Transcription

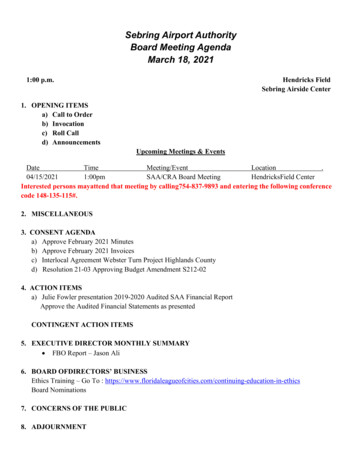

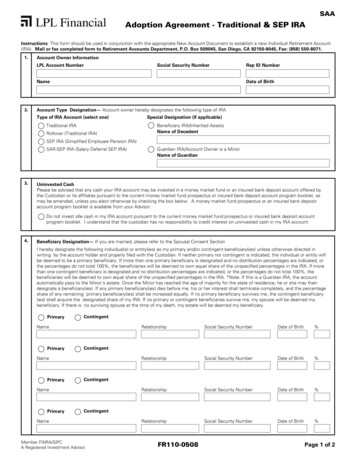

SAAAdoption Agreement - Traditional & SEP IRAInstructions: This form should be used in conjunction with the appropriate New Account Document to establish a new Individual Retirement Account(IRA). Mail or fax completed form to Retirement Accounts Department, P.O. Box 509045, San Diego, CA 92150-9045, Fax: (858) 550-8071.1.Account Owner InformationLPL Account NumberSocial Security NumberName2.Rep ID NumberDate of BirthAccount Type Designation— Account owner hereby designates the following type of IRAType of IRA Account (select one)Traditional IRARollover (Traditional IRA)Special Designation (if applicable)Beneficiary IRA/Inherited AssetsName of DecedentSEP IRA (Simplified Employee Pension IRA)SAR-SEP IRA (Salary Deferral SEP IRA)3.Guardian IRA/Account Owner is a MinorName of GuardianUninvested CashPlease be advised that any cash your IRA account may be invested in a money market fund or an insured bank deposit account offered bythe Custodian or its affiliates pursuant to the current money market fund prospectus or insured bank deposit account program booklet, asmay be amended, unless you elect otherwise by checking the box below. A money market fund prospectus or an insured bank depositaccount program booklet is available from your Advisor.Do not invest idle cash in my IRA account pursuant to the current money market fund prospectus or insured bank deposit accountprogram booklet. I understand that the custodian has no responsibility to credit interest on uninvested cash in my IRA account.4.Beneficiary Designation— If you are married, please refer to the Spousal Consent SectionI hereby designate the following individual(s) or entity(ies) as my primary and/or contingent beneficiary(ies) unless otherwise directed inwriting by the account holder and properly filed with the Custodian. If neither primary nor contingent is indicated, the individual or entity willbe deemed to be a primary beneficiary. If more than one primary beneficiary is designated and no distribution percentages are indicated, orthe percentages do not total 100%, the beneficiaries will be deemed to own equal share of the unspecified percentages in the IRA. If morethan one contingent beneficiary is designated and no distribution percentages are indicated, or the percentages do not total 100%, thebeneficiaries will be deemed to own equal share of the unspecified percentages in the IRA. *Note: If this is a Guardian IRA, the accountautomatically pass to the Minor’s estate. Once the Minor has reached the age of majority for the state of residence, he or she may thendesignate a beneficiary(ies). If any primary beneficiary(ies) dies before me, his or her interest shall terminate completely, and the percentageshare of any remaining primary beneficiary(ies) shall be increased equally. If no primary beneficiary survives me, the contingent beneficiary(ies) shall acquire the designated share of my IRA. If no primary or contingent beneficiaries survive me, my spouse will be deemed mybeneficiary. If there is no surviving spouse at the time of my death, my estate will be deemed my beneficiary.PrimaryContingentNamePrimaryDate of Birth%RelationshipSocial Security NumberDate of Birth%RelationshipSocial Security NumberDate of Birth%RelationshipSocial Security NumberDate of Birth%ContingentNamePrimarySocial Security ameMember FINRA/SIPCA Registered Investment AdvisorFR110-0508Page 1 of 2

SAALPL Account Number4.Beneficiary Designation (continued)PrimaryContingentNamePrimarySocial Security NumberDate of Birth%RelationshipSocial Security NumberDate of Birth%RelationshipSocial Security NumberDate of Birth%RelationshipSocial Security NumberDate of Birth%RelationshipSocial Security NumberDate of imary%ContingentNamePrimaryDate of BirthContingentNamePrimarySocial Security NumberContingentNamePrimaryRelationshipSpousal ConsentThis section should be reviewed if the IRA owner is located in a community or marital property state and the IRA owner is married. Due tothe important tax consequences of giving up one’s community property interest, individuals signing this section should consult with acompetent tax or legal adviser.I am the spouse of the above-named IRA owner. I acknowledge that I have received a fair and reasonable disclosure for my spouse’sproperty and financial obligations. Due to the important tax consequences of giving up my interest in this IRA, I have been advised to see atax professional. I hereby give the IRA holder any interest I have in the funds or property deposited in this IRA and consent to the beneficiarydesignation(s) indicated above, I assume full responsibility for any adverse consequences that may result. The Custodian gave no tax or legaladvice to me.DateSignature of Spouse6.Client Signature & CertificationI certify under penalties of perjury that the Social Security number shown on this form is correct and may be used for any account opened forme and I am a U.S. Person (including a U.S. resident