Transcription

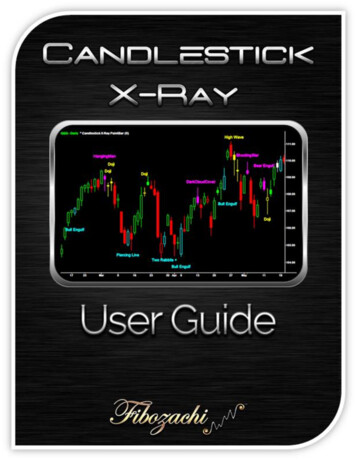

The Candlestick X-Ray Indicator Package: State-of-the-Art Pattern DetectionPage 3An Overview of the Candlestick X-Ray FeaturesPage 5The Complete List of Candlestick Patterns: 92 Fibonacci-Based PatternsPage 6Candlestick X-Ray PaintBar: Color-Coded Candlestick PatternsPage 7-Configuring and Customizing the PaintBarCandlestick X-Ray Indicator: Detect Any Candlestick Pattern-Configuring and Customizing the IndicatorAutomated Scanning Capabilities: Scanning for Crossovers & DivergencesPage 8Page 9Page 10Page 11-NinjaTrader Market AnalyzerPage 11-TradeStation RadarScreenPage 13-TradeStation Scanner ToolPage 15Frequently Occurring Intra-Day PatternsPage 16Our Favorite Candlestick PatternsPage 17Expert Tips & Advice: Scanning for Crossovers & DivergencesPage 18-Expert Tip #1: Candlestick Patterns Establish Strong S/R LevelsPage 18-Expert Tip #2: Incorporate Volume Analysis with Candlestick PatternsPage 19-Expert Tip #3: Pay Close Attention to Dojis after Rallies & SelloffsPage 20-Expert Tip #4: Use Patterns to Define Profit-Target & Stop-Loss LevelsPage 21– Continued on the Next Page – 2009-2020 Fibozachi LLC – www.fibozachi.com. All Rights Reserved.1

Superior Coding, Formulas, and Indicators: Filtering Out Weak PatternsPage 22-Problem #1: Missed Signals on “Big” and “Small” StocksPage 22-Problem #2: Incorrect Formulas & Labeling of Candlestick PatternsPage 24Harnessing the Power of Fibonacci: The Science behind our FormulasPage 25Superior Customer SupportPage 27Risk Disclosure StatementPage 28 2009-2020 Fibozachi LLC – www.fibozachi.com. All Rights Reserved.2

The Candlestick X-Ray is the most comprehensive, feature-rich collection ofcandlestick pattern Indicators on the commercial market. Whether you'reinterested in the most common or advanced patterns — the Indicator, PaintBar,and Scanner detect over 90 unique candlestick patterns — significantly more thanany other indicator or software.The Candlestick X-Ray outperforms all competitors by using strictly coded,Fibonacci-based formulas that filter out low-quality patterns. This ensures that onlythe strongest candlestick patterns are detected — avoiding weak, unreliablepatterns that plague other software and indicators. Other candlestick tools on themarket lack a proper understanding of the rules behind each pattern — resulting inincorrect formulas. This can have disastrous consequences if you're makingtrading decisions based on false patterns. 2009-2020 Fibozachi LLC – www.fibozachi.com. All Rights Reserved.3

To solve this problem, we devised each pattern's formula after studying all thecandlestick-related literature that we could get our hands on. Since manycandlestick patterns and their respective formulas are neither qualitatively definednor uniformly agreed amongst candlestick "experts", we have combined theirvarious interpretations to determine the specific rules for each pattern. We alsowent a step further to incorporate Fibonacci numbers and ratios into many of ourformulas — creating multi-faceted, extremely powerful candlestick patternIndicators. (More detailed information on pages 22-26).The Candlestick X-Ray Indicator Package includes: 2009-2020 Fibozachi LLC – www.fibozachi.com. All Rights Reserved.4

