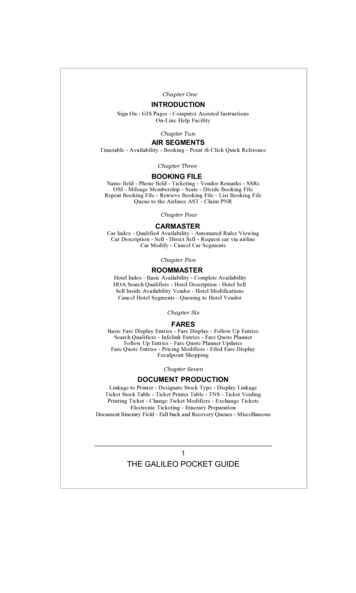

Transcription

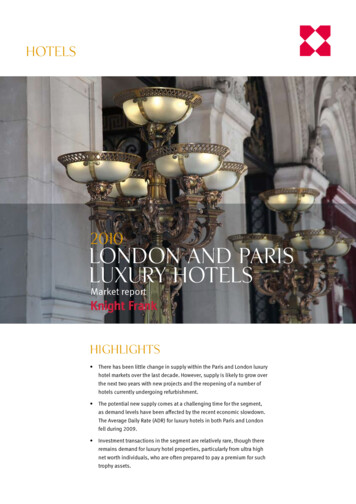

HOTELS2010LONDON AND PARISLUXURY HOTELSMarket reportHighlights There has been little change in supply within the Paris and London luxuryhotel markets over the last decade. However, supply is likely to grow overthe next two years with new projects and the reopening of a number ofhotels currently undergoing refurbishment. The potential new supply comes at a challenging time for the segment,as demand levels have been affected by the recent economic slowdown.The Average Daily Rate (ADR) for luxury hotels in both Paris and Londonfell during 2009. Investment transactions in the segment are relatively rare, though thereremains demand for luxury hotel properties, particularly from ultra highnet worth individuals, who are often prepared to pay a premium for suchtrophy assets.

2010LONDON AND PARISLUXURY HOTELSMarket reportThe manifestation of this has been theexceptional performance of the segmentand a select group of investors have gone totremendous efforts to launch new luxury hotelprojects, which are expected to open in thenext two years.This likely increase in supply coincides withan exceptionally challenging economicenvironment, which has led to significantpressure on hotel performance generally aswell as greater uncertainty in the wider realestate markets.A closer look at the underlying characteristicsof luxury hotel properties and thefundamentals of the market in Paris andLondon will help to shed some light onwhat the future holds for the segment.DefinitionThere is no internationally accepteddefinition for the luxury hotel market.Whilst there are several possible indicatorsto define a hotel market segment, theunderlying trade and its key determinants– such as location, property features,facilities, services, brand and operator –provide an insight into the segment.The Ritz, LondonThe luxuryhotels ofLondon andParis arewell-knownlandmarksable toprovide someof the mostopulenthospitalityin the world2London and ParisFew cities in the world epitomise traditionalluxury hospitality like the two most-visitedcities in the world, London and Paris, whereluxury hotels are prominent landmarks inthe cities’ landscapes with centuries-longtraditions and globally recognised names.These cities are political, financial andcultural magnets and Paris and Londonhave long been amongst the world’s mostdesirable hotel property investment markets.Over the last decade, the scarcity of viabledevelopment and conversion opportunitiesfor luxury hotel properties has subduedsupply growth in both cities, while demandfor luxury accommodation has grown stronglycommensurate with the rapid increase inglobal wealth.Capturing a property’s underlyingcharacteristics and market positioning asperceived by its guests, the Average DailyRate (ADR) is a first point of reference indefining the segment.In Paris, the segmentation of theupper end of the market is relativelystraightforward. The top performersform a distinctive set with pre-downturnADRs between 650 and 950, while thefollowers are further behind with ADRs ofbetween 300 and 400. There are veryfew properties trading in between.In London, clear segmentation provesmore difficult as the difference in ADRbetween the top and the following set isless pronounced. While top performers inLondon reached ADRs from 400 to around 550, there are several properties thatdirectly challenge the top set.