alien). I certify that I am eligible to establish the type of account referenced above. Irelease the Custodian, LPL Financial Corporation and their affiliates, from all liability and agree to indemnify the same from any and all losses,damages or cost for acting in good faith in accordance with the account privileges selected herein. In no event shall the indemnified partiesbe liable for consequential damages. By signing this document, I state that I have received a Custodial Agreement (5305-A) and disclosurestatement. Additionally, I certify the following: If this is a SEP IRA, I certify that I have received, read and accept my employer’s plan document (5305-SEP or SEP prototype). If this is a SAR-SEP, I certify that I have received, read and accept my employer’s plan document (5305A-SEP or SEP prototype). I haveverified that my employer’s plan was established in a year beginning before 1997 and I have entered into a SAR-SEP Elective DeferralAgreement with my employer. If I make a rollover contribution, I certify that I understand the rules and conditions of the deposit and that I am eligible to make the depositunder the Internal Revenue Code.Signature of Account Owner (Signature of Guardian if Account Owner is a minor)Member FINRA/SIPCA Registered Investment AdvisorFR110-0508DatePage 2 of 2

Fee Schedule (please retain for your records)Retirement FeesAnnual Custodial Maintenance Fee 1 40.00 Per Account 2Roth Conversion Fee 3 25.00 Per ConversionAccount Termination Fee 4 95.00 Per Account 5Alternative Investment Fees 6Subscription FeeRedemption FeeRe-registration FeeAnnual Special Product FeeUBTI Filing Fee 50.00 Per Purchase 50.00 Per Position 50.00 Per Position 35.00 Per Position 100.00Commission Disclosure StatementBrokerage commissions are considered a cost of the security and are not billed separately. These costs must be paid for with assets from theaccount and cannot be paid for outside of the account according to the Internal Revenue Code.1For brokerage accounts, the Annual Custodial Maintenance Fee will be invoiced annually and charged in arrears. The Annual Custodial Maintenance Fee may be waived forbrokerage accounts that are valued at 250,000 or more on the annual invoice date. The values of Alternative Investments are not considered for the purpose of this valuation.The fee is payable in the month of the first anniversary of the opening of your account and each subsequent anniversary thereafter. An invoice for the fee will be sent to you.Timely payment of this fee will avoid charges being deducted from the balance of your account. LPL has the right to liquidate any assets to collect any amount past due.2For advisory accounts, the Annual Custodial Maintenance Fee will be charged at a rate of 10.00 per quarter, in arrears. Any 12b-1 fees credited to the advisory account willoffset this charge. For Optimum Market Portfolio accounts, the Annual Custodial Maintenance Fee will be charged 10.00 annually. For Personal Wealth Portfolio accounts,the Annual Custodial Maintenance Fee will be waived.3Fee will be assessed to the Traditional, SEP or SIMPLE IRA at time of conversion.4This fee is in addition to the Annual Custodial Maintenance Fee and other LPL fees.5LPL reserves the right to close and collect fees for any account that falls below the amount required for closing fees.6The issuing party, transfer agent or general partner may require additional fees.Member FINRA/SIPCA Registered Investment AdvisorFR110-0508

INDIVIDUAL RETIREMENT CUSTODIAL ACCOUNT AGREEMENTForm 5305-A under Section 408(a) of the Internal Revenue CodeFORM (REV. MARCH 2002)Depositor’s surviving spouse, then this distribution is not required tobegin before the end of the calendar year in which the Depositor wouldhave reached age 701 2. But, in such case, if the Depositor’s survivingspouse dies before distributions are required to begin, then the remaininginterest will be distributed in accordance with (a)(ii) above (but not overthe period in paragraph (a)(iii), even if longer), over such spouse’sdesignated beneficiary’s life expectancy, or in accordance with (ii) belowif there is no such designated beneficiary.The Depositor named on the Application is establishing a Traditional individualretirement account under section 408(a) to provide for his or her retirement and forthe support of his or her beneficiaries after death.The Custodian named on the Application has given the Depositor the disclosurestatement required by Regulations section 1.408-6.The Depositor has assigned the custodial account the sum indicated on the Application.The Depositor and the Custodian make the following agreement:ARTICLE IExcept in the case of a rollover contribution described in section 402(c), 403(a)(4),403(b)(8), 408(d)(3), or 457(e)(16), an employer contribution to a simplifiedemployee pension plan as described in section 408(k), or a recharacterizedcontribution described in section 408A(d)(6), the Custodian will accept only cashcontributions up to 3,000 per year for tax years 2002 through 2004. Thatcontribution limit is increased to 4,000 for tax years 2005 through 2007 and 5,000for 2008 and thereafter. For individuals who have reached the age of 50 before theclose of the tax year, the contribution limit is increased to 3,500 per year for taxyears 2002 through 2004, 4,500 for 2005, 5,000 for 2006 and 2007, and 6,000 for2008 and thereafter. For tax years after 2008, the above limits will be increased toreflect a cost-of-living adjustment, if any.