Transcription

LTC — A Quality ofLife Decision . 8Don’t Do It! (Yet)Microsoft Releases . 16Giving the MediaWhat They Want . 21theVol. 8 No. 1 January 2007Official IARFC Publicationwww.IARFC.orgServing Financial Advisors Worldwide

IARFC 2007 Alaska Cruise ConferenceVancouver to Alaska August 17-24, 2007Get Your CE at Sea and Network with Leaders of the ProfessionBegin in Vancouver, British Columbia and cruise the calm and scenic Inside Passage, stoppingin Ketchikan, Juneau, historic Skagway, and Alaska’s wilderness port Icy Strait Point, HubbardGlacier and on to Seward. View the majestic peaks and thousands of untouched wooded islands.Short wildlife trips get you close to whales, moose, harbor seals, bald eagles and mountaingoats. Watch bears fishing for salmon. You’ll be awestruck as you sail alongside the constantlycalving Hubbard Glacier. Enjoy a local salmon bake and embark at Seward for transfer toAnchorage and optional tours.800 532 9060www.IARFC.org

in this issueFinancial Planning Building2507 North Verity ParkwayP.O. Box 42506Middletown, OH 45042-0506800 532 9060 Fax 513 424 5752www.IARFC.orgBOARD OF DIRECTORSEdwin P. Morrow, Chairman & CEOCLU, ChFC, CFP , CEP, RFC edm@IARFC.orgJudith Fisette-Losz, Executive Directordirector@IARFC.org2The 2007 IARFC Calendar of Events3Extending Financial Planning Throughout ChinaThe Mission of Liang Tien Lung6Growth Continues at Money Concepts6From the Chairman’s Deskby Ed Morrow7IARFC Financial Report for Years 2005 - 2006How the Association is Spending Your Money8Long Term Care Insurance A Quality of Life Decisionby Louise Fallica10H. Stephen Bailey, PresidentLUTCF, CEBA, CEP, CSA, RFC steve@hbfinancial.comCato Comments – About Your Image.Why Is This Young Financial Planner So Successful?by Forrest Wallace Cato12Jeffrey ChiewDBA, CLU, ChFC, CFP , RFC JeffreyChiew@yahoo.comRFC Executive Honored in ChinaDr. Teresa So — One of 100 Outstanding Women Entrepreneurs13Vernon D. GwynneCFP , RFC fsxfirst@aol.comWhat’s Your Intellectual Status Quo?Would You Like to Be an RFC Instructor?14Compliance Friendly MarketingHelping Children Reach Prosperity Thinkingby Katherine Vessenes16Don’t Do It! (Yet) —Review of the New Software from Microsoftby Ed Morrow20Consumer Focus — Identity TheftA Growing Opportunity for Financial Advisorsby Paul Richard20RFC Part One Course — to be held in Middletown in January21Giving the Media What They Want:the Dos, Don’ts and Pitfallsby Lisbeth Wiley Chapman22Business Mirrors Life — Cloning Warren Buffetby Hesh Reinfeld23Internet Marketing Starts with Key Wordsby Sylvia TodorLester W. AndersonMBA, RFC landerson@rybd.comDerek D. KlockMBA, RFC ddklock@vt.eduEdward J. LedfordCLU, RFC eledford@gmail.comConstance O. LuttrellRFC luttrell@mindspring.comRuth LyttonMS, Ph.D., RFC rlytton@vt.eduJames McCarty, SecretaryCLU, RHU, LUTCF, RFC jimmccarty@showbizselling.comBurnett Marus, TreasurerRFC bmarus@sbcglobal.netRosilyn H. OvertonMS, CFP , RFC roverton@nyfinancial.comRuben RuizChFC, CLU, MSFS, CSA, RFC rruiz@moneyconcepts.comMichael ZmistowskiRFC mzfp@aol.comWendy M. Kennedy, Editorial CoordinatorEditor@IARFC.orgStephanie Langster, Administrative AssistantStephanie@IARFC.orgThe Register January 2007The Register is published monthly by the International Association of RegisteredFinancial Consultants 2006, 2507 North Verity Parkway, Middletown, Ohio 45042-0506.It includes articles and advice on technical subjects, economic events, regulatoryactions and practice management. The IARFC makes no claim as to accuracyand does not guarantee or endorse any product or service that is advertisedor featured. Articles, comments and letters are welcomed by e-mail to:Wendy M. Kennedy, Editorial Coordinator, Editor@IARFC.orgSSN 1556-4045Application to mail at periodical postage rates is pending at Middletown, OHand additional mailing offices.POSTMASTER: Send address changes to, P.O. Box 42506, Middletown, Ohio 45042-0506Page 1

