Transcription

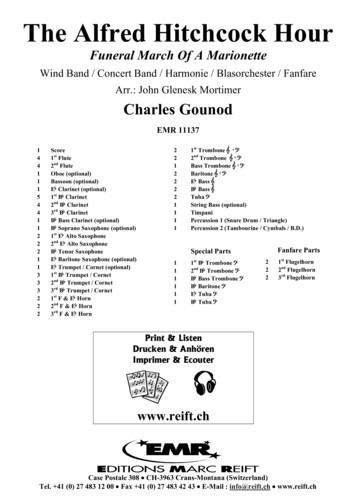

EMR-EHR in Acute andAmbulatory ApplicationsMarch 2019 – Top Level Summary & Report SampleAlex Green – alex.green@signifyresearch.netMichael Liberty – michael.liberty@signifyresearch.net 44 1234 436150Wednesday, 27 March 2019 Copyright Signify Research 2019Click here for Report Brochure1

Global and Regional TrendsThis is a top line overview taken from Signify Research’s market report “EMR/EHR in Acute and Ambulatory Application – World – 2019”published in March 2019.Please contact alex.green@signifyresearch.net for further information on this report or if you would like a one-to-one presentation.Click here for Report BrochureWednesday, 27 March 2019 Copyright Signify Research 20192

WorldClick here for Scope and DefinitionsProduct Trends Operational/admin modules still the largest marketClinical modules take next largest share and growing faster than marketaverageRCM modules, interoperability, PHM/wellness modules 20% of marketCAGR – 4.4%20182023Market Size 23B 29BEMEA Share 20%Asia Share 20%Americas Share 60%Exact numbers provided bycountry in full reportfor 20 Countries/Regions for 2017 - 202310000Millions of USD Market by Vertical 2018 – Full Report Provides Vertical Market0Regional/Network Ambulatory Only Individual Hospital Long-term CareNational2018 Revenue Share – By VendorKey Drivers of & Barriers to GrowthCerner Macro healthcare trends (e.g. new hospitals, IT expenditure, hospital bed and PCP numbers).Penetration of EMR into healthcare systems and EMR market saturationGovernment funding and national eHealth initiativesDevelopment of integrated care networks and impacts on market for different EMR solution typesRegionalisation and changes in procurement models and type of EMR procuredNational EHR roll-outsEMR maturity and the impact this has on demand for clinical systems, financial modules and otheradvanced EMR modulesGrowth of additional services FujitsuVendor 6Vendor 7Vendor 8Vendor 9Vendor 10Vendor 11Vendor 12Vendor 14Vendor 15Market by product (operational, clinical, interop, PHM, RCM) for 20 countries/subregionsMarket by vertical (Regional/network, ind. Hospital, Ambulatory only, long-term and national) for20 countries and subregions. It also shows the market by private v public purchaser.Vendor revenue share estimates for 2018 in 20 countries/subregions.Wednesday, 27 March 2019athenahealthVendor 13Additional Information in Full Report EpicAllscriptsVendor 16Vendor 17The full report presents 2018 marketshares covering 100 vendors in 20countries/subregionsVendor 18Vendor 19Vendor 20 Copyright Signify Research 20193

EMR-EHR in Acute and Ambulatory ApplicationsDrivers of GrowthDriver20182023TrendMacro Health TrendsNumber of hospitals and/or PCPs is still increasing at a global level, driving up overallTAM. Trend more focused on developing regions. In some developed countries thereverse is true reducing TAM.EMR PenetrationStill many hospitals and PCPs that are using paper-based systems. Increased penetrationis a key driver of growth in developing and emerging economies and in some developedeconomies. Once saturation is hit, market growth can suddenly slow (e.g. US ambulatorymarket).Government FundingAll EMR deployments globally have been the product of some level of governmentfunding or initiative to encourage adoption. Initially funding may spur EMR uptake. It canthen be used to encourage changes in how EMR is used (e.g. meaningful use, VBC).However, once funding is withdrawn it can hit market growth (e.g. Canada ambulatory). National Projects National projects can be headline grabbing and the number is gradually increasing.However, they are supplements to core systems and generally not major revenuegenerators. E.g. widespread deployment in Nordics but not a major revenue stream forleading Nordic EMR vendors.Information Provided in the Full Report Each of these drivers is examined in detail across more than 30 country profiles in the full report. Click here for example of typical analysis.Each profile examines which organisations are buying EMRs, and what type (network, regional, ambulatory only, long-term care).Each country profile also presents which vendors have won most of the contracts with these organisations.Each country profile presents the main drivers in that country for EMR procurement, including features required, projects driving integrated care, government funding, etc.Wednesday, 27 March 2019 Copyright Signify Research 20194

