Transcription

SIMPLE IRA kitNon-DFI approachUMB Bank, n.a.SIMPLE IRA information kit

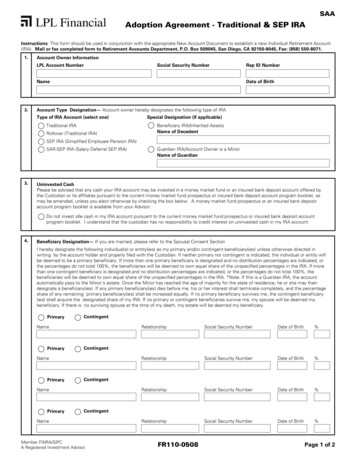

SIMPLE IRA kit: Non-DFI approachTIAA-CREF FUNDSUMB Bank, n.a.SIMPLE Individual Retirement Custodial AccountEmployee instructions for opening yourSIMPLE IRAThese instructions and the forms andmaterials with the instructions are suitableonly for establishing a SIMPLE IRA to receivecontributions under an employer SIMPLEIRA plan, or a rollover or transfer of assetsdirectly from another SIMPLE IRA. They arenot suitable for establishing a TraditionalIRA or a Roth IRA. If you are interested ineither a Traditional IRA or a Roth IRA, callthe customer service phone number orwrite to the address provided at the end ofthese instructions.A SIMPLE IRA is an individual retirement accountestablished by a Participant in an employer SIMPLE IRAplan. Only two types of contributions to a SIMPLE IRAare permitted.1. Salary reduction contributions by you under youremployer’s SIMPLE IRA plan and matching ornonmatching contributions to your account byyour employer.2. A rollover or a direct transfer from another SIMPLE IRAestablished by you as part of an employer SIMPLE IRAplan that you want to transfer to this SIMPLE IRA forinvestments in funds sponsored by TIAA-CREF FUNDS.Also, after you have participated in a SIMPLE IRA fortwo years, you may rollover or directly transfer fromanother non-SIMPLE IRA retirement plan into yourSIMPLE IRA.TIAA-CREF FUNDS has other materials for establishing aTraditional or a Roth IRA (neither of which can be part ofan employer SIMPLE IRA plan). Be sure to use the rightmaterials to establish the appropriate IRA. If you want toestablish a SIMPLE IRA, follow these instructions.Step 1: Read the disclosures and related formsRead carefully the SIMPLE IRA Disclosure Statement,the SIMPLE Individual Retirement Custodial Accountdocument, the Adoption Agreement and the prospectus(es)for any fund(s) you are considering. Consult your lawyer,accountant or other tax adviser, or a qualified financialplanner, if you have any questions about how opening aSIMPLE IRA will affect your financial and tax situation.In addition to the SIMPLE IRA Disclosure Statementincluded in these materials, as part of its SIMPLE IRAplan, your employer should give you a notice summarizingcertain key features of the employer’s SIMPLE IRA plan(including particularly, the level of employer contributions)and a summary description containing more informationabout the employer’s SIMPLE IRA plan. Be sure to readthis information carefully as well.Step 2: Complete the Adoption Agreement foryour SIMPLE IRAWWPrint the identifying information in Part 1 of theAdoption Agreement.WWIn Part 2, check the box that shows the type of SIMPLEIRA you are opening. If you are establishing a SIMPLEIRA to receive a transfer from another account underyour employer’s SIMPLE IRA plan, you are certifyingthe date the first contribution to your other SIMPLE IRAwas made. This is important for tax reporting purposes.Check with your employer or with the custodian ortrustee of the transferring account to verify the correctdate if you are unsure.WWIn Part 3, fill in the identifying information about youremployer (which is maintaining the SIMPLE IRA plan).WWIn Part 4, indicate your investment choices. If youhave elected as part of your employer’s SIMPLE IRAplan to have contributions to your TIAA-CREF FUNDSSIMPLE IRA transferred to another IRA with a differenttrustee or custodian, the contributions will be heldin the fund specified in the Adoption Agreementpending transfer.2

