Transcription

The 2021-22 Budget:Analysis of the Major University ProposalsSummaryIn this report, we first examine how the pandemic has affected the California State University (CSU) andthe University of California (UC), then analyze the Governor’s major university budget proposals. Below, weshare some of the key takeaways from the report.Adverse Fiscal Impacts of Pandemic Have Led Universities to Adjust Budgets. Due to thepandemic, CSU and UC have experienced substantial revenue declines in their noncore programs, areduction in state General Fund support, and some higher than normal costs. Although the universitieshave received federal relief funds and taken actions to contain their spending, they report having operatingdeficits in 2020-21.Base Increases Could Be Considered but Final Levels Set in May. The Governor’s budget proposesto provide CSU and UC each 3 percent base General Fund increases in 2021-22, along with certain othertargeted ongoing augmentations. In total, CSU would receive an additional 202 million in ongoing GeneralFund support and UC would receive 136 million. These increases would partly, but not entirely, restorethe universities to their pre-pandemic levels. CSU and UC would each remain more than 100 millionbelow their 2019-20 levels. Given all of the factors affecting the universities, we think providing them baseincreases merits consideration. The Legislature, however, may wish to wait until May when updated revenueinformation will be available before finalizing its decisions in this area.Base Expectations Could Be Revisited and Refined. As a condition of receiving the 3 percent baseGeneral Fund increases, the Governor would require CSU and UC to (1) develop a plan for eliminatingstudent equity gaps by 2025, (2) adopt policies to sustain online education at a level that is at least10 percentage points higher than 2018-19 levels, and (3) create a dual admissions pathway with thecommunity colleges. Though we believe the Governor has identified areas of common concern with theLegislature, we recommend making certain improvements to each of these proposals. We generally thinkthe Legislature could strengthen oversight of the universities’ performance in these areas while avoiding thedrawbacks of the Governor’s proposals (such as the arbitrary benchmark relating to online education).Student Support Proposals Could Be Better Coordinated. The Governor has five proposals inthe area of student support—signifying one of his main university budget priorities. The proposals total 90 million ( 45 million ongoing and 45 million one time). They provide funding for students’ basic needs(including food and housing), mental health, access to technology, and emergency grants. Although theGovernor has a laudable focus on issues that have been exacerbated by the pandemic, he continues thestate’s piecemeal approach to addressing those issues—even adding new programs to a hodgepodge ofexisting ones. We recommend the Legislature clarify the objectives of each student support program beforeapproving additional ongoing funding. Longer term, we encourage the Legislature to take a more holisticapproach in coordinating traditional student financial aid programs, basic needs programs, and other publicassistance programs.GABRIEL PETEKL E G I S L A T I V E A N A LY S TFEBRUARY 2021

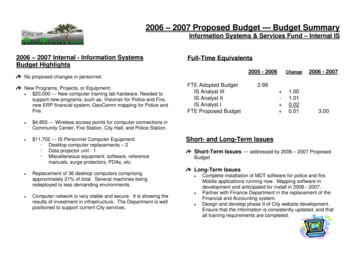

2021-22 BUDGETINTRODUCTIONThis report analyzes the Governor’s majorbudget proposals for CSU and UC. We begin thereport with a review of what is known to date aboutthe impacts of the pandemic on the universities’budgets. We then describe the Governor’s overallbudget plans for the universities. Next, we analyzethe Governor’s specific university proposals, withsections focused on base support, enrollment,student support, faculty professional development,and deferred maintenance. We plan to cover a fewremaining proposals—for example, ones relating toUC medical education—in subsequent analyses.We provide tables detailing each segment’s budgeton our EdBudget website.IMPACT OF PANDEMICCampuses Have Operated Remotely SinceStart of Pandemic. In response to the publichealth crisis, all 23 CSU campuses and 10 UCcampuses (as well as all California CommunityColleges) shifted primarily to remote operationsbeginning in March 2020. Campuses continueto offer the vast majority of their instructiononline, with the exception of a small number ofcourses that involve laboratory or other requiredhands-on work. In addition, campuses areproviding most of their student services (such asacademic advising, financial aid administration,and mental health services) online. Institutionstend to be operating their noncore programs(including their housing, dining, and parkingprograms) at substantially reduced capacity.Pandemic Is Having Adverse Fiscal Impacton Universities and Students. As Figure 1shows, the total estimated fiscal impact fromMarch through December 2020 is 1.1 billionat CSU and 1.9 billion at UC (excluding itsmedical centers and medical schools). The mostsignificant fiscal impact for campuses at bothsegments has been revenue declines, which haveresulted from operating at reduced capacity.Revenue declines have been particularly acutefor the segments’ self-supporting noncoreprograms (including their housing programs).Campuses also have experienced declines incore funding (state General Fund and studenttuition revenue). Additionally, campuses haveincurred some extraordinary costs, includinghigher technology costs and costs forcoronavirus disease 2019 (COVID-19) testing and2protective equipment. As with campuses, somestudents are facing extraordinary challenges,including reduced household income, highertechnology costs, and disruptions in housingarrangements.Federal Government Has Provided SomeFiscal Relief. One source of assistance forthe universities and students has been federalrelief funding. The federal government providedhigher education institutions with relief fundingshortly after the onset of the pandemic (inspring 2020) and is set to provide a secondround of relief funding in winter 2021. (See ourposts, Overview of Federal Higher EducationRelief and Second Round of Federal HigherEducation Relief Funding, for more detail.) AsFigure 1Universities Are Reporting SubstantialRevenue Declines Due to PandemicCumulative Adverse Fiscal ImpactFrom March Through December 2020Funding ReductionsNoncore fundsState General FundTuition revenueSubtotalsExtraordinary CostsTotalsCSUUC 68929924( 1,012) 70 1,082 1,38430238( 1,724) 150 1,874aa UC also reports funding reductions of 1.1 billion and extraordinarycosts of 361 million from its medical centers and medical schools.L E G I S L AT I V E A N A LY S T ’ S O F F I C E

