Transcription

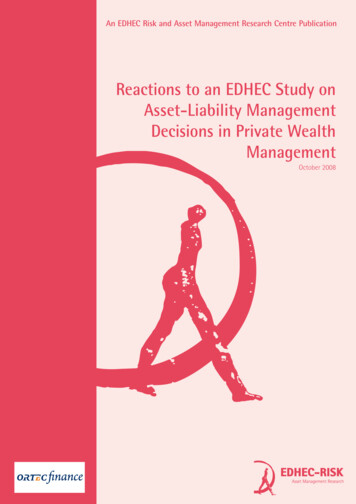

An EDHEC Risk and Asset Management Research Centre PublicationReactions to an EDHEC Study onAsset-Liability ManagementDecisions in Private WealthManagementOctober 2008

Table of ContentsForeword .3Introduction.5Executive Summary.7I. ALM Decisions in Private Wealth Management.9II: The Practitioners' View on Introducing ALM Techniques into PrivateWealth Management. 15III: Detailed Survey Results. 19Conclusion. 25About the EDHEC Risk and Asset Management Research Centre. 28About Ortec Finance . 32Printed in France, October 2008. Copyright EDHEC 2008.The opinions expressed in this study are those of the author and do not necessarily reflect those of EDHEC Business School.

Reactions to an EDHEC Study on Asset-Liability Management Decisions in Private Wealth Management - October 2008ForewordThe publication that we are pleased topresent here covers the industry reactionsto an EDHEC study entitled “Asset-LiabilityManagement Decisions in Private Banking,”which was drawn from EDHEC’s ALM andAsset Management research programme.That paper discussed the sources of addedvalue in private wealth management, andargued through a series of illustrations thatasset-liability management is the naturalapproach for the design of truly clientdriven services in private banking.The objective of the current paper is tocompare the conclusions drawn by the“Asset-Liability Management Decisionsin Private Banking” study with currentindustry perceptions. The basic question weare asking is: what do practitioners thinkabout using asset-liability management inprivate wealth management?The present publication is part of a researchchair in private asset-liability management,led by Professor Lionel Martellini, ScientificDirector of the EDHEC Risk and AssetManagement Research Centre, which thecentre is pursuing in partnership withORTEC Finance.Research in this programme will focus onthe superiority of the ALM approach inprivate wealth management (PWM), withspecial attention being given to life cycleasset allocation. Subsequent research inthe course of the three-year project willexamine the shortcomings of current PWMpractices, putting them in perspective inrelation to best practices for ALM in PWM,and also look at the consequences of highlevels of inflation for ALM in PWM. Thelatter will involve general inflation (globalprice index) or particular cases of inflation,e.g., the inflation exposure of HNWIs.We hope that you will continue to monitorand contribute to our research in thisarea and we would like to thank all therespondents who took the time to react toour study. Without their participation, thispublication would not have been possible.We would also like to extend warm thanksto our partners at ORTEC Finance for theircommitment to this research chair and theirclose involvement with our research.We hope that you will find the results ofour call for reactions both interesting andinformative.Noël Amenc, PhD,Director of the EDHEC Risk and AssetManagement Research CentreA n E D H E C R i s k a n d A s s e t M a n a g e m e n t R e s e a rc h C e n tre Pub l i ca ti on3

Reactions to an EDHEC Study on Asset-Liability Management Decisions in Private Wealth Management - October 2008About the authorsNoël Amenc is Professor of Finance and Director of Research and Developmentat EDHEC Business School, where he heads the Risk and Asset ManagementResearch Centre. He has a Masters in Economics and a PhD in Finance and hasconducted active research in the fields of quantitative equity management,portfolio performance analysis, and active asset allocation, resulting in numerousacademic and practitioner articles and books. He is Associate Editor of the Journalof Alternative Investments and a member of the scientific advisory council ofthe AMF (French financial regulatory authority).Felix Goltz is a senior research engineer and co-head of the indices andbenchmarking research programme with the EDHEC Risk and Asset ManagementResearch Centre. His research focus is on asset allocation involving alternativeinvestments, such as hedge funds and derivatives, and on equity indexingstrategies. Felix holds a Ph.D. in Finance from the University of Nice SophiaAntipolis, and has studied economics and business administration at the Universityof Bayreuth, the University of Nice Sophia-Antipolis and EDHEC.David Schröder is a senior research engineer at the EDHEC Risk and AssetManagement Research Centre. David obtained his PhD in Economics from theUniversity of Bonn. During his doctoral studies, he was also affiliated with theCentre de Recherche en Economie et Statistique (CREST) in Paris. His researchfocuses on empirical asset pricing, the predictive power of equity analysts’forecasts, and decision making under ambiguity. He is a member of theEconometric Society, and has presented at many international economic andfinance conferences.4An EDHEC Risk an d Ass et Ma na g ement R es ea rch C ent re P u b l i c a ti o n

