Transcription

Summer 2012Richmond Capitol BuildingVBOA e-NewsletterPage 1e-NewsletterSummer 2012Check out the VBOA website atwww.boa.virginia.govInside this issue:Board News2New Virginia Licensees Listing22011 Candidate Performance4The CPA Profession on the Horizon5Graph: Number of Virginia Licensees6Enforcement FAQs7Board Disciplinary Actions9Closed Investigations, 2007-201114From The Outgoing ChairAt the end of eight years of servingon the Virginia Board of Accountancy, I have been reflecting onsome of the areas of progress wehave made. One of those areas is inthe Enforcement area which wecover in several sections of thisnewsletter.Virginia have enforcement issues. Ourexperience shows that the majority ofCPAs take their responsibilities seriously and strive to do the right thing!Many of the violations exposed werecommitted by unlicensed individuals.Also, we have not had any major scandals involving CPAs in Virginia.Our primary mission at the VBOA isto protect the public and we believewe have fostered a regulatory environment which achieves this goal.We have endeavored to make iteasier for CPAs to do business withthe Board and to make the law andrelated rules more understandable.Additionally, we have begun to publiclydisclose disciplinary actions taken bythe Board. We hope the benefits ofdisclosure will include:The Board has approached enforcement cases in a “firm but fair” manner. And while some of the enforcement cases have been eye-opening,the statistics reflect that only a verysmall percentage of the approximately 25,000 licensed CPAs in Raising awareness of the types ofLarry Samuel,CPA Acting as a deterrent to others; Informing the public of violationsby CPAs; andviolations the Board is experiencingand assisting others from makingsimilar mistakes.I hope you enjoy the newsletter.Larry SamuelA Good Balancing ActOf all the services the Board provides, enforcement of Virginia Statutes and Regulations may be the leastappreciated.Enforcement is the“policing” aspect of the Board’smandate and may engender resentment among those under investigation. In the CPA profession, respectand accountability are intersectingpaths. The two-pronged process ofinvestigating complaints and takingBoard action to impose penaltieswhen appropriate - enforcement - isreally about balance.In the dictionary balance is accompanied by words like equilibrium, poiseand stability.Antonyms includewobble and unsteady. A set of scales isan apt image of balance. The truth is,enforcement is good for the profession as a whole and good for individual CPAs who value ethical standards. Respect [comes to those] whodeliver more than they promise, not tothose who promise more than they deliver (Mark Clement).

Summer 2012FY13 VBOA Board MembersTyrone E. Dickerson, CPABoard ChairRichmond, VAAndrea M. Kilmer, CPA, CFF, CGMABoard Vice-ChairVirginia Beach, VAW. Barclay Bradshaw, CPARichmond, VARegina P. Brayboy, MPA, MBACitizen MemberSuffolk, VARobert J. Cochran, Ph.D., CPABoard EducatorMidlothian, VAMarc B. Moyers, CPAManakin Sabot, VAStephanie S. Saunders, CPAVirginia Beach, VAVBOA Office9960 Mayland Drive, Suite 402Henrico, VA 23233804-367-8505 phone804-527-4409 faxboa@boa.virginia.com emailwww.boa.virginia.gov websiteVBOA Staff MembersWade A. JewellExecutive Director804-367-8540Chantal K. ScifresDeputy Director804-367-0511Mary T. CharityDirector of Operations804-367-0495Jeannette GrantEnforcement Manager804-367-0725Dreana L. GilliamBoard AdministratorCPE & Peer Review Coordinator804-367-0728Krystal D. HambrightExecutive Assistant804-367-0502Patti B. HambrightLicensing & Examination Coordinator804-367-4880Valeria S. Ribeiro-QuimpoFinancial & Procurement Coordinator804-367-1101Nicholas R. TazzaLicensing & Examination Coordinator804-367-8505Lisa J. CarsonCommunications & Training Director804-367-1586VBOA e-NewsletterPage 2Well Done is Better than Well SaidIn October 2011, the Governor appointed twonew Virginia Board of Accountancy members, W.Barclay Bradshaw of Richmond and Robert J.Cochran of Midlothian. Both appointees have along history of service to the profession but experienced a short learning curve for their newresponsibilities as Board