Transcription

Archival copy: for current recommendations see http://edis.ifas.ufl.edu or your local extension office.Financial Statements for Dairy Farm Management1J. Holt and D. Webb2Management is using what you have to get whatyou want most. This definition concentrates onobjectives, on "what you want." What you want"most" helps set priorities which keep managers’ timedevoted to important things. "Using what you have"conjures up a decision making procedure for usingresources, the most important of which ismanagement ability and time, followed closely bycapital.Therefore it follows the financialmanagement is used to help achieve objectives, tohelp identify priorities and to improve capital use byproviding the limits within which decisions may bemade. Financial management serves more as thegovernor on a car, rather than the steering wheel.Production and marketing skills generateprofitability directly, whereas financial managementserves more to conserve that profit. So managementtime must be budgeted in order to generate profits,but there is good reason for professionals to expandtheir familiarity with financial management.Weaknesses in production and marketing skills areless easily identified than weaknesses in financialmanagement. If the appropriate financial statementsare available, then financial weaknesses are easy tospot. Having identified financial weaknesses, theconcentration initially is on aligning debts withrepayment capacity. Attention then turns back towhat can be done in production and marketing inorder to improve profitability.Managers’ personal preferences play a major rolein setting objectives and priorities, and the size andorganization of the dairy drives the dailyimplementation of decisions.But financialmanagement tools are pretty well the same for momand pop dairies or dairies that milk in multiples of1,000. Balance sheets are necessary to tell how muchof the business is owned, how much collateral cansecure additional borrowing, and, if push comes toshove, how far away bankruptcy is.Incomestatements show whether the business was profitableor not, and can be used to estimate debt servicingability. Cash flow plans show how much and whenmoney flows through the dairy, and helps test thefeasibility of changes that might be made in the dairy.In essence, balance sheets measure what there isto work with, income statements tell whether enoughmoney is being made to accomplish objectives, andcash flow plans serve as a financial road map. Usedwell, they help keep a dairyman from borrowing moremoney than can be profitably used, repaid, andaccomplish the overall objectives. In the currentbusiness climate, this is no small job, and manywriters imply that whipping up the necessarydocuments will somehow make every dairy successful.Not so; good dairy management is what makes theprofits. Financial management helps protect thatprofit and helps keep dairymen from digging a deeperfinancial hole. In a recent case, a moderate size dairythat had for years been financed by a top lender wasforeclosed. Looking at the financial statements, thatlender saw equity eroding, profits declining, andcounseled the dairyman to sell out. The dairyman, anolder gentleman, wanted to keep the dairy going toprovide jobs for a son and a son-in-law. Thedairyman ignored the reality shown by the financialstatements, borrowed enough money from a differentlender to pay out the first lender, and dairied until hisequity was all gone. Had he heeded the warning, hecould have bought modest homes for his children and1.This document, is Fact Sheet DS 84 of the Dairy Production Guide, published September, 1992, Florida Cooperative Extension Service.For more information, contact your county Cooperative Extension Service office.2.Professor, Food and Resource Economics Department; Professor, Dairy Science Department; Cooperative Extension Service, Institute ofFood and Agricultural Sciences, University of Florida, Gainesville.The Institute of Food and Agricultural Sciences is an Equal Opportunity/Affirmative Action Employer authorized to provide research, educationalinformation and other services only to individuals and institutions that function without regard to race, color, sex, or national origin.Florida Cooperative Extension Service / Institute of Food and Agricultural Sciences / University of Florida / John T. Woeste, Dean