- Our 92 candlestick patterns is significantly more than ANY othercandlestick-related Indicators or software – nothing else even comes close.- Our strictly coded, Fibonacci-based formulas filter out low-qualitypatterns. This ensures that only the strongest candlestick patterns aredetected – avoiding weak, unreliable and "border-line" patterns thatplague other software and indicators.- The most important and valuable aspect of any candlestick patternsoftware is the ability to scan for patterns and signals. We includespecialized “scanner’ Indicators and templates that are explicitly designedto scan any list of symbols for any and all candlestick patterns.- Users can enable or disable any of the candlestick patterns to reducechart clutter and only be notified of the most important patterns. All colorsand text labels are also fully customizable to give you complete control.- Users can configure alerts for any patterns, allowing for audio, visual, andemail alerts and notifications to ensure that you won’t miss any signals. 2009-2020 Fibozachi LLC – www.fibozachi.com. All Rights Reserved.5

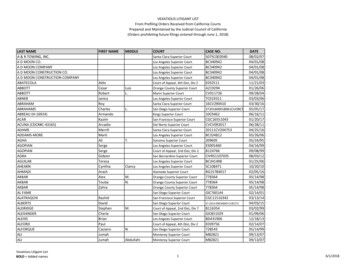

Abandoned Baby BullHarami BullishSqueeze Alert BullAbandoned Baby BearHarami BearishSqueeze Alert BearAdvance BlockHarami CrossThree Inside UpBullish EngulfingHigh Price Gap BullThree Inside DownBearish EngulfingHigh WaveThree Outside UpBullish KickingHoming Pigeon BullThree Outside DownBearish KickingIn NeckThree White SoldiersBreakaway BullishOn NeckThree Identical SoldiersBreakaway BearishLadder BottomThree Black CrowsConcealed Baby Swallow BullLadder TopThree Identical CrowsConcealed Baby Swallow BearLow Price Gap BearThree Line Strike BullDark Cloud CoverMarubozu WhiteThree Line Strike BearDeliberation BullMarubozu BlackThree Stars NorthDeliberation BearMatching LowThree Stars SouthDescending HawkMatching HighThree River BottomDescent BlockMat Hold BullishThree Mountain TopDojiMat Hold BearishThrusting BullPerfect DojiMeeting Lines BullThrusting BearDragonflyMeeting Lines BearTidal WaveEvening Doji StarMorning Doji StarTri Star BullishEvening StarMorning StarTri Star BearishFalling Three MethodPiercing LineTweezer TopFour Price DojiRising Three MethodTweezer BottomGravestoneSeparating Lines BullTwo CrowsHammerSeparating Lines BearTwo RabbitsPerfect HammerShooting StarUpside Gap Two RabbitsHanging ManPerfect Shooting StarDownside Gap Two CrowsPerfect Hang ManSide by Side BullUpside Gap Three MethodInverted HammerSide by Side BearDownside Gap Three MethodPerfect Inverted HammerStick Sandwich BullUpside Tasuki GapStick Sandwich BearDownside Tasuki Gap 2009-2020 Fibozachi LLC – www.fibozachi.com. All Rights Reserved.6

The Candlestick X-Ray PaintBar color-codes the price bars and provides a textlabel of the pattern name whenever a valid candlestick pattern is detected. It isfully customizable, allowing you to choose whether to show all patterns or only thespecific patterns that you want to see. It comes with a default setting of Cyan forbullish patterns, Magenta for bearish patterns and Yellow for indecisive or neutralpatterns (since most traders use green and red colored bars to display priceaction). 2009-2020 Fibozachi LLC – www.fibozachi.com. All Rights Reserved.7

*** Go to Format Symbol - Scaling and make Sub-Graph Margins 10% ormore on both the top and bottom so that all the patterns and text will fit onyour chart. (this tip is for TradeStation and MultiCharts users only)*** To disable any of the patterns, simply go to the tool’s Format / Inputs screenwhere you will see each pattern listed alphabetically with On/Off and acorresponding value of “1” next to it. To disable a pattern so that both its bar colorand text label are no longer displayed, change the value to “0”.*** To change the color of the bar or the text for any of the patterns, simply goto the tool’s Format / Inputs screen where you will see each pattern listedalphabetically with a corresponding color next to it. Each pattern has two colorsettings: one setting for the bar color and one setting for the text color. Thisenables each user to deactivate or remove the text labels for any patterns thatthey do not want, as well as the ability to change the color of the bar when a validpattern occurs. Choose each color you would like to use by replacing the text withyour new color choice. If you would only like to remove the text labels from somepatterns but want the bar to be a different color, you may do so by changing thetext color to match your background (most likely “black”). This is particularly usefulif you decide to remove excessive engulfing or advancing patterns that can occurwithin small intraday timeframes. 2009-2020 Fibozachi LLC – www.fibozachi.com. All Rights Reserved.8

