Transcription

5-1

Chapter5Adjustments and theWorksheetSection 1: The WorksheetSection ObjectivesMcGraw-Hill1.Complete a trial balance ona worksheet.2.Prepare adjustments forunrecorded businesstransactions. 2009 The McGraw-Hill Companies, Inc. All rights reserved.

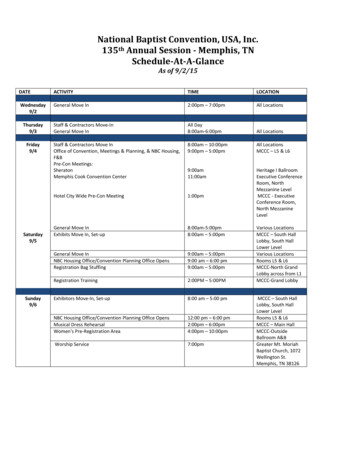

Complete a trial balance on aworksheetObjective 1The worksheet hasan Account Name columnThe worksheet alsohas five sections.Each section hastwo columns.JT’s Consulting ServicesWorksheetMonth Ended December 31, 2010TRIAL BALANCEACCOUNT NAMEDEBITCREDITADJUSTMENTSDEBITCREDIT5-3ADJ. TRIAL BAL.INCOME STMT.DEBITDEBITCREDITCREDITBALANCE SHEETDEBITCREDIT

Complete the Trial Balance section infour steps1. Enter the general ledger account names.2. Transfer the general ledger account balances to the Debitand Credit columns of the Trial Balance section.3. Total the Debit and Credit columns to prove that the trialbalance is in balance.4. Place a double rule under each Trial Balance column toshow that the work in that column is complete.5-4

Step 1: Enter the general ledger account names.JT’s Consulting ServicesStep 1: Enter the general ledger accountnames.WorksheetMonth Ended December 31, 2010TRIAL BALANCEACCOUNT NAMEDEBITCashADJUSTMENTSADJ. TRIAL BAL.Carter Consulting ServiceDEBIT CREDITDEBITWorksheetMonth Ended December 31, 2004CREDITCREDITINCOME STMT.BALANCE SHEETDEBITDEBITCREDITCREDITAccounts ReceivableSuppliesACCOUNT NAMEPrepaid RentCashEquipmentTRIAL BALANCEDEBITAccum. Depr.—Equip.Accounts PayableJason Taylor, Cap.CREDITADJUSTMENTSDEBITCREDITADJ. TRIAL BAL.DEBITCREDITINCOME STATEMENT BALANCE SHEETDEBITCREDITDEBITCREDITThese four new accounts willbe used for the adjustments.Jason Taylor, Draw.Fees IncomeSalaries ExpenseUtilities ExpenseSupplies ExpenseRent ExpenseDepr. Exp.—Equip.Totals**If additional new expense accountsare needed in the adjustment process,add them to the bottom of theACCOUNT NAME column.5-5

Step 2: Transfer the general ledger account balances tothe Debit and Credit columns of the Trial Balance section.JT’s Consulting ServicesWorksheetMonth Ended December 31, 2010TRIAL BALANCEACCOUNT NAMECashDEBITCREDITADJUSTMENTSADJ. TRIAL BAL.DEBITDEBITCREDITCREDITINCOME STMT.DEBITCREDITBALANCE SHEETDEBITCREDIT83,500Accounts Rec.101CashACCOUNTACCOUNT NO.SuppliesPrepaid RentBALANCEEquipmentDATEAccum. Depr.2010Nov. al. forwardAccounts Pay.Dec. 31J226,00091,000J. Taylor, Cap.Dec. 31J24,00095,000Dec. 31J27,00088,000Dec. 31J250087,500Dec. 31J24,00083,500J. Taylor, Draw.5-6CREDIT

Step 3: Total the Debit and Credit columns to prove thatthe trial balance is in balance.ACCOUNT NAMECashTRIAL pment7,00022,000Accounts Payable7,000Jason Taylor, Cap.90,0004,000Fees IncomeSalaries ExpenseUtilities Expense35,0007,000500Supplies ExpenseRent ExpenseDepr. Exp.—Equip.TotalsBALANCE SHEETDEBITDEBITDEBITCREDITCREDITStep 4: Place a double rule undereach Trial Balance column to showthat the work in that column iscomplete.Accum. Depr.—Equip.Jason Taylor, Draw.CREDITINCOME STMT.83,500Accounts ReceivablePrepaid RentCREDITADJ. TRIAL BAL.132,000 132,0005-7CREDIT