members. Bradshawand Cochran were appointed only five days before the November 2, 2011 Board meeting.Board agenda materials were rushed to themgiving the pair only the weekend to prepare forthe critical decision-making inherent in Boardbusiness. The calm poise and simmering intelligence they displayed left no doubt that the Governor replaced quality with quality on the Board.W. Barclay Bradshaw, CPA, graduated from theUniversity of Richmond with a bachelor’s degreein Business Administration (BBA) and has beenlicensed as a CPA in Virginia since 1979. Aftergraduation Bradshaw accepted a full-time position with the local firm Gary, Stosch, Walls &Company. In 1988 GSW & Co. merged withTouche and then Deloitte. In 1991 (to the present) Mr. Bradshaw has served as a shareholderwith L.P. Martin & Company in Glen Allen.His experience includes providing services tovoluntary health and welfare organizations, foundations, religious organizations and a variety ofother similar organizations. Bradshaw has alsoserved a variety of construction-related entities aswell as multifamily housing projects. In addition,he has provided audit services to private andgovernmental organizations in compliance withstate and federal audit requirements. He is a pastpresident of the Richmond chapter of the Virginia Society of CPAs and the Robins School ofBusiness Alumni Association.The service-orientation of Robert J. Cochran, Ph.D.,CPA, is manifested differently but no less successfully. Cochran earned a BBA at the College of William and Mary and became licensed in Virginia in1981. He began his career in Washington, D.C., atPeat, Marwick, Mitchell & Co. In 1984 he leftPMM & Co. to pursue a start-up wholesale mortgage banking opportunity eventually becoming theSenior Vice President and Chief AdministrativeOfficer for Crestar Mortgage in Richmond. In 1997he left banking and enrolled in a doctoral programat Virginia Commonwealth University. Academia isan environment that fosters the notion of service, Cochran said to the Virginia Society of CPAs in a recentinterview. Since 2001 he has taught accounting andfinance at the University of Richmond and(presently) at Longwood University where he waschosen by accounting students as an outstandingprofessor in 2010. Cochran has held several servicepositions at Longwood, including sponsor andcoach for students participating in the annual Goodman & Company Accounting challenge. Cochranspent the summer of 2010 and 2012 teaching at asister university in China.Albert Schweitzer said it well: The only ones amongyou who will be really happy are those who have soughtand found how to serve. We look forward to thechapter of service this pair will write as new members of the Virginia Board of Accountancy. Click to view the listing forNew Virginia Licensees(Individual and Firm)on the VBOA website!Super Board MembersMembers of the VBOA family have been called out by peers as examples of the best the CPA professionhas to offer in Virginia. Partnered with the Virginia Society of CPAs, Virginia Business Magazine sent 7,000official ballots to CPAs of the Commonwealth to name colleagues who were “Super CPAs”. On November 1, 2011, the VSCPA published the names of 272 Society members who had been selected. The listingincluded five current or former Virginia Board of Accountancy members:W. Barclay Bradshaw, CPA, 2011-2012 Board memberO. Whitfield Broome, Jr., Ph.D., CPA, 2003-2011 Board member, 2009-2010 Board ChairDian T. Calderone, CPA, MTX, 2004-2012 Board member, 2008-2009 Board ChairHarry D. Dickenson, Ph.D., CPA, 2001-2005 Board member, 2004-2005 Board ChairStephanie S. Saunders, CPA, 2012 Board member

