Transcription

FHA Underwriting GuidelinesEffective With Case Numbers Assigned On or After 9/14/15

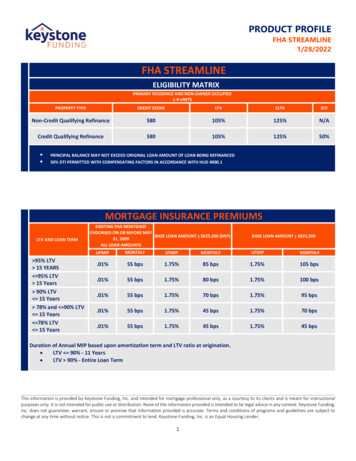

FHA Underwriting GuidelinesMortgage Lending DivisionVersion 10.5 – 01/25/22DOCUMENT OVERVIEWPurposeTable ofContentsThe following document describes the responsibilities and requirements of theCarrington Mortgage Services, LLC (CMS) Mortgage Lending Division Underwriter(Underwriter) when reviewing and underwriting Federal Housing Administration(FHA) mortgage loans with case numbers assigned on and after September 14,2015.1. Origination/Processing .11a. Applications and Disclosures .11i. Contents of the Mortgage Application Package .11ii. Disclosures and Legal Compliance.18iii. Application Document Processing .20b. General Mortgage Insurance Eligibility .27i. Mortgage Purpose .27ii. Borrower Eligibility .28iii. Occupancy Types .35iv. Property Eligibility and Acceptability Criteria .38v. Legal Restrictions on Conveyance (Free Assumability) .482. Allowable Mortgage Parameters .49a. Maximum Mortgage Amounts .49i. National Housing Act’s Statutory Limits .49ii. Nationwide Mortgage Limits .50iii. Financing of Upfront Mortgage Insurance Premium .51iv. Calculating Maximum Mortgage Amounts on Purchases .51b. Loan-to-Value Limits .51i. LTV Limitations Based on Borrower’s Credit Score (Applies to AllTransactions).51ii. Purchase .51iii. Refinance .54iv. New Construction .54c. Required Investment .54i. Total Required Investment .54ii. Minimum Required Investment .54d. Maximum Mortgage Term .54e. Mortgage Insurance Premiums .55i. Upfront Mortgage Insurance Premium .55ii. Annual (or Periodic) Mortgage Insurance Premium .553. Underwriting the Property .55a. Property Acceptability Criteria .55i. Defective Conditions .56ii. Minimum Property Requirements and Minimum Property Standards .56CMS Policies & ProceduresProprietary and confidential. For Internal use only. Do not distribute externally.Page 2 of 378

FHA Underwriting GuidelinesMortgage Lending DivisionVersion 10.5 – 01/25/22iii. Minimum Required Repairs .64iv. Leased Equipment .64v. Appraisal Review .64vi. Quality of Appraisal .64vii. Chain of Title .64ix. Reconsideration of Value .64b. Required Documentation for Underwriting the Property .65c. Conditional Commitment Direct Endorsement Statement of Appraised Value .654. Underwriting the Borrower Using the TOTAL Mortgage Scorecard (TOTAL)66a. Underwriting with an Automated Underwriting System .66i. Use of TOTAL Mortgage Scorecard .66ii. Requirements for the Submission of Data through TOTAL MortgageScorecard .66iii. Function of TOTAL Mortgage Scorecard .66iv. Feedback Certificates: Risk Classification and Related Responsibilities(TOTAL) .68v. Accept Risk Classifications Requiring a Downgrade to Manual Underwriting(TOTAL) .68vi. Applicability of Automated Underwriting System Rules (TOTAL) .69vii. TOTAL Mortgage Scorecard Tolerance Levels for Rescoring .69b. Credit Requirements (TOTAL) .69i. General Credit Review Requirements (TOTAL) .69ii. Credit Reports (TOTAL) .70iii. Evaluating Credit History (TOTAL) .71iv. Evaluating Liabilities and Debts (TOTAL) .77c. Income Requirements (TOTAL).86i. General Income Requirements (TOTAL).86ii. Employment Related Income (TOTAL) .87iii. Primary Employment (TOTAL) .89iv. Part-Time Employment (TOTAL) .89v. Overtime, Bonus or Tip Income (TOTAL) .90vi. Seasonal Employment (TOTAL) .90vii. Employer Housing Subsidy (TOTAL) .91viii. Employed by Family-Owned Business (TOTAL) .91ix. Commission Income (TOTAL) .92x. Self-Employment Income (TOTAL) .93xi. Additional Required Analysis of Stability of Employment Income (TOTAL) 94xii. Other Sources of Effective Income (TOTAL) .95xiii. Unacceptable Sources of Income (TOTAL) .108d. Asset Requirements (TOTAL) .109i. General Asset Requirements (TOTAL) .109ii. Source Requirements for the Borrower’s Minimum Required Investment(TOTAL) .112A Family Member may provide the Borrower’s MRI in accordance withSection 203(b)(9)(B) of the National Housing Act. .113CMS Policies & ProceduresProprietary and confidential. For Internal use only. Do not distribute externally.Page 3 of 378