(ii) the remaining interest will be distributed by the end of the calendar yearcontaining the fifth anniversary of the Depositor’s death.4. If the Depositor dies before his or her entire interest has been distributed and ifthe designated beneficiary is not the Depositor’s surviving spouse, no additionalcontributions may be accepted in the account.5. The minimum amount that must be distributed each year, beginning with the yearcontaining the Depositor’s required beginning date, is known as the “requiredminimum distribution” and is determined as follows:(a) the required minimum distribution under paragraph 2(b) for any year,beginning with the year the Depositor reaches age 701 2, is the Depositor’saccount value at the close of business on December 31 of the preceding yeardivided by the distribution period in the uniform lifetime table in Regulationssection 1.401(a)(9)-9. However, if the Depositor’s designated beneficiary ishis or her surviving spouse, the required minimum distribution for a yearshall not be more than the Depositor’s account value at the close of businesson December 31 of the preceding year divided by the number in the joint andlast survivor table in Regulations section 1.401(a)(9)-9. The requiredminimum distribution for a year under this paragraph (a) is determined usingthe Depositor’s (or, if applicable, the Depositor and spouse’s) attained age (orages) in the year.ARTICLE IIThe Depositor’s interest in the balance in the custodial account is nonforfeitable.ARTICLE III1. No part of the custodial account funds may be invested in life insurance contracts,nor may the assets of the custodial account be commingled with other propertyexcept in a common trust fund or common investment fund (within the meaningof section 408(a)(5)).2. No part of the custodial account funds may be invested in collectibles (within themeaning of section 408(m)) except as otherwise permitted by section 408(m)(3),which provides an exception for certain gold, silver, and platinum coins, coinsissued under the laws of any state, and certain bullion.(b) the required minimum distribution under paragraphs 3(a) and 3(b)(i) for ayear, beginning with the year following the year of the Depositor’s death (orthe year the Depositor would have reached age 701 2, if applicable underparagraph 3(b)(i)) is the account value at the close of business on December31 of the preceding year divided by the life expectancy (in the single lifetable in Regulations section 1.401(a)(9)-9) of the individual specified in suchparagraphs 3(a) and 3(b)(i).ARTICLE IV1. Notwithstanding any provision of this Agreement to the contrary, the distributionof the Depositor’s interest in the custodial account shall be made in accordancewith the following requirements and shall otherwise comply with section408(a)(6) and the regulations thereunder, the provisions of which are hereinincorporated by reference.(c) the required minimum distribution for the year the Depositor reaches age 701 2can be made as late as April 1 of the following year. The required minimumdistribution for any other year must be made by the end of such year.2. The Depositor’s entire interest in the custodial account must be, or begin to be,distributed not later than the Depositor’s required beginning date, April 1following the calendar year in which the Depositor reaches age 701 2. By that date,the Depositor may elect, in a manner acceptable to the Custodian, to have thebalance in the custodial account distributed in: (a) A single sum or (b) Paymentsover a period not longer than the life of the Depositor or the joint lives of theDepositor and his or her designated beneficiary.3. If the Depositor dies before his or her entire interest is distributed to him or her,the remaining interest will be distributed as follows:(a) If the Depositor dies on or after the required beginning date and:(i) the designated beneficiary is the Depositor’s surviving spouse, theremaining interest will be distributed over the surviving spouse’s lifeexpectancy as determined each year until such spouse’s death, or over theperiod in paragraph (a)(iii) below if longer. Any interest remaining afterthe spouse’s death will be distributed over such spouse’s remaining lifeexpectancy as determined in the year of the spouse’s death and reducedby 1 for each subsequent year, or, if distributions are being made over theperiod in paragraph (a)(iii) below, over such period.(ii) the designated beneficiary is not the Depositor’s surviving spouse, theremaining interest will be distributed over the beneficiary’s remaining lifeexpectancy as determined in the year following the death of the Depositorand reduced by 1 for each subsequent year, or over the period inparagraph (a)(iii) below if longer.