Transcription

Professional IndemnityInsurance Market Insights,2021 ProfessionalSubjectIndemnity Insurance Market Insights 2021

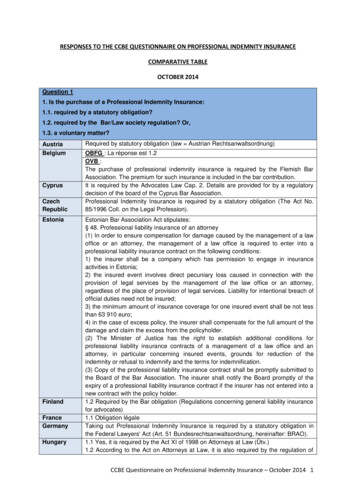

State of the ProfessionalIndemnity Insurance MarketThe 2020 professional indemnity insurancemarket was one of the most challenginginsurance markets professional servicescompanies have faced in recent memory.As described in Aon’s Q3 2020 ProfessionalWe are seeing some green shoots in the professionalindemnity market with a small amount of new capacityentering off the back of more insurer-friendly premiumconditions. This additional capacity is being deployed veryselectively and is unlikely to have a significant impact onthe majority of the professional indemnity market. Therehas also been a cautious increase in appetite for newIndemnity Insurance Market Insights report,business which may alleviate some of the more significantAon saw insurers take corrective action toincreases we saw in 2020.improve the profitability of their portfoliosContinued Professional IndemnityMarket Profitability Challengesleading to significant premium increasesranging from 5% to 210% across a selection ofThe Australian Prudential Regulatory Authority (APRA)Aon’s Professional Services clients. The averagereleased its Quarterly General Insurance Statistics onrate increase for this group in 2020 was 30%.27 May 2021. This data is sourced from the regulatorySo far 2021 has seen a continued focus by insurers onreturns submitted to APRA by authorised general insurancecompanies. It does not include data from Lloyds.underwriting performance and portfolio management.The APRA report shows a net underwriting combined ratioA low return investment market means insurers have toof 96% for professional indemnity for the year endingfocus on underwriting profitability to remain sustainable.March 2021. Insurers generally target a combined ratio ofPricing increases continue to be sought by insurers albeitat least 90% suggesting they will continue to seek pricingat a lesser rate than 2020. H1 2021 saw an average rateincreases for the foreseeable future.increase of 21% across the above-mentioned clientsranging from 0% to 58%.1Table 1 APRA Quarterly General Insurance Statistics– Professional IndemnitySource: ticsYear-End March 2020Year-End March 2021IncreaseGross Written Premium 2,531,000,000 3,038,000,00020%Gross Incurred Claims 2,298,000,000 2,931,000,00028%Gross Loss Ratio97%103%6%Net UnderwritingCombined Ratio*95%96%1%*net underwriting combined ratio net loss ratio (claims/premiums) underwriting expense ratio (expenses/premiums)1 Aon proprietary data ProfessionalSubjectIndemnity Insurance Market Insights 2021

The Insurance Market CycleIn mid-2020 we suggested that we may have enteredProfessional indemnity has not been immune to thesewhat is colloquially known as a “hard insurance market”.losses. As you can see from Table 1, the current premiumThe diagram Aon has developed below shows a graphicincreases (20%) are yet to offset the increase in lossesdepiction of the insurance market cycle and the factors(28%). The APRA Quarterly statistics also show a 39%that contribute to its stages. During a live webinar on 28increase in reinsurance costs which suggests thatJanuary 2021, Aon’s Global Chief Broking Officer, Hugoprofessional indemnity insurers are offsetting more of theirWegbrans advised that 2020 had been the fifth costliestrisk to the reinsurance market. This reduces the impactcatastrophe year in the last 20 years. He indicated thatof the current additional claims but may increase thethese “unprecedented loss levels” were one of the mainreinsurance costs in subsequent years.drivers of the current hard market.2020 - COVID-19,natural catastrophesand an increase inclass actions2Significant catastrophic events and/orpoor investment returns lead to poorperformance.Retraction in capacity as insurers focus onunderwriting profitability.Change of insurer appetite and riskselection leads to significant lackof competition in some classes/professions.Premiums start to slowly increase.Hard MarketIncrease in loss ratios due toreduction in premium pool.Rate reductions taper off.Insurers stop writing“unprofitable business”leading to significantincreases in pricing andreductions in the breadthof cover.INSURANCECYCLEInsureds control the marketswith Insurers competing onprice and cover.Insurers control pricing andcontinue to retract cover.2021 - 96%combined ration asshown in Table 1Soft MarketInsurers look to increasetheir market share.Rate reductions due tocompetitive tension.2 021-preparing-for-the-year-ahead ProfessionalSubjectIndemnity Insurance Market Insights 2021Rate increases improve underwritingprofitability and/or investmentperformance improves.Pricing becomes attractive tonew capacity.

