Transcription

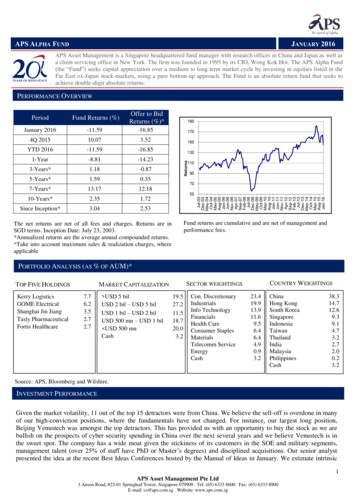

APS ALPHA FUNDJANUARY 2016APS Asset Management is a Singapore headquartered fund manager with research offices in China and Japan as well asa client servicing office in New York. The firm was founded in 1995 by its CIO, Wong Kok Hoi. The APS Alpha Fund(the “Fund”) seeks capital appreciation over a medium to long term market cycle by investing in equities listed in theFar East ex-Japan stock-markets, using a pure bottom-up approach. The Fund is an absolute return fund that seeks toachieve double-digit absolute returns.PERFORMANCE OVERVIEWPeriodFund Returns (%)Offer to BidReturns (%) January 2016-11.59-16.854Q 201510.073.52YTD 2Since Inception*3.042.53Fund returns are cumulative and are net of management andperformance fees.The net returns are net of all fees and charges. Returns are inSGD terms. Inception Date: July 23, 2003.*Annualized returns are the average annual compounded returns. Take into account maximum sales & realization charges, whereapplicablePORTFOLIO ANALYSIS (AS % OF AUM)*TOP FIVE HOLDINGSKerry LogisticsGOME ElectricalShanghai Jin JiangTasly PharmaceuticalFortis Healthcare7.76.23.52.72.7 USD 5 bilUSD 2 bil – USD 5 bilUSD 1 bil – USD 2 bilUSD 500 mn – USD 1 bil USD 500 mnCashCOUNTRY WEIGHTINGSSECTOR WEIGHTINGSMARKET CAPITALIZATION19.527.211.518.720.03.2Con. DiscretionaryIndustrialsInfo TechnologyFinancialsHealth CareConsumer StaplesMaterialsTelecomm 2ChinaHong KongSouth 2Source: APS, Bloomberg and Wilshire.INVESTMENT PERFORMANCEGiven the market volatility, 11 out of the top 15 detractors were from China. We believe the sell-off is overdone in manyof our high-conviction positions, where the fundamentals have not changed. For instance, our largest long position,Beijing Venustech was amongst the top detractors. This has provided us with an opportunity to buy the stock as we arebullish on the prospects of cyber security spending in China over the next several years and we believe Venustech is inthe sweet spot. The company has a wide moat given the stickiness of its customers in the SOE and military segments,management talent (over 25% of staff have PhD or Master’s degrees) and disciplined acquisitions. Our senior analystpresented the idea at the recent Best Ideas Conferences hosted by the Manual of Ideas in January. We estimate intrinsic1APS Asset Management Pte Ltd3 Anson Road, #23-01 Springleaf Tower, Singapore 079909 Tel: (65) 6333 8600 Fax: (65) 6333 8900E-mail: cs@aps.com.sg Website: www.aps.com.sg

APS ALPHA FUNDJANUARY 2016value to be meaningfully higher over the next 2-3 years, based on earnings growth of 50% CAGR for the next few years.Our long position in Hong Kong-listed Shenzhen International was also amongst the top 5 detractors in January. Webelieve this is a mispriced value stock with Mr. Market ignoring the company’s growth potential in the logistics businessand also that property prices in Shenzhen have risen significantly. On Shenzhen International’s balance sheet, asset valuesare recorded at cost, and market value is conservatively multiples of the cost price. We also think Shenzhen Internationaldeserves a multiple premium as it is a best-in-class Chinese SOE. The stock also benefits from a 49% stake in a domesticairline, which was bought very cheap, is consistently profitable, and also benefitted due to low fuel prices. And yet theearnings multiple on this stock, given the company’s businesses, is just 10x. If you would like us to send a copy of ourreport authored by APS analysts, please email a request to cs@aps.com.sg.Other detractors to Fund performance in January include long investments in a Chinese 3C and home appliances retailerwhich we are reducing, as corporate governance has been an issue.In January, 8 out of the top 15 contributors were South Korean stocks including portfolio companies like Hyundai Glovis,SFA Engineering, NCSoft, Kangwon Land and Hyundai Movis. Our best performers were Thai value stocks like BonFame, Big C Supercenter and Malee Sampran.Our analyst and PM teams conducted several research trips in the last 2 months, including South