SIMPLE IRA kit: Non-DFI approachWWWWIn Part 5, indicate your primary Beneficiary(ies) andalternate Beneficiary(ies). (Signature by your spouseon the spousal waiver may be needed if you residein a community or marital property state and if yourBeneficiary is other than your spouse.)In Part 6, indicate whether you are a U.S. person ora foreign person. U.S. tax regulations require thecompletion of this section in order to prevent theimposition of penalty withholding tax on distributionsfrom the account.To indicate that you (the Participant) are a “foreignperson” (an individual who is not a citizen of the U.S.and not a resident alien), check the box in Part 6. If youdo not check the box, you are certifying that you are a“U.S. person” (either a U.S. citizen or a resident alien).If you are a U.S. person, your correct Social Securitynumber should go in Part 1. If you do not have a SocialSecurity number, you should apply for one immediatelyby contacting the local office of the Social SecurityAdministration or the Internal Revenue Service (IRS).If you are a foreign person, you must obtain a FormW-8BEN from the IRS forms line at 800-829-3676 orfrom the IRS website at www.irs.ustreas.gov. Completeand return the form with the Adoption Agreement orwithin 30 days after sending the Adoption Agreement.WWIn Part 7, sign and date the Adoption Agreement atthe end. If the Participant (the individual for whom thisSIMPLE IRA is being established) is a minor underthe laws of his or her state of residence, a parent orguardian also must sign.Step 3: Universal transfer of assetsIf you are transferring assets directly from an existingSIMPLE IRA with another investment fund to this IRA,complete the Universal IRA Transfer of Assets Form.Step 4: Fee paymentThe custodian fees for maintaining your SIMPLE IRA arelisted in the Fees & Expenses section of the SIMPLEIRA Disclosure Statement. If you are paying by check,enclose a check for the correct amount payable asspecified below. If you do not pay by check, the correctamount will be taken from your account.Step 5: Finalize and mailCheck to be sure you have properly completed allnecessary forms and enclosed a check for thecustodian’s fees (unless being withdrawn from youraccount). Your SIMPLE IRA cannot be accepted withoutthe properly completed documents or the custodian fees.WWAll checks should be payable to: “TIAA-CREF FUNDS”WWSend the completed forms and checks to:WWRegular mail:––WWTIAA-CREF FUNDS P.O. Box 219227 Kansas City, MO 64121-9227Overnight mail:––TIAA-CREF FUNDS 430 W 7TH St. Suite 219227 Kansas City, MO 64105-1407For questions or to request additional materials,call 800-223-1200.Note: This kit contains materials to establish a SIMPLEIRA for use in connection with a SIMPLE IRA planmaintained by your employer. The materials in this kit arenot suitable to establish a Traditional IRA or a Roth IRAto which you may make annual contributions up to theIRA contribution limit for the year. If you are interestedin receiving information about a Traditional IRA or a RothIRA, including materials for establishing such an IRA,please call the 800 number listed above or write to theaddress at the end of the Disclosure Statement includedin this kit.Investor(s) acknowledges that neither TIAA-CREF Fundsnor any Teachers Advisors, LLC affiliate or serviceprovider to TIAA-CREF Funds has provided the investor(s)with advice, recommendations or suggestions as to anyspecific investment decisions. Investors in TIAA-CREFFunds are urged to consult their own advisors beforemaking investment-related decisions, including but notlimited to, those related to transfer or rollover fromretirement plans, purchase or sale of investments,selection or retention of investment managers, orselection of account Beneficiaries.3