EMR-EHR in Acute and Ambulatory ApplicationsDrivers of GrowthDriver2018Regionalisation &Development ofIntegrated CareNetworks2023 ClinicalSystemsHIEEMR maturityAdditional ServicesRevenue per bed/PCP can be increased as the use and breadth of EMR offerings expandsto include more departmental clinical systems, HIE, PHM, telehealth and financial tools.Change won’t be dramatic over the forecast period, but gradual.EMRPHM/T’healthRCMProcurement moving from individual health organisations to health networks, often on aregional basis and often integrating IT purchasing across different levels of health care.On one hand this could reduce vendor revenue per bed/PCP, due to volumes of scale.However, more often it increases it due to wider range of tools procured (e.g. carecoordination, data integration, workflow, managed services, etc.), e.g. ACOs in US andsote-regions in hSoftware provision is just a part of the market. Much of the market is service-driven. Theservice market is forecast to grow faster than the software market as a greater breadthof services are provided by the EMR vendor, e.g. hosting, managed and/or outsourced IT,public cloud storage, implementation, etc.Information Provided in the Full Report Each of these drivers is examined in detail across more than 30 country profiles in the full report. Click here for example of typical analysis.Each profile examines which organisations are buying EMRs, and what type (network, regional, ambulatory only, long-term care).Each country profile also presents which vendors have won most of the contracts with these organisations.Each country profile presents the main drivers in that country for EMR procurement, including features required, projects driving integrated care, government funding, etc.Wednesday, 27 March 2019 Copyright Signify Research 20195

EMR-EHR in Acute and Ambulatory ApplicationsThere are very few truly global EMR ddleEastRoAsia40 vendor profiles are provided in the full reportwhich examine portfolio, provide a SWOT analysis,and discuss each vendors’ key challenges. Anexample is provided at end of this slide 0%0%0%0%0%0%0%0%6Vendor or or ompany9Vendor dor ndor ndor dor nder ndor ndor ndor ndor dor ndor nesday, 27 March 2019 Copyright Signify Research 2019Top 20 Vendors Few of the top 20 vendors have a trulyinternational business Most sell mainly to one market. Nearly all drive 85% of business from justone market Large size of US market distorts this tosome extent. Only a few vendors buck the trend in thetop 20 list.Note full report provides all vendors’ namesand shows their estimated revenue share ineach of the countries/subregions listed.0%None/negligible share of vendor’sEMR revenues10%Vendor present, 85% of vendor’sEMR revenues55%More than 85% of vendor’s EMRrevenues6

EMR-EHR in Acute and Ambulatory ApplicationsThere are very few truly global EMR 0%0%0%0%0%0%0%Vendor ndor ndor endor ndor ndor Vendor Vendor ndor ndor ndor endor ndor il0%Benelux14%AfricaCanada40 vendor profiles are provided in the full reportwhich examine portfolio, provide a SWOT analysis,and discuss each vendors’ key challenges. Anexample is provided at end of this slide ndor 240%0%25Vendor 250%0%26Vendor 260%27Vendor 27282018CompanyWednesday, 27 March 2019 Copyright Signify Research 2019Top 40 Vendors The trend persists in the vendors ranked 2140. Although more exceptions. The large US market is no longer such afactor in determining the trend. Harris, Nexus, Dedalus, Cegedim, Indra, CGIand Orion are good examples of vendorswith international businesses. There is no true global EMR market, insteadseparate markets with their own vendorbase, driven by their own market dynamicsare the norm.Note full report provides all vendors’ namesand shows their estimated revenue share ineach of the countries/subregions listed.0%None/negligible share of vendor’sEMR revenues10%Vendor present, 85% of vendor’sEMR revenues55%More than 85% of vendor’s EMRrevenues7

