Transcription

DIVISION OF AGRICULTURERESEARCH & EXTENSIONUniversity of Arkansas SystemFamily and Consumer SciencesFSFCS49Preparing Family Net Worthand Income StatementsLaura Hendrix, Ph.D.Assistant Professor Family and ConsumerEconomicsDo you know your total familyincome for last year? Have you estimated your family income for thisyear? And do you know what thefinancial worth of your family is? Is ita positive net worth or a negative networth? The best way to answer thesequestions is to prepare a familyincome and a family financial or networth statement.have to estimate some items.However, to avoid future cash flowproblems, always underestimateincome sources.Your Family IncomeStatementThe first step toward understandingyour family’s financial situation is toknow how much money is coming innow. There are many reasons youmay want a family income statement.Your financial situation has changed,your income is irregular, you plan toapply for a credit card or a loan or youjust want a better picture of yourtotal income.Use the Family Income Statementform on page 2 to begin writingyour income statement.An accurate income statementrequires some homework. You may beArkansas IsOur CampusVisit our web site at:https://www.uaex.uada.eduable to use last year’s income taxrecords to estimate your current totalincome. Paycheck stubs, broker statements and checking account recordsshould be consulted. Recording incomesources on check deposit formsprovides a backup record. You mayYour Family NetWorth StatementBasically, your net worth orfinancial statement is the differencebetween what you own (YOURASSETS) and what you owe (YOURLIABILITIES). It measures thefinancial well-being of a family.Preparing a net worth statement will: Help determine your progresstoward a financial goal. Provide a record of the valueof your assets. Help evaluate your investment,savings and insurance needs. Help spot trouble areas if yournet worth is declining.University of Arkansas, United States Department of Agriculture, and County Governments Cooperating

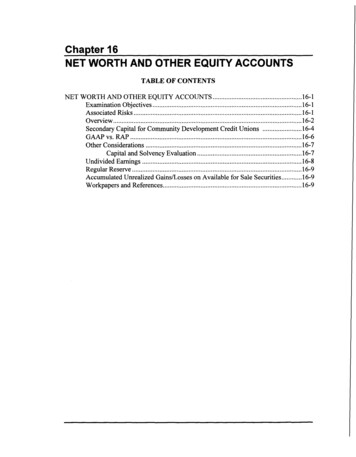

FAMILY INCOME STATEMENT FOR YEAR,Wages and Salaries (Gross)Household MemberHousehold MemberHousehold MemberBonuses and CommissionsChild Support or AlimonySocial Security PaymentsPension or Profit SharingAnnuity PaymentsVeteran’s BenefitsRental IncomeBusiness IncomeFarm IncomeInterestSavings accountsCertificates of depositBondsLoans to othersOtherDividendsStocksOtherCapital gain (or loss) from sale of assetsTrustsCash Gifts ReceivedOtherOtherAn accurate net worth statement is useful forcomparing your financial position from one timeperiod to the next. You will want to prepare a financial statement at the same time each year, such aswhen you complete your income tax statement. Inthis way, you can tell if your financial position isincreasing or decreasing. If you have one or moreretirement plans, are a homeowner, have personalsavings or investments or own a business, you maybe surprised at how much you have!Total Family IncomeAverage Monthly Income(Total 12)When you need credit, your net worth statement will: Help a lender determine if you are credit-worthy. Help you decide if you should take on additional debt. Any time you apply for credit, such as a homemortgage, a car loan or a new credit card, creditorswill examine your net worth statement carefully.

