Transcription

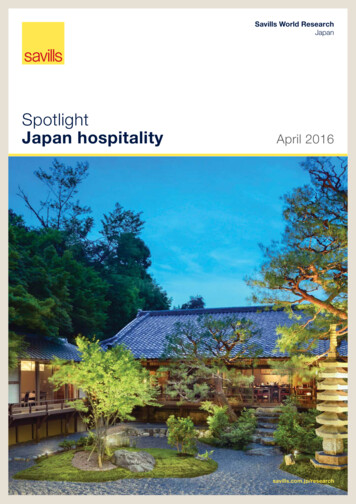

Savills World ResearchJapanSpotlightJapan hospitalityApril 2016savills.com.jp/research

Spotlight Japan hospitalityApril 2016Savills World ResearchJapanSpotlightJapan hospitalityApril 2016SpotlightJapan hospitalitysavills.com.jp/research“Japan continues to see robust growth ininbound tourism. This growth should maintainits forward momentum and fuel a strongperformance in the hospitality sector this year,despite global economic uncertainty. Tourismgrowth in Osaka has been especially notable.”Robust momentum ininternational visitorsits goal to 30 million by 2020. In lateMarch, the government announceda further increase of its goal to 40million annual tourists by 2020 and 60million by 2030. Savills believes thatthe 2020 target is possible providedseveral conditions are satisfied, namelyfurther visa relaxation, a continuedsoft currency, and infrastructureimprovement such as modernizingtraditional inns in outlying regions.Japan has strong potential as a touristdestination, which we will discuss inmore detail in this report. The countrycan achieve 40 million inbound touristsin 2020 by maintaining an annualtourism growth rate of 15%.According to the Japan NationalTourism Organization (JNTO), almost20 million international tourists visitedJapan in 2015, a record number. Thisis a 47% increase compared with lastyear. Also, for the first time in 45 years,2015 saw more inbound tourists thanoutgoing Japanese travellers. Januaryand February saw 1.9 million inboundtourists each, a 52% and 36%increase against the same months lastyear, showing strong momentum into2016.The Abe administration has alreadyalmost achieved its previous goal of20 million visitors by 2020 and so thispast December, the government raisedAsian tourists have been dominantamong international visitors to Japan.GRAPH 1International arrivals to Japan, 2003–2020TotalGovernment's target(increased to 40 08Source: JNTO, Savills Research & Consultancy20092010201120122013 Almost 20 million international tourists visitedJapan in 2015, a record number. This is a 47%increase compared with last year. The occupancy rate of hotels in Japan stood at83.7% during 2015, and has hovered above 80%since 2013. Average daily rate (ADR) and revenue peravailable room (RevPAR) have recovered significantly.However, there remains significant potential to boostrevenues, especially in US terms. In terms of the hotel supply pipeline, developersplanned to add an additional 45,000 roomsnationwide as of December 2015, more than at anypoint in the past decade. Hotel development is expanding outside Tokyoto capture more inbound tourists visiting regionaldestinations. Well-regarded international brands arealso getting involved. Transaction volumes remain high, and J-REITsand their sponsors remain the major players in themarket. Cap rates have been compressing becauseof the high demand. Savills expects the number of internationalarrivals to continue to increase considering the rangeof attractions available, in particular for Asian tourists,although a stronger yen and economic uncertainty inChina may moderate the rate of growth.of which China4035SUMMARY201420152020Chinese, Korean, and Taiwanesetravellers alone accounted for 65% ofJapan’s total inbound tourists in 2015.The growth of Chinese tourists hasbeen especially notable. The numberof Chinese tourists visiting Japandoubled from 1.3 million in 2013 to2.4 million in 2014, and then morethan doubled again to 5.0 million in2015. Some observers are concernedabout the sustainability of these figuresbecause the Chinese economy hasshown signs of a slowdown. However,January and February 2016 eachsaw 0.5 million Chinese tourists, awhopping 110% and 39% increasesavills.com.jp/research02

