Transcription

1 IAS 16 Property, plant and equipmentIAS 16 PROPERTY,PLANT AND EQUIPMENTFACT SHEET

2 IAS 16 Property, plant and equipmentThis fact sheet is based on existing requirements as at 31 December 2015 and it does not take into account recentstandards and interpretations that have been issued but are not yet effective.IMPORTANT NOTEThis fact sheet is based on the requirements of the International Financial Reporting Standards (IFRSs). In somejurisdictions, the IFRSs are adopted in their entirety; in other jurisdictions the individual IFRSs are amended. Insome jurisdictions the requirements of a particular IFRS may not have been adopted. Consequently, users of thefact sheet in various jurisdictions should ascertain for themselves the relevance of the fact sheet to their particularjurisdiction. The application date included below is the effective date of the initial version of the standard unlessotherwise stated.

3 IAS 16 Property, plant and equipmentIASB APPLICATION DATE(NON-JURISDICTION SPECIFIC)IAS 16 was reissued in December 2003 and is applicablefor annual reporting periods commencing on or after1 January 2005.OBJECTIVEThe objective of IAS 16 is to prescribe the accountingtreatment for property, plant and equipment so that usersof the financial statements can discern information aboutan entity’s investment in its property, plant and equipmentand the changes in such investment.The principal issues in accounting for property, plantand equipment are the recognition of the assets,the determination of their carrying amounts and thedepreciation charges and impairment losses to berecognised in relation to them.SCOPEIAS 16 shall be applied in accounting for property,plant and equipment except for: p roperty, plant and equipment classified as held for salein accordance with IFRS 5 Non-current Assets Held forSale and Discontinued Operations; b iological assets related to agricultural activity– refer IAS 41 Agriculture; r ecognition and measurement of explorationand evaluation assets – refer IFRS 6 Explorationfor and Evaluation of Mineral Resources; or m ineral rights and mineral reserves such as oil,natural gas and similar non-regenerative resources.

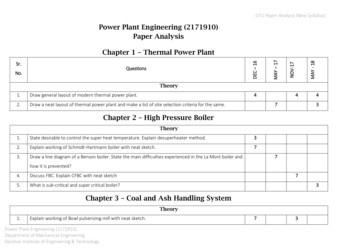

4 IAS 16 Property, plant and equipmentRECOGNITION AND MEASUREMENTRecognition and initial measurementThe cost of an item of property, plant and equipmentis recognised as an asset if, and only if:a. i t is probable that future economic benefitsassociated with the item will flow to the entity; andb. the cost of the item can be measured reliably.The costs of day-to-day servicing of an asset arenot included in the carrying amount of the asset butexpensed when incurred.An item of property, plant and equipment that satisfiesthe recognition criteria is measured at cost.The cost of an item of property, plant and equipmentcomprises:a. i ts purchase price; including duties and taxes,less trade discounts and rebates;b. a ny costs directly attributable to bringing the assetto the location and condition necessary for it to becapable of operating in the manner intended bymanagement; andc. t he initial estimate of the costs of dismantlingand removing the items and restoring the site onwhich it is located, the obligation for which anentity incurs either when the item is acquired oras a consequence of having used the item duringa particular period for purposes other than toproduce inventories during that period.Measurement after recognitionAfter initial recognition, the entity may choose betweenthe cost model and the revaluation model as its accountingpolicy. The policy chosen shall be applied to an entire classof property, plant and equipment.Cost ModelCost less any accumulated depreciation and anyaccumulated impairment losses.Revaluation ModelFair value at the date of revaluation, less any subsequentaccumulated depreciation and any subsequentaccumulated impairment losses. Revaluations are to bemade with sufficient regularity that the carrying amountdoes not differ materially from that which would bedetermined using fair value at the end of the reportingperiod.If an item of property, plant and equipment is revalued, theentire class of property, plant and equipment to which thatasset belongs is revalued.The accounting treatment prescribed by IAS 16is summarised in Diagram 1.

