Transcription

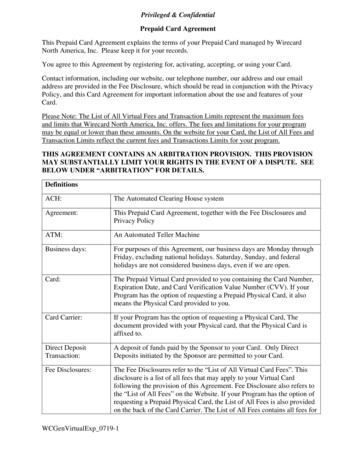

Privileged & ConfidentialPrepaid Card AgreementThis Prepaid Card Agreement explains the terms of your Prepaid Card managed by WirecardNorth America, Inc. Please keep it for your records.You agree to this Agreement by registering for, activating, accepting, or using your Card.Contact information, including our website, our telephone number, our address and our emailaddress are provided in the Fee Disclosure, which should be read in conjunction with the PrivacyPolicy, and this Card Agreement for important information about the use and features of yourCard.Please Note: The List of All Virtual Fees and Transaction Limits represent the maximum feesand limits that Wirecard North America, Inc. offers. The fees and limitations for your programmay be equal or lower than these amounts. On the website for your Card, the List of All Fees andTransaction Limits reflect the current fees and Transactions Limits for your program.THIS AGREEMENT CONTAINS AN ARBITRATION PROVISION. THIS PROVISIONMAY SUBSTANTIALLY LIMIT YOUR RIGHTS IN THE EVENT OF A DISPUTE. SEEBELOW UNDER “ARBITRATION” FOR DETAILS.DefinitionsACH:The Automated Clearing House systemAgreement:This Prepaid Card Agreement, together with the Fee Disclosures andPrivacy PolicyATM:An Automated Teller MachineBusiness days:For purposes of this Agreement, our business days are Monday throughFriday, excluding national holidays. Saturday, Sunday, and federalholidays are not considered business days, even if we are open.Card:The Prepaid Virtual Card provided to you containing the Card Number,Expiration Date, and Card Verification Value Number (CVV). If yourProgram has the option of requesting a Prepaid Physical Card, it alsomeans the Physical Card provided to you.Card Carrier:If your Program has the option of requesting a Physical Card, Thedocument provided with your Physical card, that the Physical Card isaffixed to.Direct DepositTransaction:A deposit of funds paid by the Sponsor to your Card. Only DirectDeposits initiated by the Sponsor are permitted to your Card.Fee Disclosures:The Fee Disclosures refer to the “List of All Virtual Card Fees”. Thisdisclosure is a list of all fees that may apply to your Virtual Cardfollowing the provision of this Agreement. Fee Disclosure also refers tothe “List of All Fees” on the Website. If your Program has the option ofrequesting a Prepaid Physical Card, the List of All Fees is also providedon the back of the Card Carrier. The List of All Fees contains all fees forWCGenVirtualExp 0719-1

both the Virtual and, if applicable, the Physical Card. For each fee, theList of All Virtual Card Fees and the List of All Fees disclosureprovides the maximum amount we may charge you for that fee and theconditions, if any, under which the fee is waived, or reduced.Load:Any time that funds are credited to your CardNetwork:The Network Association (Mastercard or Visa), whichever appears onyour CardSponsor:The organization that requested we issue your Card, and that may Loadthe Card for your useTransaction:Any time you use your Card to access the money on itWe, Us, and Our:Sunrise Banks N.A. of Saint Paul, Minnesota, the issuer of the Card, oursuccessors, affiliates or assigneesYou, Your andYours:The person who is issued, or accepts, activates, or registers a Card andany Authorized User of the CardUsing Your CardYour Virtual Card is a Network-branded Prepaid Card that lets you purchase goods and servicesfrom merchants that accept Virtual debit cards in the Network, like online merchants. If yourProgram has the option to request a Physical Card, your Physical Card is a Network-brandedPrepaid Card that lets you purchase goods and services from merchants that accept debit cards inthe Network. You can also use your Physical Card for additional Transactions permitted in theList of All Fees. Your Card is not a credit card, and may not provide the same rights to you asthose available in credit card transactions. It can be used only for the amounts not exceeding theamount of the Load(s).How You Can UseYour Card – LimitsYou can use your Card to complete Transactions at merchants thataccept Network-branded debit cards (including internet, mail and phoneorder purchases). Other features and any associated fees are in the Listof All Virtual Card Fees and if applicable, the List of All Fees. TheTransaction Limits are listed on the website following the List of AllFees.Use of the Card byOthersIf you provide your Card to another person, you are responsible for thatperson’s use of your Card even if that person uses the Card forTransactions you did not intend. In order to terminate the otherperson’s authority to use the Card, you must either get the Card back orcall us to deactivate the Card.Authorization HoldsWhen you use your Card to pay for goods or services, certainmerchants (such as restaurants and hotels) may ask us to authorize theTransaction in advance and may estimate its final value up to twenty(20%) more to cover any tip or gratuity that you may add to thepurchase. If this occurs and your total bill, after adding in the additional20% (or more), exceeds the amount available on the Card, yourWCGenVirtualExp 0719-1