AmericasMajor Drivers Market by Vertical 2018 - Full Report Provides Vertical Market for20 Countries/Regions for 2017 - 2023Market saturating in North America. Growth being driven by upsellingadditional PHM, RCM, mobile, clinical and hosting products and servicesPrivate hospital markets in Latin America, with many starting to focus onimproving data integration and sharingCAGR 2018-2023 – 4.0%Regional/network vertical is largest market in the Americas, driven by IDNs,ACOs, etc, in USKey Market MetricsLarge ambulatory-only market driven by government initiatives in both US andCanada. However, limited growth due to market saturation and absorption intolarger networks comprising both acute and ambulatory providers.North AmericaMore than 95% of regional market in 2018Latin AmericaForecast to grow with a CAGR significantly higher than the wholeAmericas regionProportionally the smallest individual hospital market of the three main regions2018 Revenue Share – By Vendor in AmericasBy Country US dominates the market in terms of size. However, market is approaching saturation in terms ofcore EHR in both acute and ambulatory markets.US growth driven by provider consolidation and vendors upselling supplemental products(clinical systems, PHM, RCM, services). Replacement market is key battle ground.Canadian acute and ambulatory markets very different in terms of vendors. US internationalvendors and Telus dominate acute. Telus and long list of local vendors dominate ambulatory.Latin America largely served by local vendors including MV, Philips/Tasy, Everis, Benner, Pixeonand some international vendorsAdditional Information in Full Report Market size estimates and forecasts to 2023 for US, Canada, Brazil, Mexico and Rest of LatinAmerica split by vertical, by product and public v provider purchasers. Vendor revenue shares for top vendors in US, Canada and Brazil with further US vendor sharesplits for acute, ambulatory and long-term care markets. Country profiles for five countries in the region with details on purchasers, trends in EMR solutiontypes required, major projects impacting EMR or 6Vendor 7Vendor 7Vendor 9Vendor 10Vendor 11Vendor 12Vendor 13Vendor 14The full report presents 2018 marketshares covering 100 vendors in 20countries/subregions.US market share for acute,ambulatory and long-term caremarket provided.Vendor 15Vendor 16Wednesday, 27 March 2019 Copyright Signify Research 20198

EMEAMajor Drivers Market by Vertical 2018 - Full Report Provides Vertical Market for20 Countries/Regions for 2017 - 2023Upgrades from PAS to clinical EMR solutionsRegionalisation in several countriesIntegrated care agenda in several countriesCAGR 2018-2023 – 5.1%Western EuropeEastern EuropeMEAIndividual hospital market is the largest vertical in EMEA, although with lowestgrowth rate forecast of the main verticals broken outKey Market MetricsRegionalisation and integrated care agenda will mean network/regional verticalis forecast to be the fastest growing, gaining share over forecast periodApproaching 90% of EMEA marketAmbulatory care accounted for less than 20% of the market in 2018. Shareforecast to decline over the forecast periodGrowth considerably above EMEA average2018 Revenue Share – By Vendor in EMEABy Country Unlike the other two major regions (Asia and Americas), there is no one country that dominatesthe marketDACH (Germany, Austria, Switzerland) is the largest market followed by the UK/Eire. With theexception of Cerner, the vendors supplying these two markets are largely different.France is the most fragmented market in terms of the supplier base.Regionalisation is a significant driver of growth in many markets (e.g. Finland, UK, Italy). Theshare taken by the regional/network vertical will grow faster than market average as a result.CAGR over the period 2018 to 2023 varies from a low of just over 2% in Benelux to a high of morethan 7% in subregions outside Western Europe.Additional Information in Full Report Market size estimates and forecasts to 2023 for DACH, Benelux, France, UK/Eire, Spain/Portugal,Italy, the Nordics, Rest of Western Europe, Eastern Europe, Middle East and Africa split byvertical, by product and public v provider purchasers. Vendor revenue shares for top vendors in each of the above countries/regions. Country profiles for 22 countries in the region with details on purchasers, trends in EMR solutiontypes required, major projects impacting EMR market.Wednesday, 27 March 2019CernerCGMAgfaVendor 3Vendor 4Vendor 5Vendor 6Vendor 7Vendor 8Vendor 9Vendor 10Vendor 11Vendor 12Vendor 13Vendor 14The full report presents 2018 marketshares covering 100 vendors in 20countries/subregionsVendor 15Vendor 16 Copyright Signify Research 20199