(iii) there is no designated beneficiary, the remaining interest will bedistributed over the remaining life expectancy of the Depositor asdetermined in the year of the Depositor’s death and reduced by 1 for eachsubsequent year.6. The owner of two or more Traditional IRAs may satisfy the minimum distributionrequirements described above by taking from one Traditional IRA the amountrequired to satisfy the requirement for another in accordance with the Regulationsunder section 408(a)(6).ARTICLE V1. The Depositor agrees to provide the Custodian with all information necessary toprepare any reports required by section 408(i) and Regulations sections 1.408-5and 1.408-6.2. The Custodian agrees to submit to the Internal Revenue Service (IRS) andDepositor the reports prescribed by the IRS.ARTICLE VINotwithstanding any other articles which may be added or incorporated, theprovisions of Articles I through III and this sentence will be controlling. Anyadditional articles inconsistent with section 408(a) and the related Regulations will beinvalid.ARTICLE VIIThis Agreement will be amended as necessary to comply with the provisions of theCode and the related Regulations. Other amendments may be made with the consentof the persons whose signatures appear on the Application.ARTICLE VIIIPlease refer to the Adoption Agreement establishing this IRA, which is incorporatedinto the Agreement as this part of Article VIII.1. Definitions(a) The term “Sponsor” means LPL Financial Corporation (LPL).(b) If the Depositor dies before the required beginning date, the remaininginterest will be distributed in accordance with (i) below or, if elected or thereis no designated beneficiary, in accordance with (ii) below:(i) the remaining interest will be distributed in accordance with paragraphs(a)(i) and (a)(ii) above (but not over the period in paragraph (a)(iii), evenif longer), starting by the end of the calendar year following the year ofthe Depositor’s death. If, however, the designated beneficiary is theFR110 0508Page 1 of 9The term “Custodian” means The Private Trust Company, N.A.The term “Beneficiary” means the person or persons designated as such by the“designating person” (as defined below) on a form presented to the Custodian(or former Custodian), or on such other form as may be presented to and filedwith the Custodian by the designating person, for use in connection with theCustodial Account, signed by the designating person, and filed with LPL.Individuals, trusts, estates, or other entities may be named as either primary orcontingent beneficiaries. However, if the designation does not effectivelydispose of the entire Custodial Account as of the time the distribution is to 2007 Ascensus, Inc., Brainerd, MN

commence, the term “Beneficiary” shall then mean the designating person’sspouse or if there is no surviving spouse, the designating person’s estate withrespect to the assets of the Custodial Account not disposed of by thedesignation. The designation last accepted by LPL before such distribution is tocommence, provided it was received by LPL (or deposited in the U.S. Mail orwith a reputable delivery service) during the designating person’s lifetime,shall be controlling and, whether or not fully dispositive of the CustodialAccount, thereupon shall revoke all such forms previously filed by that person.(c) The shareholder of record of all assets in the Custodial Account shall be theCustodian or its nominee. The same nominee may be used with respect toassets of other investors whether or not held under agreement similar to thisone or in any capacity whatsoever. However, each Depositor’s CustodialAccount shall be separate and distinct, a separate account thereof shall bemaintained by the Custodian, and the assets thereof shall be held by theCustodian in individual or bulk segregation either in the Custodian’s vaultsor in depositories approved by the Securities and Exchange Commissionunder the Securities and Exchange Act of 1934.The term “designating person” means the Depositor during his or herlifetime or after the Depositor’s death, unless otherwise prohibited by theDepositor in writing on file with the Custodian, the Depositor’s Beneficiary(including any beneficiary of such Beneficiary).(d) In valuing the assets of the Custodial Account for recordkeeping andreporting purposes the Custodian shall use reasonable, good faith efforts toascertain the fair market value of each asset through utilization of variousoutside sources available to the Custodian and consideration of variousrelevant factors generally recognized as appropriate to the application ofcustomary valuation techniques.