5 IAS 16 Property, plant and equipmentDIAGRAM 1: ACCOUNTING FOR PPECarrying value of PPE class is costless accumulated depreciation andany accumulated impairement lossesCost Model foreach class ofPPETangible PPEqualifies forrecognitionas an assetCostMeasurementat recognitionMeasurementsubsequentto recognitionORRevaluation increasescarrying value ofan assetRevaluationModel of eachclass of PPECarrying value of PPEclass is fair value at dateof revaluation less anysubsequent accumulateddepreciation andaccumulatedimpairment lossRevaluation decreasescarrying valueof an assetRecognised directly in othercomprehensive income andaccumulated in equity under theheading of Revaluation Surplus(unless reversing a previousdecrease of same asset previouslyrecognised in profit or loss).Recognised in profit or loss (unlessreversing a previous increase ofsame asset previously recognisedin other comprehensive income)

6 IAS 16 Property, plant and equipmentDepreciation Each part of an item of property, plant and equipmentwith a cost that is significant in relation to the total costof the item shall be depreciated separately.ImpairmentIAS 36 Impairment of Assets is applied in determiningwhether an item of property, plant and equipment isimpaired and the determination of its recoverable amount. D epreciation of an asset begins when it is availablefor use, that is, when it is in the location and conditionnecessary for it to be capable of operating in themanner intended by management.DerecognitionThe carrying amount of an item of property, plant andequipment is derecognised on disposal; or when no futureeconomic benefits are expected from its use or disposal.Any gain or loss arising from a derecognition is included inprofit or loss when the derecognition occurs. Gains are notbe classified as revenue. T he depreciation charge for each period is recognisedin profit or loss unless it is included in the carryingamount of another asset such as inventory conversioncosts (IAS 2 Inventories) or the cost of an intangibleasset (IAS 38 Intangible Assets). T he depreciable amount of an asset is allocated ona systematic basis over its useful life. T he method of depreciation used should reflect thepattern in which the asset’s future economic benefits areexpected to be consumed by the entity (these methodsinclude the straight-line method, the diminishingbalance method and the units of production method). The residual value and the useful life of an asset shallbe reviewed at least at the end of each annualreporting period and, if expectations differ fromprevious estimates, the changes shall be accounted foras a change in an accounting estimate in accordancewith IAS 8 Accounting Policies, Changes in AccountingEstimates and Errors.

7 IAS 16 Property, plant and equipmentDISCLOSURESRefer to Appendix 1 for a checklist to assist with IAS 16 disclosure requirements.DEFINITIONSCarrying amountThe amount at which an asset is recognised after deductingany accumulated depreciation and accumulated impairmentlosses.CostThe amount of cash or cash equivalents paid or the fair valueof the other consideration given to acquire an asset at thetime of its acquisition or construction.Depreciable amountThe cost of an asset, or other amount substituted for cost,less its residual value.DepreciationThe systematic allocation of the depreciable amountof an asset over its useful life.Entity-specific valueThe present value of the cash flows an entity expects to arisefrom the continuing use of an asset and from its disposal atthe end of its useful life or expects to incur when settling aliability.Fair valueThe price that would be received to sell an asset or paid totransfer a liability in an orderly transaction between marketparticipants at the measurement date.Impairment lossThe amount by which the carrying amount of an assetexceeds its recoverable amount.Property, plant and equipmentTangible items that are: h eld for use in the production or supply of goodsor services, for rental to others, or for administrativepurposes; expected to be used during more than one period.Recoverable amountThe higher of an asset’s fair value less costs to sell and itsvalue in use.Residual valueThe estimated amount that an entity would currently obtainfrom disposal of the asset, after deducting the estimatedcosts of disposal, if the asset were already of the age and inthe condition expected at the end of its useful life.Useful lifeThe period over which an asset is expected to be available foruse by an entity or the number of production or similar unitsexpected to be obtained from the asset by an entity.