Candlestick X-Ray Indicator plots color-coded histogram bars (vertical bars) inthe subpanel when a valid candlestick pattern is detected. It’s a bit less obtrusivethan the PaintBar text tool and can easily be changed to display all patterns oronly the specific patterns that you want to see. 2009-2020 Fibozachi LLC – www.fibozachi.com. All Rights Reserved.9

*** To disable any of the patterns, simply go to the tool’s Format / Inputs screenwhere you will see each pattern listed alphabetically with On/Off and acorresponding value of “1” next to it. To disable a pattern so that both its bar colorand text label are no longer displayed, change the value to “0”. This is particularlyuseful if you decide to remove excessive engulfing or advancing patterns that canoccur within small intraday timeframes. For example, if you only wish to knowwhen various dojis or marubozus occur, you can simply change the On/Off valuesof all the other patterns to “0”.*** To change the color for any of the patterns, simply go to the tool’s Format /Inputs screen where you will see each pattern listed alphabetically with acorresponding color next to it. Choose the color you would like to use for eachpattern by replacing the text with your new color choice. 2009-2020 Fibozachi LLC – www.fibozachi.com. All Rights Reserved.10

The Candlestick X-Ray also includes a special pre-formatted “Market Analyzer”Indicator and template for all NinjaTrader users. All of the columns, colors, andtext are completely customizable so that you can personalize it to your ownpreferences. Using the Candlestick X-Ray with the Market Analyzer allows youto quickly scan an entire list of symbols for all candlestick patterns in just seconds! 2009-2020 Fibozachi LLC – www.fibozachi.com. All Rights Reserved.11

A special pre-formatted Market Analyzer template is included for all NinjaTraderusers. If you would like to create your own templates, you must adhere to thefollowing values when setting up your own cell conditions:Abandoned Baby Bull 100Harami Bullish 69Squeeze Alert Bull 39Abandoned Baby Bear 99Harami Bearish 68Squeeze Alert Bear 38Advance Block 98Harami Cross 70Three Inside Up 37Bullish Engulfing 97High Price Gap Bull 67Three Inside Down 36Bearish Engulfing 96High Wave 66Three Outside Up 35Bullish Kicking 95Homing Pigeon Bull 65Three Outside Down 34Bearish Kicking 94In Neck 64Three White Soldiers 33Breakaway Bullish 93On Neck 63Three Identical Soldiers 32Breakaway Bearish 92Ladder Bottom 62Three Black Crows 31Conceal Baby Swallow Bull 91Ladder Top 61Three Identical Crows 30Conceal Baby Swallow Bear 90Low Price Gap Bear 60Three Line Strike Bull 29Dark Cloud Cover 89Marubozu White 59Three Line Strike Bear 28Deliberation Bull 88Marubozu Black 58Three Stars South 27Deliberation Bear 87Matching Low 57Three Stars North 26Descending Hawk 86Matching High 56Three River Bottom 25Descent Block 85Mat Hold Bullish 55Three Mountain Top 24Doji 83Mat Hold Bearish 54Thrusting Bull 23Perfect Doji 84Meeting Lines Bull 53Thrusting Bear 22Dragonfly 82Meeting Lines Bear 52Tidal Wave 21Evening Doji Star 81Morning Doji Star 51Tri Star Bullish 20Evening Star 80Morning Star 50Tri Star Bearish 19Falling Three Method 79Piercing Line 49Tweezer Bottom 18Four Price Doji 78Rising Three Method 48Tweezer Top 17Gravestone 77Separating Lines Bull 47Two Rabbits 16Hammer 75Separating Lines Bear 46Two Crows 15Perfect Hammer 76Shooting Star 44Downside Gap Two Crows 14Hanging Man 73Perfect Shooting Star 45Upside Gap Two Rabbits 13Perfect Hang Man 74Side by Side Bull 43Up Gap Three Method 12Inverted Hammer 71Side by Side Bear 42Down Gap Three Method 11Stick Sandwich Bull 41Upside Tasuki Gap 10Stick Sandwich Bear 40Downside Tasuki Gap 9Perfect Inverted Hammer 72 2009-2020 Fibozachi LLC – www.fibozachi.com. All Rights Reserved.12