(b) When and after distributions from the Custodial Account to Depositor’sBeneficiary commence, all rights and obligations assigned to Depositorhereunder shall inure to, and be enjoyed and exercised by, Beneficiaryinstead of Depositor.However, where assets are illiquid or their value is not readily ascertainableon either an established exchange or generally recognized market, theDepositor undertakes the responsibility of obtaining and furnishing to theCustodian on an annual basis sufficient information of fair market value withrespect to such assets so as to enable the Custodian to accurately report thevalue of such assets, and the Depositor represents and warrants that any suchinformation so provided by the Depositor will be sufficiently accurate andcomplete so as to permit the Custodian to rely upon the same. If theDepositor has not provided to the Custodian in a timely manner suchinformation as to fair market value or to assist the Custodian in making anydetermination as to value, the Custodian will attempt to assign a fair marketvalue to such assets based upon available information and, in such case,Depositor acknowledges that such valuation is by necessity not a true marketvalue and is merely an estimate of value in a broad range of values and itsaccuracy should not be relied upon by the Depositor in making investmentdecisions or for any other purposes than to satisfy the reporting requirementsunder federal law. The Custodian does not guarantee either the reliability orthe appropriateness of the appraisal techniques applied by outside appraisersin developing an estimate of value and the Custodian assumes noresponsibility for the accuracy of such valuations presented with respect toassets whose value is not readily ascertainable on either an establishedexchange or a generally recognized market. The Depositor acknowledgesthat reference to fair market value contained in Paragraph 22 of Article VIIImust be read within the context of this subparagraph.(c) Notwithstanding Section 2 of Article IV above, if the Depositor’s spouse isthe sole Beneficiary on the Depositor’s date of death, the spouse will not betreated as the Depositor if the spouse elects not to be so treated. In suchevent, the Custodial Account will be distributed in accordance with the otherprovisions of such Article IV, except that distributions to the Depositor’sspouse are not required to commence until December 31, of the year inwhich the Depositor would have turned age 701 2.2. Investment of Account Assets(a) Depositor acknowledges that any amount shall not be considered contributedto the Custodial Account until the funds clear into the Custodial Account.The Depositor shall direct the Custodian with respect to the investment of allcontributions and earnings there from. Such direction shall be in such formas may be required by the Custodian and shall be limited to publicly tradedsecurities, covered call options, married put options, mutual funds, moneymarket instruments, insured bank deposit accounts, and other investments tothe extent they are obtainable through the Custodian or its agents in theregular course of business. In addition, the Depositor acknowledges thatunless otherwise directed by him, and subject to any required minimums,cash, which is not currently invested, shall be invested in a money marketfund or an insured bank deposit account offered by the Custodian or itsaffiliates. In the absence of investment direction by the Depositor, theCustodian shall have no investment responsibility. All transactions directedby the Depositor shall be subject to the rules, regulations, customs andusages of the exchange, market or clearinghouse where executed, and to allapplicable federal and state laws and regulations, and to internal policies ofthe Custodian. The Custodian shall be responsible for the execution of suchorders and for maintaining adequate records there of. The Custodian reservesthe right to reject any investment direction from the Depositor which, in thejudgment of the Custodian, will impose upon it an administrative burdengreater than that normally incident to investments described in thisParagraph 2(a).The Custodian shall have no discretion to direct any investments of aCustodial Account, and is merely authorized to acquire and hold theparticular investments specified by the Depositor. If any investment ordersare not received as required or, if received, are unclear in the opinion of theCustodian or Sponsor, all or a portion of the contribution may be helduninvested without liability for loss of income or appreciation, and withoutliability for interest, pending receipt of such orders or clarification; or thecontribution may be returned. The Depositor shall be the beneficial owner ofall assets held in the Custodial Account. The Depositor authorizes theCustodian to hold Custodial Account contributions pending investment, thesettlement of investments or distribution in a money market sweep fund oran insured bank deposit account maintained by the Custodian.