Summer 2012 VBOA e-NewsletterPage 3Kudos for First VBOA e-Newsletter in 2011 What a great product you and your team have produced I especially liked the way you reported on correctiveactions in detail by the Board. The detail helps educate all members as they try to comply with their practicerequirements. Keep up the good work. Been in practice approximately 35 years. This is an excellent newsletter. Timely topics and information that isimportant to me. The newsletter was very informative. I feel this will provide valuable information to licensed CPAs in Virginia. Thank you, very nice newsletter, great layout and topics. The inaugural newsletter is excellent. Pass along my congratulations. Really enjoyed the information and the format. Also liked the “calling out” of folks who don't follow the rules. Afterall, isn’t that one of the reasons for the ethics training?! The first issue of the e-Newsletter is excellent in all respects! The content, graphics, layout and writing are all topnotch. Congratulations on such a high quality and informative inaugural edition. I enjoyed reading the newsletter. It serves as a good reminder to all CPAs in meeting the requisite ethics andCPEs Thanks so much for providing us a great source of information and updates that we can rely on involvingthe profession.On Topic from the Executive DirectorPublishing our second e-Newsletter,I am reminded of the importance ofcommunicating with our licensees,exam candidates and the public.One of my many goals since joiningthe VBOA staff in April of 2009 wasto increase communications to become more efficient, effective and toensure that our customer’s needs aremet and that important information is shared in a timely manner.We’ve made significant progresstoward reaching that goal; however, were still not quite there! Iencourage our customers to let usknow what types of informationwould be useful and informative,so that we can better serve eachof you!Examples of communicationefforts include our new website,e-Newsletter, broadcast emails toexam candidates and licensees, aproposal for a new database foronline applications, renewals andcomplaints, and the introductionof social media to includeFacebook, Twitter and LinkedIn(coming soon).Please let us know how we’redoing and how we can serve youbetter as we look forward! Bestwishes for an enjoyable summerand fall!Wade A. JewellBoard Members, New and Former, Stand TogetherScheduled Board MeetingsJoin Us!Tuesday, August 21, 2012Tuesday, September 18, 201210:00 am to 4:00 pm2nd Floor Conference Center9960 Mayland DriveHenrico, Virginia 23233VBOA Board members and Executive Director at the November 2, 2011, Board meeting in Queally Hall, University ofRichmond (left to right): Whitfield Broome, Robert Cochran, Wade Jewell , Dian Calderone, Barclay Bradshaw, AndreaKilmer, Larry Samuel, Steve Holton and Tyrone Dickerson (Regina Brayboy is not pictured).Persons desiring to attend the meetingand require special accommodations/interpretive services should contact theBoard office at 804-367-8505 at least10 days prior to the meeting so thatsuitable arrangements can be made.The Board fully complies with theAmericans with Disabilities Act (ADA).

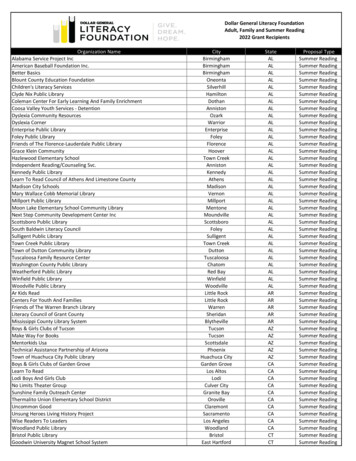

Summer 2012VBOA e-NewsletterPage 4ExamIn·tel·li·genceVirginia Scores BigSouth-of-the-Border TestingVeterans Get a Helping HandIn 2010, two Virginia universitiesscored high in exam candidateperformance, as reported by a2011 report by NASBA. TheUniversity of Virginia scoredsecond highest in the nation forschools with the top overall passrates for first-time candidateswithout an advanced degree.James Madison Uinversity came inas number 1 in the U.S. forschools with top overall pass ratesfor first-time candidates with anadvanced degree. As of February 2012 citizens andlong-term residents of Brazil willbe able to take the Uniform CPAExamination in their home country. Brazil exam centers will beopen to U.S. citizens living abroadas well as citizens and long-termresidents of Argentina, Venezuelaand Colombia. In 2011 the CPAExam began to be administeredoutside the U.S. in Japan, Bahrain,Kuwait, Lebanon and the UnitedArab Emirates. Veterans may receive a 2,000reimbursement for taking theCPA Exam, says the Departmentof Veteran Affairs.Militaryspouses may receive 4,000 infinancial assistance for CPA education and testing under the Department of Defense’s MilitaryCareer Advancement Account.For more information about thereimbursement program for veterans and active military dependents, go to www.GIBILL.va.gov. 2011 Exam Candidate Performance in Virginia & OverallThese statistics are reported by the National Association of State Boards of Accountancy (NASBA) in Candidate Performance on the Uniform CPAExamination, 2011 Q1-4 testing windows. Fifty-three out of 55 jurisdictions reported candidate performance data to NASBA in 2011. Unique candidates are considered the number of individuals attempting at least one exam section per testing window. The table and graphs compare the number ofunique candidates, sections attempted, pass rates and average scores of candidates in the 53 reporting jurisdictions (blue) and Virginia (red).Q1 Testing WindowQ2 Testing WindowQ3 Testing WindowQ4 Testing iqueCandidates 1,943Pass RateAverage %74.0Q3Q4