Objective 2ACCOUNT NAMECashTRIAL BALANCEADJUSTMENTSADJ. TRIAL BAL.INCOME STMT.BALANCE uipmentCREDITCREDITCREDITCREDIT83,500Accounts ReceivablePrepaid RentPrepare adjustments for unrecordedbusiness transactions7,00022,000Accum. Depr.—Equip.Accounts Payable7,000Jason Taylor, Cap.90,000Jason Taylor, Draw.4,000Fees IncomeSalaries ExpenseUtilities Expense35,0007,000500These adjusting entries are firstentered in the Adjustmentssection of the worksheet.Supplies ExpenseRent ExpenseDepr. Exp.—Equip.Totals132,000 132,0005-8CREDIT

The Supplies AdjustmentJT’s Consulting Services began the month with 3,000 in supplies.At the end of the month, 2,000 in supplies remained.QUESTION:What dollar amount of supplies wasused during the month? 3,000- 2,000ANSWER: 1,0005-9

JT’s Consulting ServicesWorksheetMonth Ended December 31, 2010ACCOUNT NAMECashTRIAL BALANCEADJUSTMENTSADJ. TRIAL BAL.INCOME STMT.BALANCE uipmentCREDIT83,500Accounts ReceivablePrepaid RentCREDIT(a)1,0007,00022,000Accum. Depr.—Equip.Accounts Payable7,000Jason Taylor, Cap.90,000Jason Taylor, Draw.4,000Fees IncomeSalaries ExpenseUtilities Expense35,0007,000500Supplies Expense(a)1,000Rent ExpenseDepr. Exp.—Equip.Totals132,000 132,0005-10CREDITCREDITCREDIT

The Prepaid AdjustmentOn November 20, 2010, JT’s Consulting Services paid 7,000 forthe December and January rent. As of December 31, 2010, onemonth’s rent had already been used up.QUESTION:What dollar amount of rent wasused during the month of December? 7,000- 3,500ANSWER: 3,5005-11

JT’s Consulting ServicesWorksheetMonth Ended December 31, 2010ACCOUNT NAMECashTRIAL BALANCEADJUSTMENTSADJ. TRIAL BAL.INCOME STMT.BALANCE uipmentCREDIT83,500Accounts ReceivablePrepaid RentCREDIT(a)7,00022,000(b)1,0003,500Accum. Depr.—Equip.Accounts Payable7,000Jason Taylor, Cap.90,000Jason Taylor, Draw.4,000Fees IncomeSalaries ExpenseUtilities Expense35,0007,000500Supplies Expense(a)1,000Rent Expense(b)3,500Depr. Exp.—Equip.Totals132,000 132,0005-12CREDITCREDITCREDIT

DepreciationThe cost is recorded as an asset and charged to expense over thetime the asset is used for the business. ASSETExpenseThis expense is calleddepreciation.ExpenseJan.2008Expense5-13

There are several methods to calculate depreciation. JT’sConsulting Services uses the straight-line method.QUESTION:What is straight-line depreciation?ANSWER:Straight-line depreciation (S/L) allocatesan asset’s cost in equal amounts to eachaccounting period of its useful life.S/L depreciation Cost - salvage valueEstimated months of useful life5-14

Calculating DepreciationJT’s Consulting Services purchased equipment in November, 2010.· Cost 22,000· Useful life 5 yrs or 60 months (5 yrs x 12 months)· Salvage value 0QUESTION:What dollar amount of depreciation expenseshould be recorded for the month?Cost - salvage valueEstimated months of useful lifeANSWER: 22,000 - 060 months 3675-15

Adjustment for DepreciationInstead of decreasing the asset account directly, the adjustment fordepreciation is recorded in a contra account named AccumulatedDepreciation—Equipment.Accumulated Depreciation—EquipmentEquipment Contra asset account hasa normal credit balanceAsset account has anormal debit balance5-16

JT’s Consulting ServicesWorksheetMonth Ended December 31, 2010ACCOUNT NAMECashTRIAL BALANCEADJUSTMENTSADJ. TRIAL BAL.INCOME STMT.BALANCE uipmentCREDIT(a)7,00022,000(b)Accum. Depr.—Equip.7,000Jason Taylor, Cap.90,000Utilities Expense367When all adjustments areentered, total and rule theAdjustments columns.35,0007,000500Supplies Expense(a)1,000Rent Expense(b)3,500Depr. Exp.—Equip.(c)367TotalsCREDIT3,5004,000Fees IncomeSalaries ExpenseCREDIT1,000(c)Accounts PayableJason Taylor, Draw.CREDIT83,500Accounts ReceivablePrepaid RentCREDIT132,000 132,0004,8674,8675-17

Book ValueAccumulated Depreciation—EquipmentEquipment22,000367Original cost of equipmentRecord of all depreciationtaken on equipmentBook value Original cost – Accumulated depreciation 22,000 – 367 21,6335-18

Chapter5Adjustments and theWorksheetSection 2: Financial StatementsSection ObjectivesMcGraw-Hill3.Complete the worksheet.4.Prepare an income statement, statement ofowner's equity, and balance sheet from thecompleted worksheet.5.Journalize and post the adjusting entries. 2010 The McGraw-Hill Companies, Inc. All rights reserved.

