Transcription

BROUGHT TO YOU BY MARKETBEAT.COMBEGI NNER S GUI DE TOPot Stock InvestingWRITTEN BY THOMAS HUGHES

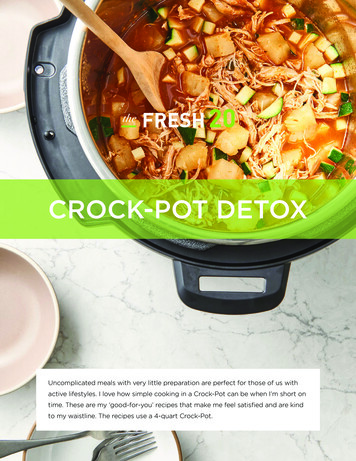

It’s A Tale Of Two, Three, Four Pot MarketsSo, you’re interested in pot stocks. Let us assure you, it’s an interesting and potentially profitablefield of investment but not one without dangers. While Cannabis is gaining traction in the USlegal system it is still unregulated on a Federal level and that can be a hurdle for businesses,consumers, and investors alike. And that’s the problem with the US market. The Canadiancannabis market is greatly improved from what it was but it is still struggling.When you get below the canopy layer you find two distinct divisions that have a profound impacton operations and profitability. Recreational and medical use. Both recreational and medical useare legal throughout Canada but there are hurdles to both in the U.S. As for Canada, the “GreenRush” forecast by all those high-flying start-ups never flowered but there’s a budding opportunityin that as well. The industry has had time to rationalize itself and get in line with the fundamentalrealities of Canadian cannabis use and a few companies are even starting to show profits.In the U.S., the Federal government is allowing individual states to make their own decisions oncannabis and no two states have done things quite the same. In some states, medical weed islegal but only under strict conditions, and in others, there is full recreational use with shades ofnuance in between. Knowing the differences between cannabis markets and types of cannabiscompanies is key to making sound investment decisions, the kind that will grow and flower withinyour portfolio.Most cannabis businesses are rooted in a license to grow. A basic license to grow allows abusiness to set up production and sell cannabis to a retailer or dispensary while the morecomprehensive license allows for vertical integration. In this case, the cannabis company grows,packages, distributes and sells its own product.2

The Canadian Cannabis MarketThe Canadian cannabis market was supposed to be worth 5 billion dollars the first year oflegalization and then grow to over 10 billion within the next 5 to 10. At least that’s what theytold us. As of June 2022, 44 months into recreational legalization, the Canadian market is finallyapproaching the 5 billion mark and may hit next year. And that’s Canadian money, not U.S. money.The good news is that most if not all of the rough water is under the bridge and many businesseswithin the industry are on the path to profitability.Here are some things to know about the Canadian cannabis market:1234When the Canadian market began to open up to recreational use the cannabis stockmarket was a wild west. Overly eager CEOs inflated expectations for sales and growththat were again inflated by the market. Many of them were not without a basis in realitybut without a proper timescale, the market got way ahead of itself.The first year to 18 months of the cannabis boom was all about expansion, growth,gaining a foothold on the global market, and growing as much pot as possible.Businesses were running on capital and not cash flow, earnings weren’t enough to coverall the spending, and balance sheets were stretched to their limits. Ramping productionand improving efficiencies helped keep the bulls interested but some other problemswere soon to spring up. In the end, the unrestricted ramp in production makes a systemicproblem worse.On the government end, Canada is slow to roll out widespread infrastructure ie grantlicenses. Legalization is nationwide but operations are largely on a province-by-provincebasis so there are snags to growth. Early attempts to keep things public, ie workingthrough dispensaries, met with failure. With little private enterprise, high barriers to entry,and no standardization bottlenecks formed hampering operating from licensing throughdistribution. The bottom line? There were too few dispensaries. The Canadian marketmight be worth 10 billion but that’s at 100% saturation and we’re still a long way offfrom that. To put this in perspective, there were fewer dispensaries in Canada than inColorado for the entire first year of Canadian legalization and that is still true on a percapita basis.A contraction began in late 2019 that helped create today’s Canadian cannabis market.The contraction began when credit started to dry up and then worsened with oversupply.Things started to look really bad when Canada’s dispensaries began returning weedto the growers; there just weren’t enough customers. The contraction included a fewbankruptcies, a few CEOs were replaced, excess capacity was trimmed, acquisitions werehalted, impairments were logged, and balance sheets were shored up but now, severalyears later, business is starting to look good. We’re not talking mad growth like in the olddays, but steady incremental growth spread between a few top players who’ve managedto consolidate their brands and cement a foothold in the market.3

