Transcription

Winter 2017Peter Franchot, Comptrollerwww.marylandtaxes.comFrom the Desk of theComptrollerThis year’s tax seasonis off to a great start.Once again, my agencyis firmly committed todelivering the highestlevel of service toMaryland taxpayers.As part of our focus on providingfirst-class service, we continue to beaggressive in our efforts to combat taxfraud and identity theft in Maryland.Earlier this month, we suspendedprocessing electronic returns from20 tax preparation services and ournationally recognized state-of-the-artfraud detection systems keep a watchfuleye for potential fraudulent returns. Wealso joined with the Attorney General’sOffice to bring indictments in four taxfraud schemes.While I am proud of my agency’snational leadership in fighting taxfraud, we need additional resourcesto keep pace with the increasinglysophisticated fraud schemes thatcontinue to emerge.That’s why this legislative session, Iwill be urging legislators to pass myagency’s Taxpayer Protection Act,which would grant my office thestatutory powers we need to moreeffectively protect Marylanders fromfraudsters and financial criminals.I’m grateful to Governor Hoganfor including this bill in hisadministration’s legislative packageand it is my hope that the GeneralAssembly passes this bill with broadbipartisan support.Peter FranchotComptroller of Maryland2017 Tax Filing Season Under WayMaryland began processing personal income tax returns for Tax Year 2016 onJanuary 23, 2017, the same day the Internal Revenue Service (IRS) began acceptingreturns.In an ongoing effort to combat tax fraud, the agency did not immediately process astate tax return if W-2 information was not on file. Employers were required to reportwage information to the Comptroller on or before Jan. 31.“When Americans have been directly affected by fraud, identity theft, data breachesand other financial crimes, the security of the Maryland taxpayer remains my toppriority this tax season,” Franchot said. “Making sure W-2 information is on file at thetime a return is received is in keeping with that effort. Last year, my agency stoppedprocessing state tax returns from more than 60 companies whose purpose was to preyon the vulnerable, the homeless and those with limited financial means. I will continueto lead the charge against these unscrupulous practices this tax season.” Continued on Page 2w ww.m a ryla n d ta x e s .c om

New for Tax Year 2016 in MarylandTax professionals and taxpayers should be aware of thefollowing changes for the upcoming tax season: New Payment Voucher – Form IND PV: Residentreturns filed with a payment by check or money order isnow submitted with a Form IND PV. The Form IND PVis a payment voucher. For more information, see the FormIND PV at www.marylandtaxes.com. Form EL102: The Form EL102 has been discontinuedfor tax year 2016. See the information above related to thenew payment voucher, Form IND PV. New Return Addresses for Form 502 or Form 505 filed:WITH payment by checkor money order:WITHOUT payment by checkor money order:Comptroller of MarylandPayment ProcessingPO Box 8888Annapolis, MD 21401-8888Comptroller of MarylandRevenue Administration DivisionPO Box 110 Carrol StreetAnnapolis, MD 21401-8888 New Political Subdivision Fields (REQUIRED):There are new required fields to be completed on page1 of the Form 502 based upon the physical address of ataxpayer as of December 31, 2016 or last day of the taxableyear. See Instruction 6 in the Resident Instruction Bookletfor more information. New Retirement Income Form – Form 502R:The Maryland General Assembly enacted House Bill 1148Continued from Page 1in the 2016 Session requiring the collection of informationdetailing the amount of retirement income reported by anindividual and/or their spouse by source. The Form 502Ris required to be filed by any resident individual who: 1)reported income from a pension, annuity, or individualretirement annuity (IRA) on a federal return; 2) receivedany