Is Social Inflation Changing theClaims Environment?The Lloyd’s 2021 Market Oversight Plan has identifieda deterioration in past years' professional indemnityinsurance claims reserves as an area of concern3. Lloyd’sis undertaking a workstream to review claims reservingassumptions and particularly whether past inflation isrepresentative of future inflation. This may lead to achange in claims reserving procedures to reflect bothchanges to general inflation caused by COVID-19 as wellas social inflation.According to a research brief by the Geneva Association“social inflation refers to all ways in which insurers’ claimscosts rise over and above general economic inflation,including shifts in societal preferences over who is bestplaced to absorb risk”.4 The Research Brief is based onAmerican data but suggests that Australia has many of thecharacteristics that they consider high risk factors for socialinflation some of which include:Silent CyberMost of 2020’s Professional Indemnity market commentarycontinues to remain relevant for 2021. One majorexception is the impact of the imposition of “silent cyber”endorsements. The issue of silent cyber was raised by theUK Prudential Regulatory Authority (PRA) after it surveyedits members and their approach to non-affirmative cybercover in May 2018. The term silent cyber is used todescribe cover for losses caused by a cyber event includedin non-cyber policies, including professional indemnity.Both Lloyd’s and the PRA recommended clarity underpolicies on whether coverage for losses caused by a cyberevent was intended to be covered or not.Lloyd’s has subsequently mandated that all policies writtenby Lloyd’s Managing Agents provide clarity as to whetherthey are excluding cyber coverage or providing affirmativecoverage. They have developed a 4-phase implementationprogram with professional indemnity falling into phase3 which covers policies incepting on or after 1 January2021. While guidance has been provided in the form of Litigation funding mechanismsdraft endorsements there is considerable variability in the Class action regimeendorsement being applied by insurers with some holding Active political/regulatory environment – i.e.significant number of Royal Commissions, regulatorychanges/oversight and public sentiment towardsorganisations and institutions.firm on the recommended wordings and others willing toLegal environmenthas led to significant confusion in the early stages of phase These concerns around increases in inflationary factorshave contributed to insurers being reluctant to offer largenegotiate on the breadth of the endorsement. We havealso seen instances of some insurers providing affirmativecover and others adopting the exclusionary wording. This3 implementation. It is important to note that in Aon’sexperience a similar approach is now being taken by some,insurance limits and pushing for higher deductibles. Onbut not all Australian Insurers.insurance programs with multiple layers and large limits ofIn light of these new endorsements, it is critical to reviewindemnity, we are seeing insurers push to move higher upand understand the cyber event cover being providedthe insurance tower.under professional indemnity policies. Firms may need toreview cyber insurance limits to ensure appropriate coveris maintained.3 d-standards/market-oversight4 Social inflation: Navigating the evolving claims eadMagazineArticle?aid 44312) ProfessionalSubjectIndemnity Insurance Market Insights 2021

Specific Industry CommentsFinancial PlannersThe Aon broking team have provided industryThe insurance market for financial plannersspecific commentary in the table below. This isbased on Aon’s experience in the professionalcontinues to be challenging as insurers grapplewith the active regulatory environment.indemnity market during the first half of 2021.Organisations that can demonstrate highAccountantscontrols are more likely to achieve a favourableInsurers are continuing to push for rate increasesresult. Any past claims activity must be clearlyacross accounting practices. Activities that insurersconsider higher risk are more heavily scrutinised.This includes auditing of listed entities andfinancial institutions, mergers and acquisitions,and valuations.compliance standards and risk managementexplained to insurers including root cause analysisand lessons learned. There is still some competitionfor smaller firms with 20 planners or less. Largefinancial planning organisations have struggled tomaintain high limits due to a retraction in capacity.Pricing increases have been significant.Credit/Mutual BanksWhilst there is still competition for credit unions,IT Professionals/Fintechssmaller banks and financial institutions, insurers areIT liability continues to be a bright spot forvery selective. They will select those institutionstraditional, longer-running IT firms. However, therethey are prepared to consider with greater care andis a limited appetite from insurers for SME start-upsa much more detailed underwriting process thanand Fintech firms. Insurers are particularly cautiousmay have been the case in the past. Premiums areof payment providers and firms dealing with retailcontinuing to increase and we are still experiencingcustomers. Crypto and block chain are still nota loss of capacity. It has become even moreunderstood by the insurance market and requireimportant for clients to be able to show insurerssignificant investment in educating insurers of thehow their risk should be differentiated, to maximiseinherent risks and risk mitigation strategies.premium competition.Construction Consultants andDesign ProfessionalsOngoing claims developments are drivingreductions in capacity which has continuedinto 2021. We are seeing a greater focus frominsurers on recruitment of key staff, projectdue diligence, cost over-runs, approach to lossmitigation, exposure to emerging markets such asrenewables, cyber exposure and environmental,social and governance (ESG) plans. Design andmanufacturing, renewables, any connection tothe grid risk, property developers, certifiers,fire engineers, geotechnical work, structuralengineering or quantity surveying are all concernsfor insurers. Early engagement with insurers andhigh-quality submissions that detail meaningfulrisk management processes are essential tosecuring terms.LawyersWe have again seen reductions in capacity andincreases in premiums in 2021 as insurers continueto manage their portfolios, particularly those inthe London market. We also saw the introductionof silent cyber exclusions on lawyers’ “top-up”PI, which has the effect of potentially limiting“professional service” losses relating to cyber. Areasof concern for insurers continue to include mergersand acquisitions, conveyancing, corporate advisory,and plaintiff law firms.ValuersCover restrictions continue to be imposed by someof the main valuers' markets around the assignmentof property valuations required under changes toSection 90 of the Banking Code of Practice. Thelimited number of insurers that provide cover forvaluers have been more open to new business in2021 as they become more comfortable with theproperty market outlook. ProfessionalSubjectIndemnity Insurance Market Insights 2021

