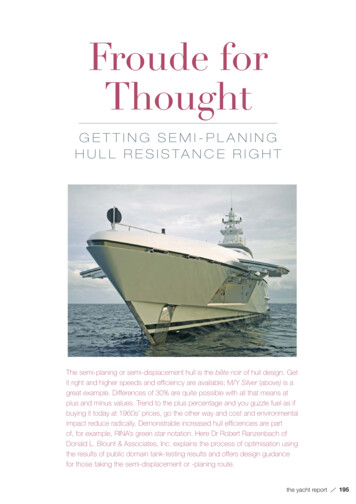

Transcription

OPPORTUNISTIC INVESTMENT STRATEGIES12.31.2021Semi-Annual ReportRIVERNORTH SPECIALTY FINANCE CORPORATION(RSF)Investment Adviser:RiverNorth Capital Management, LLC433 W. Van Buren Street, 1150-EChicago, IL 60607

RiverNorth Specialty Finance CorporationTable of ContentsPerformance Overview2Schedule of Investments5Statement of Assets and Liabilities15Statement of Operations16Statements of Changes in Net Assets17Statement of Cash Flows18Financial Highlights20Notes to Financial Statements23Dividend Reinvestment Plan34Additional Information36Consideration and Approval of Advisory Agreement37

RiverNorth Specialty Finance CorporationPerformance OverviewDecember 31, 2021 (Unaudited)WHAT IS THE FUND’S INVESTMENT STRATEGY?The investment objective of the RiverNorth Specialty Finance Corporation (“the Fund”) is to seek ahigh level of current income. The Fund seeks to achieve its investment objective by investing incredit instruments, including a portfolio of securities of specialty finance and other Financialcompanies that the Fund's investment adviser, RiverNorth Capital Management (the "Adviser"),LLC believes offer attractive opportunities for income. The Fund may invest in income‐producingsecurities of any maturity and credit quality, including below investment grade, and equitysecurities, including exchange traded funds and registered closed‐end funds.HOW DID THE FUND PERFORM RELATIVE TO ITS BENCHMARK DURING THE PERIOD?PERFORMANCE as of December 31, 2021CumulativeAnnualizedSinceTOTAL RETURN(1)6 Months 1 Year 3 Year(3) Inception(2)(3)4.18% 19.71% 6.73%RiverNorth Specialty Finance Corporation ‐ NAV(4)5.37%(5)RiverNorth Specialty Finance Corporation ‐ Market Price1.07%27.45% 6.30%(7) 5.13%(7)0.06%‐1.54% 4.79%2.82%Bloomberg Barclays U.S. Aggregate Bond Index(6)(1)(2)(3)(4)(5)(6)(7)Total returns assume reinvestment of all distributions.The Fund commenced operations on September 22, 2016.Annualized.Performance returns are net of management fees and other Fund expenses.Market price is the value at which the Fund trades on an exchange. This market price can bemore or less than its net asset value (“NAV”).The index is an unmanaged index of investment grade fixed‐rate debt issues with maturitiesof at least one year. The index cannot be invested in directly and does not reflect feesand expenses.The Fund began trading on the New York Stock Exchange (“NYSE”) on June 12, 2019 under theticker symbol RSF. Formerly the Fund was known as RMPLX and was purchased directly.Market price returns are a blend of the NAV return until June 11, 2019 combined with themarket price return thereafter.Effective as of May 22, 2020, the Fund changed its investment strategy from, under normal marketconditions, investing at least 80% of its Managed Assets in marketplace lending investments to,under normal market conditions, investing directly or indirectly in credit instruments, including aportfolio of securities of specialty finance and other financial companies that the Fund's Adviserbelieves offer attractive opportunities for income.The total annual expense ratio as a percentage of net assets attributable to common shares for theyear ended December 31, 2021 was 3.06% (excluding interest expense on loan payable anddividends to redeemable preferred stock). Including interest expense on loan payable anddividends to redeemable preferred stock, the expense ratio was 7.44% for the six months endedDecember 31, 2021.Performance data quoted represents past performance, which is not a guarantee of future results.Current performance may be lower or higher than the performance quoted. The principal valueand investment return of an investment will fluctuate so that your shares may be worth more orless than their original cost. You can obtain performance data current to the most recent monthend by calling 844.569.4750. Total return measures net investment income and capital gain or lossfrom portfolio investments. All performance shown assumes reinvestment of dividends and capitalgains distributions but does not reflect the deduction of taxes that a shareholder would pay onFund distributions or the sale of Fund shares. Other fees and expenses are applicable to aninvestment in this Fund.2(888) 848-7569 www.rivernorth.com

