Transcription

CAPITAL MARKETS NATIONAL RETAIL PARTNERS OFFERING MEMORANDUMPieology & Restaurants at Rio Rancho Towne Center II2051 RANCHO VALLEY DRIVE, POMONA, CALIFORNIA 91766

Exclusively Marketed byINVESTMENT ADVISORSNRP-WEST TEAMJIMMY SLUSHER 1 949 725 8507Lic. 01857569jimmy.slusher@cbre.comJOHN READ 1 949 725 8606Lic. 01359444john.read@cbre.comPHILIP D. VOORHEES 1 949 725 8521Lic. 01252096phil.voorhees@cbre.comKIRK BRUMMER 1 949 725 8418Lic. 01218518kirk.brummer@cbre.comMEGAN WOOD 1 949 725 8423Lic. 01516027megan.wood@cbre.comCBRE-Newport Beach3501 Jamboree Rd., Ste 100Newport Beach, CA 92660F 1 949 725 8545www.cbre.com/nrpwestTodd GoodmanPreston FetrowKirk BrummerPhilip D. VoorheesJohn ReadMegan WoodJimmy SlusherMatt BursonJames TyrrellFor all of our available listings, please visit:www.cbre.com/nrpwest

14141820INVESTMENT SUMMARYAREA OVERVIEWPROPERTY OVERVIEWTENANT PROFILESFINANCIALSInvestment HighlightsCity OverviewCounty OverviewParcel MapSite PlanAssumptionsCash FlowRent Roll

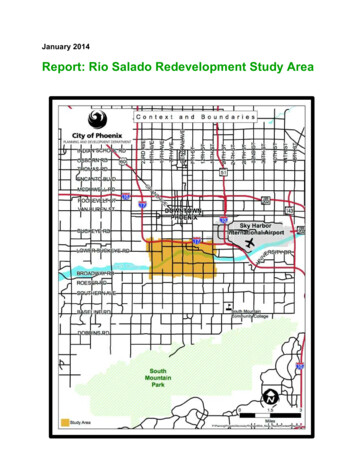

Traffic Counts (CPD Daily Averages)240,000Interstate 10(at State Route 57)154,000212,000State Route 57(at Interstate 10)State Route 60(at State Route 71)GAREY HIGH SCHOOL(1,674 STUDENTS)LEE NAILSAND SPAAERIALW. LEXINGTON AVENUEWELLSFARGOMARTIN LUTHER KING JR.MEMORIAL PARKFUTUREHOTELFUTURE RETAIL 6,300 IWS.AVEEAVRANCHOVALLERIO RANCHOTOWNE CENTER IIRIO RANCHOTOWNE CENTERYDRIVENCHO ROADRIO RA1E7UT D)ROTE 0 CPSTA63,00(PAMPER NAILAND SPA PARNUEFUTURE RESIDENTIALDEVELOPMENTS.NUE

investment highlightsInvestment SummaryOFFERING PRICE 5,130,000CAP RATE5.25%NOI 269,346TOTAL BUILDING AREA7,875 SFTOTAL LAND AREA1.26 Acres (54,885 SF )LAND COVERAGE RATIO14.34%OCCUPANCY100%PROPERTY nt Highlights100% LEASED, LONG TERM STABILITY Stable Income with Improving Returns – Net Operating Income isprojected to increase more than 69,000 (26%) over the anticipated holdperiod, providing a strong hedge against inflation NNN and Admin Fees – Pieology & Restaurants at Rio Rancho TowneCenter II feature NNN leases plus 10% administrative fee recapture,resulting in few, if any capital responsibilities – Operating costs reside withthe property’s tenants, not the landlordHIGH IDENTITY LOCATION WITHIN A NEWLY CONSTRUCTED TARGET-SHADOW ANCHOREDSHOPPING CENTER Central Location – Rio Rancho Towne Center is centrally located alongState Route 71 (63,000 cars per day), serving the communities ofPomona and Phillips Ranch, in addition to parts of Chino Hills, DiamondBar and Chino Point of Destination – Located across Rancho Valley Drive from therecently constructed Rio Rancho Towne Center, a 335,000 SF Target andRoss Dress for Less-anchored community center spread across 31.85acres Retail Hub – Synergistic surrounding tenant mix satisfies daytime andevening customer demands. Surrounding tenants include: Target, RossDress for Less, Citiwear, GNC, Panda Express, Golden Corral, Chipotle,Flame Broiler, Carl’s Jr./Green Burrito, Del Taco, Jersey Mike’s,T-Mobile, UPS Store, Planet Fitness, Wing Stop and othersPIEOLOGY & RESTAURANTS AT RIO RANCHO TOWNE CENTER II1

