Transcription

Annual Report 2019

It is evident that payment systemsin India have witnessed significantprogress in the previous year andmore importantly, the last decade.Though favourable factors likeaffordable mobile phones, internetpackages and constant supportfrom the regulator as well as fromthe government haveunquestionably contributed to thisgrowth, the real credit goes tofintechs and banks who areconstantly implementing newtechnologies and deliveringcustomer centric solutions to theircustomers.The surge in card transactions and other products like UPI, IMPS, NETCetc. and the rise in number of POS terminals over the past few monthshave been encouraging. We can now anticipate that these retail paymentproducts will collectively reduce cash dependency to a great extentprovided there is an impetus to set up multiple acquiring touchpoints in thecountry. Worldline, being one of the largest merchant acquirers, hasalways been committed to the cause of creating a ‘cash-lite’ society with itsvisionary payment solutions and wide reach across the country.This annual report takes a look and provides insights on Indian digitaltransactions in 2019 as well as insights on transactions that wereprocessed in our network. In addition, we look at how asset-lite productswill transform digital payments in 2020.Happy reading!Deepak ChandnaniManaging Director, Worldline South Asia & Middle East

Digital Payments 2020The reality is that these predictions willhappen over the next 3-5 years are allusually well off-base. As a result we willstick to soothsaying on what we think willbe the game-changer in physicalmerchant payments space in 2020.Currently, the primary channels to paydigitally for goods and services atphysical merchant locations is througheither a POS terminal or a QR (a printedone usually and in some cases a phone).There may be bells and whistles aroundboth these form factors but there isn’t anysubstantive addition.What we think will be the game changer in the coming months will be the emergence and establishment ofasset-lite technologies in merchant acquiring. Asset-lite here refers to the acceptance of all forms of digitalpayments including cards not on the traditional POS machines but on merchants’ mobile phones. On thistechnology platform, merchants using an app on their phone will be able to accept payments through QR andcards; the latter will happen on NFC enabled cards through tap-on-phone technologies. Granted, currentlymerchants can accept only up to Rs. 2000 without a PIN but rapidly developing secure technologies will leadto the ability to accept PIN on Glass allowing them to accept larger amounts too. Besides these 2 channels,merchants will also be able to send payment links to customers through SMS or WhatsApp enabling buyers tocomplete their transactions via an internet payment gateway.The reason why this technology is likely to become mainstream and have a wide acceptance by merchants isbecause of the following reasons:Cost – The transactions will be done on the merchant’s own phone eliminating the need for a POS terminalwhile giving them all the benefits. The only need is for an NFC phone but the cost of an NFC phone isdropping rapidly and is now being enabled on lower-cost smartphones too. This will also provide a huge fillipto spreading digital payments at merchants at the bottom of the pyramid as well as those located in smalltowns and villages.Multiple revenue opportunities – Apart from the ability to accept payments through multiple channels, themobile app will allow multiple revenue opportunities for the merchant by allowing them to sell value-addedservices such bill pay etc.Convenience – The application can also allow the merchant to manage their billing as well as their khaatacustomers.Sunil RongalaVice President – Strategy, Innovation & Analytics

Table Of ContentsDIGITAL OLL COLLECTION7AADHAAR ENABLEDPAYMENT SYSTEM9MERCHANTACQUIRING2UNIFIEDPAYMENTSINTERFACE6

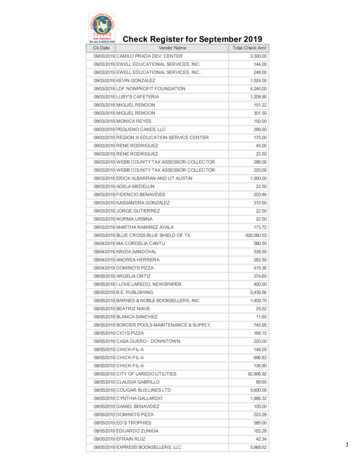

Credit Card Volume at POS (million) Debit Card Volume at POS (million) 0 100 200 300 400 500 600 700 800 19 9 Credit Card Value at POS (INR billion) Debit Card Value at POS (INR billion) Transaction value of debit cards stood at INR 6.8 trillion while transaction value of credit cards stood at INR 7.1 trillion, registering YoY growth of 21% and .