Transcription

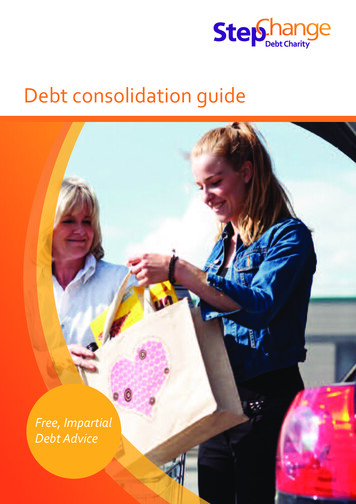

Debt consolidation guideFree, ImpartialDebt Advice

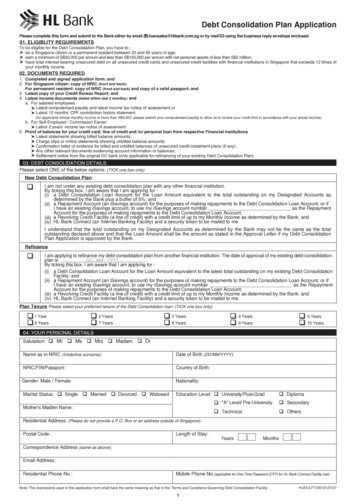

StepChange Debt CharityDebt consolidation guideContentsIntroductionHow this guide will help you3Section 1Debt consolidation loans4 What is debt consolidation? Is debt consolidation right for you? Secured and unsecured debt consolidation Can you afford a debt consolidation loan? After a debt consolidation loanSection 2Other debt solutions7 Debt management plan Individual voluntary arrangement Debt relief order BankruptcySection 3Our debt help How we can help How to contact StepChange Debt Charity9

StepChange Debt CharityDebt consolidation guideIntroductionHow this guide will help youAt StepChange Debt Charity, we help peoplewith problem debt by giving free, impartialdebt help.Although debt consolidation companies oftenpromote their services as the best way to managedebts, there are many different ways to get out offinancial difficulty, and debt consolidation is notalways the best solution for everyone.This guide explains: What debt consolidation is If consolidation is right for you What other solutions are available How we can help with your debt problem how you can contact usAs this guide will explain, you must always thinkcarefully before taking out a debt consolation loan, asit could make your situation worse rather than better.Free anonymous debt adviceFree debt help online from StepChange DebtCharity at www.stepchange.orgFor more advice about your debt problem, contact us,or use our online StepChange DebtRemedy tool.3

StepChange Debt CharityDebt consolidation guideDebt consolidation loansWhat is debt consolidation?Bigger monthly payments and longer loansYou may have to make a large payment to your debtconsolidation loan each month, or you could find thatyou are paying the money back for a long period.Debt consolidation is the name for a loanthat you use to pay off all your otherunsecured debts.If you’re applying for any kind of loan you shouldalways check how much the payments are eachmonth, and how many payments you will need tomake over the lifetime of the loan.A debt consolidation loan can be taken out to paydebts such as credit cards and store cards,catalogues and personal loans.Taking out a debt consolidation loan means that you will only have to make one monthly payment rather than several monthly payments to cover yourdebts. This can make it easier for you to manage yourfinances and, in theory, makes keeping up with yourpayments simpler.Debt consolidation feesDebt consolidation is not the best solution foreveryone. Taking out a debt consolidation loan couldleave you in a worse financial situation than you arecurrently in. Please think carefully before taking outa debt consolidation loan.If you are thinking about taking out a debtconsolidation loan it is very important that youconsider all of these things, and carefully check theterms and conditions.Most debt consolidation loan companies charge feesand these will be added to the money you areborrowing, therefore increasing the amount andpossibly the term of your loan.The Government and the Financial Services Authorityhave more information about debt consolidation loanson their websites. Visit www.gov.uk orwww.moneyadviceservice.org.ukIs debt consolidation rightfor you?Although debt consolidation can help somepeople, for others, it can create even biggerdebt problems.For many people, payments to a debt consolidationloan can work out more expensive.Higher interest ratesIt is important to remember that if you have debt, or ifyou have missed payments on your debts, this willhave affected your credit rating. You will find that theonly way you can borrow more money is at a higherinterest rate. If you have to borrow money at a higherinterest rate you will pay more money back over thelifetime (or term) of the loan.4