RiverNorth Specialty Finance CorporationPerformance OverviewDecember 31, 2021 (Unaudited)GROWTH OF A HYPOTHETICAL 1,000,000 INVESTMENTThe graph below illustrates the growth of a hypothetical 1,000,000 investment assuming thepurchase of common shares at the NAV of 25.00 on September 22, 2016 (commencement ofoperations) and tracking its progress through December 31, 2021.Past performance does not guarantee future results. Performance will fluctuate with changes inmarket conditions. Current performance may be lower or higher than the performance data shown.Performance information does not reflect the deduction of taxes that shareholders would pay onFund distributions or the sale of Fund shares. An investment in the Fund involves risk, including lossof principal.TOP TEN HOLDINGS* as of December 31, 2021First Eagle Alternative Capital BDC, Inc.Apollo Investment Corp.FS KKR Capital Corp.New Mountain Finance Corp.XAI Octagon Floating Rate Alternative Income Term TrustPennantPark Floating Rate Capital, Ltd.BlackRock Capital Investment Corp.BlackRock TCP Capital Corp.Barings BDC, Inc.Business Development Corp. of America*% of Net %2.84%51.75%Holdings are subject to change and exclude short‐term investments.Semi-Annual Report December 31, 20213

RiverNorth Specialty Finance CorporationPerformance OverviewDecember 31, 2021 (Unaudited)ASSET ALLOCATION as of December 31, 2021 4Holdings are subject to change.Percentages are based on total investments of the Fund and do not include derivatives.(888) 848-7569 www.rivernorth.com

RiverNorth Specialty Finance CorporationSchedule of InvestmentsDescriptionCLOSED‐END FUNDS (4.35%)Barings Global Short Duration High Yield FundInvesco Dynamic Credit Opportunity FundInvesco Senior Income Trust(a)Nuveen Credit Strategies Income FundPGIM High Yield Bond Fund, Inc.Western Asset High Income Opportunity Fund, Inc.(a)December 31, 2021 327TOTAL CLOSED‐END FUNDS(Cost 3,180,384)255,885499,859262,898TOTAL BUSINESS DEVELOPMENT COMPANIES(Cost 5,264,270)Semi-Annual Report December 31, 2021 87BUSINESS DEVELOPMENT COMPANIES (8.55%)Barings BDC, Inc.(a)First Eagle Alternative Capital BDC, Inc.Oaktree Specialty Lending Corp.SPECIAL PURPOSE ACQUISITION COMPANIES26 Capital Acquisition Corp.ABG Acquisition Corp. IAce Global Business Acquisition, Ltd.Advanced Merger Partners, Inc.African Gold Acquisition Corp.Agrico Acquisition Corp.Aries I Acquisition Corp.Artisan Acquisition Corp.Astrea Acquisition Corp.Athlon Acquisition Corp.Atlas Crest Investment Corp. IIAusterlitz Acquisition Corp. IAusterlitz Acquisition Corp. IIAuthentic Equity Acquisition Corp.B Riley Principal 250 Merger Corp.Big Sky Growth Partners, Inc.Biotech Acquisition Co.Bison Capital Acquisition Corp.Bite Acquisition Corp.Blue Safari Group Acquisition Corp.BlueRiver Acquisition Corp.CC Neuberger Principal Holdings IIICF Acquisition Corp. VChurchill Capital Corp. VIChurchill Capital Corp. VIIClarim Acquisition Corp.Class Acceleration Corp.Colicity, Inc.See Notes to Financial 549,20284,506221,028229,08873,44232,74234,8185