Register LettersINTERNATIONALIARFC COORDINATORSWe welcome your thoughts and ideas.Please direct correspondence to:Editor@IARFC.orgLetters may be edited for length and clarity.Jeffrey ChiewAsia ChairDBA, CLU, ChFC, CFP , RFC JeffreyChiew@yahoo.comYou Can WriteA Great Articlefor the RegisterWe are accepting articles from500 to 2,500 words on planningand practice management topics.Please submit your copy by e-mail,along with an electronic photo andshort bio statement of less than100 words to: Editor@IARFC.orgYour fine article can be sent toclients, prospects and centers ofinfluence in your community —either as a reproduction, or as acomplete copy of the entire issueof the publication. Get Noticed!Liang Tien LungChina Development Organization (IMM)RFC 2007 Calendar of Events:RFC Course — Part OneClient Acquisition & EngagementJanuary 16-17, Middletown, OhioSee page 20 for InformationCritical Illness Insurance ConferenceFairmont HotelJanuary 25-27, 2007, Victoria, BCwww.Criticalillness.caOrganizational Launch MeetingsFebruary 19–23, 2007, AustraliaFebruary 24-28, 2007, New ZealandThe Journal ofPersonal FinanceCall for PapersGet Involved: We welcome thesubmission of articles from IARFCpractitioners. This is a great way tocontribute to the profession.MarketShare LeadershipConventionMarch 6-9, 2007, Las Vegas, NVFinancial ExpoSponsored by the FPA, SFSP, NAIFAand the IARFCMarch 22, 2007, Tampa, FLAPfinSA ConferenceApril 13-15, 2007, Taipei, TaiwanProfessional Articles: The Journalof Personal Finance is seekingarticles by practitioners that maydeal with the application offinancial planning techniques,marketing and practicemanagement. These are expectedto be very high level papers orarticles.IARFC Financial Advisors ForumMay 15-17, 2007, Las Vegas, NVPublicity Opportunities: Naturally,we encourage published authors toadvise both their clients and themedia of their being published bysending a press release.IARFC Cruise/Conference — AlaskaAugust 17-24, 2007Vancouver, BC to Anchorage, AKContact Dr. Ruth LyttonE-mail: rlytton@VT.eduCall: 540 231 6678Page 2MDRT Annual MeetingJune 10-13, 2007, Denver, COInternational Dragon AwardsAugust 11-13, 2007, Xiamen, ChinaRFC Forum — ChinaSeptember, 2007, Dalian, ChinaRFC Forum — MalaysiaSeptember, 2007, Kuala LumpurRalph LiewPhilippines ChairRFC kilhk@myjaring.netTony BalmoriExecutive Assistanttonybalmori@iarfcphils.orgJerry TanSingapore ChairCIAM, CMFA, RFC jerry@iarfcsg.orgS. L. ChooChina Chair, ShanghaiRFC slchoo@vip.163.comSamuel W. K. Yung, MHChair, Hong Kong and MacaoCFP , MFP, FChFP, CMFA, CIAM, RFC chair@iarfc-hk.orgDr. Teresa SoAdvisor, Hong Kong and MacaoPhD, MFP, FChFP, CMFA, CIAM, RFC director@iarfc-hk.orgAllan WanRFC admin@iarfc-hk.orgNg Jyi WeiMalaysia ChairChFC, CFP , RFC iarfcmgt@time.net.myAidil Akbar MadjidIndonesia ChairMBA, RFC akbar@pavillioncapital.comLisa SoemartoMA, RFC lisa@pavillion.comRichard WuTaiwan ChairRFC richard@imm.com.twPreecha SwasdpeeraThailand ChairMPA, MM, RFC contact@iarfcthailand.orgDemetre KatsabekisGreece ChairMBA, Ph.D, RFC vie@otenet.grThe Register January 2007

Extending Financial Planning Throughout ChinaThe mission of Liang Tien Lung, RFC ,a native of Taiwan is quite modest —to increase the professionalism of lifeinsurance agents and financial advisorswho serve one and one half billionChinese speaking persons in Asia and he is doing it!After a career in agency training at one ofthe most prominent companies in Taiwan,Cathay Life, he formed InsuranceMarketing Magazine in 1983. But swiftlythe focus of the company expanded fromprint media to a variety of educationalopportunities and outreach programs. Asthe range of the company reachedSingapore, Malaysia, Hong Kong, Macauand China, the name of the firm waschanged to IMM International.Magazines and BooksIMM now publishes three magazines, eachfrom 100 to 126 pages in full color andbeautifully illustrated. Advisers magazineis published in two editions — one intraditional (Mandarin) Chinese for themarket in Taiwan, Hong Kong, Malaysiaand Singapore. A different version ofAdvisers is published in “Simplified”Chinese for distribution in China and thetext of the articles are a bit less technical,since the financial services industry is notyet as mature in mainland China.Both editions of Advisers include articleshelping the agents transition to financialadvisory focus, frequently including copyfrom Ed Morrow, the Chairman and CEO ofthe IARFC — who often speaks toassociation meetings across Asia.IMM still continues to publish InsuranceMarketing magazine which is very popularLiang Tien Lung, RFC (right) is shown conferring with Bo Xilai, outside the Convention Centerat Dalian, China, during the Worldwide Chinese