investment highlightsInvestment Highlights (CONTINUED)INTERNET RESISTANT TENANCYAFFLUENT, LOS ANGELES COUNTY DEMOGRAPHICS More than 18,700 people in a 1-mile radius, with an AverageHousehold Income exceeding 80,000 per year More than 150,800 people in a 3-mile radius, with an AverageHousehold Income exceeding 75,600 per year More than 342,500 people in a 5-mile radius, with an AverageHousehold Income exceeding 77,500 per year 100% Restaurant Uses – “Quick Casual” and take out restaurantslike Pieology, Little Caesar’s and Corky’s provide a strong bulwarkagainst internet competition. Dining experiences cannot bereplicated online, and benefit from internet delivery services likeDoorDash and GrubHubYou Cannot Do This Online! – The property’s location in Rio RanchoTowne Center provides a retail experience, featuring dining, fitness,beverage and service optionsPRIDE OF OWNERSHIP ASSET AND IDEAL 1031 EXCHANGE UPLEGLOW MANAGEMENT HASSLE Recent Construction – Newly built Los Angeles County retail property High Quality NNN Asset – New Construction (2016) strip center withNNN leases provide for limited management obligation Long Term Leases – Recent, long term leases (Corky’s - 10 years;Pieology – 10 years) plus options, eliminating near term leasingresponsibilityCoupon Clipper – Long term, NNN leased investment, plusadministrative recapture provides for minimal management and out ofpocket obligations Pride of Ownership, Internet Resistant Asset – You cannot eat acustom pizza or freshly baked pastry online! No Existing Financing – Delivered free and clear of debt permitting aninvestor to purchase for cash or obtain new financing at desired LTVand terms Recently Constructed, High Quality Asset – High quality, newly builtretail center with no deferred maintenance, limiting an investor’snear term capital requirements2 CAPITAL MARKETS/NATIONAL RETAIL PARTNERS

investment highlightsPIEOLOGY & RESTAURANTS AT RIO RANCHO TOWNE CENTER II3

area overviewCity OverviewThe city of Pomona is located on the eastern border of LosAngeles County and encompasses approximately 22 squaremiles. Located in the heart of the Greater Los Angeles Basin,Pomona is bordered by the San Gabriel Valley and the InlandEmpire. Of the 88 incorporated cities in Los Angeles County,Pomona ranks as the fifth largest city with just over 154,000residents. Incorporated in 1888, Pomona is connected todowntown Los Angeles and downtown Riverside by theMetrolink as well as the 10, 57, 60, 71 and 210 Freeways.Pomona is serviced by Ontario Airport which is located just 12miles from the city center and is also proximate to John WayneAirport, Long Beach Airport and Los Angeles InternationalAirport (LAX).Pomona is the site of the Fairplex, which hosts the L.A.County Fair, and the NHRA Auto Club Raceway at Pomona(formerly known as Pomona Raceway) home to the Circle KWinternationals, Auto Club Finals and other races includingthe O’Reilly Street Machine and Muscle Car Nationals and theNMCA Flowmaster West Street Car Series. The L.A. CountyFair is the fourth largest fair in the US (per visitors) and thelargest in California, attracting more than 1.4 million peopleannually, additionally the facility is used year-round to hosta variety of educational, commercial, and entertainment4 CAPITAL MARKETS/NATIONAL RETAIL PARTNERS

