Transcription

The SIMPLE IRA PlanSavings Made SimpleFor Your EmployeesRetirement Plans

About Stifel NicolausStifel Nicolaus is a full-serviceInvestment firm with a distinguishedhistory of providing securitiesbrokerage, investment banking,trading, investment advisory,and related financial services toindividual investors, institutions,corporations, and municipalities.Established in 1890 andheadquartered in St. Louis, Missouri,Stifel Nicolaus is one of the nation’sleading firms.Stifel, Nicolaus & Company,Incorporated is a wholly ownedsubsidiary of Stifel Financial Corp.Stifel Financial Corp.’s publiclytraded stock is listed on the NewYork Stock Exchange under thesymbol “SF.”Retiremen

Many small businesses face a unique set ofcircumstances. Besides competing with othercompanies in selling products or services, smallbusinesses strive to provide employee benefitscomparable with larger companies in orderto retain quality employees. Maintaining aretirement plan is usually part of the benefitspackage, but these plans were not always easy toadminister, maintain, or afford.Legislation enacted in 1996 gave small businessesand their employees additional retirementoptions. The Savings Incentive Match Planfor Employees (SIMPLE) IRA gives employersa retirement plan that is simple to administerand maintain. It gives employees a retirementsavings plan in which they can make tax-deferredcontributions and have control of investments.The plan is available for employers who have lessthan 100 eligible employees and do not maintainany other retirement plans.nt PlansThe SIMPLE Plan is designed to help smallbusinesses meet today’s challenges. Ask yourFinancial Advisor if the SIMPLE Plan is rightfor your business and employees. This brochurehighlights some features of the SIMPLE Plan.-1-

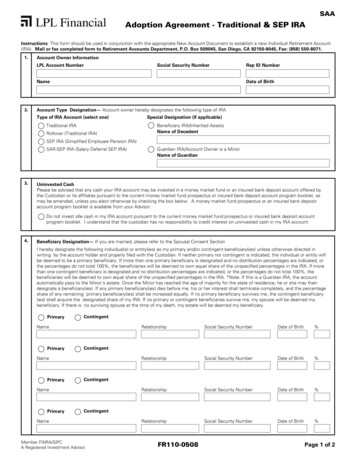

Q: What is a SIMPLE IRA?The SIMPLE IRA is an Individual RetirementAccount that is established by a smallbusiness. It allows both employee andemployer contributions to be made. TheSIMPLE IRA works like an IRA in thatcontributions are made to an account in theemployee’s name and the funds are 100%immediately vested. The contributionsearn and compound tax-deferred untildistributions are taken from the account.Q: What are the key employer benefits ofSIMPLE IRA Plans?Employers will especially like the simplicityof a SIMPLE IRA Plan, because it is mucheasier to establish and administer thana qualified plan. The SIMPLE IRA Planprovides a cost-effective way to establish aretirement plan for employees. All employercontributions and all amounts paid toemployees as compensation and deferred bythe participants to the plan are tax-deductiblefor the employer.Q: How do I determine if I’m eligible toestablish a SIMPLE Plan?An eligible employer is one who has no morethan 100 eligible employees and contributesto no other qualified plans.Q: Who is an eligible employee?An eligible employee is one who has received 5,000 in compensation from the employerin any two preceding years and is reasonablyexpected to earn 5,000 during the currentplan year.Retiremen-2-

Q: I’ve heard the SIMPLE Plan is easierto establish and maintain than atraditional 401(k) plan. How so?The SIMPLE IRA differs from traditional401(k) plans most significantly in the fact thatsome of the most challenging contributiontesting and nondiscrimination requirementsdo not apply as long as the limited numberof SIMPLE rules are observed. Also, thereis no DOL or IRS reporting, and top-heavyrules do not apply. The SIMPLE Plan is easilyunderstood by employees, and the employerknows in advance approximately what itsfinancial commitment will be. In addition,there are no fiduciary responsibilities.Q: Do ERISA rules apply?SIMPLE IRAs are not subject to ERISA.Q: What are the employee contribution limits?Employee deferrals are limited to 11,500(2011) and subject to annual cost-of-livingadjustments (COLAs) in 500 increments.In addition, individuals age 50 or older maytake advantage of a 2,500 (2011) catch-upcontribution, subject to annual COLAs in 500 increments. Employee deferrals may notexceed 100% of compensation.nt Plans-3-