Life Insurance Conference organized by IMMInternational. Bo was then the Governor of the 83 million population Liaoning Province, andhe is now one of the most influential men in China, as Minister of Commerce. He openedthe Conference, and his remarks were followed by those of IARFC Chairman, Ed Morrow.with supervisors, managers and homeoffice executives as well as agents.6,400 attendees at the 2006 Congress inChengdu, China.IMM also publishes and distributesbooks — some written by the outstandingand elites from the industry throughoutTaiwan, Hong Kong, USA, Malaysia,Mainland China and many by notedinsurance agents and financial advisors,such as Jack and Garry Kinder, RFC , BenFeldman, Norman Levine and John Savage.The WCLIC symposium is a four day eventwith the number attendees ranging from6,000 to 8,000. Until 2004, all sessionshave been presented in MandarinChinese. Translated sessions in Englishon the topic of Financial Planning wereadded in 2004 and these will beexpanded in future years as the financialplanning format becomes morewidespread in Asia.Events and RecognitionLiang Tien Lung, RFC, in the center, shown with Siak-LeungChoo, RFC , on the left and Richard Wu, RFC , at a ceremonyhonoring their appointments as Chairs for the 2008 WCLIC inSingapore and the 2007 IDA in Xiamen, China, respectively.The Register January 2007Recognizing the needfor Chinese speakingagents to have a localopportunity formotivation andeducation, Mr. Liangfounded the WorldWide Chinese LifeInsurance Congress(WCLIC), with the firstbi-annual session beingheld in 1996 in Taipei.The featured speakerthen was MehdiFakharzadeh, RFC ofNew York City — whoagain addressed theIMM also provides consulting and trainingservices to life insurance companies —aimed at advancing agents, supervisorsand agency managers.Liang also identified that life insuranceagents need a way to receive industryrecognition for their achievements andservice. So he created the IDA(International Dragon Awards) andthey rapidly increased in popularity.Last year over 2,000 persons qualifiedfor the Gold, Silver or Bronze Awards.In 2007 a new level, the Platinum Awardwill be presented for significant andcontinued on page 4Page 3

continued from page 3 Expanding Financial Planningsustained production — at levels aboveMDRT Top of the Table.The International Dragon Awards arepresented at WCLIC and on alternateyears at an IDA conference — usuallyabout half the size of WCLIC, where focusis really more on CE than recognition.For example IDA 2007 will be held in thecity of Xiamen (population 1.5 million) onthe east coast of China — a beautiful andhistoric maritime city. Attendance is nowfully subscribed for the maximum 2,000for August 10-12, 2007. The 7thWorldwide Chinese Life InsuranceCongress will be limited to the first 5,000registrants, to be held in Singapore,September 4-7, 2008 — and there’s nodoubt it will be fully subscribed.To produce each of these events the staffof IMM usually includes over 100 of thecompany’s 275 employees, plus morethan 100 students recruited from localuniversities. Normally these are graduatestudents majoring in communication,marketing, business, economics orfinancial services.Education and TrainingIn 2002 IMM accepted the challenge toextend financial planning throughoutgreater China and the results have beensignificant for the IARFC.In Taiwan, under the leadership of RichardWu, RFC , there are offices in four cities,Taipei, Kauhsiun, Taichiumg and Tainan.RFC classes have been held in each, aswell as in the cities of Hualien andTauyun. Special classes and enrollmentprograms are in place for 15 companiesand the number of RFCs in Taiwan willtotal 1,300 by the end of 2006.To penetrate the Hong Kong and Macaomarket, Liang formed a separate firmincluding highly respected local insuranceprofessionals Samuel Yung and Dr. TeresaSo. With the administrative support ofAllan Wan, the organization partneredwith the General Agents and ManagersAssociation and the Poon Kam KaiInstitute of Hong Kong University. Classesare being formed in Macau with adifferent educational sponsor, the MacauInter-University Institute.In China, under the leadership of S. L.Choo, RFC , there are office in Shanghai,Guangzhou, Beijing, Hangzhou, Dalian andChengdu. In order to provide the betterservices to the RFC members