income during the year from Social Security orRailroad Retirement (Tier I or Tier II); OR 3) claimed apension exclusion on line 10 of the 2016 Form 502. SeeForm 502R for more information. Interest Rate Decrease: The annual interest ratedecreases from 13% per annum to 12% per annum onJanuary 1, 2017. The annual interest rate changes again onJanuary 1, 2018. Interest is due at a rate of 12% annuallyor 1.00% per month for any month or part of a month thata tax is paid after the original due date of the 2016 returnbut before January 1, 2018. Form 502DEP: In a continuing effort to protectsensitive taxpayer information, the Comptroller’s Officewill no longer mail the Declaration of Estimated PersonalIncome Tax Packet (Form 502DEP coupons). To fileyour personal estimated tax payments, taxpayers areencouraged to file electronically using the Comptroller’siFile system. Taxpayers who choose not to fileelectronically may submit payment by printing andmailing the Form 502D.2016 Tax Filing Season Under Way in MarylandLast year, the Maryland Comptroller’s office stoppedaccepting income tax returns from 61 companies doingbusiness in 68 locations, including 23 different LibertyTax Service franchises, for submitting numerous highlysuspicious returns. Collectively, they filed thousands of statereturns that the agency believed to be fraudulent.April 17 in the District of Columbia, the IRS pushed thefiling deadline to Tuesday April 18.Processing of business tax returns began Jan. 6.Taxpayers are encouraged to file their returns electronicallyfor the fastest possible processing of their claims and toensure they receive all possible refunds. A list of approvedvendors for use in filing your electronic return can be foundat www.marylandtaxes.com.The 2017 tax return filing deadline this year, whichcoincides with the IRS deadline, is Tuesday, April 18, ratherthan the traditional April 15 deadline which falls on aSaturday this year. Since Emancipation Day is observed onFree state tax assistance is available at all of the agency’s 12taxpayer service offices, Monday through Friday, 8:30 a.m.to 4:30 p.m. A list of office locations can be found atwww.marylandtaxes.com.Revenews - 2www.m a ry la n d ta x e s .c om

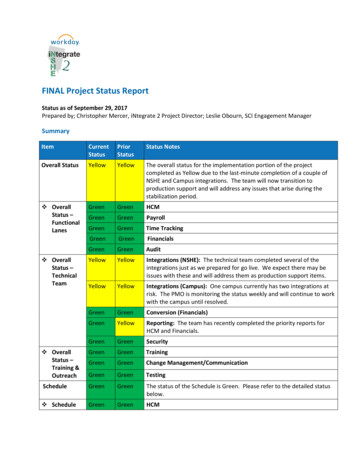

Comptroller Franchot Halts Returns from 20 Tax PreparersAmid Pattern of Questionable FilingsMoving aggressively to protect Maryland taxpayers,Comptroller Peter Franchot on February 9 announcedthat his office has immediately suspended processingelectronic tax returns from 20 paid tax preparers due to ahigh volume of questionable returns received.The tax preparers blocked from filing returns are:“Protecting Maryland taxpayers and detecting fraudulentreturns are our top priorities,” said ComptrollerFranchot. “We are resolute in our efforts to ensure thatthe tax refunds we send out are legitimate and go tothe people who have earned them. I want to thankmy Questionable Return Detection Team who workstirelessly to root out the returns that try to cheat our stateand steal from all Marylanders.”Monique’s Taxprep Services LLC, 4342 Tucker Circle, Halethorpe, MD 21227The businesses, which were sent written notice of theaction, were identified by the Comptroller’s nationallyrecognized fraud unit using state-of-the-art technologythat allows the Comptroller’s Office to detect fraudwhile processing returns. These 20 preparers join the68 businesses blocked last year. Although, the agency’sreview process provides an opportunity for the blockedpreparers to restore their filing privileges, to date, noneof the previously suspended tax preparers has had theseprivileges restored.JAE Establishments LLC, 3803 Gettysburg Road, Camp Hill, PA 17011Comptroller Franchot, pursuant to the signed IRSSecurity Memorandum of Understanding (“MOU”),has shared this information with other tax agencies.The Comptroller’s Office also has advised the Office ofthe Attorney General and the Department of Labor,Licensing and Regulation of the decision, so that theycan take any additional appropriate actions.