Q: What are the employer contributionlimits and requirements?Employers must either match each employee’selective deferrals dollar-for-dollar up to anamount equal to 3% of compensation ormake a nonelective contribution for all eligibleemployees in an amount equal to 2% ofcompensation. In the event the employer electsthe match, they may elect to match a lowerpercentage (but not lower than one percent) inany two years of a rolling five-year period.Please Note: The compensation cap forthe purpose of calculating nonelectivecontributions is 245,000 for 2011 (subjectto annual cost-of-living adjustments).Matching contributions are not subject to anycompensation cap.Q: Can the employer make discretionarycontributions in addition to themandatory 3% match or 2% nonelective?No additional contributions are allowed.Q: As an employer, can I maintain anotheremployer-sponsored plan other than mySIMPLE IRA Plan?Other plans can be maintained; however, youmay not contribute to any other plans in a yearin which you contribute to your SIMPLE IRA.Q: How many eligible employees mustparticipate in order to have aSIMPLE Plan?RetiremenThere is no minimum number or percentageof eligible employees who must participate.Participation by employees is completelyvoluntary.-4-

Q: When can I establish a SIMPLE Plan?You may establish a plan at any time beforeOctober 1 of the first plan year. The plan mustoperate on a calendar-year basis. This meansthat the year in which the plan is establishedmay be less than 12 months. Regardless,you must give your employees a ParticipationNotice with a 60-day election period. TheNotice describes employee elective deferralrights and the annual employer contributionformula chosen. For new plans or newlyeligible participants, the 60-day period mustinclude either the date the employee beginsparticipating or the day before that date.—— MandatoryMandatory EmployerEmployer ContributionContribution nNonelectiveOptionThe employer contributesto SIMPLE IRAs ofeligible employees whomake contributionsthrough deferrals, adollar-for-dollar match upto 3% of the employee’scompensation.The employercontributes 2% ofcompensation to theSIMPLE IRAs of alleligible employees,whether or not theycontribute.The maximumcontribution is 11,500for 2011 (not includingcatch-up) for eachcontributing employee,subject to annual costof-living adjustments in 500 increments.The maximumcontribution is 4,900for 2011 for eacheligible employee(the compensation capof 245,000 for 2011x 2%).nt Plans-5-

Q: When can I establish a SIMPLE Plan if Iam currently maintaining another plan?If you have contributed to another plan forthe current year, you must wait until the startof a new calendar year before your SIMPLEplan can take effect.Q: Are there any disadvantages to aSIMPLE Plan from the employer’sperspective?The employer is required to contribute tothe employee’s SIMPLE IRA every year, andthese mandatory employer contributions arevested immediately. Also, participants may notbe able to contribute as much as they couldpotentially contribute to a 401(k) plan. Whilethese reasons may be considered disadvantagesin some cases, they may be outweighed by thebenefits of the SIMPLE Plan.Retiremen-6-