2021-22 BUDGETFigure 2 shows, federal relief funding acrossthe two rounds totals 1.4 billion for CSUcampuses and 658 million for UC campuses.Both rounds designate a portion of federalfunding for emergency student financial aid,with the rest available for campus operations.Campus relief funds can be used for an array ofexpenses, including health and safety measures,technology, professional development, andbackfilling revenue declines in noncore programs.Figure 2Second Round Provides More FederalRelief Funding Than First Round(In Millions)CARES ActStudent aidCampus reliefSupplemental reliefaSubtotalsCRRSAAStudent aidCampus reliefSubtotalscTotalsCSUUC 26326338( 564) 1301307( 267b) 263591( 854) 1,418 130261( 391) 658a Can be used for either student aid or campus relief.b Excludes 861 million in CARES Act relief funds for UC medicalcenters.c As of this writing, CRRSAA supplemental relief for campuses andrelief for UC medical centers not yet been announced.CARES Act Coronavirus Aid, Relief, and Economic Security Act(enacted in late March 2020) and CRRSAA Coronavirus Responseand Relief Supplemental Appropriations Act (enacted in lateDecember 2020).OVERVIEW OF GOVERNOR’S BUDGET(4.5 percent) over the level in 2020-21, with largergrowth at CSU than at UC. Ongoing funding,however, would remain below pre-pandemicGeneral Fund levels, with 2021-22 funding belowthe 2019-20 level by 232 million (2.9 percent). InGovernor’s Budget Partly Restores GeneralFund Support for Universities. As Figure 3shows, the Governor’s budget proposes a total of 7.8 billion in ongoing funding for the universities.This level of support is an increase of 338 millionFigure 3Governor’s Proposed General Fund Support Reflects Partial RestorationOngoing General Fund Support (In 0-21Revised2021-22Proposed 4,3523,724 8,076 4,0423,465 7,507 4,2433,601 7,845Change From 2020-21Amount 202136 338Percent5.0%3.94.5%Change From 2019-20Amount- 109-123- 232Percent-2.5%-3.3-2.9%3

2021-22 BUDGETaddition to ongoing support, the Governor’s budgetincludes 450 million one-time General Fund for theuniversities ( 225 million for each segment).Governor’s 2021-22 Proposals RevolveAround a Few Areas. As Figure 4 shows, thelargest ongoing proposals provide 3 percentgeneral-purpose base increases and, for CSU only,adjustments for retirement benefit costs. The bulkof the proposed one-time funding would supportdeferred maintenance projects. Several of theremaining proposals focus on providing additionalsupport for students and faculty.Figure 4Governor Has Similar Budget Priorities forCSU and UC2021‑22 (In Millions)ProposalsCSUUCOngoing ProposalsBase increase (3 percent)Retirement benefitsaStudent mental health and technologyStudent Basic Needs InitiativePrograms in Medical Education (PRIME)OtherSubtotals 112571515—3( 202) 104—15—134( 136)One-Time InitiativesDeferred maintenanceEmergency student financial aidCalifornia Institutes for Science and InnovationFaculty professional developmentOtherSubtotalsTotals 17530—1010( 225) 427 1751520510( 225) 361a Consists of adjustments for retiree health ( 55 million) and pension contributions ( 2 million).BASE SUPPORTIn this section, we first provide backgroundon how CSU and UC responded to core fundingreductions in 2020-21. We then describe theGovernor’s proposal to increase university basesupport in 2021-22. The Governor links hisproposed increase in CSU and UC base support tothree expectations relating to student equity gaps,online education, and dual admissions. We analyzeeach of these expectations in turn. We end with adiscussion about tuition.4BackgroundState Enacted Base Reductions to theUniversities in 2020-21. Following several yearsof the state providing CSU and UC with GeneralFund base augmentations, the 2020-21 BudgetAct reduced state funding for the universities.These reductions were part of a broader statebudget package intended to address a substantialprojected shortfall in General Fund revenues. AsFigure 5 on the next page shows, the reductionsin ongoing General Fund support at CSU and UCwere 6.9 percent and 8.1 percent, respectively,L E G I S L AT I V E A N A LY S T ’ S O F F I C E