“Guarding against tax fraud schemes and fraudulentreturns are the biggest challenges facing taxadministrators across the country,” added ComptrollerFranchot. “My office will continue to use every toolat our disposal to ensure the safety and accuracy ofMaryland’s tax filing systems.”Vasquez Tax Services, 2340 University Ave., Hyattsville, MD 20783OSE Tax Services, 5006 Harford Road, Baltimore, MD 21214ALR Tax and Financial Services LLC, 76 Ritchie Road, Capitol Heights, MD 20743OFAB LLC, 3938 Minnesota Ave., Washington, DC 20019Express Tax Inc., 5501 York, Road, Baltimore, MD 21212KLS Tax Services, 18431 Shanna Drive, Accokeek, MD 20607Liberty Tax Service, 5436 Marlboro Pike, District Heights, MD 20747Quick Tax Service, 1809 1/2 Pennsylvania Ave., Baltimore, MD 21217PROTAXEM, 3104 N. Greenmount Avenue, Baltimore, MD 21218HRQT LLC, 2136 Harford Road, Baltimore, MD 21218Quick Tax, 2401 Liberty Heights Road, Baltimore, MD 21215Quick Money Tax Service, 6628 Harford Road, 2nd floor Baltimore, MD 21214One Vision First (ovf) Consulting LLC, 8120 Fenton St., Suite 301b, Silver Spring, MDTax Maid, 2558 Pratt St., Baltimore, MD 21223Eltonia Tax & Contract Service LLC, 8058 Philadelphia Road, Baltimore, MD 21237Tax Plus, 727 Northrop Lane, Middle River, MD 21220Quality Tax Service, 6 Woodstream Court, Owings Mills, MD 21117Patricia’s Bookkeeping and Accounting, 227 Mysticwood Road, Reisterstown, MD 21136A complete list of all tax preparers blocked from filingreturns is available at www.marylandtaxes.com.Taxpayers should carefully review their returns for theseissues and should be suspicious if a preparer: Deducts fees from the taxpayer’s refund to bedeposited into the tax preparer’s account, Does not sign the tax return, or, Fails to include the Preparer TaxpayerIdentification number “P-TIN” on the return.If taxpayers suspect fraud, they are asked to immediatelyreport the issue to the Comptroller’s Office by calling1-800-MD-TAXES (1-800-638-2937) or 410-260-7980in Central Maryland or by emailing:taxhelp@comp.state.md.us.Tax Help February 2 - April 18, 2016, 8 a.m. - 7 p.m., Monday - Friday,1-800-MDTAXES (1-800-638-2937) or from Central Maryland: 410-260-7980.www.m a ry la n d ta x e s .c omRevenews--33Revenews

Attorney General Frosh, Comptroller Franchot Hand DownIndictments in Tax Fraud SchemesMaryland Attorney General Brian E. Frosh and ComptrollerPeter Franchot on January 26 announced the filing ofcriminal cases against four defendants who allegedly stoletens of thousands of dollars from the State of Marylandthrough tax fraud schemes. The indictments demonstratethe Attorney General’s and Comptroller’s commitmentto identifying and prosecuting perpetrators who stealMaryland tax money.“Tax preparers have a special knowledge and a specialresponsibility to file honest returns,” said Attorney GeneralFrosh. “It’s bad when anyone tries to cheat on their taxreturns. When it is a tax preparer, it is inexcusable. Thecollaboration between the Office of Attorney Generaland the Comptroller’s Office to combat the problem offraudulent tax schemes has resulted in the prosecution ofthose who erode the trust in our tax system.”“I am personally grateful to Attorney General Frosh andhis team for their tireless work toward securing theseindictments,” said Comptroller Franchot. “Tax fraud andidentity theft pose an immediate threat to the financialsecurity of taxpayers throughout the State of Marylandand across the country. The Maryland Comptroller’sOffice is committed to using all of our resources to protectMarylanders from the consequences of these financialcrimes. The indictments today send a strong message thatwe will work together with the Maryland Attorney General’sOffice and all law enforcement agencies to fight criminalswho attempt to defraud the state and harm law-abidingtaxpayers.”The cases announced include: State of Maryland v. Darwin AcostaOn