Q: Does participation in the SIMPLEIRA Plan prohibit my employees frommaking a contribution to their personalIRA?No. Employees can continue makingcontributions to their personal IRAs;however, becoming an active participant in aSIMPLE Plan may affect an employee’s abilityto deduct the IRA contribution, dependingupon the employee’s compensation level. Thepersonal IRA contribution cannot be madeinto the SIMPLE IRA account. SeparateSIMPLE IRA and IRA accounts must beestablished.Q: Are loans or withdrawals allowed withSIMPLE IRAs?Loans are not available. Since the SIMPLE IRAis directed by the participant, the employer doesnot control withdrawals made by the employee.The employee can make withdrawals anytime,and all amounts are treated as ordinary income.Withdrawals prior to age 59 1/2 are treated aspremature distributions and are subject to apenalty. The penalty can be as high as 25% ifwithdrawals are made within the first two years ofparticipation; after two years, the penalty decreasesto 10%. Distributions can be taken penalty-freeunder the following circumstances: attainmentof age 59 1/2 or older; incurring a disability;payment for certain health insurance or medicalexpenses; payment for the purchase of a firsthome ( 10,000 lifetime maximum); taking equal,periodic payments based on life expectancy (forfive years or until the age of 59 1/2, whicheveris longer); death (payment to beneficiaries);payment for higher education expenses; forcertain declared Presidential disaster area relief;or for individuals called to active duty.nt Plans-7-

Q: Can assets be moved or transferred froma SIMPLE IRA?SIMPLE IRA assets can be rolled over ortransferred to a regular IRA two years afterthe employee initiates participation in the plan.Rollovers from one SIMPLE IRA to another arenot subject to the same two-year restriction.Q: What happens to the SIMPLE IRA if anemployee terminates employment?Because the employee is fully vested immediately,no money is forfeited by the employee. Of course,employer contributions cease upon the terminationof employment, but the terminated employee maycontinue to maintain this IRA account.Q: How will the SIMPLE IRA Plan affectmy employee’s tax situation?Your employees may benefit from a reducedtaxable wage base, because salary deferralcontributions to the SIMPLE IRA plan arenot subject to income taxes until the fundsare withdrawn from the account. In effect,the SIMPLE IRA helps your employees intwo ways — an immediate tax benefit andtax-deferred savings for retirement.Q: What is the procedure for notifyingmy employees about the contributionformula I intend to use?You must notify your employees annually, nolater than 60 days before each plan year, as towhich contribution formula you intend to use.Stifel will provide you with a form to do so.Q: What if I have additional questions?Please consult your Stifel Nicolaus FinancialAdvisor, who will be glad to answer anyadditional questions on this attractiveretirement plan option for small businesses.-8-

Stifel ServicesAnnuitiesVariable, Immediate, and FixedAsset AllocationCash Management (Stifel Prestige Accounts)Check WritingDebit MasterCard Bill Payment ServicesStifel @ccess (Online account access)College Planning529 College Savings PlansEducation Savings AccountsCommon StocksConsulting Services (Fee-Based Programs)Corporate Executive ServicesCashless Stock Option ExerciseControl and Restricted Stock TransactionsCorporate FinanceEquity Line of CreditFinancial PlanningFixed Income InvestmentsCertificates of DepositCollateralized Mortgage Obligations (CMOs)Corporate BondsGovernment and Agency SecuritiesMunicipal BondsInsuranceBusiness Owner NeedsDisability Insurance (Individual and Group)Life Insurance (Individual and Business Policies)Long-Term Care InsuranceIRAsTraditional, Roth, and RolloversManaged MoneyMoney Market FundsMutual FundsOptionsPreferred StocksPublic FinanceResearchRetirement PlanningRetirement Plans401(k) PlansProfit Sharing PlansMoney Purchase PlansSEP IRAsSIMPLE IRAsDefined Benefit PlansSyndicate OfferingsTrust and Estate PlanningUnit Investment Trusts

Investment Services Since 1890one financial plaza 501 north broadwayst. louis, missouri 63102 (314) 342-2000member sipc and nyse www.stifel.comSN17A-3/11

a qualified plan. The SIMPLE IRA Plan provides a cost-effective way to establish a retirement plan for employees. All employer contributions and all amounts paid to employees as compensation and deferred by the participants to the plan are tax-deductible for the employer. Q: How do I determine if I'm eligible to establish a SIMPLE Plan?