Korea, Indonesia,Thailand and India. The research teams are busy conducting due diligence on several new ideas and themes across theAsia Pacific universe. Please read the portfolio strategy below to highlight our recent buys and sells and currentpositioning.In January, we initiated a biannual APS Asia Investment Forum with research teams from Singapore, China and Japanpresenting long-term trends in their respective markets and sectors. If you would like the summary report on the Forum,please email a request to cs@aps.com.sg. The next Forum will be held in China in the summer.We expect continued volatility in the Asian markets in general but APS will remain focused on corporate fundamentalsand valuation instead of on macro events causing the volatility which have no material link to fundamentals. Thisinvestment approach has delivered long-term results over the more than 20-year history of the firm, through a variety ofmarket conditions. Indeed, volatility presents opportunities to initiate or increase positions in high-conviction stocks,which we identified through rigorous research, at compelling valuation. Significantly, all our major investors haveremained invested, along with the staff and directors of APS.Our 29 analysts and portfolio managers based in Singapore, Shanghai, Shenzhen, Beijing and Tokyo will remaindisciplined and stay focused on independent thinking and investigative research to unearth mispriced, well-managedcompanies with significant growth potential in the longer horizon.Source: APSPERFORMANCE ANALYSIS AND PORTFOLIO ACTIVITY*The APS Alpha Fund returned -11.59% net in the month of January 2016.Contributors to PerformanceBon Fame is a consumer products trading company that supplies hair accessories (76% of sales in FY14) to majorretailers around the world. Scale, innovation, and long-term relationships underpin Bon Fame’s stronger-than-peersprofitability. It has 25 years of supply-chain relationship with Goody (owned by Newell Rubbermaid) and 17 years withConair, the 2 largest hair accessories suppliers to major retail chains in the US. We forecast that the new clients it acquiredsince 2013, which include retailers of higher-end accessories such as Disney-licensed products, fashion retailers likeForever 21 and lower-end stores such as Dollar Tree and Dollar General, will provide a robust 22% earnings growth inFY2016. Due to its sourcing business model, the company has a limited capex plan and no borrowings and therefore hadbeen maintaining its dividend payout in excess of 85% over the past few years. Valuation at the point of initiation, 13x2APS Asset Management Pte Ltd3 Anson Road, #23-01 Springleaf Tower, Singapore 079909 Tel: (65) 6333 8600 Fax: (65) 6333 8900E-mail: cs@aps.com.sg Website: www.aps.com.sg

APS ALPHA FUNDJANUARY 2016FY2016 P/E and 6.6% dividend yield, provided a compelling entry point. Since then, the share price has outperformedsignificantly as the company continued to deliver results. At the end of last year, the company announced strong 3Q15results, with net profit increasing by 70% year-on-year.Big C Supercenter Public Company Limited is a multi-format retailer in Thailand. The group includes Big CSupercenter and Big C Extra hypermarkets, Big C Market supermarkets, Mini Big C proximity stores, and Purepharmacies. In addition, Big C manages and provides rental space within the supercenters for other service providers,including restaurants and food courts, cinemas, small theme parks for children, bookstores, mobile and electronics shopsand others. The share price increased by almost 23% year-to-date as its major shareholder, Casino, announced the disposalof its 58.56% stake in the retailer, both directly and indirectly, to TCC Corporation at THB252.88 per share, translating toa 28x FY2015 P/E.Dongpeng is one of China’s largest ceramic tile manufacturers focusing on high-end ceramic tiles. We invested in it inQ215 in the midst of a property downturn at a 8.0x P/E valuation. We saw that the company was growing market share,had strong R&D and cost-control, and noticed early signs of a property sales recovery that would lead to