area overviewLA County Fairshows such as trade and consumer shows, conventions, andsporting events. These events include Barretts horse sales,the Grand National Roadster Show, L.A. Roadster Show, thePomona Swap Meet & Classic Car Show 7 times per year andthe year-round home to the Wally Parks NHRA Museum.POMONA TOP EMPLOYERSRankEmployer1Pomona Valley Hospital# of Employees3,0782Pomona Unified School District2,9023California State Polytechnic University2,6124Fairplex5Casa Colina Rehabilitation Center8176City of Pomona6897Verizon5968County of Los Angeles Department of Social Services4009First Transit34810Inland Valley Care & Rehab954339Source: Comprehensive Financial Report, PomonaPIEOLOGY & RESTAURANTS AT RIO RANCHO TOWNE CENTER II5

area overviewCal-Poly PomonaCity Overview (CONTINUED)POMONA DEMOGRAPHICS2016 Estimated PopulationPomonaCalifornia154,34538,986,1712020 Projected Population159,52340,718,3912010 Census Population149,05837,253,9562010-2016 Annual Population Growth Rate0.56%0.73%2016-2021 Annual Population Growth Rate0.66%0.87%2016 Estimated Median Age30.3035.802016 Estimated Households39,53213,029,2922021 Projected Households40,74413,549,4372010 Census Households38,47712,577,4982010-2016 Annual Household Growth Rate0.43%0.57%2016-2021 Annual Household Growth Rate0.61%0.79%2016 Estimated Average Housing Value2016 Estimated Households 348,563 518,28039,53213,029,2922016 Estimated Average Household Income 65,154 90,8122021 Estimated Average Household Income 70,398 98,876Source: EsriPomona is home to a number of colleges and universitiesincluding: California State Polytechnic University (Cal-Poly),and Western University of Health Sciences. Cal-Poly Pomonais one of only two polytechnic universities in the 23 CaliforniaState University campus system. The Western Universityof Health Sciences main campus in Southern California isamong the most thriving enterprises in the Pomona andSan Gabriel Valleys. The Pomona campus helped transformdowntown Pomona into a thriving mix of retail, commercial,and educational enterprises.6 CAPITAL MARKETS/NATIONAL RETAIL PARTNERS

area overviewLOCAL MAPAERIALPIEOLOGY & RESTAURANTS AT RIO RANCHO TOWNE CENTER II7

area overviewSanta MonicaCounty OverviewLos Angeles County is the most populous county in the countrywith over 18 million people spread over a land area the sizeof Maine. Thirty of LA’s suburbs have populations of 80,000 ormore. Los Angeles County is home to one of the most educatedlabor pools in the country, offering a labor force of more than5 million. Los Angeles County’s continued economic growth,in contrast to other areas of the state and nation, is due to itsgrowing population, diverse economy and abundant, well-trainedworkforce.LA County FairLos Angeles County is served by one of the largest freewaynetworks in the country, providing direct access to the fiveneighboring counties of Orange, Riverside, San Bernardino, Kern,and Ventura. Los Angeles County’s extensive freeway networkfacilitates the movement of people and freight throughout theregion, the state, and the nation.Los Angeles International Airport (LAX) serves Los AngelesCounty and is the seventh busiest passenger airport in theworld and third busiest in the US serving nearly 74.9 millionpassengers per year. Along with its 742 daily flights, LAX ranks14th in the world and fifth in the US in air cargo processed. It issupplemented by its proximity to Ontario International Airport inthe City of Ontario (San Bernardino County), Burbank Airport inBurbank (Los Angeles County), John Wayne Airport in Santa Ana(Orange County), and Long Beach Airport (Los Angeles County).8 CAPITAL MARKETS/NATIONAL RETAIL PARTNERSJ. Paul Getty Museum

area overviewPerishing SquareCounty Overview (CONTINUED)Located on the southern coast of California, Los Angeles Countycovers 4,084 square miles and includes San Clemente and SantaCatalina islands. The county is comprised of approximately 88vibrant and diverse cities hosting more than 244,000 businessestablishments—the greatest concentration in the state.LOS ANGELES COUNTY DEMOGRAPHICS2016 Estimated Population10,147,7652020 Projected Population10,479,4882010 Census Population9,818,6052010-2016 Annual Population Growth Rate0.53%2016-2021 Annual Population Growth Rate0.65%2016 Estimated Median Age35.402016 Estimated Households3,321,5082021 Projected Households3,416,9662010 Census Households3,241,2042010-2016 Annual Household Growth Rate2016-2021 Annual Household Growth Rate0.39%0.57%2016 Estimated Average Housing Value 576,8902016 Estimated Households3,321,5082016 Estimated Average Household Income 85,7302021 Estimated Average Household Income 93,392Source: EsriPIEOLOGY & RESTAURANTS AT RIO RANCHO TOWNE CENTER II9