RiverNorth Specialty Finance CorporationSchedule of InvestmentsDescriptionColiseum Acquisition Corp.Colombier Acquisition Corp.Corazon Capital V838 Monoceros Corp.Corner Growth Acquisition Corp. 2Corsair Partnering Corp.COVA Acquisition Corp.D & Z Media Acquisition Corp.Data Knights Acquisition Corp.Deep Lake Capital Acquisition Corp.Delwinds Insurance Acquisition Corp.DHC Acquisition Corp.DiamondHead Holdings Corp.DILA Capital Acquisition Corp.Edify Acquisition Corp.Elliott Opportunity II Corp.EQ Health Acquisition Corp.FinTech Acquisition Corp. VIFintech Evolution Acquisition GroupFlame Acquisition Corp.Fortistar Sustainable Solutions Corp.Fortress Value Acquisition Corp. IIIFoxWayne Enterprises Acquisition Corp.Frontier Investment Corp.Fusion Acquisition Corp. IIG Squared Ascend II, Inc.G3 VRM Acquisition Corp.GigInternational1, Inc.Global Consumer Acquisition Corp.Global SPAC Partners Co.Goal Acquisitions Corp.Golden Path Acquisition Corp.Goldenbridge Acquisition, Ltd.Gores Holdings VII, Inc.Gores Metropoulos II, Inc.Graf Acquisition Corp. IVGrayscale Bitcoin Trust BTCGrowth Capital Acquisition Corp.Healthcare Capital Corp.Hennessy Capital Investment Corp. VIgnyte Acquisition Corp.ITHAX Acquisition Corp.Jack Creek Investment Corp.Jaws Mustang Acquisition Corp.Khosla Ventures Acquisition Co. IIILakeshore Acquisition I Corp.LMF Acquisition Opportunities, Inc.December 31, 2021 ,6638,97234,075 2,110See Notes to Financial Statements.6(888) 848-7569 www.rivernorth.com

RiverNorth Specialty Finance CorporationSchedule of InvestmentsDecember 31, 2021 (Unaudited)DescriptionMacondray Capital Acquisition Corp. IMaquia Capital Acquisition Corp.Marlin Technology Corp.MDH Acquisition Corp.Medicus Sciences Acquisition Corp.Model Performance Acquisition Corp.Monument Circle Acquisition Corp.Moringa Acquisition Corp.Mountain Crest Acquisition Corp. IIIMountain Crest Acquisition Corp. IVNew Vista Acquisition Corp.Noble Rock Acquisition Corp.Nocturne Acquisition Corp.North Atlantic Acquisition Corp.Northern Lights Acquisition Corp.OceanTech Acquisitions I Corp.Orion Biotech Opportunities Corp.Osiris Acquisition Corp.Oyster Enterprises Acquisition Corp.Pivotal Investment Corp. IIIPost Holdings Partnering Corp.Priveterra Acquisition Corp.Progress Acquisition Corp.Quantum FinTech Acquisition Corp.RMG Acquisition Corp. IIIScION Tech Growth IISenior Connect Acquisition Corp. IShelter Acquisition Corp. ISpartan Acquisition Corp. III, Class ASPK Acquisition Corp.SportsTek Acquisition Corp.SVF Investment Corp. 3Tailwind International Acquisition Corp.Trebia Acquisition Corp.Twelve Seas Investment Co. IIVenus Acquisition Corp.Z‐Work Acquisition 114,29735,3173,758 TOTAL SPECIAL PURPOSE ACQUISITION COMPANIES(Cost 16,864,408)DescriptionASSET‐BACKED SECURITIES (1.99%)MarketPlace Lending Senior Notes (1.14%)Marlette Funding Trust 38,682355,99536,56617,501,432MaturityDate12/17/29 PrincipalAmount2,485 Value2,489See Notes to Financial Statements.Semi-Annual Report December 31, 20217