8 IAS 16 Property, plant and equipmentRELATED INTERPRETATIONS IFRIC 1 Changes in Existing Decommissioning,Restoration and Similar Liabilities IFRIC 18 Transfers of Assets from Customers IFRIC 20 Stripping Costs in the Production Phaseof a Surface Mine SIC 29 Service Concession Arrangements: DisclosuresIFRIC 18 and IFRIC 20 are relatively more significant thanthe others.IFRIC 18 applies to the accounting for transfers of itemsof property, plant and equipment by entities that receivesuch transfers from their customers. It also applies toagreements in which an entity receives cash from acustomer when that amount of cash must be used onlyto construct or acquire an item of property, plant andequipment (PP&E) and the entity must then use the itemof PP&E either to connect the customer to a network orto provide the customer with ongoing access to a supplyof goods or services, or to do both. The interpretationaddresses the following issues: Is the definition of an asset met? I f the definition of an asset is met, how should thetransferred item of PP&E be measured on initialrecognition? I f the item of PP&E is measured at fair value on initialrecognition, how should the resulting credit beaccounted for? H ow should the entity account for a transfer of cashfrom its customer?IFRIC 20 clarifies that the costs of removing mine wastematerials (overburden) to gain access to mineral oredeposits during the production phase of a surface minemust be capitalised as inventories under IAS 2 Inventories ifthe benefits from stripping activity is realised in the form ofinventory produced. On the other hand, if stripping activityprovides improved access to the ore, stripping costs mustbe capitalised as a non-current, stripping activity asset ifcertain recognition criteria are met (as an addition to, orenhancement of, an existing asset).

9 IAS 16 Property, plant and equipmentAUSTRALIAN SPECIFIC REQUIREMENTSThe Australian equivalent standard is AASB 116 Property,plant and equipment is applicable for annual reportingperiods commencing on or after 1 January 2005. Theequivalent Australian interpretations are: Interpretation 1 Changes in Existing Decommissioning,Restoration and Similar Liabilities Interpretation 18 Transfers of Assets from Customers Interpretation 20 Stripping Costs in the ProductionPhase of a Surface Mine I nterpretation 129 Service Concession Arrangements:DisclosuresMEASUREMENT CRITERIA FOR NOT-FORPROFIT ENTITIESWhen a not-for-profit entity acquires an asset for nil ornominal cost; the cost to be recorded on the statementof financial position is its fair value as at the date ofacquisition.REVALUATION MODELFor not-for-profit entities, changes in the carrying amountof an asset due to a revaluation are accounted for asfollows: a n increase in a class of assets’ carrying amountis recognised in other comprehensive income andaccumulated in equity under the heading of revaluationsurplus unless the increase reverses a previouslyrecognised revaluation decrease of the same class ofassets, in which case the increase is recognised in profitor loss to the extent it reverses the previous profit or lossrecognition. a decrease in carrying amount of a class of assetsis recognised in profit and loss unless the decreasereverses a previously recognised revaluation increaseof the same class of assets, in which case the decreaseis debited to other comprehensive income under theheading of revaluation surplus to the extent that itreverses the previous revaluation increment. r evaluation increases and decreases relating toindividual assets within a class of property, plant andequipment are offset against one another within theclass but are not offset in respect of assets in differentclasses.REDUCED DISCLOSURE REQUIREMENTS(RDR)On 30 June 2010, the Australian Accounting StandardsBoard published AASB 1053 Application of Tiers ofAustralian Accounting Standards (and AASB 2010-2Amendments to Australian Accounting Standards arisingfrom Reduced Disclosure Requirements) which establisheda differential reporting framework, consisting of two Tiersof reporting requirements for preparing general purposefinancial statements:a. Tier 1: Australian Accounting Standards; andb. T ier 2: Australian Accounting Standards– Reduced Disclosure Requirements.Tier 2 comprises the recognition, measurement andpresentation requirements of Tier 1 and substantiallyreduced disclosures corresponding to those requirements.A Tier 2 entity is a ‘reporting entity’ as defined in SAC1 Definition of the Reporting Entity that does not have‘public accountability’ as defined in AASB 1053 and is nototherwise deemed to be a Tier 1 entity by AASB 1053.RDR is applicable to annual periods beginning on or after1 July 2013.When developing AASB 1053, the AASB concluded thatthe Australian Government and state, territory and localgovernments should be subject to Tier 1 requirements.The AASB also decided that General Government Sectorsof the Australian Government and state and territorygovernments should continue to apply AASB 1049 Wholeof Government and General Government Sector FinancialReporting, without the reduction in disclosures provided byTier 2. Other public sector entities are able to apply Tier 2reporting requirements.The requirements that do not apply to RDR entities areidentified in Appendix 1 by shading of the relevant text.Additional disclosure requirements that are applicableto RDR entities only are included in a separate table inAppendix 1.RELATED INTERPRETATIONS AASB 1030 Depreciation of Long-Lived Physical Assets:Condition-Based Depreciation and Related Methods AASB 1055 Accounting for Road Earthworks