2021-22 BUDGETfrom 2019-20 levels. CSU’s reduction, however,was slightly larger in terms of total core funding, asGeneral Fund support comprises a larger portionof core funding at CSU than at UC. WhereasCSU’s reduction in terms of total core funding was3.9 percent, it was 3.3 percent at UC.groups. Campuses also have seen savings as aresult of reduced employee travel and utility costs.Nonetheless, both segments report that thesestrategies have been insufficient to fully addresstheir core funding reductions, and campuses havehad to draw down funds from their reserves. As ofthis writing, the CSU Chancellor’s Office reportsthat campuses plan to draw down a total of roughly 200 million from their core operating reserves in2020-21 (about half of its estimated uncommittedcore reserves at the end of 2019-20). The UCOffice of the President reports that UC campusesplan to draw down as much as 174 million (about65 percent of its estimated uncommitted corereserves at the end of 2018-19, the most recentUniversities Did Not Increase Tuition toOffset State Reductions. Neither CSU nor UCincreased student tuition to help offset the declinesin 2020-21 state funding. As Figure 6 shows,resident undergraduate tuition has remained aboutflat over the past ten years, only increasing oncesince 2011-12. Though the universities kept tuitioncharges flat in 2020-21, they experienced a dropin overall tuition revenue largely resulting fromdeclines in nonresident enrollment.Figure 5CSU estimates a 24 millionreduction in tuition revenue fromState Reduced Base Support for the2019-20 to 2020-21, whereas UCUniversities in 2020-21estimates a 38 million drop.General Fund Reductions From 2019-20 Ongoing LevelsCSU Is Allocating SomeAmountPercentFederal Relief Funds for CoreCSU 299.06.9%Operations. In discussionswith our office, both universitiesUC 302.48.1%Campuses259.27.7emphasized that they are usingOfficeofthePresident27.312.7the bulk of their federal campusAgriculture and Natural Resources9.212.7relief funds to address revenue6.712.7UCPathadeclines in their noncore programsa General Fund reduction was offset by a 31.5 million increase in campus assessments. Overalland cover extraordinary costssupport for UCPath increased 24.8 million (37 percent).related to COVID-19. Accordingto staff at the Chancellor’s Office,Figure 6CSU campuses are allocatingat least a portion of their federalTuition Has Remained About Flat Over the Last Ten Yearscampus relief funds to assist theirAnnual Tuition Charges for a Full‑Time Resident Undergraduatecore programs. Any federal relieffunding allocated either to noncore 12,000or core programs is available onlyUC10,000on a one-time basis.Universities Have TakenSeveral Actions to Respond toFiscal Challenges. Given corefunding reductions, both CSU andUC have sought to reduce theircore spending by holding a portionof faculty and staff positionsvacant (that is, suspending mosthiring) and forgoing general salaryincreases for most 112012-132014-152016-172018-192020-215