www.knightfrank.comCharacteristicsWhilst each luxury hotel property is unique,the hotels in Paris and London share a set ofdistinct characteristics, which set them apartfrom the five star segment.The majority of luxury properties occupyunique historical buildings and are locatedin prime areas of their respective cities, beingthe 1st and 8th arrondissements in Paris, andMayfair and Knightsbridge in London.Table 1Property characteristicsLuxury propertiesLocationNumber of rooms1st and 8th arrondissements in Paris,Mayfair and Knightsbridge in London100-200Suite ratio15-45%F&B facilitiesSeveral outlets, Michelin-starred chefsMeeting facilitiesLimited but exclusiveSource: Knight FrankThe room count of the top performers in thetwo cities typically ranges from 100 to 200and rarely exceeds 250. These propertiesThe room fit-out is to the highest quality,have a wide range of different room and suitetypes and high suite ratios ranging from 15%to 45% are common.often combining valuable antiques withthe latest technology and state-of-the-artluxury amenities.Leisure facilities are large in size, high-endand often branded, whilst meeting facilitiesare generally limited in size and cater onlyto small but exclusive events.Although room sizes are often dictated bythe historic character of the building, mostguest rooms measure between 30 and45 sq m and the largest suites are oftensignificantly bigger.Other notable features of the top performersin the two cities are the extravagant foodand beverage offerings with fashionablerestaurants and bars, often run by Michelinstarred chefs.Apart from these property-relatedcharacteristics, it is the exceptionallyhigh service delivery and wide array ofpersonalised services that distinguisha true luxury hotel from a five star hotel.Although many luxury properties areonly discreetly affiliated to their group orcollection and operate under their individualname, operators and brands ensure that therange and standard of facilities, the qualityof the room fit-out as well as the servicedelivery, are of the same high quality acrosstheir global portfolio.To a certain extent, luxury hotels in Paris andLondon share the same exclusive clientele,with the majority of demand coming fromaffluent individual leisure travellers, largelyfrom non-European countries with a highproportion of North American, Far and MiddleEastern guests, as well as an increasingnumber from the so-called BRIC countries(Brazil, Russia, India and China).The luxury hotel markets in Paris and Londonare dominated by companies that operatein the luxury market exclusively, such asMandarin Oriental, Dorchester and FourSeasons. Only some of the major internationalhotel companies have true luxury offerings,such as Starwood’s St. Regis brand.Hôtel Plaza Athénée3

2010LONDON AND PARISLUXURY HOTELSMarket reportOperational MarketFigure 1London luxury segment performance1ADR ARO %5009045085804007535070300652506020042005 2006 2007 2008 2009ADR(Average daily rate)ARO(Average room occupancy)Source: STR GlobalIncludes The Lanesborough, The Dorchester,Claridges, Mandarin Oriental, Brown’s, The Berkeleyand The Ritz. Does not include The Connaught,The Savoy and the Four Seasons London as theywere/are closed for refurbishment.1Figure 2Paris luxury segment performance2ADR ARO %900850800LondonIn London, the luxury segment has seenlimited change over the past decade with nonew supply coming to the market other thanthat which has been removed and refurbishedprior to returning to the market. This wasprincipally the removal of Brown’s Hotelin 2004 before it re-opened in 2006.A significant change to supply occurredduring 2008 when the Four Seasons Londonclosed for renovation and refurbishment.Together with the closing of The Savoy at theend of 2007 this was a major contributingfactor to the continued strong performanceof the luxury set in 2008 and the limitationto the downturn in 2009.The recent weakness in Sterling has beenpivotal in sustaining a relatively strongperformance across all sectors of the Londonhotel market. This has particularly beenthe case with a significant uplift in leisurebusiness. In the luxury segment, the fall inADR in 2009 was a mere 1.7% compared withthe same period in the previous year, whileAverage Room Occupancy (ARO) droppedby only 2.9%.It should be mentioned, however, thatseemingly robust Sterling performance inLondon is somewhat devalued in Euro andUS Dollar 0042005 2006 2007 2008 2009ADR(Average daily rate)ARO(Average room occupancy)Source: STR GlobalIncludes the Four Seasons George V, Le Bristol,Le Meurice, Le Plaza Athénée, Le Ritz and Le Crillon.24The DorchesterWith both the Four Seasons (November) andThe Savoy (September) scheduled to reopenin the second half of this year, the impact onthe market is likely to be minimal in 2010 andwe will only be able to measure the impactmore precisely as we move into 2011.ParisParis has seen little supply change in theluxury market since 2000, when the FourSeasons George V and Le Meurice reopenedafter extensive refurbishment works.However, in the third quarter of 2006, theFouquet’s Barrière opened as the seventhand smallest luxury hotel, which had a directeffect on the ARO of the luxury set. However,this did not prevent ADR levels increasingfurther throughout 2007 and 2008.After a dismal start in 2009, the Paris setrecorded better results in July and August butthe year as a whole still saw ADR fall by 8.8%while ARO dropped significantly by 11.9% to68.2%. These movements must however, beconsidered against the exceptional marketperformance in 2008, when both ADR andARO increased strongly on the same periodin 2007.Interestingly, Revenue per Available Room(RevPAR) in London and Paris show a verysimilar growth pattern for the period from2004 to 2008, with compound annual RevPARgrowth rates of 10% and 10.7% respectively.