FHA Underwriting GuidelinesMortgage Lending DivisionVersion 10.5 – 01/25/22iii. Sources of Funds (TOTAL) .115iv. Unacceptable Sources of Funds (TOTAL) .133e. Final Underwriting Decision (TOTAL) .134i. Documentation of Final Underwriting Review Decision (TOTAL) .134ii. Conditional Approval (TOTAL) .135iii. HUD Employee Mortgages (TOTAL) .135iv. Notification of Borrower of Approval and Term of the Approval (TOTAL).1355. Manual Underwriting of the Borrower .136a. Credit Requirements (Manual) .136i. General Credit Requirements (Manual) .136ii. Types of Credit History (Manual) .136iii. Evaluating Credit History (Manual) .140iv. Evaluating Liabilities and Debts (Manual) .148b. Income Requirements (Manual) .158i. General Income Requirements (Manual) .158ii. Employment Related Income (Manual) .158iii. Primary Employment (Manual) .160iv. Part-Time Employment (Manual) .161v. Overtime, Bonus or Tip Income (Manual) .161vii. Employer Housing Subsidy (Manual) .162viii. Employed by Family-Owned Business (Manual) .163ix. Commission Income (Manual) .164x. Self-Employment Income (Manual) .164xi. Additional Required Analysis of Stability of Employment Income .166xii. Other Sources of Effective Income (Manual) .167xiii. Unacceptable Sources of Income (Manual) .180c. Asset Requirements (Manual) .181i. General Asset Requirements (Manual) .181ii. Source Requirements for the Borrower’s Minimum Required Investment(Manual) .184iii. Sources of Funds (Manual) .185iv. Unacceptable Sources of Funds (Manual) .204d. Final Underwriting Decision (Manual) .205i. Duty of Care/Due Diligence (Manual) .205ii. Specific Underwriter Responsibilities (Manual) .205iii. Underwriting of Credit and Debt (Manual) .205iv. Underwriting of Income (Manual) .206v. Underwriting of Assets (Manual) .206vi. Verifying Mortgage Insurance Premium and Mortgage Amount (Manual) 206vii. Calculating Qualifying Ratios (Manual) .206viii. Approvable Ratio Requirements (Manual) .207ix. Documenting Acceptable Compensating Factors (Manual) .208x. Borrower Approval or Denial (Manual).2116. Closing .213CMS Policies & ProceduresProprietary and confidential. For Internal use only. Do not distribute externally.Page 4 of 378

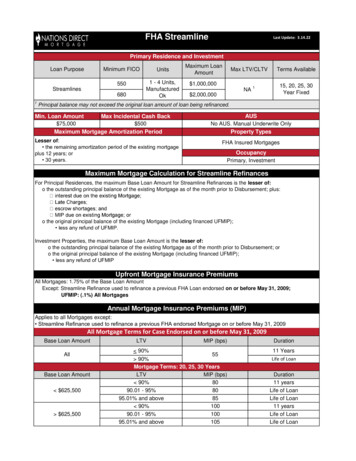

FHA Underwriting GuidelinesMortgage Lending DivisionVersion 10.5 – 01/25/22a. Mortgagee Closing Requirements .213i. Chain of Title .213ii. Title .213iii. Legal Restrictions on Conveyance (Free Assumability) .216iv. Closing in Compliance with Mortgage Approval.216v. Closing in CMS’s Name .216vi. Required Forms .216vii. Certifications.216viii. Projected Escrow.217ix. Closing Costs and Fees .217x. Disbursement Date .219xi. Per Diem Interest and Interest Credits.219xii. Signatures .219b. Mortgage and Note .220i. Definitions .220ii. Standard.220c. Disbursement of Mortgage Proceeds .220i. Standard for Disbursement of Mortgage Proceeds .220ii. Required Documentation for Disbursement of Mortgage Proceeds .2207. Programs and Products .221a. 203(k) Rehabilitation Mortgage Insurance Program .221CMS no longer offers 203(k) financing. This section is maintained forhistorical purposes. .221i. Overview .221ii. Borrower Eligibility .221iii. Property Eligibility .221iv. Application Requirements .222v. Case Number Assignment Data Entry Requirements .222vi. Standard 203(k) Transactions.223vii. Limited 203(k) Transactions .227viii. Appraisals for Standard 203(k) and Limited 203(k) .230ix. Maximum Mortgage Amount for Purchase .232x. Maximum Mortgage Amount for Refinance .232xii. Mortgage Insurance Premium .233xiii. Underwriting .234xiv. Closing .236xv. Data Delivery.238b. Disasters and 203(h) Mortgage Insurance for Disaster Victims .239i. Definition .239ii. Eligibility Requirements .239iii. Eligibility Documentation Requirements .240iv. Refinancing Policy.241v. Using Section 203(k) with 203(h) for Rehabilitation .241c. Refinances .241i. Overview .241CMS Policies & ProceduresProprietary and confidential. For Internal use only. Do not distribute externally.Page 5 of 378