Reactions to an EDHEC Study on Asset-Liability Management Decisions in Private Wealth Management - October 2008IntroductionWith the great economic growth of thepast decade, private wealth managementhas become a very profitable businessfor banks worldwide.1 As a result, moreand more asset management firms havejumped into the fray and competition hasincreased steadily. These industry changeshave led to renewed attempts to improveclient relationships and to develop toolsand methods to enhance advisoreffectiveness. Catering to the client’sspecific needs is thus a central concernof private wealth managers. To take theclient objectives into account, investmentsare frequently adapted to the client’s riskaversion, tax situation, and investmenthorizon.1 - Merrill Lynch (2006): MerrillLynch and Capgemini WorldWealth Report, availableat www.us.capgemini.com/worldwealthreport06.2 - Campbell, J. (2006):“Household finance”, Journal ofFinance 61(4), 1553-1604.3 - See e.g. Zenios, S. A.and Ziemba, W. T. (2006):Handbook of Asset and LiabilityManagement, North-Holland,Amsterdam.4 - Amenc, N., Martellini, L.,and Ziemann, V. (2007): AssetLiability Management Decisionin Private Banking, EDHECPublication, Nice.The specific requirements of portfoliodecisions in private wealth managementhave recently been examined in great detailby academic financial economists. Campbell(2006)2 argues that the development ofoptimal decision-making models forprivate households “is challenging becausehouseholds face a number of constraintsnot captured by textbook models”. Campbell(2006) lists a long planning horizon,substantial holdings in non-tradable orilliquid assets, taxation, and borrowingconstraints as key ingredients that putprivate investment decisions at odds withthe assumptions in most academic assetallocation models.Interestingly, there are tools and methodsin institutional asset management thathave been designed precisely to incorporatethe specific constraints and objectivesof long-term investors. Many pensionfunds or insurance companies adapt theirportfolio management processes to dealwith the presence of future financialobjectives or constraints.3 Although widelyused by institutional investors and theirasset managers, this approach to moneymanagement is not often used in privatewealth management. A recent publication4of the EDHEC Risk and Asset ManagementResearch Centre has assessed the potentialbenefits of using ALM techniques in privatewealth management. The bottom line ofthe study is that the presence of specificfinancial objectives significantly changesthe composition of the optimal portfolio,and that taking these constraints intoaccount with suitable ALM techniques leadsto significant reductions in shortfall risk.The objective of this paper is to compare theconclusions drawn by the paper and currentindustry perceptions. The question we poseis: what do practitioners think about usingALM in private wealth management? Foran idea about private bankers’ view of thepotential benefits of ALM, we called forreactions from private bankers and assetmanagers. This study not only describesthese reactions, but also provides a shortreview of the fundamental idea of makingALM a part of private wealth management.ALM in private wealth managementappeals to most practitioners, as reactionsshow, but there are still concerns aboutsuccessful implementation, or about theidea of transferring the rather industrialALM techniques to the private wealthmanagement sector as such.This paper proceeds as follows. After theExecutive Summary, we present the basicideas of ALM decisions in private banking.We then turn to the EDHEC call for reactionsand outline industry views of using ALM inprivate banking. Detailed survey results canbe found in the final section of this paper.A n E D H E C R i s k a n d A s s e t M a n a g e m e n t R e s e a rc h C e n tre Pub l i ca ti on5

Reactions to an EDHEC Study on Asset-Liability Management Decisions in Private Wealth Management - October 20086An EDHEC Risk an d Ass et Ma na g ement R es ea rch C ent re P u b l i c a ti o n

Executive SummaryA n E D H E C R i s k a n d A s s e t M a n a g e m e n t R e s e a rc h C e n tre Pub l i ca ti on7