AsiaMajor Drivers Market by Vertical 2018 - Full Report Provides Vertical Market for20 Countries/Regions for 2017 - 2023Upgrades from PAS to clinical EMR solutions – Japan, Oceania, parts ofRest of AsiaIntegrated care agenda & regionalised contracts in several countriesGreen-field installations in developing regions, India and ChinaCAGR 2018-2023 – 5.5%JapanIndividual hospital market is the largest vertical in AsiaKey Market MetricsRegionalisation and integrated care agenda will mean network/regional verticalis forecast to be the fastest growing, gaining share over forecast periodSecond largest market in the worldInternational VendorsAmbulatory care accounted for less than 20% of the market in 2018Limited presence in Japan and Chinese public market. However,success in Oceania, parts of Rest of Asia and private China market.2018 Revenue Share – By Vendor in AsiaBy Country Japan accounts for more than half of the Asian market. It is served largely by Japanese vendorsthat only sell solutions in Japan.Oceania and China are of comparable size. However, market dynamics and the supplier base ineach country are very different.The public hospital market in China is dominated by local vendors and offers limitedopportunities for international vendors. The private market presents some opportunities forinternational vendors, with some examples of successful implementations.Oceania presents a significant opportunity for international vendors, although it is a highlycompetitive market. Some regionalisation, but still a healthy individual/private hospital market.Additional Information in Full Report Market size estimates and forecasts to 2023 for China, Japan, India, Oceania and Rest of Asia splitby vertical, by product and public v provider purchasers. Vendor revenue shares for top vendors in each of the above countries/regions. Country profiles for 8 countries in the region with details on purchasers, trends in EMR solutiontypes required, major projects impacting EMR market.FujitsuVendor 2Vendor 3Vendor 4Vendor 5Vendor 6Vendor 7Vendor 8The full report presents 2018 marketshares covering 100 vendors in 20countries/subregionsVendor 9Vendor 10Wednesday, 27 March 2019 Copyright Signify Research 201910

Example Country/Sub-region AnalysisThis is an example of the coverage in one region. A similar analysis to the data presented on this slide and that provided over the next fewpages is replicated for the other 19 countries/sub-regions in the full reportClick here for Report BrochureWednesday, 27 March 2019 Copyright Signify Research 201911

A similar analysis to the data presented on thisslide and that provided over the next few pages isreplicated for the other 19 countries/sub-regions inthe full reportNordicsMajor DriversDigital Health Strategy 2018-2022 in DenmarkIntegration of healthcare provision into “sote-areas” in FinlandOne patient one record initiative in NorwayThe National eHealth strategy in Sweden2018Market Size 400-450MOperational/Admin Products 55%Clinical/Data Int./PHM/Wellness 45%CAGR (18-23) 4-5%Exact numbers provided infull reportClinical, data integration,PHM/wellness broken out in fullreportFull Report Provides Vertical Market forecasts to 2023Millions of USD Market by Vertical 2018 –Regional/Network Regionalisation in Denmark. Acute and ambulatory EMR procurement being centralised into fiveregions (social care remaining the remit of the 98 local authorities).Local vendor Systematic has won three regions (Central, North Jutland and South Region). Epic has wonthe other two (Zealand region and Central region), although implementation has had several issues.Regionalisation in Finland. Acute, ambulatory and social care EMR procurement being centralised into19 sote-areas. No longer remit of the 192 local authorities and 21 districts.CGI Group (former Logica business) and Tieto are expected to be the vendors to win out in Finland. Epichas one contract to-date although rollout has been delayed.Acute EMR purchasing is centralised across four regions in Norway. Primary and social careprocurement remains with the 428 municipalities. Major upgrade to test new “one-patient-one-record”initiative planned in one of the four regions - Helse Midt-Norge.Local vendor DIPS has three of the four regional contracts. Cerner the fourth - Helse Midt-Nordge.However, it is not bidding for the upgrade contract. Only Epic remains as a bidder for this new contractwhich will be allocated in 2019.Some grouping of purchasing at a regional level in Sweden, although no central regionalisationproject. Most primary care EMR purchased by 290 municipalities and acute with 21 councils.Tieto is market leader in Sweden. Followed by Cambio, Evry and CGM. Cerner has won some largeregional contracts in 2018.Wednesday, 27 March 2019Ambulatory OnlyNationalLong-term Care2018 Revenue ShareKey Trends Individual HospitalTietoVendor 2Vendor 3Vendor 4Vendor 6Vendor 6Vendor 7Vendor 8Vendor 9The full report shows the vendornames and their estimated marketshare in the Nordics in 2018Vendor 10Others Copyright Signify Research 201912

Click here to download this Nordic example as a pdf documentNordicsWednesday, 27 March 2019 Copyright Signify Research 201913

Click here to download this Nordic example as a pdf documentNordicsWednesday, 27 March 2019 Copyright Signify Research 201914