The Accounting CycleStep 1AnalyzetransactionsStep 2Journalize thedata abouttransactionsStep 3Post thedata abouttransactionsStep 4PrepareaworksheetStep 5PreparefinancialstatementsStep 9Interpretthe financialinformationStep 7RecordclosingentriesStep 8Prepare apostclosingtrial balance5-20Step 6Recordadjustingentries

Objective 3Complete the worksheetYou have already seen how to prepare the first twosections of a worksheet: Trial Balance AdjustmentsYou will now learn how to complete a worksheet.Preparing a worksheet is the fourth step of theaccounting cycle.5-21

Step 1: Combine the figures from the Trial Balance section and the Adjustmentssection. Record the results in the Adjusted Trial Balance columns.TRIAL BALANCEADJUSTMENTSADJ. TRIAL BAL.INCOME STMT.BALANCE SHEETDEBITDEBITDEBITDEBITDEBITACCOUNT NAMECREDITCREDITCash83,500Accounts )3,500(c)367Prepaid RentEquipmentAccum. Depr.—Equip.Accounts Payable7,000Jason Taylor, Cap.90,000Jason Taylor, Draw.4,000Fees IncomeSalaries ExpenseUtilities Expense35,0007,000500Supplies Expense(a)1,000Rent Expense(b)3,500Depr. Exp.—Equip.(c)3674,867Totals132,000 132,0004,8675-22CREDITCREDITCREDIT

The accounts that do not have adjustments are extended from the Trial Balancesection to the Adjusted Trial Balance section.TRIAL BALANCEADJUSTMENTSADJ. TRIAL BAL.INCOME STMT.BALANCE SHEETDEBITDEBITDEBITDEBITDEBITACCOUNT NAMECREDITCREDIT83,50083,500Accounts 00(b)3,500CashPrepaid RentEquipmentCREDIT22,000Accum. Depr.—Equip.(c)367Accounts Payable7,0007,000Jason Taylor, Cap.90,00090,000Jason Taylor, Draw.4,000Fees IncomeSalaries ExpenseUtilities Expense4,00035,00035,0007,0005007,000500Supplies Expense(a)1,000Rent Expense(b)3,500Depr. Exp.—Equip.(c)3674,867Totals120,000 120,0004,8675-23CREDITCREDIT

The Supplies account has a 3,000 debit balance in the Trial Balance sectionand a 1,000 credit in the Adjustments section.( 3,000 debit and 1,000 credit 2,000)TRIAL BALANCEADJUSTMENTSADJ. TRIAL BAL.INCOME STMT.BALANCE SHEETDEBITDEBITDEBITDEBITDEBITACCOUNT NAMECREDITCREDIT83,50083,500Accounts Receivable5,0005,000Supplies3,000CashPrepaid RentEquipment(a) 1,0007,00022,000(b)CREDIT2,0003,50022,000Accum. Depr.—Equip.(c)367367Accounts Payable7,0007,000Jason Taylor, Cap.90,00090,000Jason Taylor, Draw.4,000Fees IncomeSalaries ExpenseUtilities Expense4,00035,00035,0007,0005007,000500Supplies Expense(a)1,000Rent Expense(b)3,500Depr. Exp.—Equip.(c)3674,867Totals132,000 132,0004,8675-24CREDITCREDIT

Step 2: Total the Debit and Credit columns in the Adjusted Trial Balancesection. Confirm that debits equal credits.TRIAL BALANCEADJUSTMENTSADJ. TRIAL BAL.INCOME STMT.BALANCE SHEETDEBITDEBITDEBITDEBITDEBITACCOUNT NAMECREDITCREDIT83,50083,500Accounts Receivable5,0005,000Supplies3,000CashPrepaid RentEquipment(a) m. Depr.—Equip.(c)367367Accounts Payable7,0007,000Jason Taylor, Cap.90,00090,000Jason Taylor, Draw.4,000Fees IncomeSalaries ExpenseUtilities Expense4,00035,00035,0007,0005007,000500Supplies Expense(a)1,0001,000Rent Expense(b)3,5003,500Depr. Exp.—Equip.(c)3674,8673674,867 132,367 132,3675-25Totals132,000 132,000CREDITCREDIT