SIMPLE IRA kit: Non-DFI approachUMB Bank, n.a.SIMPLE Individual Retirement Custodial AccountThe following provisions of Articles I to VIIare in the form promulgated by the InternalRevenue Service in Form 5305-SA for use inestablishing a SIMPLE Individual RetirementCustodial Account. (Revised April 2017)Article I.The Custodian will accept cash contributions made onbehalf of the Participant by the Participant’s employerunder the terms of a SIMPLE IRA plan described insection 408(p). In addition, the Custodian will accepttransfers or rollovers from other SIMPLE IRAs of theParticipant and, after the two-year period of participationdefined in section 72(t)(6), transfers or rollovers from anyeligible retirement plan (as defined in section 402(c)(8)(B))other than a Roth IRA or a designated Roth account. Noother contributions will be accepted by the Custodian.Article II.The Participant’s interest in the balance in the CustodialAccount is nonforfeitable at all times.Article III.1. No part of the Custodial Account funds may beinvested in life insurance contracts, nor may theassets of the Custodial Account be commingledwith other property except in a common trust fundor common investment fund (within the meaning ofsection 408(a)(5)).2. No part of the Custodial Account funds may beinvested in collectibles (within the meaning ofsection 408(m)) except as otherwise permitted bysection 408(m)(3), which provides an exception forcertain gold, silver and platinum coins, coins issuedunder the laws of any state, and certain bullion.Article IV.1. Notwithstanding any provision of this agreementto the contrary, the distribution of the Participant’sinterest in the Custodial Account shall be made inaccordance with the following requirements and shallotherwise comply with section 408(a)(6) and theregulations thereunder, the provisions of which areincorporated by reference.2. The Participant’s entire interest in the CustodialAccount must be, or begin to be, distributed not laterthan the Participant’s required beginning date, April 1following the calendar year in which the Participantreaches age 72. By that date, the Participant mayelect, in a manner acceptable to the Custodian,to have the balance in the Custodial Accountdistributed in:(a) A single sum or(b) Payments over a period not longer than the life ofthe Participant or the joint lives of the Participantand his or her Designated Beneficiary.3. If the Participant dies on or after January 1, 2020,and before his or her entire interest is distributed tohim or her, the remaining interest will be distributedas follows:Designated Beneficiary. Upon the death of a(i) Participant the individual Beneficiary would berequired to take a full distribution by the end ofthe tenth year after the year of the Participant’sdeath (“Ten Year Rule”). The Ten Year Ruleapplies regardless of whether RMD’s had begunprior to the Participant’s death.(ii) Eligible Designated Beneficiary. An EligibleDesignated Beneficiary is any DesignatedBeneficiary who is, the surviving spouse, achild under the age of majority, disabled orchronically ill, or any other person who is notmore than ten years younger than the deceasedParticipant. If the Designated Beneficiary is anEligible Designated Beneficiary, the Ten YearRule would not apply to any portion payableto an Eligible Designated Beneficiary if theBeneficiary’s interest will be distributed overthe Beneficiary’s life or a period not exceedinghis or her life expectancy, as long as the first4

SIMPLE IRA kit: Non-DFI approachdistribution is taken by December 31 of theyear following the year of the original owner’sdeath. If the Eligible Designated Beneficiary isthe surviving spouse, then such distributionswould not be required to begin earlier than thedate on which the Participant/IRA owner wouldhave attained age 72. If the Eligible DesignatedBeneficiary is a spouse, the spouse may electto treat the account as their own. Consult yourtax or financial adviser for further information onthis and specific requirements for distributions toEligible Designated Beneficiaries.(iii) If there is no surviving Beneficiary, or if theBeneficiary is decedent’s estate, a businessentity or a non-look-through trust, suchBeneficiary must take a full distribution by theend of the fifth year after the year of death(“Five Year Rule”).4. If the Participant dies before his or her entire interestis distributed or if the Designated Beneficiary is notthe Participant’s surviving spouse, no additionalcontributions may be accepted in the Account.5. The minimum amount that must be distributedeach year, beginning with the year containing theParticipant’s required beginning date, is knownas the “required minimum distribution” and isdetermined as follows:(a) The required minimum distribution underparagraph 2(b) for any year, beginning withthe year the Participant reaches age 72, isthe Participant’s Account value at the closeof business on December 31 of the precedingyear divided by the distribution period inthe Uniform Lifetime Table in Regulationssection 1.401(a)(9)-9. However, if the Participant’sDesignated Beneficiary is his or her survivingspouse, the required minimum distribution fora year shall not be more than the Participant’sAccount value at the close of business onDecember 31 of the preceding year dividedby the number in the joint and last survivortable in Regulations section 1.401(a)(9)-9. Therequired minimum distribution for a year underthis paragraph (a) is determined using theParticipant’s (or, if applicable, the Participant andspouse’s) attained age (or ages) in the year.(b) The required minimum distribution for the yearthe Participant reaches age 72 can be made aslate as April 1 of the following year. The requiredminimum distribution for any other year must bemade by the end of such year.6. The owner of two or more IRAs (other than Roth IRAs)may satisfy the minimum distribution requirementsdescribed above by taking from one IRA the amountrequired to satisfy the requirement for anotherin accordance with the regulations undersection 408(a)(6).Article V.1. The Participant agrees to provide the Custodian withall information necessary to prepare any reportsrequired by sections 408(i) and 408(l)(2) andRegulations sections 1.408-5 and 1.408-6.2. The Custodian agrees to submit to the InternalRevenue Service (IRS) and Participant the reportsprescribed by the IRS.3. The Custodian also agrees to provide the Participant’semployer the summary description described insection 408(l)(2) unless this SIMPLE IRA is a transferSIMPLE IRA.Article VI.Notwithstanding any other articles which may be addedor incorporated, the provisions of Articles I through IIIand this sentence will be controlling. Any additionalarticles inconsistent with sections 408(a) and 408(p)and the related regulations will be invalid.Article VII.This agreement will be amended as necessary tocomply with the provisions of the Code and the relatedregulations. Other amendments may be made with theconsent of the persons whose signatures appear on theAdoption Agreement.Article VIII.1. Definitions. As used in this Article VIII the followingterms have the following meanings: “Account” or“Custodial Account” means the SIMPLE IndividualRetirement Account established using the terms ofthis Agreement and the Adoption Agreement signed bythe Participant.5