The Candlestick X-Ray also includes a special pre-formatted “RadarScreen”Indicator and template for all TradeStation users. All of the columns, colors, andtext are completely customizable so that you can personalize it to your ownpreferences. Using the Candlestick X-Ray with the RadarScreen allows you toquickly scan an entire list of symbols for all candlestick patterns in just seconds! 2009-2020 Fibozachi LLC – www.fibozachi.com. All Rights Reserved.13

The Candlestick X-Ray also includes a special pre-formatted “Market Scanner”Indicator and template for all MultiCharts users. All of the columns, colors, and textare completely customizable so that you can personalize it to your ownpreferences. Using the Candlestick X-Ray with the Market Scanner allows youto quickly scan an entire list of symbols for all candlestick patterns in just seconds! 2009-2020 Fibozachi LLC – www.fibozachi.com. All Rights Reserved.14

We have found that scanning intraday for our favorite patterns can be quite usefulas an “early warning” detection system, since the Candlestick X-Ray Scannercan display valid daily patterns before the trading day has ended. In other words,you can see which stocks exhibit valid pattern setups at 12 PM (EST) rather thanhaving to wait for the close at the end of the trading day.*** While this screening technique allows for aggressive pre-emptive strategies,always exercise extreme caution when doing so because a pattern that appearsvalid at 12 PM (EST) may prove to be invalid at 4 PM on close.We prefer using the Candlestick X-Ray Scanner to keep an eye on whichpatterns are developing within a specific group of key issues at around 10:30 –10:45 am, 2:15 – 2:30 pm and once again at 3:35 – 3:50 pm (EST). 2009-2020 Fibozachi LLC – www.fibozachi.com. All Rights Reserved.15

To avoid excessive chart clutter and unnecessary signals when analyzing smallintraday timeframes that are below 5 minute or 15 minute intervals, werecommended eliminating patterns that can occur too frequently, such as: Bullish & Bearish Engulfing; Bullish & Bearish Marubozu; Three Inside Up, Three Inside Down; Three Outside Up, Three Outside Down; Three White Soldiers / Three Black Crows; Matching High / Matching Low; Tweezer Top / Tweezer Bottom; 2009-2020 Fibozachi LLC – www.fibozachi.com. All Rights Reserved.16

Abandoned Baby, Morning Doji Star & Evening Doji Star- High probability reversal patterns with expanding volatility and explosive priceactionAdvance Block, Descent Block, Deliberation- These patterns often coincide with significantly overbought / oversold conditions,signaling that trend momentum is markedly waningHigh Wave- These patterns often coincide with significant turning points in market character,reflecting drastic changes in price action (e.g. March 6th, 2009)Homing Pigeon & Descending Hawk- Provide extraordinary risk / reward ratiosPiercing Line, Dark Cloud Cover, Thrusting- High probability reversal patterns 2009-2020 Fibozachi LLC – www.fibozachi.com. All Rights Reserved.17

- Wait for price to revert to the support/resistance established where the patternoccurred and enter there for a greater risk/reward ratio. If price fails to revert,leaving you with a missed trade, OH WELL!There is no harm and no foul in missing a trade when it fails to meet your riskcontrol parameters, regardless of how it plays out.By exercising technicaldiscipline and emotional patience with your candlestick pattern trading, you cansignificantly increase both your success rate and risk/reward ratio. 2009-2020 Fibozachi LLC – www.fibozachi.com. All Rights Reserved.18