Reactions to an EDHEC Study on Asset-Liability Management Decisions in Private Wealth Management - October 2008Executive SummaryA recent publication5 by the EDHECRisk and Asset Management ResearchCentre highlights the potential benefits ofusing asset-liability management (ALM)techniques in private wealth management.The fundamental idea of ALM is toincorporate future financial liabilitiesdirectly into portfolio optimisation,thereby providing a better matchbetween investment returns and paymentobligations. ALM is predominantly appliedto entities such as pension funds orinsurance companies that have uncertainfuture payment obligations. The EDHECpaper proposed to model a private client’sobjectives—such as purchasing a houseor maintaining a certain consumptionlevel during retirement—as liabilities andthus to transpose the advantages ofinstitutional ALM techniques to privatewealth management.5 - Amenc, N., Martellini,L., and Ziemann, V. (2007):Asset-Liability ManagementDecisions in Private Banking,EDHEC Publication, Nice.Following the publication of this paper,EDHEC issued a call for practitionerreactions to the notion of using ALM inprivate wealth management. Reactionsshow that there is overwhelming supportfor applying ALM techniques to privatewealth management. However, whilemost practitioners are convinced of thepotential advantages offered by ALM, theyalso express concern about successfulimplementation.Conclusion of the EDHEC study:ALM is a unique device to deliverpersonalised solutions to the multipleand complex needs of the privatewealth management clientele.The key motivation for making ALM apart of the private wealth managementsector is to tailor personalised investment8An EDHEC Risk an d Ass et Ma na g ement R es ea rch C ent re P u b l i c a ti o nstrategies that not only take the risk-returnpreferences of the clients into account,but also reflect the specific objectives andtime horizons of their investments. As theEDHEC study showed, ALM leads to theconstruction of more efficient portfoliosthan does standard asset management byexplicitly making personal liabilities a partof the asset allocation equation.The industry perspective: most practitioners believe that ALM could becomea considerable source of progress forprivate wealth management.Overall, making ALM a part of privatewealth management decisions is a goodidea to most practitioners: 87% of therespondents to our call for reactions seethe potential benefits of ALM for theprivate wealth management business. Themain benefit they see is its ability tomanage the clients’ multi-term risks. Othernoted benefits of ALM are its clear focuson the clients’ specific objectives and thepositive impact ALM could have on theclient relationship. However, there aresome concerns as well. Many practitionersperceive ALM techniques as highlycomplex. They thus fear not onlyrejection of it by the wealthy, but alsothe challenges of using this new toolor method. In addition, bankers foreseeobstacles to transferring the institutionalALM approach to private wealthmanagement. The bottom line is thatpractitioners see ALM as a way forwardin private wealth management, but arenonetheless hesitant to express fullacceptance of this new technology.

I. ALM Decisions inPrivate Wealth ManagementA n E D H E C R i s k a n d A s s e t M a n a g e m e n t R e s e a rc h C e n tre Pub l i ca ti on9