www.knightfrank.comFigure 3RevPAR indexation, base year 20042004 100200150100Le Meurice2005Source: STR GlobalComparisonThere is a considerable difference betweenthe level of RevPAR in the Paris and Londonluxury hotel markets, with Paris achievingsignificantly higher ADRs than London. Thiswas already evident before Sterling startedto weaken against the Euro in mid 2007 andthe impact of the recent downturn in ADRand ARO in Paris is illustrated by Figure 3.There is, of course, more to hotel propertiesthan headline performance. Behind thescenes, high ancillary income of sometimes50% of total sales, extensive but sometimesmoderately profitable food and beveragefacilities and significant human resources ofup to three employees per bedroom, result ina very distinctive business profile.Payroll is the biggest cost issue, particularlyin Paris, where it is significantly higher thancomparable hotels in London. Overall thehigher cost ratios result in a considerabledifference in Gross Operating Profit margins.2006LondonHaving analysed the supply side on the basisof what we interpret to be the full luxury set,we have included the Fouquet’s Barrièrein Paris and The Connaught in London, whichwere not included in the operational survey.Including the recent extensions of the OetkerHotel Collection’s Le Bristol in Paris andthe Maybourne Hotel Group’s Connaught inLondon, there are currently 1,170 rooms inParis and 1,334 rooms in London with 357suites on sale in Paris and 369 in London.This results in an average suite ratio of 31%in Paris and 28% in London.As outlined earlier, properties in the twocities share the main basic characteristics.However, certain differences between themarkets are apparent.On the basis of the full set, the propertiesin Paris have larger average room and suitesizes, with balconies and terraces morecommon in Paris than in London. Several ofthe properties in London have single rooms of200720082009Parisless than 25 sq m, while in Paris the minimumroom size is 30 sq m across the board.Also, many of the properties in Paris haveextensive signature suites in excess of 300sq m, while most signature suites in Londonare less than 200 sq m. However, the largestsuite is The Dorchester’s Royal Penthouse inLondon, which is in excess of 750 sq m.General real estate values which are clearlyamongst the highest in the two cities ensurethat the Gross Internal Area (GIA) of a propertyplays a key role when appraising a luxuryhotel property.The GIA of luxury properties in both citiesvaries between 100 and 180 sq m per key andan assessment on the basis of profit per sq mof GIA is recommended for a thorough reviewof an asset’s performance.Table 2Currently operating luxury hotelsTotal numberof roomsAverageroom countAveragesuite ratioGuest roomsJunior suitesOne bedroomsuitesParis1,17016731%30-60 sq m45-75 sq m55-110 sq mLondon1,33416729%20-55 sq m40-63 sq m56-124 sq mSource: Knight Frank5