Spotlight Japan hospitalityApril 2016GRAPH 2against the same months last year.The depreciation of the RMB maynegatively affect the growth rate, butbaseline figures should continue toincrease into the future.Breakdown of inbound tourists by nationality, 2015Other19%Japan hotel marketChina25%The hotel market in Japan continued toperform strongly, thanks to burgeoninginternational tourism. The occupancyrate stood at 83.7% during 2015, andhas hovered above 80% since 2013.Average daily rate (ADR) and revenueper available room (RevPAR) haverecovered significantly as well. TheADR for 2015 was JPY14,576, 11.6%higher than the 2014 figure but stillslightly lower than the 2007 number.RevPAR during 2015 was JPY12,218,14.0% higher than the 2014 figure andexceeding the 2007 level, thanks to amuch higher occupancy rate. Positivemarket conditions are likely to furtherspur improvement of both ADR andRevPAR and we are expecting bothindicators to hit a 10 year high in thenear future.Thailand4%US5%Hong Kong8%Korea18%Taiwan19%Source: JNTO, Savills Research & ConsultancyGRAPH 3Japan hotel performance, 2007–2015ADR (LHS)RevPAR (LHS)Occupancy rate : STR Global, Savills Research & ConsultancyGRAPH 4ADR, occupancy rate, RevPAR of large cities in theworld, 2015300Paris (222)260New York (218)Tokyo hotel marketADR (US )220London (180)Hong Kong (175)180Tokyo (131)14010074%76%78%80%82%Source: STR Global, Savills Research & Consultancy*Numbers in parentheses show RevPAR84%86%Even with improving ADR, room ratesin Tokyo (ADR: US 151, 2015) andOsaka (US 132, the same period)are still attractive, especially in US terms, partly thanks to a relativelysoft yen. Paris, New York, London,and Hong Kong saw higher ADRsof US 286, US 256, US 218 andUS 210 respectively during thesame period. This implies thatJapanese cities have significantpotential to boost their ADRs. Inaddition, the occupancy rates inTokyo (86.7%, 2015) and Osaka(90.8%, the same period) are thehighest among the cities’ peers:Paris (76.3%), New York (84.4%),London (81.9%), and Hong Kong(83.4%). Given the very highoccupancy rates, hotel operatorsin Japan remain well positioned toincrease ADR and RevPAR.88%Osaka (120)90%92%Occupancy rateThe Tokyo hotel market is alsostrong and the occupancy ratehas hovered over 86% since 2013.ADR and RevPAR figures haverecovered but there is still someroom for improvement in order tohit 2008 highs. ADR during 2015was JPY18,225, 9.4% up from the2014 figure, but still 14.4% lowerthan its 2008 level. RevPAR duringsavills.com.jp/research03

Spotlight Japan hospitalityGRAPH 5Tokyo hotel performance, 2007-2015ADR (LHS)RevPAR (LHS)Occupancy rate (RHS)10025,0009520,000908010,000Osaka hotel marketThe Osaka hotel market has recentlyseen phenomneal growth. The annualoccupancy rate has remained over80% since 2012 and reached 90.8%in 2015. ADR and RevPAR showedrobust two-digit growth in both 2014and 2015. ADR stood at JPY15,987during 2015, a 22.8% increaseagainst 2014. RevPAR during 2015was JPY14,536, a powerful 27.2%improvement over the 2014 figure.Both ADR and RevPAR hit new post2007 highs.8515,000JPYConsidering the robust conditionsin the Tokyo hotel market, andADR still lagging internationally, weexpect ADR and RevPAR to furtherincrease in Tokyo even consideringthe conservative nature of Japanesebusiness culture.%the same period was JPY15,829 yen,only 2.0% lower than its 2008 levelbecause of a higher occupancy rate(86.7% during 2015 against 75.6%during 2008).April 2015Source: STR Global, Savills Research & ConsultancyGRAPH 6Osaka hotel performance, 2007-2015ADR (LHS)RevPAR (LHS)Occupancy rate (RHS)25,00010095This is in part because the airport isa hub for low cost carriers (LCCs)in Japan – as many as 17 LLCsoperate at the airport. Additionally,approximately 25% of all flightsat Kansai are operated by LCCsvs. about 10% for the rest of thecountry. In April 2016 the governmentwill privatise the airport and handmanagement over to Orix, aJapanese financial conglomerate,and VINCI, a French airport operator.Both are experienced institutions andthe airport may further strengthen itscompetitiveness by leveraging theexpertise of its new private owners.Universal Studios Japan in Osaka isa big draw for international touristsand the popular amusement park islikely to break last year’s record of12.7 million entrants by another one20,000908515,000%JPYThis phenomenal growth seems tobe driven by the growing number ofinternational tourists as overseastravel through Kansai InternationalAirport has skyrocketed. The airportserviced 16.3 million passengersat international terminals in 2015, a24% increase compared with 2014.In 2015, international passengersexceeded 10 million, an historicalhigh, while take-offs and landingsincreased by 20% in 2015 thanks toadditional flights from 2201320142015Source: STR Global, Savills Research & Consultancymillion in its fiscal year end reportingin March 2016. The number ofinbound tourists to the park is said tohave increased by 70-80% over thesame period, hitting 1 million for thefirst time. A new attraction featuringHarry Potter has spurred the explosivegrowth of entrants, and the park’sHalloween event is especially popular.Universal Studios Japan has recentlychanged hands from Goldman Sachs,a US bank, to Comcast, a US mediagroup. Jean-Louis Bonnier, the currentCFO of Universal Park and Resorts,will become the new CEO of UniversalStudios Japan and analysts are eagerto see whether he can maintain thepark’s robust momentum.Given a strong focus on LCCs atKansai International Airport, greatlocal tourist attractions, and excellentaccess to Kyoto, Osaka is likely tocontinue attracting tourists fromoverseas and from emerging Asia inparticular.Hotel pipeline andregional expansionAs of December 2015, developerswere planning to add an additional45,000 hotel rooms nationwide in orderto capture robust inbound demand.This planned expansion is greaterthan at any point in the past decade.The capacity will take some time tomaterialize, but we have written aboutthe lack of hotel room supply in thepast and see this uptick as a positivesign that developers are correctlymoving to pre-empt the forthcomingrise in demand.savills.com.jp/research04