10 IAS 16 Property, plant and equipmentAPPENDIX 1 – DISCLOSURE CHECKLISTThis checklist can be used to review your financial statements. You should complete the “Yes / No / N/A” column aboutwhether the requirement is included. To ensure the completeness of disclosures, provide an explanation for “No” answers.YES /NO / N/ACODEIAS 16.73Is the following information disclosed for eachclass of property, plant and equipment:a. t he measurement bases used fordetermining the gross carrying amount;b. the depreciation methods used;c. t he useful lives or the depreciation ratesused;d. t he gross carrying amount and theaccumulated depreciation (aggregatedwith accumulated impairment losses) at thebeginning and end of the period; ande. a reconciliation of the carrying amountat the beginning and end of the periodshowing:–– additions;–– a ssets classified as held for sale orincluded in a disposal group classified as‘held for sale’ in accordance with IFRS 5and other disposals;–– a cquisitions through businesscombinations;–– i ncreases or decreases during the periodresulting from revaluations (under IAS16 paragraphs 31, 39, 40) and fromimpairment losses recognised or reverseddirectly in other comprehensive incomeunder IAS 36;–– i mpairment losses recognised in profit orloss in accordance with IAS 36;–– i mpairment losses reversed in profit or lossin accordance with IAS 36;–– depreciation;– the net exchange differences arising onthe translation of the financial statementsfrom the functional currency into adifferent presentation currency, includingthe translation of a foreign operation intothe presentation currency of the reportingentity;–– other changes?EXPLANATION(If required)

11 IAS 16 Property, plant and equipmentYES /NO / N/ACODEIAS 16.74Has the following information been disclosed:a. t he existence and amounts of restrictionson title, and property, plant and equipmentpledged as security for liabilities;b. the amount of expenditures recognised inthe carrying amount of an item of property,plant and equipment in the course of itsconstruction;c. the amount of contractual commitmentsfor the acquisition of property, plant andequipment; andd. if it is not disclosed separately in thestatement of comprehensive income, theamount of compensation from third partiesfor items of property, plant and equipmentthat were impaired, lost or given up that isincluded in profit or loss?IAS 16.77When items of property, plant and equipmentare stated at revalued amounts, has the followinginformation been disclosed:a. the effective date of the revaluation;b. w hether an independent valuer wasinvolved;c. f or each revalued class of property, plantand equipment, the carrying amount thatwould have been recognised had the assetsbeen carried under the cost model; andd. t he revaluation surplus, indicating thechange for the period and any restrictionson the distribution of the balance toshareholders?IAS 16.79The following disclosures are encouraged butnot required:a. t he carrying amount of temporarily idleproperty, plant and equipment;b. t he gross carrying amount of any fullydepreciated property, plant and equipmentthat is still in use;c. t he carrying amount of property, plant andequipment retired from active use and notclassified as held for sale in accordance withAASB 5; andd. w hen the cost model is used, the fair valueof property, plant and equipment whenthis is materially different from the carryingamount.EXPLANATION(If required)