For accounts that appear on the balance sheet, enter the amount in theappropriate column of the Balance Sheet section. For accounts that appear onthe income statement, enter the amount in the appropriate column of the IncomeStatement section.TRIAL BALANCEADJUSTMENTSADJ. TRIAL BAL.INCOME STMT.BALANCE SHEETDEBITDEBITDEBITDEBITDEBITACCOUNT NAMECREDITCREDIT83,50083,500Accounts Receivable5,0005,000Supplies3,000CashPrepaid RentEquipment(a) m. Depr.—Equip.(c)367367Accounts Payable7,0007,000Jason Taylor, Cap.90,00090,000Jason Taylor, Draw.4,000Fees IncomeSalaries ExpenseUtilities Expense4,00035,00035,0007,0005007,000500Supplies Expense(a)1,0001,000Rent Expense(b)3,5003,500Depr. Exp.—Equip.(c)3674,8673674,867 132,367 132,3675-26Totals132,000 132,000CREDITCREDIT

After all the account balances are transferred to the financial statementsections, total the Debit and Credit columns.TRIAL BALANCEADJUSTMENTSADJ. TRIAL BAL.INCOME STMT.BALANCE SHEETDEBITDEBITDEBITDEBITDEBITACCOUNT unts 00022,00022,000CashPrepaid RentEquipment(a) 1,0007,00022,000(b)Accum. Depr.—Equip.(c)3,500367CREDIT3,500367Accounts Payable7,0007,0003677,000Jason Taylor, Cap.90,00090,00090,000Jason Taylor, Draw.4,000Fees IncomeSalaries ExpenseUtilities 07,000500Supplies Expense(a)1,0001,0001,000Rent Expense(b)3,5003,5003,500Depr. Exp.—Equip.(c)3674,867Totals132,000 132,0003673674,867 132,367 132,367 12,367 35,000 120,000 97,3675-27

Subtract the smaller total from the larger total in the Income Statement section tofind the Net Income or Net Loss.ACCOUNT NAMETRIAL BALANCEADJUSTMENTSADJ. TRIAL BAL.INCOME STMT.BALANCE 0Accounts Receivable3,000SuppliesPrepaid Rent7,000Equipment22,000Accum. Depr.—Equip.7,000Accounts PayableJason Taylor, Cap.90,0004,000Jason Taylor, Draw.Fees Income35,000Salaries Expense7,000Utilities Expense500Supplies ExpenseRent ExpenseDepr. Exp.—Equip.Totals132,000 132,000Net IncomeCREDIT83,5005,000(a) 1,0002,0003,500(b) 3,50022,000(c) 90,0003677,00090,0004,0004,00035,000(a) 1,0003,500(c)3674,083(b)7,0005001,0003,5003674,083 120,583 35,000 120,000 97,367

If the credit total is more than the debit total, the firm has net income. . .Enter the amount on the Net Income line. (35,000 – 12,367 22,633)ACCOUNT NAMETRIAL BALANCEADJUSTMENTSADJ. TRIAL BAL.INCOME STMT.BALANCE 0Accounts Receivable3,000SuppliesPrepaid Rent7,000Equipment22,000Accum. Depr.—Equip.7,000Accounts PayableJason Taylor, Cap.90,0004,000Jason Taylor, Draw.Fees Income35,000Salaries Expense7,000Utilities Expense500Supplies ExpenseRent ExpenseDepr. Exp.—Equip.Totals132,000 132,000Net IncomeCREDIT83,5005,000(a) 1,0002,0003,500(b) 3,50022,000(c) 90,0003677,00090,0004,0004,00035,000(a) 1,0003,500(c)3674,083(b)7,0005001,0003,5003674,083 120,583 22,63335,000 120,000 97,367

Total the Income Statement and the Balance Sheet sections.ACCOUNT NAMETRIAL BALANCEADJUSTMENTSADJ. TRIAL BAL.INCOME STMT.BALANCE 0Accounts Receivable3,000SuppliesPrepaid Rent7,000Equipment22,000Accum. Depr.—Equip.7,000Accounts PayableJason Taylor, Cap.90,0004,000Jason Taylor, Draw.Fees Income35,000Salaries Expense7,000Utilities Expense500Supplies ExpenseRent ExpenseDepr. Exp.—Equip.Totals132,000 132,000Net IncomeCREDIT83,5005,000(a) 1,0002,0003,500(b) 3,50022,000(c) 90,0003677,00090,0004,0004,00035,000(a) 1,0003,500(c)3674,083(b)7,0005001,0003,5003674,083 120,583 120,5835-30CREDIT35,0007,0005001,0003,50036712,367 35,000 120,000 97,36722,63322,63335,000 35,000 120,000 120,000