Summer 2012VBOA e-NewsletterPage 5Wanted: Calling All SpecialistsThe National Association of StateBoards of Accountancy (NASBA)is recruiting CPAs across the nation with specialties in accounting,auditing and tax to join the newlyorganized Registry ReviewerProgram, designed to develop aroster of qualified CPA professionals (including educators) toreview CPE courses for technicalaccuracy and sufficiency for continuing professional itingandTaxtoReviewCPEVirginia CPAs may qualify for thereviewer program with: A valid Virginia CPA License; Fulfillment of CPE requirements as defined by VirginiaStatutes and Board Regulations; No record of Board disciplinaryactions or charges; and At least five years experience inthe specialty field (either as aprovider or educator).NASBA has created an onlineapplication process for the registry. Go to the Learning Market onNASBA’s website for informationon reviewer resources, responsibilities, expectations, compensation and how to apply. Mobility in MotionIn general terms, mobility is a practice privilege that permits a licenseein good standing from a substantiallyequivalent jurisdiction to use theCPA Title and provide services outside his/her principal place of business without obtaining another license. Most of the 55 U.S. jurisdictions have adopted mobility legislation. In the past year, mobility hasbeen gaining momentum.In August 2011, New York’s gover-nor, Andrew Cuomo, enactedlegislation to make the empirestate the 48th to accept substantiallyequivalent legislation andenact CPA mobility.In October 2011, the Washington,D.C. mayor moved mobility alongby signing the Accounting Mobility Act. Funding for the FY2013budget is being sought. Supporters hope mobility will be effectivein time for the January 1, 2013licensing renewal date.The VBOA and Virginia Societyof CPAs have been long-timeadvocates of mobility before national support developed. Lastyear, an online mobility searchengine for CPAs was launched. byNASBA.The tool searcheslicensure requirements for out-ofstate licensees for the 55 jurisdictions. The VBOA invites you touse the CPAmobility.org link. The CPA Profession on the HorizonIn 2010, the American Institute of CPAs (AICPA) undertook an exploration of challenges facing the CPA profession over the next 15 years. The initiative called on CPAs across the profession to define the future for themselves and those they serve. A 22 member advisory board oversaw the ambitious project. Panel membership was diverse in age, gender and ethnicity, from sole practitioners to medium and large firms hailing from the bucolic heartland tometropolitan hotspots. Over 5,600 CPAs spent 6,000 hours producing 75,000 statements which coalesced into meaningful discourse on purpose, skilland direction. The CPA Horizons 2025 Report was published in the fall of 2011. Below is an example of the report’s offerings, a study in the essential andenduring beliefs upheld over time, or core values. IntegrityCompetenceLifelong LearningObjectivityExcellenceRelevanceA CPA conductshim/herself withintegrity and honesty,holding to rigorousstandards ofprofessional ethics.A CPA demonstratessuperior technicalproficiency byperforming witha high level ofexpertise andknowledge.A CPA highly valueseducation beyondcertification andcontinually pursuesbroad skills andknowledge.A CPA maintainsimpartiality andintellectual honestyby remaining free ofpersonal bias andconflicts of interest.A CPAcontinuallydelivers exemplary,high-qualityservices.A CPA enhancesvalue by meeting theever-changing needsof the globalmarketplace.