in China, thePage 4IARFC China Region haddeveloped the Code ofEthics and ProfessionalResponsibility,Disciplinary Rules andProcedures, financialplanning practicestandards, authorizationto use the IARFC and RFCMarks, the requirementas a RFC member. RFCclasses are being offeredin Beijing, Shenyang,Tianjin, Guangzhou,Shenzhen and Dalian,with more classes beingorganized. Theeducational sponsor isBeijing Union University,one of the largestinstitutions in thecapital city.Liang Tien Lung, Mehdi Fakharzadeh, and Ed Morrow at theFinancial Advisors Forum 2006.Personal BackgroundMr. Liang has threechildren, each of whichwas educated in theUnited States. His eldestdaughter, JJ Han-YingLiang, who holds boththe RFC and CFP designation, graduatedfrom San Diego StateUniversity, San Diego, CA,where she acquired twoMBA degrees (BusinessShown here are Siak-Leung Choo, Charlie “Tremendous”Administration andJones, Liang Tien Lung, and Richard Wu following theInformation Systemwell-received presentation by Jones at the Financial AdvisorsMSBA), and previouslyForum 2006.worked with CrowellWeedon, Corp. in theUnited States as ahe successfully orchestrated all ofFinancial Planner and currently with Fortisthe IMM employees, volunteers, speakersWealth Management Taipei, as anand the 300 executives of the lifeInvestment Professional.insurance companies. We asked himthe following questions His son, Ben Chia-Ho Liang, is a graduateof Grossmont College, San Diego, CA, whoDo you feel the life insurance industryholds a Bachelor Degree in Computerwill continue its rapid expansion in Asia?Science, and currently works at IMM as aSales Executive. He has been especiallyYes, especially in the emergingeffective helping with al the technology atmarkets such as India, Vietnam andthe large events produced by IMM.Mainland China.His youngest child, Jackie Chia-Tzu Liang,is a graduate of San Francisco StateUniversity, San Francisco, CA, who holds aBachelor Degree in News Broadcasting,and she is currently advancing her studiesin Japan.We visited with Mr. Liang at the recentWorld Wide Chinese Life InsuranceCongress in Chengdu, China whereWhat do you feel will be the role ofRegistered Financial Consultants in thedelivery of financial services in China?The life insurance industry in China hasgrown rapidly in the past 13 years andnow is the time for transition — in order tobuild the professional image of thecontinued on page 5The Register January 2007

continued from page 4 Expanding Financial Planningindustry. The RFC emphasis on theclient’s interest, integrity, ethical, fairness,professionalism, competence is based onthose principles to help people benefitfrom financial planning. The core valuesof RFC will increase the healthiness of theindustry and finally, benefit the clients.Does IMM plan to continue publishingbooks and are you looking for more titles?Yes. Besides the Chinese authors, wework closely with the MDRT PowerCenterto bring the intelligence of the MDRTmembers to the Chinese underwriters.For example, IMM worked with the MDRTPowerCenter to translate and publishbooks, such as Million Dollar ClosingTechniques, Million Dollar ProspectingTechniques, Million Dollar SellingTechniques, Expecting Referrals, TheMDRT Objections Handbook, Savage onSelling and with other publishers fromUSA, UK, Japan and Korea.We have published more than 100 bookswhich coverage the topic of motivation,sales ideas and technique, handlingobjection, prospecting, selling process,insurance story, insurance writing,recruiting, biography, trend analysis,management and we are looking for moretitles on practice management andfinancial planning.You now have six offices in China, five inTaiwan, Hong Kong and also Malaysia.Do you plan to continue expansion toother countries in Asia?I will focus on the management anddevelopment on the existing IMM offices.However, if the opportunities presentthemselves, we will consider and plan tocontinue the expansion of IMM to othercountries.Do you feel that life insurance companiesin Asia will add the marketing ofsecurities as they have in America?It depends on the market in each differentcountry and region. The maturity of thelife insurance industry is very different invarious countries and regions. I think thatwhen the Asia market is as mature as inAmerica, most insurance companies