area overviewDowntown LACounty Overview (CONTINUED)Los Angeles County has a Gross Domestic Product (GPD) ofapproximately 544 billion, placing it among the top 20 economiesin the world–higher than Switzerland, Sweden, and Saudi Arabia. Ofits 244,000 businesses, there are more minority and women-ownedbusinesses than any other county in the nation. Los Angeles Countyis also the nation’s top international trade and manufacturing center.Los Angeles is recognized worldwide as a leader in entertainment,health sciences, business services, aerospace, and internationaltrade. While Hollywood and the Southern California beach cultureare part of the collective image of Los Angeles, the city also boastsmore museums than any other city in the US and some of the besthotels in the world.Los Angeles County possesses a diverse economic base,boasting a number of Fortune 500 companies headquarteredin the county, including the Walt Disney Company, EdisonInternational, Health Net, and Jacobs Engineering Group to namea few (see chart on page 13). Key factors positively influencingthe region’s economic position include increased local mediaproduction by the entertainment industry, a continuing expansionof import flows, and growth in aerospace, homeland security,and in the private business sector. Los Angeles County’s welleducated labor pool, numerous universities, appealing climate,and world-class infrastructure will enable Greater Los Angeles tocontinue to be a world leader in economic and cultural influence.KEY JOBS IN LOS ANGELES COUNTYENTERTAINMENT162,850TRADEPort of Los Angeles163,600BUSINESS SERVICES162,850EDUCATION91,730FASHION65,510Union StationHOSPITALITY & TOURISM63,750FINANCE SERVICES55,180Source: www.chooselacounty.com10 CAPITAL MARKETS/NATIONAL RETAIL PARTNERS

area overviewUniversity City WalkWarner Brothers StudiosCounty Overview (CONTINUED)INTERESTING FACTS ABOUT LOS ANGELES COUNTY Los Angeles County has more than 80 stage theaters and300 museums. The Port of Los Angeles is the busiest in the US and one ofthe busiest in the world. The Los Angeles five-county region, which includes LosAngeles, Riverside, Ventura, Orange, and San Bernardinocounties has a population of over 18 million. If the five-county Los Angeles area were a state it would bethe fourth largest in the United States. If Los Angeles County were a nation, it would have the 19thlargest economy in the world. Los Angeles is regarded as the entrepreneurial capital of theworld with nearly twice as many small businesses than anyother similarly-sized region of the United States.Dolby TheatreMagic MountainPIEOLOGY & RESTAURANTS AT RIO RANCHO TOWNE CENTER II11

area overviewRodeo DriveMadame TussaudsGriffith Observatory12 CAPITAL MARKETS/NATIONAL RETAIL PARTNERSCalifornia Science Center

REGIONAL MAParea overviewREGIONAL MAPFORTUNE 500 COMPANIES IN LOS ANGELES COUNTY1COMPANYLOCATIONThe Walt Disney CompanyBurbankRANK612DirecTVEl Segundo983Occidental Petroleum CorporationLos Angeles1164Amgen Inc.Thousand Oaks1545Edison InternationalRosemead2226Jacobs Engineering Group Inc.Pasadena2377Health Net, Inc.Woodland Hills2548Reliance Steel & AluminumLos Angeles2999AECOM Technology CorporationLos Angeles33210Oaktree Capital Group, LLCLos Angeles35411CBRE, Inc.Los Angeles36312Molina Healthcare, Inc.Long Beach39313Avery Dennison CorporationGlendale39814Mattel, Inc.El Segundo40315Live Nation EntertainmentBeverly Hills40447131215136108115Source: http://fortune.com/fortune500214TOP EMPLOYERS IN LOS ANGELES COUNTY(BY REVENUE)EMPLOYERREVENUEThe Walt Disney Co 48BIngram Micro Inc. 44BDirecTV 32BQualcomm Inc. 26BAmgen Inc. 19B9Source: ocal-companies-20130514-photogallery.htmlPIEOLOGY & RESTAURANTS AT RIO RANCHO TOWNE CENTER II13