Reactions to an EDHEC Study on Asset-Liability Management Decisions in Private Wealth Management - October 2008I. ALM Decisions in Private WealthManagement6 - We can give only a shortsummary here. For a moredetailed exposition, pleaserefer to the EDHEC studymentioned above.Proximity to clients is often seen as thereason for the existence of private wealthmanagement. A private banker’s abilityto come up with customised responsesto the objectives of individual clients isimportant for a successful private wealthmanagement business. Yet for the momentthere is no consensus in the industry onhow to tailor a private client’s investmentstrategy to take into account not only theclient’s risk preferences but also his exactspending objectives and the time horizonof his investments.2003—institutional investing was oftenseen as a simple asset management task:the search for the optimal portfolio witha clear focus on high expected returns. Inthe years that followed, however, theseinvestments—generally heavily tiltedtowards equities—lost so much value thatthese funds could no longer meet theirobligations, i.e., making defined benefitpension payments. In many cases, thepension plan sponsor had to make up forthe shortfall, sometimes with considerablefinancial consequences.Asset-liability management (ALM), widelyused now by institutional investors, may bea suitable response to the complex demandsof private wealth management. The basicidea of all ALM tools and methods is toincorporate future liability, such as pensionpayments, directly into the portfoliooptimisation process, thereby providing abetter match between investment returnsand payment obligations. ALM could thushelp private bankers meet their clients’investment objectives.As a result of this disastrous experience,pension funds started to pay attentionagain to their primary obligations: futurepension payments. This change led torenewed interest in money managementapproaches that explicitly take liabilitiesinto account, an approach also calledasset-liability management. We describebelow some of the most widely used ALMtechniques.6In this section, we first summarise the riseof ALM concepts for institutional investors,and the standard methods they use. Wethen discuss the possible advantages thatALM could bring to the private wealthmanagement industry. At the end ofthis section, we present the example ofa person investing for a subsequent realestate purchase.Asset-Liability ManagementTechniques for InstitutionalInvestorsIn the years before the stock marketdownturn—in other words, from 2000 to10An EDHEC Risk an d Ass et Ma na g ement R es ea rch C ent re P u b l i c a ti o nThe first technique, known as cash-flowmatching, involves ensuring a perfectstatic match between the cash flowsfrom the portfolio of assets and thecommitments in the liabilities. In a verysimple way, this match can be made byholding a portfolio of inflation-indexedzero-coupon bonds that mature just ascommitments (pension payments) must bemade good on. Although this technique isvery simple (leaving aside the complexityrelating to the uncertain life expectancyof the retiree, and the divergence betweenspecific wage evolution and generalinflation), it comes at the cost of very lowaverage returns.

Reactions to an EDHEC Study on Asset-Liability Management Decisions in Private Wealth Management - October 2008I. ALM Decisions in Private WealthManagementIn an attempt to improve the profitabilityof the assets, and thus to reduce the levelof contributions, it is necessary to includein the portfolio (stocks and bonds) assetclasses that are not perfectly correlatedwith the liabilities. The objective isthen to find the best possible trade-offbetween the risk thereby taken on, andthe excess return that the pension fundhopes to earn. To implement these surplusoptimisation techniques, one must builda comprehensive model to capture therisk factors and their interrelations. Theoptimal portfolio can then be constructed,given some specified level of risk. Surplusoptimisation leads to higher expectedreturns than cash-flow matching, andhence to lower contributions. However,the risk exposure can be significant.Finally, it is worth mentioning a techniquereferred to as liability-driven investment(LDI). While they may vary greatly fromone provider to the next, LDI solutionsusually involve a hedge of the durationand convexity risks via standard buildingblocks, while keeping some assets free forinvesting in higher yielding asset classes.In general, a fraction of the assets (knownas the liability-matching portfolio) isallocated to risk management, whileanother fraction is allocated to performancegeneration. This technique may actuallybe seen as a combination of immunisationstrategies(forriskmanagement)and standard asset management (forperformance generation). It stands insharp contrast to more traditional surplusoptimisation techniques, in which bothobjectives (liability risk management andperformance generation) are pursuedsimultaneously in an attempt to achievethe portfolio with the highest possiblerelative risk/relative return ratio.The table below shows how these threeapproaches correspond to well-knownapproaches to pure asset management.Applying ALM to Private WealthManagementGiven the recent increase in interest inALM for institutional investment, as wellas the available expertise, it is logical toask whether these techniques could also beuseful for the private wealth managementindustry. In private wealth management,clients are usually asked about their savingsobjectives, i.e., whether they want to setaside money for their retirement or perhapsfor their children’s education. These arethe client’s “liabilities”. The time horizonof the investment is also discussed. Next,sometimes using even more sophisticatedmethods, the client’s personal risk-returnpreferences are analysed to optimisehis portfolio. Finally, to design the bestpossible investment plan, the contributionscheme must be taken into account, i.e.,how much money the client is ready to setaside regularly.Investment Management Approaches in Asset Management and their Counterparts in Asset-Liability ManagementRisk/Return ProfileAsset ManagementAsset-Liability ManagementZero risk – no access to risk premiaInvestment in risk-free assetCash-flow matchingOptimal risk return trade-offOptimally diversified portfolioof risky assetsSurplus optimisationFund separationCapital market line: mix of cash andoptimal risky portfolioLDI solution: mix of liability matchingportfolio and optimal risky portfolioA n E D H E C R i s k a n d A s s e t M a n a g e m e n t R e s e a rc h C e n tre Pub l i ca ti on11