willbe offering securities.What do you feel will be the greatestneeds of Asian insurance agents andfinancial advisors in the next few years?The values and principles of integrity,fairness, ethical selling and client’sThe Register January 2007interest. Besides that, theprofessionalism of the industry is veryimportant also because it will help theunderwriters be competent and supportthe healthiness of the industry.What can the IARFC do to help agentsand financial advisors in Asia?Emphasize and promote the principles ofRFC. Advocate the right ethical andservice values to be a professionalfinancial advisor. What the IARFC is doingright now in Asia is to help agents totransform from a life insuranceunderwriter to a professional financialadvisor through the training, educationand continuing education programs.You have delegated responsibility for the2007 IDA conference to Richard Wu,RFC . What do you feel will be hismajor challenge in presenting nextAugust’s conference in Xiamen?Before Richard Wu took over as theIDA Chairman, he served the committeeas the Vice Chairman and ChiefExecutive. He is a very creative andtalented leader. The major challengefor Richard will be to advocate andpromote the spirit of IDA, which is thespirit of Paragon, Perfection, andNoble pursuit of high-quality life,obedience to professional principles,practice of moral integrity, establishmentof occupational dignity, and cultivation ofa sound career environment. IDAadvocates and promotes its members’ lifequality as well as builds up their statusand honor internationally. I am sureRichard has very good ideas to bring theIDA and will lead this event to a higherstandard. I have the confidence thatRichard will lead his outstandingcommittee members to organize the2007 conference in Xiamen as thebest IDA ever.The responsibility for the 2008 WCLICin Singapore has been placed withS.L. Choo, RFC . Do you expecthim to present any unique eventsor opportunities?S. L. Choo has vast experience inorganizing major conferences. Since theWCLIC was founded, he served thecommittee as the Vice Chairman,Executive Vice Chairman and ChiefExecutive. The spirit, values and theprinciples of WCLIC will be continued byhis leadership. Choo will aggressivelylead all of his committee members toinvent, plan and organize effectively.Liang Tien Lung was the recipient of theLoren Dunton Memorial Award in 2005.Whether the topic is to be discussion, orformal presentation, the educationalcontent of the conference will beoutstanding. The speakers at WCLICrepresent many countries and companies,and Choo will invite the very best to coverthe most important topics. Further, allregions will be embraced at a higher levelthan in the past. I have confidence in himand surely he will serve and reward theattendees and the industry, and the nextWCLIC will be the best event that we haveever produced.You’ve recently had some IARFC staffchanges in Taiwan. How will this affectRFCs there?Our firm has been in operation since1983 and we are blessed with more than275 associates. That’s a great depth oftalent — and I’m pleased we have manyloyal and enthusiastic young men andwomen. Under Richard Wu’s guidance wewill continue all the periodic CE meetingsfor RFC graduates and launch neweducational programs. We are veryexcited to be planning new marketingtools for all our RFC associates — that willhelp them acquire new clients andincrease their production even further. You may contact Liang Tien Lung, RFC atIMM International: imm001@imm.com.twPage 5

GrowthContinues atMoney ConceptsFrom theChairman’s Desk.This Year is Full of Promise. This will prove true — for our Association, and for all thefinancial advisors that we serve — on a globally expanding basis. Across the worldthose who provide financial advice are prospering in a career of service.You are Engaged in a Noble Calling. You help people realize, achieve and preservetheir dreams. You secure their families and their businesses, you help themdevelop self-reliance, you pave the way for them to have a better life. What could bemore important?This was brought forward to me by a young lady in Hong Kong — at the RFCgraduation ceremony held at a venerable auditorium on the campus of Hong KongUniversity. After the presentation of certificates and the many photographs, shecame up to me, accompanied