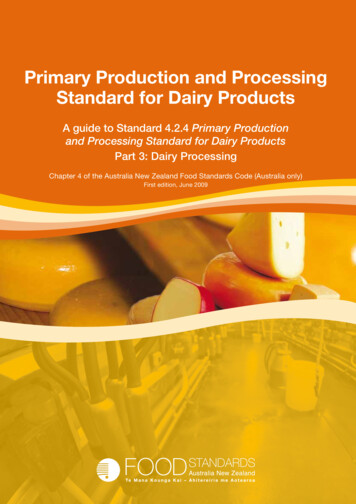

Archival copy: for current recommendations see http://edis.ifas.ufl.edu or your local extension office.Dairy Farm Financial ManagementPage 2still had enough left for an adequate retirement. Hepersisted, and neither he nor his family wound upwith anything. On the positive side, successfuldairymen have carefully monitored their financialprogress and expanded only when they werefinancially able to make a major move.been accumulating, which account for most of theaccounts payable of 165,000. Too many of the otherdebts may have been grouped into the "current"portion of liabilities. Some of that debt may be onlonger terms than shown here. If so, the paymentexpected in the coming year would be less.BALANCE SHEETThe intermediate category includes cows andequipment, with estimated useful lives of 3 and 5years respectively. Evaluating the worth of the cowherd is a difficult problem, one that can be deferredto another day. Equipment is easier to estimateuseful lives, but appraisal of it can also be tricky.Values of used equipment have gone downsignificantly in value over the last three years becauseof the bind dairymen and other farmers are in. Thesevalues indicate a possibility of some collateral valueremaining in cows and equipment ( 423,000 assets vs. 126,168 liabilities). Whether or not lenders wouldconsider this as additional loan support would dependon their own appraisals.Financial analysis is anchored on each end by thebalance sheet. It gives a stop-action look at thefinancial situation at the beginning and end of theyear. In between, income statements detail incomeand expenses. These are tied closely to the cash flowanalysis, which monitors cash coming into thebusiness and how it is used.Where do the data come from? The oldestmanagement truism is that good records arenecessary, but too many people view records as abackward-looking tool intended only to help lendersand tax collectors. The real value in keeping recordsis in helping the manager:***set goals for the futuremake the management decisions needed toachieve those goals, andtrack financial progress toward those goalsalong the way.The major hurdle in providing the examplenumbers came in assembling the scattered pieces ofinformation into a form which permits analysis.The balance sheet provided (Table 1)sufferssomewhat from the lack of record keeping, in that anup-to-date asset ledger was not available. It is alsonot known which assets were pledged to secure whatloans. The example balance sheet has both assets andliabilities broken into three classifications based onthe length of life. The idea is to try and match loanrepayment schedules to asset lifespans. In practice,most loans will mature somewhat before theunderlying security is worn out.The first thing that leaps out of the balance sheetis the terrible liquidity bind the dairyman is in.Current assets are less than 9,000 against currentliabilities of more than 300,000.In anunderstatement, this calls for some debt restructuring.De facto restructuring has already been going on, butit has been going the wrong way. Current debts haveSpeaking of collateral, lenders in general aremuch less disposed toward collateral lending thanthey were five years ago. Rapid decreases in thevalue of land, buildings and equipment (cows, too)have made them gunshy. They want to see loanapplications supported by earnings, not collateral.That point is made in the long-term assetcategory. The example shows almost 300,000 moreasset value than liabilities. Two points here: the firstis how far the lender would be willing to go oncollateral. This dairy is getting pretty tight (debt toequity of 980,403 divided by assets of 1,231,800 .8). If assets were valued conservatively, and if therewas strong profitability, and a strong price outlook,this might not worry too many lenders. But thesecond point is that most of the equity in thisoperation comes from land and buildings being valuedat 2,000 per acre. An appraisal at 1,500 per acrewould wipe out 200,000 of that equity it one swoop.Assets can be financed with borrowed money(debts or liabilities) or with equity capital or networth. Total assets must balance with liabilitiesplus net worth, hence the name balance sheet. Whennet worth is gone, the business is operatingcompletely on other people’s money, and it is broke,so net worth measures the distance to bankruptcy.Year end balance sheets tell where the business

Archival copy: for current recommendations see http://edis.ifas.ufl.edu or your local extension office.Dairy Farm Financial ManagementPage 3Table 1. Balance sheet -- a small north Florida dairy.ASSETSTable 2. Example dairy income statement.INCOME:CURRENT:Milk Sold 643,175Cash 800Cull Cows43,694Cash value Life Ins.5,000Calves Sold12,500Feed inventory3,000Sub-TotalTOTAL INCOME 8,800INTERMEDIATE:Mature Cows (278 @ 900) 251,000Heifersa) Bred (26 @ 750)b) Calves (25 @ 100)19,5002,500Dairy Equipment50,000Field Equipment100,000Sub-Total 1,231,800LIABILITIESCURRENT:Accounts payableCurrent portion of otherdebt 165,002141,303 306,305INTERMEDIATE:Equipment (5 yrs)Sub-Total34,750126,168Total LiabilitiesNet Worth11,276Breeding4,800Contract Labor3,000DHIA2,952 160,918 513,18011,1005,400213,678Fertilizer5,600Fill 7,435Labor69,600Milk Hauling20,197Office RM:Land (20 yrs)Advertisement & PromotionMiscellaneousSub-TotalCows (3 yrs) 4,980Feed 800,000Total AssetsAccounting & LegalEmployee RentLONG-TERM:Land, Facilities andBuildingsEXPENSES:Electric 423,000 699,3692,400Supplies12,000Taxes10,800Vet & Drugs2,640 980,403TOTAL EXPENSES 546,660 251,397NET INCOME 152,709Debt Payments125,000NET CASH 27,709