Click here to download this Nordic example as a pdf documentNordicsThe white paper presented over the last few pages is an extractfrom the full report. Similar country analyses are provided in thefull report for the following countries: BelgiumThe ranceGreecePoland RussiaThe BalticsSaudi ArabiaUAEIsraelAustraliaNew ZealandChinaJapanIndiaSingaporeSouth KoreaBrazilMexicoRest of Latin AmericaThe USCanadaThe market estimates, forecasts and vendor revenue shares arepresented for a sub-set of these countries, namely:EMEA Benelux DACH France Italy The Nordics Spain/Portugal UK/Eire Rest of Western Europe Eastern Europe MEAWednesday, 27 March 2019 Copyright Signify Research 2019Asia China India Japan Oceania Rest of AsiaAmericas Brazil Canada Mexico US Rest of Americas15

Nordics – Example Vendor ProfileVendor profiles are provided in the full report for 41 vendors.These include: Agfa HealthcareAllscripts, Inc.AthenahealthCambio Healthcare SystemsCegedemCernerChipSoftComarch HealthcareCompugroup MedicalCPSIDedalusDIPSDXC ujitsuGreenway HealthHarris Healthcare InterSystemsMaincare SolutionsMedhostMEDITECHMV SistemasNECNeusoftNextGen HealthNexusPhilips TasyRuisoftSanter ReplayServelec ing Health TechnologyGroupClick here to download this example profile as apdf documentWednesday, 27 March 2019 Copyright Signify Research 201916

ConclusionsWednesday, 27 March 2019 Copyright Signify Research 201817

ConclusionsDeeplearningis a trulytransformativeand arethelargelylonger-termThereis nosingle globalEMR market.With a fewtechnologyexceptions, thereindividualimpactlocal marketsthatdrivenby localshouldissues andby local e under-estimated.Total market value and forecast growth are hugely influenced by the US market. The US market hasDeep learning has the potential to improve the accuracy and sensitivity of imagereached saturation in terms of EMR penetration into healthcare organisations, with growth falling toanalysistools belowand willaccelerateinnovationand newproductratessignificantlythoseseen duringthe last decade.This willreduce launches.global growth rates too.Few vendors have had success in breaking into new geographic markets. Exceptions areInterSystems, CGM, Cerner and DXC. Most others have nearly all ( 85%) their business in one or twomarkets. Acquisition of a local vendor is often a precursor to success when entering new geographicmarkets. Organic entry into a new market is often a difficult process with few examples of success.Most geographic markets are quite different to the US, and far from saturated. EMR solutionsreplacing paper systems will still drive a substantial proportion of market growth.Growth is also being driven by revenue per bed/PCP being increased as EMR vendors integrate morefunctionality (e.g. PHM, HIE, telehealth, RCM, clinical systems) into EMRs.In many developed countries the number of EMR customers is reducing and the value of contractsincreasing owing to regionalisation and integrated care initiatives. Local legacy vendors may struggleto scale to meet requirements. At the same time a proven track record in a given country can offer asignificant advantage.Wednesday, 27 March 2019 Copyright Signify Research 2019“With more than 700 vendors supplying solutions, andwith nearly all vendors driving the overwhelming majorityof their revenues from one country, the global EMRmarket would appear very fragmented in terms ofsupply. However, the dominance of the US & Japanesemarkets, where there are established and entrenchedsuppliers, results in the top 10 vendors commanding 62%of world revenues. On that basis quite a consolidatedmarket in terms of supply. These two facts capture thedynamics of the global EMR market well. The large USmarket skews many of the global trends. However, theUS is a saturated market with vendors battling to takeshare in order to grow. Geographic expansion offers analternative. However, it’s one with many pitfalls andvendors need to understand the nuances of localmarkets if they are to succeed.”18

Related InsightsWednesday, 27 March 2019 Copyright Signify Research 201819

Key Insights on the global EMR marketClick Here to Find Out MoreClick Here to Find Out MoreClick Here to Find Out MoreWednesday, 27 March 2019 Copyright Signify Research 201820

Scope & DefinitionsWednesday, 27 March 2019 Copyright Signify Research 201921

EMR-EHR in Acute and Ambulatory ApplicationsScopeClick here to request the blank tables from the report and asample of the 300 page report pdfClick here for Report Brochure with full Table of Contents.Wednesday, 27 March 2019 Copyright Signify Research 201922

A different approach toHealthTech marketintelligenceReliable market data you can trust, insightful analysisand exceptional Analyst support. A world-class team of Analystsdelivering the market intelligence you need, when you need it.Wednesday, 27 March 2019 Copyright Signify Research 201923

There are very few truly global EMR vendors Top 20 Vendors Few of the top 20 vendors have a truly international business Most sell mainly to one market. Nearly all drive 85% of business from just one market Large size of US market distorts this to some extent. Only a few vendors buck the trend in the top 20 list.