The Canadian Cannabis Market In One ChartThe highs and lows of Canada’s pot story are all too apparent in the chart of the Alternative HarvestETF MJ (NYSEARCA: MJ). The ETF first starts seeing increased activity in late 2017/early 2018when it becomes clear Canada is on track for full legalization. Later in the year, driven by hype andover-expectant markets, the ETF surges to a new all-time high only to plummet when legalizationfinally arrives. Why? Because there were some in the market prescient enough to know the wildclaims made by industry CEOs were smoke and mirrors. The real hurdle for legalized cannabis is theblack market and Canada wasn’t really set up to put it out of business.Later, the ETF tried to make a rebound when the Canadian market began to gain traction, but it wastoo little too late. Corporate balance sheets were stretched to the point of breaking, oversupply wasrampant, the growth outlook was evaporating, and more than one analyst suggested bankruptcieswould quickly follow. And there were a few bankruptcies, quite a few growth projects were halted,and no few production facilities were closed but most of the major players have pulled through.Now the ETF is sitting near its historic lows with two things going for the market. One, the valuationsare as low as they’ve ever been, if there is a time to get interested in the Canadian cannabis marketit’s now. The second is the industry. The Canadian cannabis industry has been downsizing, cuttingcosts, and focusing on current operations for several years now and those efforts have begun tobear fruit. The problem for the industry now is that consumers aren’t as eager to get high as theywere a year or two ago.The first signs of trouble appear, Canada’scannabis market goes up in smokeThe Canadian Cannabismarket falls to a new low butnow real profits are in sightThe first glimmers oflegalized, publicly-tradedcannabis, the market getsexcited by a multi-billiondollar opportunityAdult-use is legalized,the market goes wild onover-inflated growthoutlook and wild-weststyle acquistions4Recovery begins, profits are sight but thenpandemic-related issues put that on hold

The Top Five Canadian Cannabis Companies55Hexo Corp (NYSE: HEXO)45Sundial Growers, Inc (NASDAQ: SNDL)35Cronos Group (NASDAQ: CRON)Hexo Corp. is Canada’s 5th largest integrated cannabis company and one that weexpect to see reach sustained profitability sooner than most others. The company,first and foremost, was conservative in the early days of the cannabis boom and didnot make the same mistakes as others ie ramp production too quickly, make too manyacquisitions, or take on too much debt. The problem now, however, is that profitabilitycontinues to be elusive in the face of irregular consumer trends and a downtrend inconsumer use.Sundial Growers, Inc is a great example of all that is best in Canadian Cannabis today.The company has been around since the early days of medical use and it survived thehey-days of adult-use cannabis too. Now, it is one of the better-run and better-positionedas it has the capability for acquisitions which is how it reached the #4 position. And theprofits? Sundial is still struggling with profits but they seem to be just around the corner.Cronos Group is among the fastest-growing Canadian cannabis companies and is wellon track to produce profitability. The company is also noteworthy for its partnershipwith U.S. tobacco giant Altria. Altria holds a minority stake in the company as partof its long-term cannabis strategy and will likely buy it out once U.S. legalization isapproved. Cronos is also the owner of Redwood Brands, a prominent U.S.craft-beverage label and inroad to the infused beverage market.5

2Canopy Growth Corporation (NYSE: CGC)Canopy Growth Corporation is Canada’s second-largest integrated cannabiscompany and closing in on claiming the #1 spot. Canopy Growth Corporation hasbeen averaging more than 100 million in sales on a quarterly basis and growing viathe international market. The risk in this stock is that it is still working to overcomehandicaps that developed during the early days of legalized recreational use. Ifthe company can’t achieve profitability soon management will be faced with harddecisions that may lead to a sale of the company or liquidation of assets.1Tilray Brands (NASDAQ: TLRY)Tilray Brands is a late comer to the Canadian market but quickly rose to the number1 position through a merger with then-#1 Aphria. The merger produced the singlelargest cannabis company in Canada but the company is still small potatoescompared to the budding U.S. market. The takeaway, however, is this company beganproducing profits early in 2022 and is on track to continue profiting. The companyreports that merger-related synergies are moving along quicker than anticipatedand will save the company millions in operating costs each quarter. The best news,however, is that additional synergies are expected the following year and will helpwiden the margin. Tilray is also ready to expand into the US market given the properlegalization and has partnered with multistate operator Medmen to do it.6