RiverNorth Specialty Finance CorporationSchedule of InvestmentsDecember 31, 2021 /25/22 32,462 /30728,770730,609937,844MarketPlace Lending Residual Securities (0.85%)Prosper Marketplace Issuance Trust0.000%Series Fi Consumer Loan Program 2019‐4TrustSoFi Consumer Loan Program 2020‐1TrustUpstart Securitization Trust 2020‐1TOTAL ASSET‐BACKED SECURITIES(Cost 3,999,360)1,635,823DescriptionRateBUSINESS DEVELOPMENT COMPANY NOTES (52.53%)Apollo Investment Corp.5.250%Bain Capital Specialty Finance, Inc.8.500%BlackRock Capital Investment Corp.5.000%BlackRock TCP Capital Corp.4.625%Business Development Corp. of4.850%AmericaFirst Eagle Alternative Capital BDC, Inc. 5.000%FS KKR Capital Corp.(a)4.125%FS KKR Capital Corp.(a)4.750%FS KKR Capital Corp. II4.250%New Mountain Finance Corp.5.750%Oxford Square Capital Corp.6.250%Oxford Square Capital Corp.6.500%PennantPark Floating Rate Capital, Ltd. 4.250%XAI Octagon Floating Rate Alternative 6.500%Income Term 10/2306/15/2203/01/2212/15/245,292,895 51TOTAL BUSINESS DEVELOPMENT COMPANY NOTES(Cost 41,236,596)DescriptionSMALL BUSINESS LOANS (55.61%)(d)(e)(f)SquareRate4.81%TOTAL SMALL BUSINESS LOANS(Cost 50,500,881)Value43,092,240MaturityDate10/3/2018 9445,617,494See Notes to Financial Statements.8(888) 848-7569 www.rivernorth.com

RiverNorth Specialty Finance CorporationSchedule of InvestmentsDescriptionRIGHTS (0.10%)(b)Blue Safari Group Acquisition Corp., Strike Price 0.01,Expires 09/24/2026Golden Path Acquisition Corp., Strike Price 0.00, Expires12/31/2049Goldenbridge Acquisition, Ltd., Strike Price 0.01, Expires12/31/2049Model Performance Acquisition Corp., Strike Price 0.00,Expires 04/30/2026Mountain Crest Acquisition Corp. III, Strike Price 0.01,Expires 05/15/2026Mountain Crest Acquisition Corp. IV, Strike Price 0.00,Expires 06/30/2026Nocturne Acquisition Corp., Strike Price 0.01, Expires12/29/2025SPK Acquisition Corp., Strike Price 11.50, Expires12/31/2049Venus Acquisition Corp., Strike Price 0.01, Expires02/02/2022December 31, 2021 (Unaudited)Shares22,124 L RIGHTS(Cost 99,913)DescriptionWARRANTS (0.59%)(b)26 Capital Acquisition Corp., Strike Price 11.50, Expires12/31/2027Ace Global Business Acquisition, Ltd., Strike Price 11.50,Expires 12/31/2027AdTheorent Holding Co., Inc., Strike Price 11.50, Expires12/31/2027Advanced Merger Partners, Inc., Strike Price 11.50, Expires06/30/2026African Gold Acquisition Corp., Strike Price 11.50, Expires03/13/2028Agrico Acquisition Corp., Strike Price 11.50, Expires12/31/2028Aries I Acquisition Corp., Strike Price 11.50, Expires05/07/2023Artisan Acquisition Corp., Strike Price 11.50, Expires12/31/2028Astrea Acquisition Corp., Strike Price 11.50, Expires01/13/2026Athlon Acquisition Corp., Strike Price 11.50, Expires03/05/2026Austerlitz Acquisition Corp. I, Strike Price 11.50, 2423,6772,61110,6205,41412,7927,6745,7105,996See Notes to Financial Statements.Semi-Annual Report December 31, 20219