downstreambuilding material demand recovery. In 2015 amidst the downturn, Dongpeng grew distributor storecount 10% to 2,200 asit expanded further into lower-tier cities. On Feb 3rd 2016, Dongpeng’s founder and private equity firm Sequoia made atender offer to privatize Dongpeng at HKD 4.48/sh, a 48% premium to its end-2015 share price.Detractors from PerformanceTasly Pharmaceutical’s stock price was down by 18.8% in January, outperforming the sector index by 7ppt, and Tasly’sfundamentals remain robust. The company’s recurring net profit grew by an estimated 6% yoy in FY2015. With thecompletion of provincial drug tenders in 1H2016, Tasly’s sales growth may recover in 2H2016. The global multi-centerphase III clinical trial of Danshen Dripping Pill is progressing as planned and is expected to conclude in 1H2016. Apreliminary report may be announced in 2H2016.Venustech Group’s share price slid along with the broader market sell-off. As the company’s fundamentals remainstrong, we took the opportunity to add to our position. The company released a new generation of data security, loggingand audit tools for government and enterprise customers to use in a big data era.GOME Electrical Appliances is one of China’s largest retailers of electrical appliances both online and offline. InJanuary, the stock was negatively affected by weak retail sentiments and slowing same-store sales growth. But the outlookis positive as the new round of property market stimulus should boost demand for household appliances in the foreseeablefuture. Additionally, GOME took the opportunity of a low interest rate environment to issue a RMB 3bn bond at 4%,which will ease debt-financing pressure on net profits. Further positive developments came in the form of shareholdersapproving a plan for GOME’s major shareholder Wong Kwong Yu to inject unlisted assets into the company.Recent BuysEstablished in 1983, Engtex Group Bhd wholesales and distributes pipes, valves and fittings (PVF), plumbing materialsand general hardware products. Engtex’s wholesale and distribution division serves more than 3,000 customers via itsextensive nationwide distribution network. The wholesale and distribution division accounted for 62.6% and 60.3% ofrevenues and EBITDA respectively. In addition, the company manufactures water pipes and wire mesh and is the secondlargest pipe manufacturer in Malaysia with an estimated market share of 33%. It is also one of the top 3 largest wire meshmanufacturers in Malaysia with 7 plants nationwide. Engtex has a competitive advantage over its competitors, thanks to itsstrategic plant locations, which in turn resulted in reduced logistics costs. The upcoming 11th Malaysia Plan will ramp upthe demand for water pipes. According to the National Water Services Commission (SPAN), Malaysia is suffering fromchronic non-revenue water i.e. water that is lost before it reaches users; about 36% of water is “lost”, well above the 25%recommended by the World Bank. One of the biggest culprits is the age and condition of the water pipes in the country.According to SPAN, an estimated 40% or about 50,900km old asbestos cement (AC) pipes in Malaysia were laid 40-60years ago and are in serious need of replacement. This situation presents a market opportunity for Engtex and valuation at7x forward P/E is attractive in view of its growth prospects.3APS Asset Management Pte Ltd3 Anson Road, #23-01 Springleaf Tower, Singapore 079909 Tel: (65) 6333 8600 Fax: (65) 6333 8900E-mail: cs@aps.com.sg Website: www.aps.com.sg