The U.S. Cannabis MarketThe U.S. cannabis market has not been immune to the wild expectations put in place by theinvesting community. Federally illegal, a wave of state-by-state legalizations opened investors’ eyesto the billion-dollar opportunity in U.S. cannabis and that played right into the wild west atmospherecreated in Canada. The same analysts and CEOs that projected the Canadian market at 10 billionsaid the U.S. market could be worth ten times that figure, 100 billion, and it might be one day.The reality is cannabis sales were about 13 billion for the U.S. in 2019 but there is good news too.The industry has grown steadily over the past 3 years and is on track to end 2022 with a valuationabove 33 billion. For those expecting a boom in value after U.S. legalization, don’t, the states thataren’t allowing weed now aren’t likely to allow it then, either, unless there is some Federal mandateto force them.There are 19 U.S. states with fully legalized weed, that’s 8 more than when we first issuedthis guide in 2019. California may be the most recognizable but Colorado so far has the mostsuccessful system.Another 19 states allow medical use of THC-bearing cannabis. The laws vary from state tostate but the trend with medical is that, once one treatment is permitted more and more areadded until full legalization is on the table and eventually passed.The main takeaway for cannabis investors is the U.S. market is fractured. No two states do it thesame and cross-border operations are difficult at best. The multistate operators seem to be doing thebest and are growing the quickest but you’ll still have to buy two or three of them to get full coverageof the market. A few of them have made partnerships with larger companies in preparation for fullU.S. legalization including some with Canadian operators and others with U.S. beverage and tobaccocompanies. These partnerships are what will ultimately drive profits within the industry because theymean instant access to national distribution systems.Ultimately, the opportunity in U.S. cannabis today is the hope of legalization. Full US legalization willallow the larger operators to cross borders with ease, improve volume sales and leverage, and allowlarge established operators like Big Alcohol and Big Tobacco to get into the action. The multistateoperators will be the best positioned but make no mistake, the big U.S. tobacco companies are justwaiting for legalization to focus their full attention on cannabis. What that means is every successfulU.S. cannabis company is a potential takeover target, we just have to wait for legalization before theconsolidation can begin.7

Top Five U.S. Cannabis Companies55Cresco Labs (OTCPink: CRLBF)45Verano Holdings Corp (OTCQX: VRNOF)35Green Thumb Industries (OTCQX: GTBIF)Cresco Labs is a Chicago-based cannabis company riding the wave of legalizationnationwide. Cresco Labs owns 48 dispensaries in 10 major jurisdictions and may be thefastest-growing of all U.S. cannabis companies. Cresco is among the largest wholesalersof cannabis in the US and supplies products to over 700 dispensaries nationwide.Verano Holdings Corp is a multistate operator with business in 16 markets. Thecompany operates 96 dispensaries and counting with footholds in some of the mostrecently legalized states. Verano Holdings’ claim to fame is a premium flower and topshelf offerings across all product lines, not just for a few, making it a go-to choice fordiscerning consumers.Green Thumb Industries was an under-the-radar name headquartered in Chicago alongwith Cresco Labs and Verano Holdings. The company spring to prominence in thewake of Illinois legalization and now stands as a top-three U.S. integrated cannabiscompany. The company has 77 operational store locations in more than half of U.S.markets with licenses for as many more.8

2Trulieve Cannabis Corp. (OTCQX: TCNNF)Trulieve Cannabis Corp. is a Florida-based integrated cannabis company operating asa medical cannabis company. The company operates 113 dispensaries in its homestate of Florida where medical use is allowed and another 49 in 7 other states.1Curaleaf (OTCPink: CURLF)Curaleaf is the largest U.S. multi-state operator by revenue, store count, and thenumber of states it’s licensed to operate in. As of the last count, the companyoperated 131 dispensaries and 26 cultivation sites in 21 states and it is still growing.9

An Interesting Way To Play TheNorth American Cannabis MarketINNOVATIVE INDUSTRIAL PROPERTIESIndustrial Properties (NYSE:IIPR) lives up to its name. The company is a REIT and it has innovatedthe real estate market for industrially produced cannabis. The company invests in cannabiscompanies via sale-leaseback agreements which means Innovative Industrial Properties is buyingcannabis infrastructure and then leasing it back to the producer. The sale/leaseback arrangement,which gained in popularity over the last two years, puts much-needed cash in the hands of thecannabis producers and provides long-term revenue for Innovative Industrial Properties.This is how it works. When a cannabis company needs capital it can sell its production facilitiesand property to IIPR. IIPR owns the property and then leases it back to the cannabis companyfor contract terms that ensure a profit. In most cases, the terms of the lease are triple-net whichmeans the leaseholder is responsible for taxes, maintenance, and insurance which is a win-win forIIPR because they get the property, the rent, and virtually no responsibility for the property.The win for investors is three-fold. First, investors get direct exposure to the cannabis market.Second, investors get a dividend of about 5.5%. Third, investors have the safety net of ownedproperty. If any of the cannabis companies go bust, or if the entire industry goes bust, IIPR still hasthe properties to sell or lease to another occupant. The only downside for investors is taxes. REITscome with some tax implications that make owning them in traditional accounts less attractivethan ordinary stock.The Conclusion: There’s Never Been A BetterTime To Invest In CannabisNow that the wild west era of pot stock investing is over and the dust has settled investors canstart nibbling on these investments again. Not only are the valuations at historic lows but thebusinesses are in the best shape of their existence with profitability in the forecast. Federallegalization in the U.S. may not bring about the boom that was the first forecast but it will allow theindustry to mature and consolidate and that will drive value for shareholders.10

The Canadian Cannabis Market When the Canadian market began to open up to recreational use the cannabis stock market was a wild west. Overly eager CEOs inflated expectations for sales and growth that were again inflated by the market. Many of them were not without a basis in reality but without a proper timescale, the market got way ahead of .