- It’s a general rule that candlestick patterns which occur on increased volumeexhibit greater probabilities for follow-through. If a valid pattern setup looks goodbut volume is either suspiciously lacking or utterly unconvincing, prudencewarrants exercising caution. This simple, straightforward tip can greatly enhanceyour candlestick analysis. 2009-2020 Fibozachi LLC – www.fibozachi.com. All Rights Reserved.19

- Pay more attention to “dojis” which occur after prolonged or extended rallies(possible tops) rather than those occurring after extensive sell-offs (possiblebottoms). While it is fundamentally correct that “going up” simply requires greatercumulative buying than selling, we have observed that doji signals exhibit muchgreater probabilistic predictive power and hence effective value for traders whenthey follow exhaustive rallies. 2009-2020 Fibozachi LLC – www.fibozachi.com. All Rights Reserved.20

- You can project effective price targets and stop loss levels when employingmany candlestick patterns. Placing your stop either just underneath the low orhigh of the respective pattern (depending on bullish or bearish character) is asimple, straightforward way to effectively manage risk and minimize time decay.For your price target, adding or subtracting the pattern’s High-Low range to the topor bottom of the breakout level is another simple and straightforward way tocalculate a realistically achievable price target. 2009-2020 Fibozachi LLC – www.fibozachi.com. All Rights Reserved.21

All “doji-based” as well as “matching high or low” patterns that require an equalopen, high, low and/or close are simply impossible to code for both “high-priced”and “low-priced” issues when utilizing formulas which require precision; thisprevents many candlestick patterns from registering valid signals on “high-priced”stocks, “penny” stocks, bonds, futures, or options.We believe that our coding has solved this problem by requiring the definition of a“doji” and a “matching high or low” to have a real body (Open - Close) that is lessthan approximately 13% of the current bar’s trading range (High-Low). This allowsfor “high-priced” stocks (e.g. several hundred dollars) such as GOOG or PCLN toexhibit effective signals for these patterns in situations where “simple” coding fallsshort. We have also provided many of the original patterns, in addition to ourcustom modified patterns.*** Patterns with an “ ” after them are the “textbook” codes that requireexact Opens / Closes / Highs / Lows. 2009-2020 Fibozachi LLC – www.fibozachi.com. All Rights Reserved.22

GOOG opens at 400.50 and closes at 400.00, where the Low is 397.00 and theHigh is 405.00.“Simple” Coding: fails to classify as a “Doji” day; no pattern is registered.Fibozachi Coding: recognizes that the 50-cent real body is only 6.25% of theHigh-Low range, thereby correctly registering as a “Doji” day.FNM opens at 1.10 and closes at 1.09, where the Low is 1.00 and the High is1.20.“Simple” Coding: fails to classify as a “Doji” day; no pattern is registered.Fibozachi Coding: recognizes that the 1-cent real body is only 5% of the HighLow range, thereby correctly registering as a “Doji” day. 2009-2020 Fibozachi LLC – www.fibozachi.com. All Rights Reserved.23

Many other candlestick pattern tools on the market have fundamentalmisconceptions about candlestick patterns and incorrect formulas of certainpatterns; as a result, they plot invalid patterns and often miss the good ones.As systematic candlestick traders, we find such programming errors utterlyunacceptable. We have painstakingly proofed every one of the 156,335 characterswithin each of the 4,445 specific lines of code that comprise the Candlestick XRay Package and take great pride in the quality of our work.Understanding the inherent price action within specific patterns adds a criticalcomponent to one’s knowledge of candlesticks. Employing such nificantlyenhancetheeffectiveness of their predictive value.“Simple” Coding: incorrectly plots the hammer, inverted hammer, hanging manand shooting star, due to the lack of an added rule requiring that an uptrend ordowntrend MUST be present. (Hammers that register after a selloff is much morevaluable than a hammer that registers during a rally).Fibozachi Coding: includes an added rule, where the midpoint of the current barmust also be above or below the 8-day SMA, which confirms the presence of anuptrend / downtrend. This helps to properly validate candlestick pattern signals. 2009-2020 Fibozachi LLC – www.fibozachi.com. All Rights Reserved.24