APS ALPHA FUNDJANUARY 2016Acset is known for its expertise in building foundations for high-rise buildings in Indonesia. The company focuses on lessprice-sensitive high-end projects (grade-A offices, 5-star hotels and high-end apartments). With United Tractors, part ofAstra International, officially becoming the controlling shareholder (40%) since early 2015, ACST is set to have a strongerbusiness platform. ACST will be the main beneficiary of a greater focus on infrastructure across Astra International’sbusiness units. Valuation at 13x forward P/E does not fully reflect the strong earnings growth potential from leveraging onthe first-class business platform of its new owners and management team.Hangzhou Hikvision Digital is the largest provider of security surveillance devices in China with around 20% marketshare. Despite a weak macro environment and delayed government spending, the company continues to deliver stronggrowth. In 3Q15, revenue was up 47.9% YoY and net income was up 31.4%. Overseas revenue growth stayed strong ataround 60% YoY. We expect growth to remain around 30% p.a. over the next 3 years driven by overseas marketexpansion and development of the solution business which has higher margins. Trading at less than 13x 2016E P/E, webelieve the company is significantly undervalued.Recent SellsWowprime is a leading restaurant chain operator in Taiwan with 11 brands ranging from high-end (Wang’s Steakhouseand Chamonix’s French teppanyaki) to mid-end (Tasty steak house, Ikki modern Japanese, Tokiya Japanese restaurant,etc) and low-end hot pot (12 Hotpot). As of end-1Q2015, Wowprime operates 431 stores in Taiwan and China. The Funddecided to liquidate this position because the expected recovery in Wowprime’s Taiwan operations isn’t materializing dueto intense competition and its China operations is also negatively affected by the slowing economy.JCY International Berhad is a leading hard disk drive (HDD) component maker. While JCY’s ambitious productionautomation plan will reduce labor costs, the outlook for the industry is weak. We believe that global HDD demand isunlikely to post a meaningful recovery in the currently challenging macro environment. According to Trendfocus, HDDshipment was estimated to have fallen 17-18% yoy to 115m-116m units in 4Q15. Meanwhile, the PC market (which is stillthe largest customer of HDD in terms of volume), suffered an 8.3% yoy fall in shipments in 4Q15, according to Gartner’sestimates. Despite a favorable exchange rate trend, JCY could face pricing pressure from its key client, Western Digital(WD). Therefore, we expect sluggish earnings growth going forward.* The information above reflect the Fund's positions held at the underlying fund’s level4APS Asset Management Pte Ltd3 Anson Road, #23-01 Springleaf Tower, Singapore 079909 Tel: (65) 6333 8600 Fax: (65) 6333 8900E-mail: cs@aps.com.sg Website: www.aps.com.sg

APS ALPHA FUNDJANUARY 2016STATISTICAL PROPERTIES & RISK ANALYSISRETURNSSince InceptionLast 60 mthsLast 36 mthsLast 12 mthsAVE %-8.81%RISKSince InceptionLast 60 mthsLast 36 mthsLast 12 mthsAVE 62%20.54%RELATIVE RATIOSAnnualised AlphaInformation RatioUp CaptureDown CaptureINDEX-2.94%-0.4548%98%Notes:Index: MSCI AC Far East ex Japan Net TR SGDInception date: Jul 2003Fund performance is expressed in SGD and is net of all fees and charges.All risk statistics are calculated from Inception to January 2016 unless otherwise specified.FUND INFORMATIONInvestment ManagerCompanyAPS Asset Management Pte LtdFund DetailsDomicileSingaporeLead PortfolioManagerWong Kok HoiStructureOpen ended Unit TrustInception DateJuly 23, 2003LiquidityFund AUMSGD 46.65mnFund Base CurrencyISIN Class A (SGD)SGDSG9999009229Class ADailyClass BDailyMinimum InitialSubscriptionManagement FeeSGD 5,000SGD 5,0000%1.5%Performance Fee25% over 6%hurdle rate0%NAV Price as at January 31st, 2016Class A: SGD 1.45USD 1.02Dealing Deadline5pm Daily (Singapore Time) eachBusiness DaySubscription FeeRedemption FeeUp to 5%1%AuditorDeloitte & Touche LLPTrustee / CustodianRBC Investor Services Trust SingaporeLimitedRBC Investor Services Trust SingaporeLimitedThere were no units in Class B as of January 2016Fund Included Under:CPFIS-OA*SRS*with effect from 23 July 2012, only Class B Units of theFund are eligible to accept new CPF monies.Client Services Contact InformationE-mailRegistrarcs@aps.com.sgComposite reports which have been prepared in compliance with the Global Investment Performance Standards (GIPS) are availableupon requests.Sources: APS, RBC Investor Services Trust Singapore LimitedAPS Asset Management Pte Ltd3 Anson Road, #23-01 Springleaf Tower, Singapore 079909 Tel: (65) 6333 8600 Fax: (65) 6333 8900E-mail: cs@aps.com.sg Website: www.aps.com.sg5