RiverNorth Specialty Finance CorporationSchedule of InvestmentsDescriptionAusterlitz Acquisition Corp. II, Strike Price 11.50, Expires12/31/2027Authentic Equity Acquisition Corp., Strike Price 11.50,Expires 12/31/2027Babylon Holdings, Ltd./Jersey, Strike Price 0.00, Expires10/21/2026Big Sky Growth Partners, Inc., Strike Price 11.50, Expires02/26/2023BigBear.ai Holdings, Inc., Strike Price 11.50, Expires12/31/2028Biotech Acquisition Co., Strike Price 11.50, Expires11/30/2027Bison Capital Acquisition Corp., Strike Price 11.50, Expires08/31/2027Bite Acquisition Corp., Strike Price 11.50, Expires12/31/2027BlueRiver Acquisition Corp., Strike Price 11.50, Expires01/04/2026Bowlero Corp., Strike Price 11.50, Expires 03/01/2026BuzzFeed, Inc., Strike Price 11.50, Expires 12/31/2027CC Neuberger Principal Holdings III, Strike Price 11.50,Expires 12/31/2027CF Acquisition Corp. V, Strike Price 11.50, Expires12/31/2027Churchill Capital Corp. VI, Strike Price 11.50, Expires12/31/2027Churchill Capital Corp. VII, Strike Price 11.50, Expires02/29/2028Clarim Acquisition Corp., Strike Price 11.50, Expires12/31/2027Class Acceleration Corp., Strike Price 11.50, Expires03/31/2028Colicity, Inc., Strike Price 11.50, Expires 12/31/2027Coliseum Acquisition Corp., Strike Price 11.50, Expires12/31/2028Colombier Acquisition Corp., Strike Price 11.50, Expires12/31/2028Corazon Capital V838 Monoceros Corp., Strike Price 11.50,Expires 12/31/2028Corner Growth Acquisition Corp. 2, Strike Price 11.50,Expires 03/01/2023Corsair Partnering Corp., Strike Price 11.50, Expires12/31/2027COVA Acquisition Corp., Strike Price 11.50, Expires12/31/2027December 31, 2021 (Unaudited)Shares9,292Value 736,4374,5722,263See Notes to Financial Statements.10(888) 848-7569 www.rivernorth.com

RiverNorth Specialty Finance CorporationSchedule of InvestmentsDescriptionD & Z Media Acquisition Corp., Strike Price 11.50, Expires12/31/2027Data Knights Acquisition Corp., Strike Price 11.50, Expires12/31/2028Deep Lake Capital Acquisition Corp., Strike Price 11.50,Expires 12/31/2027Delwinds Insurance Acquisition Corp., Strike Price 11.50,Expires 08/01/2027DHC Acquisition Corp., Strike Price 11.50, Expires12/31/2027DiamondHead Holdings Corp., Strike Price 11.50, Expires01/28/2028DILA Capital Acquisition Corp., Strike Price 11.50, Expires12/31/2028Edify Acquisition Corp., Strike Price 11.50, Expires12/31/2027Elliott Opportunity II Corp., Strike Price 11.50, Expires02/19/2023EQ Health Acquisition Corp., Strike Price 11.50, Expires02/02/2028Fintech Evolution Acquisition Group, Strike Price 11.50,Expires 03/31/2028Flame Acquisition Corp., Strike Price 11.50, Expires12/31/2028Fortistar Sustainable Solutions Corp., Strike Price 11.50,Expires 12/31/2027Fortress Value Acquisition Corp. III, Strike Price 11.50,Expires 12/31/2027FoxWayne Enterprises Acquisition Corp., Strike Price 11.50,Expires 01/12/2026Frontier Investment Corp., Strike Price 11.50, Expires12/31/2026Fusion Acquisition Corp. II, Strike Price 11.50, Expires12/31/2027G Squared Ascend II, Inc., Strike Price 11.50, Expires12/31/2026G3 VRM Acquisition Corp., Strike Price 0.00, Expires12/31/2049GigInternational1, Inc., Strike Price 11.50, Expires12/31/2028Ginkgo Bioworks Holdings, Inc., Strike Price 11.50, Expires12/31/2027Global Consumer Acquisition Corp., Strike Price 11.50,Expires 12/31/2027Global SPAC Partners Co., Strike Price 11.50, Expires11/30/2027December 31, 2021 (Unaudited)Shares378Value 7964,726See Notes to Financial Statements.Semi-Annual Report December 31, 202111