property overviewProperty Overview (CONTINUED)LOCATIONBUILT2051 Rancho Valley DrivePomona, California 91766The subject was constructed in2016.LAND AREAFREEWAY TRAFFIC COUNTSThe subject site consists of 7,875 SFof building area.Interstate 10(at State Route 57) 240,000State Route 57(at Interstate 10) 154,000State Route 60(at State Route 71) 212,000State Route 71 63,000FRONTAGE & ACCESSZONINGThe subject site consists of 54,885SF of land area (1.26 Acres).BUILDING AREAThe subject is visible from StateRoute 71 and accessed throughone (1) access point on Rio RanchoRoad and three (3) access points onRancho Valley Drive.14 CAPITAL MARKETS/NATIONAL RETAIL PARTNERSAccording to the city of Pomona thesubject site is currently zoned asC-4 highway commercial.ADJACENT PROPERTIESNorth: Rio Rancho Towne CenterII is bordered to the northby Rio Rancho TowneCenter Phase I.East: Rio Rancho Towne CenterII is bordered to the east bythe remaining portions ofRio Rancho Towne Centerand Pomona AutoCenterbeyond that.South: Rio Rancho Towne CenterII is bordered to the southby SR-71.West: Rio Rancho Towne CenterII is bordered to the westby SR-71 and adjacentfuture developments.

property overviewPARCEL MAPPIEOLOGY & RESTAURANTS AT RIO RANCHO TOWNE CENTER II15

PAMPER NAILAND SPA FUTURERESIDENTIALDEVELOPMENTFUTUREHOTELOWNEDFUTURE RETAILBY WATER 6,300 SFDISTRICT(MWD)RANCHOTSTARIOTOWNE CENTER IIIVERIRYDLEALOVONRACHOCHADRO16)CPDONGTIN EEX NU.L EW AVE 71UTE RO000(63,NRALEE NAILSAND SPARIO RANCHOTOWNE CENTERWELLSFARGO

property overviewSITE PLANUEENAVTEHISWTarget is located adjacent toRio Rancho Towne Center Phase IIPAMPER NAILAND SPADRIVERANCHO VALLEYFUTURE HOTEL CORONA FREEWAY ROUTE 71RIO RANCHO ROADFUTURE RETAIL6,300 SFPIEOLOGY & RESTAURANTS AT RIO RANCHO TOWNE CENTER II17

tenant overviewPIEOLOGYLITTLE CAESARSCORKY’S KITCHEN & BAKERYPieology is an artisan-style, casually upscale,build-your-own pizza parlor that has endlesscombinations of pies. Customers get the option tochoose from three different kinds of crusts, sevensauces, six cheese options, seven meats, andsixteen veggie toppings, which can be finishedwith an option of five drizzles, such as pesto or fierybuffalo sauce. in 2015, Pieology was named thecountry’s fastest-growing restaurant chain by foodconsultancy Technomic.Little Caesars Pizza, known for its HOT-NREADY pizza and famed Crazy Bread, isthe largest carryout-only pizza chain in theworld with locations in all 50 states and 18countries and territories worldwide. Named“Best Value in America” for the eighth year ina row, Little Caesars products are made withquality ingredients, such as fresh, never frozen,mozzarella and Muenster cheese, dough madefresh daily in every store and sauce made fromfarm fresh crushed tomatoes.Corky’s is a Southern California based homestyleAmerican cuisine, full-service restaurant chain thathas 10 locations in the Inland Empire and RiversideCounty. With memories of his Grandmother “Corky”,Mike Towles and his wife Jennifer, have re-createdthose same memories with homestyle breakfast,lunch and dinner. Corky’s proudly featureshomemade pies, baked fresh daily with thefinest ingredients and flaky crust. The restaurantalso offers an assortment of fresh baked goods,including cookies, muffins and other uarters:www.pieology.comPrivate137Rancho Santa Margarita, CA18 CAPITAL MARKETS/NATIONAL RETAIL ww.littlecaesars.comPrivate4,301Detroit, kyskitchenandbakery.comPrivate10Alta Loma, CA