Spotlight Japan hospitalityApril 2016Because many repeat tourists areventuring off the beaten track outsideof Tokyo and Osaka, and hotels inthese two major cities are almost full,Japan’s regional markets are expectedto see more inbound tourists. Inresponse to this trend, a large numberof hotels are expected to be developedin the regions including internationalhotel brands. This trend is supportedby data published by the government.According to the Japan TourismAgency, 5 out of 47 prefecturesdoubled the total number of stays(the number of tourists multiplied bythe number of stays) by internationaltourists, while more than half of the 47prefectures show over 50% growthduring 2015. Also, 27 state-managedairports have generated profits for thefirst time in the last 5 years.In February 2016, MarriottInternational, Inc. and Mori Trust Group,a Japanese property conglomerate,announced the signing and rebrandingof five Laforet hotels in Japan underthe iconic Marriott Hotels brand name.This agreement will double the footprintof the flagship Marriott Hotels brandin Japan. Over the next two years,Mori Trust Group will renovate fiveexisting Laforet properties totallingalmost 840 rooms and rebrand themas Marriott Hotels. The five rebrandedhotels – Lake Biwa Marriott Hotel(formerly Laforet Biwako), NankiShirahama Marriott Hotel (formerlyLaforet Nanki-Shirahama), Fuji MarriottHotel (formerly Laforet Yamanakako),Izu Marriott Hotel Shuzenji (formerlyLaforet Shuzenji), and KaruizawaMarriott Hotel (formerly LaforetNaka-Karuizawa) – are all located inGRAPH 7Planned new hotel rooms, Jun 2004 - Dec 0010,000Source: Hoteres, 4 December 2015, Savills Research & Consultancyscenic regional destinations. They arepart of a large-scale hotel renovationplan announced by Mori Trust Groupin October 2015 and represent aninvestment of approximately 16billion yen. Mori Trust has multiplehotels across Japan, including Suiranin Kyoto (cover photo), a LuxuryCollection Hotel, the highest gradeband by Starwood Group.Trust Group. The new property willbe located in the capital city of Nara,known for its traditional Japanesehistory and culture. Located next toOsaka, Nara is home to many of thecountry’s oldest surviving palaces,temples, and shrines, including severalUNESCO world heritage properties.It is worth noting that Nara prefecturehas the largest number of UNESCOheritage properties in Japan.In March 2016, the same two partiesannounced a plan to open the JWMarriott Hotel Nara in the springof 2020. The new hotel will markthe JW Marriott brand’s debut inJapan, Nara's first luxury property,and the continuation of a successfulpartnership between the twocompanies. Marriott International willoperate the hotel under a long-termmanagement agreement with MoriFurther growth potentialWe expect continued strong increasesin the number of international arrivals.A stronger yen and economicuncertainty in China may moderatethe rate of growth, but headlinenumbers should remain strong andwe anticipate that the government willmeet its new target of 40 million annualvisitors by 2020. However, to achieveTABLE 1Planned new hotel rooms, Dec 2015TokyoGreater OsakaGreater NagoyaGreater 7511,1645,8434,5077,8505,13210,06844,564Sub totalSource: Hoteres, 4 December 2015, Savills Research & Consultancysavills.com.jp/research05