RiverNorth Specialty Finance CorporationSchedule of InvestmentsDescriptionGoal Acquisitions Corp., Strike Price 11.50, Expires01/31/2022Golden Path Acquisition Corp., Strike Price 11.50, Expires12/31/2028Goldenbridge Acquisition, Ltd., Strike Price 11.50, Expires10/28/2025Gores Metropoulos II, Inc., Strike Price 11.50, Expires01/31/2028Graf Acquisition Corp. IV, Strike Price 11.50, Expires05/31/2028Growth Capital Acquisition Corp., Strike Price 11.50, Expires06/01/2027Healthcare Capital Corp., Strike Price 11.50, Expires03/08/2025Hennessy Capital Investment Corp. V, Strike Price 11.50,Expires 01/11/2026Ignyte Acquisition Corp., Strike Price 11.50, Expires12/31/2027ITHAX Acquisition Corp., Strike Price 11.50, Expires12/31/2027Jack Creek Investment Corp., Strike Price 11.50, Expires12/31/2027Jaws Mustang Acquisition Corp., Strike Price 11.50, Expires01/30/2026Lakeshore Acquisition I Corp., Strike Price 11.50, Expires04/30/2028LMF Acquisition Opportunities, Inc., Strike Price 11.50,Expires 01/31/2027Macondray Capital Acquisition Corp. I, Strike Price 11.50,Expires 05/17/2026Maquia Capital Acquisition Corp., Strike Price 11.50, Expires12/31/2027Marlin Technology Corp., Strike Price 11.50, Expires03/05/2026MDH Acquisition Corp., Strike Price 11.50, Expires02/02/2028Medicus Sciences Acquisition Corp., Strike Price 11.50,Expires 12/31/2027Model Performance Acquisition Corp., Strike Price 11.50,Expires 04/29/2026Monument Circle Acquisition Corp., Strike Price 11.50,Expires 12/31/2027Moringa Acquisition Corp., Strike Price 11.50, Expires02/10/2026New Vista Acquisition Corp., Strike Price 11.50, Expires12/31/2027December 31, 2021 (Unaudited)Shares22,188Value 75,2982,96611788See Notes to Financial Statements.12(888) 848-7569 www.rivernorth.com