SIMPLE IRA kit: Non-DFI approach“Adoption Agreement” is the application signedby the Participant to accompany and adopt thisCustodial Account. The Adoption Agreement may alsobe referred to as the “Account Application”.“Agreement” means this UMB Bank, n.a. SimpleIndividual Retirement Account Custodial Agreementand the Adoption Agreement signed by the Participant.“Ancillary Fund” means any mutual fund or registeredinvestment company designated by Sponsor,which is (i) advised, sponsored or distributed by aduly licensed mutual fund or registered investmentcompany other than the Custodian, and (ii) subjectto a separate agreement between the Sponsorand such mutual fund or registered investmentcompany, to which neither the Custodian nor theService Company is a party; provided, however,that such mutual fund or registered investmentcompany must be legally offered for sale in the stateof the Depositor’s residence. “Beneficiary” has themeaning assigned in Section 11 below.“Custodial Account” means the SIMPLE individualretirement account established using the terms ofthis Agreement.“Custodian” means UMB Bank, n.a. and anycorporation or other entity that by merger,consolidation, purchase or otherwise, assumes theobligations of the Custodian.“Distributor” means the entity which has a contractwith the Fund(s) to serve as distributor of the sharesof such Fund(s). In any case where there is noDistributor, the duties assigned hereunder to theDistributor may be performed by the Fund(s) or by anentity that has a contract to perform management orinvestment advisory services for the Fund(s).“Fund” means a mutual fund or registeredinvestment company which is advised, sponsored ordistributed by Sponsor; provided, however, that sucha mutual fund or registered investment companymust be legally offered for sale in the state ofthe Participant’s residence in order to be a Fundhereunder. Subject to the provisions of Section 3below, the term “Fund” includes an Ancillary Fund.“Participant” means the person signing the AdoptionAgreement accompanying this Custodial Agreement.“Qualified Reservist Distribution” means a distribution(i) from an IRA or elective deferrals under a section401(k) or 403(b) plan, or a similar arrangement, (ii) toan individual ordered or called to active duty afterSeptember 11, 2001 (because he or she is a memberof a reserve component) for a period of more than 179days or for an indefinite period, and (iii) made duringthe period beginning on the date of the order or calland ending at the close of the active duty period.“Service Company” means any entity employed bythe Custodian or the Distributor, including the transferagent for the Fund(s), to perform various administrativeduties of either the Custodian or the Distributor. In anycase where there is no Service Company, the dutiesassigned hereunder to the Service Company will beperformed by the Distributor (if any) or by an entity thathas a contract to perform management or investmentadvisory services for the Fund(s).“Sponsor” means TIAA-CREF FUNDS. Reference to theSponsor includes reference to any affiliate of Sponsorto which Sponsor has delegated (or which is in factperforming) any duty assigned to Sponsor underthis Agreement.“Spouse” means an individual married to theParticipant under the laws of the applicablejurisdiction. The term “spouse” shall include same-sexindividuals whose marriage was validly entered intoin a jurisdiction whose laws authorize such marriageeven if the couple is domiciled in a jurisdiction thatdoes not recognize the validity of same-sex marriages.The term “spouse” shall not include individuals(whether of the same or opposite sex) who haveentered into a registered domestic partnership, civilunion or other similar relationship recognized underthe laws of a jurisdiction that is not denominatedas marriage under the laws of the jurisdiction.A Participant and his or her spouse are deemed tobe “married” for all purposes of this Agreement.2. Revocation. To the extent required by regulationsor rulings pertaining to SIMPLE IRAs under CodeSection 408(p), the Participant may revoke theCustodial Account established hereunder by mailing6

