Transcription

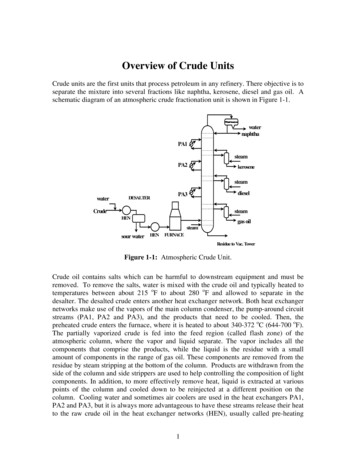

Commodity Options :Gold, Crude, Copper, Silver

WHY OPTIONS?An option contract offers the best of both worlds. It will offer the buyer ofthe contract protection if the price of the underlying moves against him butallows him to walk away from the deal if the underlying price moves in hisfavour.Options: Give buyer the “right”, but not the “obligation” To buy or to sell an agreed amount of underlying asset (NotionalValue) On or before an agreed future date (expiry date) At an agreed exchange rate (Strike Price) In exchange for fee (Option Premium)

Call Option A call option gives the buyer, the right but not the obligationto buy specified quantity of the underlying asset at the setstrike price on or before a specified date. The seller (writer) however, has the obligation to sell theunderlying asset if the buyer decides to exercise his option tobuy.

Put Option A Put option gives the buyer of the option the right but notthe obligation to sell specified quantity of the underlying assetat the set strike price on or before a specified date. The writer of the option however, has the obligation to buythe underlying asset if the buyer of the put option decides toexercise his option to sell.

WHAT ARE OPTIONS? An option is the right, but not the obligation, to buy or sell a futures contract & buyer of anoption acquires this right.Commodity Call Option : Buy asset (futures contract) in the future at a pre-determineddecided rate today.Commodity Put Option : Sell asset (futures contract) in the future at a pre-determineddecided rate today.

OPTION TERMINOLOGY Option price: Option price is the price which the option buyer pays tothe option seller. It is also referred to as the option premium. Expiration date: The date specified in the options contract is known asthe expiration date, the exercise date, the strike date or the maturity. Strike price: The price specified in the options contract is known asthe strike price or the exercise price. European options: European options are options that can beexercised only on the expiration date itself.

Some terms unique to options trading In the Money for Call Option: Futures contract value is abovestrike price In the Money for Put Option: Futures contract value is below strikeprice At the Money: Futures contract value equals strike price Out of Money for Call Option: Futures contract value is belowstrike price Out of Money for Put Option: Futures contract value is abovestrike price Open interest: The total number of options contracts outstanding oropen in the market at any given point of time.

FACTORS AFFECTING OPTION PRICESImplied Volatility How much does the Futures move? More Futures fluctuation Optionmore likely to be exercised Higher risk Higher PriceTimeFutures Direction (View) Which direction is the Futures likelyto move? Expected favourable Futuresmovement Option more likely tobe exercised Higher Risk Higher Price How much time left for the Futures toTail Riskmove? More time left Option more likely to Hugely ITM or OTM Options arecostlier than theoretical valuesbe exercised Higher Risk HigherPriceStrike Rate What is the rate that the Optionbecomes effective? Strike Rate closer Forward Rate Option more likely to be exercised Higher Risk Higher Price

Option StrategiesCall OptionPut OptionBuy Call(Bullish)Sell Call(Bearish)Buy Put(Bearish)Sell Put(Bullish)Unfixed GoldInventoryInventoryUnfixed GoldPremium LowPremium HighPremium LowPremium High

HOW ARE OPTIONS DIFFERENT FROMFUTURES?Futures ContractsOptions Contracts DefinitionAn agreement to buy or sell an underlyingon a certain date and at a certain price, inthe future. An agreement which gives the buyer the right but not theobligation to buy or sell an underlying at a certain price on orbefore a certain date.ObligationBuyer and seller are both obligated tohonor the contract upon expiry.Margin Account Advance payment/Contract pricing RisksBoth buyer and seller have unlimited riskMargin AccountOnly option writer/seller maintains a margin. Advance payment/Contract pricingRequires upfront fixed premium from the buyer.No, except the initial margin ObligationOnly seller is obligated to honor the contract on expiration.Both parties need to maintain a margin. Definition RisksOption buyer has limited risk; Option writer/seller has unlimitedrisk