RiverNorth Specialty Finance CorporationSchedule of InvestmentsDescriptionNoble Rock Acquisition Corp., Strike Price 11.50, Expires12/31/2027North Atlantic Acquisition Corp., Strike Price 11.50, Expires10/20/2025Northern Lights Acquisition Corp., Strike Price 11.50, Expires12/02/2022OceanTech Acquisitions I Corp., Strike Price 11.50, Expires05/10/2026Orion Biotech Opportunities Corp., Strike Price 11.50,Expires 12/31/2027Osiris Acquisition Corp., Strike Price 11.50, Expires05/01/2028Oyster Enterprises Acquisition Corp., Strike Price 11.50,Expires 12/31/2027P3 Health Partners, Inc., Strike Price 11.50, Expires01/31/2027Pivotal Investment Corp. III, Strike Price 11.50, Expires12/31/2027Post Holdings Partnering Corp., Strike Price 11.50, Expires02/09/2023Priveterra Acquisition Corp., Strike Price 11.50, Expires12/31/2027Progress Acquisition Corp., Strike Price 11.50, Expires12/31/2027Quantum FinTech Acquisition Corp., Strike Price 11.50,Expires 12/31/2027RMG Acquisition Corp. III, Strike Price 11.50, Expires12/31/2027SAB Biotherapeutics, Inc., Strike Price 11.50, Expires12/07/2025ScION Tech Growth II, Strike Price 11.50, Expires01/28/2026Senior Connect Acquisition Corp. I, Strike Price 11.50,Expires 12/31/2027Shelter Acquisition Corp. I, Strike Price 11.50, Expires12/31/2027SportsTek Acquisition Corp., Strike Price 11.50, Expires12/31/2027Tailwind International Acquisition Corp., Strike Price 11.50,Expires 03/01/2028Twelve Seas Investment Co. II, Strike Price 11.50, Expires03/02/2028Venus Acquisition Corp., Strike Price 11.50, Expires12/31/2027VEW AG, Strike Price 11.50, Expires 02/28/2026December 31, 2021 (Unaudited)Shares8,975Value 38335,3172,2129,8501,813See Notes to Financial Statements.Semi-Annual Report December 31, 202113

RiverNorth Specialty Finance CorporationSchedule of InvestmentsDecember 31, 2021 (Unaudited)DescriptionZ‐Work Acquisition Corp., Strike Price 11.50, Expires01/04/2026Shares1,252TOTAL WARRANTS(Cost 604,256)DescriptionSHORT‐TERM INVESTMENTS (6.76%)State Street Institutional TrustTOTAL SHORT‐TERM INVESTMENTS(Cost 5,545,759)Value 5,7595,545,759TOTAL INVESTMENTS (151.82%)(Cost 127,295,827) 124,535,688Liabilities in Excess of Other Assets (‐51.82%)NET ASSETS (100.00%)(42,508,304) 82,027,384(a)(b)(c)(d)(e)(f)All or a portion of the security is pledged as collateral for loan payable. As of December 31,2021 the aggregate market value of those securities was 29,919,834 representing 36.48% ofnet assets.Non‐income producing security.Security is the unrated subordinated (residual) class of asset‐backed securities with anestimated yield based on projected future cash flows.Contains past‐due loans. A loan is deemed past‐due at December 31, 2021, if the loanborrower has not made its required payment as of the most recent due date. As of December31, 2021, 687,869 of whole loans were past due, which represents 0.84% of net assets.Fair Valued by the Adviser using a discounted cash flow (DCF) methodology.Loans are issued at discounts and do not have a stated interest rate. Rate indicated based onprojected future cash flows and an implied 18‐month final maturity. Actual yield and maturityis dependent on timing of future payments.See Notes to Financial Statements.14(888) 848-7569 www.rivernorth.com

RiverNorth Specialty Finance CorporationStatement of Assets and LiabilitiesDecember 31, 2021 (Unaudited)ASSETS:Investments in securities:At costAt value Receivable for investments soldInterest receivableDividends receivablePrepaid and other assetsTotal AssetsLIABILITIES:Interest payable on facility loanSeries A Term Preferred Stock, net of unamortized deferred offering costs(Liquidation Preference 41,400,000)Loan payable (Note 6)Dividend payable ‐ redeemable preferred stockPayable to Adviser, net of waiverPayable to fund accounting and administrationPayable to Transfer agencyPayable to DirectorsPayable for Custodian feesPayable for Audit feesOther payablesTotal LiabilitiesNet AssetsNET ASSETS CONSIST OF:Paid‐in capitalTotal distributable earnings (accumulated deficit)Net AssetsPRICING OF SHARES:Net AssetsShares of common stock outstanding (40,000,000 of shares authorized, at 0.0001 par value per share)Net asset value per 25,914,1921,470 ,71846,432138,67143,886,80882,027,384 97,791,128(15,763,744)82,027,384 82,027,384 4,112,78219.94See Notes to Financial Statements.Semi-Annual Report December 31, 202115