January 20, 2017, an Anne Arundel County grand jury returneda two-count indictment against Darwin Acosta, 30, of PrinceGeorge’s County. According to the allegations contained in theindictment, between March 2014 and June 2014, Acosta preparedand filed fraudulent tax returns with the Comptroller using thepersonal identifying information of numerous victims. Through thefiling of the fraudulent returns, Acosta unlawfully had approximately 53,700.73 of tax refunds deposited into his personal bank account.Acosta has been charged with one count of felony theft schemebetween 10,000 and 100,000, and one count of identity fraud. State of Maryland v. Rochelle CunninghamOn January 20, 2017, an Anne Arundel County grand jury returnedan 11-count indictment against Rochelle Cunningham, 46, ofBaltimore City. According to the allegations contained in theindictment, between March 2005 and April 2009, Cunninghamobtained the personal identifying information of numerous victimsand used that information to file fraudulent tax returns with theComptroller in the names of the victims. By filing the fraudulentreturns, Cunningham unlawfully had deposited over 80,000 of taxrefunds into various bank accounts she controlled. Cunninghamhas been charged with one count of felony theft scheme between 10,000 and 100,000, and 10 counts of identity fraud. State of Maryland v. Scott JacobsonOn January 20, 2017, an Anne Arundel County grand juryreturned a 16-count indictment against Scott L. Jacobson, 38, ofBaltimore County. According to the allegations contained in theindictment, during the 2014 tax filing season, Jacobson operateda tax return preparation business through which he prepared andfiled fraudulent federal and state tax returns for clients, claimingfraudulently inflated tax refunds. Through the filing of the inflatedtax refund claims, Jacobson unlawfully obtained more than 10,000in State tax refunds. Jacobson has been charged with 13 counts offalse return preparation, counts for theft and attempted theft, andone count of filing a false personal income tax return. State of Maryland v. Evelyn ThompsonOn January 24, 2017, the Attorney General filed criminalinformation against Evelyn Thompson, 54, of Prince George’sCounty. According to the allegations contained in the information,between January 2014 and April 2016, Thompson, who was notregistered as a licensed tax preparer in Maryland, prepared and filedfraudulent tax returns with the Comptroller on behalf of numerousMaryland residents. In most of the returns, Thompson included falseinformation to fraudulently increase the tax refunds her taxpayerclients would receive. Thompson also charged her clients a fee forthe preparation and filing of their tax returns. Thompson, however,did not report the fees received on her personal income tax returns.She also included false information on her personal tax returnsto fraudulently inflate the tax refunds she received. Thompsonhas been charged with one count of felony theft scheme between 10,000 and 100,000.Attorney General Frosh and Comptroller Franchotcommended the investigative efforts of the Comptroller’sField Enforcement and Revenue Administration Divisions,and the Attorney General’s Criminal InvestigationsDivision, along with the Maryland State Police. The casesare being prosecuted by the Attorney General’s Office.Comptroller Peter Franchot reminds taxpayers thatthe most efficient and secure way to file a state and federal tax return is to file electronically.Revenews - 4www.m a ry la n d ta x e s .c om