12 IAS 16 Property, plant and equipmentAUSTRALIAN DISCLOSURE REQUIREMENTSIn respect of not-for-profit entities, for each revalued class of property, plant and equipment, the requirement to disclosethe carrying amount that would have been recognised had the assets been carried under the cost model does not apply.In addition to the requirements of paragraph 73 of IAS 16, in respect of not-for-profit entities, the reconciliation ofthe carrying amount at the beginning and end of the period needs to show the increases or decreases resulting fromrevaluations under paragraphs Aus 39.1, Aus 40.1 and Aus 40.2.ADDITIONAL DISCLOSURE REQUIREMENTS APPLICABLE TO RDR ENTITIES ONLYYES /NO / N/ACODEAASB 116.RDR 73.1An entity applying RDR is not required todisclose the reconciliation specified in paragraph73(e) for prior periodsEXPLANATION(If required)

13 IAS 16 Property, plant and equipmentOTHER MATTERSLEGAL NOTICE CPA Australia Ltd (ABN 64 008 392 452), 2011. All rightsreserved. Save and except for direct quotes from the AustralianAccounting Standards Board (AASB) and accompanyingdocuments issued by the Australian Accounting Standards Board(AASB) (“AASB Copyright”), all content in these materials is ownedby or licensed to CPA Australia. The use of AASB Copyrightin these materials is in accordance with the AASB’s Terms andConditions. All trademarks and trade names are proprietary toCPA Australia and must not be downloaded, reproduced orotherwise used without the express consent of CPA Australia.You may access and display these pages on your computer,monitor or other video display device and make one printedcopy of any whole page or pages for personal and professionalnon-commercial purposes only. You must not: (i) reproduce thewhole or part of these materials to provide to anyone else; or (ii)use these materials to create a commercial product or to distributethem for commercial gain.CPAH1814 02.16AASB Standards may contain IFRS Foundation copyright material(“IFRS Copyright”). Enquiries concerning reproduction of IFRSCopyright material within Australia should be addressed to TheDirector of Finance and Administration, AASB, PO Box 204, CollinsStreet West, Victoria 8007. All existing rights in this material arereserved outside Australia. Requests to reproduce IFRS Copyrightoutside Australia should be addressed to the IFRS Foundation atwww.ifrs.org. CPA Australia Ltd (ABN 64 008 392 452), 2010. All rightsreserved. Save and except for direct quotes from the InternationalFinancial Reporting Standards (IFRS) and accompanyingdocuments issued by the International Accounting Standards Board(IASB) (‘IFRS Copyright’), all content in these materials is owned byor licensed to CPA Australia. The use of IFRS Copyright in thesematerials is in accordance with the IASB’s Terms and Conditions. Alltrademarks and trade names are proprietary to CPA Australia andmust not be downloaded, reproduced or otherwise used withoutthe express consent of CPA Australia. You may access and displaythese pages on your computer, monitor or other video displaydevice and make one printed copy of any whole page or pages forpersonal and professional non-commercial purposes only. You mustnot: (i) reproduce the whole or part of these materials to provideto anyone else; or (ii) use these materials to create a commercialproduct or to distribute them for commercial gain. Requeststo reproduce IFRS Copyright should be addressed to the IFRSFoundation at www.ifrs.org.DISCLAIMERCPA Australia Ltd has used reasonable care and skill in compilingthe content of these materials. However, CPA Australia Ltdmakes no warranty that the materials are complete, accurate andup to date. These materials do not constitute the provision ofprofessional advice whether legal or otherwise. Users should seektheir own independent advice prior to relying on or entering intoany commitment based on the materials. The materials are purelypublished for reference purposes alone and individuals should readthe latest and complete standards.LIMITATION OF LIABILITYCPA Australia, its employees, agents and consultants excludecompletely all liability to any person for loss or damage of anykind including but not limited to legal costs, indirect, special orconsequential loss or damage (however caused, including bynegligence) arising from or relating in any way to the materialsand/or any use of the materials. Where any law prohibits theexclusion of such liability, then to the maximum extent permittedby law, CPA Australia’s liability for breach of the warranty will, atCPA Australia’s option, be limited to the supply of the materialsagain, or the payment of the cost of having them supplied again.

Measurement after recognition After initial recognition, the entity may choose between the cost model and the revaluation model as its accounting policy. The policy chosen shall be applied to an entire class of property, plant and equipment. Cost Model Cost less any accumulated depreciation and any accumulated impairment losses. Revaluation Model