Spotlight Japan hospitalitythis number, current momentum mustcontinue and the government alsoneeds to commit to promoting tourismin outlying regions. On the demandside, Japan’s plethora of touristattractions, rich cultural heritage,world-class dining, and popular themeparks make it an attractive destinationfor Asia’s burgeoning middle class. Onthe supply side, recent bottleneckswill ease as government initiativesand private investment boost capacityto help absorb this influx of foreignvisitors.Demand for tourism will continue toincrease, especially among travellersfrom Asia. A variety of surveysconsistently rank Japan in the topthree international destinations forChinese tourists, making Japanwell-situated to benefit from Chinesegrowth over the near and long term.Arrivals from Indonesia, Vietnam, andthe Philippines will also remain strongafter the Japanese government easedvisa requirements in mid 2014.April 2016TABLE 2Number of UNESCO properties by country, Northand South East AsiaWorld heritage sitesChina48Japan19Australia19South Korea12Viet Nam8Indonesia8Philippines6Thailand5Source: UNESCOWe see potential for further growthas inbound tourists journey beyondTokyo and Osaka to explore Japan’sadditional sightseeing destinations.First, Japan boasts 19 UNESCOworld heritage properties spreadacross the country, ranking secondin North and South East Asia afterChina. Second, Japan had three ofthe five most visited theme parks inthe world in 2014, according to theThemed Entertainment Association.TABLE 3Number of visitors to theme parks in 2014Million visitorsRankParkLocation%change20132014Lake Buena Vista, Florida4.018.619.3Tokyo, Japan0.517.217.3Anaheim, California3.516.216.81Magic Kingdom at Walt Disney World2Tokyo DisneyLand3Disneyland4Tokyo Disney SeaTokyo, Japan0.114.114.45Universal Studios JapanOsaka, Japan16.810.111.86Epcot at Walt Disney WorldLake Buena Vista, Florida2.011.211.57Disney's Animal KingdomLake Buena Vista, Florida2.010.210.48Disney's Hollywood StudiosLake Buena Vista, Florida2.010.110.39Disneyland park at Disneyland ParisMarne-La-Vallee, France-4.710.49.910Disney's CA AdventureAnaheim, California3.08.58.811Universal StudiosUniversal Orlando, Florida17.07.18.312Island of AdventureUniversal Orlando, Florida0.08.18.113Ocean ParkHong Kong4.27.57.814Lotte WorldSeoul, South Korea2.87.47.615Hong Kong DisneylandHong Kong1.47.47.516EverlandGyeonggi-Do, South Korea1.17.37.417Universal Studios HollywoodUniversal City, California11.06.16.818Songcheng ParkHangzhou, China38.34.25.8Kuwana, Japan-3.65.85.6Hengqin, China (new)NANA5.519Nagashima Spaland20Chimelong Ocean KingdomSource: Themed Entertainment Associationsavills.com.jp/research06