Governor Hogan, Comptroller Franchot AnnounceTaxpayer Protection Act of 2017Governor Larry Hogan and Comptroller Peter Franchotannounced on January 19 plans for the administration tointroduce the Taxpayer Protection Act of 2017, legislationthat will provide greater protections to Maryland taxpayersfrom tax fraud and identity theft. The proposed legislationwill strengthen the ability of the Office of the Comptrollerto prevent tax fraud, protect taxpayer information, and holdfraudulent filers and tax preparers accountable.“Tax fraud is real, it’s unacceptable, and it often unfairlytargets some of our most vulnerable citizens,” GovernorHogan said. “This legislation makes key reforms to protectMarylanders from predatory tax practices and safeguardtaxpayers’ private information.”“As Comptroller, my top priority continues to beprotecting taxpayers from the devastating consequencesof tax fraud and identity theft,” Comptroller Franchot said.“The provisions in the Taxpayer Protection Act will grantmy office additional statutory powers that bolster ourexisting efforts to prevent financial criminals from preyingon innocent and hardworking Marylanders.”Since 2007, the Comptroller’s Office has identified andblocked more than 76,000 fraudulent returns – worth morethan 174 million – from being processed. The Comptroller’sQuestionable Returns Detection Team (QRDT) uses ananalytics-driven fraud detection model that has enhanced theagency’s ability to identify potential fraudulent tax returns.The bill: Grants additional statutory responsibilities to the agency’sField Enforcement Division to investigate potential incidentsof tax fraud and allow it to seek injunctions against taxpreparers suspected of fraudulent and criminal practices inan effort to protect consumers from financial harm. Extends the statute of limitations for tax crimes to sixyears from the current three years, matching the statute oflimitations under the Internal Revenue Code for federaltax crimes. This extension will allow sufficient time toinvestigate fraud cases. Holds unscrupulous tax preparers accountableby placing greater legal responsibility on predatory taxpreparers who use unknowing taxpayers to commit fraud.The legislation adds a penalty for fraudulent tax returnpreparers and provides legal authority to issue injunctionsagainst fraudulent tax preparers to protect consumersduring ongoing investigations. Prohibits tax professionals from employing anindividual to provide tax preparation services who is notregistered with the Board of Tax Preparers through theDepartment of Labor, Licensing, and Regulation. Authorizes the Office of the Comptroller to disclosecertain tax information to the State Board of IndividualTax Preparers, the U.S. Internal Revenue Service, andthe U.S. Department of Justice. This provision allowsthe Comptroller’s Office to work with state and federalgovernment entities to take swift legal action againsttax return preparers who have been found to have beenengaging in fraudulent activity.Comptroller Franchot Hosted Taxpayer Security Summit at University of BaltimoreOn January 19, Comptroller Peter Franchot convened adiverse group of government and private industry leaders aswell as consumer protection advocates at the University ofBaltimore for a taxpayer security summit. Participants discussedand shared information on new and disturbing forms of incometax fraud confronting tax administrators and challenginginformation technology teams in states throughout the country.Last tax season, the Maryland Comptroller’s office stoppedaccepting income tax returns from 61 companies doing businessin 68 locations, including 23 different Liberty Tax Servicefranchises, for submitting numerous highly suspicious returns.Collectively, they filed thousands of state returns that the agencybelieved to be fraudulent. The summit featured presentationsfrom U.S. Attorney for the District of Maryland Rod Rosenstein,federal and state tax administrators, private industry leadersComptroller Peter Franchot hosted a Taxpayer Security Summit January19 at the University of Baltimore. Joining the Mr. Franchot wereDeputy Comptroller Sharonne Bonardi and Chief of Staff Len Foxwell.and consumer protection advocates who discussed ongoinginitiatives and strategies to identify and combat tax fraud.www.m a ry la n d ta x e s .c omRevenews--55Revenews