transactions may be declined. Accordingly, you should ensure that theCard has an available balance that is 20% (or more) greater than yourtotal bill prior to using the Card for these types of purchases. When wepreauthorize a Transaction, we commit to make the requested fundsavailable when the Transaction finally settles and may place atemporary hold on your Card’s funds for the amount indicated by themerchant (which may be more than the final settled Transactionamount). We also may add an amount for certain merchants to ensurethat sufficient funds will be available to cover the final Transaction.Transactions at certain merchants that authorize high dollar amounts,especially rental car companies and hotels, may cause an“authorization” or “hold” on your available balance for up to thirty (30)days. Until the Transaction finally settles or we determine that it isunlikely to be processed, the funds subject to the hold will not beavailable to you for other purposes. We will only charge your Card forthe correct amount of the final Transaction, however, and will releasethe hold on any excess amount when the Transaction finally settles.Receipts and OtherCard InformationYou can get a receipt at the time you make any Transaction using yourCard at a merchant. A receipt may not be provided for certain smallticket Transactions. You may obtain information about the amount ofmoney you have remaining on your Card by calling us. Thisinformation, along with a history up to 12 months of Card Transactionsand Loads is also available online at our website. You also have theright to obtain a written history up to 24 months of Card Transactionsand Loads preceding your request by calling us or writing to us. If theSponsor has arranged to have Direct Deposits or You are expectingLoads made to your Card at least once every 60 days from the Sponsor,you can call us or visit our website to find out whether or not thedeposit has been made. Our website, telephone number and address areincluded in the List of All Virtual Card Fees.FeesYou agree to pay all fees set forth in the List of All Virtual Card Feesand the List of All Fees. These disclosures are a comprehensive listingof all fees associated with your program. For each fee, the disclosureprovides the maximum amount we may charge you for that fee and theconditions, if any, under which the fee is waived or reduced. We cancollect all fees by deducting them from the money on your Card andfrom any Loads. We can change the fees, as described below under“Changes to this Agreement.”Transactions Madein ForeignCurrenciesTransactions made in currencies other than U.S. dollars will beconverted to U.S. dollars under the rules of the Network at the time ofthe Transaction. Currently those rules provide that the conversion ratemay be either a wholesale market rate or government-mandated rate ineffect the day the Network processes the Transaction. The currencyconversation rate in effect on the processing date may be different fromthe rate in effect on the Transaction date or the posting date. We willalso add a Foreign Currency Conversion Fee on all Transactions madein currencies other than U.S. dollars. The Foreign CurrencyConversion Fee will be equal to a percentage amount of each foreignWCGenVirtualExp 0719-1