tenant overviewPIEOLOGY & RESTAURANTS AT RIO RANCHO TOWNE CENTER II19

financialsAssumptionsGLOBALAVAILABLE SPACE LEASINGAnalysis PeriodOccupancy and AbsorptionCommencement DateSeptember 1, 2017End DateSECOND GENERATION LEASINGRetention RatioProjected Available at 9/1/17August 31, 2027Currently Available as of 6/1/170 SF10 YearsPercentage Available at 6/1/170.00%TermFinancial Terms2017 Monthly Market RentRent AdjustmentLease TermArea MeasuresBuilding Square Feet (SF)7,875 SFExpense Reimbursement TypeEXPENSESGrowth Rates2017 BudgetOperating Expense SourceConsumer Price Index (CPI)[3]3.00%Other Income Growth Rate3.00%Operating Expenses3.00%Real Estate Taxes2.00%Management Fee (% of EGR)Real Estate Taxes ReassessedMillage RateCY 2018-3.00%CY 2019-3.00%CY 2020-3.00%CY 2021-3.00% For customized Debt Quotations, please contact:CY 2022-3.00%CY 2023-3.00%CY 2024-3.00%CY 2025-3.00%Bruce Francis 1 602 735 1781Lic. BK-0018505bruce.francis@cbre.comCY 2026-3.00%-5.00%Capital Reserves (CY 2017 Value) 0.25 PSF4.00%Yes 5,0003 Month(s)Renewal0 Month(s)Weighted AverageShaun Moothart 1 949 509 2111Lic. 01773201shaun.moothart@cbre.comCBRE Debt & Equity Finance (DEF) is a division of CBRE Inc. In the US, DEF represents approximately 300 lendersincluding: banks, life insurance companies, pension funds, CMBS lenders and a variety of other lending sources.DEF also acts as a correspondent for over 200 life insurance companies. The Quote above is an approximationof available terms.MARKET LOAN[1][2]0.75 Month(s)Tenant Improvements ( /SF)Weighted AverageLoan Funding (as of Jul-17) 3,078,000Loan-To-Price60.00%Funding DateSep-17Maturity DateAug-27[1] General Vacancy Loss factor includes losses attributable toprojected lease-up, rollover downtime, and fixturing downtime. Thefollowing tenants are excluded from this loss factor for current andoption terms only: Little Caesars.Amortization PeriodInterest Rate4.25%[2]Origination Fee on Initial Loan Funding1.00%20 CAPITAL MARKETS/NATIONAL RETAIL PARTNERS[4][5]NewRenewalLoan Term[3] Operating Expenses are based on the 2017 Budget, less any ownerspecific expenses. Assumes a 15% OEA Administrative Fee.5 YearsNNN (No Mgmt) 10% AdTenanting CostsNewFINANCINGNotes: All market rent rates are stated on calendar-year basis.Capital Reserves do not inflate during the term of the analysis.3.00% Annually1.171179%Special Assessments (Estimated)3.00%General Vacancy Loss 3.00 - 3.40 PSFRent AbatementsMarket Rent GrowthCY 2027 75%0 SFInitial Interest Only Period (If Any)10.0 Years30 Years24 Months 30.00 PSF 6.00 PSF 12.00 PSFCommissionsNew[5]6.00%Renewal1.20%Weighted Average2.40%DowntimeNew6 Month(s)Weighted Average2 Month(s)[4] Real Estate Taxes have been reassessed at the estimated purchase price based on amillage rate of 1.171179% plus special assessments of 5,000.[5] Rent Abatement includes NNN charges as well as base rent.