by her husband and small daughter who had enjoyedcelebrating her achievement. What she said to me was really a message to you:Denis Walsh, CFP , RFC The October issue of the Register featuredthe career accomplishments andpioneering back ground of Jack Walsh. Hiscontinued development of managementskills among the Money Conceptsorganization continues with theannouncement of Denis Walsh, CFP , RFC as president and Chief Executive Officer.Denis is uniquely qualified for thisexpanded responsibility. He is a trueprofessional in the field of FinancialPlanning and Wealth Management, havingstarted with the company in its third year ofexistence, more than 25 years ago.Throughout those 25 years Denis has madesignificant contributions to every aspect ofoperations of the company, particularly intechnology, money management, financialplanning, sales and marketing andInternational development. Mr. Walsh is agraduate of Florida State University with aBS degree in Business. He, his wife Aliceand their two children reside in Palm BeachGardens, Florida.Money Concepts was founded in 1979 withthe principle objective to deliver professionalfinancial planning services to individuals,families, and businesses by establishing andsupporting an international network ofidentifiable Money Concepts financialplanning “centres.” Money ConceptsCompanies now has over 1,000 licensedrepresentatives and 615 franchise locationsworldwide. Franchise locations are inCanada, Hong Kong, China, Malaysia, NewZealand and the Republic of Ireland.561 472 2000info@moneyconcepts.comPage 6Please thank all the members of our association for sponsoring this courseand sharing with me all of their wisdom and experience. And tell them thathere in Hong Kong we will carry on their tradition of serving others.I must admit that I felt proud to be a part of this professional delivery – for my rolepersonally, and for the support of thousands of financial advisors who are helping usdeliver a quality education and superior practice management tools.We are Making a Difference. In many countries, in many communities. And thistrend is continuing It is accelerating It is becoming clearer It is becoming nearer.What Can I Do To Help? This was a question asked by an RFC at our exhibit boothat the NAIFA-Chicago “Taste of MDRT” one-day conference. We talked for a fewminutes, and I soon learned that he had grown disappointed teaching CFP classes.He said, “I have been teaching the materials and conveying academic concepts, butthe students aren’t learning how to deliver plans. The curriculum just doesn’tprepare them for the profession — they can’t market their services, don’t know howto prospect, aren’t ready to close a fee-based engagement, and most important —they haven’t learned how to build a financial plan!” When I described the nature ofthe RFC course we are developing he grew very excited, and said, “Count me in, Iwant to teach that course!”Not Everyone Wants to Teach. Many members are better at writing, some atselling, others at speaking. Where can you make the best contribution? Maybe youwould like to help out at the Financial Advisors Forum. We need helpers in theRegistration Booth and to position the signs guiding attendees to each of theworkshop sessions.You can Always Recruit! Our strongest source of new members and new courseenrollees is from our existing members. No one knows better how much the IARFChas to offer and how dedicated we are to supporting our members. You can do thisquite easily — in two ways. Get the prospect to sign up instantly on line. They just go to IARFC.ORG anddownload the RFC Application, fill it out, and fax or mail it back. We will be happy to send a comprehensive membership kit to all the advisorsyou recommend. Just call 800 532 9060 and give us the information.Next month we will run a Business Success Profile — a two page feature ona member that will be interesting reading for you as a fellow professional, andalso by the prospects, clients and area professionals of our featured RFC.Look for this profile, and imagine yourself appearing here, and sending outseveral hundred reprints. The Register January 2007

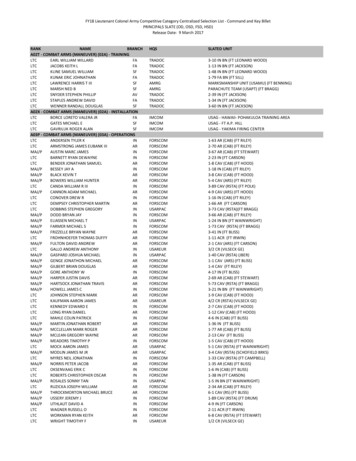