We have devised each formula within our candlestick patterns in a comprehensivefashion. Since many candlestick patterns and their respective formulas are neitherqualitatively defined nor uniformly agreed upon by the several seminal authors ofcandlestick literature, we have both manually and mathematically assessed thevarious interpretations to determine the formula and rules behind each pattern.Additionally, we have incorporated Fibonacci numbers and their derivative ratiosinto the vast majority of our uniquely coded candlestick pattern formulas, resultingin the creation of multifaceted and extremely powerful candlestick patternIndicators.The following is a prime example of our initial frustration during the earlystages of the developmental process:Author “X” states that a hammer’s lower shadow must be at least 2 times thelength of its real body, where author “Y” states that a hammer’s lower shadowmust be at least 3 times the length of its real body. If we follow the guideline of Author “X” we catch all signals, though they maybe probabilistically weaker than those of Author “Y”. If we follow the guideline of Author “Y” we may miss some signals, thoughthey may be probabilistically greater than those of Author “X”. 2009-2020 Fibozachi LLC – www.fibozachi.com. All Rights Reserved.25

Rather than relying on amorphous guidelines, our rule states that a hammer’slower shadow must be at least 2.236 times the length of its real body. We alsodefine that the Upper Shadow * 7.618 High-Low Range; in other words, theupper shadow must be less than 13.13% of the bar’s entire range for the hammerpattern to verifiably confirm itself, thereby forming a valid signal.*** Our “Standard” Doji, Hammer, Inverted Hammer, Hanging Man, and ShootingStar Patterns employ the “13% Rule”, where Open - Close 13% of the Range.We have also included “Perfect Pattern” versions (for classic candlestick patterntraders), wherever applicable, which employ a “3% Rule” in order to isolate onlythe strongest, most “textbook” patterns that the market has to offer. 2009-2020 Fibozachi LLC – www.fibozachi.com. All Rights Reserved.26

Have a question about the Candlestick X-Ray Indicator Package? Contactus at support@fibozachi.com. We take great pride in our customer supportand are happy to help our fellow traders! 2009-2020 Fibozachi LLC – www.fibozachi.com. All Rights Reserved.27

The terms “Company”, “us” or “we” refer to Fibozachi.com, its parent company Fibozachi LLC, and allsubsidiaries, affiliates, officers or employees therein. The term “you” refers to the user or customer ofFibozachi.com. The terms “Content” and “Information” refer to the indicators, tools, strategies,techniques, systems, manuals, data, communications and any other associated products or material ofthe Company.License:You are purchasing a single user license. You may not: copy, modify, publish, retransmit, participate inthe transfer or sale of, distribute, perform, display, or create derivative works from, any of the Content orInformation in any way.Disclaimer:All Content and Information provided is for educational purposes only. Fibozachi.com and Fibozachi LLC(the “Company”) is not an investment advisory service, broker-dealer, commodity trading advisor, legaladvisor, tax advisor, or registered investment advisor, and does not purport to tell or suggest whichcommodities, currencies or securities customers should buy or sell for themselves. The affiliates,employees or officers of the Company may hold positions in the commodities, currencies or securitiesdiscussed here.You understand and acknowledge that there is a high degree of risk involved in trading commodities,currencies or securities. You also understand and acknowledge that there is an extremely high degreeof risk involved in trading leveraged vehicles such as futures or options, where you can lose more thanthe initial sum of your investment. The Company, its subsidiaries, affiliates, officers and employeesassume no responsibility or liability for your trading or investment results.It should not be assumed that the indicators, tools, strategies, techniques, systems, manuals, data,communications or any other associated products and material of the Company, collectively the“Content” and “Information,” presented in its products or services will be profitable or that they will notresult in losses. Past results of any individual trader or trading system published by Company are notindicative of future returns by that trader or system, and are not indicative of future returns, which may ormay not be realized by you. In addition, the articles, blogs, chat, columns, indicators, methods,strategies, systems, techniques, tools, and all other features of Company's website (collectively, the“Information”) are provided for educational purposes only and should not be construed as investmentadvice. Any articles, blogs, chat, columns, comments, discussions, drawings, and examples, includingany other items intended to illustrate Information presented on Company's website, are for educationalpurposes only; such are not solicitations of any order to buy or sell. Accordingly, you should not relysolely on the Information in making any investment. Rather, you should use the Information only as astarting point for doing additional independent research in order to allow you to form your own opinionregarding any investment. You should always check with your licensed financial advisor and tax advisorto determine the suitability of any investment. 2009-2020 Fibozachi LLC – www.fibozachi.com. All Rights Reserved.28