RiverNorth Specialty Finance CorporationStatement of OperationsFor the Six Months Ended December 31, 2021 (Unaudited)INVESTMENT INCOME:Interest IncomeDividend IncomeTotal Investment Income EXPENSES:Dividends to redeemable preferred stockInvestment Adviser feeLoan service feesAmortization of preferred stock and credit facility issuance costAccounting and Administration feesDirector expensesAudit expensesTransfer agent expensesValuation expensesInterest expense on loan payableLegal expensesPrinting expensesCompliance expenseCustodian feesInsurance feeOther expensesTotal expenses before recoupment of previously reimbursed expensesRecoupment of previously reimbursed expensesNet expensesNet Investment 6,7003,142,60360,3083,202,9117,057,524REALIZED AND UNREALIZED GAIN/(LOSS):Net realized gain/(loss) on:InvestmentsNet realized lossNet change in unrealized appreciation/depreciation on:InvestmentsNet change in unrealized appreciation/depreciationNet Realized and Unrealized Loss on InvestmentsNet Increase in Net Assets Resulting from 1,180,997)(2,429,886)(2,429,886) (3,610,883)3,446,641See Notes to Financial Statements.16(888) 848-7569 www.rivernorth.com

RiverNorth Specialty Finance CorporationStatements of Changes in Net AssetsFor theSix Months EndedDecember 31, 2021(Unaudited)NET INCREASE/(DECREASE) IN NET ASSETS FROMOPERATIONS:Net investment incomeNet realized gain/(loss)Net change in unrealized appreciation/depreciationNet increase in net assets resulting from operations DISTRIBUTIONS TO SHAREHOLDERS:From distributable earningsFrom tax return of capitalNet decrease in net assets from distributions toshareholdersCAPITAL SHARE TRANSACTIONS:Cost of shares redeemedNet decrease in net assets from capital sharetransactionsNet Decrease in Net AssetsNET ASSETS:Beginning of periodEnd of period 7,057,524(1,180,997)(2,429,886)3,446,641For theYear EndedJune 30, 2021 75)(9,371,426)91,377,65982,027,384 100,749,08591,377,659See Notes to Financial Statements.Semi-Annual Report December 31, 202117

RiverNorth Specialty Finance CorporationStatement of Cash FlowsFor the Six Months Ended December 31, 2021 (Unaudited)CASH FLOWS FROM OPERATING ACTIVITIES:Net increase in net assets resulting from operationsAdjustments to reconcile net increase in net assets from operations to netcash provided by operating activities:Purchases of investment securitiesProceeds from disposition and paydowns on investment securitiesAmortization of premium and accretion of discount on investments, netNet proceeds from short‐term investment securitiesAmortization of preferred share deferred costsNet realized (gain)/loss on:InvestmentsNet change in unrealized appreciation/depreciation on:Investments(Increase)/Decrease in assets:Interest receivableDividends receivableReceivable for principal paymentsPrepaid and other assetsIncrease/(Decrease) in liabilities:Decrease in interest due on loan payableDividend payable ‐ redeemable preferred stockPayable to Transfer agencyPayable to AdviserPayable to fund accounting and administration feesPayable to Directors and OfficersPayable for Audit feesPayable for Custodian feesOther payablesNet cash provided by operating activities 45,4051,180,9972,429,88686,17966,553416,075721 3332,01421,283,161CASH FLOWS FROM FINANCING ACTIVITIES:Proceeds f

XAI Octagon Floating Rate Alternative Income Term Trust 5.51% PennantPark Floating Rate Capital, Ltd. 4.99% BlackRock Capital Investment Corp. 4.67% BlackRock TCP Capital Corp. 3.63% . Delwinds Insurance Acquisition Corp. 18,890 187,200 DHC Acquisition Corp. 35,466 345,084 DiamondHead Holdings Corp. 227 2,212 .