Comptroller Meets With Greater Cumberland CommitteeOn January 26, Comptroller Peter Franchot met with members of the Greater Cumberland Committee during the group’s annual visit to Annapolis.Brenda Smith, standing to the Comptroller’s right, is the group’s executive director. The Comptroller later attended the Mountain Maryland PositiveAttitudes Change Everything (PACE) Reception and spoke during the PACE breakfast the following morning.Form 1099G Mailed to TaxpayersFederal law requires the Comptroller’s Office to senda Form 1099G by February 1, 2017, to taxpayers whoitemized deductions on their federal return and to whoman income tax refund, credit, or offset of more than 10was sent in 2016.As a result, the Comptroller’s Office has mailedapproximately 1.22 million Form 1099Gs to taxpayers. Inaddition, email notifications have been sent to taxpayerswho have requested the paperless Form 1099G informingthe taxpayers that their Form 1099G is available tobe accessed and printed from our website at www.marylandtaxes.com.Taxpayers can elect to save the state money by using theelectronic Form 1099G.Look for the checkbox on your electronic return torequest your Form 1099G electronically.IRS: Safeguarding Taxpayer Data – Secure Your OfficeTax professionals can help protect taxpayer data by lookingaround their own offices. It’s more important than ever thattax professionals take aggressive steps to protect taxpayerinformation. Securing office space is as important as securingcomputers. In assessing how secure your office is, considerthese questions: Are all the places where taxpayer information is locatedprotected from unauthorized access and potential dangersuch as theft, flood and tornado? Do you have written procedures that prevent unauthorizedaccess and unauthorized processes? Do you leave taxpayer information, including dataon hardware and media, unsecured? Check on desks,photocopiers, mailboxes, vehicles and trashcans. What aboutin rooms in the office or at home where unauthorized accessRevenews - 6could occur? Who authorizes and/or controls delivery and removalof taxpayer information, including data on hardware andmedia? Are the doors to file rooms and/or computer roomslocked? Do you provide secure disposal of taxpayer information?Do you use items such as shredders, burn boxes or securetemporary file areas for information until it can be properlydisposed?The answers can be very important to protecting yourclients and your business. To learn more about how to protectboth, review Internal Revenue Services’ Publication 4557,Safeguarding Taxpayer Data.For more information, visit IRS.gov.www.m a ry la n d ta x e s .c om

Comptroller Franchot Opens Salisbury Taxpayer Call CenterComptroller Peter Franchot cut the ribbon January 23 toofficially open his agency’s first remote customer call centerin Salisbury to assist Maryland taxpayers throughout the stateduring the 2017 tax season and beyond.The new center, which is opposite the existing SalisburyBranch Office at Sea Gull Square, enhances the agency’sability to assist taxpayers in a timely manner and has addedup to 25 jobs to the local economy.“This new center significantly increases our capacity torespond more quickly to taxpayers’ calls – especially duringthe busy tax season -- and boosts Salisbury’s local economywith some new jobs,” Comptroller Franchot said.The center’s staff will assist Marylanders with tax questionsand tax payment options. During the busy tax season fromnow through April, the agency’s Taxpayer Services unit inAnnapolis typically swells from 35 to 75 employees to handlethe volume of taxpayer inquiries. Some of the new Salisburyjobs will be permanent and others will be temporary for thetax season.Joining the Comptroller for the official grand openingwere Salisbury University President Janet Dudley-Eshbachand Salisbury Mayor Jake Day along with other electedComptroller Peter Franchot joins with local and state elected officials incutting the ribbon for the agency’s first remote Call Center