financialsPIEOLOGY & RESTAURANTS AT RIO RANCHO TOWNE CENTER II21

financialsCash FlowFiscal Year9/17-8/18 9/18-8/19 9/19-8/20 9/20-8/21 9/21-8/22 9/22-8/23 9/23-8/24 9/24-8/25 9/25-8/26 9/26-8/27 9/27-8/28Physical %100.00%100.00%100.00%100.00%100.00%Overall Economic Occupancy %95.76%95.80%95.80%Total Operating Expenses PSF Per Year 18.65 19.07 19.50 20.03 20.55 21.02 21.49 21.98 22.58 23.17 22.64 368,025REVENUESScheduled Base RentCY 2018 /SF/MO [2]Gross Potential Rent 3.11 294,154 294,154 294,154 314,548 328,977 328,977 328,977 328,977 351,879 368,025Absorption & Turnover Vacancy0.0000000000000Base Rent Abatements0.0000000000000368,025Total Scheduled Base 328,977328,977351,879368,025Expense 383158,126161,966165,903169,948172,349171,479TOTAL GROSS 103490,943494,880521,827540,374539,504General Vacancy FECTIVE GROSS 634470,310474,080499,710517,673516,841OPERATING ,873)Management Fee ,260)(2,329)(2,399)(2,470)(2,545)(2,621)Real Estate OTAL OPERATING 449)(178,258)NET OPERATING 35301,080301,022321,855335,224338,583CAPITAL COSTSTenant Improvements0.0000000000000Leasing Commissions0.0000000000000Capital 1,969)(1,969)(1,969)(1,969)(1,969)(1,969)TOTAL CAPITAL 69)(1,969)(1,969)(1,969)(1,969)(1,969)OPERATING CASH FLOW 2.83 267,377 267,329 267,283 285,834 299,214 299,166 299,111 299,053 319,886 333,255 336,614[1] This figure takes into account vacancy/credit loss, absorption vacancy, turnover vacancy, and base rent abatements.[2] Based on 7,875 square feet.22 CAPITAL MARKETS/NATIONAL RETAIL PARTNERS

financialsCash Flow (CONTINUED)Fiscal Year9/17-8/18 9/18-8/19 9/19-8/20 9/20-8/21 9/21-8/22 9/22-8/23 9/23-8/24 9/24-8/25 9/25-8/26 9/26-8/27 9/27-8/28ACQUISITION & RESIDUAL SALEPurchase Price0000000000Tenant Improvements( 5,130,000)00000000000Leasing Commissions00000000000Net Residual Value00000000005,389,113All CashIRR( 5,130,000) 267,377 267,329 267,283 285,834 299,214 299,166 299,111 299,053 319,886 5,722,3686.04%3,078,000000000000(2,594,141)[3]CASH FLOW BEFORE DEBTMARKET LOAN [4]Loan Funding / PayoffLoan FeesAnnual Debt ServiceCASH FLOW AFTER DEBTNOI 1,703)(181,703)LeveragedIRR( 2,082,780) 136,562 136,514 85,580 104,131 117,511 117,463 117,408 117,350 138,183 .87%6.27%6.53%6.50%UNLEVERAGED Cash %LEVERAGED Cash Return 37%Rolling - All Cash olling - Leveraged IRRN/MN/MN/M2.56%3.77%4.56%5.11%7.07%7.98%8.16%[3] Net Residual Value is calculated by dividing Year 11 NOI by the Residual Cap Rate of 6.00% and applying a 4.50% Cost of Sale.[4] Market Debt based on 60% Loan-to-Value, 4.25% Interest Rate, 30-Year Amortization, 24 Months Interest Only and 1.00% Loan Fee.[5] Leveraged Cash Return is based on NOI less debt service divided by equity including costs to stabilize.PIEOLOGY & RESTAURANTS AT RIO RANCHO TOWNE CENTER II23