SIMPLE IRA kit: Non-DFI approachor delivering a written notice of revocation tothe Custodian within such time limits as may bespecified in such regulations or rulings. Mailed noticeis treated as given to the Custodian on date of thepostmark (or on the date of Post Office certificationor registration in the case of notice sent by certifiedor registered mail). Upon timely revocation, theParticipant’s initial contribution will be returned asprovided in such regulations or rulings.The Participant may certify in the Adoption Agreementthat the Participant has received the DisclosureStatement related to the Custodial Account at leastseven days before the Participant signed the AdoptionAgreement to establish the Custodial Account, andthe Custodian may rely upon such certification.3. Investments. All contributions to the Custodial Accountshall be invested and reinvested in full and fractionalshares of one or more Funds. All such shares shall beissued and accounted for as book entry shares, and nophysical shares or share certificates shall be issued.Such investments shall be made in such proportionsand/or in such amounts as Participant from time totime in the Adoption Agreement or by other writtennotice to the Service Company (in such form as maybe acceptable to the Service Company) may direct (butsubject to the provisions of Section 25).The Service Company shall be responsible forpromptly transmitting all investment directions bythe Participant for the purchase or sale of shares ofone or more Funds hereunder to the Funds’ transferagent for execution. However, if investment directionswith respect to the investment of any contributionhereunder are not received from the Participant asrequired or, if received, are unclear or incomplete inthe opinion of the Service Company, the contributionwill be returned to the Participant (or the Participant’semployer), or will be held uninvested (or invested in amoney market fund if available) pending clarificationor completion by the Participant, in either casewithout liability for interest or for loss of income orappreciation. If any other directions or other orders bythe Participant with respect to the sale or purchaseof shares of one or more Funds for the CustodialAccount are unclear or incomplete in the opinionof the Service Company, the Service Company willrefrain from carrying out such investment directionsor from executing any such sale or purchase,without liability for loss of income or for appreciationor depreciation of any asset, pending receipt ofclarification or completion from the Participant.All investment directions by Participant will besubject to any minimum initial or additionalinvestment or minimum balance rules or other rules(by way of example and not by way of limitation,rules relating to the timing of investment directionsor limiting the number of purchases or sales orimposing sales charges on shares sold within aspecified period after purchase) applicable to a Fundas described in its prospectus.All dividends and capital gains or other distributionsreceived on the shares of any Fund held in theParticipant’s Account shall be retained in the Accountand (unless received in additional shares) shallbe reinvested in full and fractional shares of suchFund (or of any other Fund offered by the Sponsor, ifso directed).If any Fund held in the Custodial Account is liquidatedor is otherwise made unavailable by the Sponsor asa permissible investment for a Custodial Accounthereunder, the liquidation or other proceeds ofsuch Fund shall be invested in accordance with theinstructions of the Participant; if the Participant doesnot give such instructions, or if such instructions areunclear or incomplete in the opinion of the ServiceCompany, the Service Company may invest suchliquidation or other proceeds in such other Fund(including a Money Market Fund or Ancillary Fund ifavailable) as the Sponsor designates, and providedthat the Sponsor gives at least thirty (30) days’advance written notice to the Participant and theService Provider. In such case, neither the ServiceCompany, the Sponsor nor the Custodian will haveany responsibility for such investment.Alternatively, if the Participant does not giveinstructions and the Sponsor does not designate suchother Fund as described above then the Participant(or his or her Beneficiaries) will be deemed to havedirected the Custodian to distribute any amountremaining in the Fund to (i) the Participant (or to his7