BENEFITS OF COMMODITY OPTIONSBENEFITS TO INDUSTRY/CORPORATES Options trading will make the commodities market robust and efficient. The combination of Futures and Options can give participants the benefit of pricediscovery of Futures and simpler risk management of Options. The premiums on options are much lower, sometimes a quarter of the initialmargins paid on futures contracts. Hedgers can use option contracts where there is no further outgo after the initialpayment for the option premium. Risk for options buyer is limited to the premium paid

PARTICIPANTS AND THEIR PAY-OFFS IN OPTIONSMARKETPARTICIPANTPROFIT (Upside potential)COST (Downside potential)Call holder/buyerUnlimited (to the extent of increase Limited (to the extent of premiumin price above strike price)paid)Put holder/buyerPractically unlimited (to the extentof price of underlying becomingzero)Limited (to the extent of premiumpaid)Call writer/sellerLimited (to the extent of premiumreceived)Unlimited (to the extent of increasein price above strike price)Put writer/sellerLimited (to the extent of premiumreceived)Practically unlimited (to the extent ofprice of underlying becoming Zero)Unlike an option holder who has a limited risk (thecost of the option premium) but practically unlimitedpotential for gains; an option writer is exposed topractically unlimited risk with limited gains (to theextent of option premium received).

FACTORS INFLUENCING OPTIONS PRICES (BLACK -76MODEL)FactorsIncreaseCall PricesWillUnderlying PriceTime until ExpirationVolatilityInterest RatesStrike PricePut PricesWillDecreaseCall PriceswillPut PricesWill

Commodity Options detailsOptions DetailsGoldLaunch dateStrike IntervalNumber of strikesNumber of Call & Put17th Oct.17 15th May.18 21st May. 18 24th May.1810050525015,-1,-157,-1-,77,-1-,710,-1,-1031 CE & PE15 CE & PE 15 CE & PE 21 CE & PEMarket LotTick SizeTick ValueCrude piry day3 days prior to 2 days prior 2 days prior1st tender day to expiry of to expiry ofof futuresfuturesfutures3 days priorto 1st tenderday of futuresFuture Expiry5th June19th June29th June5th JulyOption expiry29th May15th June27th June27th June

Settlement MechanismSettlement Mechanism of Commodity OptionsITM (In the money)Devolve into futuresCTM (Close to money)Devolve into futures onlyon instructionsOTM (Out of the money) No devolvement

Options CostingBusiness Development DetailsParticularGoldSilverCrude Oil Copper ZincTrading Lot1 Kg30 Kg100 bblPrice*Turnover (PremiumBuy & Sell)Per Rupee Movement*Please insert latestprices of premium1MT5MT22570016011445000420003200022000 40000100301001000 5000

Options CostingParticularTransaction Charge (Nil uptosept. 18)SEBI charges (Rs 0.15 /lac) GSTSTT (Rs. 50 /lac) only on sellside premiumStamp duty (Rs. 1 Lac) ofpremium turn overBrokerageGST on brokerage (18%)Total CostCosting DetailsGoldSilver Crude Oil Copper ZincCost per lac Amount Amount Amount Amount Amount0000000.177 0.07965 0.07434 0.05664 0.03894 4001211861018%

Gold CostingDevolvement costingCallPutBuyer Seller BuyerGold Future pricePremium priceSeller30000300CTT on exercise of options@0.0001 of FSP (only for Rs.purchaser)0.10/lacDevolvement of optionsinto futures @0.01% ofShort positionRs. 10/LacIf buyer squares offdevolved position (CTT onshort position)Rs. 10/Lac33300300300300

Crude Oil costingDevolvement costingCallBuyerCrude Oil Future pricePutSellerBuyerSeller4500Premium price45CTT on exercise of options@0.0001 of FSP (only forpurchaser)Rs. 0.10/lacDevolvement of options intofutures @0.01% of ShortpositionRs. 10/LacIf buyer squares off devolvedposition (CTT on short position) Rs. 10/Lac0.450.4545454545