financialsRent RollLease TermRental RatesSuiteTenant NameSquareFeet% 00ALittle Caesars1,26016.00%Aug-2016Aug-2021Current 4,032 3.20 48,384 38.40RecoveryTypeMarket Assumption /Market RentNNN (No Mgmt) 10% AdOption 3.20 NNN (Restaurant)Notes:Tenant has three (3) - five (5) year options at 12% increase over prior rent for each of the first two (2) options and FMV for the 3rd option (two modeled below). Tenant has a 5%cap on controllables (assumed not hitting, not modeled).Sep-2021 Aug-2031OPTIONFUTURESep-2026 4,511 5,053 3.58 4.01 54,130 60,631 42.96 48.12NNN (No Mgmt) 10% AdMarket 3.20 NNN (Restaurant)CurrentJun-2021 5,481 6,029 3.40 3.74 65,770 72,347 40.80 44.88NNN(No Mgmt) 10% Ad (95%) PIEOption 3.40 NNN (Restaurant)Notes:Assumed tenant exercises two (2) - five (5) year options with no leasing Notes:Tenant has two (2) - five (5) year options at 10% increase over prior rent and FMV, respectively (first option modeled below). Tenant has a 5% cap on controllables (not hitting,not modeled).Jun-2026 May-2031OPTIONFUTURE 6,632 4.11 79,581 49.37NNN(No Mgmt) 10% Ad (95%) PIEMarket 3.40 NNN (Restaurant)CurrentNov-2020 15,000 16,877 3.00 3.37 180,000 202,521 35.98 40.48NNN(No Mgmt) 10% Ad (95% GLA)Option 3.00 NNN (Restaurant)Notes:Assumed tenant exercises one (1) - five (5) year option with no leasing costs.2051-230Corky’s Kitchen& Bakery5,00363.53%Nov-2015Oct-2025Notes:Tenant has four (4) - five (5) year options at 12.5% increase over prior rent for each option (modeled below). Tenant has a 5% cap on controllables (assumed not hitting, notmodeled).Nov-2025 Oct-2045OPTIONFUTURENov-2030Nov-2035Nov-2040 18,984 21,359 24,027 27,029 3.79 4.27 4.80 5.40 227,813 256,304 288,323 324,344 45.54 51.23 57.63 64.83 24,513 3.11 294,154 37.35Notes:Assumed tenant exercises four (4) - five (5) year options with no leasing costs.TOTALS / AVERAGESOCCUPIED SFAVAILABLE SFTOTAL SF7,8757,87507,87524 CAPITAL MARKETS/NATIONAL RETAIL PARTNERS100.0%0.0%100.0%NNN(No Mgmt) 10% Ad (95% GLA)Market 3.00 NNN (Restaurant)

D isclaimerAFFILIATED BUSINESS DISCLOSURECBRE operates within a global family of companies with many subsidiaries and/or related entities (each an “Affiliate”) engaging in a broad range of commercial real estatebusinesses including, but not limited to, brokerage service s, property and facilities management, valuation, investment fund management and development. At timesdifferent Affiliates may represent various clients with competing interests in the same transaction. For example, this Memorandum may be received by our Affiliates,including CBRE Investors, Inc. or Trammell Crow Company. Those, or other, Affiliates may express an interest in the property described in this Memorandum (the “Property”)may submit an offer to purchase the Property and may be the successful bidder for the Property. You hereby acknowledge that possibility and agree that neither CBRE,Inc. nor any involved Affiliate will have any obligation to disclose to you the involvement of any Affiliate in the sale or purchase of the Property. In all instances, however,CBRE Inc. will act in the best interest of the client(s) it represents in the transaction described in this Memorandum and will not act in concert with or otherwise conductits business in a way that benefits any Affiliate to the detriment of any other offeror or prospective offeror, but rather will conduct its business in a manner consistent withthe law and any fiduciary duties owed to the client(s) it represents in the transaction described in this Memorandum.CONFIDENTIALITY AGREEMENTThis is a confidential Memorandum intended solely for your limited use and benefit in determining whether you desire to express further interest in the acquisition of theProperty.This Memorandum contains selected information pertaining to the Property and does not purport to be a representation of the state of affairs of the property or the ownerof all Property (the”Owner”), to be all-inclusive or to contain all or part of the information are provided for general reference purposes only and are based on assumptionsrelating to the general economy, market conditions, competition and other factor

5 Casa Colina Rehabilitation Center 817 6 City of Pomona 689 7 Verizon 596 8 County of Los Angeles Department of Social Services 400 9 First Transit 348 10 Inland Valley Care & Rehab 339 Source: Comprehensive Financial Report, Pomona LA County Fair AREA OVERVIEW 5.