StepChange Debt CharityDebt consolidation guideDebt consolidation loansSecured and unsecureddebt consolidationFor more advice about consolidation loans andinformation on other ways of dealing with your debtproblems, please contact us, or use our onlineStepChange Debt Remedy tool.There are two types of debt consolidationloans – secured and unsecured.Free anonymous debt adviceSecured and unsecured loans have differentconsequences for your finances and it is veryimportant that you understand the differencesbetween the two.Free debt help online from StepChange DebtCharity at www.stepchange.orgSecured loansA secured loan is when a debt is secured againstyour property. Taking out a secured loan is liketaking out another mortgage. If you cannot pay theloan back, the loan company can sell your property.We would never recommend that you take out asecured loan to pay back your unsecured debts.A secured loan is usually cheaper than an unsecuredloan, because lenders know that they can sell yourassets if you do not pay the money back. As there isless risk to lenders, they are usually able to offerlower interest rates for secured loans.But a secured loan is much more risky for you. Younever know how your circumstances might change inthe future and you could be putting your home at riskwith a secured loan.Unsecured loansAn unsecured loan is also known as a personal loan.If you’re struggling with your finances and you don’tkeep up with your repayments, your credit rating willbe affected, but the loan company will not be able torepossess your home.In these circumstances, you would normally be ableto reach an agreement with the lender for them toaccept lower payments or refinance your loan over alonger period.5

StepChange Debt CharityDebt consolidation guideDebt consolidation loansCan you afford a debtconsolidation loan?After a debt consolidation loanIf you do decide on a debt consolidationloan, make sure that you use it to pay off allyour debt for good.Taking out a debt consolidation loan is notthe best solution for everyone.You are most likely considering a debt consolidationloan because you cannot afford to pay the monthlyrepayments on the debts you have at the moment.If you do decide to take out a debt consolidationloan, you will only have one company to pay backeach month. However, you may be making largepayments to that company every month and over along period of time.If you decide to take out a debt consolidation loan,always pay your existing debts off in full. Cut up allyour credit cards and cancel the agreement inwriting, otherwise you might be tempted to borrowmore money.If you’re struggling to pay the debts you have at themoment, you may not be able to afford the paymentsto a debt consolidation loan. Look at your income and expenditure to see what money you haveavailable and make sure that you can comfortablyafford the repayments.Be aware that if you do borrow more money afterconsolidating everything into one debt, you will havean even bigger debt problem than you started with.If you can’t afford the payments, you will end upstruggling even more in the future. To find out whatother options are available to you, get in touch with us today.Free debt adviceFree debt help from StepChange Debt Charitycall 0800 138 11116

StepChange Debt CharityDebt consolidation guideOther debt solutionsIf you are having difficulty paying back yourdebts, there may be a better solution for youthan getting a debt consolidation loan.How can we help?Unlike fee-charging debt management companies,our services are completely free and we don’t chargeyou for arranging and managing your debtmanagement plan. That means everything you paywill go towards reducing your debts.Everyone’s circumstances are different, and whatworks for some people, won’t necessarily work bestfor you. We can help you to identify your best wayforward. Our online StepChange Debt Remedy tool,will assess your finances and recommend the rightdebt solution for you.The key to the success of any debt management planis that you only pay what you can afford and, as yoursituation improves, you pay the debt off as soon asyou can.This section of the guide will take you through someof these solutions. It will look at:If we arrange a DMP for you we will make sure youhave a reasonable amount of money to live on, sothat you can keep up with all your household bills,while clearing your debts as quickly as possible. Debt management plans Individual voluntary arrangements Debt relief orders BankruptcyFree anonymous debt adviceDebt management planFree debt help online from StepChange DebtCharity at www.stepchange.orgWho is it for?A debt management plan, or DMP, is for those whohave some money left over at the end of each month,but not enough to pay all their debts.How does it work?A third party will normally arrange a debtmanagement plan for you – this could be a charitylike us, or a debt management company. Theorganisation arranging your DMP will draw up aproposal for your creditors, which asks them toaccept reduced payments. They will also ask forinterest and any charges to be stopped.7