currency Transaction, as set forth in the List of All Virtual Card Feesand the List of All Fees.No Interest PaidWe do not pay any interest on the money Loaded on your Card (theinterest rate and the Annual Percentage Yield are 0%).Recurring PaymentsBecause your Card can be used only for the amount that is Loaded to it,we recommend that you do not use your Card for recurring payments.If you do, please be sure that you have sufficient money on your Cardfor each payment. Otherwise, your payments may be rejected andreturned for insufficient funds, and your Card may be terminated orsuspended.If a TransactionExceeds the Amountof Money on YourCardYou should expect that any Transaction that exceeds the amount ofmoney on your Card should be declined. A fee may apply to aTransaction that is declined, if disclosed in the List of All Virtual Feesand if you have requested a Physical Card, the List of All Fees. If amerchant completes a Transaction that results in a negative balance onyour Card, you agree to immediately pay us the amount of the negativebalance. If you do not make the required payment, we have the right toinitiate collection proceedings against you, report your failure toconsumer reporting agencies and take other remedies. See Terminationand Other Remedies.Expiration DateSubject to applicable law, you may use the Card only through itsexpiration date. If you attempt to use the Card or add funds to yourCard after the expiration date, the transactions may not be processed.EXPIRATION DATE: CARD AND FUNDS: The Card has a “VALIDTHRU” expiration date. Once this expiration date has passed, the Cardwill be voided and will not be replaced except in our sole discretion.All funds on the Card expire on the expiration date. If you do not spendall the funds on the Card prior to this expiration date, the remainingfunds will not be available to you. You have no right to the fundsexcept to use them for authorized transactions prior to the expirationdate of the Card.Other Obligations and Restrictions On YouYou agree to each of the following obligations and restrictions when you use your Card.Required InformationWCGenVirtualExp 0719-1You must provide your full legal name, residential or businessstreet address (not a P.O. Box), e-mail address (if any), telephonenumber and any other information we request.

Important information about procedures for obtaining a newCard: To help the government fight the funding of terrorism andmoney laundering activities, Federal law requires all financialinstitutions to obtain, verify, and record information that identifieseach person who opens an account.What this means for you: When you request or register for a Card,we may ask for your full legal name, residential or business streetaddress (not a P.O. Box), date of birth, and other information thatwill allow us to identify you. We may also ask to see your driver'slicense or other identifying documents.Your Disputes withMerchantsWe do not guarantee, and we are not responsible for, the delivery,quality, safety, legality or any other aspect of goods and servicesyou purchase using your Card. You agree to resolve any disputeswith a merchant who honored your Card directly, and not toinvolve us in that dispute.Your Relationship Withthe SponsorThe terms of any payments from the Sponsor to you, includingwhether the money belongs to you and is the correct amount, arematters between you and the Sponsor. We are not responsible forresolving any disputes between you and the Sponsor.Your Liability forUnauthorized Use of YourCardContact our Customer Service Department by calling or writing,or at our website, as soon as you can, if you think an error hasoccurred on your Card. Tell us AT ONCE if you believe yourCard has been lost or stolen. Telephoning us at 1-800-439-9568is the best way of keeping your possible losses down. If you tellus orally, we may require that you send us your complaint orquestion in writing. You could lose all the money on your Card.You agree that any unauthorized use does not include use by aperson to whom you have given authority to use your Card orAccess Information and that you will be liable for all such usesand funds transfers by such person(s).Unauthorized PurchasesYou agree to safeguard your Card against loss, theft andunauthorized use by taking all reasonable precautions. If yourCard has been lost or stolen or believe that someone has made anunauthorized transaction with your Card (or may attempt to useyour Card without permission) or you believe an error hasoccurred with your Card, you agree to notify us IMMEDIATELYand in no event later than sixty (60) days of the date of thetransaction at issue. When you notify us, you must provide yourfull name, Card number and other identifying details, adescription of why you believe there is an error or transaction thatyou are unsure about (if applicable), and the dollar amountinvolved. We will cancel your Card, and if our records show thatavailable funds remain on your Card, we may issue you aWCGenVirtualExp 0719-1

replacement Card loaded with the remaining value. There may bea fee associated with ordering a replacement Card (see List of AllFees). We reserve the right to decline to issue you a replacementCard in accordance with applicable law. You agree to assist us indetermining the facts relating to any possible unauthorized use orerror associated with your Card, and to comply with theprocedures we may require for our investigation. Following ourinvestigation, if we determine that unauthorized use or an errorhas occurred w

WCGenVirtualExp_0719-1 currency Transaction, as set forth in the List of All Virtual Card Fees and the List of All Fees. No Interest Paid We do not pay any interest on the money Loaded on your Card (the interest rate and the Annual Percentage Yield are 0%).