in Salisburyon January 23. The new center enhances the agency’s ability to assisttaxpayers during the busy tax season and beyond.officials from the city, Wicomico County and the university’sadministration and staff.The call center is not open to the public, but anyone witha tax question or in need of free tax help can stop by theneighboring Salisbury Branch Office at Unit 182, 1306 S.Salisbury Blvd., weekdays from 8:30 a.m. to 4:30 p.m.Local Branch Offices Ready for Tax SeasonBranch Offices Listed by City - Assistance is available 8:30 a.m. - 4:30 p.m., Monday through Friday.AnnapolisRevenueAdministration Center110 Carroll StreetAnnapolis, MD 21411410-260-7980BaltimoreState Office Bldg.301 W Preston StreetRoom 206,Baltimore, MD 21201410-767-1306CumberlandAllegany Museum3 Pershing StreetSuite 101,Cumberland, MD 21502301-722-5741ElktonUpper ChesapeakeCorporate Center103 Chesapeake Blvd.Suite DElkton, MD 21921410-996-0465FrederickCourthouse/Multiservice Center100 W. Patrick StreetRoom 2110,Frederick, MD 21701301-600-1982HagerstownProfessional Arts Bldg.One South Potomac StreetHagerstown, MD 21740301-791-7108LandoverTreetops Bldg.8181 Professional PlaceSuite 101Landover, MD 20785301-459-0209SalisburySea Gull Square1306 South Salisbury Blvd.Suite 182Salisbury, MD 21801410-546-8100TowsonHampton Plaza300 E. Joppa RoadPlaza Level 1ATowson, MD 21286410-296-3982www.m a ry la n d ta x e s .c omUpper MarlboroPrince George’sCounty Courthouse14735 Main StreetRoom 083BUpper Marlboro, MD 20772301-952-2810Waldorf1036 Saint Nicholas DriveSuite 202Waldorf, MD 20603301-645-7818WheatonWestfield WheatonSouth Building11002 Veirs Mill RdSuite 408Wheaton, MD 20902301-942-5400Revenews--77Revenews

RevenewsTaxpayer Services: Call 1800 MDTAXES (1-800-638-2937)or from Central Maryland 410-260-7980.Central Registration Unit: For help in completing the Combined RegistrationApplication, call 410-260-7980 from Central Maryland or 1-800-638-2937from elsewhere. You can also fax your completed application to 410-260-7908or complete and file the application online at www.marylandtaxes.com.Refund Unit, Compliance Division: For information about sales and use tax,admissions and amusement tax and tire fee refunds, call 410-767-1530.License Bureau, Investigative Services Unit: To determine if special licensesare required, call 410-260-6240 or toll-free 1-866-239-9359. Send Emailinquiries to slb@comp.state.md.us.No Tax Due? If you have no tax due for the filing period, you may telefile yourbusiness tax return at 410-260-7225. You can also file your business tax returnelectronically, using bFile.Visit the agency’s website www. marylandtaxes.com to:file business taxes electronically, using bFile; pay existing income and businesstax liabilities online, using BillPay; register business tax accounts online; verifysales tax exemption certificates online; and use other online services.Revenews is a quarterly publication of theComptroller of Maryland, printed in Annapolis, MD.Inquiries concerning Revenews can be directed to:Office of CommunicationsPO Box 466Annapolis, MD 21404-0466410-260-7300 (voice)TTY users call via Maryland Relay at 711or 1-800-735-2258Executive Editor: Alan Brody(abrody@comp.state.md.us)Content Writer/Editor: Barbara Sauers(bsauers@comp.state.md.us)Writer: Emmanuel Welsh(ewelsh@comp.state.md.us)Design/Layout: Deirdre Tanton(dtanton@comp.state.md.us)To subscribe online, visit www.marylandtaxes.comand click the Revenews link.REVENEWSComptroller of MarylandGoldstein Treasury BuildingPO Box 466Annapolis, MD 21404-0466Important Maryland Tax Phone NumbersPERMIT #7876BALTIMORE, MDPAIDPRESORTEDSTANDARDU.S. POSTAGE

JAE Establishments LLC,3803 Gettysburg Road, Camp Hill, PA 17011 One Vision First (ovf) Consulting LLC, 8120 Fenton St., Suite 301b, Silver Spring, MD Tax Maid,2558 Pratt St., Baltimore, MD 21223 Eltonia Tax & Contract Service LLC,8058 Philadelphia Road, Baltimore, MD 21237 Tax Plus, 727 Northrop Lane, Middle River, MD 21220