The Accounting CycleStep 1AnalyzetransactionsStep 2Journalize thedata abouttransactionsStep 3Post thedata abouttransactionsStep 4PrepareaworksheetStep 5PreparefinancialstatementsStep 9Interpretthe financialinformationStep 7RecordclosingentriesStep 8Prepare apostclosingtrial balance5-31Step 6Recordadjustingentries

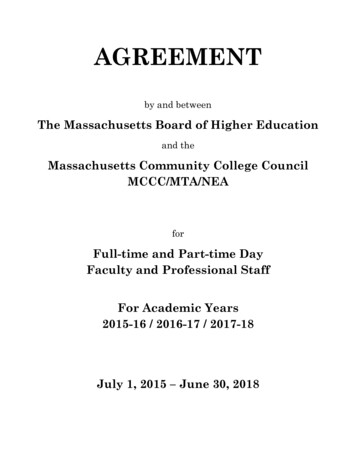

Objective 4Prepare financial statements fromthe worksheetJT’s Consulting ServicesIncome StatementMonth Ended December 31, 2010RevenueFees Income 35,000ExpensesSalaries Expense 7,000Utilities500Supplies Expense1,000Rent Expense3,500Depreciation Expense - EquipmentTotal Expenses367 12,367Net Income for the Month 22,6335-32

JT’s Consulting ServicesStatement of Owner’s EquityMonth Ended December 31, 2010Jason Taylor, Capital, December 1, 2010Net Income for December 90,000 22,633Less Withdrawals for December4,000Increase in Capital18,633Jason Taylor, Capital, December 31, 20105-33 108,633

JT’s Consulting ServicesBalance SheetDecember 31, 2010LiabilitiesAccounts Payable Owner’s EquityJason Taylor, CapitalTotal Liabilities and Owner’s Equity108,633.00 115,633.00AssetsCash 83,500.00Accounts Receivable5,000.00Supplies2,000.00Prepaid Rent3,500.00Equipment22,000.00Total Assets 115,633.00The balance sheet in Chapter 4 was prepared using theaccount form.5-347,000.00

JT’s Consulting ServicesBalance SheetMonth Ended December 31, 2010AssetsCash 83,500Accounts Receivable5,000Supplies2,000Prepaid Rent3,500Equipment22,000Less Accumulated Depreciation367Total Assets21,633 115,633Liabilities and Owner’s EquityLiabilitiesAccounts Payable 7,000Owner’s EquityJason Taylor, Capital108,633Total Liabilities and Owner’s Equity 115,6335-35

Journalize and post theadjusting entriesObjective 5The worksheet is NOT A Afinancial statementpermanent part of the accounting recordIt is only a tool.5-36

The Accounting CycleStep 1AnalyzetransactionsStep 2Journalize thedata abouttransactionsStep 3Post thedata abouttransactionsStep 4PrepareaworksheetStep 5PreparefinancialstatementsStep 9Interpretthe financialinformationStep 7RecordclosingentriesStep 8Prepare apostclosingtrial balance5-37Step 6Recordadjustingentries

QUESTION:What adjustments must JT’sConsulting Services record forthe month?ANSWER:(a) Adjustment for supplies used(b) Adjustment for expired rent(c) Adjustment for depreciation5-38

GENERAL JOURNALDATEACCOUNTDATE2010Dec. 31POST.REF .DESCRIPTIONPAGEDEBIT2010Adjusting EntriesDec. 31 Supplies ExpenseSupplies5171211000.0031 Rent ExpensePrepaid Rent5201373,500.0031 Depr. Expense–EquipmentAccum. Depr.–Equipment523142367.00Supplies 003,500.00367.00ACCOUNT .00

Thank Youfor usingCollege Accounting, 12th EditionPrice Haddock Farina5-40

DEBIT CREDIT DEBIT CREDIT DEBIT CREDIT DEBIT CREDIT DEBIT 132,000 132,000 83,500 7,000 90,000 4,000 35,000 7,000 500 22,000 7,000 5,000 3,000 These adjusting entries are first entered in the Adjustments section of the worksheet. ACCOUNT NAME Cash Accounts Receivable Supplies Prepaid Rent Equipment Accum. Depr.—Equip. Jason Taylor, Cap .