Transcription

Guide to UnderstandingEmployee Stock OptionsCERTAINTYINGENUITYADVANTAGE

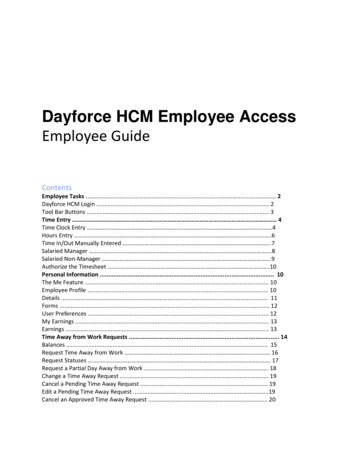

ContentsIntroduction to Employee Stock Options 2An Opportunity for Reward with Limited Risk 2How Do Employee Stock Options Work? 2Understanding your stock options 3Exercising Stock Options 4Exercise Methods 4Cash Exercise 4Cashless for Cash 4Cashless Hold Exercise 4Limit Orders 4Net Settled Exercise 4Stock Swap Exercise 4Taxation of Stock Options 4Receiving Your Net Proceeds 5Direct Deposit (for US citizens only) 5Wire Transfers 5Check 5Required Forms 5Accessing and Managing your Account 5Glossary 61 Guide to Understanding Employee Stock Options

Introduction to Employee Stock OptionsEmployee stock options are often an important element in acompany’s compensation package and are usually designed asboth a reward and an incentive. Companies grant stock optionsto their employees to promote a sense of ownership, recognizeindividual contributions and encourage a focus on the company’slong-term success.An Opportunity for Reward withLimited RiskEmployee stock options present an opportunity for you to sharein the rewards of the company’s financial growth without havingto worry about risks normally associated with buying stock. Withan employee stock option plan, a company grants a specificnumber of stock options, which give the right to purchase thecompany’s stock in the future under certain terms. Employeeswho receive grants are not required to invest any of their ownmoney when they receive stock option grants. As a result, anemployee will not lose any money if the price of the stock goesdown below the option’s exercise price. If your company’s stockloses value all that is lost is the opportunity to exercise yourstock options and sell the shares at a profit. On the other hand, ifthe value of the stock goes up above the option’s exercise price,an employee can profit from this increased value. Of course,if options are exercised and held, the employee becomes ashareowner. As an owner, an employee is generally entitled tocertain benefits, including company voting rights and dividendsthat may be declared.How Do Employee Stock Options Work?Employee stock options provide you with the opportunity topurchase a specified number of shares of your company’s stockat a preset price (the option price) for a fixed period of time(the term of the option). Generally stock options are subject toa service-based vesting period. This means that you may needto work for the company for a period of time before you canexercise your options. This could be a cliff vesting in which 100%vests at one time at the end of the period. (i.e. 3 years) Anotherexample is a graded vesting over a period of time such as 5 yearswhereby 20% will become vested on the anniversary each year. 2

Understanding your stock optionsUntil you choose to exercise them, your stock options do notgenerally have any monetary value. Your stock options will havemonetary value only if you decide to exercise them once theyare vested and the current stock price is greater than the optionprice. You are never required to exercise your stock options, butbe aware; stock options have a limited lifespan and will expireafter a certain period of years. If you leave the company youroption may be subject to an accelerated expiration or they maybe forfeited. If you do not exercise your stock options beforeyour grant expires or is forfeited, you will no longer have theright to exercise them. Please review your company’s stockoption grant plan and agreements for the expiration date(s) ofyour options and conditions that may cause them to be forfeited.3 Guide to Understanding Employee Stock Options