StepChange Debt CharityDebt consolidation guideOther debt solutionsIndividual voluntaryarrangementDebt relief orderWho is it for?A debt relief order, or DRO, is a legal procedure. Toqualify for a debt relief order you must have debts ofless than 15,000 in total and no more than 50 leftover each month after paying essential living costs.Who is it for?An individual voluntary arrangement, or IVA, is a legalprocess for those with unsecured debts of 15,000 or more.A debt relief order is not suitable for anyone whoowns a home or has assets of more than 300. Thislimit excludes one car up to the value of 1,000.How does it work?An IVA is arranged by an insolvency practitioner. Yourinsolvency practitioner will help and advise youthroughout the process. They will assess yourfinances and draw up a proposal for your creditors.With an IVA, your available income is used to makeaffordable monthly payments towards your debt overan agreed period of time – usually 5 years. How does it work?An intermediary must submit your DRO application to the official receiver. You will have to pay a fee of 90, which you will not get back if your application is unsuccessful.You may also pay a lump sum towards your debts. Atthe end of the agreed period, your remaining debtsare written off. There is a fee involved in organisingthe IVA, but this will be included in the paymentsyou make. Creditors representing at least 75% ofyour total debt must vote in favour of the IVA for it tobe able to go ahead. When your creditors agree tothe IVA they are also agreeing to take no further legalaction against you to recover the debt, providing youkeep to the terms of the arrangement.If your DRO application is successful, your debts willbe written off after a year, providing you keep to theterms and conditions of the order. During this 12month period, your creditors cannot chase you forpayments or add interest and charges to the debt.How can we help?We are one of the few approved organisations able tosubmit your debt relief order application. We have ateam of intermediaries who can help you with yourDRO application.Your insolvency practitioner will contact you once ayear to review your finances. You and your creditorswill receive annual progress reports and you will benotified when your IVA is complete.Free debt adviceHow can we help?Free debt help from StepChange Debt Charitycall 0800 138 1111StepChange Debt Remedy, our online tool, will beable to tell you if an IVA is the best solution for you.Should you decide to go ahead, StepChangeVoluntary Arrangements, our IVA service, will supportyou throughout. You may also contact your own IVAprovider if you wish.8

StepChange Debt CharityDebt consolidation guideDebt solutionsBankruptcyHow can we help?We can provide you with free, confidential debtadvice and find the best debt solution for yoursituation. We can advise you more on bankruptcy ifyou use our online tool, Debt Remedy, which willadvise if bankruptcy is the best option for you.Who is it for?Bankruptcy is a legal procedure for people whocannot pay their debts within a reasonable time. It’s aform of insolvency so to be eligible, your unsecureddebts must outweigh your assets, including propertyand vehicles.How does it work?If you make yourself bankrupt, creditors write off yourunsecured debts, meaning you have a fresh start.However, you will be subject to certain restrictionsduring the term of the bankruptcy, which is usually 12 months.In order to file for bankruptcy, you have to pay a feeof 700 ( 175 to the court and 525 to the officialreceiver). If the bankruptcy is approved, creditorsmust stop charging interest and are prevented fromcontacting you or taking legal action to recover the debt. In some cases, you are asked to make monthlypayments towards your debts from your availableincome. This is known as an Income PaymentArrangement, and can last for three years.Bankruptcy should not be taken lightly as it is a bigstep and you may have to give up your assets. Youshould always get expert advice before making thedecision to go ahead with it.Free anonymous debt adviceFree debt help online from StepChange DebtCharity at www.stepchange.org9

StepChange Debt CharityDebt consolidation guideOur debt helpContact usWe know debt and understand that debtproblems can be very stressful.Our StepChange Debt Remedy tool is freeand confidential, giving you online debt help,advice and support when you need it most.However big or small your debt problem is, we canhelp you. We will give you all the information andsupport that you need to tackle it and take the firststep towards getting debt free.If you would prefer to talk to someone in confidence,call our free Helpline on 0800 138 1111 to arrangea telephone appointment.First stepsThe sooner you start to deal with your problem, thebetter. It is important that you get in touch with usstraight away. Also, put a stop to any more borrowing:Free anonymous debt advice Don’t take out any more loansFree debt help online from StepChange DebtCharity at www.stepchange.org Don’t increase your overdraft Stop using your credit cards and cut them up Don’t consolidate your debts into one loan Don’t secure any loans against your homeHow we can helpIf you are worried about your debts, makesure you get expert debt help straight away.We provide free, impartial and confidential debtadvice that will help you through your financialdifficulties. We help thousands of people each yearand we will be able to give you the debt help you need.Our online StepChange Debt Remedy tool willrecommend a solution for you based on your uniquesituation. StepChange Debt Remedy will alsobuild you a personal action plan, so you can seeexactly where your money is going each month, andbegin to take control of your spending again. 2012 Foundation for Credit CounsellingRegistered Office: Wade House, Merrion Centre, Leeds LS2 8NGRegistered in England No 2757055 Registered Charity No 101663010SCDCG10/12

What is debt consolidation? Debt consolidation is the name for a loan that you use to pay off all your other unsecured debts. A debt consolidation loan can be taken out to pay debts such as credit cards and store cards, catalogues and personal loans. Taking out a debt consolidation loan means that