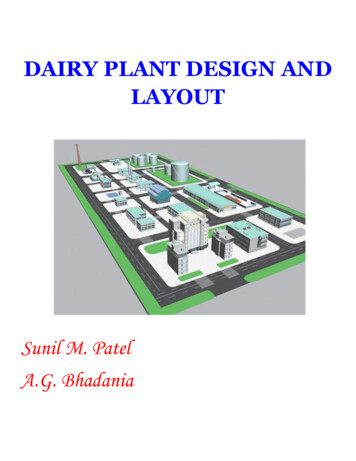

Archival copy: for current recommendations see http://edis.ifas.ufl.edu or your local extension office.Dairy Farm Financial Managementstands going into the next year. Another year, andanother balance sheet tells the financial conditionthen. The difference between the two shows howmuch financial progress was made during the year.Income or earnings statements for the year will showhow that progress was made.INCOME STATEMENTThe classic income statement would show farmincome and expenses divided into three sections: cashoperating statement, adjustments for inventorychanges, and adjustments for capital items. Table 2is probably more a cash-flow statement than a trueincome statement. It contains no adjustments forinventories (principally feed and cows) or capitalassets (purchases or depreciation). What is shown isa cash accounting statement of actual expenses andincomes.Analysis of income statements is straightforward.First a preliminary look at profitability shows incomesgreater than expenses but the debt load is very large.Looking at the debt payments -- which wouldnormally be on a cash flow statement but not on anincome statement -- shows that the dairy lacked thecash to cover its commitments. Clearly somethingmust be done.The income statement gives some places to lookfor improvements in operating efficiency. Big savingscan only come from big ticket items. As expected,the biggest is feed. Interest is next and improvementsthere imply some debt replacement or restructuring.Labor and repairs are other relatively large expenseitems that might suggest a review of managementpractices in those areas. Milk hauling is one expensethat needs to be increased.Page 4BUDGETSBudgets offer the best hope for providing somesort of comparative analysis. A budget shows anestimate of economic cost of facilities and equipmentin addition to the income and expense data provided.Thus an individual could compare his costs and acrude estimate of profitability to a budget for his typeoperation. Budget information, or more precisely,budget projections, are a must before making somemajor change such as adding a silage operation. Anexample budget for a 500-cow dairy is given in Table3.SUMMARY*A series of financial statements is needed tomeasure progress.*Lenders need these documentsthemselves about loan quality.*Managers need financial objectives and they needcontinually to measure progress toward them.*Measuring progress forced decisions. If equity iseroding, why? What can be done about it? Whatis the outlook? How many years of staying powerare there before an effective shift is no longerpossible?*Financial analysis can give identical answers todifferent dairymen who will make differentdecisions based on the data, depending on theirobjectives and what they think their alternativesreally are.tosatisfy

Archival copy: for current recommendations see http://edis.ifas.ufl.edu or your local extension office.Dairy Farm Financial ManagementPage 5Table 3. Example budget for 500 cow dairy, 15,000 lbs. RHA, twice daily milking, raising replacements, and purchasingsilage.UnitQuantityPrice Total Milk salescwt.75,00015.501,162,500Cull cowshead125480.0078,000Bull calveshead26725.0020,025Resources: 1,260,525Variable Costs:Feed1. Cow rationton1,750160.00280,0002. Heifer rationton341.3150.0051,1953. e ,100Vet and litiesmonth121500.0018,000Fuel and ees and duescow5009.004,500Interestdollar880,239.0870,419 950,646Fixed costs:Interest on cattledollar570,000.1268,400DIRI on cow facilitiesdollar276,000.10529,044DIRI on equipmentdollar44,000.177,480DIRI on heifer equip.dollar30,000.159,720Interest on landdollar420,000.1042,000 156,644Return to risk and management 153,235

Assets can be financed with borrowed money (debts or liabilities) or with equity capital or net worth. Total assets must balance with liabilities plus net worth, hence the name balance sheet. When net worth is gone, the business is operating completely on other people’s money, and it is