Summer 2012VBOA e-NewsletterPage 6Hong Kong ColleaguesAround the world, on the southeastern tip of Asia, lies the tinyisland of Hong Kong, a Britishcolony for nearly the entire 20thcentury; now a thriving city-state ofChina. With a land mass of only426 square miles and a populationof seven million, Hong Kong isone of the most densely populatedzip codes in the world.ments of CPAs in Hong Kong andare confident they are substantiallyequivalent to those of the U.S. CPA.Our agreement with Hong Kongvalidates our purposeful and determined quest to be truly global andallows qualified accountants in theU.S. and Hong Kong to work acrossborders.CPAs in Hong Kong have beenholding their collective breath forrecognition from across the Pacific.It came in October 2011 when afive-year mutual recognition agreement establishing reciprocity between United States and HongKong accounting professionals wassigned by the Hong Kong Instituteof Certified Public Accountants(HKICPA) and the U.S. International Qualifications AppraisalBoard (IQAB), a joint body of theAICPA and NASBA.WilliamTreacy, chair of IQAB, said at theNashville, TN ceremony, We haveThis is the sixth agreement theIQAB has signed with non-U.S.accounting organizations.TheHKICPA has joined like-qualifiedprofessional groups in Australia,Canada, Ireland, Mexico and NewZealand.thoroughly evaluated the educational,examination and experience require-Although approved by nationalorganizations, mutual recognitionagreements that assist cross-borderreciprocity must be accepted byindividual state boards of accountancy. The VBOA did so at theNovember 2, 2011 board meeting,staged in the Robins School ofBusiness, University of Richmond,Virginia. Number of Virginia Licensees, Individuals and FirmsFY fiscal year, the annual period beginning July 1 and ending June 30. From FY07 to FY12, the number of licensed CPAs in Virginia increased from19.9K to 24.9K, a 25.4 percent increase. From FY07 to FY09, the number of licensed CPA firms decreased from 1.6K to 1.2K, a 28.1 percent decrease.However, firm licensure requirements changed, requiring only the firms performing attest and/or compilation services to be licensed. As a result manytax-only practices surrendered their firm licenses. From FY09 to FY12, the number of licensed CPA firms in Virginia increased from 1.15K to 1.22K, a5.5 percent increase. 4,93615,000Licensed CPAs10,000Licensed Y09FY10FY11FY12

Summer 2012VBOA e-NewsletterEnforcement FAQs: CPA PerspectiveHow do I know if a complaint hasbeen filed against me? The VBOA willsend written notification when a complaintis filed against you.Upon receiving anotice of complaint, you should respond inwriting to the Board within ten days.Failure to respond to a request for information regarding a complaint is a violationof Board Regulation 18VAC5-22-170 andmay result in additional sanctions.A complaint has been filed against me.Do I need an attorney to representme? The decision to retain or consult legal counsel is entirely yours. The Boarddoes not require that you hire an attorney.What happens if the allegations in thecomplaint are unfounded?If theallegations are unfounded, the complaintwill be closed and marked with “No Findings” or “No Violation”; however, yourrecord will indicate that a complaint wasfiled against you.What happens if I am found in violation? What type of sanctions will theBoard impose? The VBOA EnforcementCommittee will review the case and makea recommendation to the full Board. TheBoard will render a final decision and notifyyou. The Board may take into consideration your past complaint history, theseverity of the violation and risk of harmto the public.Disciplinary action mayinclude consent orders with assessedmonetary penalties, license s.If I am found in violation will I berequired to re-take the CPA Exam? No.You will not be required to re-take the CPAExam but the Board has the authority tosuspend or revoke your license if the offense is serious enough.Will actions taken against me by theVBOA affect a CPA License granted byother state boards of accountancy ormembership in professional accounting organizations? All Board disciplinaryactions are posted on the VBOA website.In addition, the VBOA sends a notice of theviolation to associated state boards ofaccountancy.Most states require thatlicensees disclose disciplinary actionstaken against them by other state licensing boards and professional accountingorganizations.What happens if I am convicted of amisdemeanor or felony? You arerequired to notify the Board immediatelyand provide an explanation.Includecertified copies of court papers, sentencing and probation information. The Boardwill review the case and determineappropriate action.I provided services to a former client.I returned his original records andprovided work product records. He isnow requesting an additional copy ofmy work product records. Am I required to provide them? A CPA mustreturn client records and provide workproduct records to the client or formerclient (unless