Spotlight Japan hospitalityApril 2016TABLE 4Selected investment transactions, Sep 2015 - Mar 2016Property namePrice (JPY bil)Cap rateBuyerLeased land of Rihga Royal HotelOsaka27.0NARihga Royal HotelsLoisir Hotel & Spa Tower Naha20.05.9%United Urban InvestmentHoshino Resorts Tomamu18.3NAShanghai Yuyuan Tourist Mart OBOFosun GroupUrawa Royal Pines Hotel17.55.8%United Urban InvestmentActive-Inter City Hiroshima17.35.6%Japan Hotel REITSource: Nikkei RE, RCA, Savills Research & ConsultancyConsidering the expansion plan,Japan’s Tokyo Disneyland may wrestthe top spot from Disney’s own MagicKingdom in the US. Finally, Japanboasts three of the top five cities inthe world — Tokyo, Kyoto, and Osaka— in terms of the number of MichelinStar restaurants and Tokyo retainedthe gourmet crown in Michelin’s globalrankings for the ninth straight year in2015. A restaurant featuring ramennoodles took its place among moretraditionally gourmet restaurants inMichelin’s most recent report.To meet this increased demand, theJapanese government and privatesector are implementing new plansto expand capacity and provideservices catering to foreign travellers.In April 2015 Narita InternationalAirport opened an LCC-dedicatedterminal, which has significantlybrought down the cost of regional airtravel, and Kansai International Airportis scheduled to open its own LCCdedicated terminal in March 2017.To accommodate more than 40million visitors, regions in Japanshould play a more important rolethan before since hotels in Tokyo andOsaka are operating at almost fullcapacity. Trends look to be shifting inthis direction. With regions in Japanwelcoming more tourists, Japanshould not have a capacity issue.InvestmentsThe hotel investment market hasremained active throughout 2015and into 2016 as many J-REITs anddevelopers are working to capitalizeon the opportunities provided byincreased international tourism. Datafrom Real Capital Analytics (RCA)indicate that there have been over60 hotel transactions in the periodAugust 2015 - February 2016, abouthalf of which involved J-REITs ortheir sponsors. This is in line withthe January 2015 - July 2015 periodand active by historical standards.Hotel rent structures typically includea variable rent component whichallows investors to capture additionalupside when performance is strong.This makes hotel property an idealchoice for bullish investors who wishto secure additional income withoutwaiting for rent revisions. Robust ADRand RevPAR growth into 2016 paint apositive picture for investors hopingto profit from such variable rentalincome.Cap rates for hotel transactions havebeen compressing throughout 2015,and prime locations in central Tokyohave sold at rates close to 4.0%. OUTLOOKThe prospects for the marketThe hospitality sector is likelyto perform very strongly for theforeseeable future. The numberof inbound tourists did not slowin January and February, andgrowth is expected to continue,albeit at a more moderate pace.Since Osaka and Tokyo arealmost full, inbound touristsand international hoteliers havestarted to expand to outlyingregions. There are many touristattractions, including UNESCOWorld Heritage properties,outside of Tokyo, Osaka, andKyoto, so regions show strongpotential to attract travellers.The government’s new goalof welcoming 40 millioninbound tourists a year by 2020should be achievable through thisregional involvement and currentfavourable tailwinds. Such tailwindsinclude government support, a softcurrency, flourishing LCCs, emergingAsian economies, popular touristattractions, and the upcomingOlympics. The government andprivate sector are also spendingmore on multilingual services anddevices. An unexpected disaster maychange this trend, but for now thehospitality sector in Japan is enjoyinga strong upward trend.savills.com.jp/research07

Spotlight Japan hospitalityApril 2016Please contact us for further informationSavills JapanSavills ResearchChristian ManciniRepresentative Director, CEO 81 3 6777 5150cmancini@savills.co.jpTetsuya KanekoHead of Research &Consultancy, Japan 81 3 6777 5192tkaneko@savills.co.jpHafiz IsmailManager, Research &Consultancy, Japan 81 3 6777 5171hismail@savills.co.jpSimon SmithSenior Director,Asia Pacific 852 2842 4573ssmith@savills.com.hkSavills HotelsRaymond ClementManaging DirectorAsia Pacific 65 6415 7570rclement@savills.com.sgTomotsugu IchikawaSenior Manager,Japan 81 3 6777 5184toichikawa@savills.co.jpNatasha BellResearch Manager,Asia Pacific 65 6415 3622natasha.bell@savills.com.sgSavills plcSavills is a leading global real estate service provider listed on the London Stock Exchange. The company established in 1855, has a rich heritage with unrivalled growth. It is a companythat leads rather than follows, and now has over 600 offices and associates throughout the Americas, Europe, Asia Pacific, Africa and the Middle East.This report is for general informative purposes only. It may not be published, reproduced or quoted in part or in whole, nor may it be used as a basis for any contract, prospectus,agreement or other document without prior consent. Whilst every effort has been made to ensure its accuracy, Savills accepts no liability whatsoever for any direct or consequential lossarising from its use. The content is strictly copyright and reproduction of the whole or part of it in any form is prohibited without written permission from Savills Research.savills.com.jp/research08

international tourists as overseas travel through Kansai International Airport has skyrocketed. The airport serviced 16.3 million passengers at international terminals in 2015, a 24% increase compared with 2014. In 2015, international passengers exceeded 10 million, an historical high, while take-offs and landings increased by 20% in 2015 thanks to