2010LONDON AND PARISLUXURY HOTELSMarket reportInvestment marketAlthough luxury hotels are a highly soughtafter asset class, the luxury hotel propertymarket is characterised by few going-concerntransactions. Where they do take place, theyare often sold at significant premiums to theirnet book values or commercial investmentvalues.Most luxury hotel properties are conversionsof five star hotels or landmark buildings inalternative uses, which are subject to strictplanning controls. These conversions canconsume several hundred millions of Eurosor Pounds and take several years to complete.Nowhere is this more evident than therenovation of The Savoy in London whichhas seen a significant cost overrun anda delay in reopening that will stretch toalmost 18 months.The majority of luxury hotel properties arebacked by prestigious owner operators whoalso own the corresponding luxury hotelbrands. Hotel groups that want to secure amanagement agreement on a property usuallyhave to take a share in the investment or offersignificant financial incentives to secure astrategic entry into the market place.Investors in luxury hotel properties are mostlysovereign wealth funds or ultra high net worthindividuals with long investment horizonsand deep pockets for vital and continualrenovation and improvement. Often from theMiddle and Far East, these equity investorsgenerally prefer freehold properties and maybe willing to pay premiums to acquire trophyassets. The dearth of available debt in themarket will continue to highlight this buyerprofile.After a quiet 2008 and 2009, current investorinterest is improving, mainly from buyerslooking for opportunistic acquisitionsin London where overseas investors seeattractive capital values based on thecurrency arbitrage. The Stafford Hotel inLondon, which recently sold to an Egyptianinvestor for a reported 77.5 million, is oneexample and several groups are showinginterest in the In and Out Club on Piccadilly.The latter has the potential, with significantinvestment, to become a luxury hotel.In Paris, Starwood Capital’s marketing of theCrillon, the Louvre and Lutetia hotels hasresulted in the Lutetia being recently sold toAlrov Properties for c. 145m. This is the firstsale in the segment since 2008, when theformer Le Majestic was taken over and thePrince des Galles was sold.DevelopmentsThere is considerable development activityin London and Paris which will impact theluxury market segment. We elaborate onthe most prominent projects below.In London, the Four Seasons Londonis currently closed for extension andredevelopment. Guest rooms, suites andpublic areas are to be reconfigured andthe property will feature a new spa andfitness suite on the top floor of the buildingwhen it reopens in late 2010 with 200 roomsand suites.The Savoy will reopen in 2010 with 268 roomsand suites, after a complete and somewhatdelayed renovation with a reputed totalinvestment of c. 200m. The property will beoperated under the Fairmont brand and havea suite ratio of more than 20%. It will alsofeature one of London’s largest suites at300 sq m.The Dorchester Collection will open asecond property in London under the nameof 45 Park Lane with 50 guest rooms andsuites. It is expected to operate as a sisterhotel to the Dorchester, albeit with a morecontemporary feel.The only new development in the luxurymarket segment that is currently in the earlystages of construction is the KnightsbridgePalace scheme. This is expected to comprise85 rooms and suites and to be operated as aBulgari branded hotel.In Paris, the former 236 bedroom RoyalMonceau on Avenue Hoche in the 8tharrondissement is currently beingredeveloped and will open under the Rafflesbrand with a significantly reduced roomcount of around 150, including 42 suites.The largest suite will be 400 sq m and thespa will be 1,500 sq m in size.The former hotel Le Majestic on AvenueKléber in the 16th arrondissement will behome to Peninsula’s first hotel in Europe. Theproperty is being redeveloped, to include 200rooms and suites. The renovation cost aloneis expected to be in the region of 250m.The Paris Shangri-La will be in a buildingdating from 1896 on Avenue d’Iéna inthe 16th arrondissement. The minimumroom size is 37 sq m and suite sizes rangefrom 50 sq m to 235 sq m. The total suiteratio will be in the region of 40% and theproperty will feature a 1,000 sq m spa.Brown’s6A Mandarin Oriental is set to open in 2011with 150 rooms and suites on Rue SaintHonoré in the 1st arrondissement, situated ina 1930s building. Amongst its main featureswill be a substantial swimming pool.