IARFC Financial Report 2005 - 2006As a non-profit professional association, the financial records of the organization are open to review by the members. The accounting ismaintained in the offices of the IARFC and is carefully reviewed by James Hendricks, CPA, who prepares the filings with the IRS for theassociation’s continued non-profit status. The fiscal year for IARFC ends June 30. The two most recent periods are summarized below.2005Miscellaneous 32,808Sources of IARFC RevenueInvestment 1,219Miscellaneous 30,174Materials 17,649Materials 21,442Conferences 31,474Conferences 100,567Membership Fees 347,521Membership FeesConferencesMaterials nt 3,590Membership Fees 505,483Membership FeesConferencesMaterials SoldMiscellaneousInvestment76%15%3%5%1%Uses of IARFC FundsConferences 24,329Conferences 107,172GeneralOverhead 109,164GeneralOverhead 152,822Printing 117,079Printing 158,494Marketing 15,014Marketing 14,518Consulting Fees 1,225ConferencesPrintingPostage & ShippingPayrollConsulting FeesMarketing ExpenseGeneral OverheadThe Register January 2007Payroll 56,737Postage& Shipping 54,4106%32%14%15%0%4%29%Consulting 42,245Payroll 74,103ConferencesPrintingPostage & ShippingPayrollConsulting FeesMarketing ExpenseGeneral OverheadPostage& Shipping 74,98917%26%12%12%7%2%24%Page 7

Long Term Care Insurance. A Quality of Life Decisionimportant decision. He was still wellenough to swim daily and ride his bicycle,and he enjoyed playing with hisgrandchildren. He was just tired ofstruggling to maintain his weight.Louise Fallica, RFC Dad retired at age 62 and my parentsmoved west to Arizona to start the nextchapter in their lives — and, boy, were theyready for it! They had worked hard, saved,invested and now looked forward topension checks, Social Security andgrandchildren on the way. Mom and Dadthought they had everything covered:Wills, Living Trust, Health Care Proxies,Powers of Attorney. They even uppedtheir life insurance at this time(something Dad swore he would neverdo, even if his daughter and son-in-lawwere in the business).Another difficult chapter of this sagastarted. Dad’s insurance carrier refusedto pay for his liquid nutrition. It wasn’t asupplement, it was all he could eat —and the cost was 1,400 each month!After two weeks of calls, we finally got itcovered. Of course, as time wore on,Mom was relied upon for more and morecustodial care. Dad’s medical insurancedidn’t provide sufficient home health care,and Mom didn’t like these “strangers”constantly entering her house. For her,sleep became a luxury.On October 10, 1997, Dad fell. It was5:00 am and Mom was asleep. Dad layon the kitchen floor, panic-stricken,unable to yell for help or move. Momfound him almost two hours later, but shewas unable to lift him. Mom had to call911, and then she placed her call to me,2,500 miles away.My husband and I had made frequenttrips to Arizona during Dad’s illness; now itwas a medical necessity. Mom needed abreak. She couldn’t leave Dad for morethan an hour at a time. How could sheshop for groceries or arrange to obtain hismedication? What about her needs? OnNovember 20, 1997, we flew to Arizonaand sent Mom to bed for some muchneeded rest.During the evening, we would taketwo-hour shifts caring for Dad. Mygreatest fear was that my father wouldhave to use the bathroom on my shift. Iwould do anything for Dad, but I certainlydid not want to embarrass him.Thankfully, my husband was able to assisthim at those times.On Thanksgiving morning, Dad couldn’tbreathe. He had to go to the hospital, butafter his treatment, the doctors wantedhim discharged. We knew he had to beadmitted for at least three days. Have youever tried to reach your primary carephysician at 8:00 am on Thanksgivingmorning? Mercifully, the doctor came tothe hospital and had Dad admitted. Atfirst he felt better, but he soon contractedpneumonia which extended his stay.After ten days in bed, he was too weak togo home.Dad was always active and retirementyears were no different. At age 65, hereceived a baseball bat and glove forChristmas; he had discovered SeniorSoftball and we had to worry aboutbrok

insurance agents and financial advisors, such as Jack and Garry Kinder, RFC , Ben Feldman, Norman Levine and John Savage. Events and Recognition Recognizing the need for Chinese speaking agents to have a local opportunity for motivation and education, Mr. Liang founded the World Wide Chinese Life Insurance Congress (WCLIC), with the first