APS ALPHA FUNDJANUARY 2016Registration No.: 1980-00835-GNote: The CPF Board currently pays a legislated minimum annual interest rate of 2.5% on monies in the CPF Ordinary Account (OA).The CPF interest rates are based on the 12-month fixed deposit and month-end savings rates of the major local banks and it is reviewedby the CPF board quarterly. In addition, the CPF Board pays an extra interest rate of 1% per annum on the first S 60,000 of a CPFmember's combined balances, including up to S 20,000 in the CPF Ordinary Account. The first S 20,000 in the CPF Ordinary Accountis not allowed to be invested under the CPF Investment Scheme.IMPORTANT NOTICE: This publication is strictly for information and general circulation only and does not have regard to thespecific objectives, financial situation and particular needs of any specific person. It is not, and should not be construed as an offer,invitation to offer, solicitation, recommendation or commitment to enter into any dealing in securities and form of transaction. Nothingcontained herein constitutes investment advice and should not be relied upon as such. APS is not carrying out any financial advisoryservices and not acting as any investor’s and potential investor’s financial adviser or in any fiduciary capacity in respect of anyproposed or potential investment. Investors and potential advisers should seek independent advice from a financial advisor regarding thesuitability of the Fund and securities mentioned before making any investment. In the event that the investor or potential investorchooses not to do so, he should consider carefully whether the Fund and securities are suitable for him in his financialcircumstances. Past performance of the Fund, securities and the Investment Manager and any forecasts made or opinionsexpressed on the economy, stock market or economic trends of the markets are definitely not indicative of future or likelyperformance or any guarantee of returns. APS accepts no liability and responsibility, whatsoever, for any direct or consequential lossarising from any use of or reliance on this publication. Investments in units in the Fund (“Units”) are subject to high degree of risks,including possible loss of entire principal amount invested. Investors and potential investors should carefully evaluate their financialcircumstances, ability and willingness to take such risks. The value of the Units and the income accruing to the Units, if any, may fall orrise. Investments in the Units are not deposits or other obligations of or guaranteed or insured by APS. While APS believes theinformation for the publication, which is based on certain assumptions, conditions and facts available, to be reliable, this publication isprovided on an “as is” and “as available” basis and subject to change, of whatsoever form and nature, at any time without notice. APShas not independently verified and does not make any representation or warranty as to the accuracy, adequacy, completeness,reasonableness or truth of the information. Investors and potential investors must read the Prospectus, which may be obtained from APSor any of its appointed distributors, to fully understand the investment objectives, all the terms, conditions and risks before decidingwhether to subscribe for Units. Investors may only redeem Units in the manner set out in the Prospectus. Distribution of this publicationto any person other than the recipient and its adviser(s) is unauthorized and any reproduction of the publication, in whole or in part, orthe disclosure of any of the contents, in each such instance is strictly prohibited.6APS Asset Management Pte Ltd3 Anson Road, #23-01 Springleaf Tower, Singapore 079909 Tel: (65) 6333 8600 Fax: (65) 6333 8900E-mail: cs@aps.com.sg Website: www.aps.com.sg

PORTFOLIO ANALYSIS (AS % OF AUM)* The net returns are net of all fees and charges. Returns are in SGD terms. Inception Date: July 23, 2003. *Annualized returns are the average annual compounded returns. Take into account maximum sales & realization charges, where Fund returns are cumulative and are net of management and performance fees. I .