Copper CostingDevolvement costingCallBuyerCopper Future price450Premium price4.5CTT on exercise of options @0.0001of FSP (only for purchaser)Rs. 0.10/lacDevolvement of options intofutures @0.01% of Short positionRs. 10/LacIf buyer squares off devolvedposition (CTT on short position)Rs. 10/LacPutSellerBuyer0.450.454545Seller4545

EXAMPLE – HEDGING STRATEGIES Options represent a form of Price Insurance, cost of which isthe Option Premium determined during its trading by markets Improves market Liquidity, Transparency Maximum Loss to the extent of Premium paid for Buyer Possible apportioning of Hedging cover as may be neededBasic hedging strategies:Call or Put ProtectionBuying Calls ( for metalconsumers having boughtUnfixed Gold from Banks ,Importers , Wholesalers etc)Buying Puts ( for metalconsumers having bought FixedGold from Banks, Importers,Wholesalers etc)

OPTION STRATEGY FOR BULLION DEALER: PROTECTINGINVENTORY – FIXED GOLDBullion Dealer: Risk ofdepreciation in Gold(CMP 30000)Pricesgo upLoss: Maximum upto Rs.300Buy Put option:Strike price 30000Premium Rs.300Prices godownProfit: Actual loss isCompensated byappreciation in thepremium priceThe loss is limited to the extent of the premium paid i.e. Rs. 300/ & no MTM

EXAMPLE: PROTECTING INVENTORY – FIXED GOLDBuy Put option : Strike price 30000 Premium Rs.300P&L Payoff at Expiration Matrix (Premium: 300)Underlying Price Payoff from PhysicalAt 0300200100029500 29600 29700 29800 29900 30000 30100 30200 30300 30400 30500-100-200-300-400Payoff from optionsNet Profit/LossHaving hedge through options Bullion dealer protect himself against downside risk and also avails opportunityprofit if prices go beyond 30300/- in physical markets

OPTIONS STRATEGY FOR JEWELERS: BUYING UNFIXEDGOLDExporter : Risk ofappreciation in Goldpost receiving order(CMP 30000)Prices godownBuy Call optionStrike price 30000Premium Rs.300Loss: Maximum upto Rs.300Pricesgo upProfit: Actual loss isCompensated byappreciation in thepremium priceThe loss is limited to the extend of the premium paid i.e. Rs. 300/- & no MTM

EXAMPLE : BUYING UNFIXED GOLDBuy Call option Strike price 30000 Premium Rs.300P&L Payoff at Expiration Matrix (Premium: 300)Underlying Payoff fromPrice At Expiry optionsNetPhysical 10000-100-100-200-200-300-300-400-400Payoff from optionsNet Profit/LossHaving hedge through options Jeweller protect himself against upside risk and also avails opportunity profit ifprices break below 29700 in physical markets

OPTIONS TRADING STRATEGIESSTRADDLE:Simultaneously buying of a put and a call ofthe same underlying, strike price andexpiration date.Used when anticipating a price swing butdirection of swing not known.BULL CALL SPREAD:Buying a call option at a particular strike priceand simultaneously selling a call option athigher strike price of the same underlying andexpiration month. Used when one ismoderately bullish.STRANGLE:Simultaneous buying of out-of-the-money putand out-of-the-money call of the sameunderlying and expiration date. Works bestwhen underlying price moves sharply ineither direction.BEAR PUT SPREAD:Buying a put option at a particular strike priceand simultaneously selling a put option atlower strike price of the same underlying andexpiration month. Used when one ismoderately bearish.

BENEFITS - AMENDMENTS TO SECTION 43(5) The Finance Act, 2013 has removed this anomaly and provided for coverageof commodity derivatives transactions undertaken in recognized commodityexchanges too under the ambit of Section 43(5) of the Income Tax Act, 1961,on the lines of the benefit available to transactions undertaken in recognizedstock exchanges. Hedgers are no longer forced to undertake physical delivery of commoditiesin order to prove that their transactions are in the nature of hedging and not‘speculation’. This is clearly a great impetus for the growth of the commodityderivatives market in India.

THANK YOUwww.mcxindia.com

Options trading will make the commodities market robust and efficient. The combination of Futures and Options can give participants the benefit of price discovery of Futures and simpler risk management of Options. The premiums on options are much lower, sometimes a quarter of the initial margins paid on futures contracts.