Getting Better Outcomesfrom InsurersA hard insurance market as described above requires a different approach to engaging with insurers. TheStrategic meetings with alternative markets2020 experience has demonstrated that there is noare an important hedge against last-minuteroom for complacency and time and effort is required tosurprises. Depending on the limits purchased,differentiate your risk from your peers. Aon recommends a diversified approach to insurerStart the renewal process earlyselection spanning both the Australian, UK, andSingapore markets where necessary.In the current climate, it is vital that you are preparedto start the renewal process earlier. This allows time to navigate the challenging market conditions, meetIt is important to demonstrate to insurers the strengthunderwriting enquiry, and ensure the best possibleof your risk management frameworks and corporaterenewal outcome. Insurers are asking for more andculture. A proactive approach to risk management ismore information so be prepared to engage morea key differentiator against industry peers. Use casefulsomely with insurers. The quality of your responsesstudies to bring the frameworks to life. Do not relymay impact the quality of the insurers' terms.on insurers’ proposal forms to demonstrate yourIdentify your trade-offsWork with your Aon broker to identify the areas ofcommitment to risk management. cover insurers are most likely to want to restrict. Havein the past, address these with insurers. What lessonsReview your risk appetite and reassess your exposureswere learnt? Demonstrate the changes that have beenmade in the business to minimise the chance of aProfessional indemnity insurance programs developrecurrence. Your Aon broker will assist you to pre-over time. Limits may have been set or increasedempt the areas of concern and the types of questionsduring the soft insurance market when capacity wasthe underwriters are likely to ask so that you can tailorsignificantly cheaper and more readily available.your submission/presentations.When prices increase and cover retracts it can oftenbe an opportune time to review the rationale behindlimits of indemnity and reassess your limit. In somecases, minimum limits will be dictated by regulatoryor contractual requirements. In other circumstanceslimits may have been selected based on a cost benefitanalysis. Reducing the limit on a claims made policyis often a big decision as it applies to both futureand past activities. To assist with this review Aoncan provide Insurable Risk Profiling. Aon Global RiskConsulting will assist to determine key risks andunderstand their financial impact to determine theappropriate limit.5 021-preparing-for-the-year-ahead ProfessionalSubjectIndemnity Insurance Market Insights 2021Do not leave insurers guessingIf there have been claims or risk management issuesa plan around what you may be willing to trade. Take the time to demonstrate the strength of riskmanagement/culturewith their underwriters to facilitate a higher level of Cultivate relationships with multiple markets Meet with your insurersInsurer meetings are becoming crucial as they are a keyopportunity for you to differentiate the organisationby demonstrating good governance culture and acontinued process of review and improvement. Italso allows you to demonstrate the value you placeon a relationship and your collaborative approach toinsurance. Again, Hugo Wegbrans, Aon Global ChiefBroking Officer, has said that “we want carriers to look atthe individual characteristics of a client and make surethey differentiate”.5 Clients need to contribute to this byensuring that they allow time to meet with your insurers.

ContactTanya FergusonClient Director Financial Institutions and ProfessionsFinancial Services GroupT 61 3 9211 3249E tanya.ferguson@aon.com 2021 Aon Risk Services Australia Limited (Aon) ABN 17 000 434 720 AFSL 241141The information provided in this document is current as at the date of publication and subject to any qualifications expressed. While Aon has taken care in the production of this document and theinformation contained in it has been obtained from sources that Aon reasonably believes to be reliable, it does not make any representation as to the accuracy of information received from thirdparties or in respect of any views expressed by Aon which relate to decisions of third parties (such as insurers). This information is intended to provide general insurance related information only. It isnot intended to be comprehensive and it must not (under any circumstances) be construed as constituting legal advice in whole or in part. You should seek independent legal or other professionaladvice before acting or relying on any of the content of this information. Before deciding whether a particular product is right for you, please consider the relevant Product Disclosure Statement andpolicy terms and conditions or contact us to speak to an adviser. Aon will not be responsible for any loss, damage, cost or expense you or anyone else incurs in reliance on or use of any informationcontained in this document.CORP20210723

The APRA report shows a net underwriting combined ratio of 96% for professional indemnity for the year ending March 2021. Insurers generally target a combined ratio of at least 90% suggesting they will continue to seek pricing increases for the foreseeable future. Table 1 APRA Quarterly General Insurance Statistics - Professional Indemnity