(b) The Depositor may delegate the investment responsibility for all of theCustodial Account to an agent or attorney-in-fact acceptable to theCustodian by notifying the Custodian in writing on a form acceptable to theCustodian of the delegation of such investment responsibility and the nameof the person or persons to whom such responsibility is delegated.The Custodian shall carry out the instructions of the agent or attorney-in-factwith respect to the management and investment of the assets of the CustodialAccount and the Custodian shall not incur any liability on account of itscompliance with such instructions. The Custodian shall be under no duty toreview or question any direction, action or failure to direct or act of suchagent or attorney-in-fact, nor to make any suggestions to the agent orattorney-in-fact in connection therewith. The agent or attorney-in-fact shallbe required to execute any documents related to the investment of assetsunder its control deemed necessary or advisable by the Custodian. TheDepositor may revoke the authority of any agent or attorney-in-fact at anytime by notifying the Custodian in writing of such revocation and theCustodian shall not be liable in any way for transactions initiated prior toreceipt of such notice.FR110 0508(e) The Depositor, by making a transfer or rollover contribution, as described inArticle I, hereby certifies that the contribution meets all requirements fortransfer or rollover contributions.(f) The Depositor understands that certain transactions are prohibited in IRAsunder Section 4975 of the Internal Revenue Code. The Depositor furtherunderstands that the determination of a prohibited transaction depends on thefacts and circumstances that surround the particular transaction. TheCustodian will make no determination as to whether any IRA investment isprohibited. The Depositor further understands that, should the Depositor’sIRA engage in a prohibited transaction, the Depositor will incur a taxabledistribution as well as possible penalties. The Depositor represents to theCustodian that the Depositor has consulted or will consult with theDepositor’s own tax or legal professional to ensure that none of theDepositor’s IRA investments will constitute a prohibited transaction and thatthe Depositor’s IRA investments will comply with all applicable federal andstate laws, regulations and requirements.3. Shareholder Rights - The Custodian agrees to deliver or cause to be executedand delivered to the Depositor all notices, prospectuses, financial statements,proxies, and proxy solicitation materials that are received by the Custodianrelating to assets credited to the Custodial Account. The Custodian shall exerciseany rights of a shareholder (including voting rights) with respect to anysecurities held in the Custodial Account only in accordance with instructions ofthe Depositor pursuant to any applicable rules of the Securities and ExchangeCommission. In the event the Depositor fails to instruct the Custodian as to theexercise of shareholder rights, that failure to instruct shall be deemed to be aninstruction not to exercise such rights.4. Distribution(a) To receive an annuity distribution, a Depositor may roll over or transfer thevalue of the Custodial Account to purchase an individual retirement annuitypayable in equal or substantially equal payments over the Depositor’s lifeexpectancy or the joint and last survivor life expectancy of the Depositor andhis or her designated beneficiary.Page 2 of 9(b) The Custodian shall not be responsible for any distribution made inaccordance with instructions acceptable to the Custodian or failure todistribute in the absence of instructions acceptable to the Custodian from theDepositor (or Beneficiary if Depositor is deceased) in accordance withArticle IV including, but not limited to, any tax or penalty resulting fromsuch distribution or failure to distribute. The Depositor shall be solelyresponsible for distributing the required minimum distribution from theCustodial Account each year in accordance with Article IV. 2007 Ascensus, Inc., Brainerd, MN

5. Amendments and Termination - The Depositor may, at any time and fromtime to time, terminate the Custodial Agreement in whole or in part bydelivering to the Custodian a signed written copy of such termination in a formacceptable to the Custodian. The Depositor delegates to the Custodian the rightto amend the Custodial Agreement (including retroactive amendments) bywritten notice to the Depositor, and the Depositor shall be deemed to haveconsented to any such amendment, provided that no amendment shall cause orpermit any part of the assets of the Custodial Account to be diverted to purposesother than for the exclusive benefit of the Depositor or Beneficiaries, noamendment shall be made except in accordance with any applicable laws andregulations affecting this Custodial Account, and any amendment which affectsthe rights, duties or responsibilities of the Custodian may only be made with

Rollover (Traditional IRA) Name of Decedent. SEP IRA (Simplified Employee Pension IRA) SAR-SEP IRA (Salary Deferral SEP IRA) Guardian IRA/Account Owner is a Minor. Name of Guardian 3. Uninvested Cash . Please be advised that any cash your IRA account may be invested in a money market fund or an insured bank deposit account offered by