IN CONSIDERING WHETHER TO TRADE, YOU SHOULD BE AWARE OF THE FOLLOWING:HYPOTHETICAL OR SIMULATED PERFORMANCE RESULTS HAVE CERTAIN INHERENTLIMITATIONS. UNLIKE AN ACTUAL PERFORMANCE RECORD, SIMULATED RESULTS DO NOTREPRESENT ACTUAL TRADING AND MAY NOT BE IMPACTED BY BROKERAGE AND OTHERSLIPPAGE FEES. ALSO, SINCE THE TRADES HAVE NOT ACTUALLY BEEN EXECUTED, THERESULTS MAY HAVE UNDER- OR OVER-COMPENSATED FOR THE IMPACT, IF ANY, OF CERTAINMARKET FACTORS, SUCH AS LACK OF LIQUIDITY. SIMULATED TRADING PROGRAMS INGENERAL ARE ALSO SUBJECT TO THE FACT THAT THEY ARE DESIGNED WITH THE BENEFITOF HINDSIGHT. NO REPRESENTATION IS BEING MADE THAT ANY ACCOUNT WILL OR IS LIKELYTO ACHIEVE PROFITS OR LOSSES SIMILAR TO THOSE SHOWN.TRADING IS AN EXTREMELY DIFFICULT PROBABILISTIC ENDEAVOR THAT REQUIRESTECHNICAL SKILL AND EMOTIONAL DISCIPLINE AT THE VERY MINIMUM. EVEN A GREATTRADER WITH EXCELLENT ANALYSIS, RESOURCES, TOOLS, TECHNIQUES, STRATEGIES,PLANS, CONTINGENCIES, AND EXPLICITLY DEFINED RULES FOR MANAGING RISK EXPOSUREIS OFTEN WRONG. THERE ALWAYS REMAIN REAL AND UNQUANTIFIABLE RISKS SUCH ASGOVERNMENT INTERVENTION OF RULE / LAW CHANGES. RISK PREVENTION MEASURES SUCHAS PROTECTIVE STOPS DO NOT PREVENT THE RISK OF GAP OPENINGS OR LOCK-LIMITMOVES.YOU AGREE THAT NEITHER FIBOZACHI LLC, NOR ITS SUBSIDIARIES, AFFILIATES, OFFICERSOR EMPLOYEES, SHALL BE LIABLE TO YOU OR ANY OTHER THIRD PARTY FOR ANY DIRECT,INDIRECT, INCIDENTAL, SPECIAL, OR CONSEQUENTIAL DAMAGES. MEMBERS AND VISITORS(“USERS”) AGREE TO INDEMNIFY AND HOLD FIBOZACHI LLC, AND ITS SUBSIDIARIES,AFFILIATES, OFFICERS AND EMPLOYEES, HARMLESS FROM ANY CLAIM OR DEMAND,INCLUDING REASONABLE ATTORNEYS’ FEES, MADE BY ANY THIRD PARTY DUE TO ORARISING OUT OF A USER’S USE OF FIBOZACHI LLC’S WEBSITE.TradeStation Disclaimer:“Neither TradeStation Technologies nor any of its affiliates has reviewed, certified, endorsed, approved,disapproved or recommended, and neither does or will review, certify, endorse, approve, disapprove orrecommend, any trading software tool that is designed to be compatible with the TradeStation OpenPlatform.” 2009-2020 Fibozachi LLC – www.fibozachi.com. All Rights Reserved.29

- Our 92 candlestick patterns is significantly more than ANY other candlestick-related Indicators or software - nothing else even comes close. - Our strictly coded, Fibonacci-based formulas filter out low-quality patterns. This ensures that only the strongest candlestick patterns are detected - avoiding weak, unreliable and "border-line .