the payment for the servicehas not been received). A CPA is underno ethical obligation to comply with subsequent requests to provide records orcopies of records (unless the client or former client experiences a loss of recordsdue to natural disaster or act of war). ACPA may charge the client or formerclient a reasonable fee for the time andexpense incurred to retrieve and copy therequested records and require that thefee be paid prior to providing suchrecords.Absent extenuating circumstances a CPA has 45 days to provide therequested records. This standard does notapply to tax records. IRS Circular 230,subsection 10.28, states that a CPA mustreturn any and all tax records necessaryfor a client to comply with federal taxobligations.I want to sit for the CPA Exam in Virginia; however, the Board did not accept classes from my degree programwhich makes me deficient in credithours and ineligible to take the exam.I feel the Board should reconsider myeducation qualifications. What can Ido? You may request an Informal FactFinding Conference (IFF) to come beforea committee or designated member of theBoard to discuss your case in an informalsetting. A recommendation will be madeto the full Board. However, historically,the Board has not allowed an individual inVirginia to sit for the CPA Exam who didnot meet current education requirements.Page 7

Summer 2012VBOA e-NewsletterPage 8Enforcement FAQs: Public PerspectiveCan I file a complaint anonymously?The VBOA will investigate an anonymouscomplaint provided that enough information and supporting documentation issubmitted with the Complaint Form. If youdo not provide sufficient documentationand the VBOA is unable to contact you forfurther information, the investigation maybe determined as “no probable cause”.What happens after I file a complaint?The VBOA sends a copy of the allegation tothe respondent (individual or firm namedin the complaint) requesting a writtenresponse. The VBOA may request additional information from you and/or therespondent. All documentation is sent tothe VBOA Enforcement Committee for review. If there is sufficient evidence that aviolation has occurred, the EnforcementCommittee will make a recommendation tothe Board to impose sanctions.Are complaints filed against a CPA,firm or unlicensed individual availableto the public? Open complaint cases arenot public information. However, once thecase is closed it becomes public information. Disciplinary actions by the Board areposted on the VBOA website and publishedin an electronic newsletter. A copy of aclosed case may be obtained through aFreedom of Information Act (FOIA)request.I am bringing charges against my CPAin civil/criminal court. I also want tofile a complaint with the VBOA so Iwill have more leverage in court.What is the Board’s policy regardingthis?It is generally the Board'spreference to defer investigation of acomplaint until after the court has resolvedthe civil/criminal matter.Can I check to see if a CPA has hadprevious complaints and/or disciplinary action taken against him/her?You may contact the VBOA’s EnforcementManager at (804) 367-0725 or emailjean.grant@boa.virginia.gov to request astatus report on an individual CPA or firm.I think my CPA overcharged me forservices.Does the Board regulatefees charged by CPAs? The VBOA hasno authority to regulate fees charged byCPAs. Fee disputes are civil matters andshould be handled through the courts.My CPA will not return tax documents that I gave him because Ihave refused to pay him/her. Howcan I get my tax documents back soI can file my taxes? IRS Circular 230,subsection 10.28, states that a CPAmust, at the request of a client,promptly return any and all records ofthe client necessary to comply withfederal tax obligations. Generally, a feedispute does not relieve the CPA of his/her responsibility under this section.Nevertheless, if applicable state lawallows the CPA to keep client’s records ina dispute over fees for servicesrendered, the CPA need only returnthose tax documents that must be attached to the taxpayer’s income taxreturn.My CPA did not file my taxes in atimely manner resulting in a latepenalty from the IRS. Can the Boardforce the CPA or firm to reimburseme? No. The Board has no statutoryauthority to award restitution. If theBoard determines that a CPA or firm hasviolated a statute or Board Regulationthe individual or firm will be sanctionedaccordingly. You may file a civil lawsuitagainst an individual or firm to recoverlost fees/penalties.Where can I get a copy of the codeof conduct and regulations that aCPA must follow? Visit the VBOAwebsite. On the lower right corner of thehome page are links to the Code ofVirginia Statutes and Board Regulationsthat govern the practice of CPAs and CPAfirms. Visit the website of the AmericanInstitute of CPAs (AICPA) for the AICPACode of Professional Conduct.Enforcement Customer ServiceFor information regarding the VBOAenforcement process, phone or emailJean Grant at (804) 367-0725 orjean.grant@boa.virginia.gov.