www.knightfrank.comTable 3Developments in LondonPropertyOperatorType of workTotal roomsupon openingOpening dateFour Seasons LondonFour SeasonsExtension and redevelopment2002010The SavoyFairmontRedevelopment268201045 Park LaneDorchester GroupConversion502010Bulgari KnightsbridgeRitz Carlton/MarriottDevelopment852012OperatorType of workTotal roomsupon openingOpening dateSource: Knight FrankTable 4Developments in ParisPropertyRoyal MonceauRafflesRedevelopment1522010Palais d’IénaShangri-LaConversion1092010Mandarin OrientalMandarin OrientalConversion1502011Le MajesticPeninsulaRedevelopment2002012Source: Knight FrankOutlookThe luxury hotel market had an exceptionallysuccessful up-cycle until the beginning of thefourth quarter of 2008, subsequent to which,the economic crisis has placed significantpressure on this segment.At a time when demand for luxuryaccommodation is subdued, supply is likelyto increase substantially in Paris. Withthe market segment’s relative sensitivityto changes in supply, this may lead tocontinued pressure on ADRs and AROs.However, as two of the world’s leadinggateway cities with diverse source marketsand business mixes, we should see a gentlebut sustained recovery in demand for luxuryhotel accommodation in the short term.Several operators are reaching out todistinguish themselves through a superiorquality of service, increased room sizesand superior fit-out and facilities in theirproperties.Whilst new brands might generate demandfrom markets that do not already havesignificant exposure in the two cities, itremains to be seen how new names andconcepts are received in the market place.The prevailing financial restrictions on newdevelopments and the top prices paid at thepeak of the last cycle, lead us to believe thatsome projects might be considered at risk orwill be postponed.Also, the general scarcity of suitablebuildings and land and the prevailinghigh real estate values of surroundingproperties and competing uses, resultingin exceptionally high capital requirements,will continue to restrict supply as has beenthe case historically.If we see any increase in supply, the luxuryhotel markets in Paris and London maysub-divide into a leader group and a followergroup. Whilst in Paris the current trading levelis unlikely to be exceeded in the near future,the London market may be ready for a newperformance benchmark.In particular, some of the Far Eastern brandsstill desire a presence in London and TheSavoy and Four Seasons will re-enter themarket with essentially brand new products.A new group of properties together with theexisting top performers may form a distinctiveset, enhancing London’s reputation as a trueluxury hotel destination.This is one of the most interesting but atthe same time challenging hotel marketsegments. Increased competition, the pushfor larger rooms, improved services and betterefficiency of flows in the hotels will, as ever,require continued investment in the future.Luxury hotel properties will rarely attractmainstream commercial property investorswith their strict investment returnrequirements. Even for the trophy hunters,it is absolutely essential to understand theunderlying market dynamics and propertycharacteristics in order to generate themaximum return on an investment in thissegment.7

LondonDominic MayesHead of Hotels Department 44 (0) 207 861 1086dominic.mayes@knightfrank.comParisLuke CondonAssociate 33 (0)1 43 16 88 90luke.condon@fr.knightfrank.comIan ElliottHead of Hotel Valuations 44 (0) 207 861 aNew ZealandGraham DoddPartner, UK and Europe 44 (0) 207 861 h ndPortugalRomaniaRussiaSpainThe NetherlandsUkraineAlex SturgessPartner, London 44 (0) 207 861 yaMalawiNigeriaSouth AfricaTanzaniaUgandaZambiaZimbabweKnight Frank Research provides strategic advice, consultancy services and forecastingto a wide range of clients worldwide including developers, investors, fundingorganisations, corporate institutions and the public sector. All our clients recognisethe need for expert independent advice customised to their specific needs.AsiaCambodiaChinaHong KongIndiaIndonesiaMacauMalaysiaSingaporeSouth KoreaThailandVietnamKnight Frank Reports are also available at www.knightfrank.com Knight Frank LLP 2010This report is published for general information only. Although high standards have been used in thepreparation of the information, analysis, views and projections presented in this report, no legal responsibilitycan be accepted by Knight Frank Research or Knight Frank LLP for any loss or damage resultant from thecontents of this document. As a general report, this material does not necessarily represent the view of KnightFrank LLP in relation to particular properties or projects. Reproduction of this report in whole or in part isallowed with proper reference to Knight Frank Research.The GulfBahrainUAEKnight Frank LLP is a limited liability partnership registered in England with registered number OC305934.Our registered office is 55 Baker Street, London, W1U 8AN, where you may look at a list of members’ names.NewmarkKnight FrankGlobalNewmarkKnight Frank

2010 LONDON AND PARIS LUXURY HOTELS Market report 2 The Ritz, London The manifestation of this has been the exceptional performance of the segment and a select group of investors have gone to tremendous efforts to launch new luxury hotel projects, which are expected to open in the next two years. This likely increase in supply coincides with