A home mortgage lender will want to know theamount of long-term debt (car loans, alimony, childsupport and balances on charge cards that will takemore than 10 months to pay off) and if a mortgage(principal and interest) plus real estate taxes andhomeowners insurance on the house you want tobuy will be more than 33 to 36 percent of yourgross income.When you apply for a car loan, the lender willwant to know if your long-term debt plus the new carloan will be less than 20 percent of your net income(gross income minus taxes and social security).The credit card lender wants to know theoutstanding balances on your current chargeaccounts and credit cards.How do you make a net worth statement?Net worth is the difference between your totalassets and total liabilities for the same time period.Your net worth statement will consist of two lists –assets and liabilities. Use current market or today’sdollar value for each item. Market value reflects thecash you would receive for an item should you have tosell it.List assets in three broad categories: Cash on hand and other liquid assets – thosethat can easily be converted to cash Market value of investments Personal and family assetsLiabilities are today’s dollar value of whatyou owe. Use the Net Worth Statement worksheet onpage 5.Consider the following as you prepare yourfamily net worth statement:AssetsWhat liquid assets do you have? Cash on hand Cash in checking account Savings account balances Money market funds Life insurance, cash surrender valueUse today’s values. Your last month’s statementcan give you an estimate of the value of your moneymarket fund. Your insurance agent can give you thecash surrender value of each policy.What investments do you have? Certificates of deposit Loans owed to you Savings bonds Government securities Municipal bonds Preferred stock Common stock Corporate bonds Mutual funds Annuities, current values IRA accounts Vested retirement plans, current values Ownership in a business, current value Ownership in real estate, market valueYou will need to consult a number of sources forthe market value of your investments. The currentcash value of a savings bond may be found on a tableon the bond certificate. An estimate of the currentvalue of your stocks and bonds may be computed fromthe various quotations in the daily newspaper. Callyour broker for investments not listed in the newspaper. Periodic reports from your employer will giveyou the vested value of your retirement plan.

Which personal and family assets do you have? Home(s) Household furnishings Personal (jewelry, art, etc.) Automobile(s) Appliances Collectables (antiques, coin or stamp collections, etc.) Most of the information in this category will berough estimates. The price of the most recently soldhouse in your neighborhood will give you an estimated value of your home, an insurance agent willgive you the blue book value of your car and retailersor appraisers can provide you with estimated valuesof jewelry and collections. For personal items, estimate a conservative market value should you beforced to sell.LiabilitiesWhen listing liabilities, check your latestbalance(s) for the most up-to-date figures.Among the liabilities you will want to includemay be: Mortgage debt – home(s) Mortgage debt – other real estate Personal loans Business loans Medical and other current bills Taxes due Car loan(s) Credit card and charge account balances School loansAs you prepare your net worth statement, writeaccount numbers and addresses of creditors andfinancial advisors in the Financial Affairs AddressList provided on page 6 of this fact sheet. Lenderswill need this information to verify the accuracy ofthe information you give them.

AssetsLiquid AssetsCash on handNET WORTH STATEMENTCash in checking accountSavings account(s)Money market fundsLife insurance, cash surrender valueOtherOtherInvestmentsTotal Liquid AssetsCertificates of depositLoans owed to youSavings bondsLiabilitiesMortgage debt – home(s)Mortgage debt – real estatePersonal loansBusiness loansMedical and other current billsTaxes dueCar loan(s)Credit card/charge account balancesSchool loansOtherOtherTotal LiabilitiesGovernment securitiesMunicipal bondsPreferred stockCommon stockCorporate bondsMutual fundsAnnuities, current valuesIRA accountsVested retirement plans, current valueOwnership in a business, current valueOwnership in real estate, market valueOtherOtherTotal InvestmentsPersonal and Family AssetsHome(s)Household furnishingsPersonal (jewelry, art, etc.)Automobile(s)AppliancesCollectables (antiques, coins, etc.)OtherTotal Personal and Family AssetsTotal Assets (add all areas)Net Worth CalculationTotal Assets ( ) addTotal Liabilities ( ) subtractNet Worth ( )

AddressAccount NumberInvestmentsLendersBanksNameFINANCIAL AFFAIRS ADDRESS LISTPrinted by University of Arkansas Cooperative Extension Service Printing Services.DR. LAURA HENDRIX is an assistant professor - family andconsumer economics with the University of Arkansas SystemDivision of Agriculture in Little Rock.FSFCS49-PD-1-2017RVIssued in furtherance of Cooperative Extension work, Acts of May 8and June 30, 1914, in cooperation with the U.S. Department ofAgriculture, Director, Cooperative Extension Service, University ofArkansas. The University of Arkansas System Division of Agriculture offers all its Extension and Research programs and serviceswithout regard to race, color, sex, gender identity, sexual orientation,national origin, religion, age, disability, marital or veteran status,genetic information, or any other legally protected status, and is anAffirmative Action/Equal Opportunity Employer.

apply for a credit card or a loan or you just want a better picture of your total income. Usethe Family Income Statement formon page 2 to begin writing yourincome statement. Anaccurate income statement requiressome homework. You may be able to use last year's income tax records to estimate your current total income. Paycheck stubs, broker state-