Exercising Stock OptionsWhen you exercise your stock options, you purchase the sharesunderlying the option. The purchase price equals the exerciseprice multiplied by the number of options being exercised.Different exercise methods may be available that give you thechoice of paying for these shares with cash or profits fromyour exercise.Exercise MethodsWhen you are ready to exercise your vested stock options, youmust decide which exercise method you wish to use. Pleasenote: Depending on the plan rules and local laws, certain exercisemethods may not be available to all optionees.Cash ExerciseFor this type of exercise, you use your own money to buy stock.The payment due includes option costs, applicable taxes andfees and must be sent to the plan administrator prior to thecompletion of the exercise. Once the exercise is completed, thepurchased shares belong to you.Cashless for CashFor this type of exercise, you do not provide any cash to exerciseyour options. Simultaneously with the exercise of your options,the underlying shares are sold on the open market. The purchaseprice for the shares and any taxes due is deducted from theproceeds of the sale. You receive cash in the amount of thedifference between the gross proceeds (sale price x number ofoptions exercised) and the option costs (exercise price x numberof options exercised), less applicable taxes and transaction fees.Cashless Hold ExerciseIn this transaction, you do not provide any cash to exerciseyour options. Simultaneously with the exercise, a portion of theunderlying shares is sold to cover all option costs, applicabletaxes and transaction fees. You receive the balance of theunderlying shares [with a value at the time of the exerciseequal to the difference between the gross proceeds (sale pricex number of options exercised) and the option costs (exerciseprice x number of options exercised), less applicable taxes andtransaction fees].Limit OrdersLimit orders can be made on the Cashless for Cash or CashlessHold exercises if they are permitted. A limit order allows youto exercise and specify a specific price at which you would likethe shares to be sold. If the stock price reaches or exceeds yourspecified price after you place the order and the shares can besold in the market, your exercise will be executed. When placinga limit order, it is important to know that your order will not beexecuted if the stock does not reach your specified price. Limitorders can be placed as good-for-day and good-for-30-days.Net Settled ExerciseIn this exercise, a portion of the optioned shares are withheld inorder to satisfy the cost of the exercise price and or taxes due.This nets you a smaller number of options than you would gainby exercising all the options with cash and then holding the stock.Stock Swap ExerciseThis exercise method allows you to exchange shares that youalready own in lieu of cash to pay for the option cost and/ortaxes. Typically rather than actually submitting the shares, thenet number of new shares will be issued after you attest to theownership of the required number of shares.Taxation of Stock OptionsExercising your options is a taxable event. The value of theoption at the time of exercise minus your option cost isconsidered taxable income. In the event that tax withholdingis required, Computershare and/or your local payroll providerwill estimate taxes and mandatory payments due and assist infacilitating the payment based on the exercise method selected. 4

Receiving Your Net ProceedsRequired FormsThe following are common methods for disbursement of netproceeds. Please check your plan documents to determine whichmethods are available to you.The IRS requires that you certify your tax status bycompleting Form W-9 or Form W-8BEN. You cancertify your tax status via Computershare’s website atwww.computershare.com/employee/us or by calling thecommunications center to have a copy of the appropriate formmailed to the address on record with Computershare. If you donot certify your tax status, your net proceeds will be subject tothe Internal Revenue Service’s (IRS) mandated 28% withholdingtax. Please note: Form W-9 does not expire. Form W-8BENexpires on December 31, three years after the year you certify.Direct Deposit (for US citizens only)You can receive proceeds through direct deposit.You can set up direct deposit instructions onlineby logging in to your Computershare account atwww.computershare.com/employee/us.Wire TransfersYou can receive proceeds by Wire Transfer. You can set up wireinstructions online by logging in to your Computershare accountat www.computershare.com/employee/us. Over 100 foreigncurrencies are available for international wire transfers.CheckYou are able to receive proceeds via a USD or foreigncurrency check.5 Guide to Understanding Employee Stock OptionsAccessing and Managing your AccountLog in to your account at www.computershare.com/employee/usto view, manage and transact on your account. You can alsocall the Computershare communications center at the numberlisted on your plan correspondence. The Computersharecommunications center is available from 3:00 a.m. - 9:00p.m. ET. The same phone number may be used to access theComputershare Interactive Voice Response (IVR) system.

GlossaryCommon Stock – A security that represents units of ownershipof a company. An owner of common stock would typically beentitled to proxy votes and any dividend payments made by thecompany.In the Money – The term for a stock option that has an exerciseprice that is less than the fair market value.Market Price – The price at which a stock is sold in the openmarket.Dividend – A distribution to shareholders that representsparticipation in the company’s earnings or profits. Dividends maybe paid in either stock or cash.Under Water – The term for a stock option that has an exerciseprice that is greater than the fair market value.Exercise – To purchase the stock offered in your stock optiongrant at the grant price.Vested – Stock options that have met certain time and/orperformance criteria and are eligible for exercise.Expiration Date – The last day that you are able to exercise youroption.Fair Market Value (FMV) – The price at which a company’s stockcan be bought or sold in the open market at any given time.Grant Date – The date that a stock option is “granted” or issued.This date is used as a starting point for other relative dates suchas vesting and expiration.Please note: The information contained herein is not investmentadvice or tax advice, but only a general overview of employeestock options. Computershare and your company do not makeany recommendations as to whether and when you shouldexercise your stock options or sell the shares you acquire uponexercise of your option. We suggest that you consult with yourown tax and/or investment advisor about these matters, as wellas the personal tax consequences of your stock option grant,option exercise and the sale of underlying shares.Grant Price – The fixed price at which you can purchase sharesof stock pursuant to a stock option. 6

Computershare is a global market leader in transferagency, employee equity plans, proxy solicitation,stakeholder communications, and other diversifiedfinancial and governance services. Many of theworld’s leading organizations use Computershare’sservices to help maximize the value of relationshipswith their investors, employees, creditors, membersand customers.www.computershare.comComputershare does not provide tax or legal advice. Please consult yo

undErStAndInG yOur StOck OptIOnS Until you choose to exercise them, your stock options do not generally have any monetary value Your stock options will have monetary value only if you decide to exercise them once they are vested and the current stock price is greater than the option price You are never required to exercise your stock options, but be aware; stock options have a limited lifespan .