2021-22 BUDGETyear of information available). (As we discussin An Analysis of University Cash ManagementIssues, UC also borrowed externally in 2020-21 tohelp it cover both its noncore and core operatingexpenses.)Base IncreasesGovernor Proposes Base Increases.The Governor proposes providing ongoingaugmentations of 112 million to CSU and 104 million to UC, reflecting 3 percent GeneralFund increases over 2020-21 levels. Theseproposed increases partially restore the universitiesto their 2019-20 levels. In addition to the 3 percentbase increase, the budget would provide a 57 million augmentation for CSU pension andretiree health cost increases, resulting in a totalongoing base augmentation of 169 million. (UnlikeCSU, UC would have to accommodate retirementbenefit cost increases from within its 3 percentbase augmentation.)First Call on Base Augmentation Likely IsCovering Increases in Certain Operating Costs.Like most government agencies, the universitiestend to experience operating cost increases eachyear, such as rising pension and health care costs.For CSU, most of these types of cost pressuresare driven by requirements in state law and otherexternal factors, such that campuses have littleflexibility to directly affect these costs. Relativeto CSU, UC has somewhat greater flexibility toadjust the policies driving these cost pressures.For example, UC determines the share of healthpremiums it subsidizes for employees and retirees.It also sets its own policies determining thesize of pension benefits for new employees andits annual employer contribution. (Though UChas greater flexibility in setting its own pensionpolicies, reducing its employer contribution ratewould slow its progress in fully funding its pensionsystem and increase out-year cost pressures.)Based on information provided by the segmentsand the administration, we estimate these typesof operating costs will increase by 114 million atCSU and 76 million at UC. (We include pensionand health care cost increases for both segments,along with a few other segment-specific costs6involving debt service, facility maintenance, andnew statutory requirements.)Salaries Are Another Cost Pressure Facingthe Universities. After covering benefits anddebt-service payments, the universities typicallyface decisions about salaries. In its budget plan for2021-22, CSU does not anticipate funding generalsalary increases for any employee group. For mostemployee groups, the CSU Chancellor’s Office hasnegotiated two-year contract extensions through2021-22 that do not provide salary increases.(One employee group—the California FacultyAssociation—has a contract extension that expiresat the end of 2020-21.) While UC’s 2021-22 budgetplan also forgoes salary increases for manyemployee groups, the plan anticipates salarygrowth of 82 million to fund previously agreedupon increases for represented employee groups,faculty merit increases, and a 1.5 percent generalsalary increase for certain nonrepresented staff.Universities Likely Would Use RemainingFunds for Restoration. After weighing salarydecisions, campuses likely would prioritize restoringsome of the reductions they incurred in 2020-21.Most notably, campuses likely would resume somehiring in 2021-22—filling a portion of vacant facultyand staff positions. These hires could supportsome combination of more courses and morestudent support services. Campuses also mightconsider undertaking more building maintenanceprojects in 2021-22. As base General Fund supportwould remain below pre-pandemic levels underthe Governor’s budget, campuses likely would notbe able to fully fund all of these priorities, absentfurther drawing down their reserves.State Budget Has Limited Capacity forGiving Universities Additional Ongoing Funding.While the fiscal challenges currently facing theuniversities suggest that more ongoing basesupport than the Governor’s proposed level couldbe warranted, the state’s ability to expand ongoingCSU and UC support is limited. As we noted inThe 2021-22 Budget: Overview of the Governor’sBudget, we and the administration project annualstate operating deficits that grow over the outlookperiod. Specifically, the administration anticipatesstate operating deficits of 7.6 billion in 2022-23,growing to 11.3 billion by 2024-25.L E G I S L AT I V E A N A LY S T ’ S O F F I C E

2021-22 BUDGETConsider Proposed Base Increases asStarting Point. The proposed 3 percent baseincreases could serve as a starting point forlegislative deliberations. The 3 percent increaseswould help the universities cover some increasesin their operating costs and leave some fundingremaining for salary and staffing increases while stillbeing attentive to the state’s tight fiscal outlook. InMay, the Legislature will get updated state revenueestimates and be in a better position to assess thestate’s ongoing budget capacity. In light of thatupdated information, the Legislature then couldrevisit the size of the proposed university baseincreases. Regardless of the level of support theLegislature ultimately decides to provide, it couldconsider adopting language having each segmentreport key information about its budget plans in thefall. Specifically, such reports could include eachsegment’s projected core funding, spending byprogram area, operating deficits, budget reserves,and specific actions taken to implement budgetplans. These reports could help the Legislaturekeep better apprised of how the segments areresponding to remaining fiscal challenges.Student Equity Gapsby race/ethnicity, gender, and socioeconomicstatus. Both the CSU Board of Trustees and theUC Board of Regents have expressed concernover student achievement gaps and developedmultiyear plans to eliminate them. CSU’s plan aimsto eliminate gaps by 2025, whereas UC’s plan aimsto eliminate gaps by 2030. The Legislature also hassought to raise attention to student equity gaps—for example, by requiring the universities to submitperformance reports each March that contain dataon persistence and graduation rates for low

CSU UC CARES Act Student aid 263 130 Campus relief 263 130 Supplemental reliefa 38 7 Subtotals( 564) ( 267b) CRRSAA Student aid 263 130 Campus relief 591 261 Subtotalsc ( 854) ( 391) Totals 1,418 658 a Can be used for either student aid or campus relief. b Excludes 861 million in CARES Act relief