Reactions to an EDHEC Study on Asset-Liability Management Decisions in Private Wealth Management - October 2008I. ALM Decisions in Private WealthManagementThe problem with current private assetmanagement is that these importantfactors are rarely sufficiently combined.So, although the banker’s advice mightbe beneficial from a risk perspective, theclient’s liabilities are not adequately takeninto account. ALM, by contrast, makes itpossible to merge the various needs fortailored banking solutions. By explicitlyincluding the individual liabilities in theasset allocation decision, it is possibleto construct portfolios more efficientthan those relying on standard assetmanagement. The reason is that solutionsthat might be optimal from an assetmanagement perspective are usually nolonger efficient when the liabilities aretaken into account.7 - The example is adaptedfrom the EDHEC study.For more details, such as thedynamic model of real estateand other asset prices, pleaserefer to this document.12In what situations could ALM add valuefor private wealth management clients?First of all, and quite naturally, ALM couldbe useful for private retirement accounts.Much as with pension funds, the expectedreal pension is then the client’s liability.Second, using ALM-based investmentwould provide protection from inflationrisk superior to that provided by standardasset management. A similar case mightbe a wealthy retiree, who wishes tomaintain a certain (real) standard of livingbut also to maximise her bequest to herchildren. Finally, wealthy families mightbe interested in making a large acquisitionin the near future, such as buying property.ALM techniques allow for sound riskmanagement of the related real-estateprice risk of such an investment, as thefollowing example will show.An EDHEC Risk an d Ass et Ma na g ement R es ea rch C ent re P u b l i c a ti o nAn Example:Acquisition of a HouseAs an illustration of the ALM conceptwithin private wealth management,consider the situation of a family whoplans to purchase a house for theirdaughter once she has finished her studies.Suppose that she is expected to finishher studies five years from now, and thatthe current value of the projected housemay be at 1,000,000. The family wantsto set aside the required money throughfixed annual contributions. The essentialrisk the family faces is hence unexpectedchanges in real estate prices. Given anappropriate model for the dynamics ofproperty prices and reasonable parametervalues7, one may show that the expectedprice of the house in five years is at about 1,570,000, with a standard deviation ofabout 270,000.The standard asset management approachin private wealth management wouldbe then to find an investment solutionthat has a maturity of five years, with anexpected value at maturity of 1,570,000.Usually, such an investment will consistof both bonds and stocks. If real estateprices rise at a slower pace than excepted(and hence the value of the portfolioexceeds the price of the apartment), thefamily is lucky and saves some money–ifnot, it must close the gap with anothersource of money.The ALM approach instead directly takesthe known liability of the investor, i.e.,the house to be purchased in five years,into account when searching for theoptimal saving strategy. Assuming thatthere exists an investment vehicle whichis linked to real estate prices (such as

Reactions to an EDHEC Study on Asset-Liability Management Decisions in Private Wealth Management - October 2008I. ALM Decisions in Private WealthManagementREITS), one can decrease the varianceof the difference between investmentreturn and property prices (also calledsurplus volatility) significantly. Becauseof the link between investment returnand house prices, the family can reduceexpected shortfalls at maturity. If realestate prices rise at a much higher ratethan expected, the investment return willincrease accordingly. On the other hand, ifproperty prices slump, the investment willalso yield lower (even negative) returnswhich is not a problem given the clearobjective of the household. AlthoughREITS do not hedge the investment riskperfectly, their positive correlation withthe price of the envisaged acquisition canhelp to reduce the client’s risk exposuresignificantly. Through a trade-off ofincreased risk for an increase in expectedreturns, the client’s optimal portfolio mayof course not only consist of REITS, butwill generally include stocks and bonds aswell. The objective of the ALM technique isto tailor the investment to the objectivesof the family in a better way than throughsimple asset management approaches,which ignore the future purchase.for reactions from them. The followingsection describes the results of this callfor reactions.The EDHEC study on asset-liabilitymanagement decisions in private bankinghas presented evidence that this newconcept has decisive advantages overstandard asset management, and maythus deliver dedicated value added toclients of private bankers. But whatdo practitioners actually think? Foran idea of what private bankers andasset managers really believe to be theimportant aspects of their business, andof their views on the potential benefitsof the use of ALM concepts in the privatewealth management industry, we calledA n E D H E C R i s k a n d A s s e t M a n a g e m e n t R e s e a rc h C e n tre Pub l i ca ti on13