SIMPLE IRA kit: Non-DFI approachor her Beneficiaries as their interests shall appearon file with the Custodian) or, (ii) if the Participantis deceased with no Beneficiaries on file with theCustodian, then to the Participant’s estate, subject tothe Custodian’s right to reserve funds as provided inSection 17(b). The Sponsor and the Custodian will befully protected in making any and all such distributionspursuant to this Section 3, provided that the Sponsorgives at least thirty (30) days’ advance written noticeto the Participant and the Service Provider. In suchcase, neither the Service Company nor the Custodianwill have any responsibility for such distribution. TheParticipant (or his or her Beneficiaries) shall be fullyresponsible for any taxes due on such distribution.4. Exchanges. Subject to the minimum initial oradditional investment, minimum balance and otherexchange rules applicable to a Fund, the Participantmay at any time direct the Service Company toexchange all or a specified portion of the shares ofa Fund in the Participant’s Account for shares andfractional shares of one or more other Funds. TheParticipant shall give such directions by written,telephonic or other form of notice acceptable tothe Service Company, and the Service Companywill process such directions as soon as practicableafter receipt thereof (subject to the first and secondparagraphs of Section 3 of this Article VIII.5. Transaction Pricing. Any purchase or redemption ofshares of a Fund for or from the Participant’s Accountwill be effected at the public offering price or netasset value of such Fund (as described in the theneffective prospectus for such Fund) next establishedafter the Service Company has transmitted theParticipant’s investment directions to the transferagent for the Fund(s). Any purchase, exchange,transfer or redemption of shares of a Fund for or fromthe Custodial Account will be subject to any applicablesales, redemption or other charge as described in thethen effective prospectus for such Fund.Any purchase, exchange, transfer or redemptionof shares of a Fund for or from the Participant’sAccount will be subject to any applicable sales,redemption or other charge as described in the theneffective prospectus for such Fund.6. Recordkeeping. The Service Company shall maintainadequate records of all purchases or sales of sharesof one or more Funds for the Participant’s CustodialAccount. Any Account maintained in connectionherewith shall be in the name of the Custodianfor the benefit of the Participant. All assets of theCustodial Account shall be registered in the name ofthe Custodian or of a suitable nominee. The booksand records of the Custodian shall show that all suchinvestments are part of the Custodial Account.The Custodian shall maintain or cause to bemaintained adequate records reflecting transactionsof the Custodial Account. In the discretion of theCustodian, records maintained by the ServiceCompany with respect to the Account hereunder willbe deemed to satisfy the Custodian’s recordkeepingresponsibilities therefor. The Service Companyagrees to furnish the Custodian with any informationthe Custodian requires to carry out the Custodian’srecordkeeping responsibilities.7.Allocation of Responsibility. Neither the Custodiannor any other party providing services to theCustodial Account will have any responsibility forrendering advice with respect to the investment andreinvestment of Participant’s Custodial Account, norshall such parties be liable for any loss or diminutionin value which results from Participant’s exercise ofinvestment control over his or her Custodial Account.Participant shall have and exercise exclusiveresponsibility for and control over the investmentof the assets of his or her Custodial Account, andneither Custodian nor any other such party shallhave any duty to question his or her directions inthat regard or to advise him or her regarding thepurchase, retention or sale of shares of one or moreFunds for the Custodial Account.8. Appointment of Investment Advisor. The Participantmay in writing appoint an investment advisorwith respect to the Custodial Account on a formacceptable to the Custodian and the ServiceCompany. The investment advisor’s appointmentwill be in effect until written notice to the contrary isreceived by the Custodian and the Service Company.While an investment advisor’s appointment is in8

SIMPLE IRA kit: Non-DFI approacheffect, the investment advisor may issue investmentdirections or may issue orders for the sale orpurchase of shares of one or more Funds to theService Company, and the Service Company willbe fully protected in carrying out such investmentdirections or orders to the same extent as if they hadbeen given by the Participant.The Participant’s appointment of any investmentadvisor will also be deemed to be instructions tothe Custodian and the Service Company to paysuch investment advisor’s fees to the investmentadvisor from the Custodial Account hereunderwithout additional authorization by the Participant orthe Custodian.9. (a) Distributions. Distribution of the assets of theCustodial Account shall be made at such timeand in such form as Participant (or the Beneficiaryif Participant is deceased) shall elect by writtenorder to the Custodian. It is the responsibility ofthe Participant (or the Beneficiary) by appropriatedistribution instructions to the Custodian to ensurethat any applicable distribution requirementsof Code Section 401(a) (9) and Article IV aboveare met. If the Participant (or Beneficiary) doesnot direct the Custodian to make distributionsfrom the Custodial Account by the time thatsuch distributions are required to commence inaccordance with such distribution requirements,the Custodian (and Service Company) shallassume that the Participant (or Beneficiary) ismeeting any applicable minimum distributionrequirements from another individual retirementarrangement maintained by the Participant (orBeneficiary) and the Custodian and ServiceCompany shall be fully protected in so doing.Participant acknowledges that any distribution of ataxable amount from the Custodial Account (exceptfor distribution on account of Participant’s disabilityor death, return of an “excess contribution”referred to in Code Section 4973, or a “rollover”from this Custodial Account) made earlier thanage 59½ may subject Participant to an “additionaltax on early distributions” under Code Section72(t) unless an exception to such additional taxis applicable. For that purpose, Participant will beconsidered disabled if Participant can prove, asprovided in Code Section 72(m)(7), that Participantis unable to engage in any substantial gai

A SIMPLE IRA is an individual retirement account established by a Participant in an employer SIMPLE IRA plan. Only two types of contributions to a SIMPLE IRA are permitted. 1. Salary reduction contributions by you under your employer's SIMPLE IRA plan and matching or nonmatching contributions to your account by your employer. 2.