FHA Underwriting GuidelinesMortgage Lending DivisionVersion 10.5 – 01/25/22ii. General Eligibility.243iii. Temporary Interest Rate Buydowns .244iv. Upfront Mortgage Insurance Premium Refunds .244v. Cash-Out Refinances .245vi. No Cash-Out Refinances .246d. New Construction.261i. Definitions .261ii. Eligible Property Types .261iii. Required Inspections for New Construction Financing .261iv. Required Documentation for New Construction Financing .263vi. Documents to be Provided to Appraiser at Assignment .263vii. Property Considerations .264viii. Mortgagee Review of Appraisal.264ix. Completion of Construction.266e. Building on Own Land .266i. Definition .266ii. Eligibility .266iii. Calculating the Maximum Mortgage Amount .267iv. Minimum Required Investment .267v. Borrower’s Additional Equity in the Property .267vi. Required Documentation .267f. HUD Real Estate Owned Purchasing .268i. Definition .268ii. Sales Contract and Required Supporting Documentation .269iii. Ordering Case Numbers .270iv. Appraisals .270v. Occupancy Types .270vi. Maximum Mortgage Amounts .270vii. Additional Section 203(b) With Repair Escrow Requirements .271vii. Additional 100 Down Requirements for FHAC Insuring Application .271g. Condominiums .272i. Units Not Requiring Approval.272ii. Requirements for Units in approved Condominium Projects .272iii. Single-Unit Approval .279iv. Site Condominium .2918. 203(k) Consultant Requirements.292a. Overview .292b. Consultant Duties.292i. Feasibility Study/Plan Review .292ii. Consultant Inspection.292iii. Architectural Exhibits .292iv. Work Write-Up and Cost Estimate.292v. Draw Request Inspection .293vi. Change Order .293vii. Work Stoppages or Deviations from the Approved Write-Up .293CMS Policies & ProceduresProprietary and confidential. For Internal use only. Do not distribute externally.Page 6 of 378

FHA Underwriting GuidelinesMortgage Lending DivisionVersion 10.5 – 01/25/22c. Consultant Fee Schedule .293i. Feasibility Study/Plan Review .293ii. Work Write-up .293iii. Draw Inspection Fee .293iv. Change Order Fee .294v. Re-inspection Fee .294vi. Mileage Fee .294d. Architectural Exhibit Review .294e. Preparing the Work Write-Up and Cost Estimate .294i. Conformance with Minimum Property Requirements or Minimum Property294ii. Health and Safety.294f. Feasibility Study/Plan Review .295g. Draw Request Inspection .295h. Change Order .295i. Additional Required Documentation.295i. 203(k) Consultant’s Certification .295ii. Consultant/Borrower Agreement .296iii. Inspections and Draw Requests .296iv. Change Order Requests .2969. Commencement of the Appraisal .297a. Information Required before Commencement of Appraisal .297b. Additional Information Required Before Commencement of an Appraisal onNew Construction .29710. General Appraiser Requirements .29811. Acceptable Appraisal Reporting Forms and Protocols .299a. Additional Documentation Required for Appraisals of New Construction .299b. Application of Minimum Property Requirements and Minimum PropertyStandards by Construction Status .300i. Existing Construction .300ii. New Construction .300iii. Determination of Defective Conditions .300iv. Inspection by a Qualified Individual or Entity.301c. Minimum Property Requirements and Minimum Property Standards .302i. Legal Requirements .302ii. Legal and Land Use Considerations .303iii. Externalities .305iv. Site Conditions .307v. New Construction Site Analysis .311vi. Excess and Surplus Land .311vii. Characteristics of Property Improvements .312CMS Policies & ProceduresProprietary and confidential. For Internal use only. Do not distribute externally.Page 7 of 378

FHA Underwriting GuidelinesMortgage Lending DivisionVersion 10.5 – 01/25/22d. Gross Living Area .315i. Definition .315ii. Required Analysis and Reporting .315iii. Additions and Converted Space .315iv. Partially Below-Grade Habitable Space .316v. Bedrooms .316e. Appliances .316i. Definition .316ii. Standard.316iii. Required Analysis and Reporting .316f. Swimming Pools .317g. Utilities – Mechanical Components .317i. Heating and Cooling Systems.318ii. Electrical System .318iii. Plumbing System .318h. Roof Covering .319i. Structural Conditions .319j. Defective Paint .319k. Attic Observation Requirements .319l. Foundation .320i. Basement .320ii. Sump Pumps .320m. Crawl Space Observation Requirements.320n. Environmental and Safety Hazards .321i. Lead-Based Paint .321ii. Methamphetamine Contaminated Property .

Mortgage Lending Division Version 10.5 - 01/25/22 CMS Policies & Procedures Page 2 of 378 Proprietary and confidential. . Carrington Mortgage Services, LLC (CMS) Mortgage Lending Division Underwriter (Underwriter) when reviewing and underwriting Federal Housing Administration (FHA) mortgage loans with case numbers assigned on and after .