Reactions to an EDHEC Study on Asset-Liability Management Decisions in Private Wealth Management - October 200814An EDHEC Risk an d Ass et Ma na g ement R es ea rch C ent re P u b l i c a ti o n

II: The Practitioners' View onIntroducing ALM Techniques intoPrivate Wealth ManagementA n E D H E C R i s k a n d A s s e t M a n a g e m e n t R e s e a rc h C e n tre Pub l i ca ti on15

Reactions to an EDHEC Study on Asset-Liability Management Decisions in Private Wealth Management - October 2008II: The Practitioners' View on Introducing ALMTechniques into Private Wealth ManagementWe describe below the main results of thiscall for reactions. We group responses intoseveral major points.ALM restores the focus on theclient’s objectivesIn principle, practitioners are extremelypositive about the idea of using ALMtechniques in the private wealth managementsector. 95% of private bankers agree thatfinancial consulting should go beyond taxand legal advice, that it should also takethe clients’ financial constraints and privatewealth objectives into account. In addition,75% of the respondents see the ability todeliver customised financial managementas the predominant benefit private bankerscan offer their clients—and hence it wouldbe their primary added value. 87% of theprivate bankers and asset managers whoresponded argue that ALM techniques,which would make it possible to focus onthe clients’ individual financial constraints,could become a considerable source ofprogress for their business. Some bankerseven believe that ALM in private wealthmanagement could become irreplaceable,as it might be one of the few methodsthat allow private bankers to differentiatethemselves from their competitors. In thisvein, a participant noted that ALM wouldcreate a “new value chain in a sector whichis becoming more and more capital marketdriven”.ALM is difficult to understand andimplementThis point is seen as the main drawback ofthis promising methodology. And the mainconcern is not only that some clients willprobably not fully understand this rather16An EDHEC Risk an d Ass et Ma na g ement R es ea rch C ent re P u b l i c a ti o ncomplex approach to asset management.Indeed, 55% of respondents assume thatthe biggest challenge for implementing ALMis with the private wealth managementteams themselves. In fact, whether ALM isused or not, the client “is exposed to thecompetencies of the banker—this seems tobe the biggest risk”, as one of the privatebankers confessed. As one respondentargued, there are already many tools andmethods available. “The [ ] fundamentalproblem is that private banks [and] wealthmanagers do not always use them!” AddingALM to the menu may not be the logicalnext step if other more basic tools ormethods are not well understood by theprivate wealth manager.ALM would have to includetaxationAs mentioned above, many bankers agreethat financial consulting should go beyondtax and legal advice. At the same time,taxes and unforeseen changes in taxationseem to be very important for privatewealth management. It is even the mostimportant part of some bankers’ business:“Tax efficiency is [ ] often overlooked. Agood private banker might not be able tomake [ ] money [for the client], especiallyin uncertain markets, but should be able tohelp the client keep from giving the taxmanmore than [necessary].” The question thenis how to make tax considerations part ofan ALM framework.Liabilities are hard to define inprivate wealth managementIn addition to the alleged complexity of ALMand the possible incompetence of privatebankers, there are some other concerns about

Reactions to an EDHEC Study on Asset-Liability Management Decisions in Private Wealth Management - October 2008II: The Practitioners' View on Introducing ALMTechniques into Private Wealth Managementthe idea of transferring the ALM conceptfrom institutional investment to privatewealth management. Most of all, somebankers see too many differences betweenboth investment style and objectives:“private banking supposes a very tailor-madeapproach, which means that an industrialapproach is difficult”. Or, as one banker putsit: “the liabilities of a wealthy individualare largely discretionary, in contrast to thoseof a pension fund”. Indeed, modelling theliabilities of a private client may be morechallenging than modelling those of apension fund, for which future liabilitiesare an aggregate of individual pensions.Private bankers point out that the risksin private banking are mostly of a veryindividual nature, such as sudden changesin the employment or family situation,or—on a larger scale—unexpected changesto the clien

Reactions to an EDHEC Study on Asset-Liability Management Decisions in Private Wealth Management - October 2008 Introduction With the great economic growth of the past decade, private wealth management has become a very profitable business for banks worldwide.1 As a result, more and more asset management firms have