Summer 2012VBOA e-NewsletterPage 9July 2011 to June 2012BoardDisciplinaryActionsSuspensions & RevocationsTax-related Issues, Due Professional Care and Discreditable ActsNameAbod, Jr., Kenneth J.License #12729City, StateViolationDateStatutes/RegulationsAnnandale, VADue Professional Care;SEC Suspension2/21/2012§ 54.1-4413.3Final OrderThe Board ordered the suspension of Mr. Abod’s Virginia CPA License to run concurrent with the SEC suspension that began on7/23/2010. In addition, the Board ordered Mr. Abod to: 1) Provide proof to the Board of his application for reinstatement to practice before the SEC prior to applying for reinstatement of his Virginia CPA License; and 2) Reimburse the VBOA 1,000 for investigative costs.NameCovington, II, John B.License #City, , VADiscreditable Acts;Due Professional Care6/26/2012§ 54.1-4413.3 and18VAC5-22-170 (A.3)Final OrderThe Board ordered the revocation of Mr. Covington’s Virginia CPA License. In addition, the Board ordered Mr. Covington to 1) Return his wall certificate within 30 days of the entry date of the Final Order; 2) Pay 10,000 monetary penalty; and 3) Reimbursethe VBOA 500 for investigative costs.NameEdley, Jr., RobertLicense #23085City, StateViolationDateStatutes/RegulationsRichmond, VADiscreditable Acts;Sanctioned by State Bar12/15/2011§ 54.1-4413.4Final OrderThe Board ordered the suspension of Mr. Edley’s Virginia CPA License for a period of no less than three years beginning December15, 2011. In addition, the Board ordered Mr. Edley to: 1) Remove the CPA designation from all signage, business cards, letterhead, resume, print/internet advertisements, email, software, websites and search engines; 2) Reimburse the VBOA 500 forinvestigative costs; and 3) Appear before the Board after the three-year suspension to demonstrate his competency, provideproof of having met his CPE requirements with certificates of completion and show his responsibilities as a CPA under Virginia law.For the Board to consider license reinstatement Mr. Edley is required to complete all terms and conditions of the Order.Policy Notice: It is the policy of the VBOA to publish the information of licensees against whom the Board has taken a disciplinaryaction resulting in suspensions and revocations and for other professional violations. The VBOA publishes information of licenseesfound to be deficient in CPE credit-hours only in the event of a previous CPE deficiency finding or previous professional violation.This policy is subject to change without notice at any time.

Summer 2012VBOA e-NewsletterPage 10Suspensions & Revocations, continuedTax-Related Issues, Due Professional Car

Regina P. Brayboy, MPA, MBA Citizen Member Suffolk, VA Robert J. Cochran, Ph.D., CPA Board Educator Midlothian, VA Marc B. Moyers, CPA Manakin Sabot, VA Stephanie S. Saunders, CPA Virginia Beach, VA VBOA Office 9960 Mayland Drive, Suite 402 Henrico, VA 23233 804-367-8505 phone 804-527-4409 fax boa@boa.virginia.com email