMOF EIGHTCHARACTERS (1-9, a-z,A-Z, !@# % &*)INSTRUCTIONSActivate your account by clicking [CLICK HERE TOLOGIN]. Use the username and password that is assignedto you in the confirmation email.Once you login, you will be prompted to reset yourpassword for your privacy. Your new password must havea minimum of eight characters (1-9, a-z, A-Z), whichincludes one special character (!@# % &*).

11UPLOAD DOCUMENTS & BANK INFOUPLOAD DOCUMENTSAND CONNECT BANKACCOUNT.INSTRUCTIONSOnce logged into the Portal, click [UPLOAD DOCUMENTS& BANK INFO] to submit the required documents and linkyour bank account.

12CHOOSE BUSINESS TYPECHOOSE YOURBUSINESS TYPEBUSINESSTYPESChoose from thefollowing businesstypes:CLICK [YES]TO CONFIRMA notification willappear once

3. 25 million is allocated to Pennsylvania CDFI Network members for support of loan loss reserves and to process portfolio loan deferrals. The process for LLR and loan deferrals is in development and will be outlined in separate procedures. 4. The program is not a "first come, first served" basis. The application portal will open